Battery Energy Storage Market Report

Published Date: 31 January 2026 | Report Code: battery-energy-storage

Battery Energy Storage Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive overview of the Battery Energy Storage market, analyzing key trends, market dynamics, and forecasts from 2023 to 2033, offering valuable insights into opportunities and challenges in the industry.

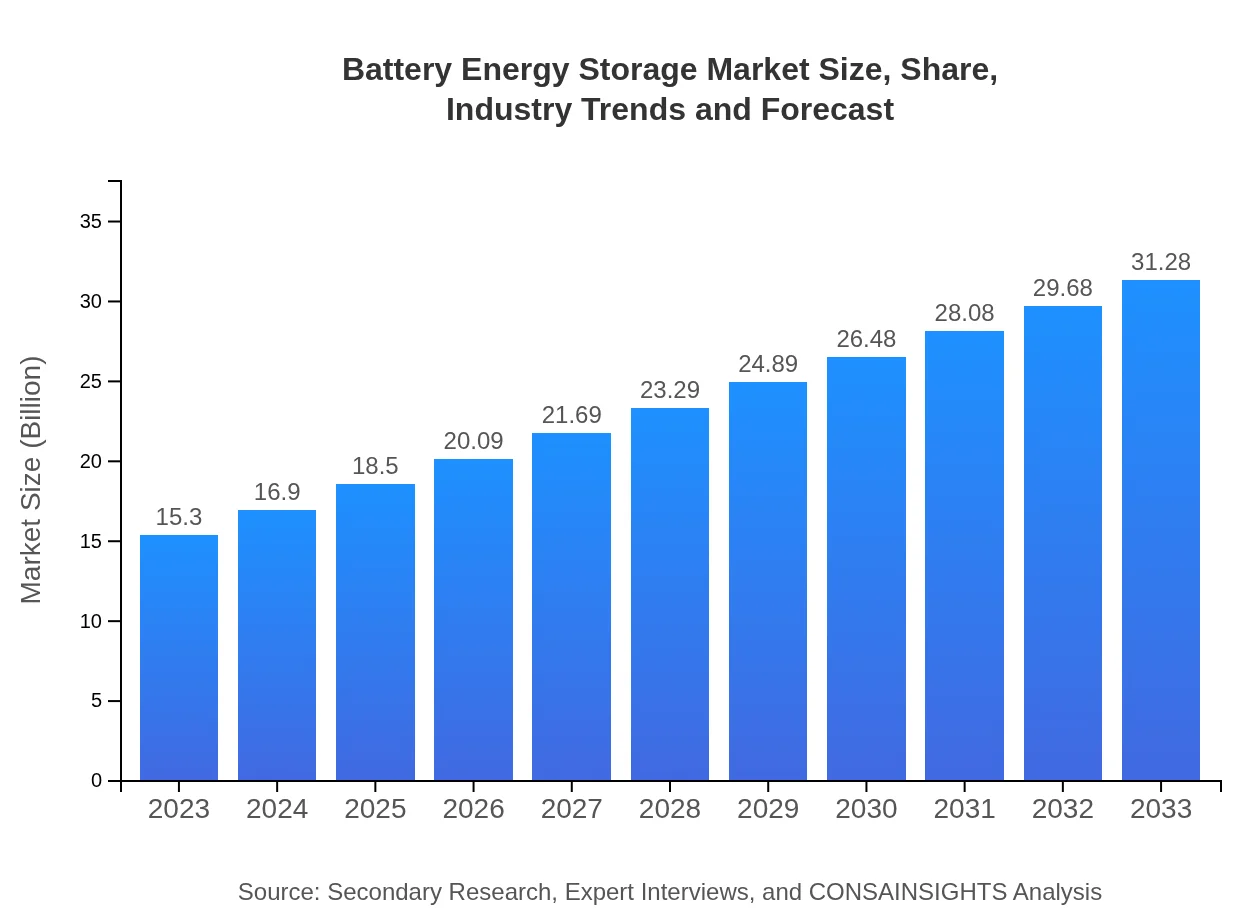

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.30 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $31.28 Billion |

| Top Companies | Tesla, Inc., LG Chem, Panasonic Corporation, Samsung SDI, SK Innovation |

| Last Modified Date | 31 January 2026 |

Battery Energy Storage Market Overview

Customize Battery Energy Storage Market Report market research report

- ✔ Get in-depth analysis of Battery Energy Storage market size, growth, and forecasts.

