Beer Processing Market Report

Published Date: 31 January 2026 | Report Code: beer-processing

Beer Processing Market Size, Share, Industry Trends and Forecast to 2033

This report covers the Beer Processing market from 2023 to 2033, providing insights into market trends, segmentation, regional analysis, and forecasts. It aims to offer a comprehensive overview of the current landscape and future opportunities within the industry.

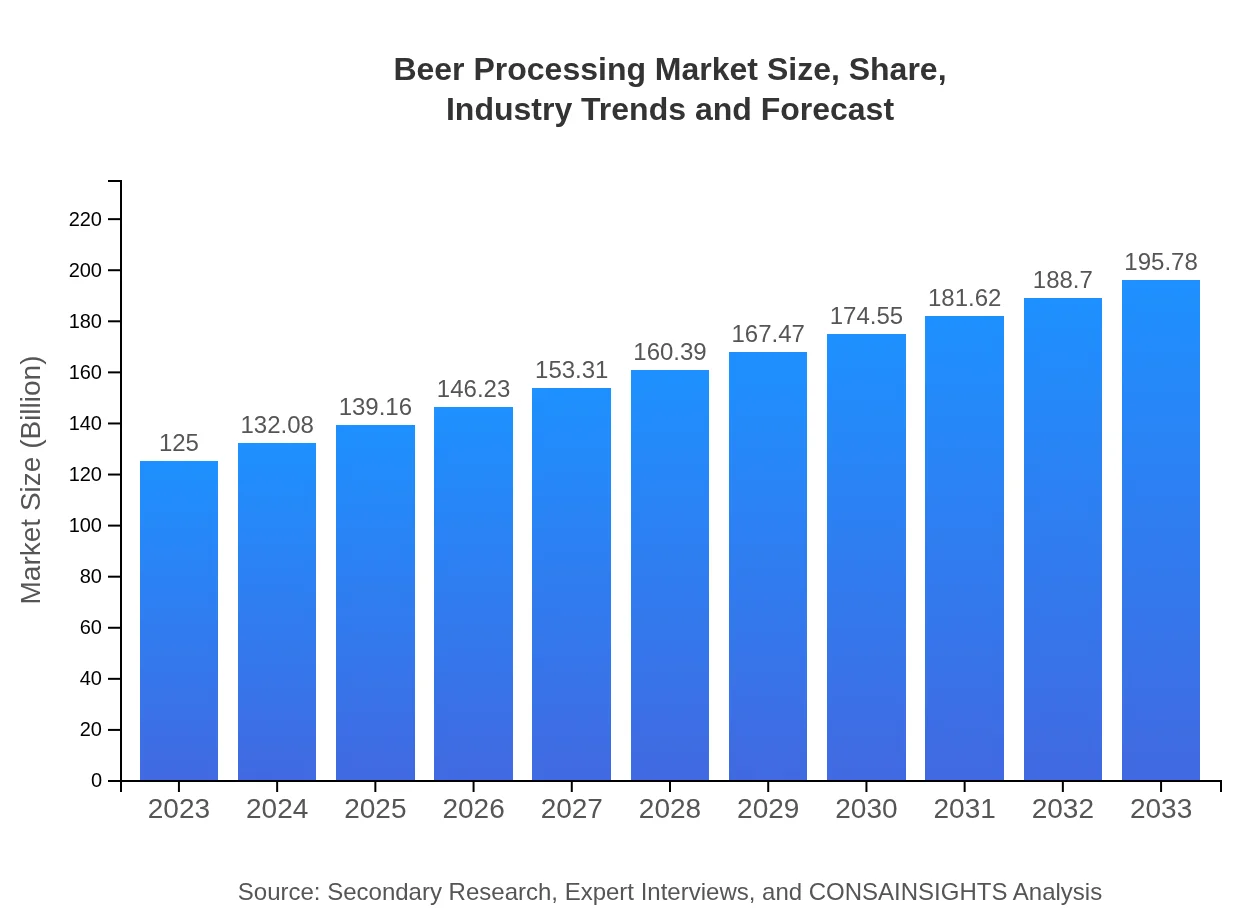

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $125.00 Billion |

| CAGR (2023-2033) | 4.5% |

| 2033 Market Size | $195.78 Billion |

| Top Companies | Anheuser-Busch InBev, Heineken N.V., Molson Coors Beverage Company, Carlsberg Group |

| Last Modified Date | 31 January 2026 |

Beer Processing Market Overview

Customize Beer Processing Market Report market research report

- ✔ Get in-depth analysis of Beer Processing market size, growth, and forecasts.

