Battlefield Management System Bms Market Report

Published Date: 03 February 2026 | Report Code: battlefield-management-system-bms

Battlefield Management System Bms Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Battlefield Management System (BMS) market from 2023 to 2033, including market insights, trends, size, and forecasts, along with a detailed segmentation and regional analysis.

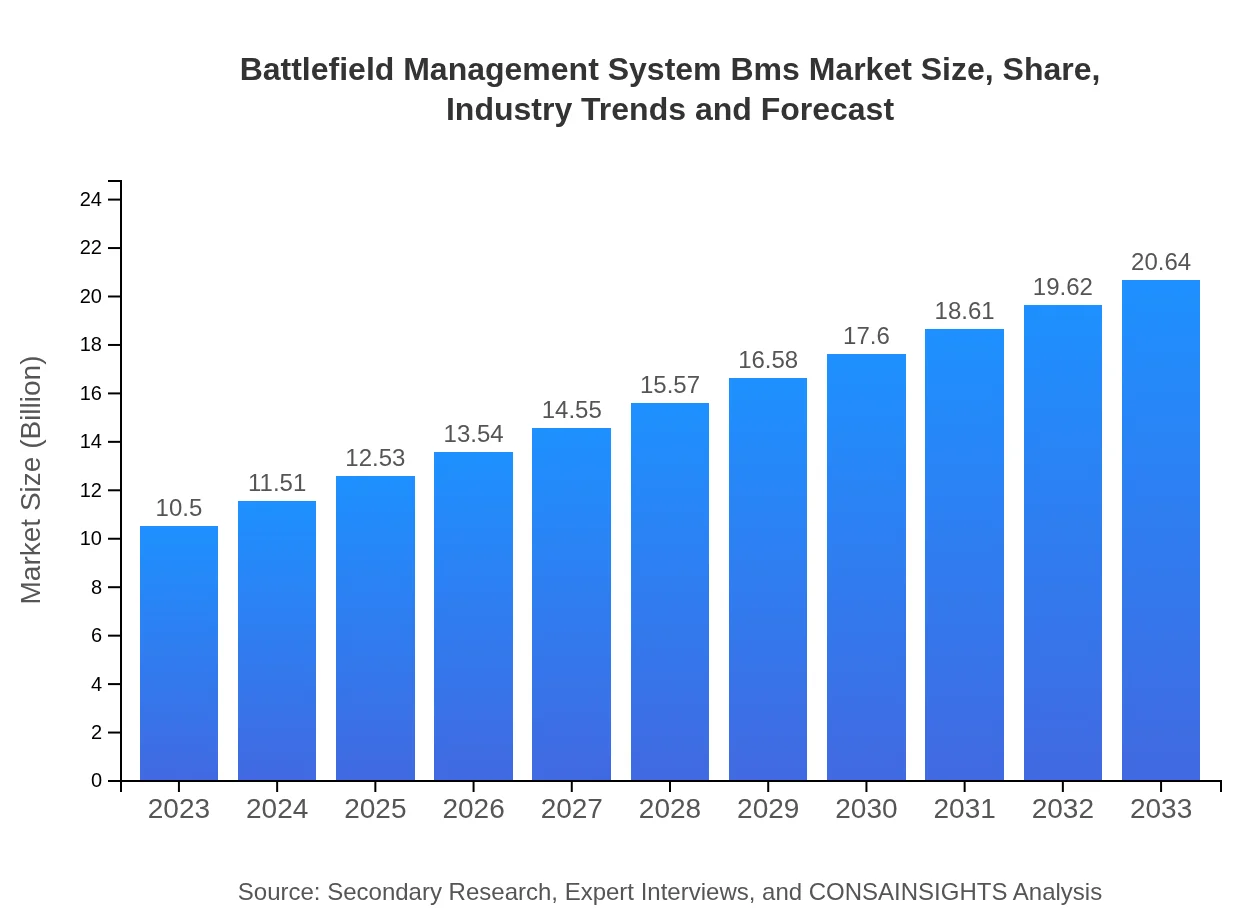

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $20.64 Billion |

| Top Companies | General Dynamics Corporation, Thales Group, Raytheon Technologies, Lockheed Martin |

| Last Modified Date | 03 February 2026 |

Battlefield Management System Bms Market Overview

Customize Battlefield Management System Bms Market Report market research report

- ✔ Get in-depth analysis of Battlefield Management System Bms market size, growth, and forecasts.