- ✔ Understand Battery Energy Storage's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery Energy Storage

What is the Market Size & CAGR of Battery Energy Storage market in 2023 and 2033?

Battery Energy Storage Industry Analysis

Battery Energy Storage Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Energy Storage Market Analysis Report by Region

Europe Battery Energy Storage Market Report:

The European market is expected to grow from $4.24 billion in 2023 to $8.67 billion by 2033, as various EU initiatives aim to reduce carbon emissions. Countries such as Germany, France, and the UK are investing heavily in battery storage solutions, particularly to balance renewable energy generation.Asia Pacific Battery Energy Storage Market Report:

In the Asia Pacific region, the Battery Energy Storage market is projected to grow from $3.11 billion in 2023 to $6.35 billion by 2033. Countries like China and Japan are leading in terms of investment and development, driven by government initiatives to support renewable energy sources. The growing demand for electric vehicles in this region further drives the adoption of battery storage solutions.North America Battery Energy Storage Market Report:

North America is anticipated to grow significantly, from $5.62 billion in 2023 to $11.48 billion by 2033. The United States leads in energy storage deployment supported by federal incentives and regulations for renewable integration. The growth of the electric vehicle market also contributes positively to the battery storage sector.South America Battery Energy Storage Market Report:

In South America, the market is set to increase from $0.42 billion in 2023 to $0.87 billion by 2033, primarily driven by rising energy demands and renewable energy projects. Countries such as Brazil and Argentina are advancing in energy storage technologies to enhance grid stability and integrate more renewable energy solutions.Middle East & Africa Battery Energy Storage Market Report:

The Middle East and Africa region will see growth from $1.91 billion in 2023 to $3.91 billion by 2033. Driven by initiatives to enhance energy security and integrate renewable sources, countries like South Africa and the UAE are becoming hotspots for energy storage investments.Tell us your focus area and get a customized research report.

