Beverage Cans Market Report

Published Date: 02 February 2026 | Report Code: beverage-cans

Beverage Cans Market Size, Share, Industry Trends and Forecast to 2033

This report offers an in-depth analysis of the Beverage Cans market, offering insights on market trends, size, segmentation, and regional dynamics, with a forecast period from 2023 to 2033.

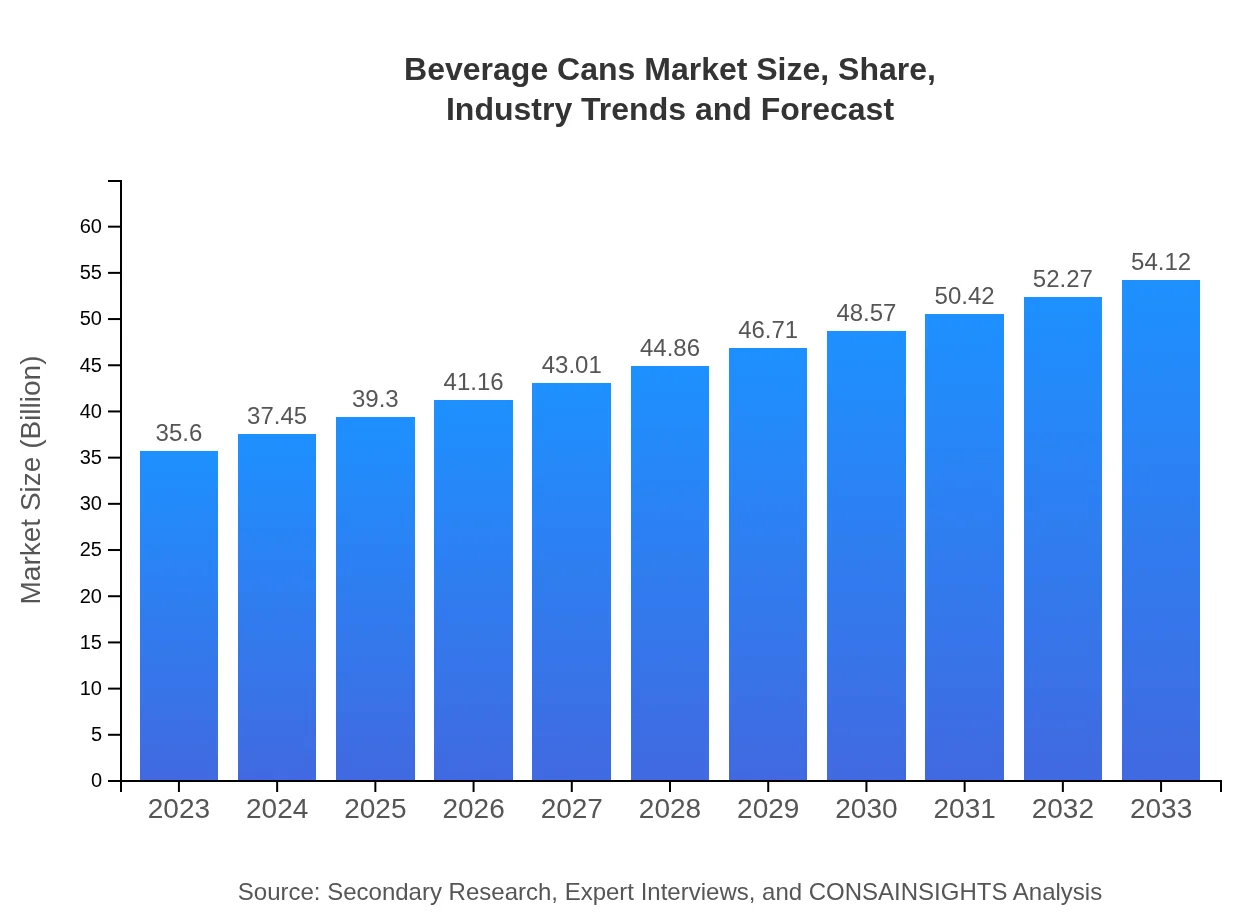

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $35.60 Billion |

| CAGR (2023-2033) | 4.2% |

| 2033 Market Size | $54.12 Billion |

| Top Companies | Crown Holdings, Inc., Ball Corporation, Ardagh Group, Mondi Group |

| Last Modified Date | 02 February 2026 |

Beverage Cans Market Overview

Customize Beverage Cans Market Report market research report

- ✔ Get in-depth analysis of Beverage Cans market size, growth, and forecasts.