- ✔ Understand Beer Processing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beer Processing

What is the Market Size & CAGR of Beer Processing market in 2023?

Beer Processing Industry Analysis

Beer Processing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beer Processing Market Analysis Report by Region

Europe Beer Processing Market Report:

Europe is a leading market, projected to grow from USD 30.86 billion in 2023 to USD 48.34 billion by 2033. The region is known for its rich beer heritage, with Germany, the UK, and Belgium being major contributors. Premiumization trends are boosting the demand for artisanal and craft beers, alongside traditional favorites. Regulatory support for local breweries is also influencing market dynamics.Asia Pacific Beer Processing Market Report:

The Asia Pacific region is projected to grow from USD 26.70 billion in 2023 to USD 41.82 billion by 2033. The rise in urbanization, coupled with growing disposable incomes, is driving the demand for premium beer products across countries like China and India. Millennials and Gen Z consumers are increasingly experimenting with craft beers, contributing to market growth. Regional regulations promoting local brewing also provide opportunities for small-scale breweries.North America Beer Processing Market Report:

The North American Beer Processing market, valued at USD 45.89 billion in 2023, is anticipated to expand to USD 71.87 billion by 2033. The craft beer movement continues to thrive, with a significant number of microbreweries emerging across the United States and Canada. Health-conscious consumers are also driving the introduction of low-alcohol and non-alcoholic options.South America Beer Processing Market Report:

In South America, the Beer Processing market is expected to rise from USD 8.24 billion in 2023 to USD 12.90 billion by 2033. Countries like Brazil and Mexico dominate the market, with a growing inclination towards both alcoholic and non-alcoholic craft beers. Traditional beer styles are being reimagined, appealing to modern consumers looking for unique flavors and experiences.Middle East & Africa Beer Processing Market Report:

The Middle East and Africa Beer Processing market is set to grow from USD 13.31 billion in 2023 to USD 20.85 billion by 2033. Despite cultural and regulatory challenges in some areas, there is a growing acceptance of beer consumption in urban centers. Craft beer is gaining traction, supported by a burgeoning millennial population eager for new experiences.Tell us your focus area and get a customized research report.

