Beer Brewing Ingredients Market Report

Published Date: 31 January 2026 | Report Code: beer-brewing-ingredients

Beer Brewing Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report explores the Beer Brewing Ingredients market, offering a comprehensive analysis of market trends, size forecasts, regional insights, and a look at key players from 2023 to 2033.

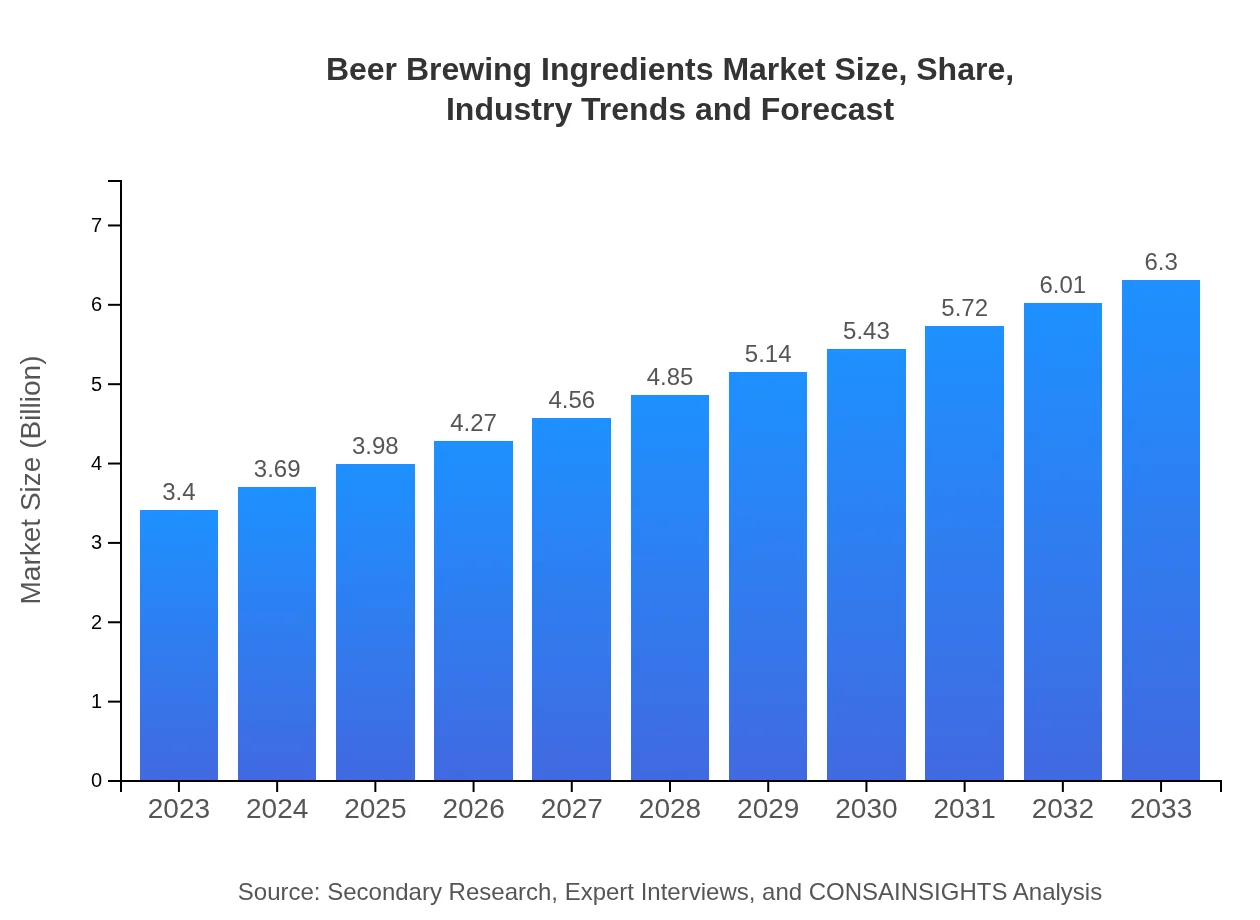

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.40 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $6.30 Billion |

| Top Companies | AB InBev, Heineken N.V., MillerCoors, Carlsberg Group |

| Last Modified Date | 31 January 2026 |

Beer Brewing Ingredients Market Overview

Customize Beer Brewing Ingredients Market Report market research report

- ✔ Get in-depth analysis of Beer Brewing Ingredients market size, growth, and forecasts.

