Battery Additives Market Report

Published Date: 22 January 2026 | Report Code: battery-additives

Battery Additives Market Size, Share, Industry Trends and Forecast to 2033

This report covers the comprehensive analysis of the Battery Additives market, including market dynamics, regional insights, segmentation, and future forecasts for 2023-2033. It provides essential data for stakeholders to understand trends and growth opportunities within the industry.

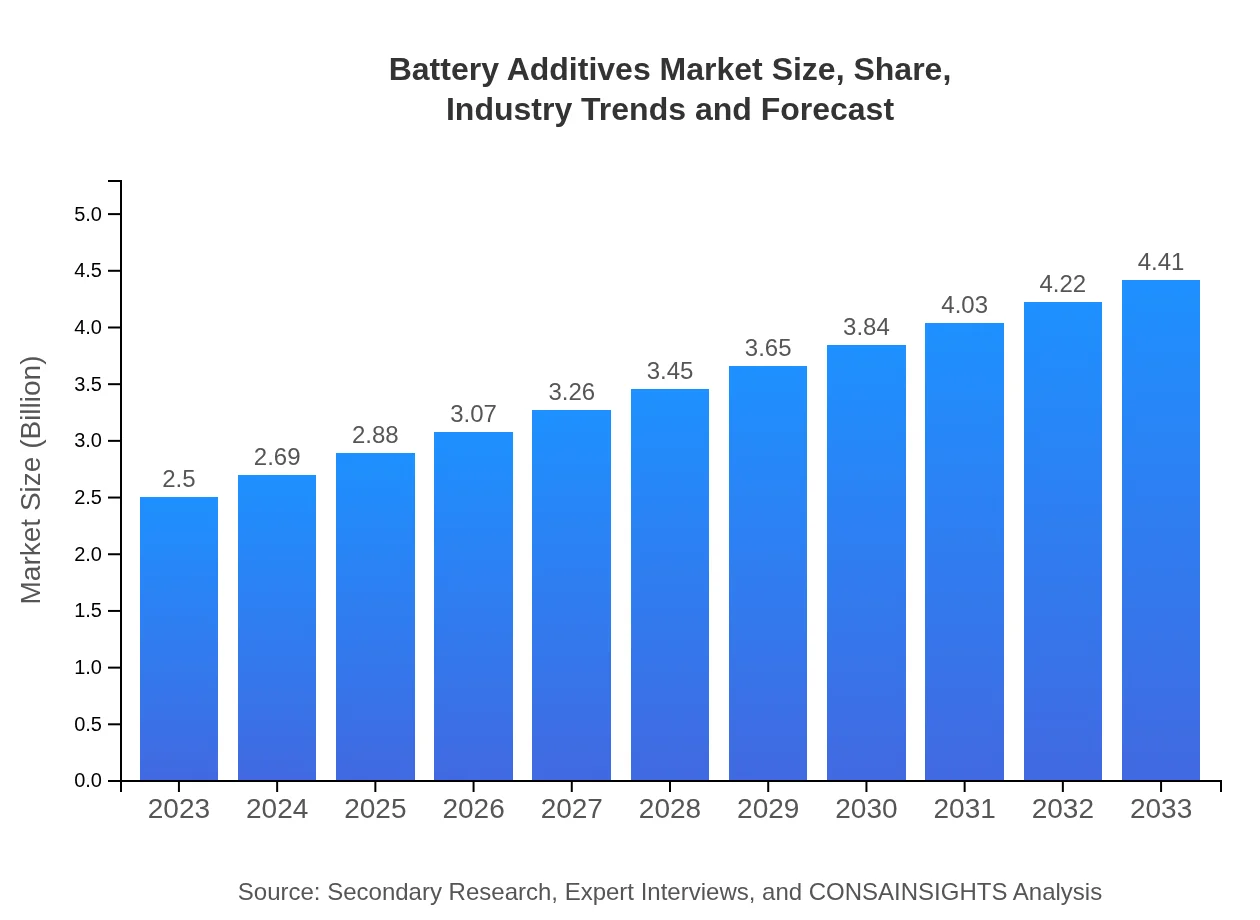

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 5.7% |

| 2033 Market Size | $4.41 Billion |

| Top Companies | BASF SE, 3M Company, Evonik Industries AG, Henkel AG & Co. KGaA, Shenzhen Capchem Technology Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Battery Additives Market Overview

Customize Battery Additives Market Report market research report

- ✔ Get in-depth analysis of Battery Additives market size, growth, and forecasts.

