Battery Materials Market Report

Published Date: 22 January 2026 | Report Code: battery-materials

Battery Materials Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Battery Materials market from 2023 to 2033, including market size, growth trends, segmentation, and regional dynamics, along with insights into key players and future forecasts.

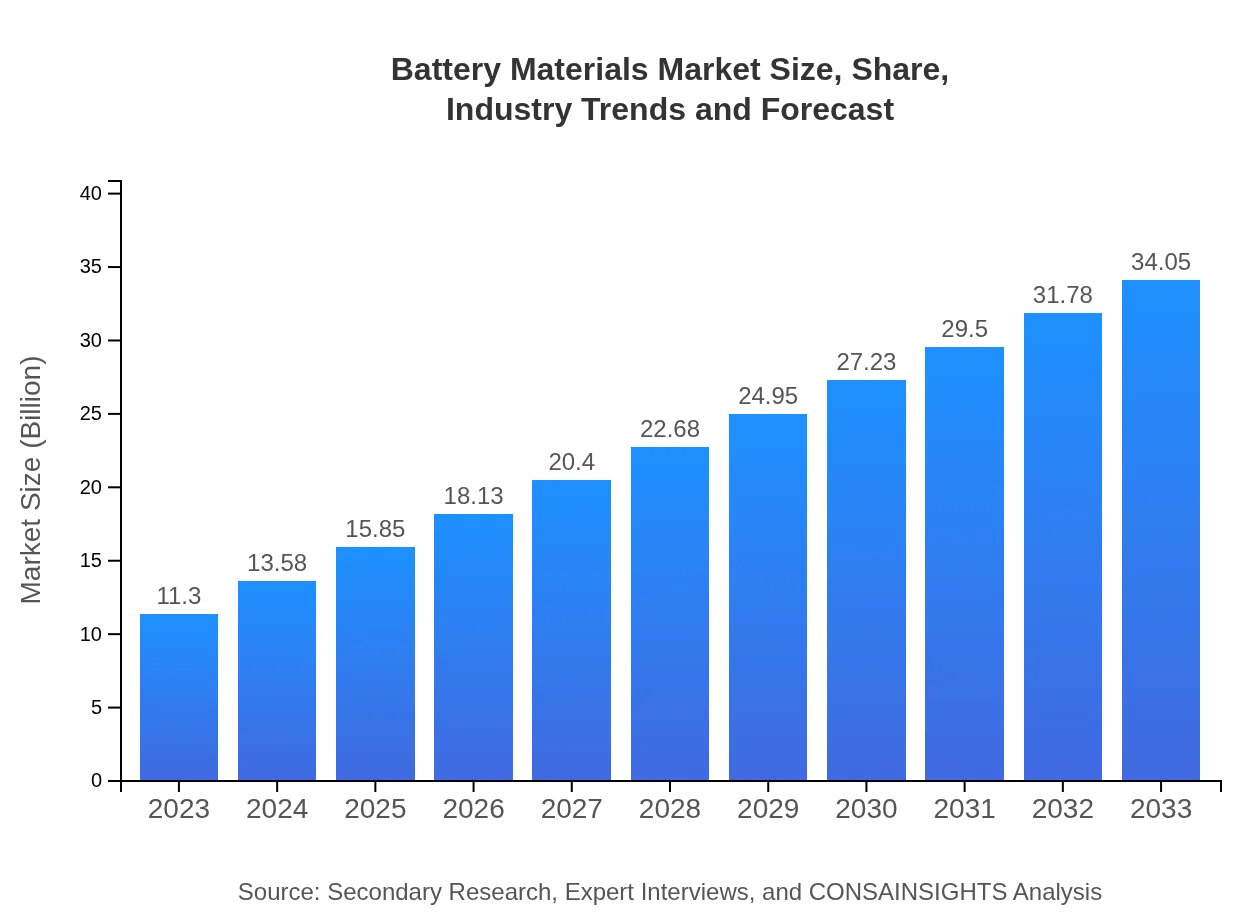

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $11.30 Billion |

| CAGR (2023-2033) | 11.2% |

| 2033 Market Size | $34.05 Billion |

| Top Companies | CATL, Livent Corporation, Umicore, Albemarle Corporation |

| Last Modified Date | 22 January 2026 |

Battery Materials Market Overview

Customize Battery Materials Market Report market research report

- ✔ Get in-depth analysis of Battery Materials market size, growth, and forecasts.

