Battery Raw Material Market Report

Published Date: 02 February 2026 | Report Code: battery-raw-material

Battery Raw Material Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Battery Raw Material market from 2023 to 2033, including trends, regional insights, market size, and forecasts for various segments. It aims to equip stakeholders with vital data for strategic planning and decision-making.

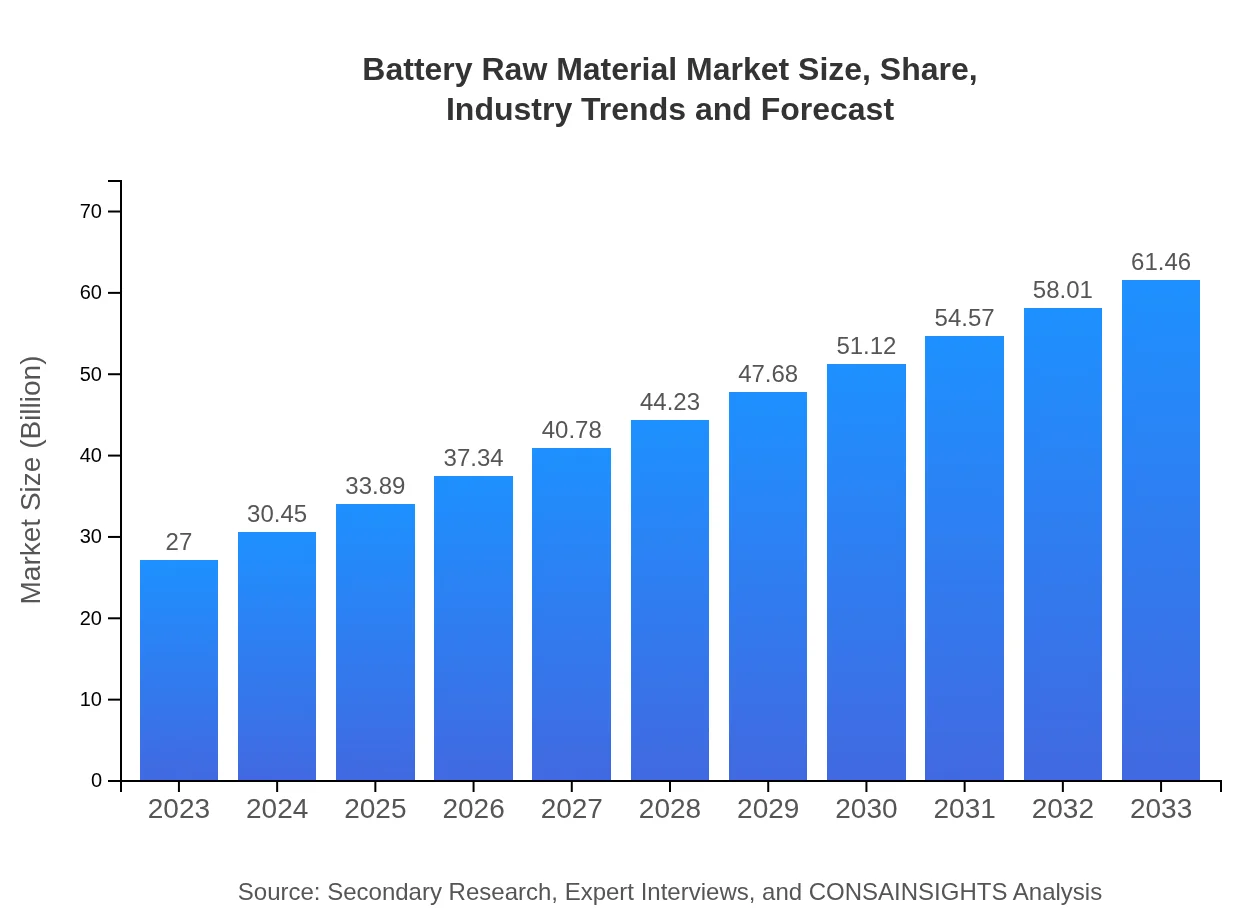

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $27.00 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $61.46 Billion |

| Top Companies | Albemarle Corporation, SQM, Ganfeng Lithium, Vale S.A., BHP Group |

| Last Modified Date | 02 February 2026 |

Battery Raw Material Market Overview

Customize Battery Raw Material Market Report market research report

- ✔ Get in-depth analysis of Battery Raw Material market size, growth, and forecasts.

