Benzene Toluene Xylene Btx Market Report

Published Date: 02 February 2026 | Report Code: benzene-toluene-xylene-btx

Benzene Toluene Xylene Btx Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Benzene Toluene Xylene (BTX) market, covering market size, growth forecasts, regional insights, industry trends, and competitive landscape from 2023 to 2033.

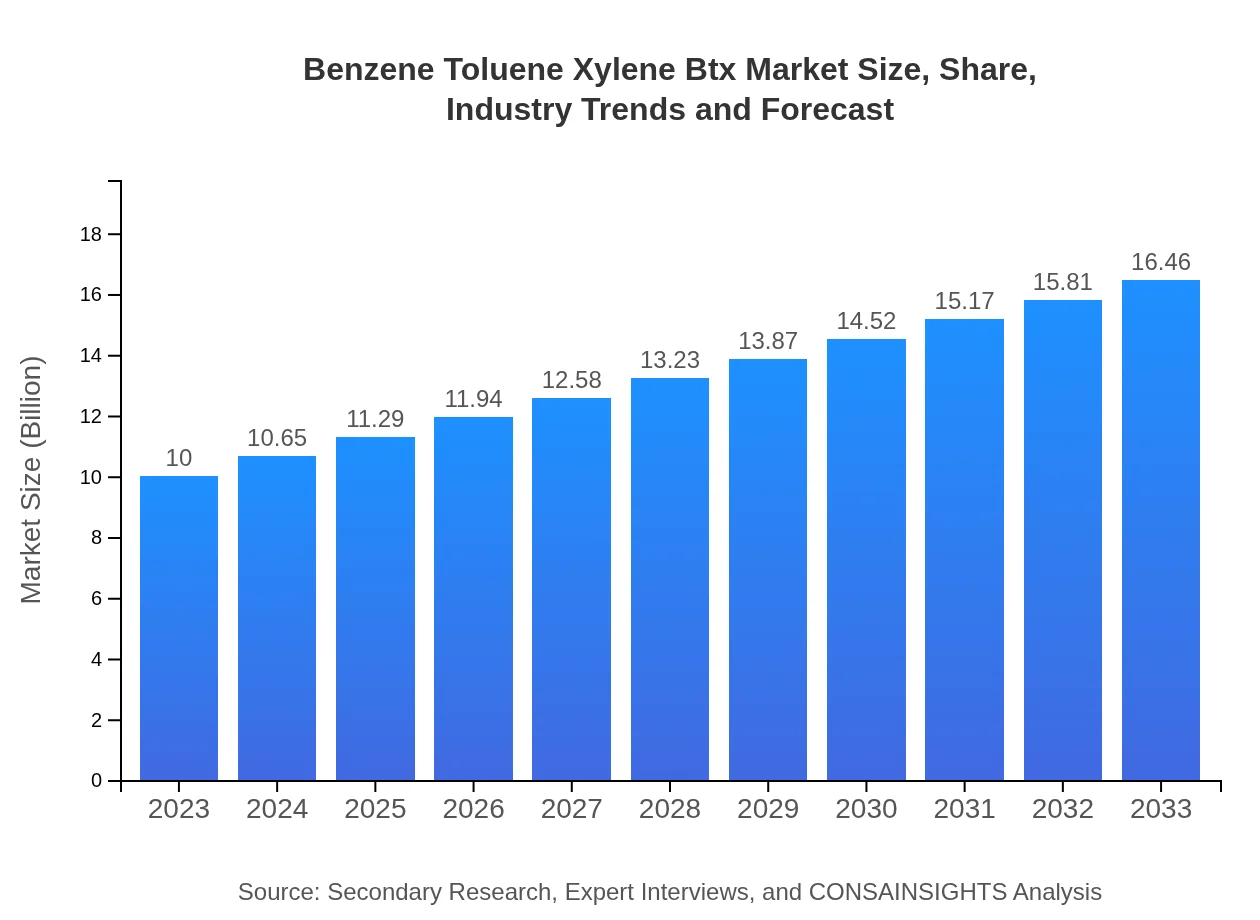

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.00 Billion |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $16.46 Billion |

| Top Companies | ExxonMobil, BASF SE, China National Petroleum Corporation (CNPC), SABIC |

| Last Modified Date | 02 February 2026 |

Benzene Toluene Xylene Btx Market Overview

Customize Benzene Toluene Xylene Btx Market Report market research report

- ✔ Get in-depth analysis of Benzene Toluene Xylene Btx market size, growth, and forecasts.

