Battery Packaging Market Report

Published Date: 22 January 2026 | Report Code: battery-packaging

Battery Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Battery Packaging market, including insights on market trends, segmentation, regional dynamics, and industry leaders from 2023 to 2033.

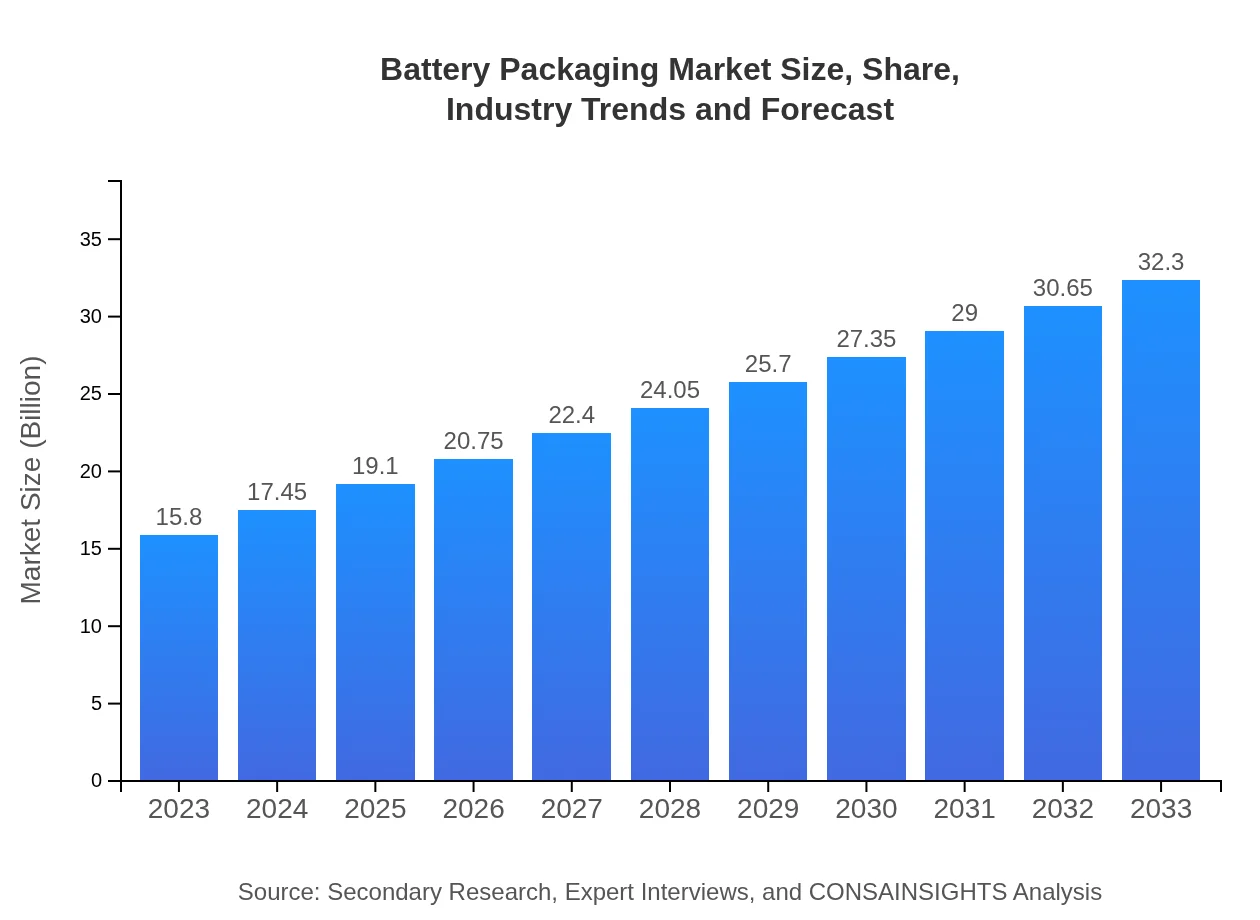

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $15.80 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $32.30 Billion |

| Top Companies | Amcor, Berry Global, Inc., Sealed Air Corporation, Schneider Electric, Dai Nippon Printing Co., Ltd. |

| Last Modified Date | 22 January 2026 |

Battery Packaging Market Overview

Customize Battery Packaging Market Report market research report

- ✔ Get in-depth analysis of Battery Packaging market size, growth, and forecasts.