- ✔ Understand Battery Raw Material's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battery Raw Material

What is the Market Size & CAGR of Battery Raw Material market in 2023?

Battery Raw Material Industry Analysis

Battery Raw Material Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battery Raw Material Market Analysis Report by Region

Europe Battery Raw Material Market Report:

Europe's Battery Raw Material market stands at $8.16 billion in 2023 and is forecasted to reach $18.58 billion by 2033. Europe's robust regulatory framework for battery recycling and sustainability practices boosts the adoption of raw materials for energy-efficient battery alternatives.Asia Pacific Battery Raw Material Market Report:

The Asia Pacific region holds a significant share of the Battery Raw Material market, with a market size of $4.62 billion in 2023, projected to grow to $10.51 billion by 2033. The surge is driven by major manufacturing hubs in countries like China, Japan, and South Korea that are investing heavily in battery production and technology.North America Battery Raw Material Market Report:

North America, with a market currently valued at $10.30 billion in 2023, is projected to grow to $23.43 billion by 2033. The increasing shift toward electric vehicles and government incentives for green energy initiatives are key drivers of this growth.South America Battery Raw Material Market Report:

The South American market is valued at $2.18 billion in 2023, expected to reach $4.95 billion by 2033. The region holds vast natural resources, particularly lithium reserves in countries such as Argentina and Chile, making it a critical player in the industry.Middle East & Africa Battery Raw Material Market Report:

The Middle East and Africa region shows a market size of $1.75 billion in 2023, anticipated to expand to $3.98 billion by 2033. Increased investments in mining and processing of critical battery materials are expected to foster this growth, alongside rising energy demands from renewable resources.Tell us your focus area and get a customized research report.

