Beverage Container Market Report

Published Date: 01 February 2026 | Report Code: beverage-container

Beverage Container Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Beverage Container market, projecting trends and growth from 2023 to 2033. It encompasses market size, regional overviews, industry analysis, segmentation, and future forecasts based on current data and insights.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

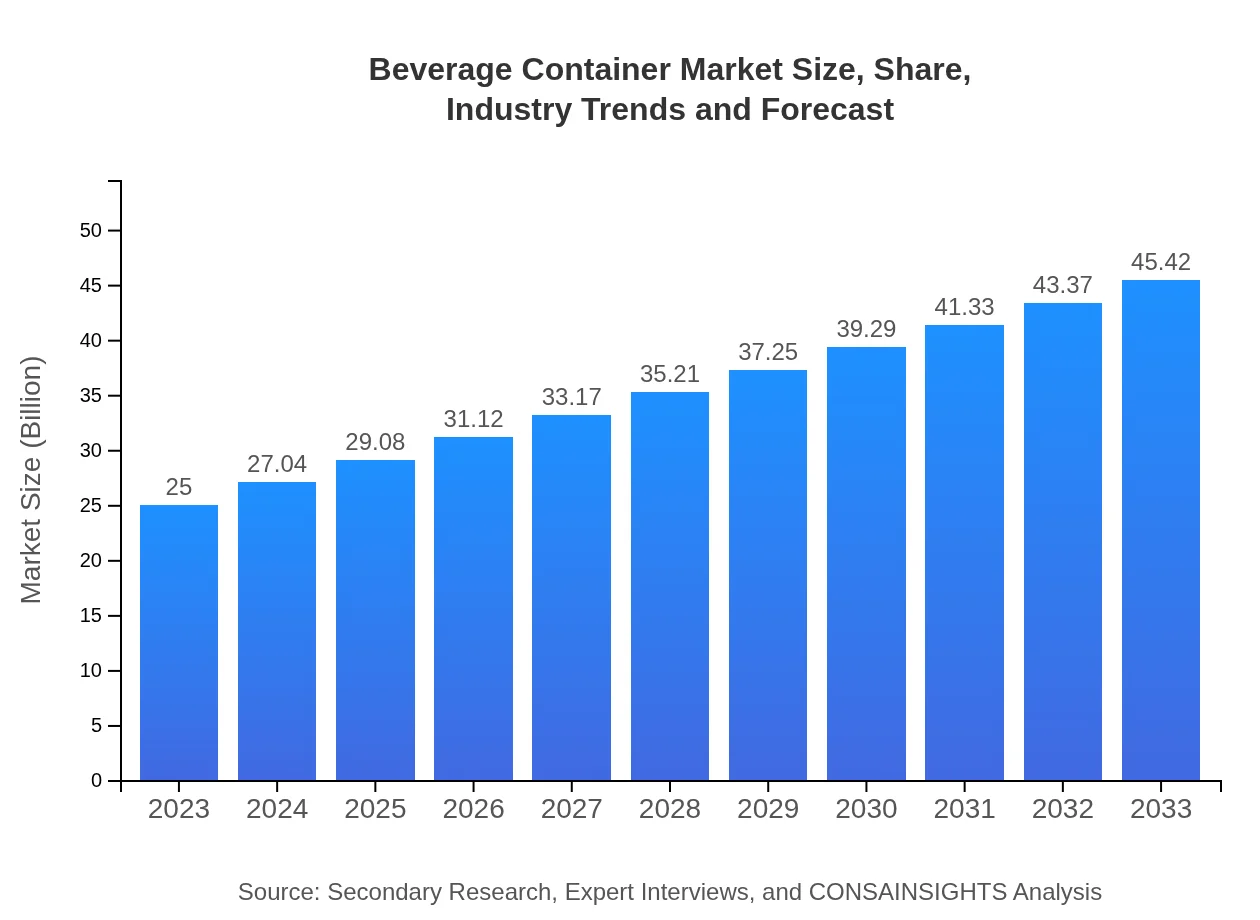

| 2023 Market Size | $25.00 Billion |

| CAGR (2023-2033) | 6% |

| 2033 Market Size | $45.42 Billion |

| Top Companies | Amcor plc, Crown Holdings, Inc., Ball Corporation, Packaging Corporation of America |

| Last Modified Date | 01 February 2026 |

Beverage Container Market Overview

Customize Beverage Container Market Report market research report

- ✔ Get in-depth analysis of Beverage Container market size, growth, and forecasts.

