Battery Market Report

Published Date: 22 January 2026 | Report Code: battery

Battery Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Battery market from 2023 to 2033, featuring data on market size, growth trends, key segments, regional analysis, and competitive landscape insights. It aims to offer valuable predictions and trends critical to stakeholders and investors in the battery industry.

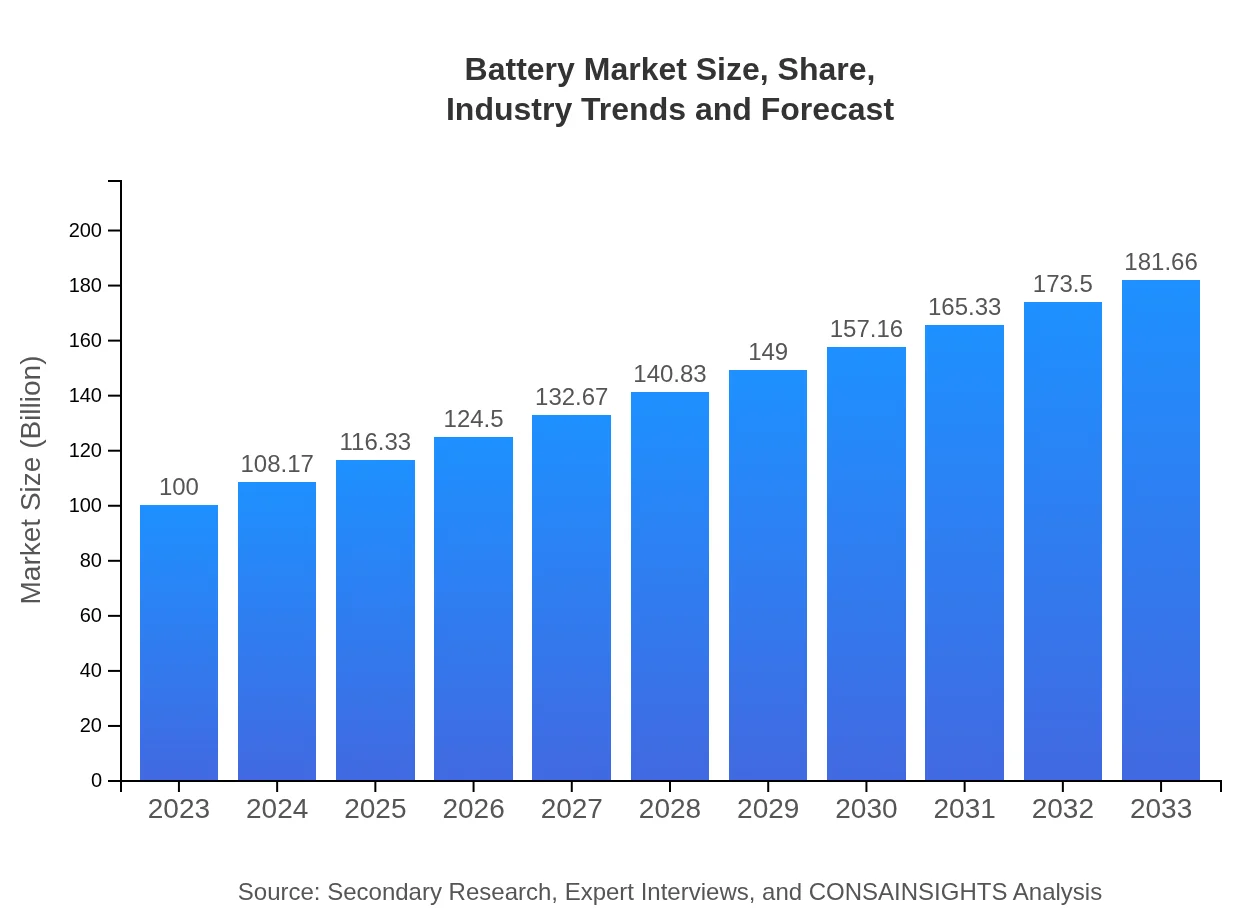

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $181.66 Billion |

| Top Companies | Tesla, Inc., Panasonic Corp., LG Chem Ltd., Samsung SDI Co., Ltd., BYD Company Ltd. |

| Last Modified Date | 22 January 2026 |

Battery Market Overview

Customize Battery Market Report market research report

- ✔ Get in-depth analysis of Battery market size, growth, and forecasts.