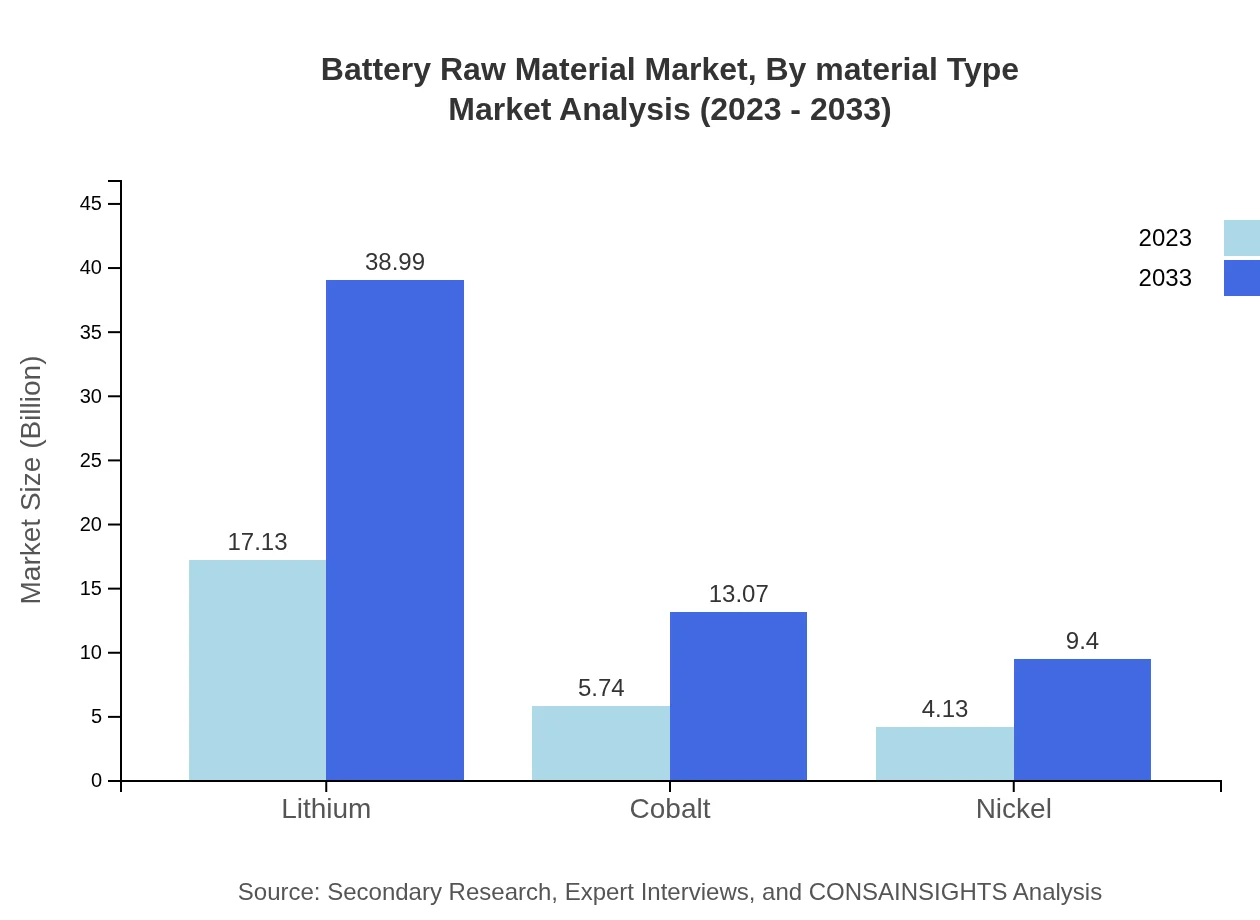

Battery Raw Material Market Analysis By Material Type

The Battery Raw Material market by material type indicates a strong emphasis on lithium, with a market size of $17.13 billion in 2023, estimated to reach $38.99 billion by 2033. Cobalt follows closely, projected to grow from $5.74 billion in 2023 to $13.07 billion in 2033. Nickel remains pivotal for its contribution to battery performance, projected to grow from $4.13 billion to $9.40 billion in the same period.