- ✔ Understand Beverage Container's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Container

What is the Market Size & CAGR of Beverage Container market in 2023?

Beverage Container Industry Analysis

Beverage Container Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Container Market Analysis Report by Region

Europe Beverage Container Market Report:

Europe's market size stands at 9.00 billion USD in 2023, likely to rise to 16.35 billion USD by 2033. The region is experiencing robust growth due to stringent regulations on packaging waste and a growing consumer shift towards sustainable alternatives.Asia Pacific Beverage Container Market Report:

In 2023, the Asia Pacific Beverage Container market is valued at 4.24 billion USD, projected to reach 7.70 billion USD by 2033. The region's growth is propelled by urbanization, increasing consumer spending, and the demand for ready-to-drink beverages.North America Beverage Container Market Report:

North America dominates the market, valued at 8.10 billion USD in 2023 and expected to reach 14.71 billion USD by 2033. The strong focus on health and wellness and the demand for sustainable packaging options are key growth drivers.South America Beverage Container Market Report:

South America, with a market size of 1.77 billion USD in 2023, is anticipated to grow to 3.22 billion USD by 2033. Rising disposable incomes and the popularity of varied beverages are stimulating market growth in this region.Middle East & Africa Beverage Container Market Report:

The Middle East and Africa are projected to grow from 1.88 billion USD in 2023 to 3.42 billion USD by 2033, fueled by increasing urbanization and a younger consumer demographic seeking diverse beverage options.Tell us your focus area and get a customized research report.