- ✔ Understand Beer Brewing Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beer Brewing Ingredients

What is the Market Size & CAGR of Beer Brewing Ingredients market in 2023?

Beer Brewing Ingredients Industry Analysis

Beer Brewing Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beer Brewing Ingredients Market Analysis Report by Region

Europe Beer Brewing Ingredients Market Report:

In Europe, the Beer Brewing Ingredients market is forecasted to grow from $0.92 billion in 2023 to $1.71 billion by 2033. The increasing popularity of craft brewing and regional specialties in beer types are influencing the ingredient market positively.Asia Pacific Beer Brewing Ingredients Market Report:

The Asia Pacific Beer Brewing Ingredients market was valued at $0.71 billion in 2023 and is projected to reach approximately $1.31 billion by 2033. The region's growing interest in craft beer and traditional brewing techniques, combined with a rising urban population and disposable income, are key factors in this growth.North America Beer Brewing Ingredients Market Report:

North America represents the largest market for Beer Brewing Ingredients, with a projected value increase from $1.21 billion in 2023 to $2.24 billion by 2033. The region's robust craft beer culture and consumer demand for unique beer flavors significantly drive ingredient sales.South America Beer Brewing Ingredients Market Report:

The South American market for Beer Brewing Ingredients is expected to grow from $0.16 billion in 2023 to $0.29 billion in 2033. Increased demand for craft beers and local brewing methods are paving the way for growth in this region, with an emphasis on traditional ingredients.Middle East & Africa Beer Brewing Ingredients Market Report:

The Middle East and Africa market for Beer Brewing Ingredients is expected to grow from $0.40 billion in 2023 to $0.74 billion by 2033, driven by rising interest in brewing among the younger population and economic developments enhancing the beverage sector.Tell us your focus area and get a customized research report.

