Betaine Market Report

Published Date: 01 February 2026 | Report Code: betaine

Betaine Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Betaines market from 2023 to 2033, including market size, industry trends, segmentation, regional insights, and forecasts. It aims to offer valuable insights into the future growth trajectory and dynamics of this market.

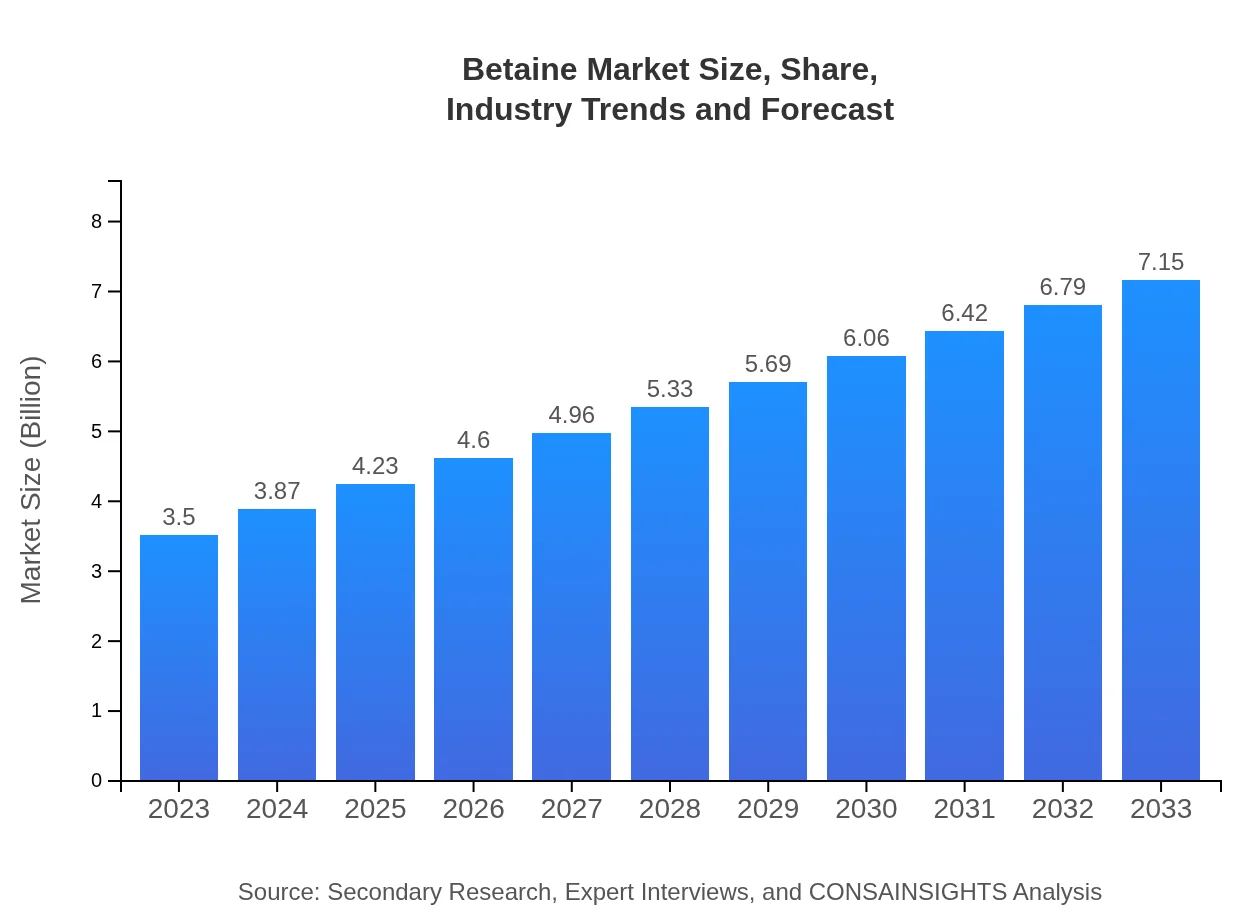

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $3.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $7.15 Billion |

| Top Companies | BASF SE, Cargill, Inc., Solvay S.A., American Crystal Sugar Company |

| Last Modified Date | 01 February 2026 |

Betaine Market Overview

Customize Betaine Market Report market research report

- ✔ Get in-depth analysis of Betaine market size, growth, and forecasts.