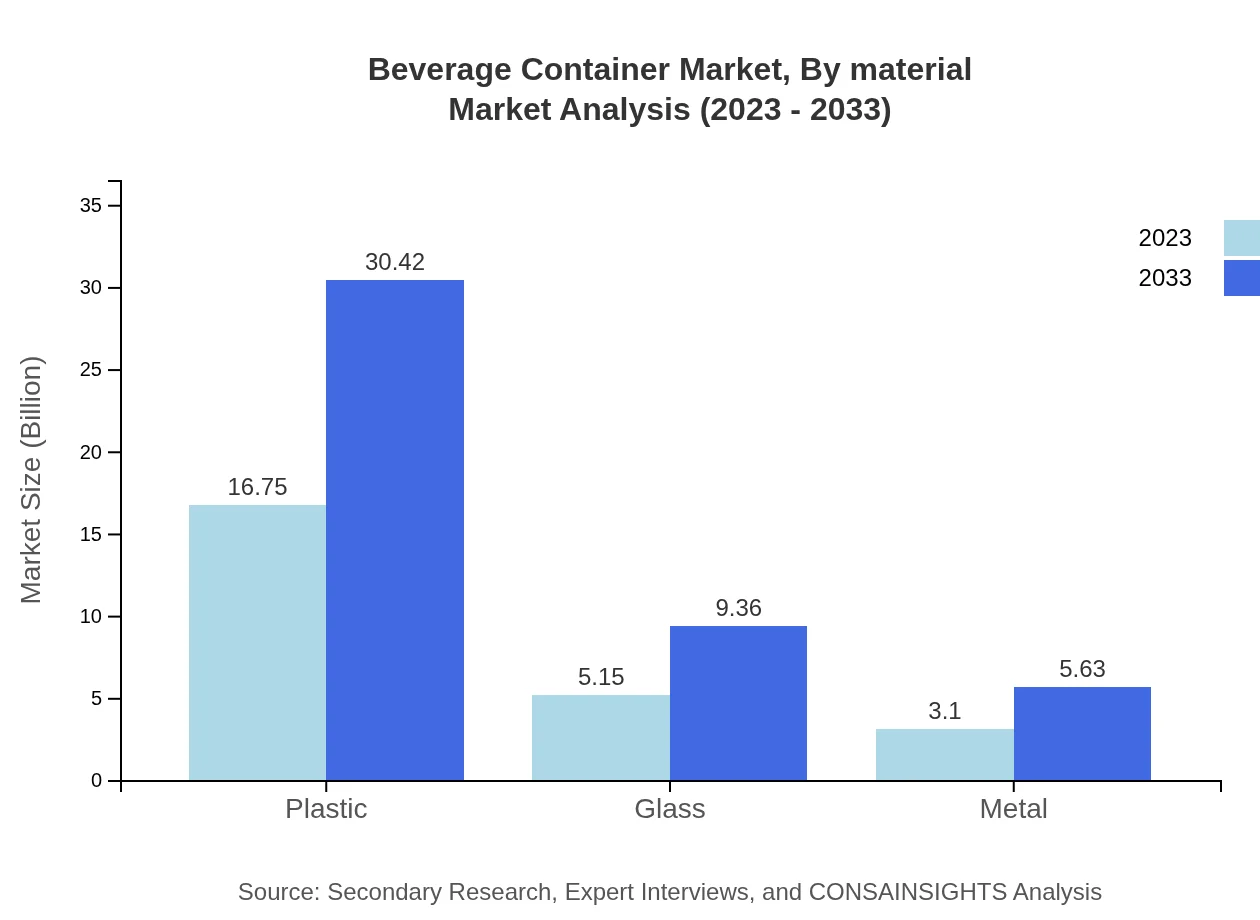

Beverage Container Market Analysis By Material

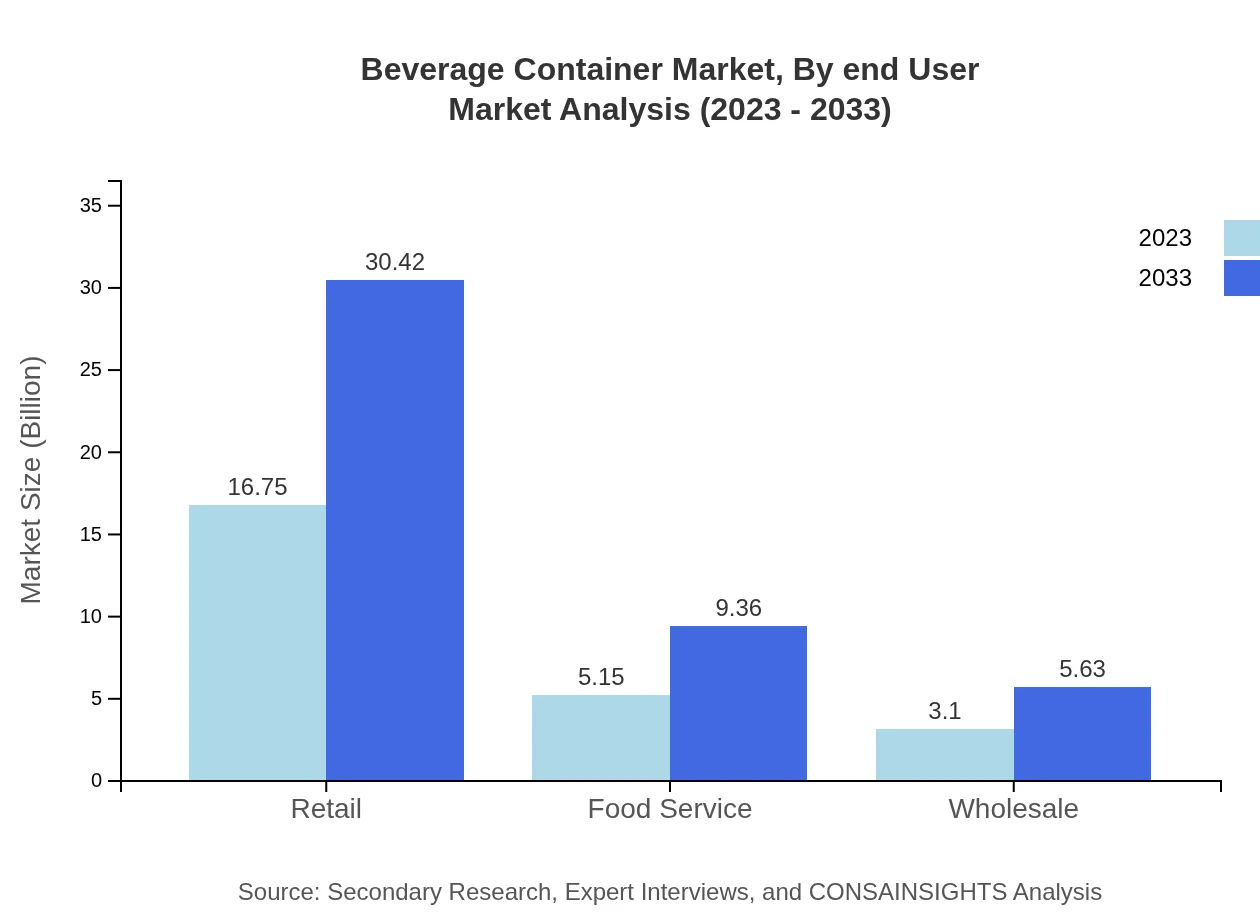

Plastic containers dominate the market, valued at 16.75 billion USD in 2023 and projected to grow to 30.42 billion USD by 2033, accounting for 66.99% of the share. Glass is expected to grow from 5.15 billion USD to 9.36 billion USD, holding a 20.61% share while metal containers start at 3.10 billion USD and grow to 5.63 billion USD, with a 12.40% share.