- ✔ Understand Battery Materials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery Materials

What is the Market Size & CAGR of Battery Materials market in 2023?

Battery Materials Industry Analysis

Battery Materials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Materials Market Analysis Report by Region

Europe Battery Materials Market Report:

Europe's Battery Materials market is projected to grow from $3.65 billion in 2023 to $11.01 billion by 2033. The region is becoming a hub for electric vehicle manufacturers, leading to a surge in battery material demand, catalyzed by stringent environmental regulations and a strong push towards sustainability.Asia Pacific Battery Materials Market Report:

The Asia-Pacific region dominates the Battery Materials market, with a market value of approximately $2.12 billion in 2023 projected to grow to $6.37 billion by 2033. This growth is fueled by China's significant investments in electric vehicle production and the increasing adoption of energy storage systems across countries like Japan and South Korea.North America Battery Materials Market Report:

North America is poised for substantial growth, with the market size anticipated to rise from $3.94 billion in 2023 to $11.86 billion by 2033. The increasing penetration of electric vehicles and energy efficiency initiatives are the key growth drivers, alongside technological advancements in battery chemistry.South America Battery Materials Market Report:

In South America, the market is projected to expand from $0.45 billion in 2023 to $1.37 billion by 2033. Strong demand for portable electronics and increasing government initiatives for renewable energy sources are pivotal in driving this growth in the region.Middle East & Africa Battery Materials Market Report:

In the Middle East and Africa, the market is expected to escalate from $1.14 billion in 2023 to $3.43 billion by 2033. Emerging trends of adopting renewable energy solutions and expanding portable electronics markets create promising avenues for growth.Tell us your focus area and get a customized research report.