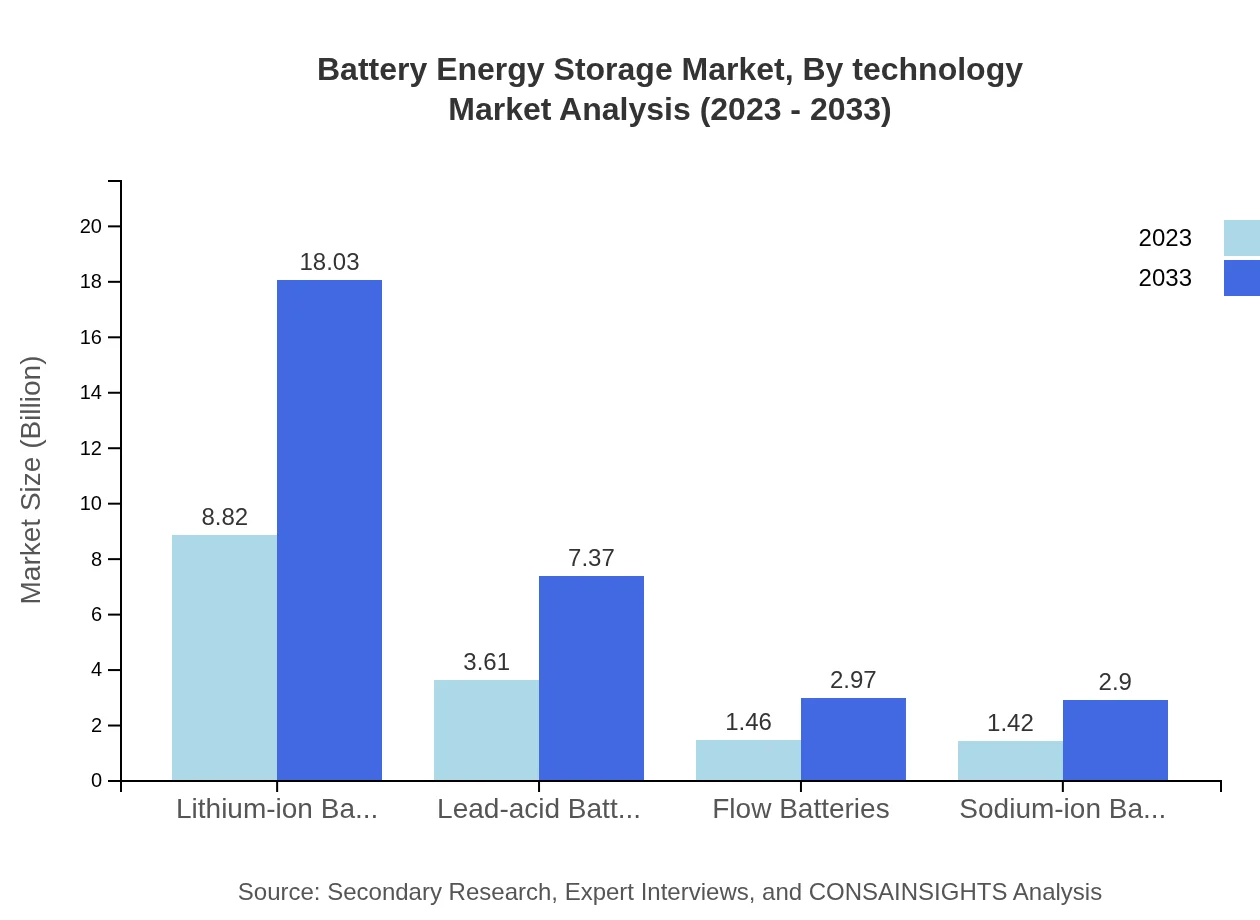

Battery Energy Storage Market Analysis By Technology

The technology segment is dominated by lithium-ion batteries, which accounted for a market size of $8.82 billion in 2023, growing to $18.03 billion by 2033, making up 57.65% of the overall market share. Other technologies, such as lead-acid, sodium-ion, and flow batteries, also play vital roles, with their respective growth rates highlighting the diversification in battery technology preferences across different sectors.