- ✔ Understand Battery's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery

What is the Market Size & CAGR of Battery market in 2023?

Battery Industry Analysis

Battery Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Market Analysis by Region

Europe Battery Market Report:

The European Battery market is set to rise from $24.05 billion in 2023 to $43.69 billion in 2033. The driving force behind this growth includes stringent regulations for carbon emissions and a significant push towards renewable energy sources. Countries like Germany and Sweden are leading the charge in adoption and innovation.Asia Pacific Battery Market Report:

The Asia-Pacific region is a major hub for the Battery market, with a market size projected to grow from $19.21 billion in 2023 to $34.90 billion in 2033, driven by robust demand in countries like China and Japan for electric vehicles and electronic applications. Additionally, government initiatives supporting clean energy adoption are accelerating market expansion.North America Battery Market Report:

North America’s Battery market will see substantial growth, expanding from $37.51 billion in 2023 to $68.14 billion by 2033. The rise in electric vehicle manufacturing, coupled with technological advancements in battery technologies, drives this market segment. Innovations aimed at enhancing energy efficiency and sustainability are also prevalent.South America Battery Market Report:

In South America, the Battery market is anticipated to grow from $6.93 billion in 2023 to $12.59 billion in 2033. Brazil and Argentina are leading this growth, largely due to increasing investments in renewable energy projects and infrastructure development, which bolster battery storage needs.Middle East & Africa Battery Market Report:

Middle East and Africa's Battery market is forecasted to increase from $12.30 billion in 2023 to $22.34 billion in 2033. This growth is largely fueled by a rise in renewable energy projects and government initiatives aimed at diversifying energy sources to enhance domestic production.Tell us your focus area and get a customized research report.