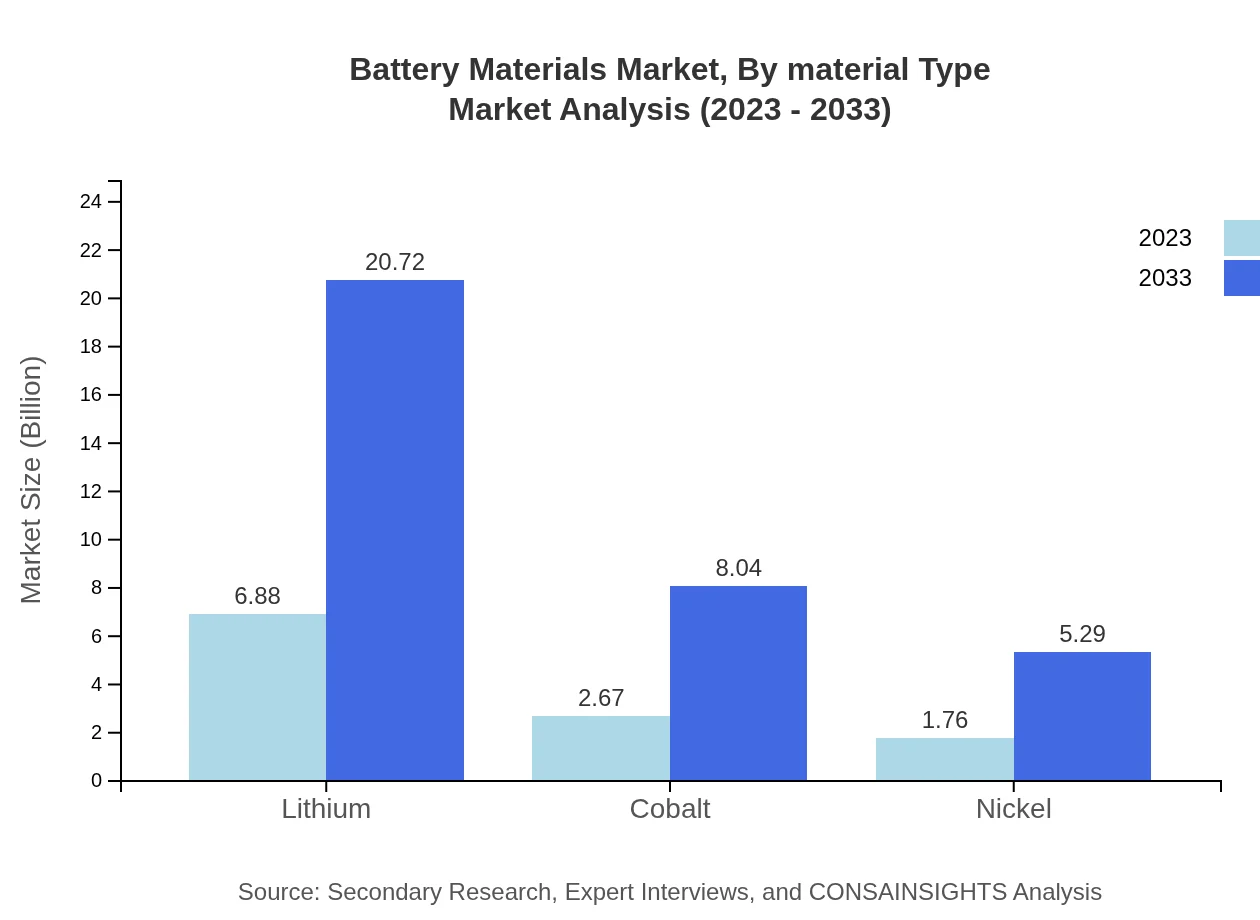

Battery Materials Market Analysis By Material Type

The analysis indicates that lithium materials dominate the market, with a size of $6.88 billion in 2023 and projected growth to $20.72 billion by 2033. Cobalt and nickel also hold significant portions, enhancing battery performance with market figures of $2.67 billion and $1.76 billion respectively in 2023.

