Bauxite Market Report

Published Date: 02 February 2026 | Report Code: bauxite

Bauxite Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bauxite market, examining its size, growth prospects, segmentation, and regional performance. Insights include current market trends and forecasts from 2023 to 2033, offering valuable data for stakeholders.

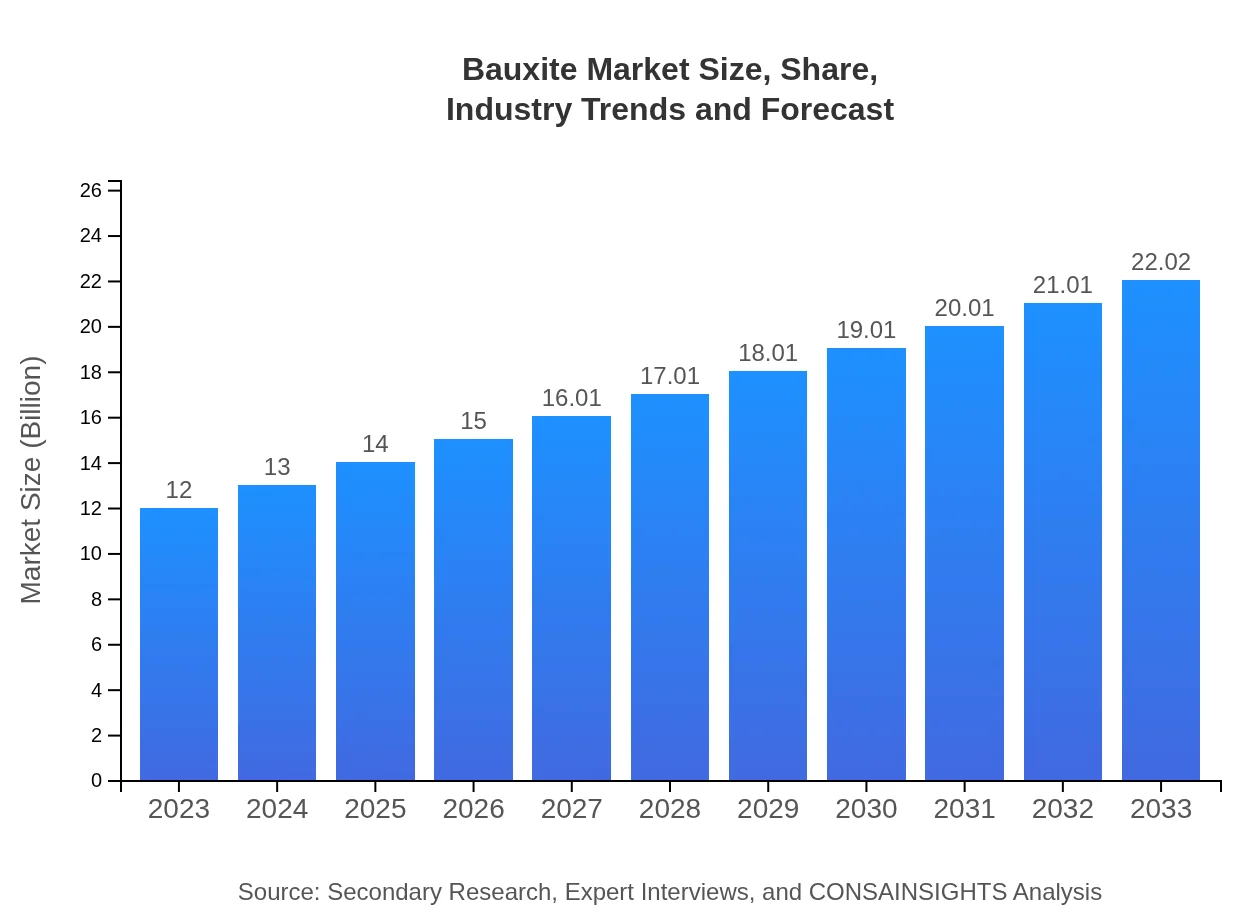

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.00 Billion |

| CAGR (2023-2033) | 6.1% |

| 2033 Market Size | $22.02 Billion |

| Top Companies | Alcoa Corporation, Rio Tinto, Surface Mining and Civil Earthworks (SMCE), Norsk Hydro |

| Last Modified Date | 02 February 2026 |

Bauxite Market Overview

Customize Bauxite Market Report market research report

- ✔ Get in-depth analysis of Bauxite market size, growth, and forecasts.