- ✔ Understand Benzene Toluene Xylene Btx's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Benzene Toluene Xylene Btx

What is the Market Size & CAGR of Benzene Toluene Xylene Btx market in 2023?

Benzene Toluene Xylene Btx Industry Analysis

Benzene Toluene Xylene Btx Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Benzene Toluene Xylene Btx Market Analysis Report by Region

Europe Benzene Toluene Xylene Btx Market Report:

Europe's BTX market is forecast to grow from $3.59 billion in 2023 to $5.90 billion in 2033, driven by stringent environmental regulations and a push toward sustainable chemical processes. Investment in green technologies within the petrochemical sector will further enhance growth.Asia Pacific Benzene Toluene Xylene Btx Market Report:

In Asia Pacific, the BTX market is projected to grow from $1.87 billion in 2023 to $3.08 billion in 2033, driven by industrial expansion and increasing consumer demand in countries like China and India. The rise of the automotive and chemicals sectors in these countries supports robust market growth.North America Benzene Toluene Xylene Btx Market Report:

In North America, the market size will increase from $3.34 billion in 2023 to $5.50 billion in 2033, largely due to advancements in shale gas extraction leading to higher feedstock availability and competitive pricing, thus fostering growth in petrochemical production.South America Benzene Toluene Xylene Btx Market Report:

The South American BTX market is expected to grow slightly from $0.14 billion in 2023 to $0.23 billion by 2033. Growth is impacted by economic factors and political stability, which affect manufacturing capabilities and industrial demand in the region.Middle East & Africa Benzene Toluene Xylene Btx Market Report:

In the Middle East and Africa, the market is expected to increase from $1.06 billion in 2023 to $1.74 billion in 2033. The region's rich oil reserves create a favorable environment for BTX production, spurring growth in the local chemical industry.Tell us your focus area and get a customized research report.