- ✔ Understand Battlefield Management System Bms's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Battlefield Management System Bms

What is the Market Size & CAGR of Battlefield Management System Bms market in 2023?

Battlefield Management System Bms Industry Analysis

Battlefield Management System Bms Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Battlefield Management System Bms Market Analysis Report by Region

Europe Battlefield Management System Bms Market Report:

Europe's BMS market is forecasted to grow from $3.34 billion in 2023 to $6.56 billion by 2033. Increased focus on NATO collaborations and defense-related initiatives are sparking growth across countries, while emerging threats in Eastern Europe push investments in updated BMS solutions to new heights.Asia Pacific Battlefield Management System Bms Market Report:

In the Asia Pacific region, the BMS market is anticipated to expand from $1.98 billion in 2023 to $3.88 billion by 2033. The growth is driven by increased defense expenditure by countries like India and China, as well as growing military modernization efforts across Southeast Asian nations. The integration of new technologies is expected to enhance strategic capabilities, promoting further investment.North America Battlefield Management System Bms Market Report:

The North American BMS market is expected to grow from $3.83 billion in 2023 to $7.53 billion by 2033, attributed to heightened defense budgets in the United States and Canada. The adoption of advanced BMS technologies for homeland security and military applications is a significant driver in this region.South America Battlefield Management System Bms Market Report:

The South American market remains relatively small but stable, projected to remain flat at approximately $0.01 billion. Economic constraints and lower defense budgets limit substantial growth; however, emerging cooperation agreements between nations could stimulate modest market activities.Middle East & Africa Battlefield Management System Bms Market Report:

In the Middle East and Africa, the BMS market is expected to increase from $1.36 billion in 2023 to $2.68 billion by 2033. Regional conflicts and the necessity for enhanced military capabilities have driven investment, especially in nations like Saudi Arabia and the UAE, fostering a demand for sophisticated BMS technologies.Tell us your focus area and get a customized research report.