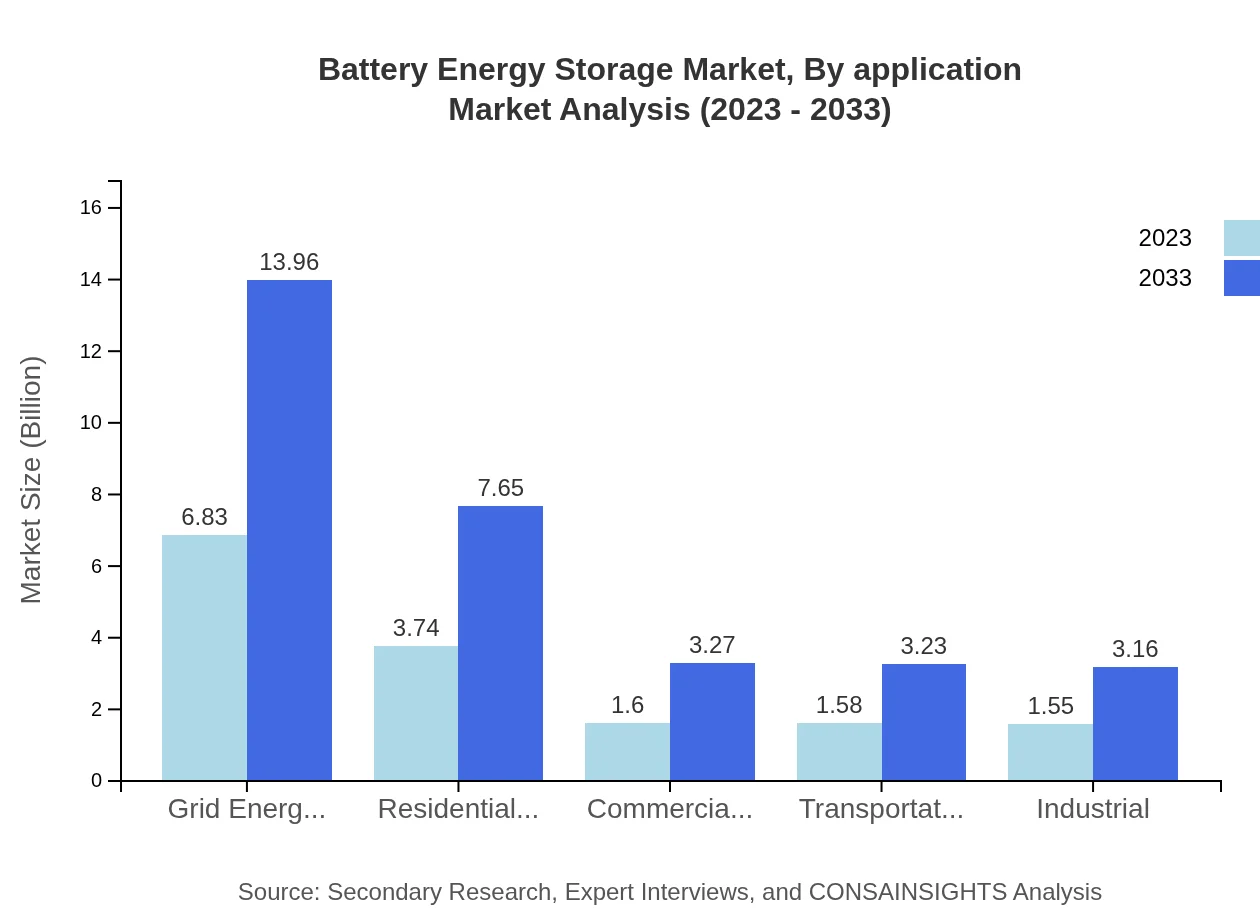

Battery Energy Storage Market Analysis By Application

The application segment of battery storage shows that grid energy storage is leading with $6.83 billion in 2023 and projected to grow to $13.96 billion by 2033. Residential and commercial energy storage are also significant contributors, emphasizing the growing trend toward decentralized energy solutions and smart grid applications.