- ✔ Understand Betaine's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Betaine

What is the Market Size & CAGR of Betaine market in 2023?

Betaine Industry Analysis

Betaine Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Betaine Market Analysis Report by Region

Europe Betaine Market Report:

In Europe, the market for Betaines was USD 1.22 billion in 2023 and is anticipated to reach USD 2.50 billion by 2033. Regulatory support for food safety and clean-label products, along with a well-established cosmetics sector, are the key contributors to this growth.Asia Pacific Betaine Market Report:

In the Asia Pacific region, the Betaines market was valued at USD 0.64 billion in 2023 and is projected to grow to USD 1.31 billion by 2033, supported by rising consumer spending on health and wellness products and an expanding food and beverage sector. The demand for animal feed is also aiding market growth in this region.North America Betaine Market Report:

North America leads the Betaines market with a valuation of USD 1.18 billion in 2023, projected to grow to USD 2.41 billion by 2033. Continuous innovation in the food and beverage industry, alongside a strong focus on health and nutrition, significantly drives growth in this market.South America Betaine Market Report:

The South American Betaines market exhibited a value of USD 0.07 billion in 2023 with expectations to reach USD 0.14 billion by 2033. Growth in this region is primarily driven by the increasing trend of natural ingredients in food and personal care products, coupled with agricultural advancements.Middle East & Africa Betaine Market Report:

The Middle East and Africa region recorded a market size of USD 0.38 billion in 2023, with projections of reaching USD 0.79 billion by 2033. The growth is fueled by increasing dietary supplement consumption and rising awareness around health and wellness.Tell us your focus area and get a customized research report.