- ✔ Understand Battery Additives's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery Additives

What is the Market Size & CAGR of Battery Additives market in 2023 and 2033?

Battery Additives Industry Analysis

Battery Additives Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Additives Market Analysis Report by Region

Europe Battery Additives Market Report:

Europe's Battery Additives market is witnessing substantial growth, valued at USD 0.69 billion in 2023 and expected to reach USD 1.22 billion by 2033. The European Union's stringent regulations on emissions and the push for sustainable energy solutions are pivotal in driving demand for advanced battery solutions. The region is a global leader in electric vehicle adoption, further boosting the need for effective battery additives.Asia Pacific Battery Additives Market Report:

The Asia-Pacific region is the largest market for Battery Additives, valued at approximately USD 0.48 billion in 2023 and expected to reach USD 0.85 billion by 2033. This growth is driven by the booming automotive sector, particularly in countries like China and Japan, where electric vehicle adoption is accelerating significantly. Additionally, the rising manufacturing capabilities of electronics in the region contribute to the increasing demand for high-performance batteries in consumer devices.North America Battery Additives Market Report:

North America has a market size of USD 0.93 billion in 2023, anticipated to grow to USD 1.64 billion by 2033, driven by significant investments in electric vehicle infrastructure and renewable energy. The market is supported by robust research and development activities in the region, with many companies focusing on innovative battery technologies to meet increasing consumer demand.South America Battery Additives Market Report:

In South America, the Battery Additives market was valued at USD 0.05 billion in 2023 and is projected to grow to USD 0.09 billion by 2033. The growth is slower compared to other regions due to limited electric vehicle penetration and lower production capacities; however, advancements in renewable energy initiatives and investments in battery technologies are expected to enhance market dynamics in the coming years.Middle East & Africa Battery Additives Market Report:

The Middle East and Africa region is seeing a market growth from USD 0.35 billion in 2023 to USD 0.61 billion by 2033. Demand for battery additives is increasing in this region, driven by a rise in renewable energy initiatives and growing applications in energy storage solutions. However, challenges include economic instability and varying regulatory frameworks across countries.Tell us your focus area and get a customized research report.