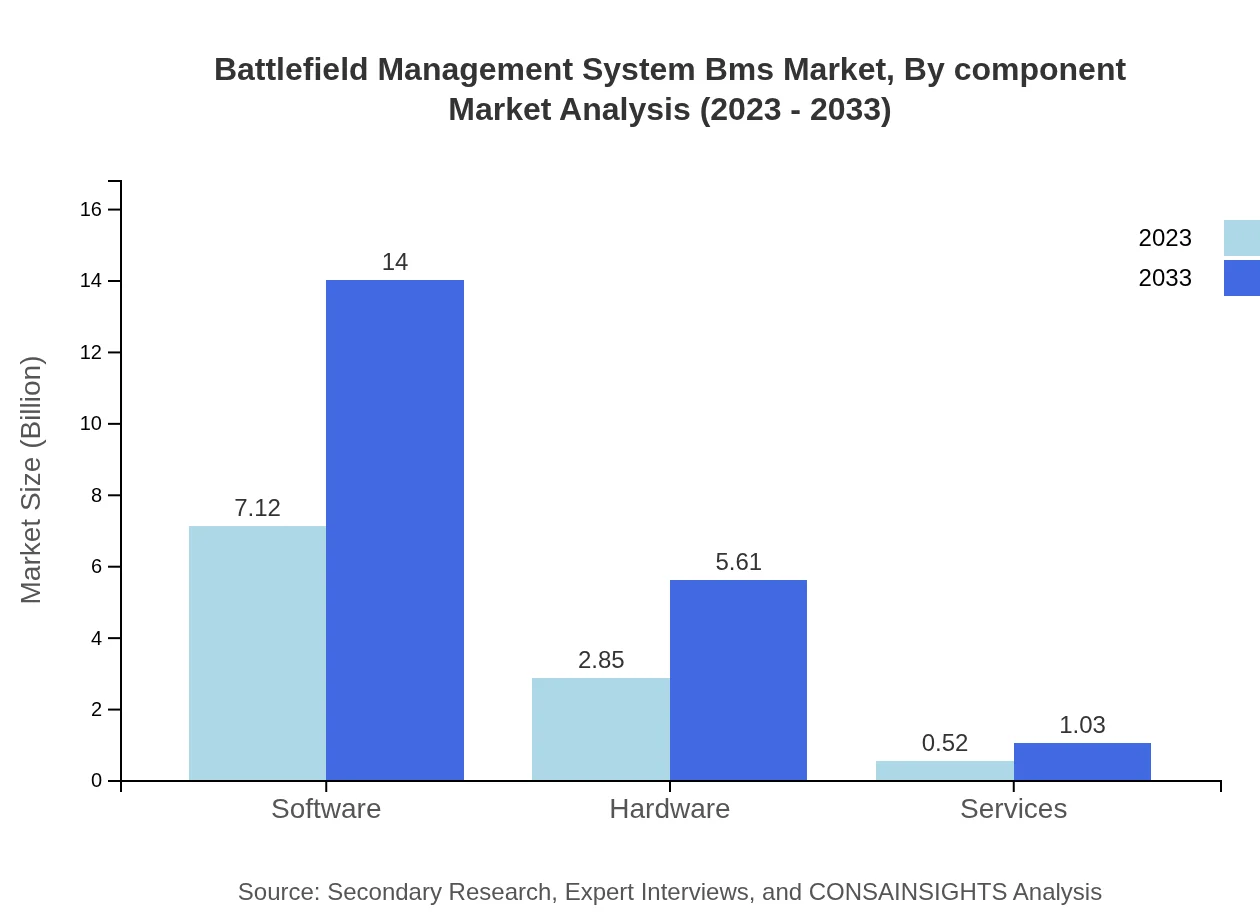

Battlefield Management System Bms Market Analysis By Component

The Battlefield Management System market, analyzed by components, is dominated by software solutions, which are projected to grow significantly from $7.12 billion in 2023 to $14.00 billion by 2033. Hardware components are also significant, expected to grow from $2.85 billion to $5.61 billion, whereas services will see a rise from $0.52 billion to $1.03 billion, illustrating the increasing reliance on integrated systems and support services.