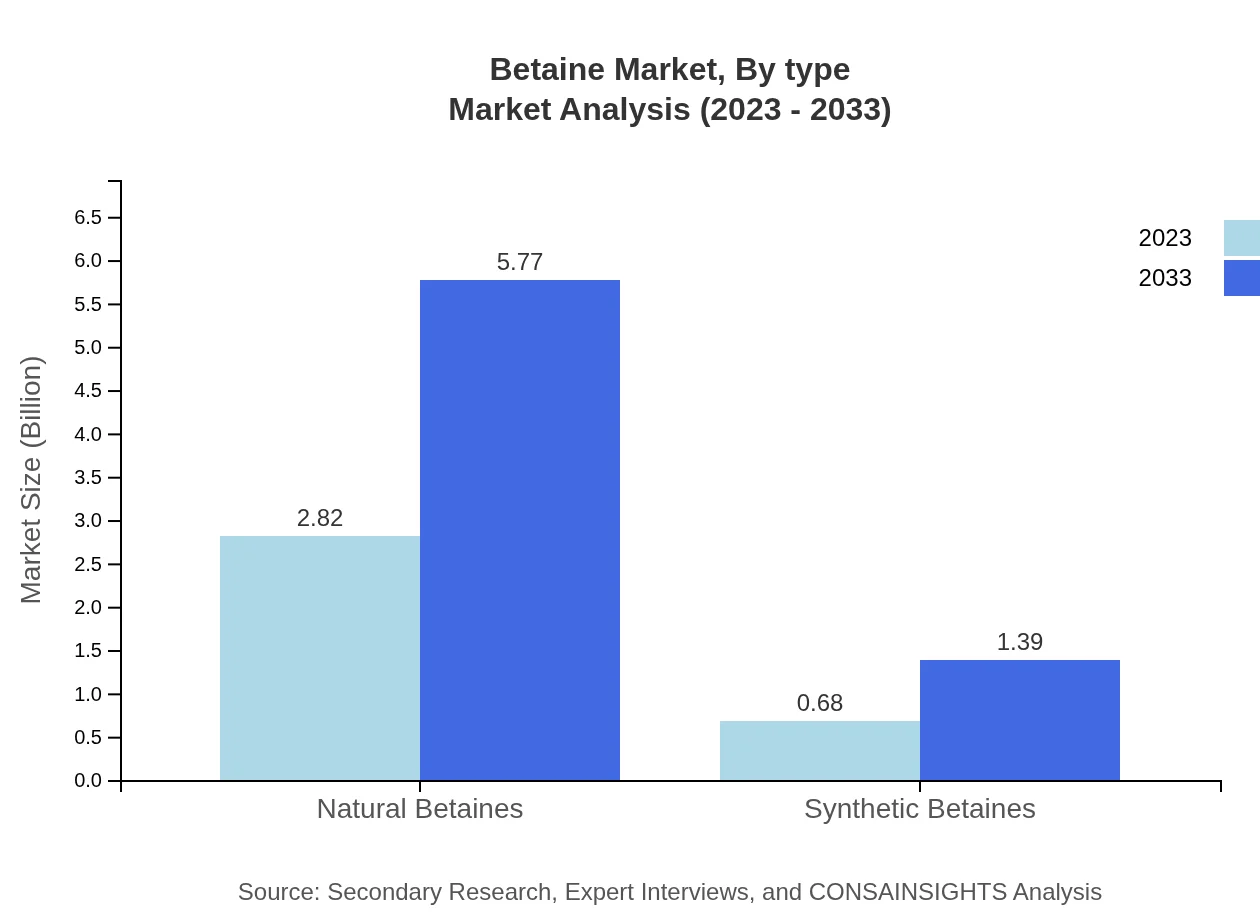

Betaine Market Analysis By Type

The Betaine market is segmented into natural and synthetic types. Natural Betaines dominate the market with a size of USD 2.82 billion in 2023 and an expected growth to USD 5.77 billion by 2033, accounting for 80.62% market share. Synthetic Betaines, although smaller at USD 0.68 billion in 2023, are projected to grow to USD 1.39 billion by 2033, maintaining a 19.38% market share.