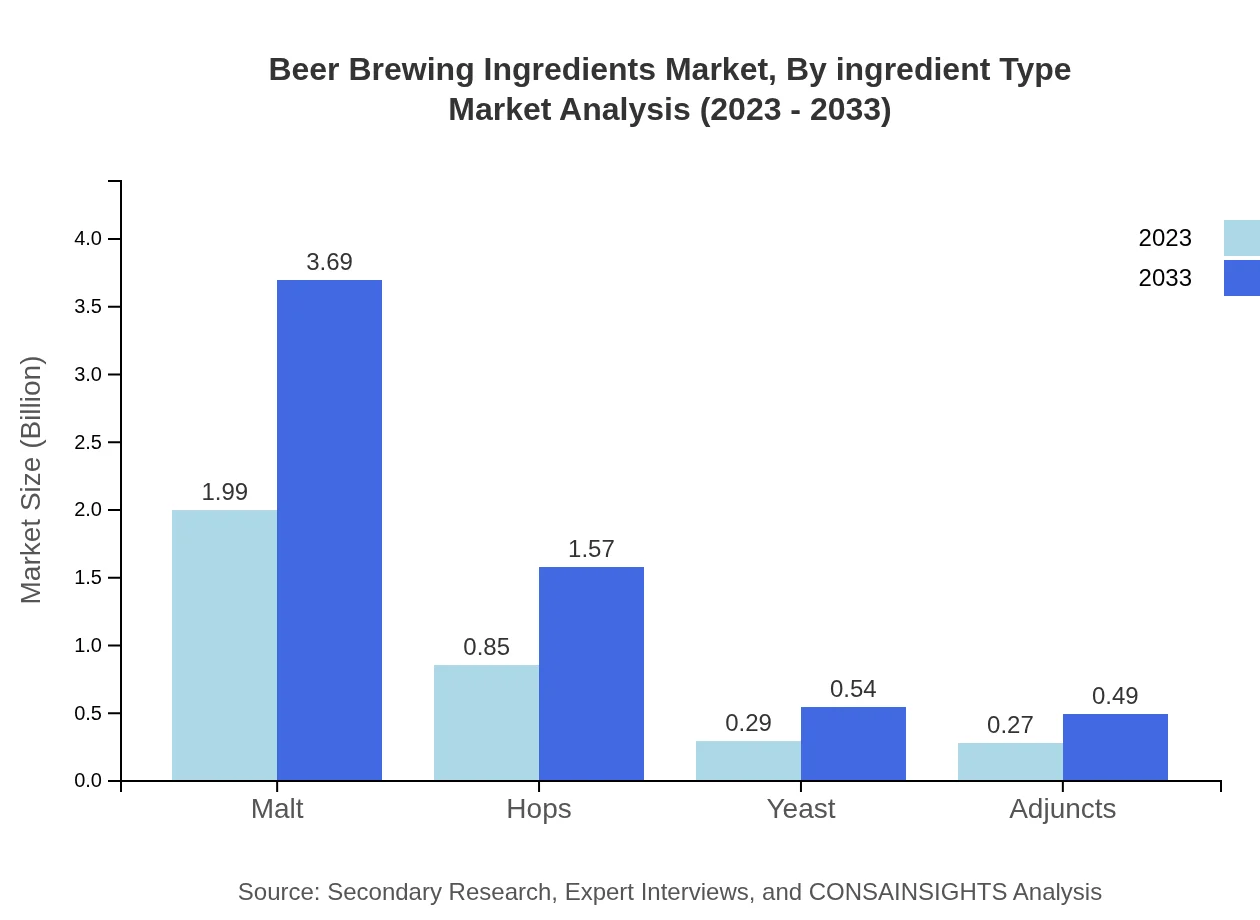

Beer Brewing Ingredients Market Analysis By Ingredient Type

The Beer Brewing Ingredients market, by ingredient type, sees malt as the leading segment at approximately $1.99 billion in 2023 and projected to grow to about $3.69 billion by 2033. Hops and yeast also contribute significantly, with current values at $0.85 billion and $0.29 billion respectively, expanding toward $1.57 billion and $0.54 billion in the next decade. Traditional ingredients represent about 85% share while specialty ingredients hold a smaller niche.