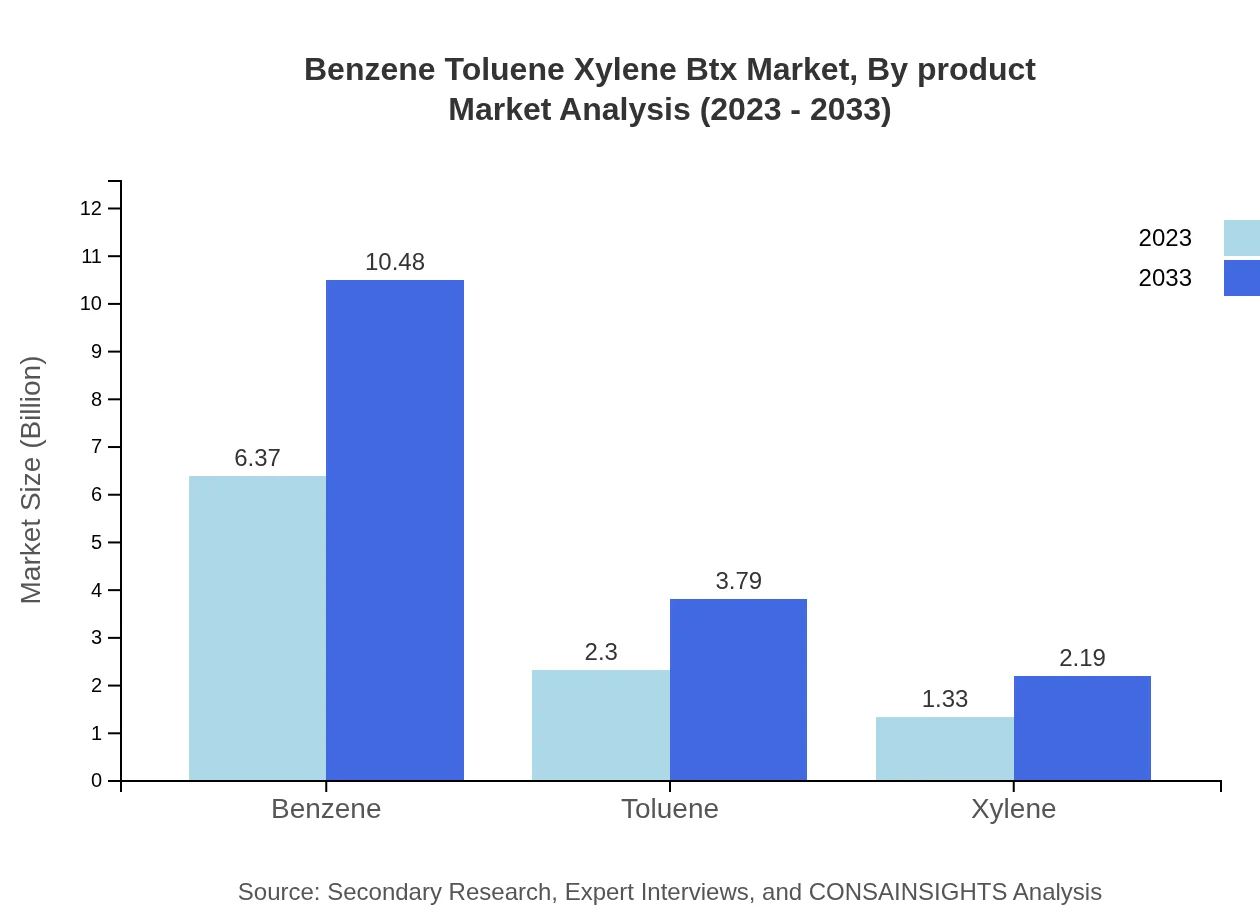

Benzene Toluene Xylene Btx Market Analysis By Product

The market is dominated by Benzene, accounting for approximately 63.7% of the total market in both 2023 and 2033, highlighting its essential role in various chemicals. Toluene shares around 23% of the market, while Xylene contributes about 13.3%, which is indicative of its niche applications.