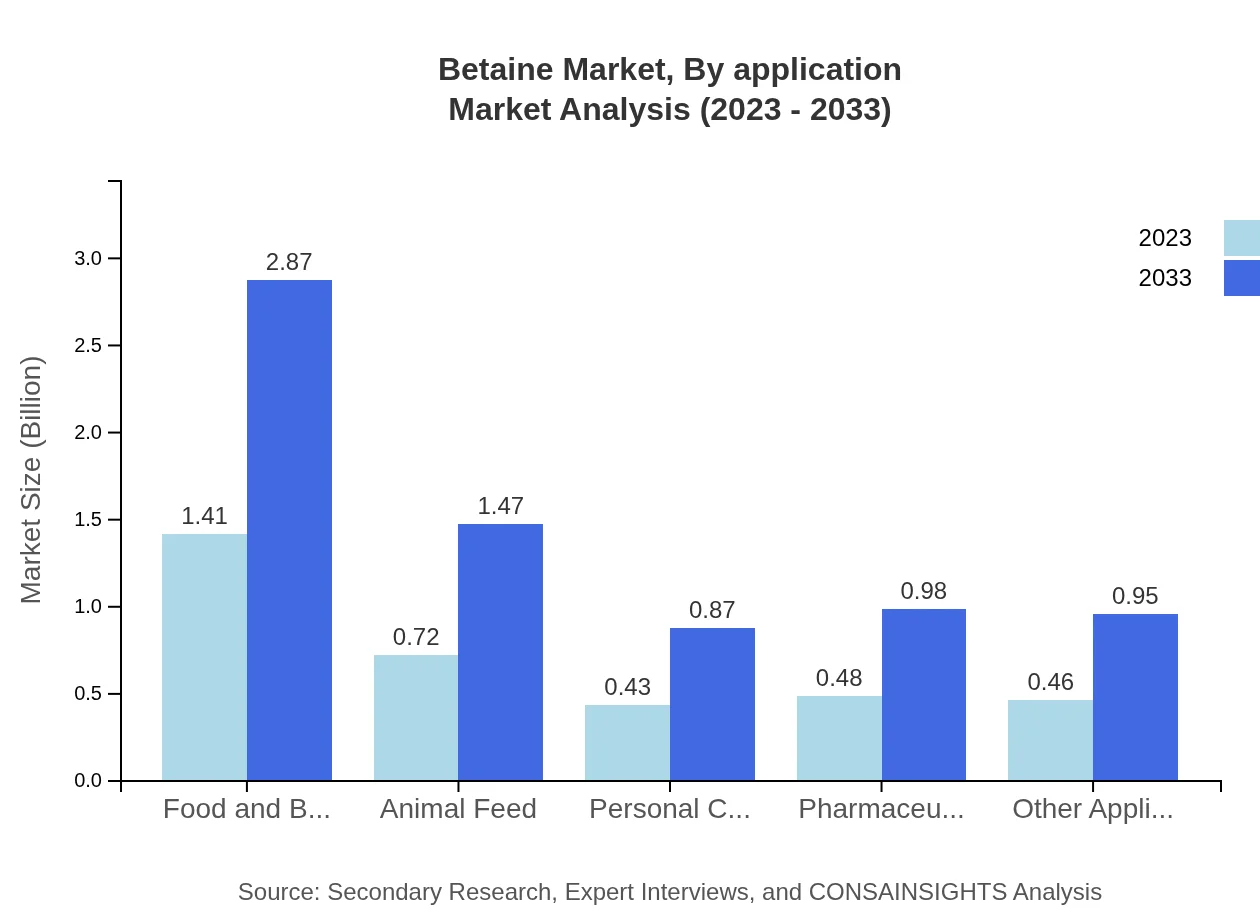

Betaine Market Analysis By Application

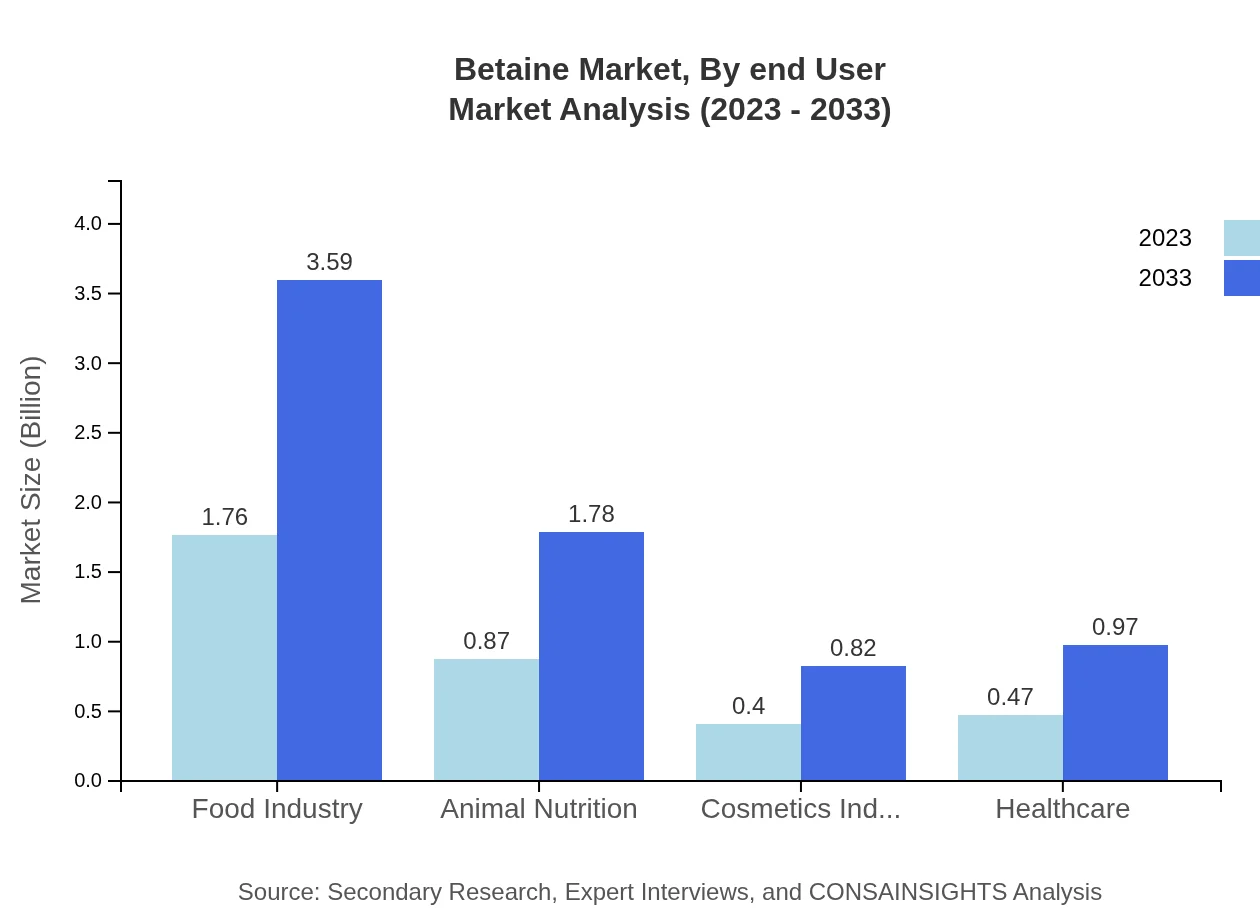

Applications of Betaines are diverse, with the food industry valued at USD 1.76 billion in 2023 and projected to grow to USD 3.59 billion by 2033, representing a 50.2% market share. The animal nutrition segment follows closely with a market size of USD 0.87 billion in 2023, expected to reach USD 1.78 billion by 2033, holding a share of 24.87%. Other significant applications include personal care, pharmaceuticals, and healthcare, which demonstrate substantial growth as well.