- ✔ Understand Beverage Cans's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Cans

What is the Market Size & CAGR of Beverage Cans market in 2023?

Beverage Cans Industry Analysis

Beverage Cans Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Cans Market Analysis Report by Region

Europe Beverage Cans Market Report:

Europe's Beverage Cans market size is projected to grow from $12.07 billion in 2023 to $18.35 billion by 2033, fueled by strong regulations for sustainability and packaging innovation initiatives.Asia Pacific Beverage Cans Market Report:

The Asia Pacific Beverage Cans market size was valued at approximately $6.74 billion in 2023 and is expected to reach $10.25 billion by 2033, driven by rising urbanization, a growing middle-class population, and increased consumption of bottled drinks.North America Beverage Cans Market Report:

North America's market was valued at $11.52 billion in 2023, expected to reach $17.51 billion by 2033, largely supported by consumer demand for diverse beverage options and a well-established packaging industry.South America Beverage Cans Market Report:

In South America, the Beverage Cans market was valued at $2.38 billion in 2023, projected to increase to $3.62 billion by 2033. This growth can be attributed to changing consumer preferences towards packaged beverages.Middle East & Africa Beverage Cans Market Report:

The market for Beverage Cans in the Middle East and Africa is expected to grow from $2.89 billion in 2023 to $4.40 billion by 2033, driven by the burgeoning beverage industry and increasing awareness regarding sustainability.Tell us your focus area and get a customized research report.