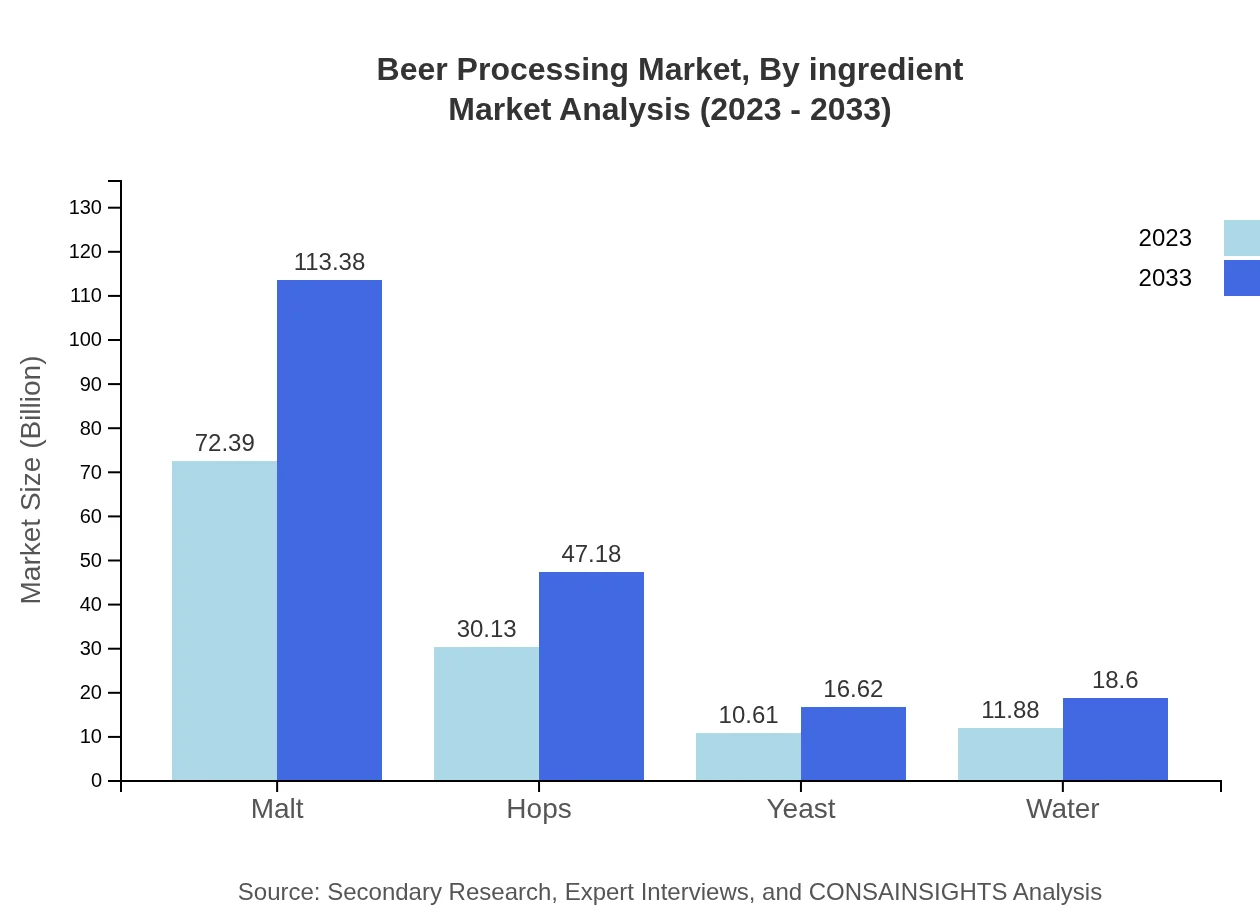

Beer Processing Market Analysis By Ingredient

The ingredient segment outlines varying performances of fundamental components in the brewing process, such as Malt, Hops, Yeast, and Water. Malt accounts for a substantial share, with a projected size of USD 72.39 billion in 2023 growing to USD 113.38 billion by 2033. Hops and Yeast show steady growth alongside the rise in craft and specialty beers, reflective of evolving consumer preferences.