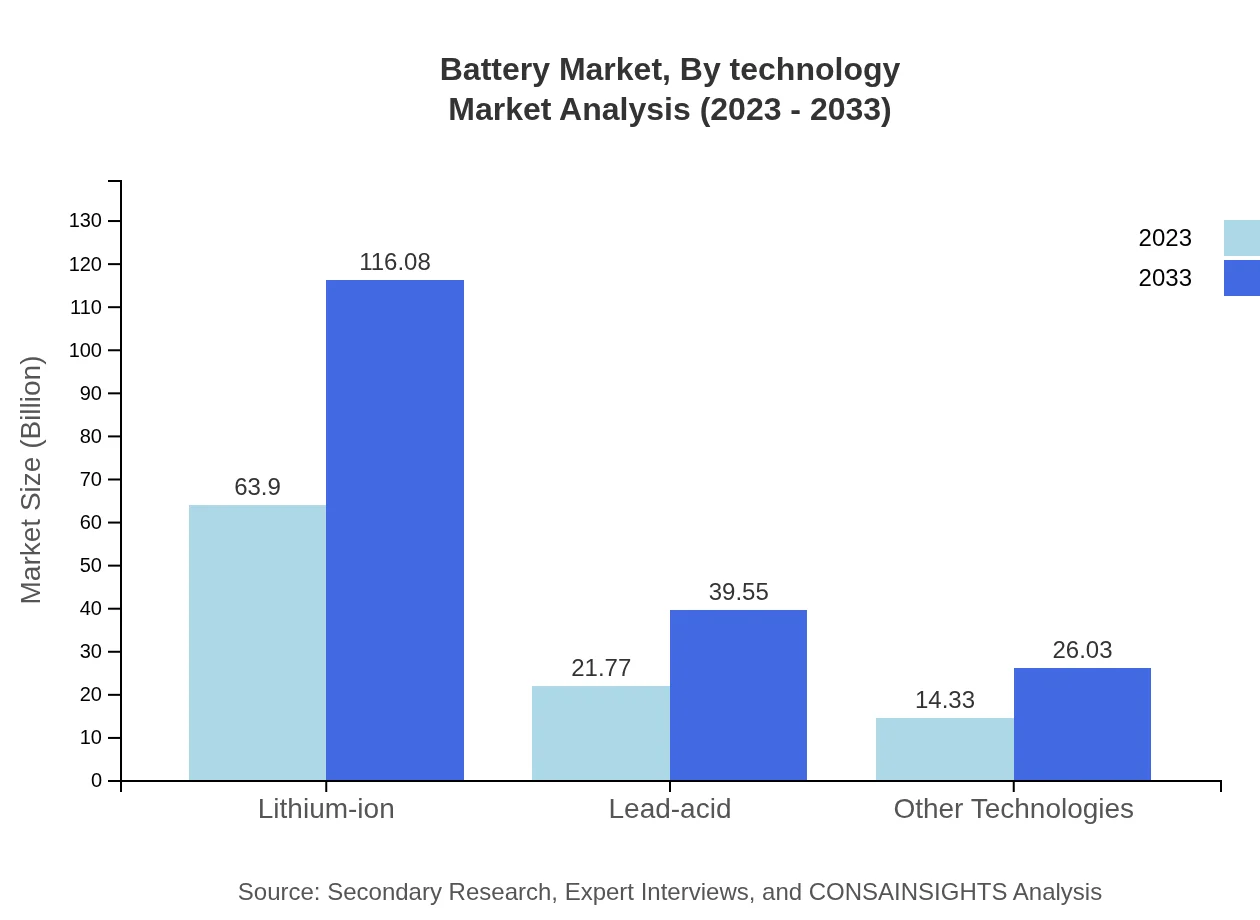

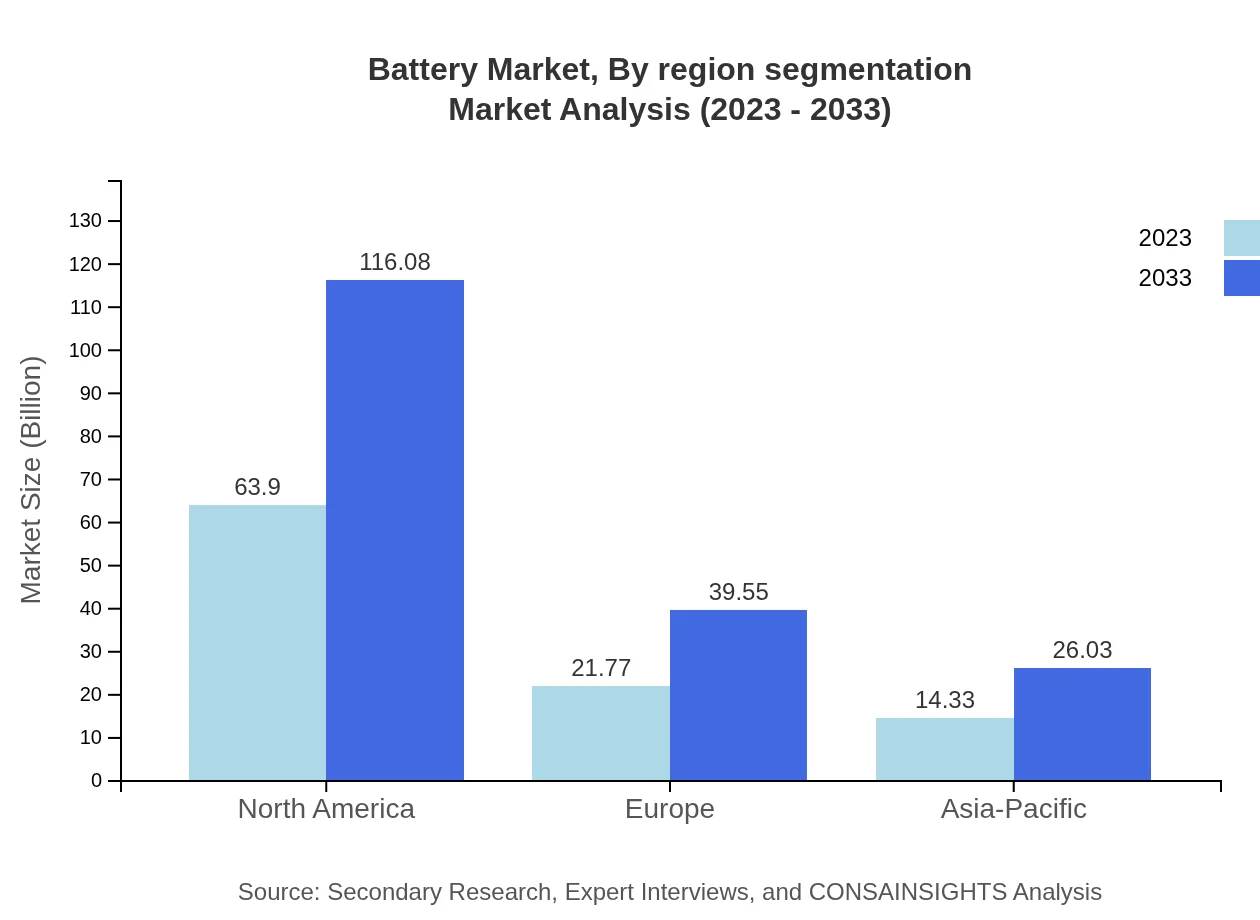

Battery Market Analysis By Technology

The technology segment shows significant performance variations across lithium-ion, lead-acid, and other technologies. Lithium-ion batteries dominate the market, projected to grow from $63.90 billion in 2023 to $116.08 billion in 2033, due to their efficiency and compact design. Lead-acid batteries, while slower growing, are still essential for applications requiring reliability and cost-effectivity, expected to expand from $21.77 billion to $39.55 billion over the same period.