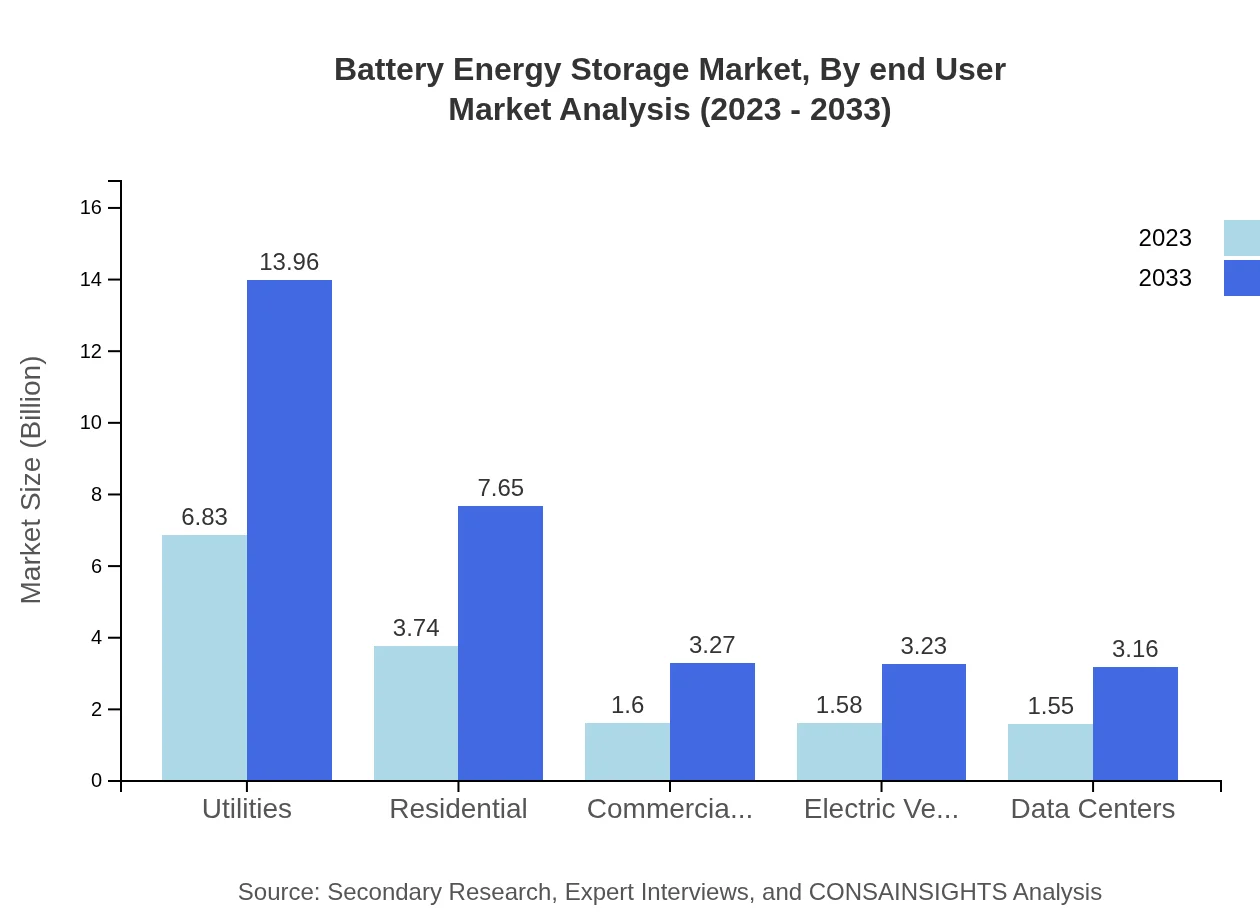

Battery Energy Storage Market Analysis By End User

In terms of end-users, utilities dominate the sector with a market size of $6.83 billion in 2023, forecasted to reach $13.96 billion by 2033, reflecting the critical importance of energy storage in maintaining grid reliability. The commercial and industrial segments are also growing, fueled by increasing onsite energy generation and efficiency needs.