- ✔ Understand Bauxite's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bauxite

What is the Market Size & CAGR of Bauxite market in 2023?

Bauxite Industry Analysis

Bauxite Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bauxite Market Analysis Report by Region

Europe Bauxite Market Report:

Europe is set for robust growth, with the market size expected to rise from $3.11 billion in 2023 to $5.71 billion by 2033. The demand for Bauxite is increased by stringent regulations to enhance recycling rates and promote sustainable sourcing of raw materials.Asia Pacific Bauxite Market Report:

The Asia Pacific region is expected to witness significant growth, with the market size projected to increase from $2.55 billion in 2023 to $4.69 billion by 2033. This robust expansion is driven by accelerated industrialization in countries like China and India, alongside a growing demand for aluminum in automotive and construction sectors.North America Bauxite Market Report:

In North America, the market is projected to expand from $4.34 billion in 2023 to $7.96 billion by 2033. Factors behind this growth include a resurgence in manufacturing and infrastructure development, propelling Bauxite demand, particularly in the aluminum processing industry.South America Bauxite Market Report:

South America shows a promising growth trajectory, with its market size forecasted to grow from $1.13 billion in 2023 to $2.07 billion by 2033. This growth is attributed to increasing aluminum production and the region’s abundant Bauxite reserves, enhancing its competitive advantage in the global market.Middle East & Africa Bauxite Market Report:

The Middle East and Africa's Bauxite market is anticipated to grow from $0.87 billion in 2023 to $1.59 billion by 2033. Investments in mining technology and favorable government policies aimed at increasing local processing capabilities will drive growth in this region.Tell us your focus area and get a customized research report.