- ✔ Understand Battery Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery Packaging

What is the Market Size & CAGR of the Battery Packaging market in 2023?

Battery Packaging Industry Analysis

Battery Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Packaging Market Analysis Report by Region

Europe Battery Packaging Market Report:

Europe's Battery Packaging market, valued at $5.79 billion in 2023, is expected to reach $11.84 billion by 2033. The region's commitment to sustainability and significant investments in electric vehicle infrastructure are primary growth drivers, with Germany and France at the forefront.Asia Pacific Battery Packaging Market Report:

The Asia Pacific region, valued at $2.58 billion in 2023, is projected to grow to $5.28 billion by 2033, driven by rapid industrialization and a pivotal shift towards electric vehicles. Countries like China, Japan, and South Korea lead in battery innovation and production, making the region a powerhouse in battery packaging solutions.North America Battery Packaging Market Report:

North America is anticipated to grow from $5.11 billion in 2023 to $10.44 billion in 2033. This growth is predominantly fueled by technological advancements in electric vehicles and legislative support for clean energy initiatives. The U.S. market remains a focal point for major battery packaging innovations.South America Battery Packaging Market Report:

In South America, the Battery Packaging market is expected to expand from $0.42 billion in 2023 to $0.87 billion in 2033. The growth will be spurred by increasing investments in renewable energy projects and the expanding consumer electronics market, particularly in Brazil and Argentina.Middle East & Africa Battery Packaging Market Report:

The Middle East and Africa market is projected to experience growth from $1.89 billion in 2023 to $3.87 billion in 2033, largely driven by increased adoption of electric vehicles and renewable energy solutions as countries diversify their energy sources.Tell us your focus area and get a customized research report.