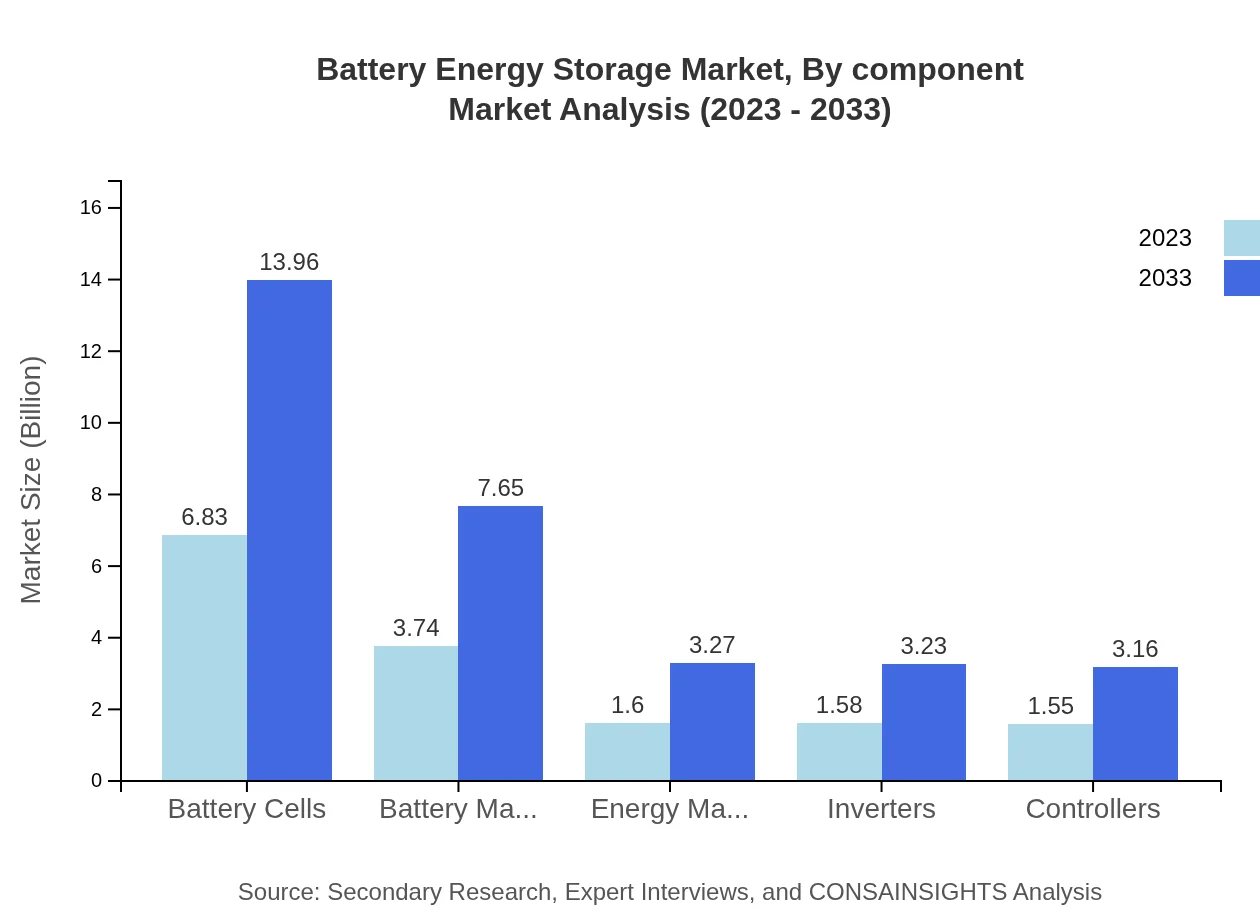

Battery Energy Storage Market Analysis By Component

Components like battery management systems and inverters are essential for the efficiency of energy storage systems. For instance, battery management systems are projected to grow from $3.74 billion in 2023 to $7.65 billion by 2033, representing a significant share in the overall market landscape.