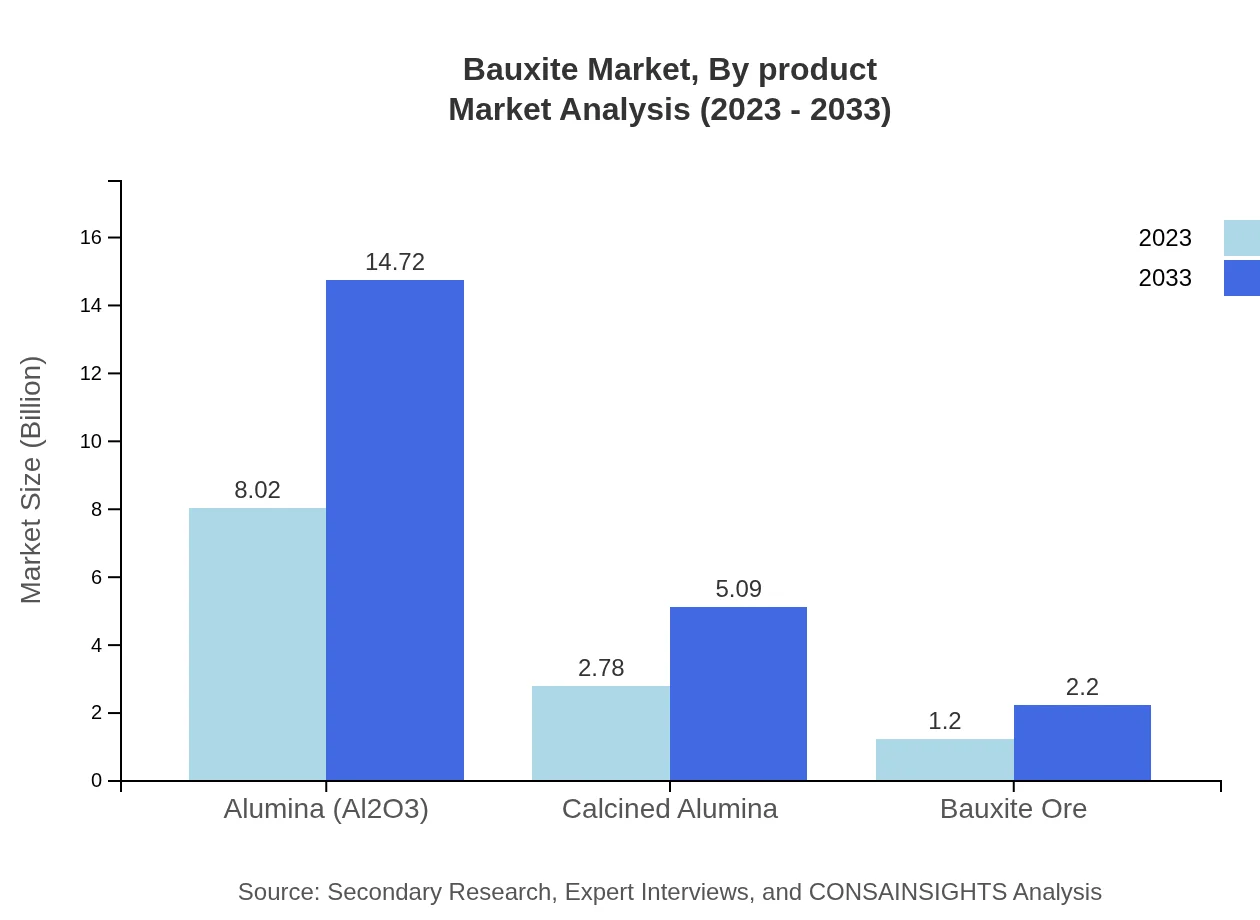

Bauxite Market Analysis By Product

In terms of product segments, Alumina (Al2O3) holds a significant market size of $8.02 billion in 2023, projected to increase to $14.72 billion by 2033. Calcined Alumina accounts for $2.78 billion in 2023, with a forecasted rise to $5.09 billion by 2033. Bauxite Ore, while smaller, shows growth from $1.20 billion to $2.20 billion in the same period.