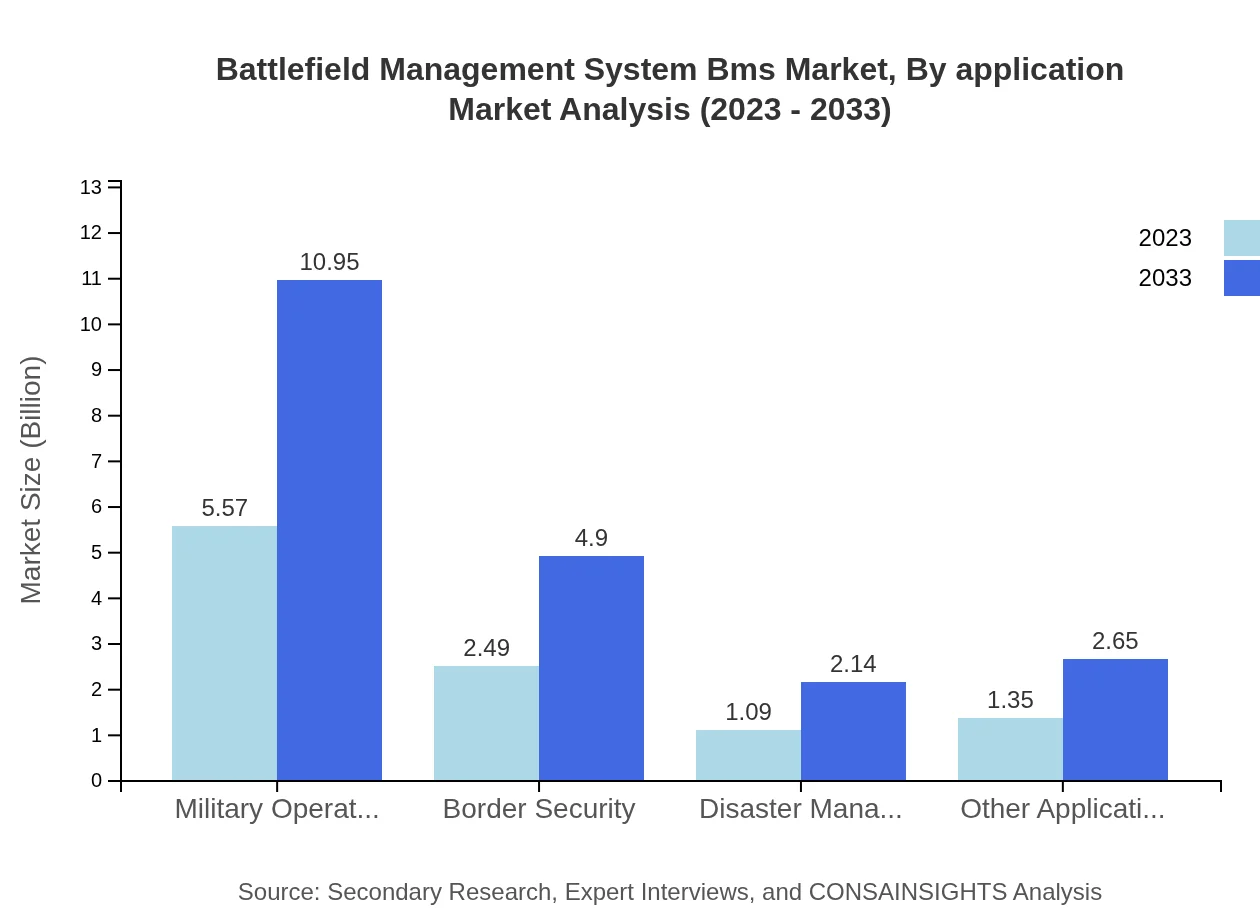

Battlefield Management System Bms Market Analysis By Application

The application segment of the BMS market reflects its versatility, with military operations being the largest segment at 53.04% market share. Other applications such as border security and disaster management are also notable, highlighting the BMS's utility beyond traditional warfare, ensuring relevance across diverse fields.