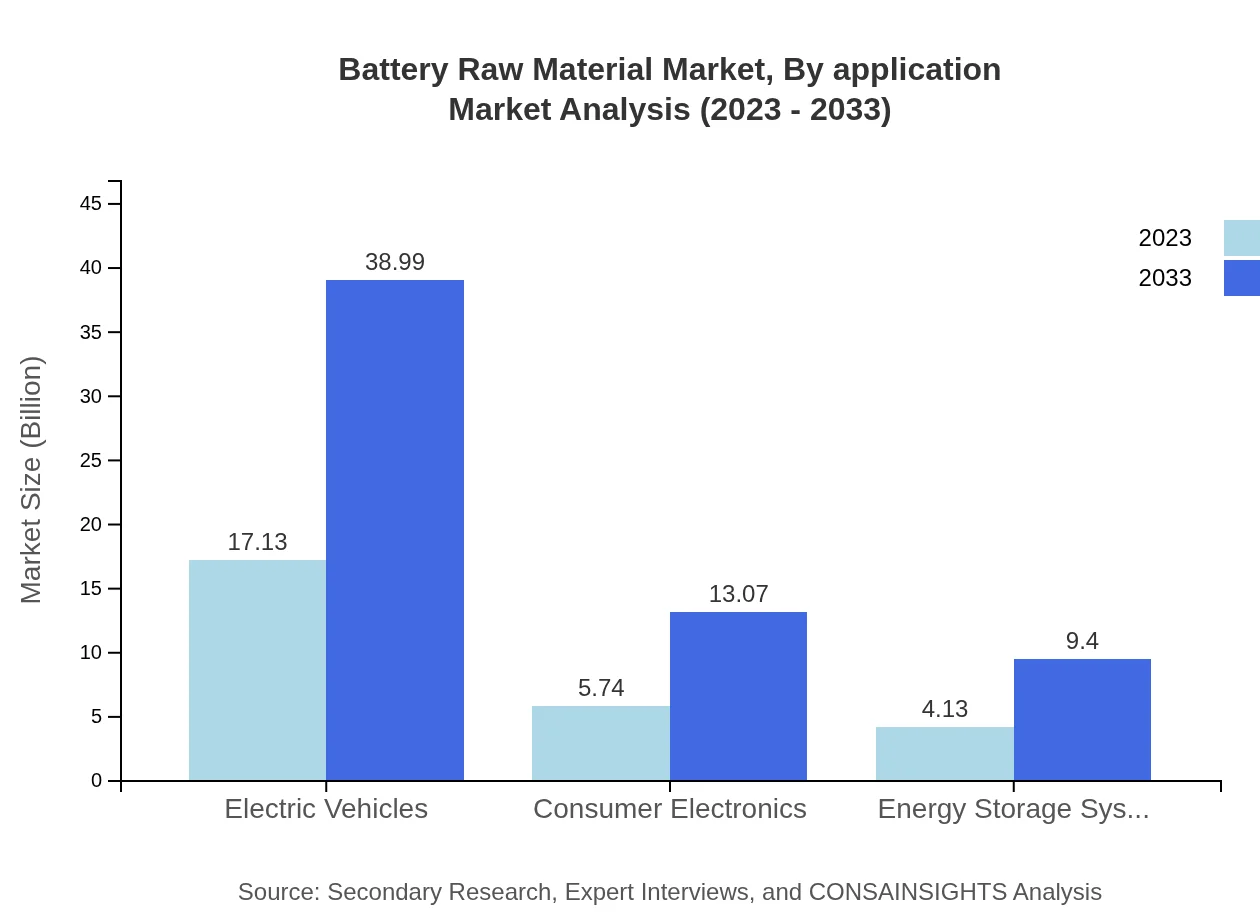

Battery Raw Material Market Analysis By Application

The Battery Raw Material market by application reveals significant growth in electric vehicles, which command a market share of 63.44% in 2023, projected to maintain the same share by 2033. This sector alone is expected to increase from $17.13 billion to $38.99 billion. Consumer electronics and energy storage systems also play vital roles, with respective market sizes of $5.74 billion and $4.13 billion in 2023, growing to $13.07 billion and $9.40 billion by 2033.