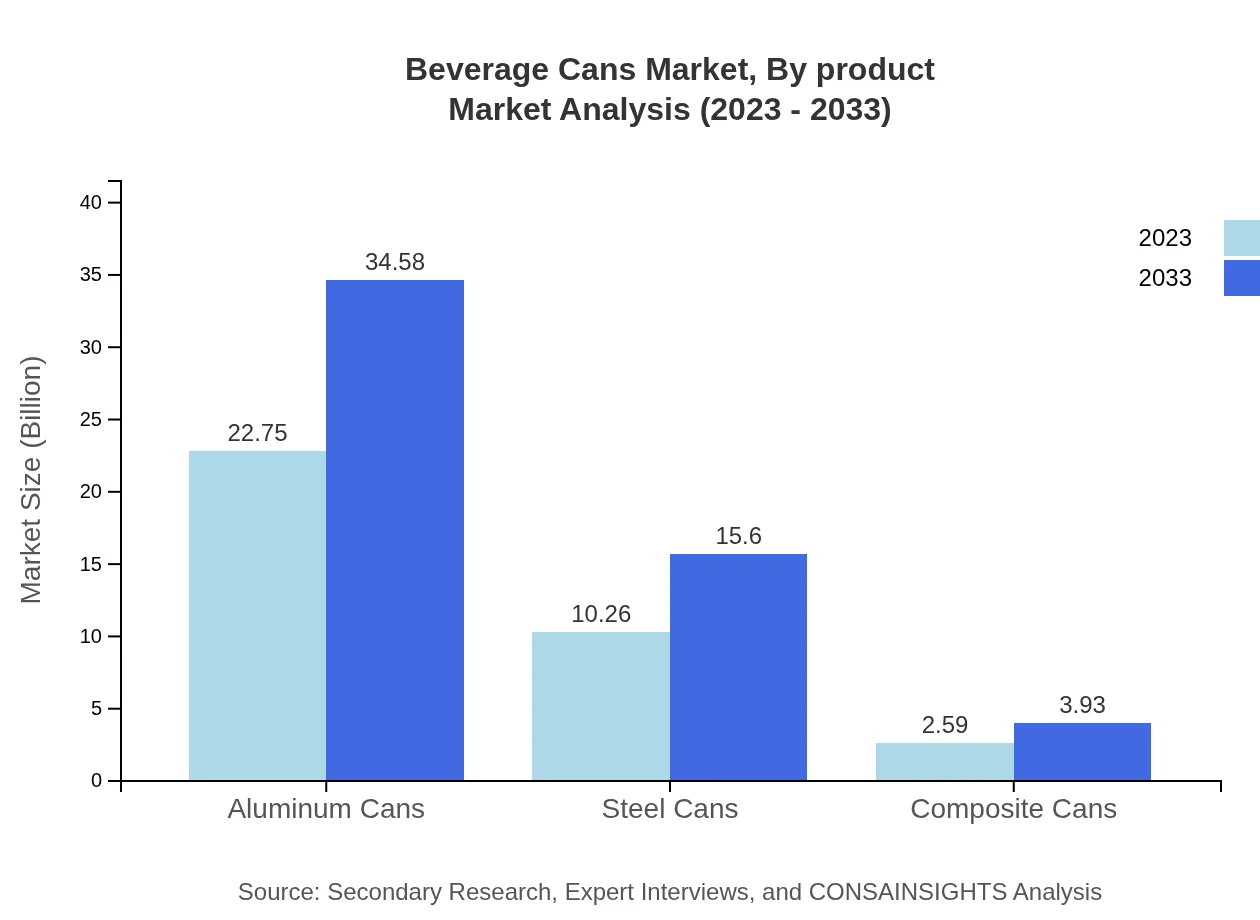

Beverage Cans Market Analysis By Product

The Beverage Cans market is significantly influenced by product types. Aluminum cans dominate this segment, expected to grow from $22.75 billion in 2023 to $34.58 billion by 2033, maintaining a market share of 63.9% due to their lightweight benefits and recyclability. Steel cans follow, with expected growth from $10.26 billion to $15.60 billion, making up 28.83% of the market. Custom design cans show potential growth as brands seek unique packaging solutions, increasing from $2.59 billion to $3.93 billion.