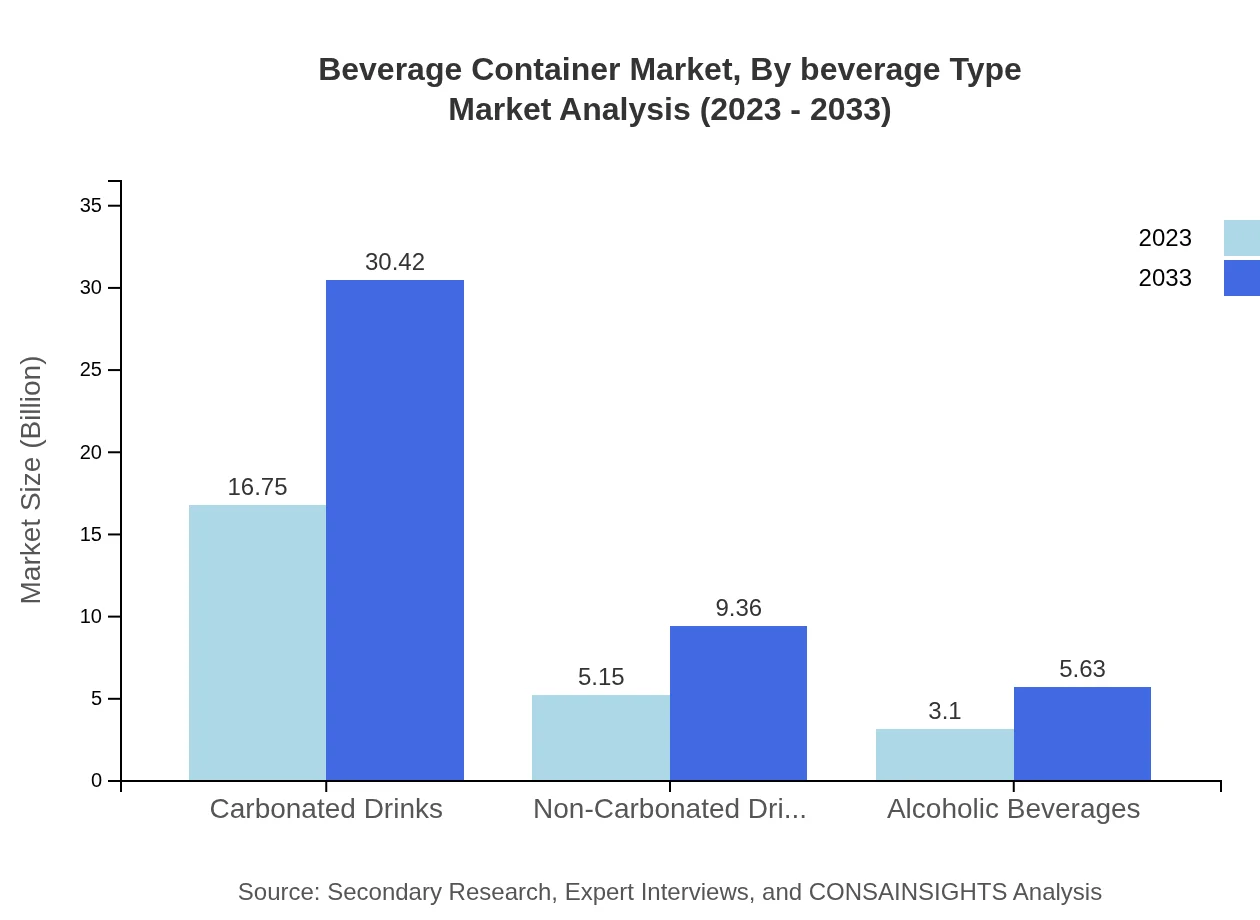

Beverage Container Market Analysis By Beverage Type

The market for carbonated drinks is projected to account for a significant portion, with a size of 16.75 billion USD in 2023, expanding to 30.42 billion USD by 2033. Non-carbonated beverages are also set to grow, increasing from 5.15 billion USD to 9.36 billion USD. Alcoholic beverages are anticipated to grow from 3.10 billion USD to 5.63 billion USD by 2033.

Beverage Container Market Analysis By Usage

In 2023, the retail segment is forecasted to generate 16.75 billion USD, expanding to 30.42 billion USD by 2033. The food service segment will rise from 5.15 billion USD to 9.36 billion USD, while the wholesale market is projected to grow from 3.10 billion USD to 5.63 billion USD, benefiting from the rise of e-commerce.