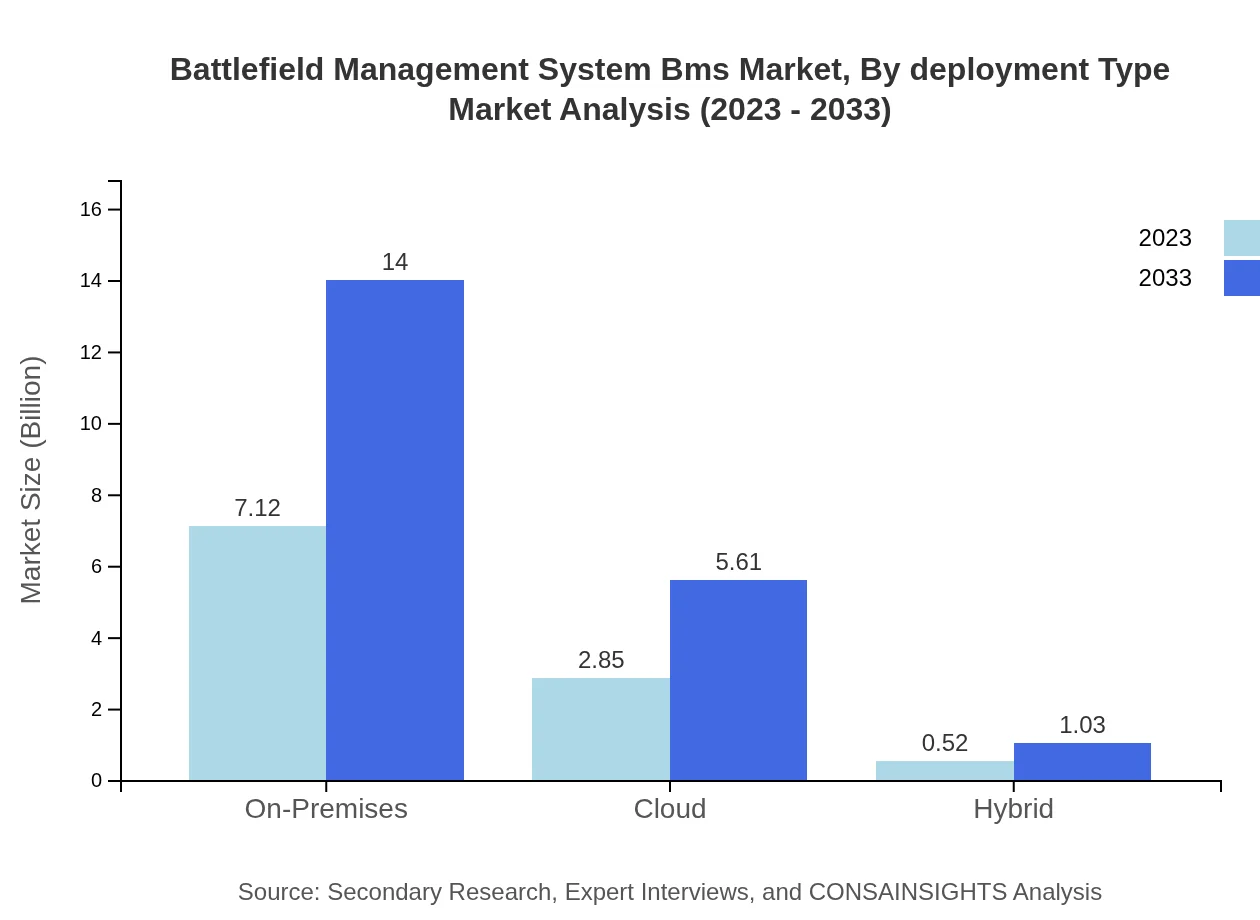

Battlefield Management System Bms Market Analysis By Deployment Type

By deployment type, the on-premises solution remains the leading choice at a market share of 67.84%, growing from $7.12 billion to $14.00 billion by 2033. The cloud-based deployment is also expanding significantly due to the flexibility it offers, moving from $2.85 billion to $5.61 billion, while hybrid solutions keep a minor share yet steadily increase in importance.