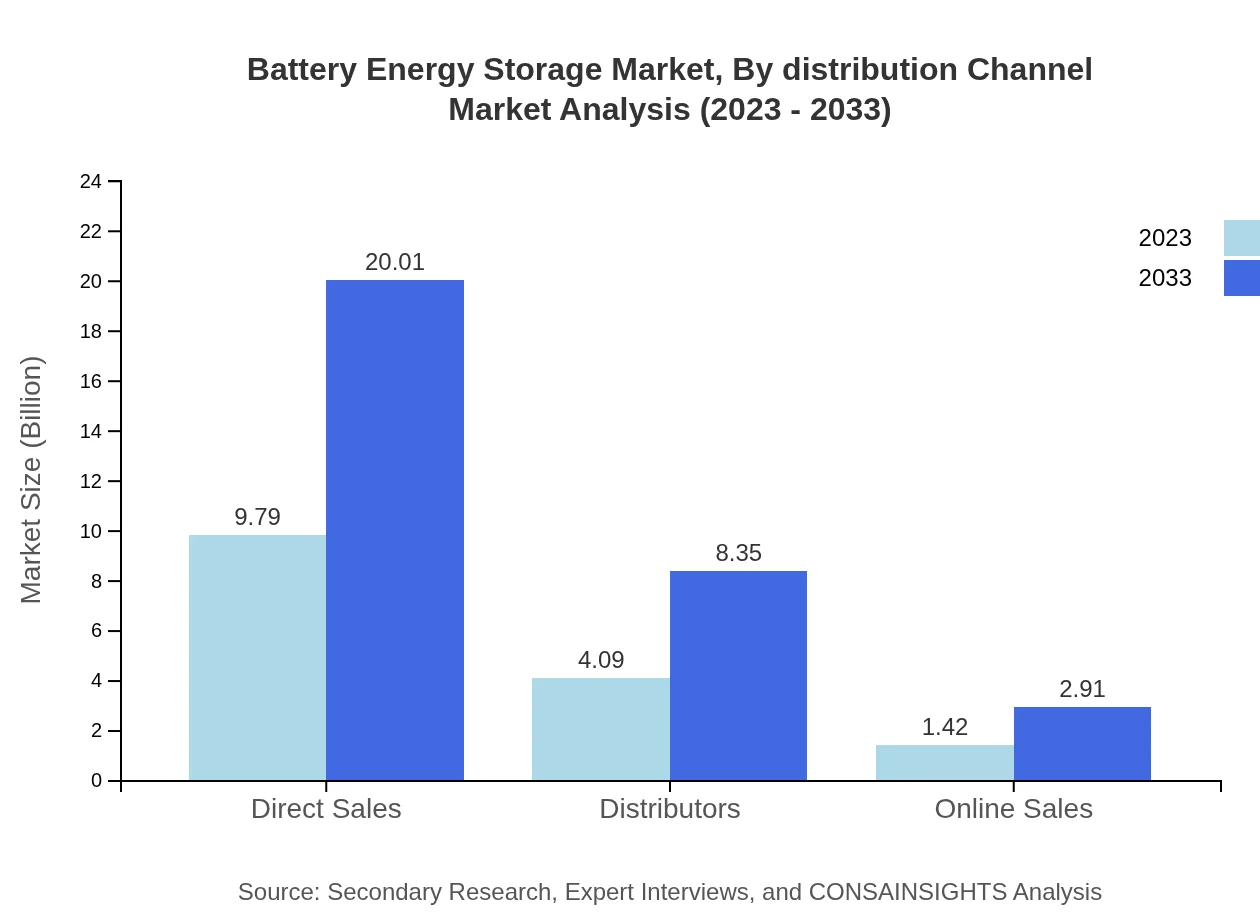

Battery Energy Storage Market Analysis By Distribution Channel

The distribution channel segment indicates that direct sales constitute the largest share, with a market value of $9.79 billion in 2023 expected to rise to $20.01 billion by 2033. This channel prevalence highlights the importance of direct engagement between manufacturers and consumers in the fast-evolving energy storage marketplace.

Battery Energy Storage Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Energy Storage Industry

Tesla, Inc.:

Tesla is a leading innovator in lithium-ion battery technologies and energy storage solutions, renowned for its Powerwall and Powerpack systems that integrate easily with solar installations.LG Chem:

LG Chem is a key player in the battery technology sector, supplying advanced energy storage systems to various industries, including electric vehicles and renewable energy.Panasonic Corporation:

Panasonic specializes in providing comprehensive battery solutions, contributing significantly to electric vehicle battery supply chains and energy storage systems across the globe.Samsung SDI:

Samsung SDI focuses on developing advanced battery technologies, including lithium-ion batteries, supporting energy storage applications for commercial and residential use.SK Innovation:

SK Innovation is an emerging leader in battery technologies focused on supplying high-performance batteries for electric vehicles and energy storage systems.We're grateful to work with incredible clients.

FAQs

What is the market size of Battery Energy Storage?

The Battery Energy Storage market is projected to reach a size of $15.3 billion by 2033, growing at a CAGR of 7.2%. This growth is driven by the increasing demand for renewable energy integration and energy efficiency solutions.

What are the key market players or companies in the Battery Energy Storage industry?

Key players in the Battery Energy Storage industry include Tesla, LG Chem, Panasonic, and ABB. These companies are known for their innovations in battery technologies and energy management systems, driving advancements in the market.

What are the primary factors driving the growth in the Battery Energy Storage industry?

The primary factors driving growth in the Battery Energy Storage industry include rising energy demand, the transition to renewable energy, government incentives for energy storage solutions, and advancements in battery technologies that improve efficiency and decrease costs.

Which region is the fastest Growing in the Battery Energy Storage market?

North America is the fastest-growing region in the Battery Energy Storage market, expected to grow from a market size of $5.62 billion in 2023 to $11.48 billion by 2033, reflecting a significant increase in renewable energy investments and storage solutions.

Does ConsaInsights provide customized market report data for the Battery Energy Storage industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Battery Energy Storage industry, allowing clients to gain insights relevant to their business strategy and market positioning.

What deliverables can I expect from this Battery Energy Storage market research project?

Deliverables from the Battery Energy Storage market research project typically include detailed market analysis reports, forecasts, competitive landscape studies, segmentation data, and actionable insights to guide strategic decision-making.

What are the market trends of Battery Energy Storage?

Current trends in the Battery Energy Storage market include the rise of lithium-ion batteries, increasing adoption in residential sectors, growing investments in grid-level storage solutions, and advancements in sustainable and cost-effective storage technologies.