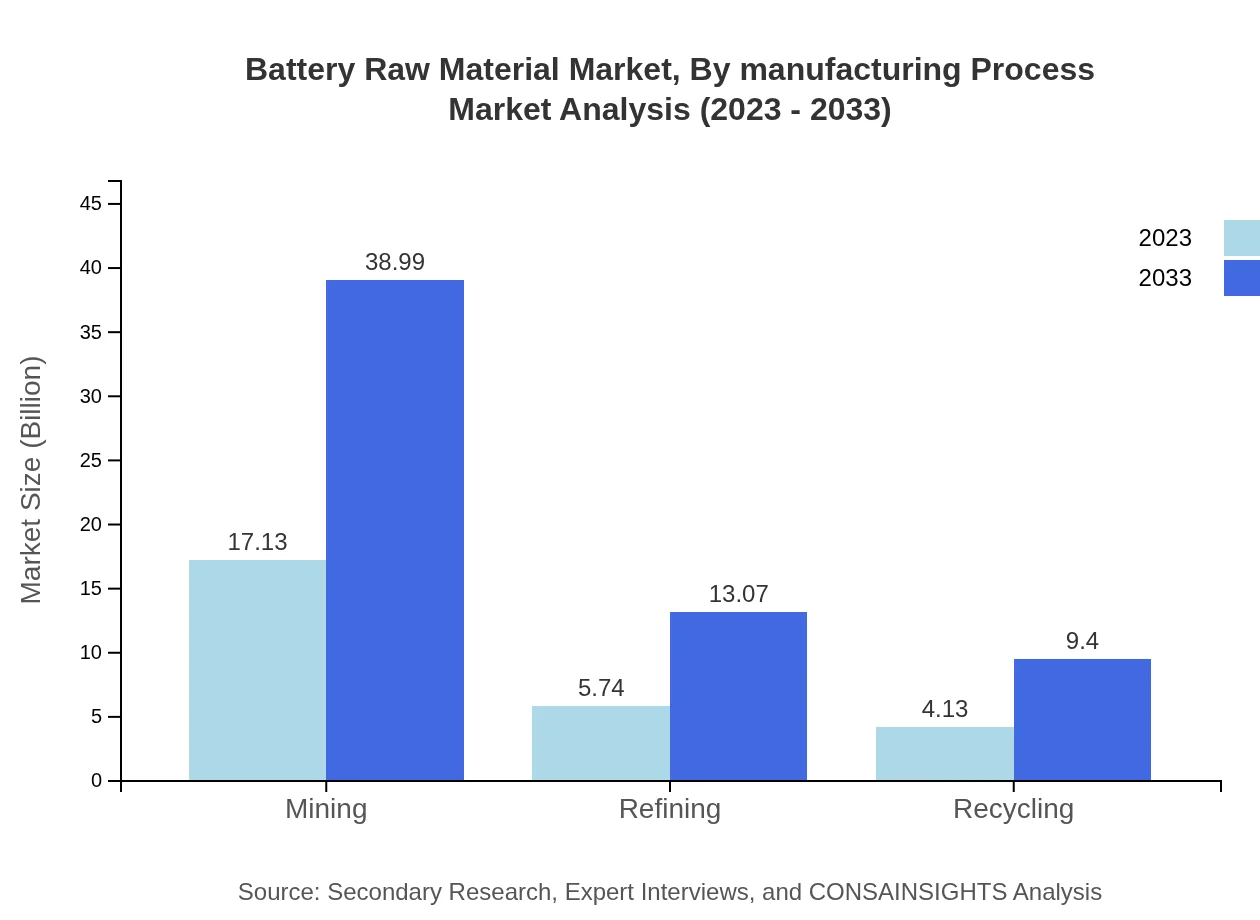

Battery Raw Material Market Analysis By Manufacturing Process

By manufacturing process, the market highlights upstream segments (lithium extraction and refining) with significant sizes of $17.13 billion (2023) and $38.99 billion (2033). Midstream processes exhibit a market value of $5.74 billion, growing to $13.07 billion, while downstream processes account for $4.13 billion in 2023, expected to rise to $9.40 billion by 2033.