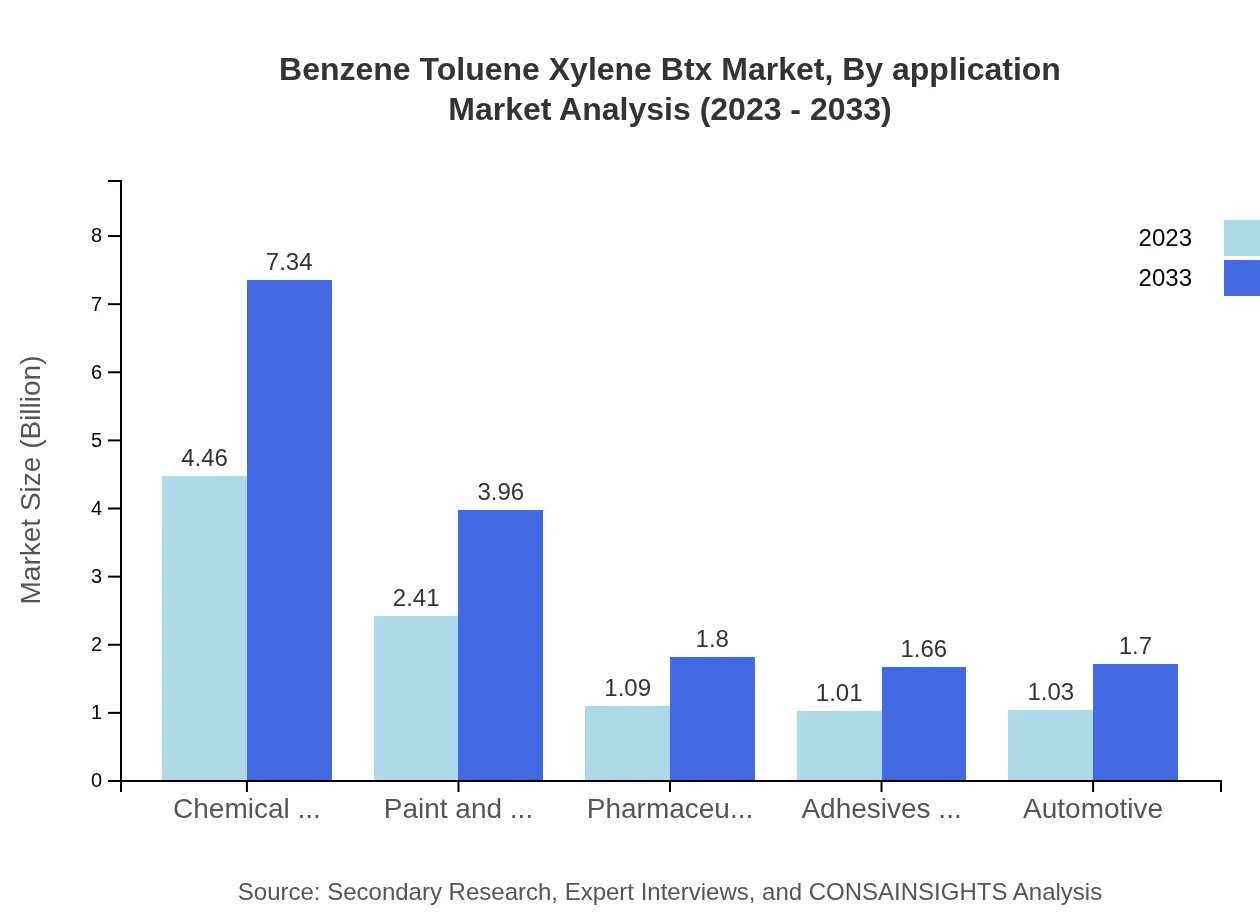

Benzene Toluene Xylene Btx Market Analysis By Application

Major applications of BTX include the automotive industry, where demand for solvents and coatings is high, alongside paints and coatings, which absorb a significant portion of Toluene and Xylene. Pharmaceutical formulations also extensively utilize BTX derivatives, contributing to consistent demand.