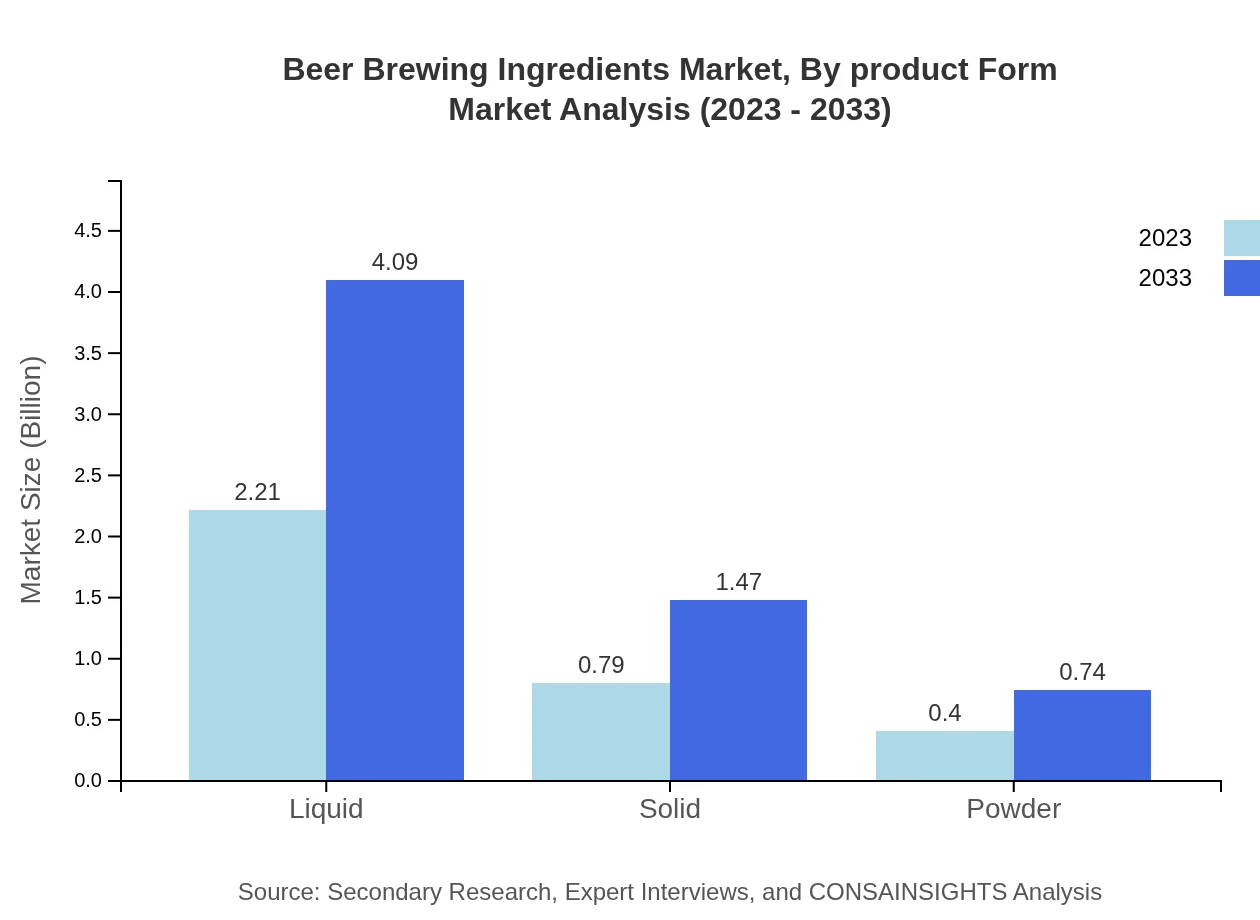

Beer Brewing Ingredients Market Analysis By Product Form

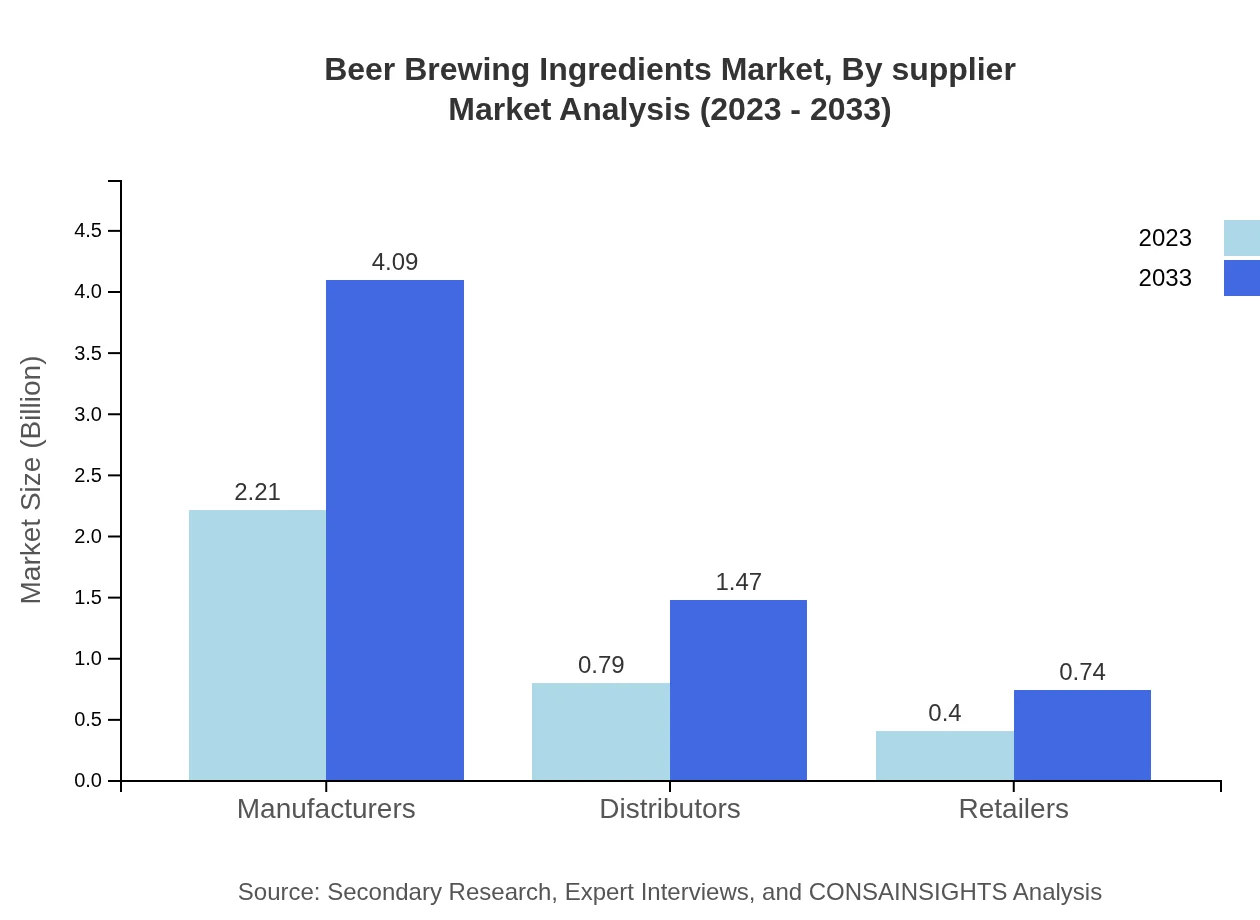

In terms of product form, liquid forms dominate with a market size of $2.21 billion and an expected increase to $4.09 billion by 2033. Solid forms follow with $0.79 billion moving towards $1.47 billion, and powdered forms at a modest $0.40 billion growing to $0.74 billion. This distribution indicates a preference for liquid forms, which are more readily integrated into brewing processes.