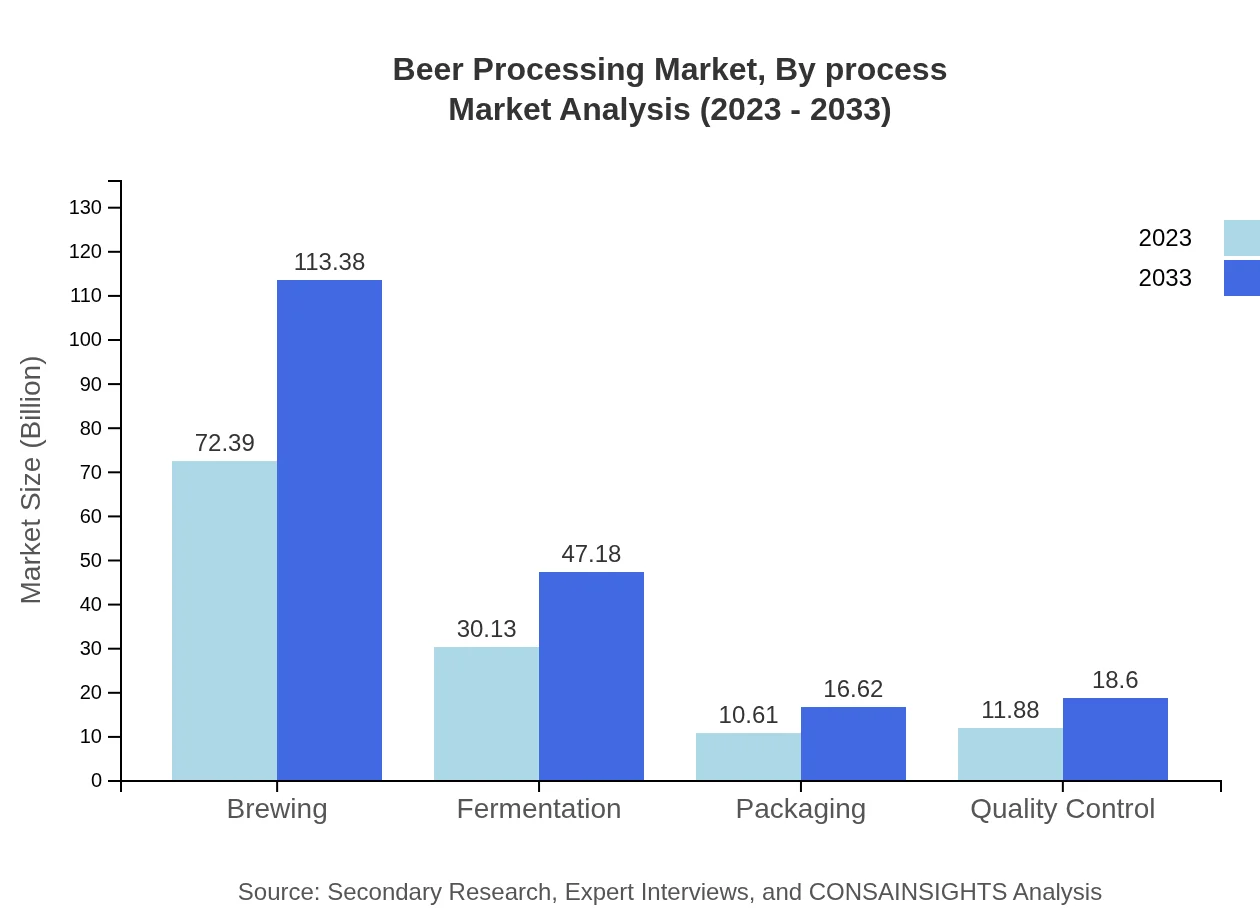

Beer Processing Market Analysis By Process

This segment emphasizes techniques like Brewing, Fermentation, and Packaging. Brewing holds a significant market share, valued at USD 72.39 billion in 2023, while Packaging contributes crucial logistical support. Fermentation processes are becoming increasingly sophisticated, focusing on enhancing flavor profiles and reducing fermentation time, thus aligning with modern consumer palates.