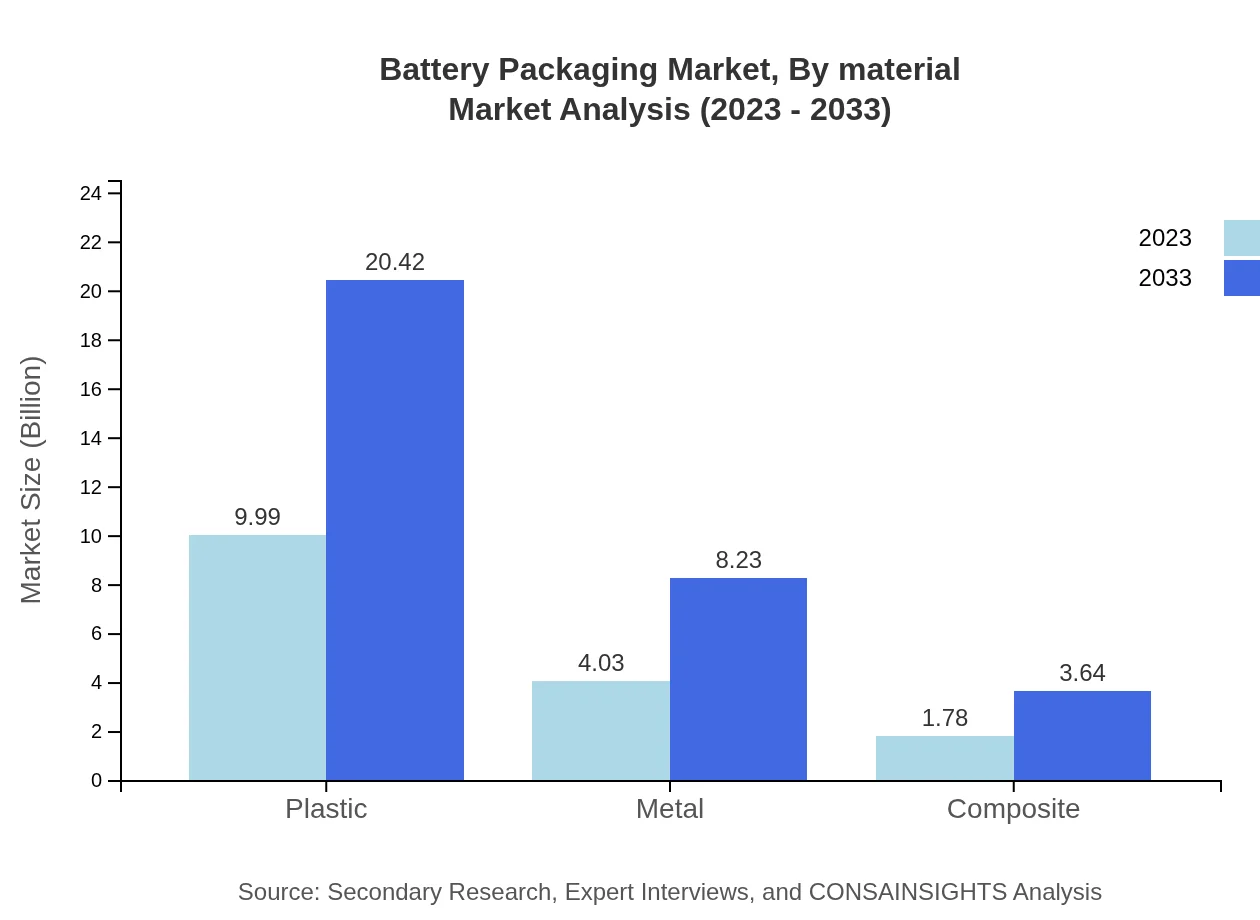

Battery Packaging Market Analysis By Material

The segment analysis of the Battery Packaging market indicates that plastic constitutes the largest portion, with a market size of $9.99 billion in 2023 and $20.42 billion in 2033. Following plastic, metal accounts for $4.03 billion in 2023 and is expected to grow significantly. Composite materials, though smaller at $1.78 billion initially, are anticipated to gain traction as demand for lightweight and durable solutions increases.