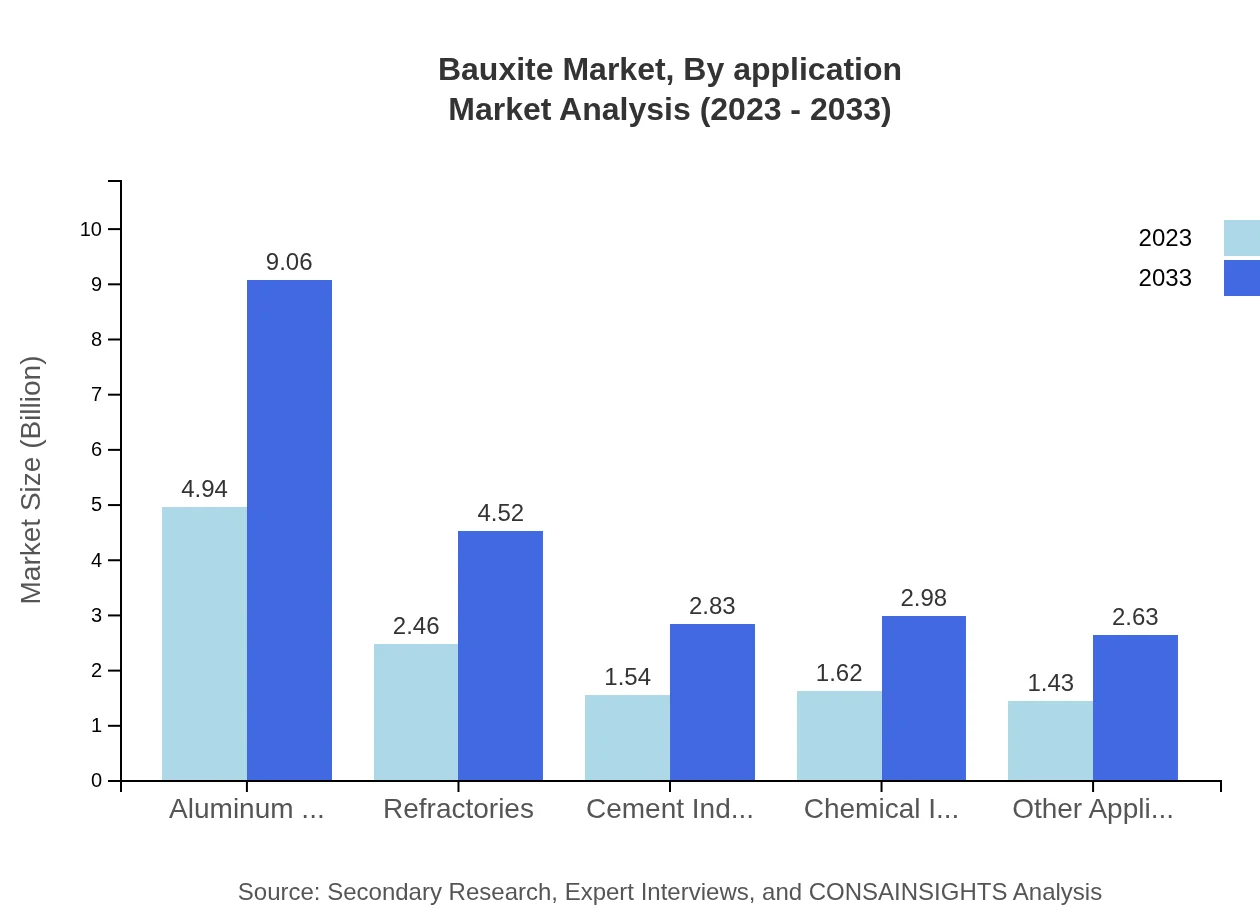

Bauxite Market Analysis By Application

Bauxite applications span several industries, with the aluminum production sector leading at $4.94 billion in 2023, expected to soar to $9.06 billion by 2033. Other notable applications include Aerospace, Construction, and Electronics, reflecting the material's versatility and importance across multiple sectors.