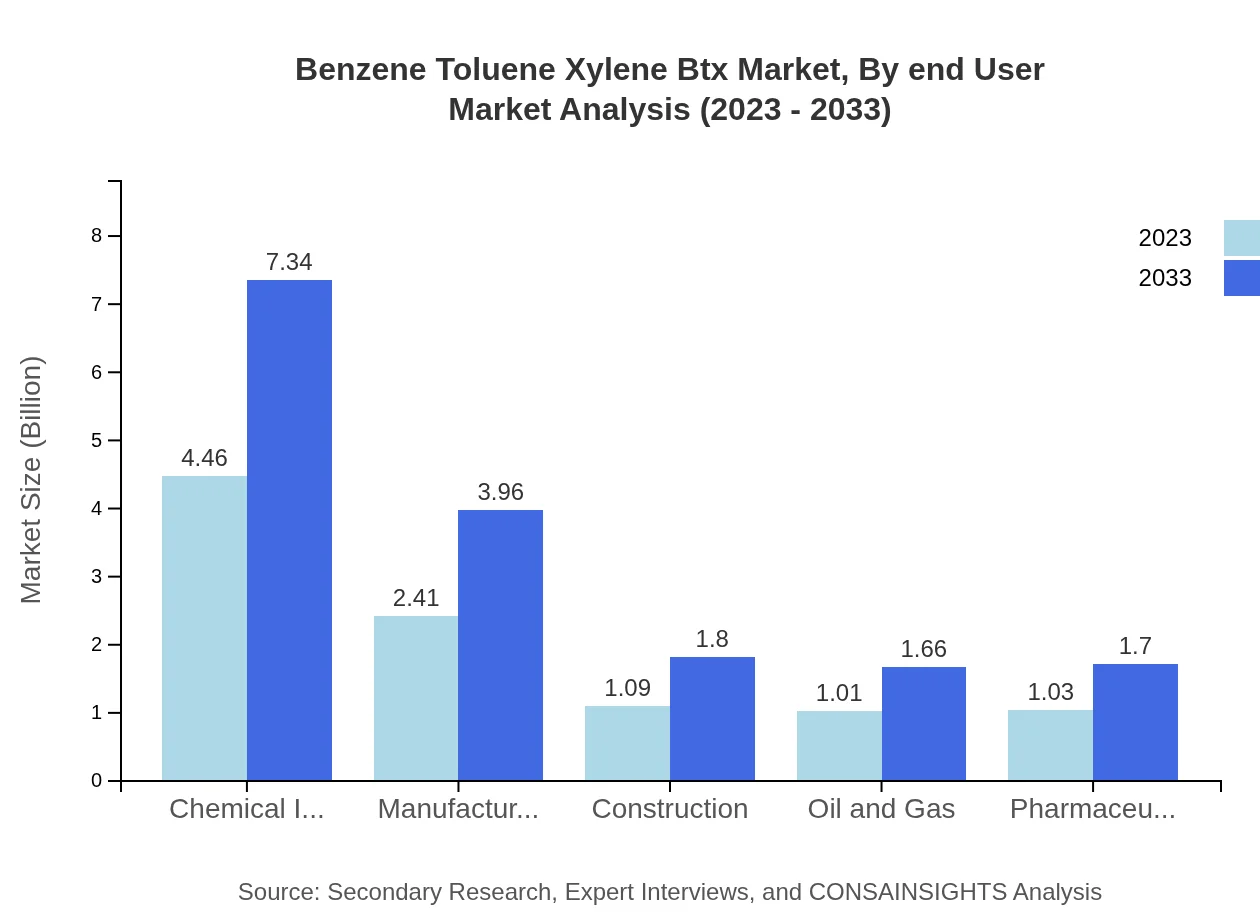

Benzene Toluene Xylene Btx Market Analysis By End User

End-user industries predominantly include chemicals and manufacturing, contributing over 60% to the market share. Sectors such as construction, oil and gas, and automotive are also significant, ensuring broad growth opportunities for BTX producers.