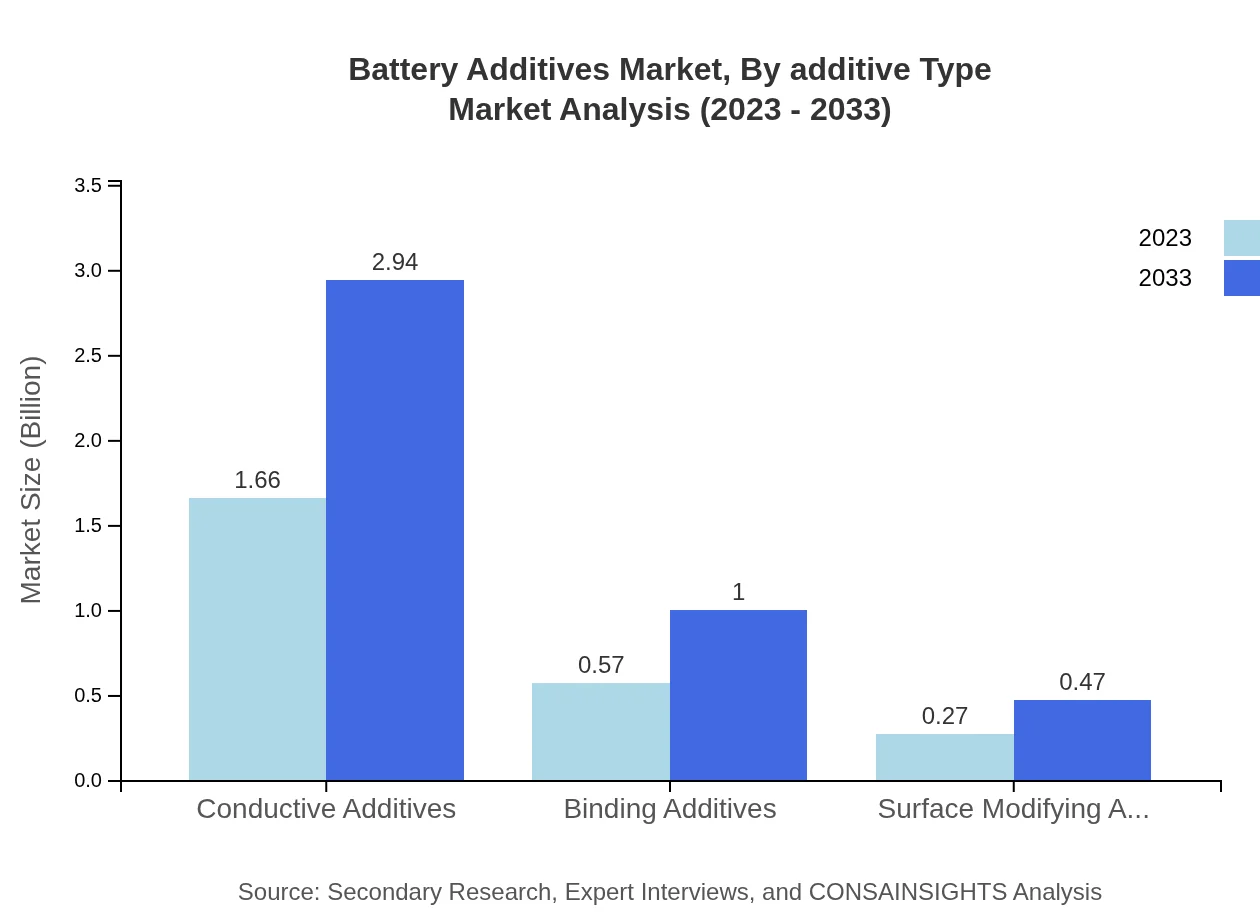

Battery Additives Market Analysis By Additive Type

The market for Battery Additives is significantly influenced by various additive types. Organic additives dominate the market with a share of approximately 87.3% in 2023, valued at USD 2.18 billion, expanding to USD 3.85 billion by 2033. Conductive additives follow, accounting for 66.57% of the market, while binding and surface-modifying additives contribute significantly as well. Understanding the dynamics of these segments enables targeted product development.