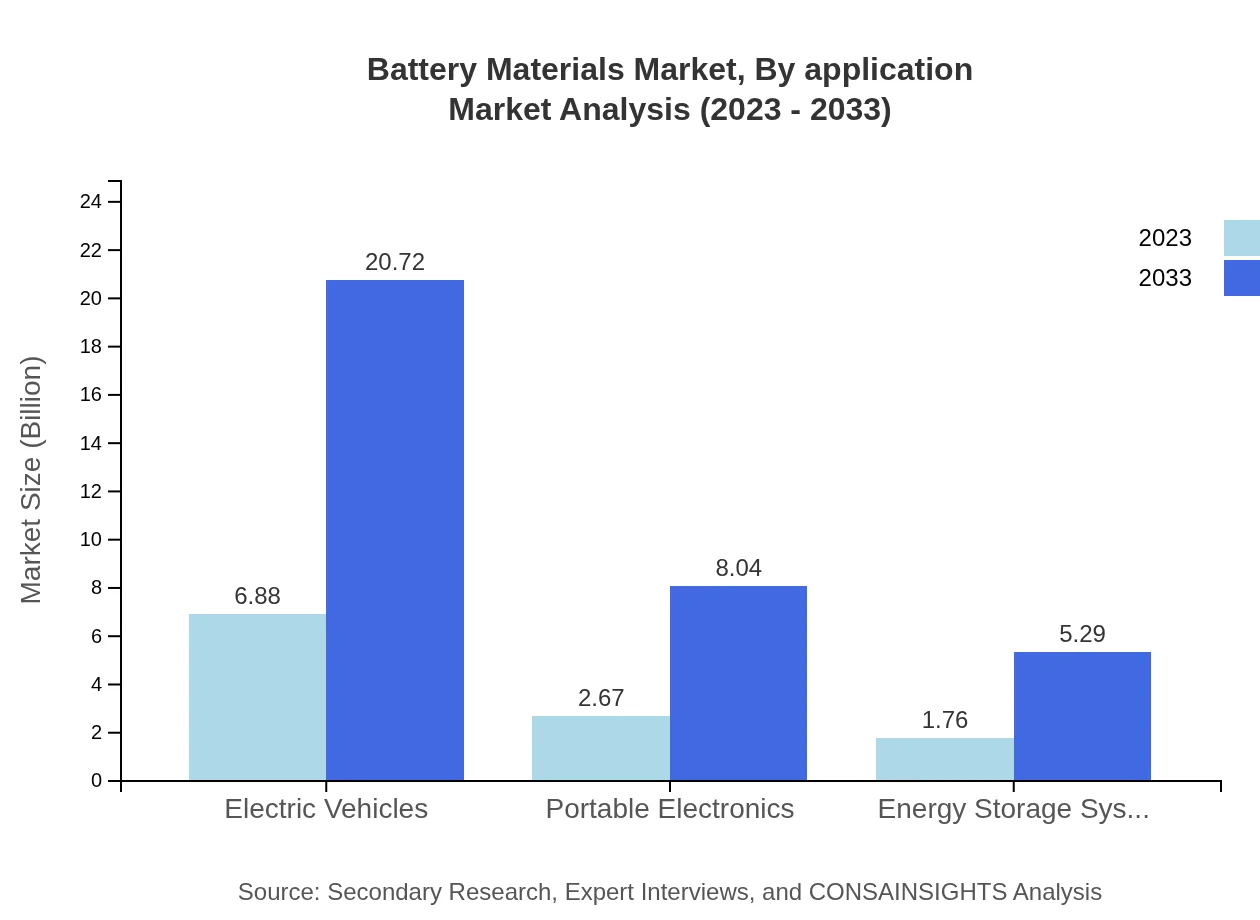

Battery Materials Market Analysis By Application

Electric vehicles comprise a significant share of the market, accounting for $6.88 billion in 2023 with a constant market share of 60.85%. Portable electronics and energy storage systems also contribute considerably, with sizes of $2.67 billion and $1.76 billion in 2023, respectively.