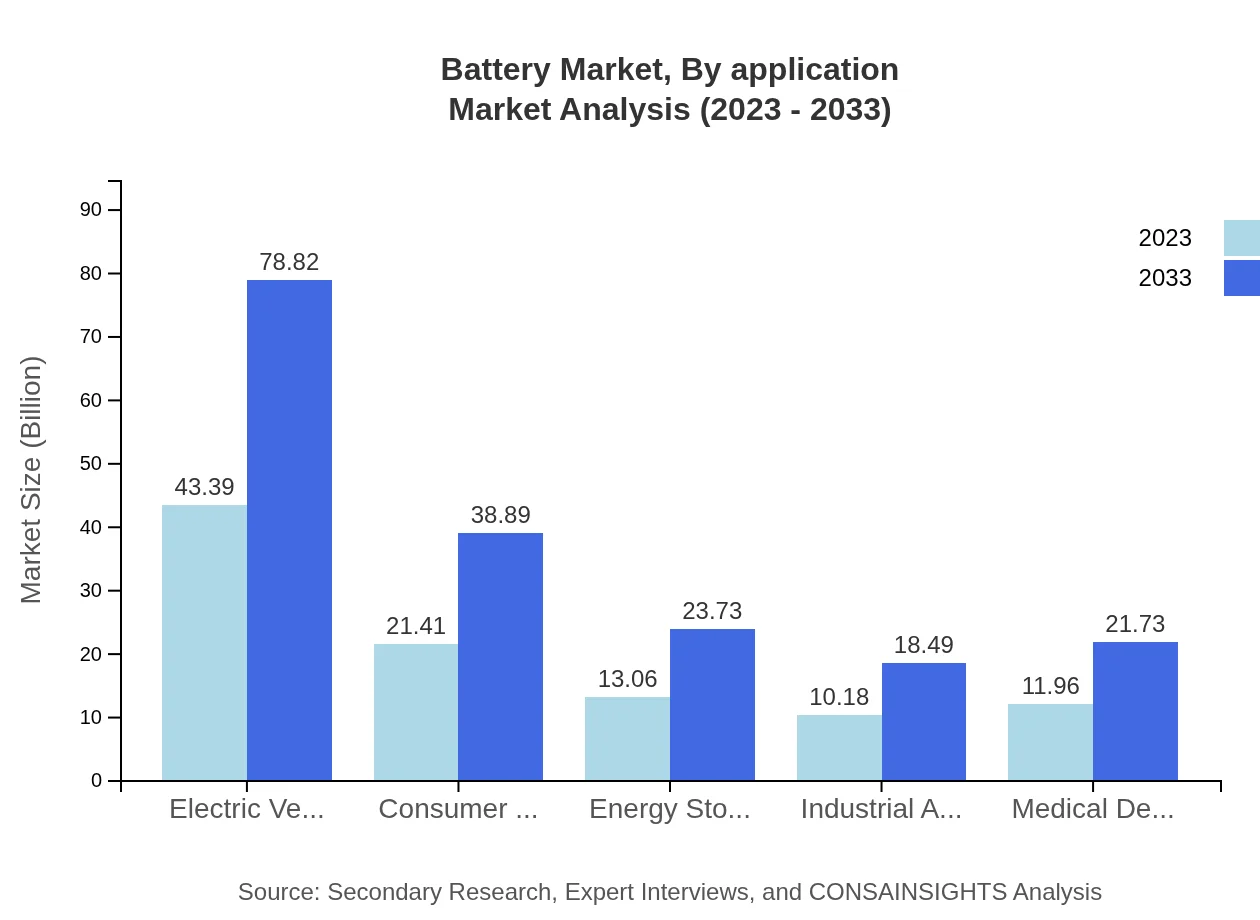

Battery Market Analysis By Application

In terms of application, the automotive industry is expected to lead the segment, rising from $43.39 billion in 2023 to $78.82 billion by 2033. Telecommunications and consumer electronics also hold significant shares, expected to grow substantially as the demand for smart devices increases, highlighting the importance of batteries in modern technology.