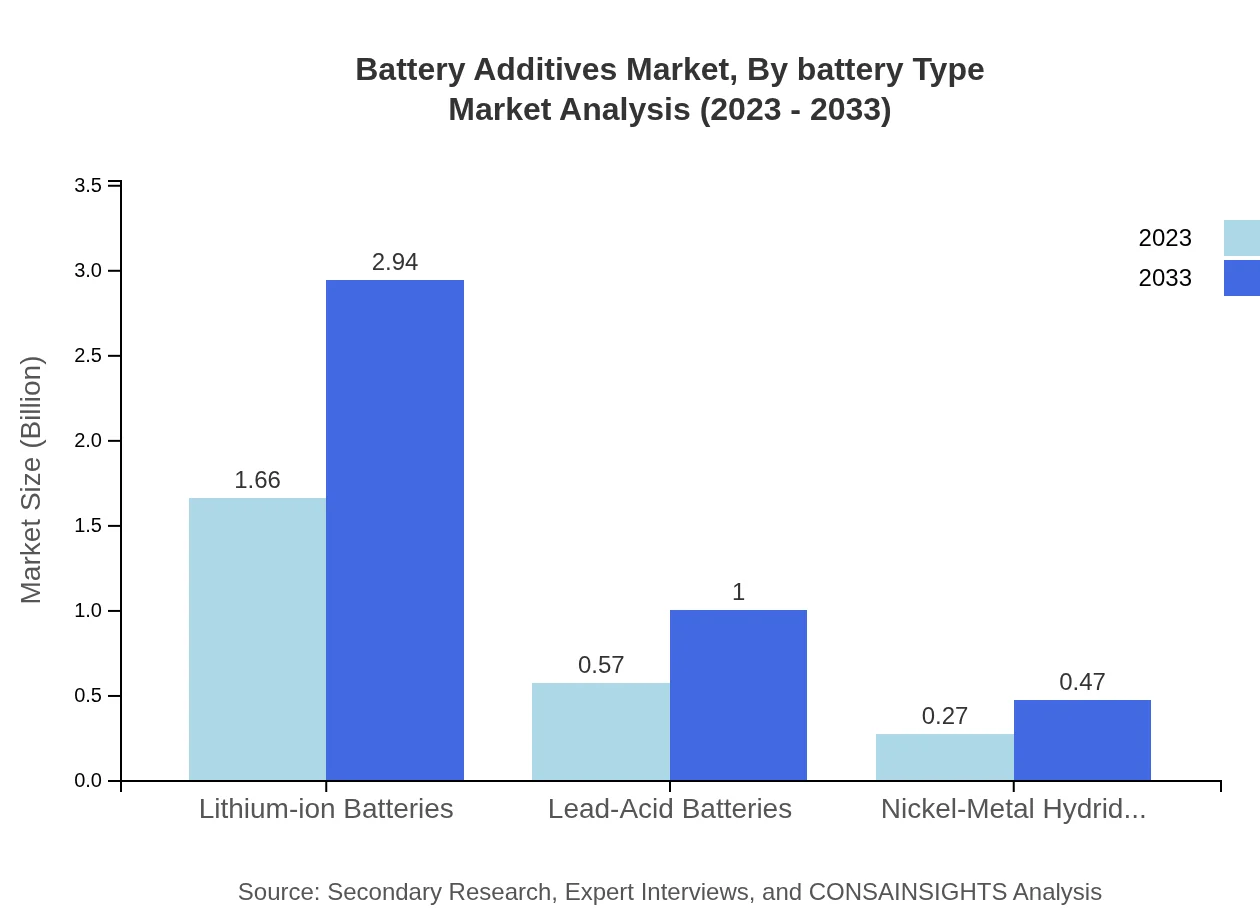

Battery Additives Market Analysis By Battery Type

Lithium-ion batteries represent the largest segment in the Battery Additives market, with a size of USD 1.66 billion in 2023 and projected to grow to USD 2.94 billion by 2033. In contrast, lead-acid and nickel-metal hydride batteries also contribute to the market, holding shares of 22.7% and 10.73%, respectively, highlighting the diverse applications of battery technologies across different sectors.