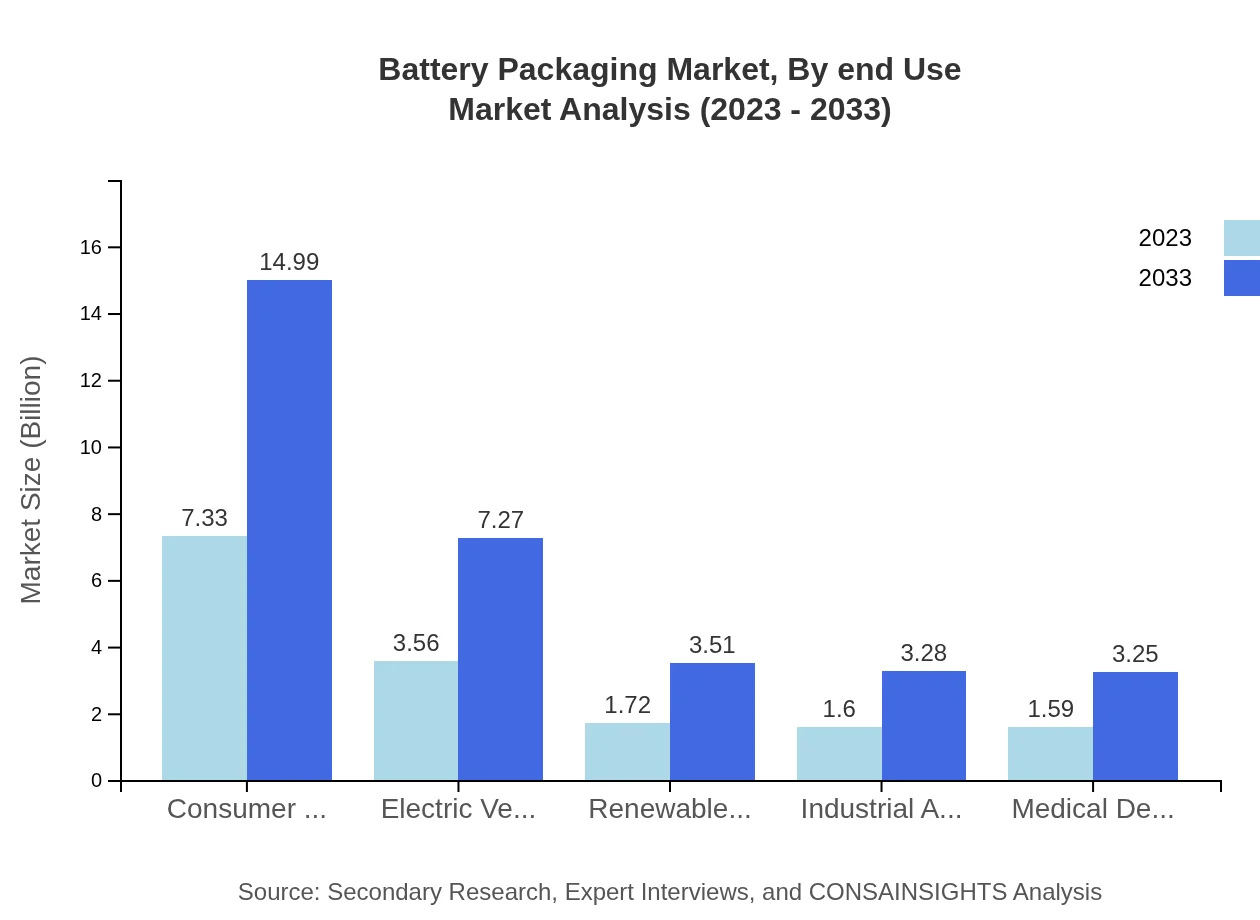

Battery Packaging Market Analysis By End Use

Based on end-use, the consumer electronics segment dominates the Battery Packaging market, with a market size of $7.33 billion in 2023 and is projected to reach $14.99 billion by 2033. Electric vehicles represent a critical segment as well, growing from $3.56 billion to $7.27 billion in the same timeframe, underscoring the transition towards sustainable transportation.