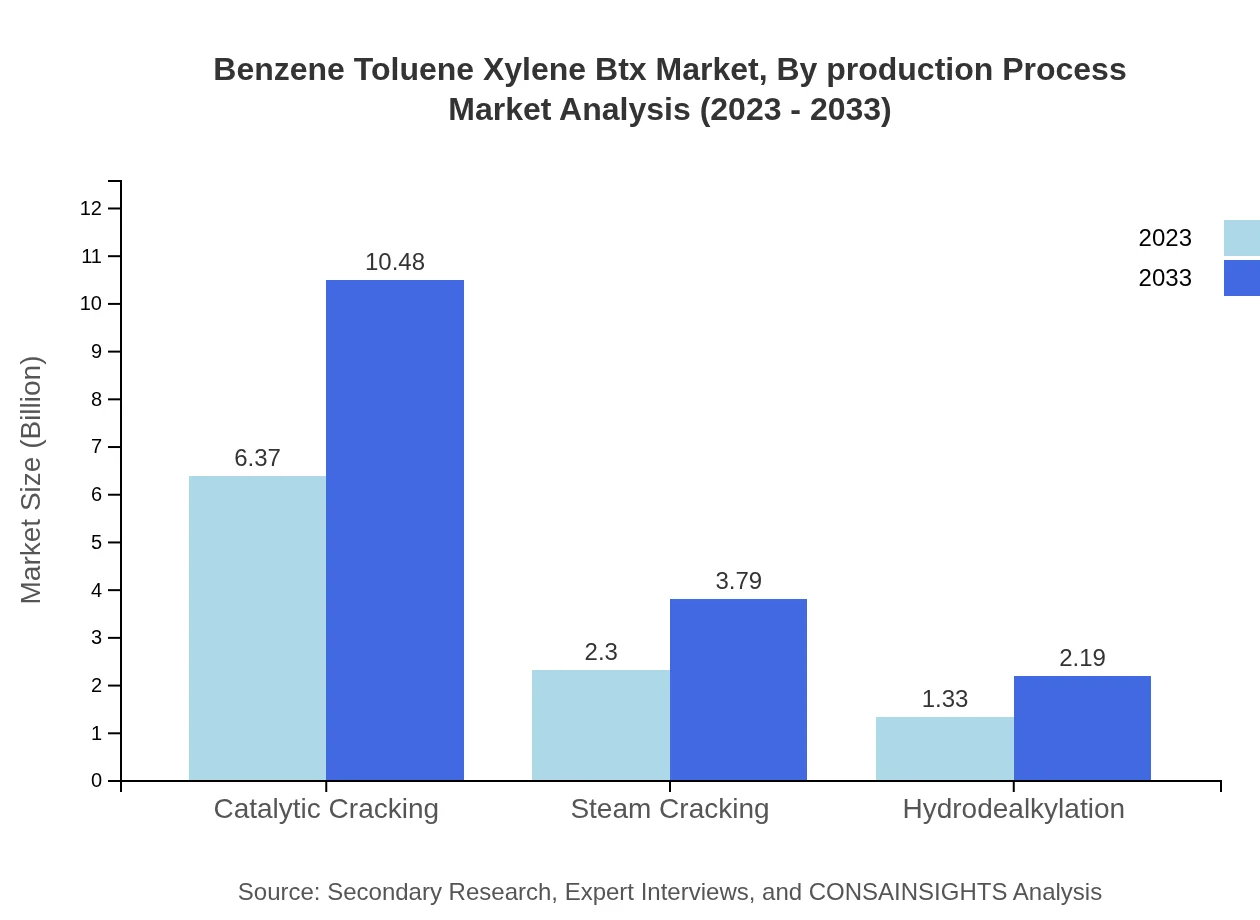

Benzene Toluene Xylene Btx Market Analysis By Production Process

Production methods like catalytic cracking dominate the BTX market with a 63.7% share, thanks to their efficiency. Steam cracking also holds a significant 23% share, while hydrodealkylation accounts for 13.3%, indicating the advancements in oil refining technologies.