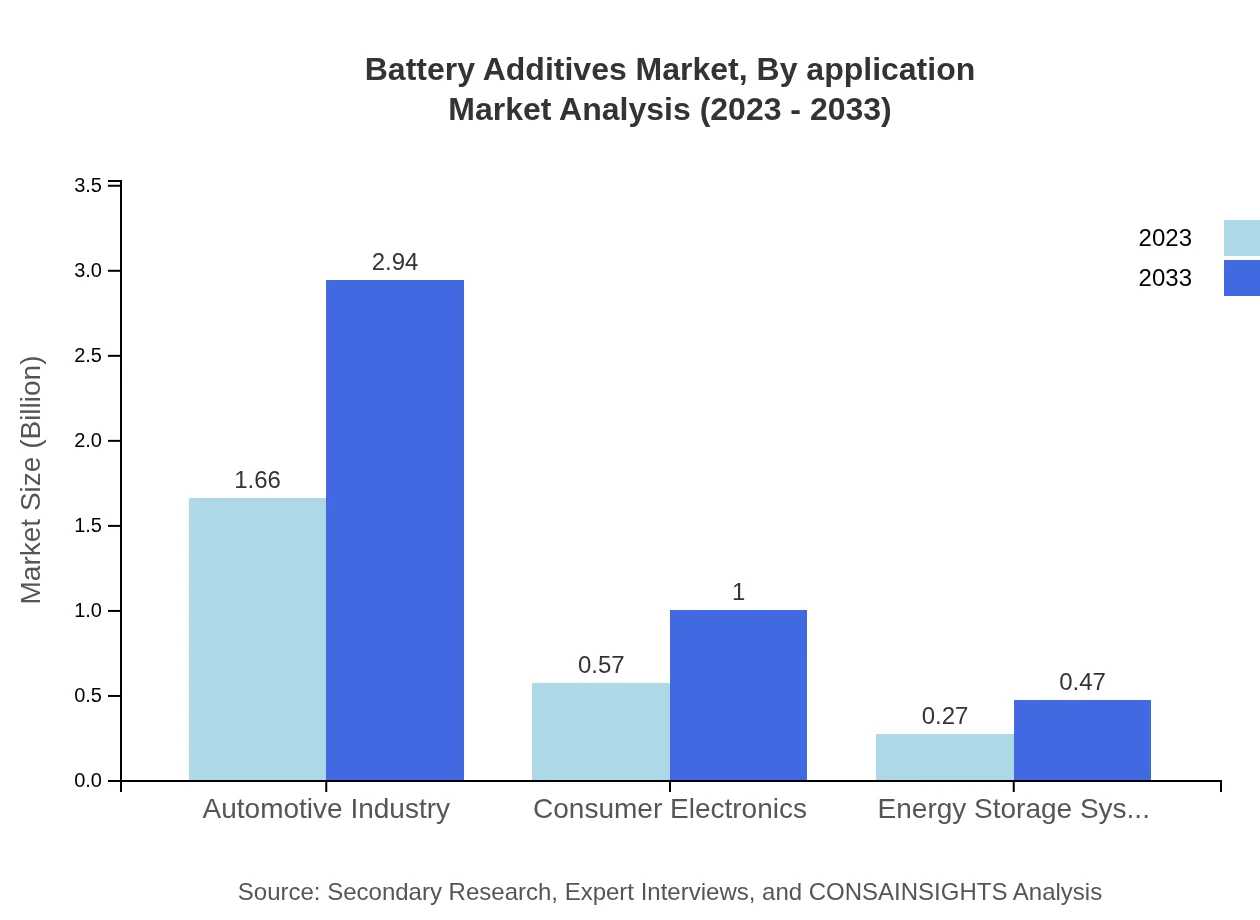

Battery Additives Market Analysis By Application

Prominent applications of Battery Additives include the automotive industry, consumer electronics, and energy storage systems. The automotive sector leads with a market size of USD 1.66 billion and a share of 66.57%, followed closely by consumer electronics at USD 0.57 billion. Energy storage systems also present a growing application area, evidenced by their increasing use in renewable energy projects.