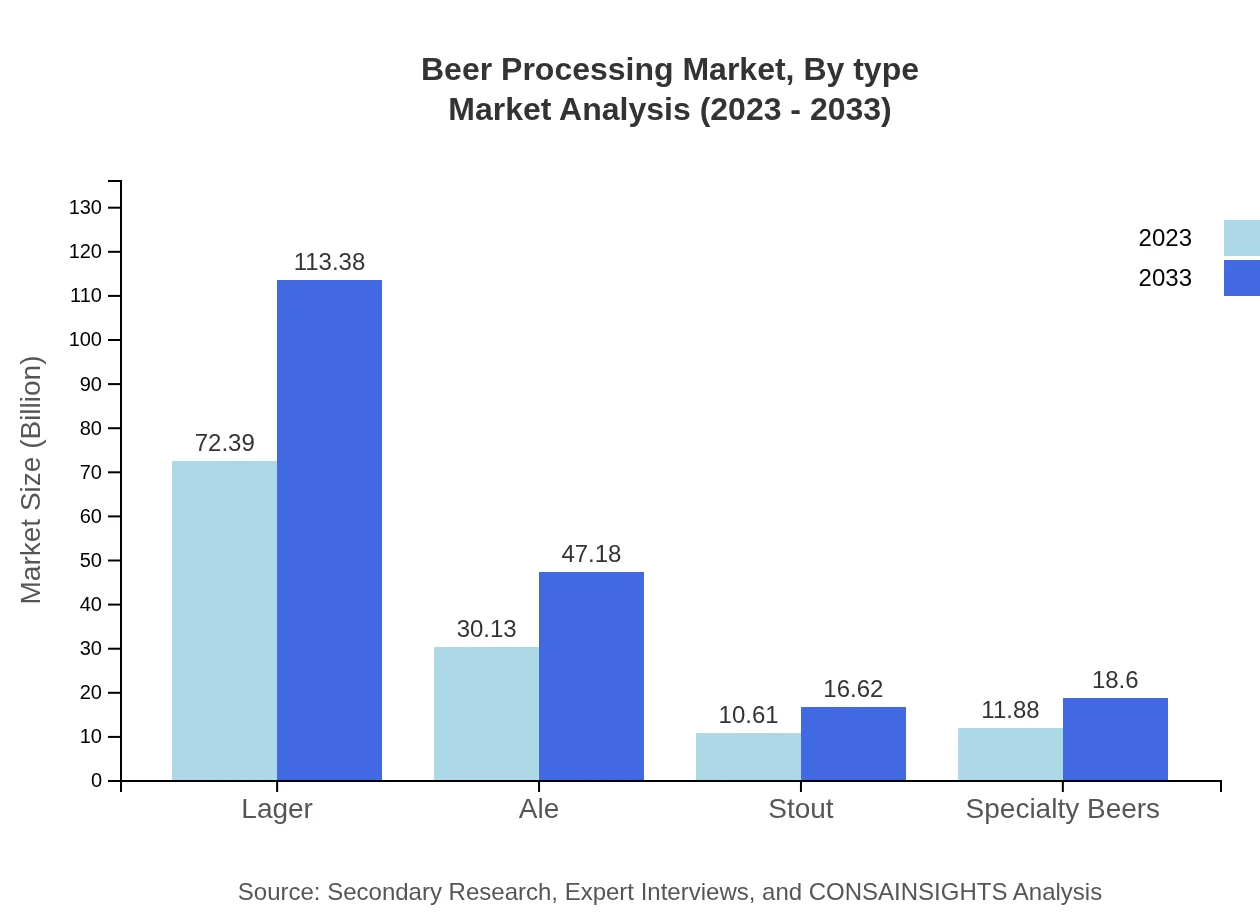

Beer Processing Market Analysis By Type

This section discusses various beer types including Lager, Ale, Stout, and Specialty beers. Lager dominates the market with USD 72.39 billion in 2023 and is expected to achieve growth beyond USD 113.38 billion by 2033. Specialty beers are increasingly popular, attracting consumers looking for offbeat flavors, contributing to diversified market dynamics.