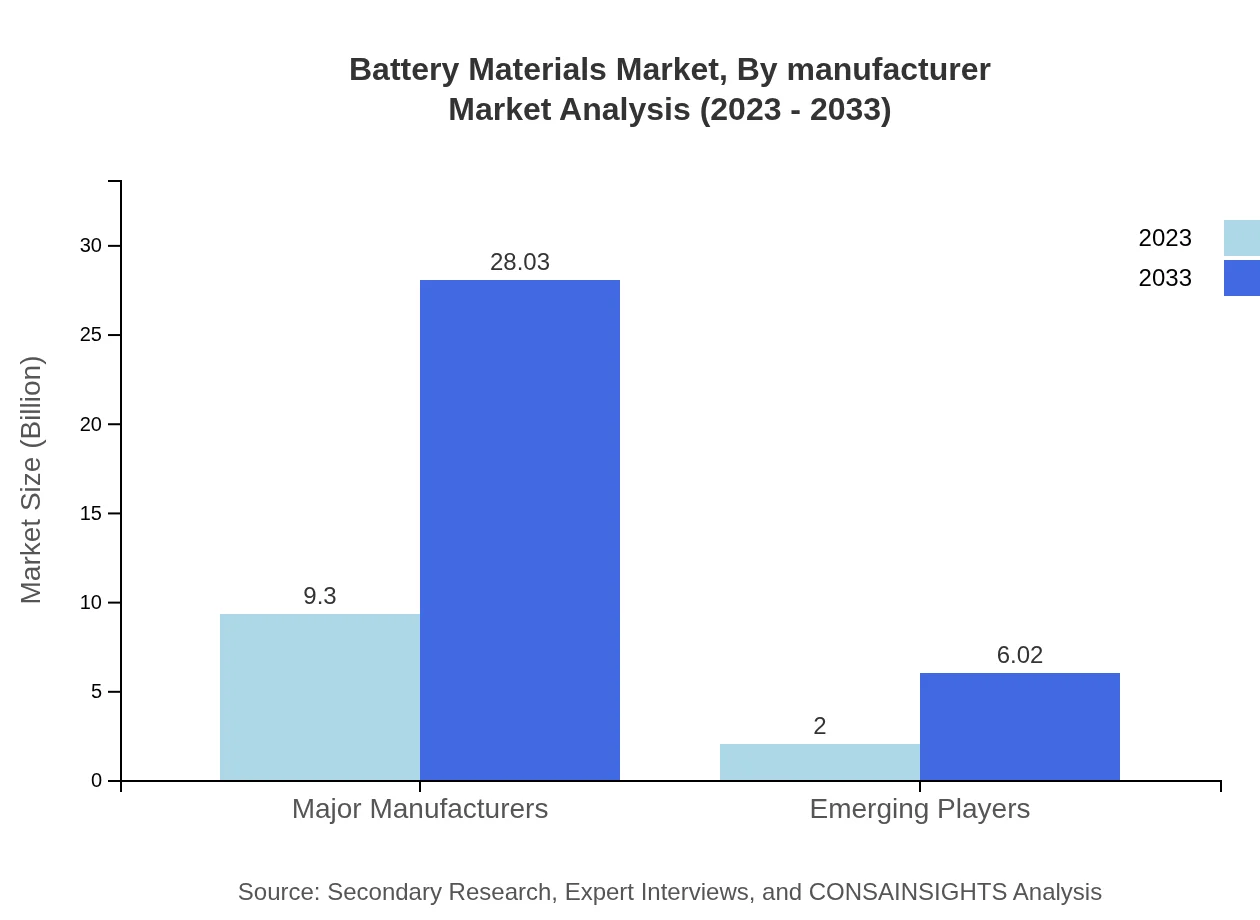

Battery Materials Market Analysis By Manufacturer

The dominance of major manufacturers is evident with a size of $9.30 billion in 2023, constituting 82.31% of the market share. Emerging players, although smaller, are seeing a significant rise, growing from $2.00 billion in 2023 to capture 17.69% of the market by 2033.