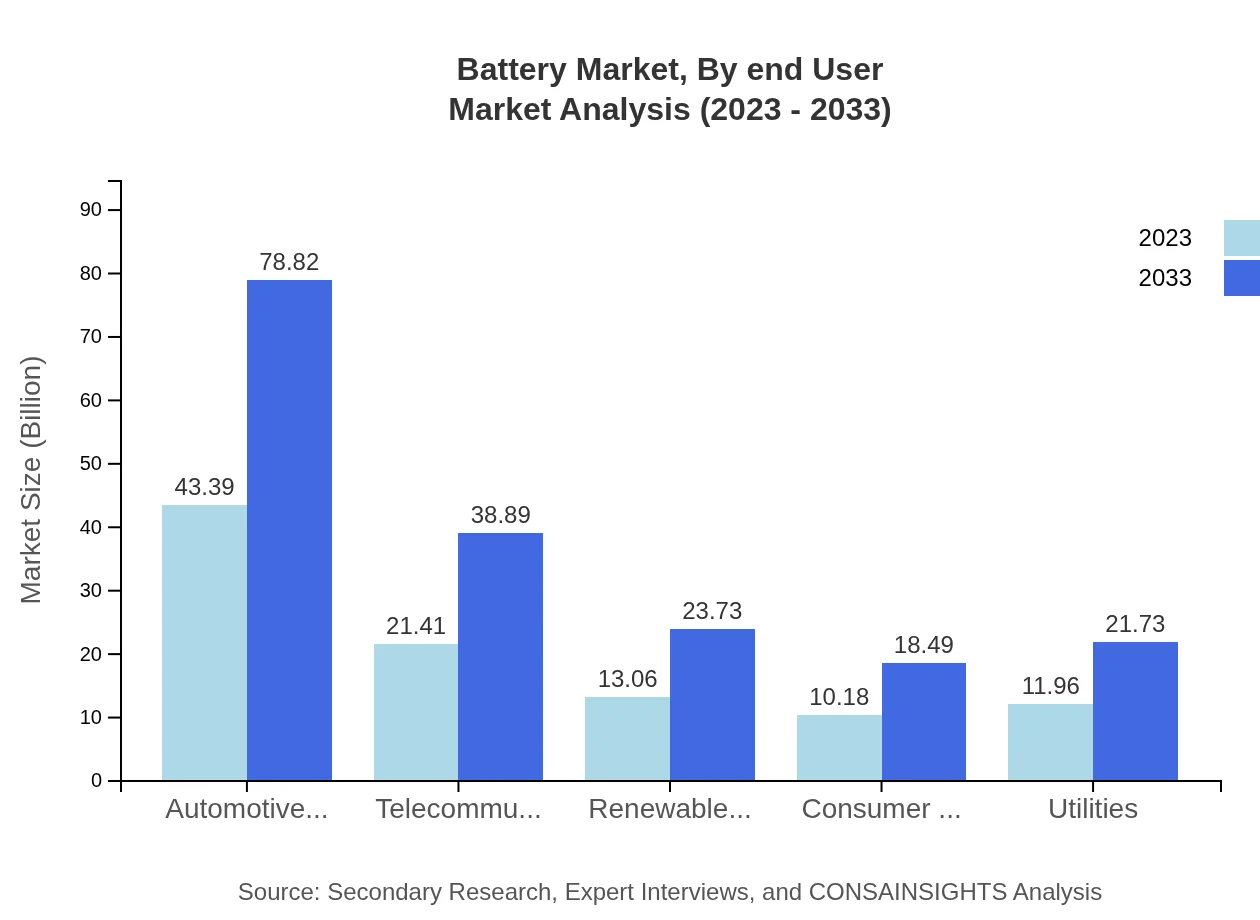

Battery Market Analysis By End User

Key end-user categories include automotive, consumer electronics, and renewable energy sectors. The automotive sector particularly stands out with a rising consumption of batteries in electric vehicles, leading the segment's growth, while the renewable energy sector is increasingly adopting battery storage solutions to stabilize energy supply.