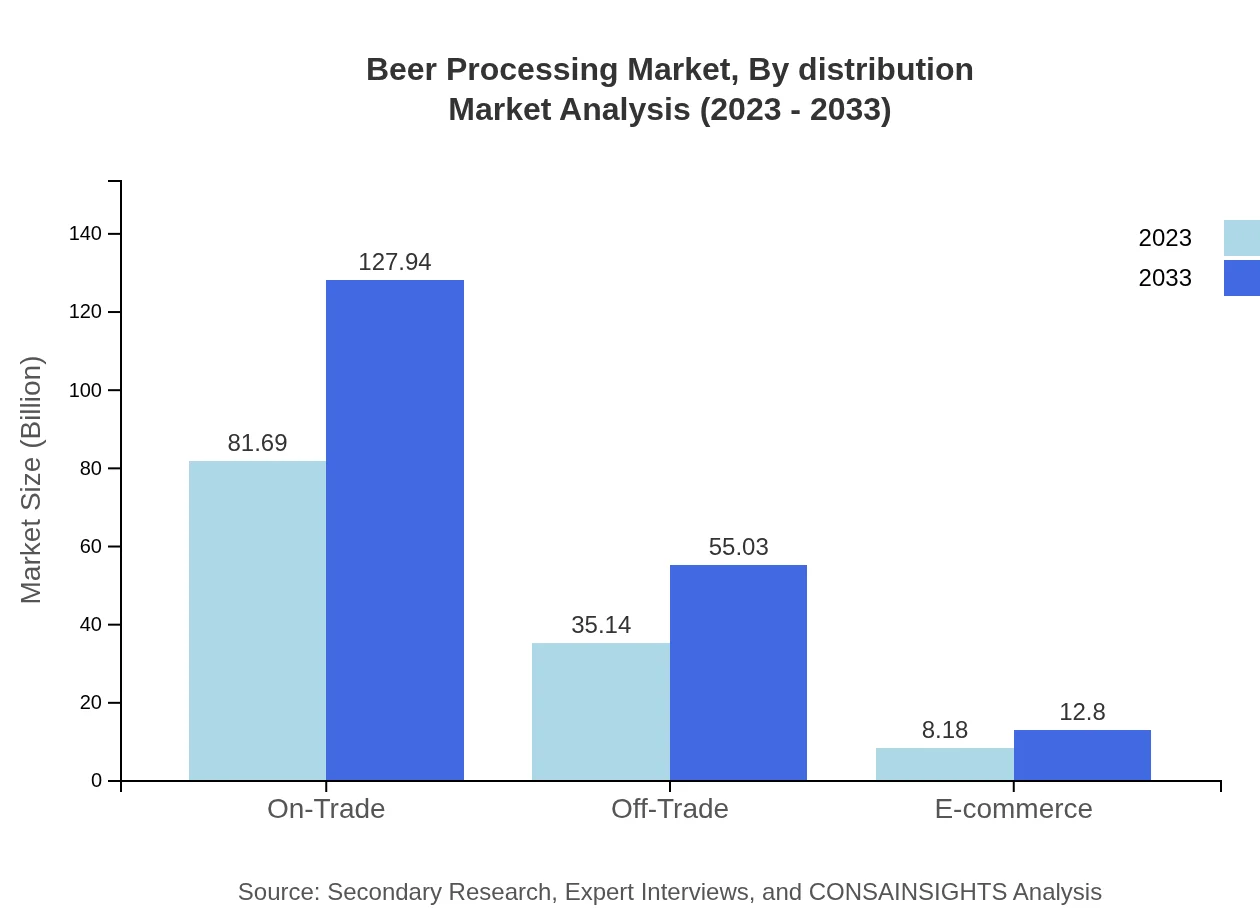

Beer Processing Market Analysis By Distribution

The distribution channels are segmented into On-Trade and Off-Trade sales. On-Trade captured USD 81.69 billion in 2023, while Off-Trade saw notable growth due to e-commerce and retail adjustments. E-commerce platforms are gaining ground as consumers shift towards online purchasing, driven by convenience and accessibility.