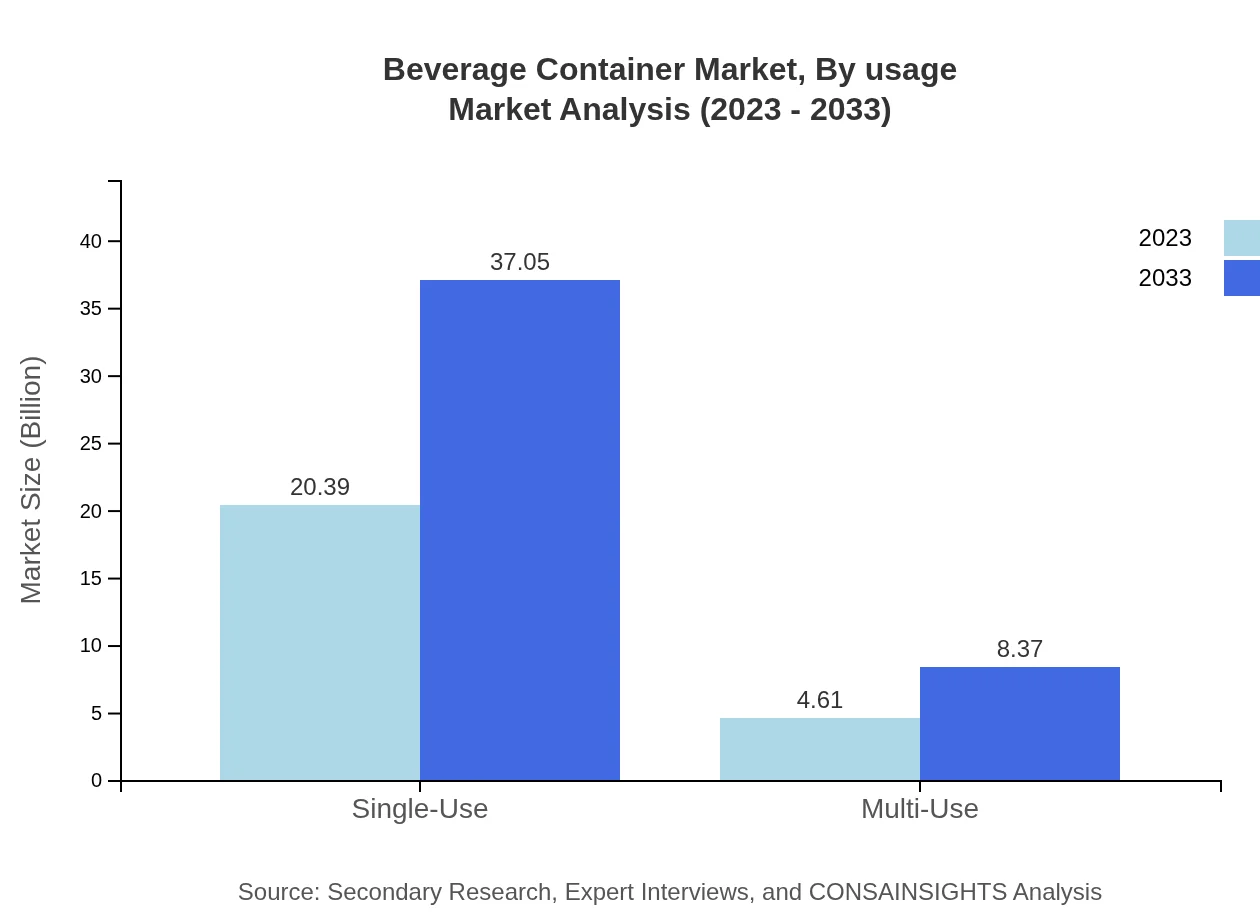

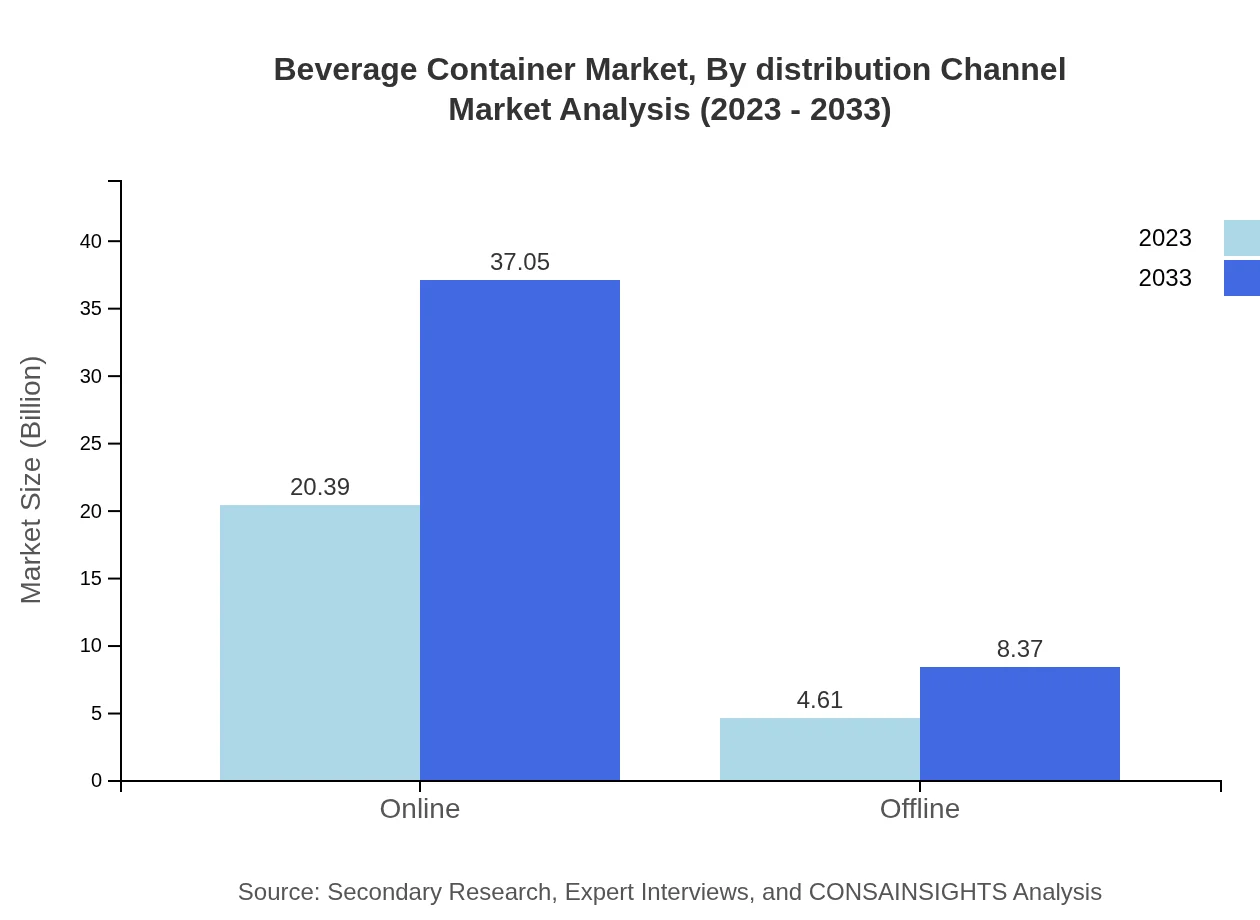

Beverage Container Market Analysis By Distribution Channel

The online distribution channel, valued at 20.39 billion USD in 2023, is set to double to 37.05 billion USD by 2033, capturing an 81.58% market share. Offline channels are expected to grow modestly from 4.61 billion USD to 8.37 billion USD.

Beverage Container Market Analysis By End User

The end-user analysis reveals that consumer preferences are shaping the beverage container choices, with sustainable packaging gaining traction. The retail segment is crucial, due to its large share in beverages sold across different platforms.

Beverage Container Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Container Industry

Amcor plc:

A global leader in packaging solutions that is heavily invested in sustainable packaging technologies.Crown Holdings, Inc.:

A major player in metal packaging, known for its innovative can designs and sustainable practices.Ball Corporation:

Specializes in packaging for beverages, including aluminum cans, and has a strong focus on sustainability.Packaging Corporation of America:

Leads in corrugated packaging solutions, catering to various beverage brands with customized packaging.We're grateful to work with incredible clients.

FAQs

What is the market size of beverage Container?

The beverage container market is valued at $25 billion in 2023, with a projected CAGR of 6%. This growth signifies increasing demand across various segments and regions, driving market expansion until 2033.

What are the key market players or companies in the beverage Container industry?