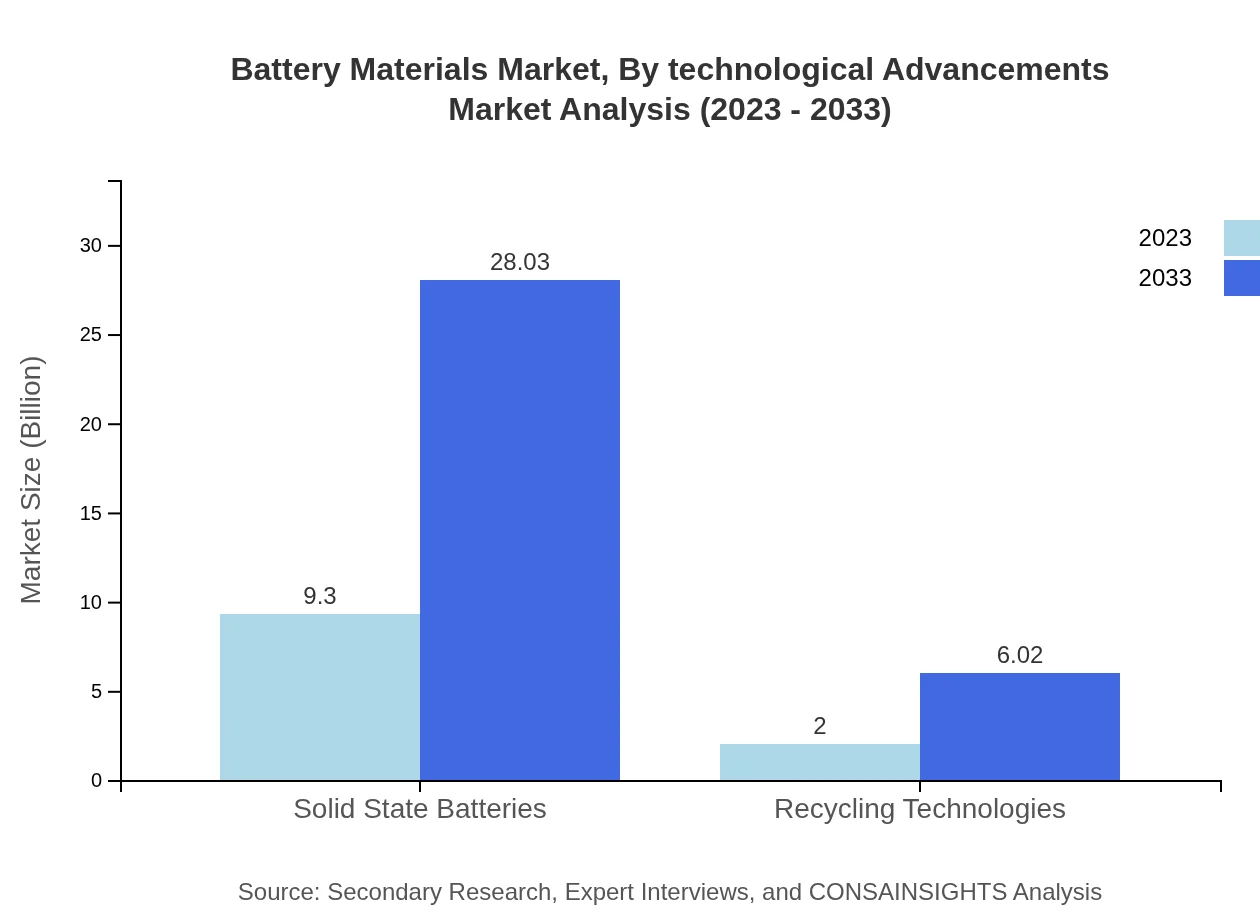

Battery Materials Market Analysis By Technological Advancements

Technological advancements in battery chemistry and recycling technologies are crucial for market growth. In 2023, traditional battery materials are valued at $9.30 billion while innovations in recycling technologies show promising growth from $2.00 to $6.02 billion by 2033.