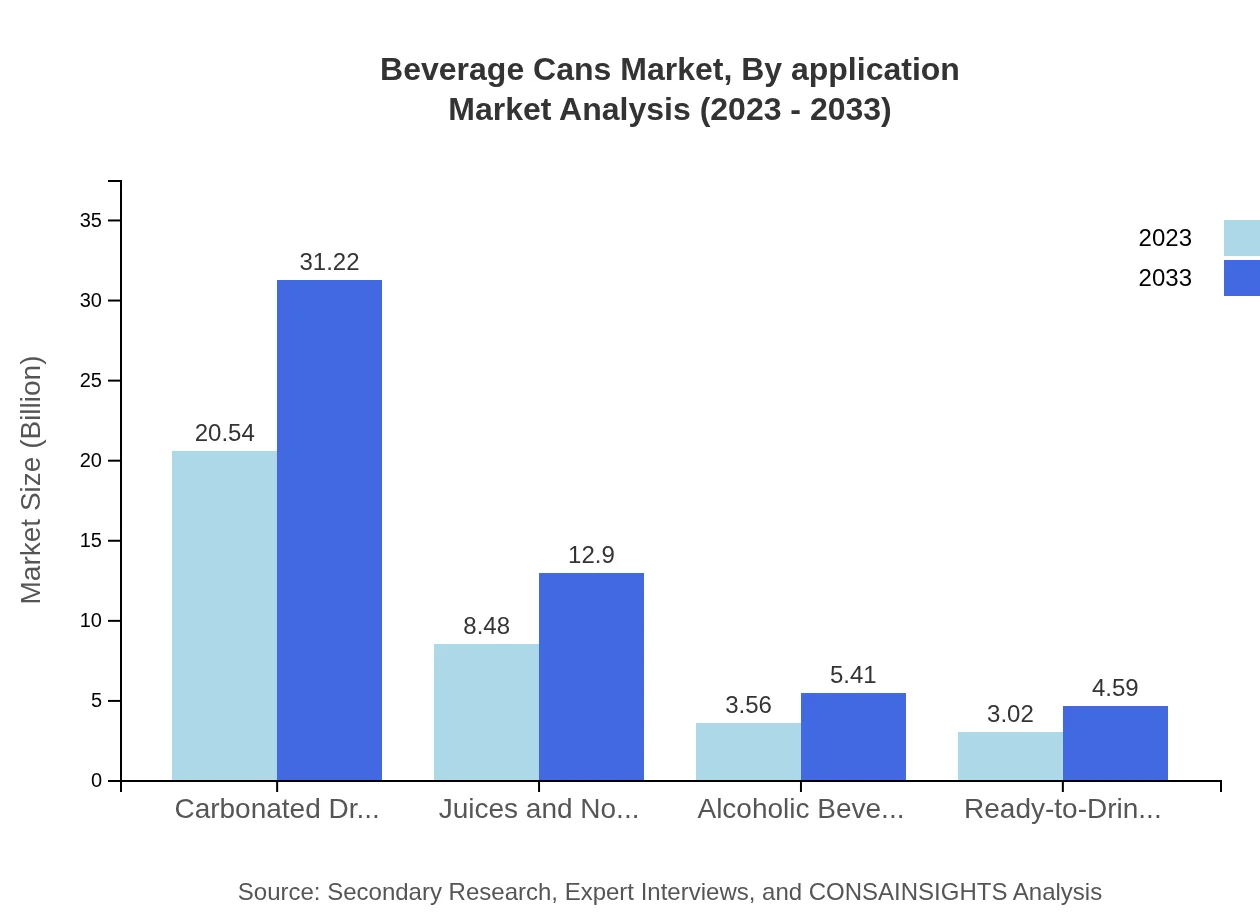

Beverage Cans Market Analysis By Application

Key applications for Beverage Cans include carbonated drinks, juices, and alcoholic beverages. Carbonated drinks lead this segment, projected to increase from $20.54 billion in 2023 to $31.22 billion by 2033, holding 57.69% market share. Juices and non-carbonated beverages are expected to see growth from $8.48 billion to $12.90 billion, expanding their market share. Alcoholic beverages maintain consistent growth, expected to grow from $3.56 billion to $5.41 billion.