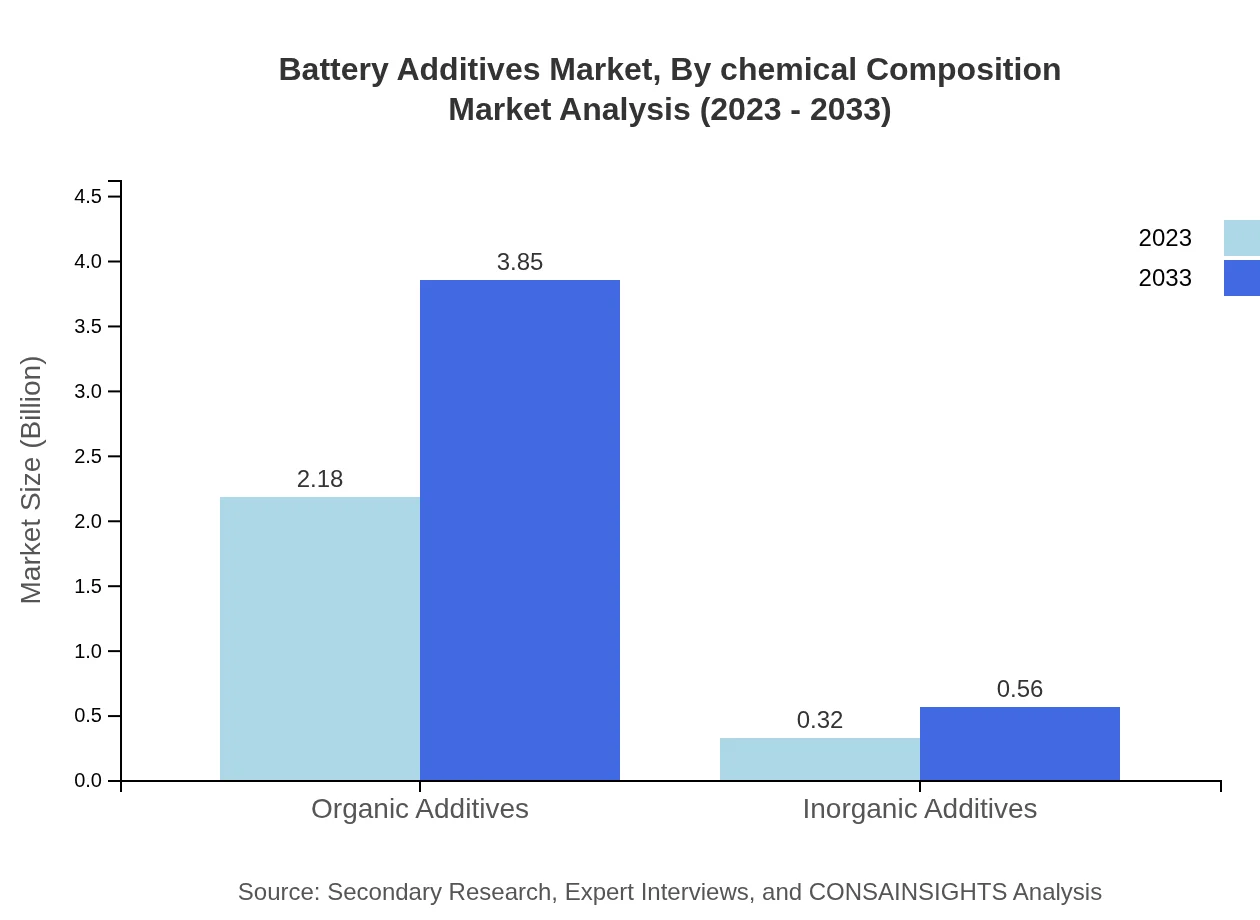

Battery Additives Market Analysis By Chemical Composition

The market is diverse in chemical compositions with organic and inorganic additives playing distinct roles. Organic additives are predominant, accounting for a market share of 87.3% in 2023, while inorganic additives make up 12.7%. These differences influence performance characteristics and applicability in various battery types.