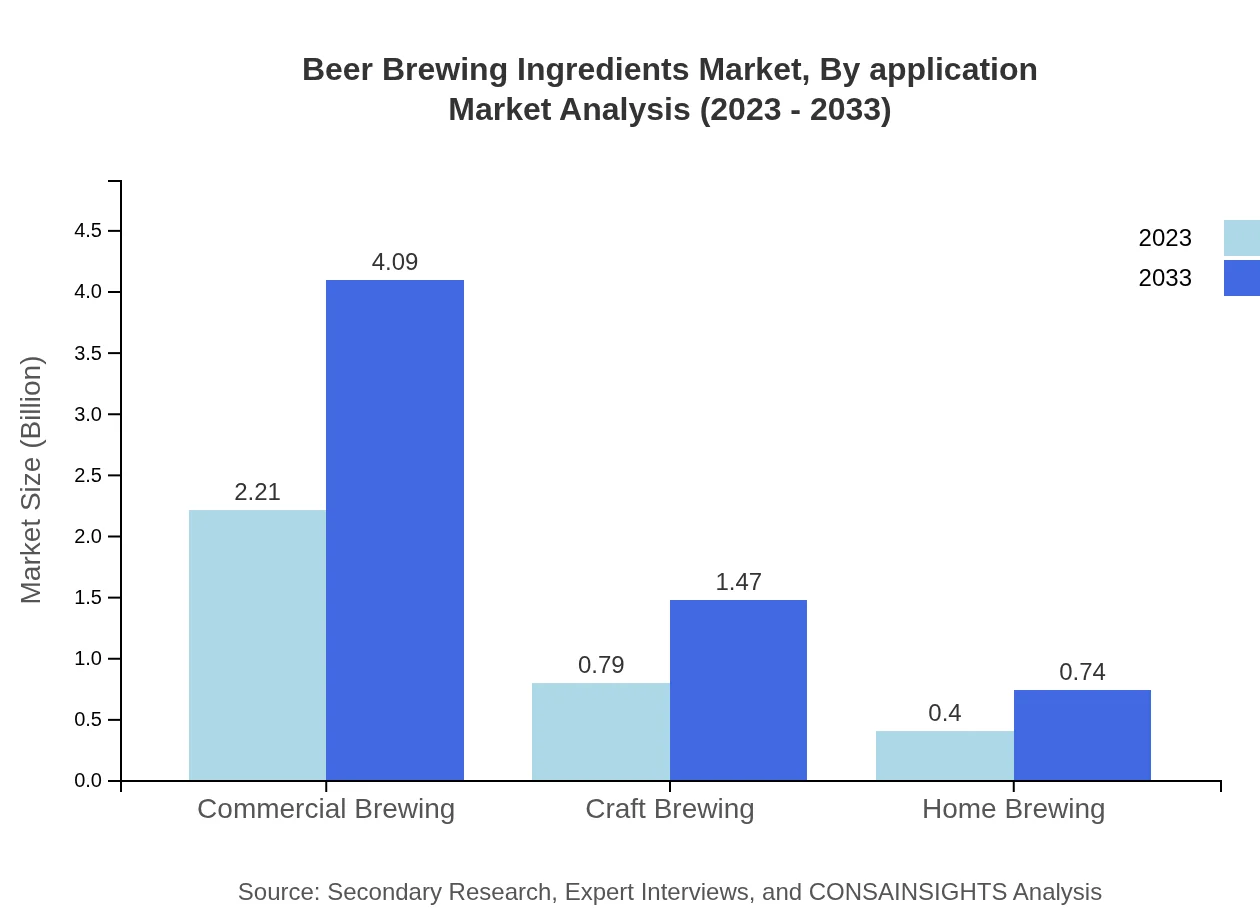

Beer Brewing Ingredients Market Analysis By Application

The application segment is predominantly led by commercial brewing at about $2.21 billion in 2023 and a forecasted $4.09 billion in 2033. Craft brewing is notable as well, growing from $0.79 billion to $1.47 billion, driven by increasing consumer preferences for craft products. Home brewing remains a smaller segment, currently at $0.40 billion.