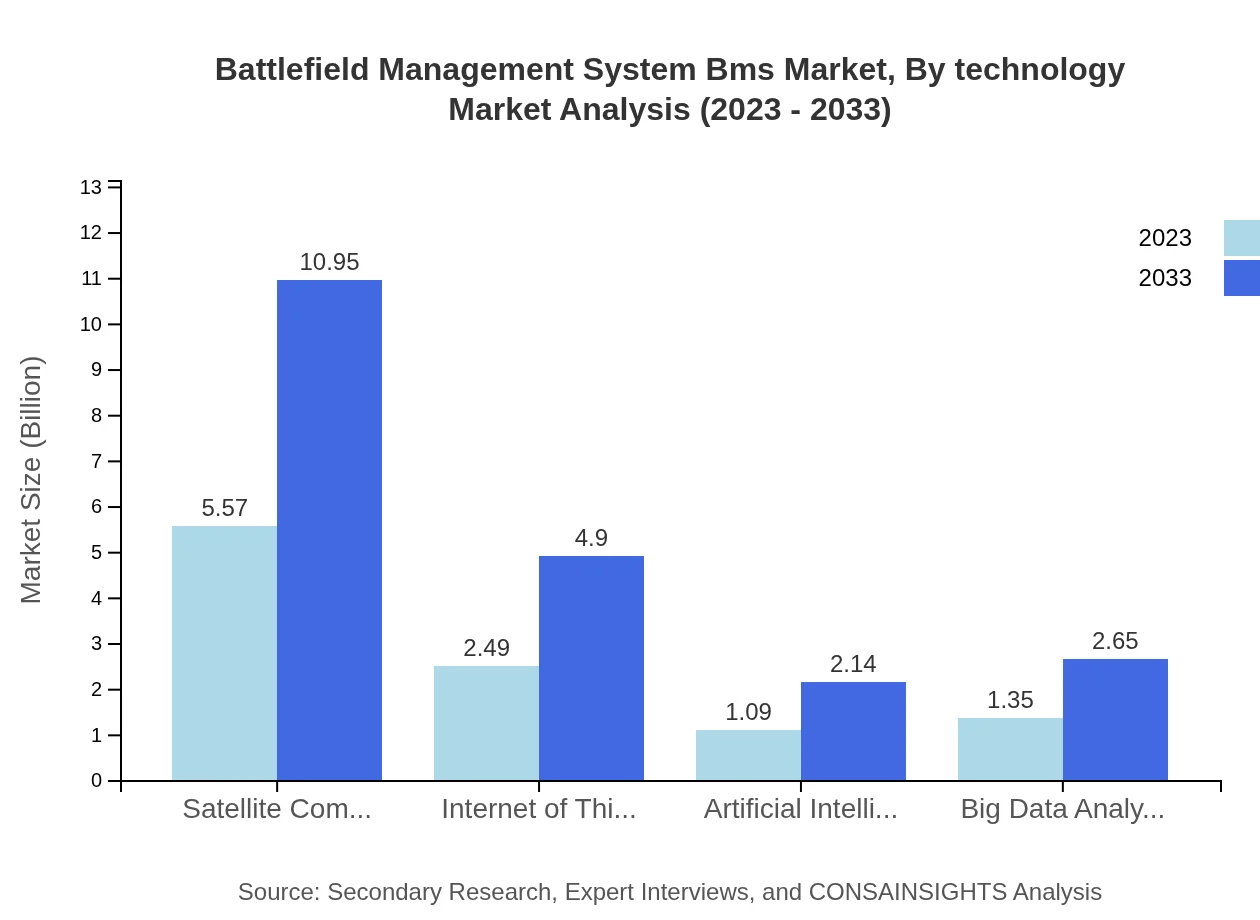

Battlefield Management System Bms Market Analysis By Technology

Technology analysis indicates that satellite communications will see the most growth, with a size projection of $5.57 billion in 2023 rising to $10.95 billion by 2033. Innovations in AI and big data analytics are poised to transform BMS technology, with AI's size increasing from $1.09 billion to $2.14 billion, thereby enhancing analytic capabilities and operational effectiveness.

Battlefield Management System Bms Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Battlefield Management System Bms Industry

General Dynamics Corporation:

A key player in the defense technology sector, known for its advanced battlefield management solutions and integrated systems that enhance military operations.Thales Group:

A leading global technology provider, delivering critical BMS and communication systems for defense applications, emphasizing collaborative interoperability.Raytheon Technologies:

Focusing on various advanced defense solutions, Raytheon is crucial in developing systems that elevate battlefield command and control capabilities.Lockheed Martin:

As a prominent defense contractor, Lockheed Martin engineers innovative management systems and services to enhance military vehicle operations.We're grateful to work with incredible clients.

FAQs

What is the market size of battlefield Management System Bms?

The battlefield management system (BMS) market is valued at approximately $10.5 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033, reflecting robust growth in military operational efficiency.

What are the key market players or companies in this battlefield Management System Bms industry?

Key players in the battlefield management system industry include major defense contractors and technology providers, renowned for their innovations and comprehensive solutions tailored to military operations and security applications.

What are the primary factors driving the growth in the battlefield Management System Bms industry?

Growth in the battlefield management system industry is driven by technological advancements, rising defense budgets, increasing geopolitical tensions, and the need for enhanced situational awareness and operational efficiency in military operations globally.

Which region is the fastest Growing in the battlefield Management System Bms?

North America holds the fastest-growing market for battlefield management systems, projected to grow from $3.83 billion in 2023 to $7.53 billion by 2033, driven by advanced military infrastructure and defense expenditure.

Does ConsaInsights provide customized market report data for the battlefield Management System Bms industry?

Yes, ConsaInsights offers customized market report data tailored to specific research needs within the battlefield management system industry, ensuring relevant insights and strategic analysis for stakeholders.

What deliverables can I expect from this battlefield Management System Bms market research project?

Deliverables include comprehensive market analysis reports, segment insights, growth forecasts, competitive landscape assessments, and tailored recommendations for investment opportunities in the battlefield management system market.

What are the market trends of battlefield Management System Bms?

Key trends include the integration of artificial intelligence and big data analytics, the shift towards cloud-based solutions, and increased collaboration among defense sectors to enhance military capability and border security.