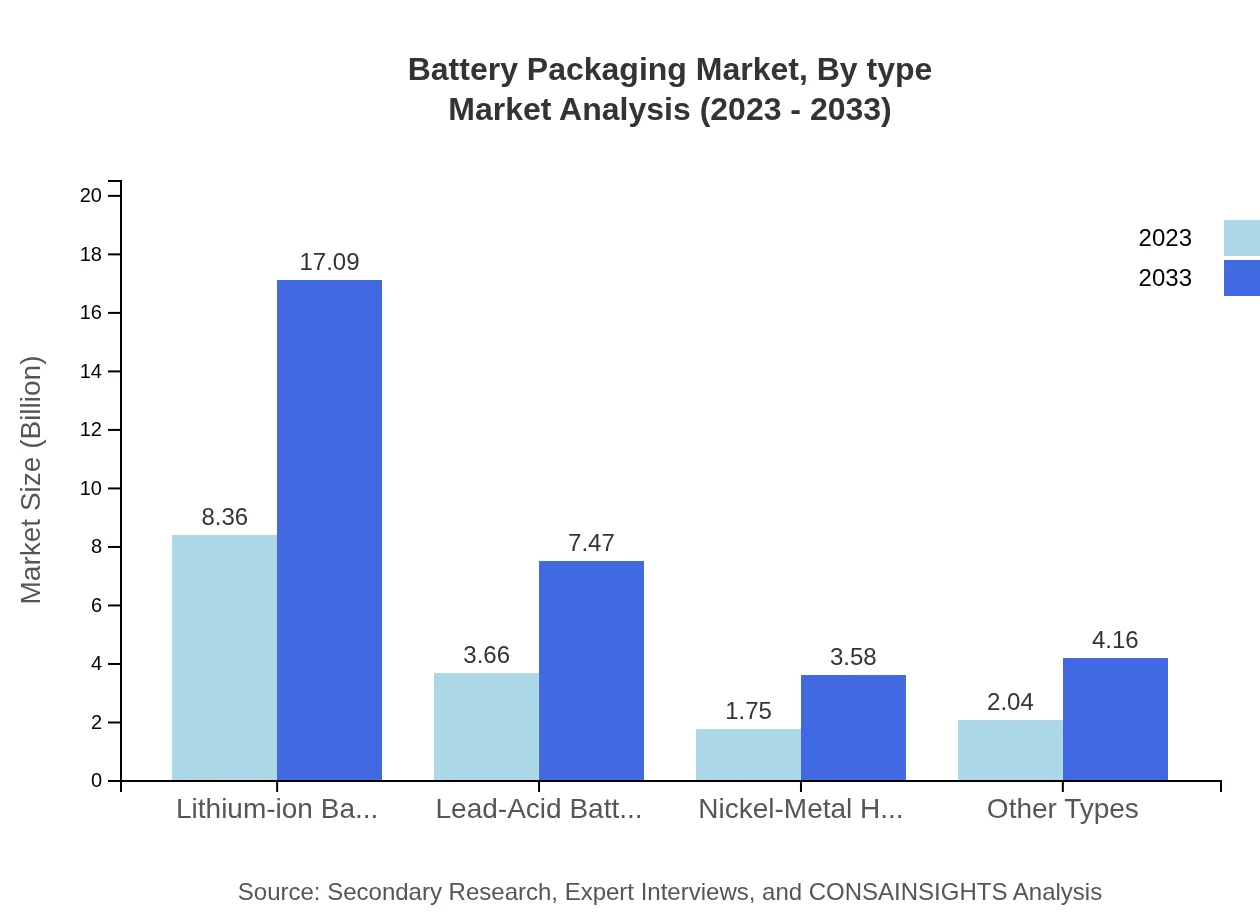

Battery Packaging Market Analysis By Type

Lithium-ion batteries are the leading segment in the Battery Packaging market, valued at $8.36 billion in 2023 and projected to expand significantly. Lead-acid batteries hold a critical share but are gradually being phased out in favor of more efficient types, while nickel-metal hydride batteries maintain a stable presence due to niche applications.