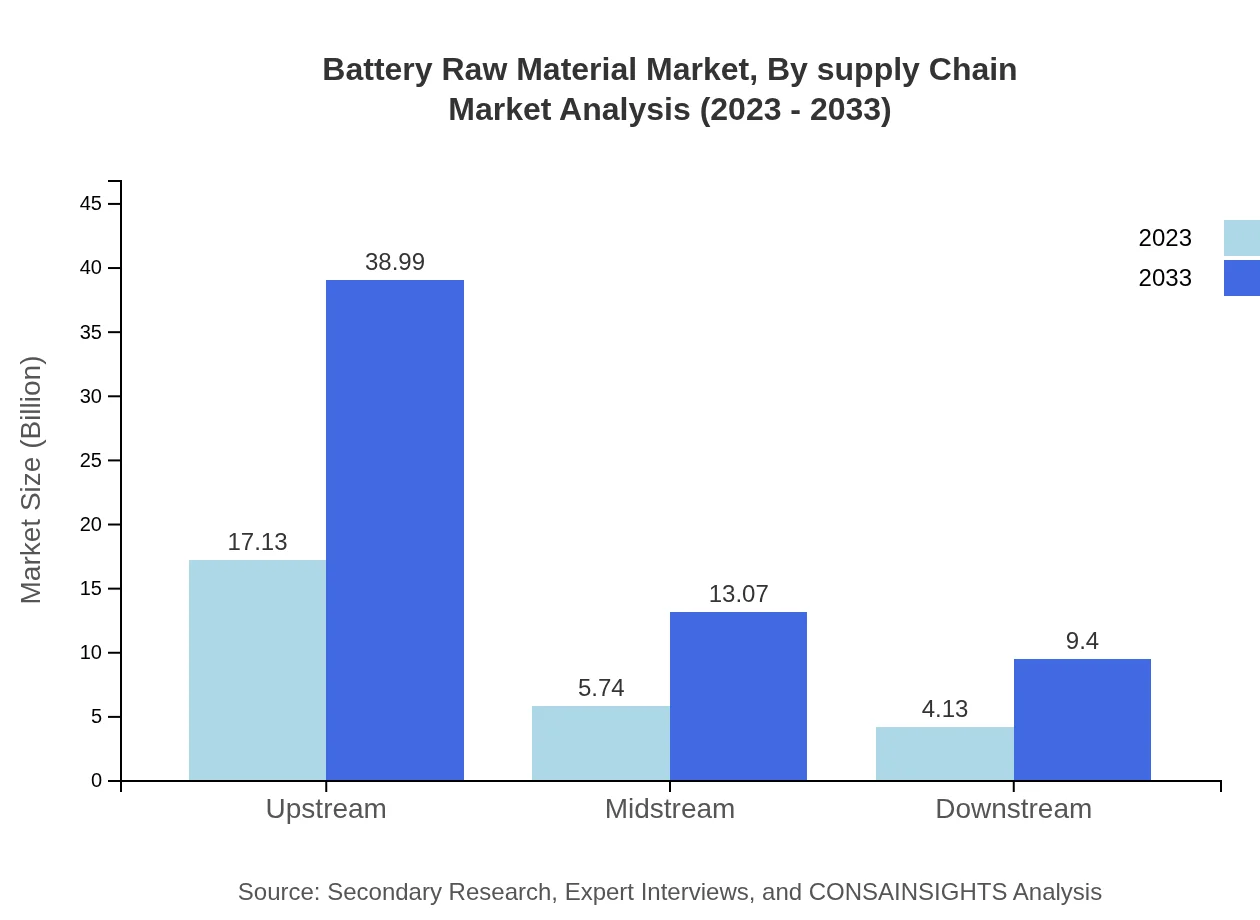

Battery Raw Material Market Analysis By Supply Chain

The Battery Raw Material market by supply chain illustrates robust growth across all stages. Upstream operations dominate with a market size of $17.13 billion in 2023, projected to reach $38.99 billion by 2033. Midstream markets show growth from $5.74 billion to $13.07 billion, while downstream markets, primarily concerned with battery production and recycling, grow from $4.13 billion to $9.40 billion.

Battery Raw Material Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battery Raw Material Industry

Albemarle Corporation:

A key player in the lithium production market, Albemarle is prominent for its innovative solutions in lithium, bromine, and refining technologies.SQM:

SQM is one of the world's largest lithium producers, focusing on sustainable practices and expanding its lithium carbonate production capabilities to meet rising global demand.Ganfeng Lithium:

Ganfeng Lithium has established itself as a leading lithium producer with a focus on comprehensive mining and refining processes, enhancing the supply chain.Vale S.A.:

As a major player in the mining sector, Vale is involved in nickel production and has implemented projects aiming for sustainable mining practices.BHP Group:

BHP is a leading global resources company with operations in nickel and copper, emphasizing innovation and sustainability in its extraction processes.We're grateful to work with incredible clients.

FAQs

What is the market size of battery Raw Material?

The battery raw material market is valued at $27 billion in 2023, with a projected CAGR of 8.3% through 2033. The growing demand for electric vehicles and energy storage systems significantly drives this market expansion.

What are the key market players or companies in this battery Raw Material industry?

Key players in the battery raw material market include major mining companies, battery manufacturers, and chemical suppliers that specialize in lithium, cobalt, and nickel production, all integral to battery manufacturing processes.

What are the primary factors driving the growth in the battery Raw Material industry?

Factors driving growth in the battery raw materials industry include the rapid growth in electric vehicle production, increasing demand for renewable energy storage, and advancements in battery technology that require high-quality raw materials.

Which region is the fastest Growing in the battery Raw Material?

The North America region is the fastest-growing market for battery raw materials, with a market value projected to increase from $10.30 billion in 2023 to $23.43 billion by 2033.

Does ConsaInsights provide customized market report data for the battery Raw Material industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs, focusing on particular segments or geographical areas of interest in the battery raw materials market.

What deliverables can I expect from this battery Raw Material market research project?

Clients can expect comprehensive market analysis reports, data visualizations, trend forecasts, competitive analysis, and insights that facilitate informed decision-making in the battery raw materials sector.

What are the market trends of battery Raw Material?

Current trends in the battery raw materials market include a shift toward sustainable sourcing practices, increased recycling efforts, and innovations in battery technology, driving demand for efficient and eco-friendly materials.