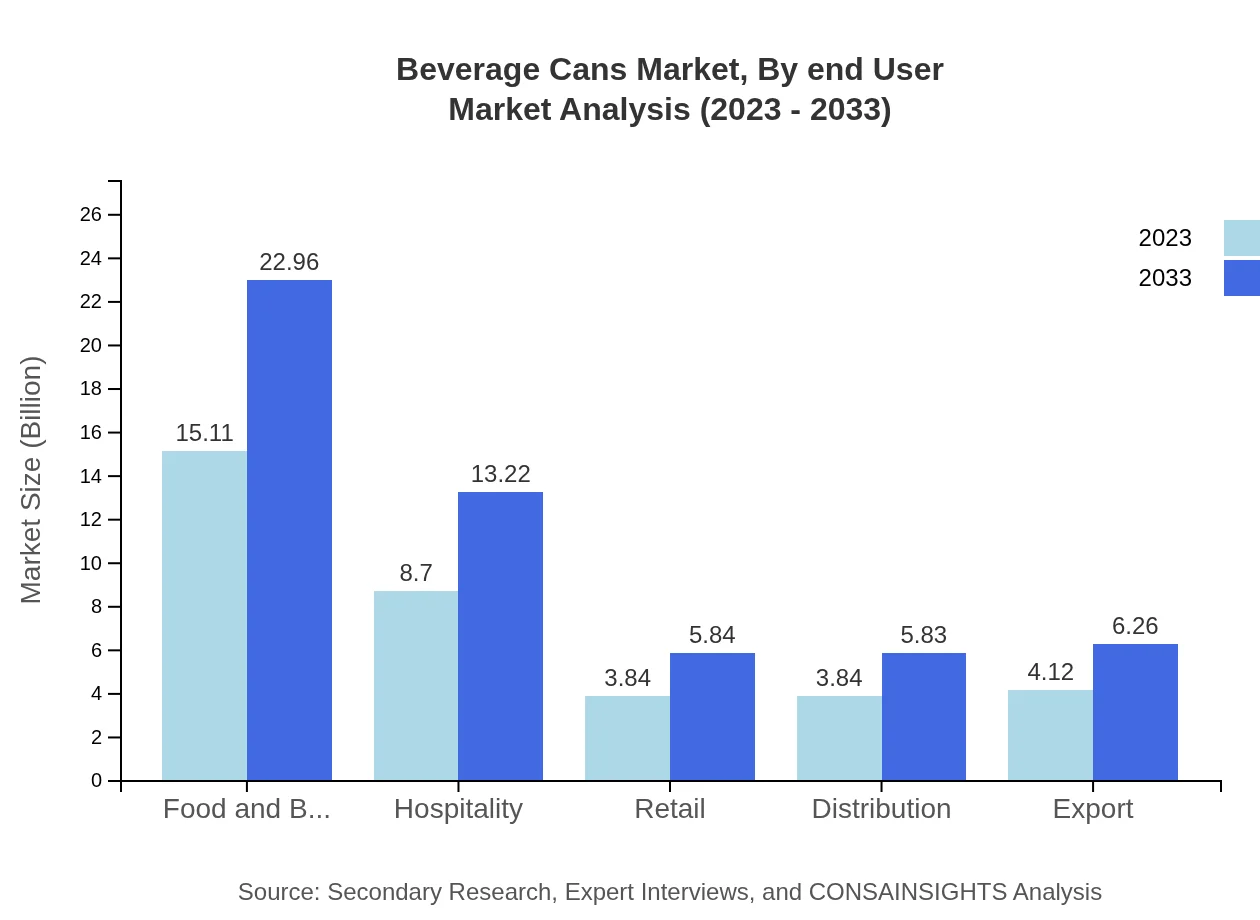

Beverage Cans Market Analysis By End User

The end-user industry for Beverage Cans is diversified, including food and beverage, hospitality, and retail sectors. The food and beverage segment is projected to grow from $15.11 billion to $22.96 billion, capturing 42.43% of the market. In hospitality, a shift towards canned beverages is causing growth from $8.70 billion to $13.22 billion, representing 24.43% market share. Retail is expected to grow from $3.84 billion to $5.84 billion as consumer preferences shift towards convenient purchasing options.