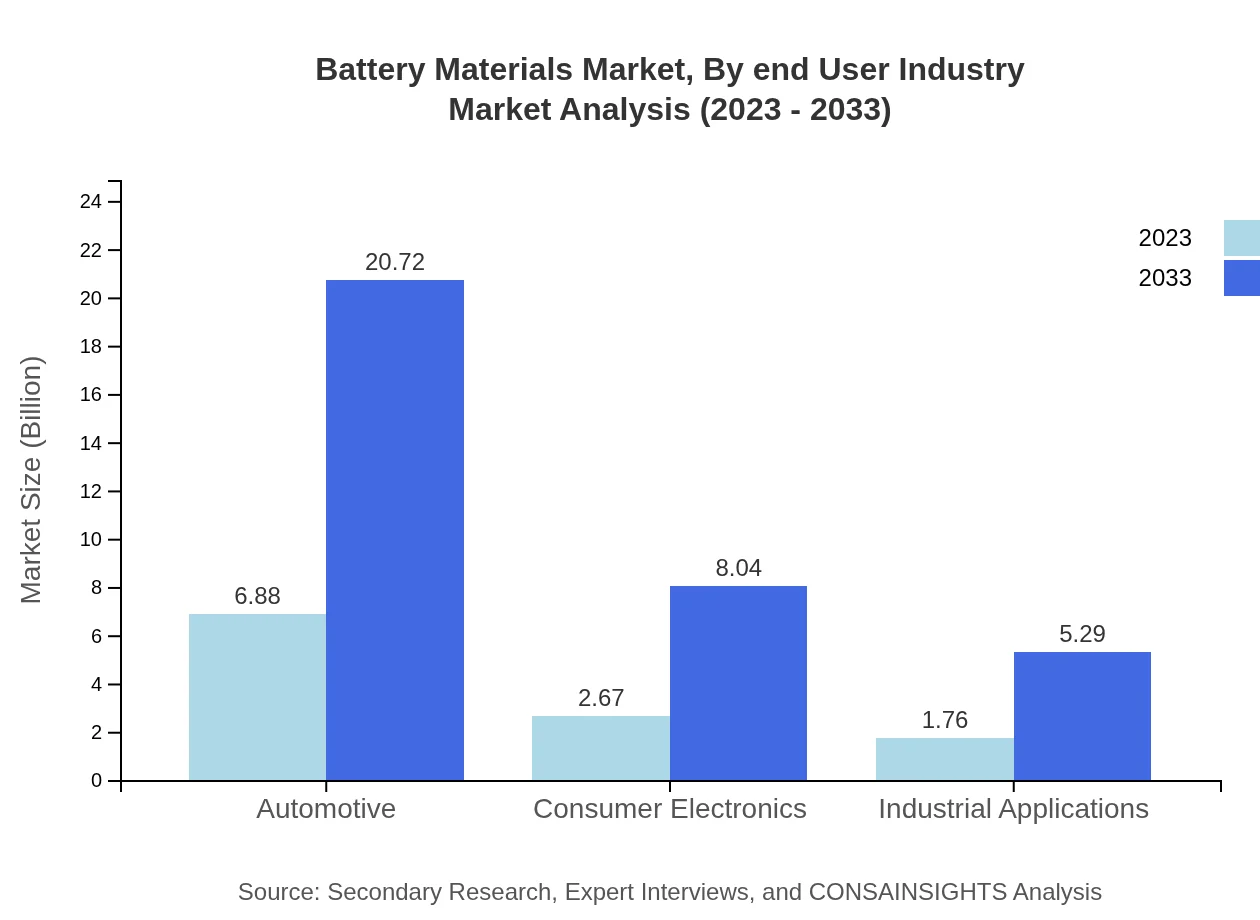

Battery Materials Market Analysis By End User Industry

Consumer electronics demonstrated a strong industry presence with a market size of $2.67 billion in 2023, while industrial applications also showcase potential growth with a value of $1.76 billion, thus showcasing the importance of battery materials in various sectors.

Battery Materials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Materials Industry

CATL:

Contemporary Amperex Technology Co., Limited (CATL) is a leading global battery manufacturer, specializing in lithium batteries for electric vehicles and energy storage solutions.Livent Corporation:

Livent produces lithium hydroxide and lithium carbonate, key materials for the lithium-ion battery market, contributing to advancements in battery technology and sustainability initiatives.Umicore:

Umicore is a global materials technology and recycling company, focusing on sustainable battery materials and recycling technologies, positioning itself as a leader in the transition to a circular economy.Albemarle Corporation:

Albemarle is a key player in the lithium and specialty chemicals market, supplying essential material components for batteries, particularly for electric vehicles.We're grateful to work with incredible clients.

FAQs

What is the market size of battery materials?

The battery materials market is projected to reach $11.3 billion by 2033, growing at a CAGR of 11.2% from its current size in 2023. This growth reflects the increasing demand for various battery technologies and innovations.

What are the key market players or companies in this battery materials industry?

Key players in the battery materials industry include major manufacturers who dominate the market share. They are pivotal in innovating and supplying lithium, cobalt, and nickel, which are essential for battery production.

What are the primary factors driving the growth in the battery materials industry?

Growth in the battery materials industry is driven by rising demand for electric vehicles, advancements in battery technologies, and the increasing focus on renewable energy solutions, leading to enhanced energy storage systems.

Which region is the fastest Growing in battery materials?

The fastest-growing region in the battery materials market is Europe, projected to grow from $3.65 billion in 2023 to $11.01 billion by 2033, showcasing significant investments in electric vehicles and renewable energy.

Does Consainsights provide customized market report data for the battery materials industry?

Yes, Consainsights offers customized market report data tailored to the specific needs of clients in the battery materials industry, ensuring relevant insights and detailed analysis for different applications and regions.

What deliverables can I expect from this battery materials market research project?

Expect comprehensive deliverables including market sizing, trend analysis, competitive landscape, segment breakdown, and regional insights, along with forecasts for the next decade in the battery materials sector.

What are the market trends of battery materials?

Current trends in the battery materials market include rising adoption of lithium-ion technologies, an emphasis on sustainable practices such as recycling, and significant shifts towards solid-state innovations providing enhanced energy density and safety.