Key players in the beverage container industry include major manufacturers and distributors of glass, plastic, and metal containers. These companies continuously innovate to enhance sustainability and cater to consumer preferences.

What are the primary factors driving the growth in the beverage Container industry?

Factors driving growth include increasing beverage consumption, demand for sustainable packaging, and innovations in container design. Additionally, shifting consumer preferences towards convenience and eco-friendly products play a significant role.

Which region is the fastest Growing in the beverage Container?

The fastest-growing region for beverage containers is Europe, projected to increase from $9.00 billion in 2023 to $16.35 billion by 2033. Other regions like North America and Asia Pacific also show strong growth potential.

Does ConsaInsights provide customized market report data for the beverage Container industry?

Yes, Consainsights offers customized market reports tailored to specific needs in the beverage container industry, allowing clients to gain detailed insights and data relevant to their business objectives.

What deliverables can I expect from this beverage Container market research project?

From the beverage-container market research project, you can expect comprehensive reports, detailed analyses, market trends, regional data, segment insights, forecasts, and strategic recommendations to inform business decisions.

What are the market trends of beverage Container?

Market trends for beverage containers include a shift toward single-use plastics, an increase in online distribution, and rising consumer preference for eco-friendly materials, all contributing to evolving strategies among manufacturers and retailers.