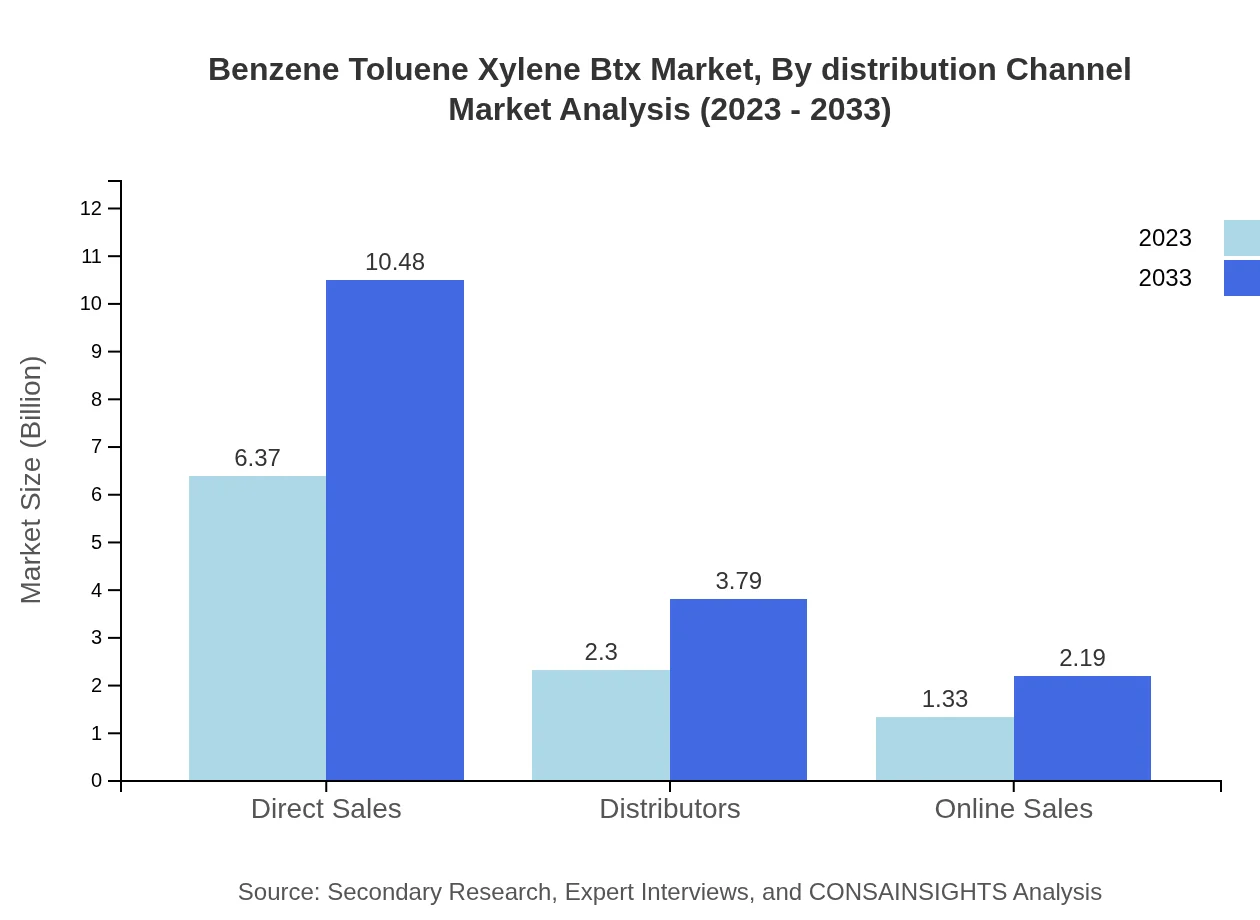

Benzene Toluene Xylene Btx Market Analysis By Distribution Channel

Direct sales channel remains significant, representing 63.7% of the market share, driven by manufacturers' direct engagement with end-users. Distributors and online sales are also emerging as crucial channels, adapting to modern economic and technological landscapes.

Benzene Toluene Xylene Btx Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Benzene Toluene Xylene Btx Industry

ExxonMobil:

A leading chemical and petrochemical manufacturer, ExxonMobil has a significant share in the BTX market due to its extensive production capabilities and technological advancements in refining processes.BASF SE:

BASF is a global leader in chemical production, prominent in the BTX market, specializing in sustainable solutions and innovation, focusing on reducing environmental impact while meeting growing demands.China National Petroleum Corporation (CNPC):

CNPC is a major player in the BTX sector, capitalizing on China's vast resources and demand for chemical products, positioning itself as a front-runner through continuous investments in production technologies.SABIC:

Saudi Basic Industries Corporation (SABIC) is known for its extensive operations in the BTX market, focusing on maximizing efficiency and sustainable practices across its production lines.We're grateful to work with incredible clients.

FAQs

What is the market size of benzene Toluene Xylene Btx?

The market size of the Benzene, Toluene, and Xylene (BTX) industry is currently valued at approximately $10 billion in 2023. The market is projected to grow at a CAGR of 5%, reaching significant value by 2033, indicating robust growth prospects.

What are the key market players or companies in this benzene Toluene Xylene Btx industry?

Key market players in the BTX industry include major chemical manufacturers and oil refining companies, which dominate the supply chain. They focus on sustainable practices and innovations to meet increasing demand effectively, thereby influencing market dynamics.

What are the primary factors driving the growth in the benzene Toluene Xylene Btx industry?

The BTX market's growth is driven by increased demand in industries like chemicals, pharmaceuticals, and construction. Additionally, technological advancements and a shift towards greener production processes contribute to market expansion, making BTX essential for future applications.

Which region is the fastest Growing in the benzene Toluene Xylene Btx?

The Asia Pacific region is the fastest-growing market for BTX, projected to grow from $1.87 billion in 2023 to $3.08 billion by 2033. This growth is fueled by rapid industrialization and increased demand for petrochemical products in emerging economies.

Does ConsaInsights provide customized market report data for the benzene Toluene Xylene Btx industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the BTX industry. These reports provide in-depth analysis and tailored insights that align with unique market requirements and strategic goals.

What deliverables can I expect from this benzene Toluene Xylene Btx market research project?

Deliverables from the BTX market research project typically include comprehensive reports, market forecasts, segment analysis, competitor insights, and actionable recommendations. These resources provide valuable guidance for strategic decision-making and investment opportunities.

What are the market trends of benzene Toluene Xylene Btx?

Current market trends include a focus on eco-friendly processes, technological advancements, and diversification of applications for BTX chemicals. Increasing environmental regulations are also prompting manufacturers to innovate and reduce emissions, shaping the industry's future direction.