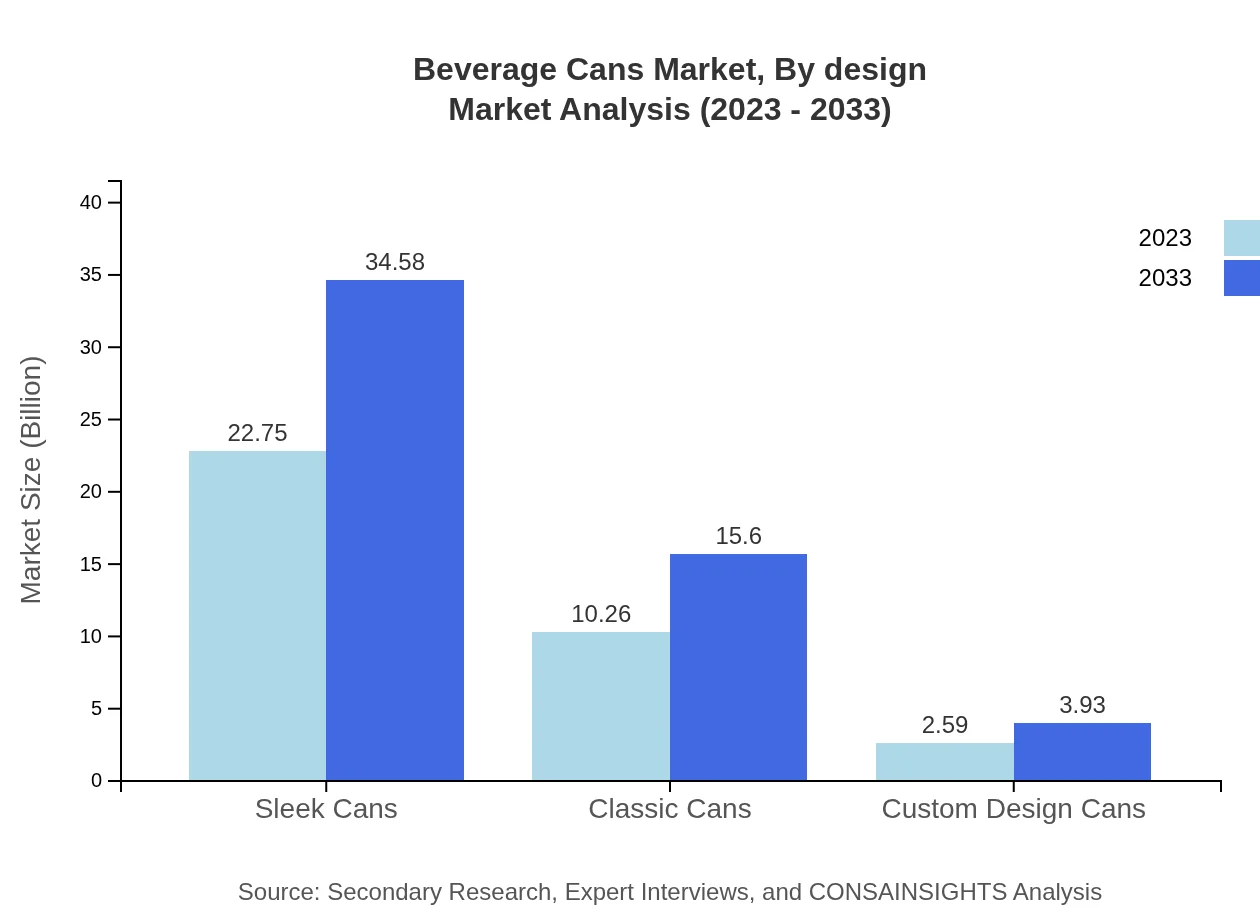

Beverage Cans Market Analysis By Design

Design types of Beverage Cans include standard, sleek, and custom-designed cans. Sleek cans have gained popularity due to their modern aesthetics, projected to grow from $22.75 billion in 2023 to $34.58 billion by 2033, holding a consistent market share of 63.9%. Custom designs are emerging as brands aim to differentiate themselves, growing from $2.59 billion to $3.93 billion, highlighting the importance of unique packaging in marketing strategy.