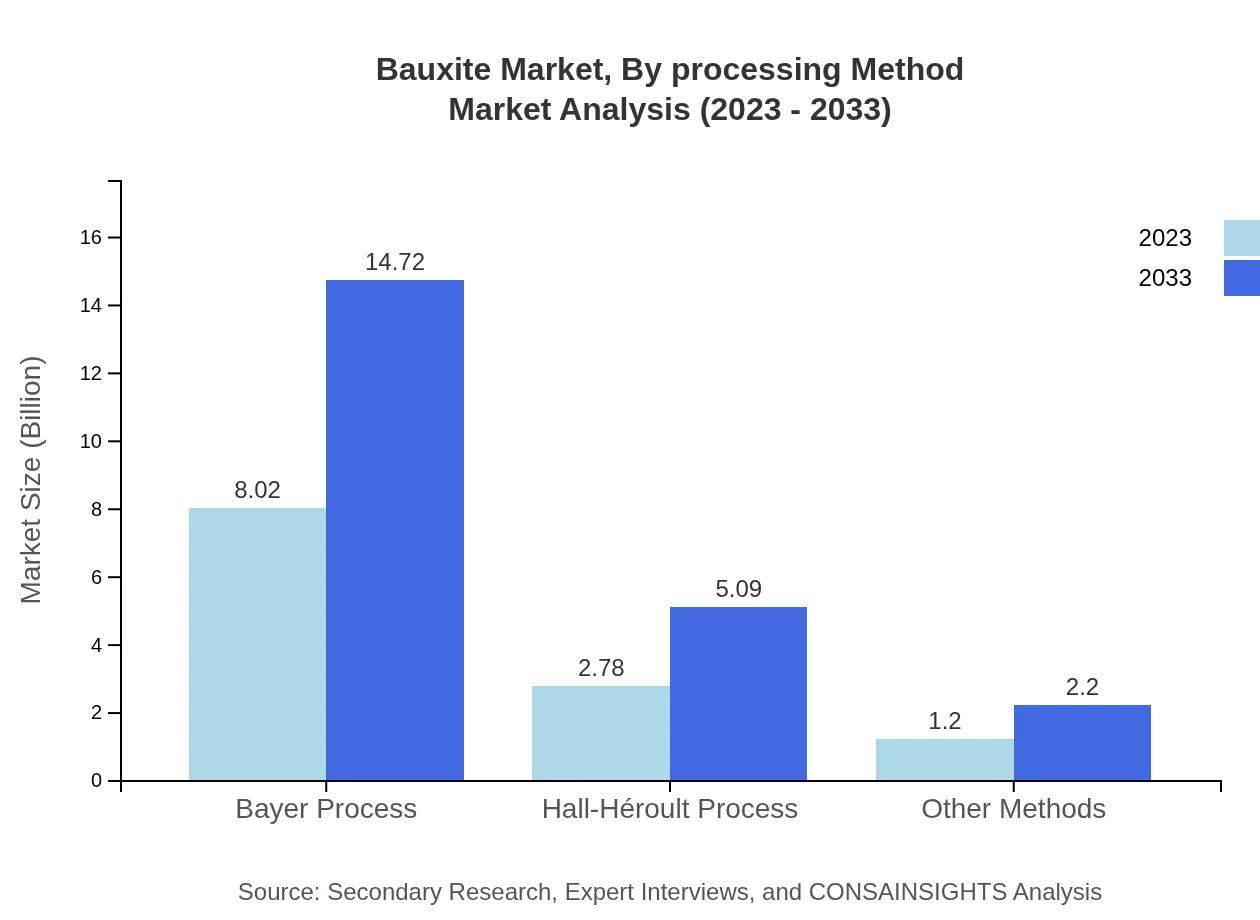

Bauxite Market Analysis By Processing Method

The Bayer Process dominates with a market size of $8.02 billion in 2023 and a forecast of $14.72 billion by 2033. The Hall-Héroult Process also plays a crucial role, expected to grow from $2.78 billion to $5.09 billion between 2023 and 2033, highlighting advancements in processing efficiency and technology.