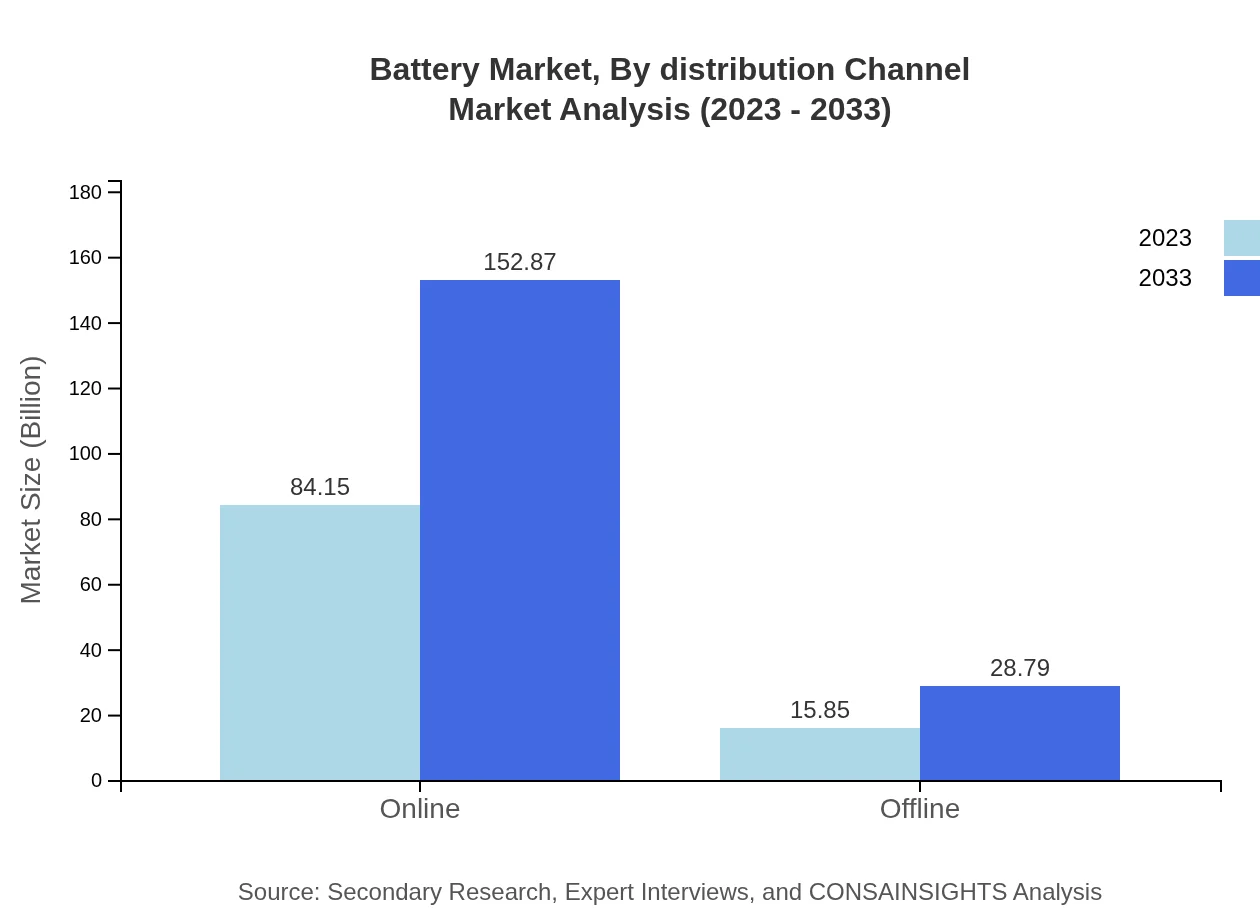

Battery Market Analysis By Distribution Channel

Distribution channels are crucial for market penetration, with online retailing emerging as a strong segment, projected to grow from $84.15 billion to $152.87 billion by 2033. Offline channels remain important, though their growth will be at a slower rate, reflecting shifting purchasing patterns.

Battery Market Analysis By Region segmentation

Regional market insights further reflect varied growth patterns influenced by local energy policies and technological advancements, influencing market dynamics significantly. Asia-Pacific remains a key region for overall demand and supply dynamics due to manufacturing dominance.

Battery Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Industry

Tesla, Inc.:

A pioneer in electric vehicle manufacturing and lithium-ion battery technologies, Tesla is known for its Gigafactories which streamline battery production and reduce costs.Panasonic Corp.:

Panasonic specializes in battery technology and is a leading supplier to the automotive and consumer electronics sectors, focusing on the development of high-performance lithium-ion batteries.LG Chem Ltd.:

As one of the largest battery manufacturers globally, LG Chem invests heavily in R&D to produce high-density batteries for electric vehicles, storage systems, and mobile devices.Samsung SDI Co., Ltd.:

Samsung SDI focuses on developing advanced lithium-ion batteries for a range of applications, including electric vehicles and consumer electronics, with a strong commitment to sustainability.BYD Company Ltd.:

BYD is a major player in the battery manufacturing space, producing batteries for electric vehicles and energy storage systems, and is recognized for its innovation in lithium iron phosphate technology.We're grateful to work with incredible clients.

FAQs

What is the market size of battery?

The battery market is projected to reach a market size of approximately $100 billion by 2033, with a CAGR of 6%. This growth signifies the escalating demand across various industries, particularly electric vehicles and renewable energy.

What are the key market players or companies in this battery industry?

Key players in the battery industry include significant manufacturers such as LG Chem, Panasonic, Samsung SDI, BYD, and Tesla. These companies dominate the market through continuous innovation and strategic partnerships, enhancing their competitive edge.

What are the primary factors driving the growth in the battery industry?

Growth is primarily driven by the increasing adoption of electric vehicles, the expansion of renewable energy storage solutions, and advancements in battery technology. Additionally, government incentives and policies promoting clean energy contribute significantly to market dynamics.

Which region is the fastest Growing in the battery market?

The fastest-growing region in the battery market is North America, projected to grow from $37.51 billion in 2023 to $68.14 billion by 2033, supported by robust electric vehicle sales and energy storage initiatives.

Does ConsaInsights provide customized market report data for the battery industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the battery industry, enabling clients to gain detailed insights and actionable data relevant to their unique business requirements.

What deliverables can I expect from this battery market research project?

Clients can expect comprehensive deliverables including market forecasts, competitive analysis, regional breakdowns, and insights into industry trends, along with detailed reports segmented by technology and application to guide strategic decisions.

What are the market trends of battery?

Current trends in the battery market include a surge in lithium-ion battery usage, increased investments in sustainable technologies, and a notable shift towards smart batteries. These elements reflect the evolving landscape influenced by innovation and environmental considerations.