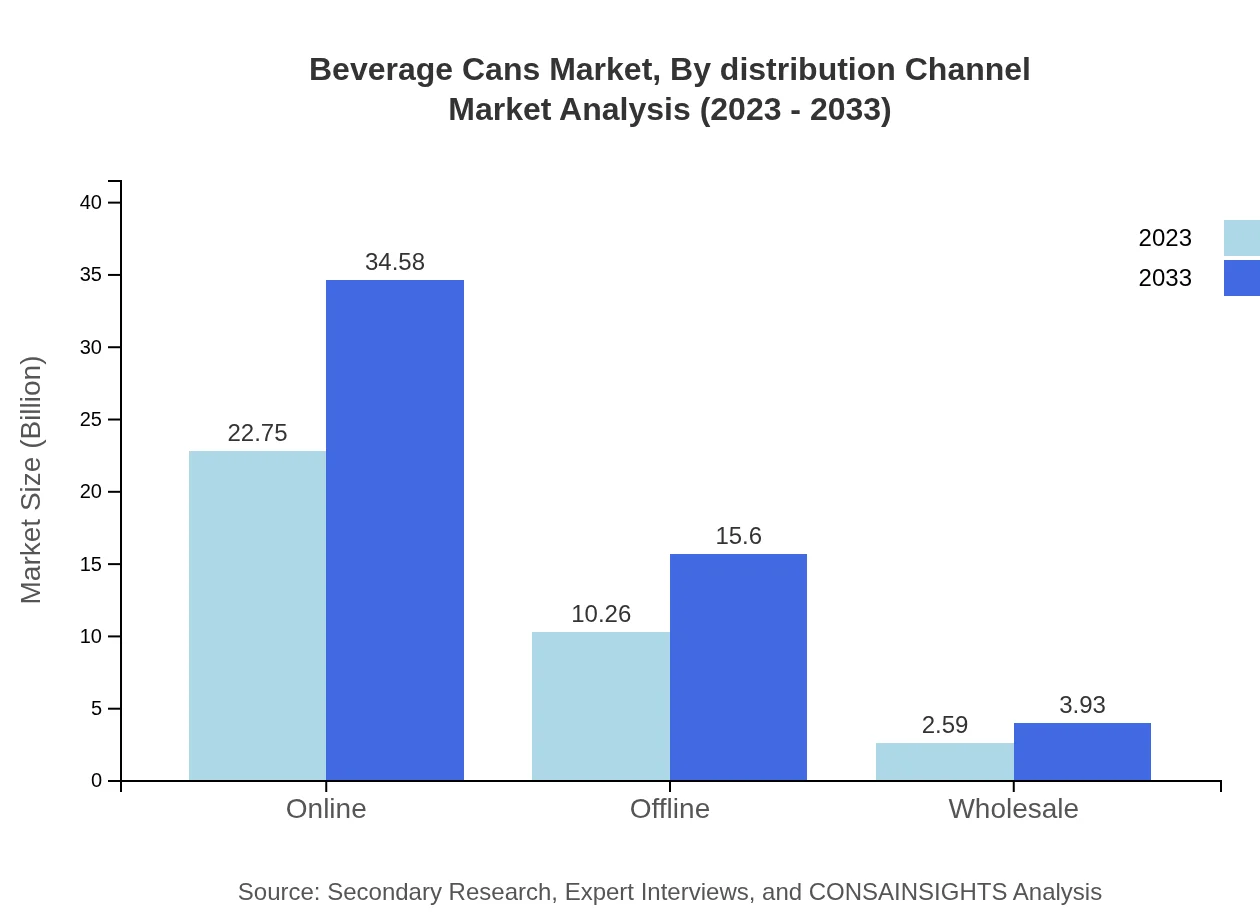

Beverage Cans Market Analysis By Distribution Channel

The distribution channels for Beverage Cans include online and offline segments. Online channels are projected to grow from $22.75 billion in 2023 to $34.58 billion by 2033, embodying 63.9% of the market as consumer purchasing habits evolve towards e-commerce. Offline distribution, while significant, is expected to grow at a slower pace from $10.26 billion to $15.60 billion, reflecting the ongoing shift in consumer behavior towards digital shopping.

Beverage Cans Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Cans Industry

Crown Holdings, Inc.:

A leading supplier of metal packaging products, Crown Holdings focuses on innovation in the Beverage Cans sector with a strong emphasis on sustainability and lightweight packaging solutions.Ball Corporation:

Ball Corporation is a prominent manufacturer of beverage cans, known for its commitment to sustainability and expanding recycling capabilities, catering to the rising demand for eco-friendly packaging.Ardagh Group:

A global leader in glass and metal packaging, Ardagh Group provides a diverse range of beverage cans, focusing on innovative designs and sustainable production methods.Mondi Group:

Mondi Group specializes in sustainable packaging solutions and focuses on using renewable materials to produce their range of beverage cans, aligning with global growth in environmental consciousness.We're grateful to work with incredible clients.

FAQs

What is the market size of beverage Cans?

The beverage cans market is projected to reach a size of $35.6 billion by 2033, growing at a CAGR of 4.2% from 2023 to 2033.

What are the key market players or companies in the beverage cans industry?

The beverage cans industry includes notable companies such as Ball Corporation, Crown Holdings, and Ardagh Group, which dominate the market through innovation in sustainable packaging and production efficiency.

What are the primary factors driving the growth in the beverage cans industry?

Key drivers of growth in the beverage cans industry include increasing consumer preference for sustainable packaging, rising demand for canned beverages, and the convenience of cans for both manufacturers and consumers.

Which region is the fastest Growing in the beverage cans market?

The Asia Pacific region is the fastest-growing in the beverage cans market, expected to expand from $6.74 billion in 2023 to $10.25 billion by 2033, driven by increasing urbanization and beverage consumption.

Does ConsaInsights provide customized market report data for the beverage cans industry?

Yes, ConsaInsights offers customized market report data for the beverage cans industry, tailoring insights to specific client needs based on unique market parameters and requirements.

What deliverables can I expect from this beverage cans market research project?

Deliverables from the beverage cans market research project typically include comprehensive market reports, trend analysis, competitive landscape assessments, and segmented data insights covering various regions and product types.

What are the market trends of beverage cans?

Current market trends in the beverage cans sector include a shift towards aluminum cans due to recyclability, innovation in sleek can designs, and a growing online sales channel that reflects changes in consumer purchasing behavior.