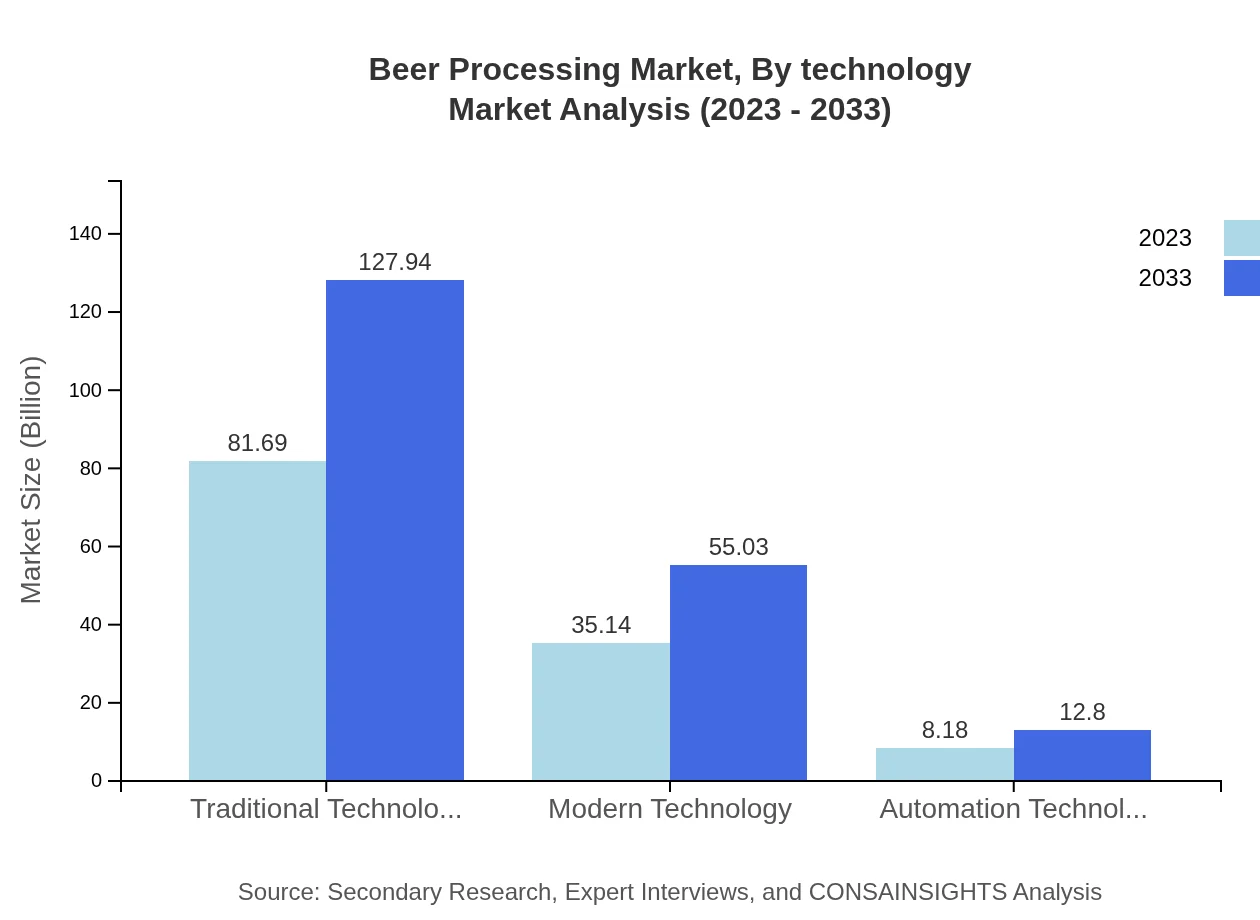

Beer Processing Market Analysis By Technology

The Beer Processing market is shaped by technological innovations, with Traditional methods still prevalent but Modern and Automation technologies gaining traction. Traditional Technology commands a market size of USD 81.69 billion in 2023, while Automation is growing due to increased efficiency and reduced operational costs.

Beer Processing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beer Processing Industry

Anheuser-Busch InBev:

A multinational beverage and brewing company headquartered in Leuven, Belgium, Anheuser-Busch InBev is the world's largest brewer, producing numerous iconic beer brands.Heineken N.V.:

Based in Amsterdam, Netherlands, Heineken is renowned for its pale lagers and innovative beer products, leading in sustainability practices within the brewing industry.Molson Coors Beverage Company:

An American multinational brewing company, Molson Coors specializes in beers and is known for adapting to changing consumer demands through diverse product offerings.Carlsberg Group:

A major international brewing company, Carlsberg based in Copenhagen, Denmark, focuses on sustainable brewing and offers a broad range of beer products globally.We're grateful to work with incredible clients.

FAQs

What is the market size of beer Processing?

The global beer-processing market is valued at approximately $125 billion in 2023 and is projected to grow at a CAGR of 4.5% over the next decade, reaching significant market expansion by 2033.

What are the key market players or companies in the beer Processing industry?

Key players in the beer-processing industry include Anheuser-Busch InBev, Heineken N.V., Carlsberg Group, Molson Coors Beverage Company, and Diageo, among others, all contributing to market dynamics.

What are the primary factors driving the growth in the beer processing industry?

Growth in the beer-processing industry is driven by rising consumer demand for craft and specialty beers, innovations in brewing technology, and increasing popularity of beer across various demographics.

Which region is the fastest Growing in the beer processing industry?

The Asia Pacific region is the fastest-growing market for beer processing, projected to increase from $26.70 billion in 2023 to $41.82 billion by 2033, reflecting a robust growth rate.

Does ConsaInsights provide customized market report data for the beer processing industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the beer processing industry, ensuring targeted insights and analyses.

What deliverables can I expect from this beer processing market research project?

Expect comprehensive deliverables including detailed market analysis, growth forecasts, competitive landscape, key trends, and segmented data covering all aspects of the beer processing industry.

What are the market trends of beer processing?

Current market trends include the rise of craft brewing, sustainability initiatives in production, innovative packaging solutions, and the increasing integration of technology within brewing processes.