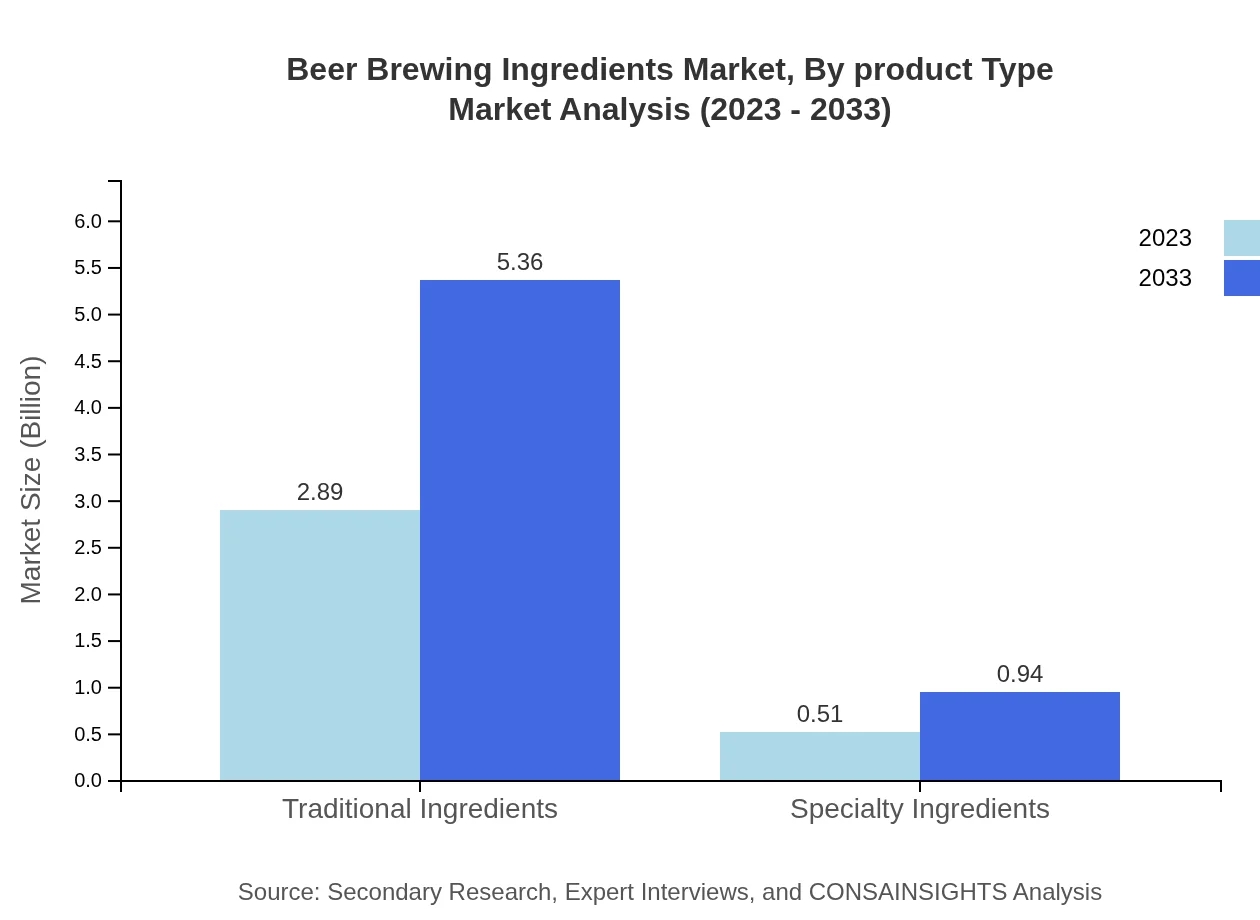

Beer Brewing Ingredients Market Analysis By Product Type

By product type, traditional ingredients constitute the largest segment with a size of $2.89 billion in 2023, expected to grow to $5.36 billion by 2033. Specialty ingredients, while smaller at $0.51 billion in 2023, are anticipated to see growth to $0.94 billion as innovations continue to emerge, catering to niche markets and unique flavor profiles.

Beer Brewing Ingredients Market Analysis By Supplier

The supplier segment shows manufacturers currently holding a 64.87% market share, with expected growth from $2.21 billion to $4.09 billion from 2023 to 2033, whereas distributors and retailers show steady growth as well, indicating a robust supply chain that supports the increasing demand for brewing ingredients.

Beer Brewing Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beer Brewing Ingredients Industry

AB InBev:

A leading global brewer headquartered in Leuven, Belgium. It has a vast portfolio of over 500 beer brands and is heavily invested in sourcing quality brewing ingredients.Heineken N.V.:

A Dutch brewing company with a widely recognized brand portfolio. Heineken focuses on innovation and sustainable sourcing of brewing ingredients.MillerCoors:

An American beverage company formed through a merger of Miller Brewing Company and Coors Brewing Company, committed to producing high-quality beer with superior ingredients.Carlsberg Group:

A major global brewery with operations in Europe, Asia, and markets worldwide, emphasizing the use of natural brewing ingredients to ensure high standards of quality.We're grateful to work with incredible clients.

FAQs

What is the market size of beer Brewing Ingredients?

The global beer brewing ingredients market is valued at approximately $3.4 billion in 2023, with a projected CAGR of 6.2% from 2023 to 2033.

What are the key market players or companies in the beer Brewing Ingredients industry?

Key players include major manufacturers and distributors within the sector, particularly those involved in the production and distribution of malt, hops, yeast, and adjuncts.

What are the primary factors driving the growth in the beer Brewing Ingredients industry?

Growth is driven by increasing craft brewing trends, rising disposable incomes, and evolving consumer preferences towards diverse beer flavors and brewing styles.

Which region is the fastest Growing in the beer Brewing Ingredients?

The Asia-Pacific region represents the fastest-growing market segment, expected to increase from $0.71 billion in 2023 to $1.31 billion by 2033.

Does ConsaInsights provide customized market report data for the beer Brewing Ingredients industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the beer brewing ingredients industry, including insights on niche markets and emerging trends.

What deliverables can I expect from this beer Brewing Ingredients market research project?

Deliverables include a comprehensive report detailing market size, growth forecasts, competitive analysis, and detailed segment insights.

What are the market trends of beer Brewing Ingredients?

Current trends include a shift towards organic ingredients, sustainability in sourcing, and the emergence of low-alcohol and craft beer options.