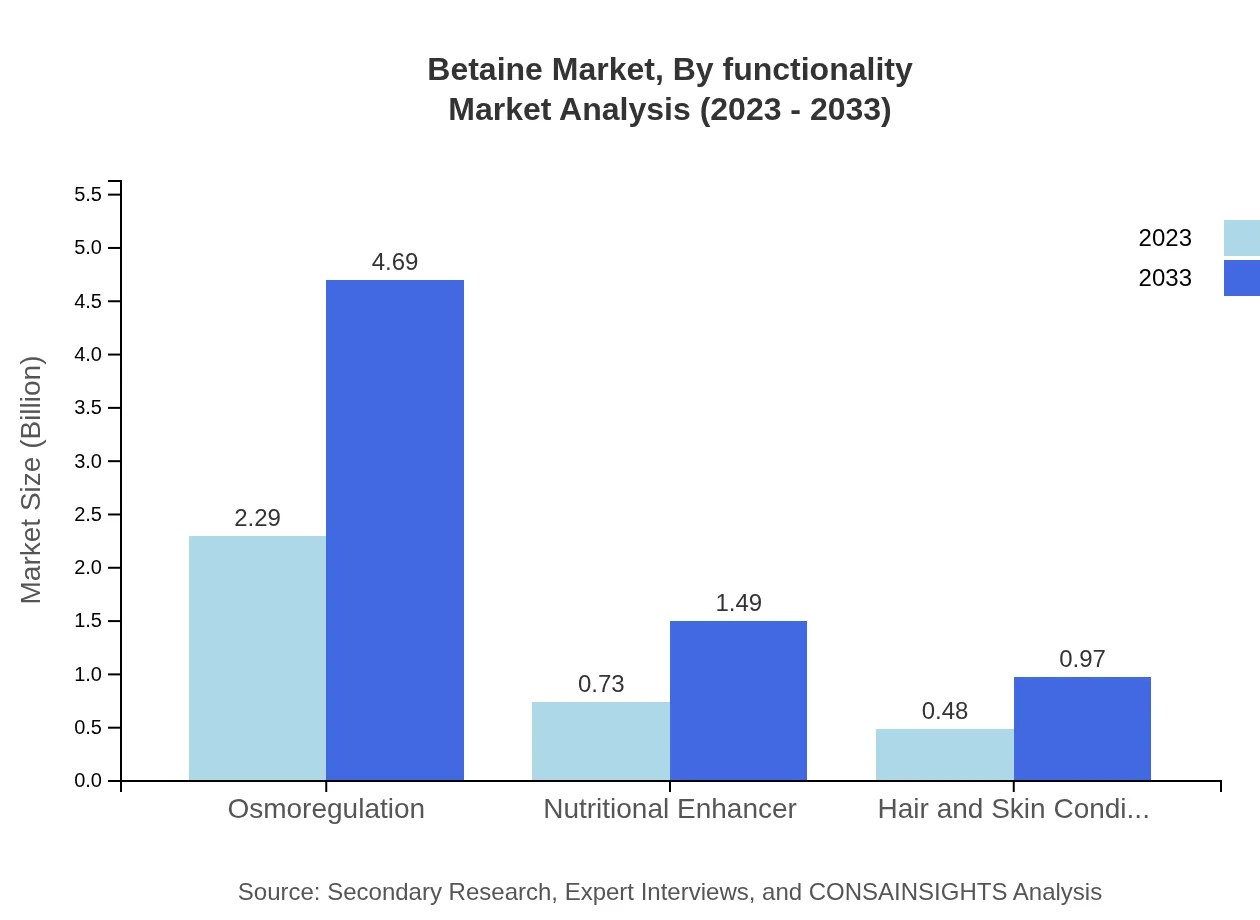

Betaine Market Analysis By Functionality

The functionality segments encompass osmoregulation and nutritional enhancement, with osmoregulation leading at USD 2.29 billion in 2023 and projected to increase to USD 4.69 billion by 2033, accounting for 65.57% market share. Nutritional enhancers stand at USD 0.73 billion in 2023 with a forecast of USD 1.49 billion by 2033, representing a 20.81% share.

Betaine Market Analysis By End User

End-user industries such as food and beverages, animal feed, cosmetics, and pharmaceuticals exhibit promising growth potential. The food and beverages segment is valued at USD 1.41 billion in 2023, expecting USD 2.87 billion by 2033, with a 40.18% share. Followed by pharmaceuticals at USD 0.48 billion in 2023, anticipated to double to USD 0.98 billion by 2033, maintaining a 13.75% share.

Betaine Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Betaine Industry

BASF SE:

A global leader in chemicals, BASF produces high-quality natural betaines for various applications, contributing significantly to market growth with its innovative product solutions.Cargill, Inc.:

Cargill is vital in the production and distribution of betaine derived from sugar beets, promoting clean label initiatives, and expanding its footprint in the animal nutrition market.Solvay S.A.:

Specializing in sustainable solutions, Solvay offers a range of betaine products focusing on health, performance, and the advancement of personal care applications.American Crystal Sugar Company:

A prominent sugar beet producer, American Crystal Sugar Company is deeply integrated in the betaïne production chain, providing natural products to both food and animal feed sectors.We're grateful to work with incredible clients.

FAQs

What is the market size of betaine?

As of 2023, the global betaine market is valued at approximately $3.5 billion, with a projected CAGR of 7.2% through 2033, indicating strong growth potential in this sector.

What are the key market players or companies in this betaine industry?

Key players in the betaine industry include major manufacturers and suppliers who are actively engaged in the production of natural and synthetic betaines, enhancing the market's competitive landscape with their innovative solutions.

What are the primary factors driving the growth in the betaine industry?

The betaine industry is primarily driven by rising demand in food and beverages, animal nutrition, and cosmetics, alongside increasing healthcare awareness and utilization, promoting overall market expansion.

Which region is the fastest Growing in the betaine?

Europe is the fastest-growing region for betaine, projected to grow from $1.22 billion in 2023 to $2.50 billion by 2033, outpacing other regions like Asia-Pacific and North America.

Does ConsaInsights provide customized market report data for the betaine industry?

Yes, ConsaInsights offers tailored market report data for the betaine industry, addressing specific client needs and ensuring relevant insights for different business sectors such as food, pharmaceuticals, and cosmetics.

What deliverables can I expect from this betaine market research project?

Deliverables from the betaine market research project include comprehensive market analysis reports, segmentation data, growth forecasts, and strategic recommendations tailored to industry needs.

What are the market trends of betaine?

Current market trends in betaine include a shift towards natural formulations, increasing consumer awareness regarding health benefits, and sustained demand across food, animal feed, and cosmetic sectors.