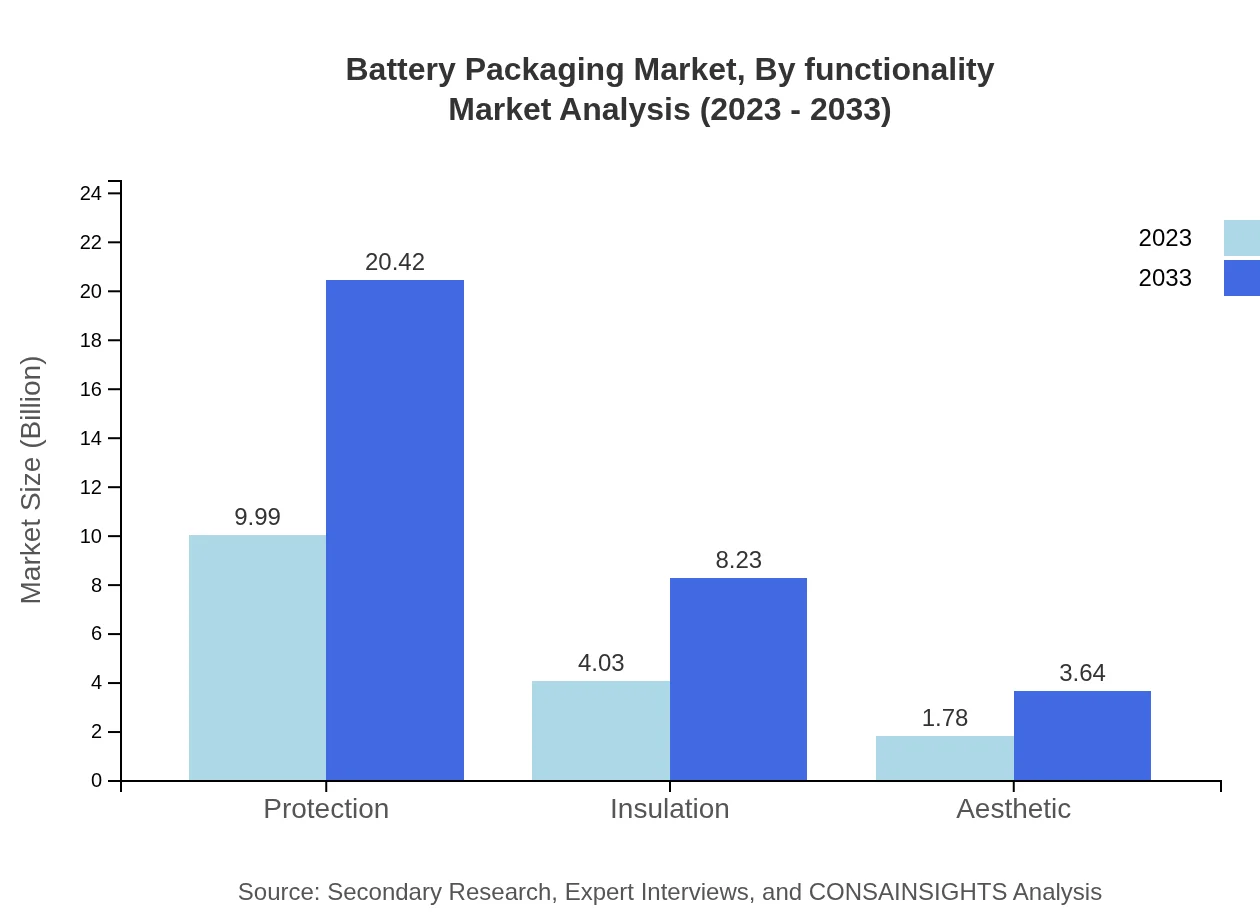

Battery Packaging Market Analysis By Functionality

In terms of functionality, protection solutions dominate the market with a significant share. This entails packaging that ensures the safety and stability of battery products during transit and usage. Insulation and aesthetic packaging functionalities are also relevant but play smaller roles overall.

Battery Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Packaging Industry

Amcor:

Amcor is a global leader in packaging solutions, known for its innovative designs and commitment to sustainability. It offers a wide range of advanced packaging solutions for the battery industry.Berry Global, Inc.:

Berry Global is a key player in the packaging industry, providing innovative protective packaging solutions for various applications, including battery packs for electronics and automotive.Sealed Air Corporation:

Sealed Air specializes in packaging and protective solutions, focusing on maintaining product integrity. Its solutions are widely used in the battery packaging sector to enhance safety and performance.Schneider Electric:

A leading energy management company that also provides advanced storage solutions, including battery packaging systems that ensure energy efficiency.Dai Nippon Printing Co., Ltd.:

A significant contributor to the battery packaging market, Dai Nippon Printing is focused on integrating packaging with advanced technology to enhance battery safety and functionality.We're grateful to work with incredible clients.

FAQs

What is the market size of battery Packaging?

The global battery packaging market is valued at approximately $15.8 billion in 2023 and is projected to grow with a CAGR of 7.2% through 2033.

What are the key market players or companies in this battery Packaging industry?

The battery packaging industry features major players including Samsung SDI, LG Chem, Panasonic, and Contemporary Amperex Technology Co., Ltd (CATL), each contributing significantly to product innovations and market expansion.

What are the primary factors driving the growth in the battery Packaging industry?

Key factors fueling market growth include rising demand for electric vehicles, advancements in battery technology, and a growing emphasis on renewable energy storage solutions, contributing to increased battery utilization.

Which region is the fastest Growing in the battery Packaging?

Asia-Pacific is set to become the fastest-growing region, increasing from $2.58 billion in 2023 to $5.28 billion by 2033, propelled by heightened consumer electronics and electric vehicle production.

Does ConsaInsights provide customized market report data for the battery Packaging industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the battery-packaging industry, supporting strategic planning and informed decision-making.

What deliverables can I expect from this battery Packaging market research project?

Deliverables include comprehensive reports, market analysis data, trend summaries, competitive landscape reviews, and strategic recommendations tailored for informed stakeholder decisions.

What are the market trends of battery Packaging?

Market trends include an increased focus on sustainable packaging materials, innovations in lithium-ion technology, and growing investments in battery recycling processes, responding to environmental concerns.

What are the market segments in the battery Packaging industry?

The battery packaging market consists of segments like lithium-ion (52.91% share), lead-acid (23.14% share), and consumer electronics (46.41% share), with notable growth in each segment projected by 2033.