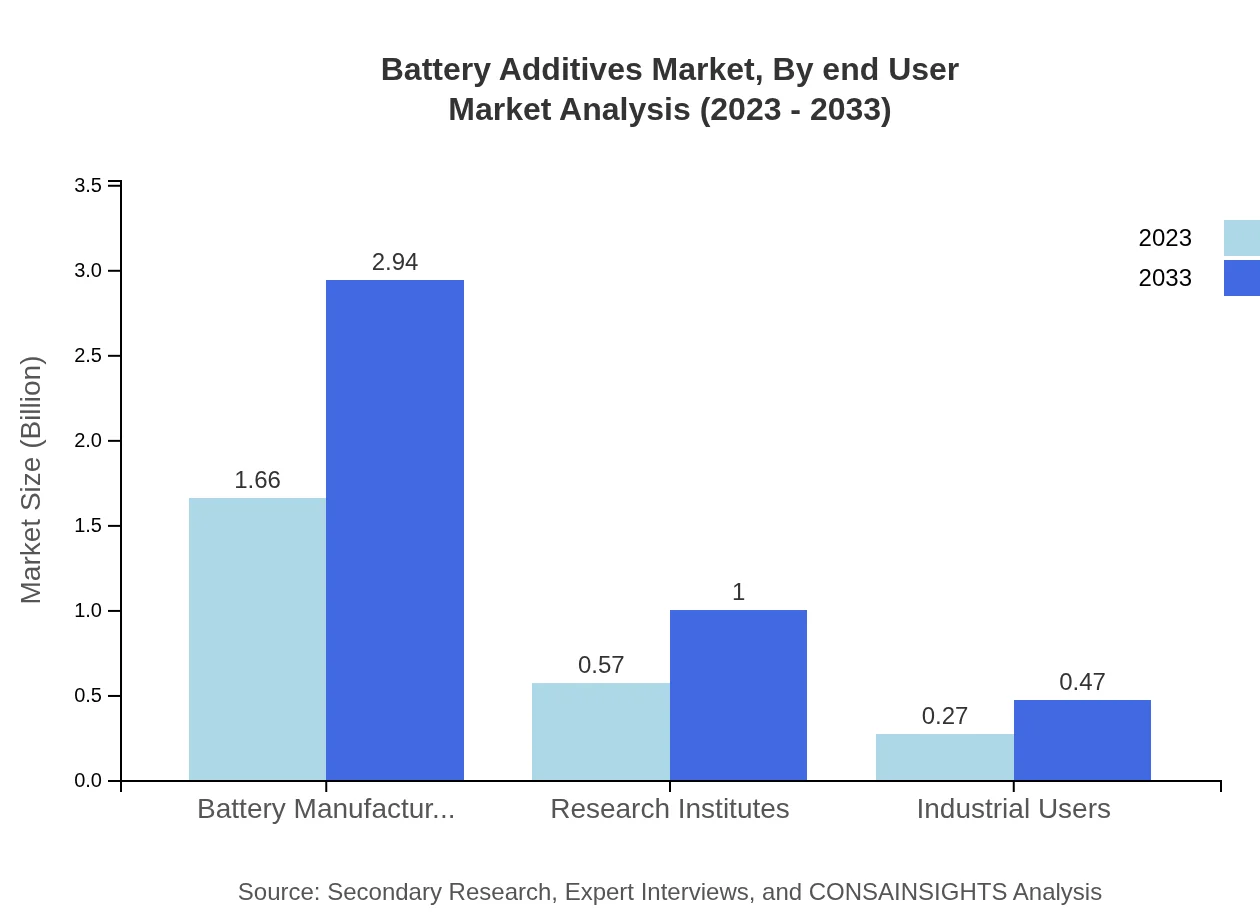

Battery Additives Market Analysis By End User

Key end-users of Battery Additives include battery manufacturers, research institutes, and industrial users. Battery manufacturers alone dominate the market with a size of USD 1.66 billion, representing 66.57% of the overall market share. Research institutes also play a vital role in developing and testing new additives, comprising 22.7%.

Battery Additives Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Additives Industry

BASF SE:

A leading chemical company known for its innovative solutions, BASF offers a range of battery additives aimed at improving the performance and safety of various battery types.3M Company:

3M is a global conglomerate that produces a wide array of products, including high-performance battery additives designed to enhance energy density and extend battery life.Evonik Industries AG:

Evonik specializes in specialty chemicals and is heavily involved in research and development of battery additives to meet the evolving needs of the automotive and electronics industries.Henkel AG & Co. KGaA:

Henkel offers technologically advanced solutions for battery additives, prioritizing sustainability and performance enhancement in battery technologies.Shenzhen Capchem Technology Co., Ltd.:

A prominent player in the battery additives market, Capchem is dedicated to providing high-quality additives for lithium-ion and other battery types, emphasizing innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of battery Additives?

The global battery additives market was valued at approximately $2.5 billion in 2023, with a projected CAGR of 5.7% over the next decade, indicating robust future growth and innovation in battery technologies.

What are the key market players or companies in the battery Additives industry?

Key players in the battery additives industry include major manufacturers such as BASF, Cabot Corporation, and Umicore, driving advancements in battery performance and sustainability through their innovative additive solutions.

What are the primary factors driving the growth in the battery Additives industry?

Growth is primarily driven by increasing demand for electric vehicles, advancements in battery technologies, and the rising need for renewable energy solutions, leading to significant investments in research and development within the sector.

Which region is the fastest Growing in the battery Additives?

North America is the fastest-growing region in the battery additives market, projected to grow from $0.93 billion in 2023 to $1.64 billion by 2033, fueled by substantial investments in electric vehicle infrastructure and innovation.

Does ConsaInsights provide customized market report data for the battery Additives industry?

Yes, ConsaInsights offers tailored market reports that cater to specific needs within the battery additives industry, ensuring that clients receive relevant and actionable insights aligned with their business objectives.

What deliverables can I expect from this battery Additives market research project?

Deliverables from the market research project include detailed reports encompassing market analysis, segment performance, growth forecasts, competitive landscape assessments, and actionable insights to guide strategic planning.

What are the market trends of battery Additives?

Current trends in the battery additives market include increasing adoption of organic and inorganic additives, a shift towards sustainable materials, and innovations aiming to enhance battery lifespan and efficiency.