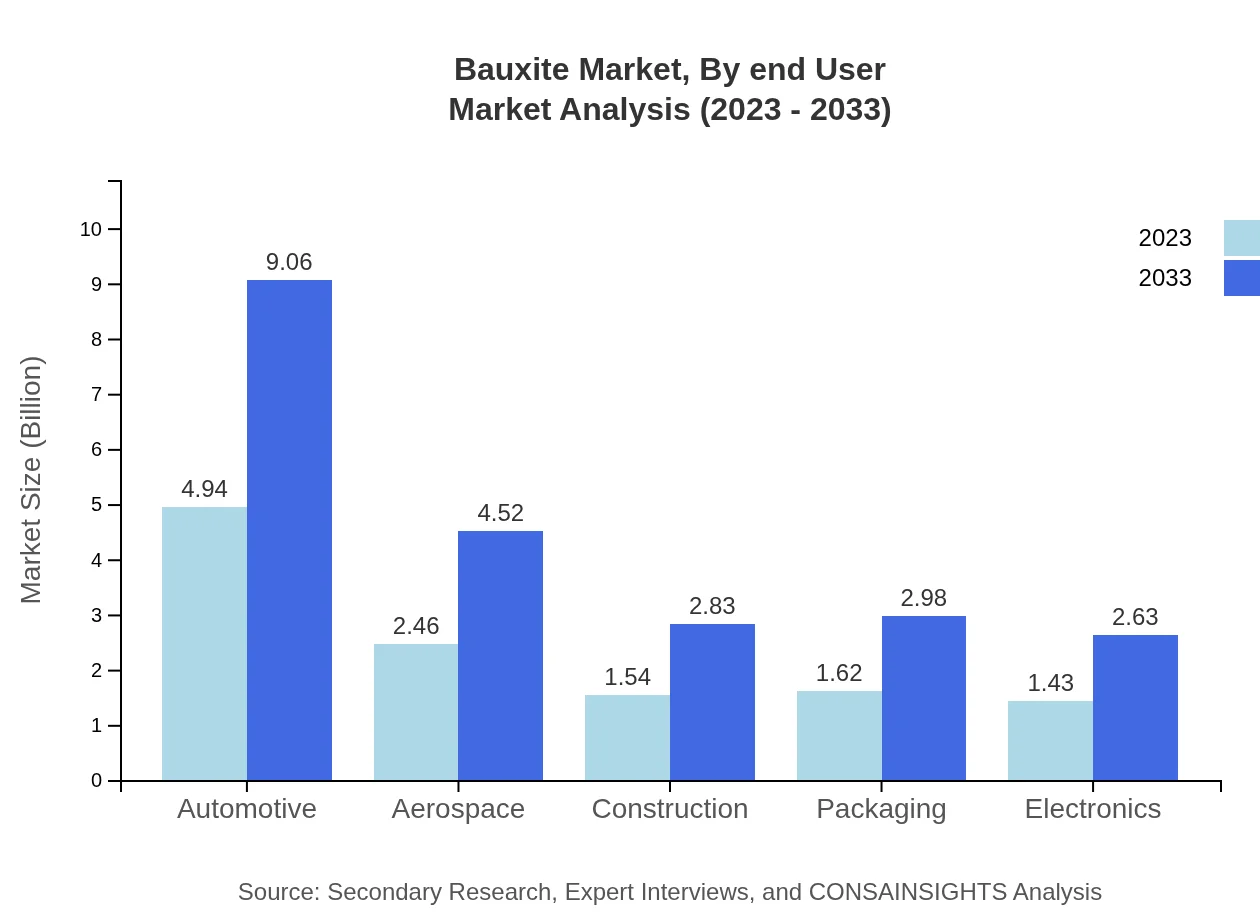

Bauxite Market Analysis By End User

The automotive industry leads in Bauxite consumption, with a market share of $4.94 billion in 2023, projected to rise to $9.06 billion by 2033. Aerospace and construction sectors follow, underscoring the diverse applications of aluminum and bauxite-derived products.

Bauxite Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bauxite Industry

Alcoa Corporation:

A leader in bauxite mining and aluminum production, Alcoa has a robust portfolio of sustainable mining practices and technological innovations to enhance productivity.Rio Tinto:

An international mining giant, Rio Tinto is heavily invested in the Bauxite sector, emphasizing eco-friendly mining techniques and a commitment to reducing carbon emissions across its operations.Surface Mining and Civil Earthworks (SMCE):

SMCE specializes in integrated mining operations, focusing on extracting Bauxite and enhancing its supply chain through technological advancements.Norsk Hydro:

Norsk Hydro stands out for its commitment to sustainability, employing innovative technologies to ensure efficient and responsible Bauxite extraction and processing.We're grateful to work with incredible clients.

FAQs

What is the market size of bauxite?

The global bauxite market is projected to reach $12 billion by 2033, growing at a CAGR of 6.1%. This growth is driven by the increasing demand for aluminum in various sectors.

What are the key market players or companies in the bauxite industry?

Key players in the bauxite market include Alcoa Corporation, Rio Tinto Group, and Chalco. These companies play a significant role in global production and supply, especially in key regions like Australia and Guinea.

What are the primary factors driving the growth in the bauxite industry?

The growth in the bauxite industry is primarily driven by rising aluminum production, increased automotive demand, and investments in construction. Additionally, technological advancements in extraction methods contribute to efficiency.

Which region is the fastest Growing in the bauxite industry?

The fastest-growing region in the bauxite market is projected to be North America, increasing from $4.34 billion in 2023 to $7.96 billion in 2033, reflecting a surge in industrial demand.

Does ConsaInsights provide customized market report data for the bauxite industry?

Yes, ConsaInsights offers customized market reports tailored to specific client needs in the bauxite industry, ensuring comprehensive analysis based on unique business requirements and target markets.

What deliverables can I expect from this bauxite market research project?

From the bauxite market research project, expect detailed market size data, segment analyses, regional forecasts, competitive landscape insights, and actionable strategic recommendations for informed decision-making.

What are the market trends of bauxite?

Current trends in the bauxite market include a shift towards sustainable mining practices, rising demand from the aerospace sector, and innovations in refining processes that enhance production efficiency.