Beverage Emulsion Market Report

Published Date: 31 January 2026 | Report Code: beverage-emulsion

Beverage Emulsion Market Size, Share, Industry Trends and Forecast to 2033

This report provides in-depth insights into the Beverage Emulsion market, exploring its current landscape and projections from 2023 to 2033. It covers market size, trends, industry analysis, segmentation, regional analysis, and competitive landscape.

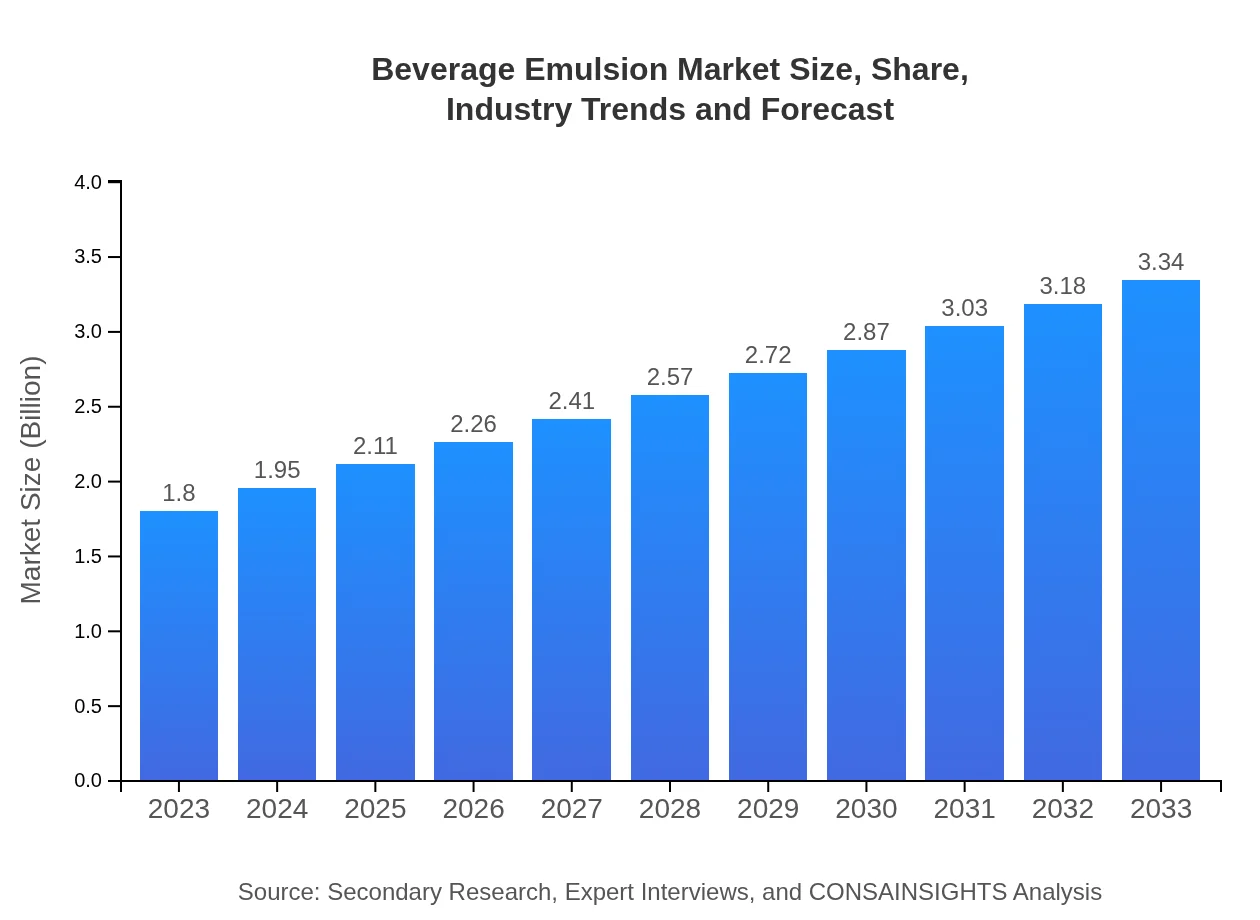

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $3.34 Billion |

| Top Companies | Ingredients Solutions, Inc., Givaudan, Tate & Lyle, DuPont, Kerry Group |

| Last Modified Date | 31 January 2026 |

Beverage Emulsion Market Overview

Customize Beverage Emulsion Market Report market research report

- ✔ Get in-depth analysis of Beverage Emulsion market size, growth, and forecasts.

- ✔ Understand Beverage Emulsion's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Emulsion

What is the Market Size & CAGR of Beverage Emulsion market?

Beverage Emulsion Industry Analysis

Beverage Emulsion Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Emulsion Market Analysis Report by Region

Europe Beverage Emulsion Market Report:

Europe's Beverage Emulsion market is estimated at $0.50 billion in 2023, with expectations to increase to $0.93 billion by 2033. The region's sophisticated culinary scene and demand for premium beverages enhance market growth.Asia Pacific Beverage Emulsion Market Report:

In the Asia Pacific region, the Beverage Emulsion market is valued at approximately $0.35 billion in 2023, expected to grow to $0.64 billion by 2033. This growth is due to the rising population, urbanization, and growing demand for carbonated and health-oriented beverages.North America Beverage Emulsion Market Report:

In North America, the market is robust, estimated at $0.59 billion in 2023, and anticipated to expand to $1.09 billion by 2033. The region's growth is driven by health-conscious consumers seeking functional and innovative beverage options.South America Beverage Emulsion Market Report:

The South American Beverage Emulsion market is relatively smaller, valued at $0.11 billion in 2023 and projected to grow to $0.20 billion by 2033. Growth factors include the increasing popularity of flavored beverages and the influence of Western consumption patterns.Middle East & Africa Beverage Emulsion Market Report:

The Middle East and Africa's market is valued at $0.25 billion in 2023 and projected to grow to $0.47 billion by 2033. The growth is fueled by an increasing focus on healthy living and emerging beverage markets in the region.Tell us your focus area and get a customized research report.

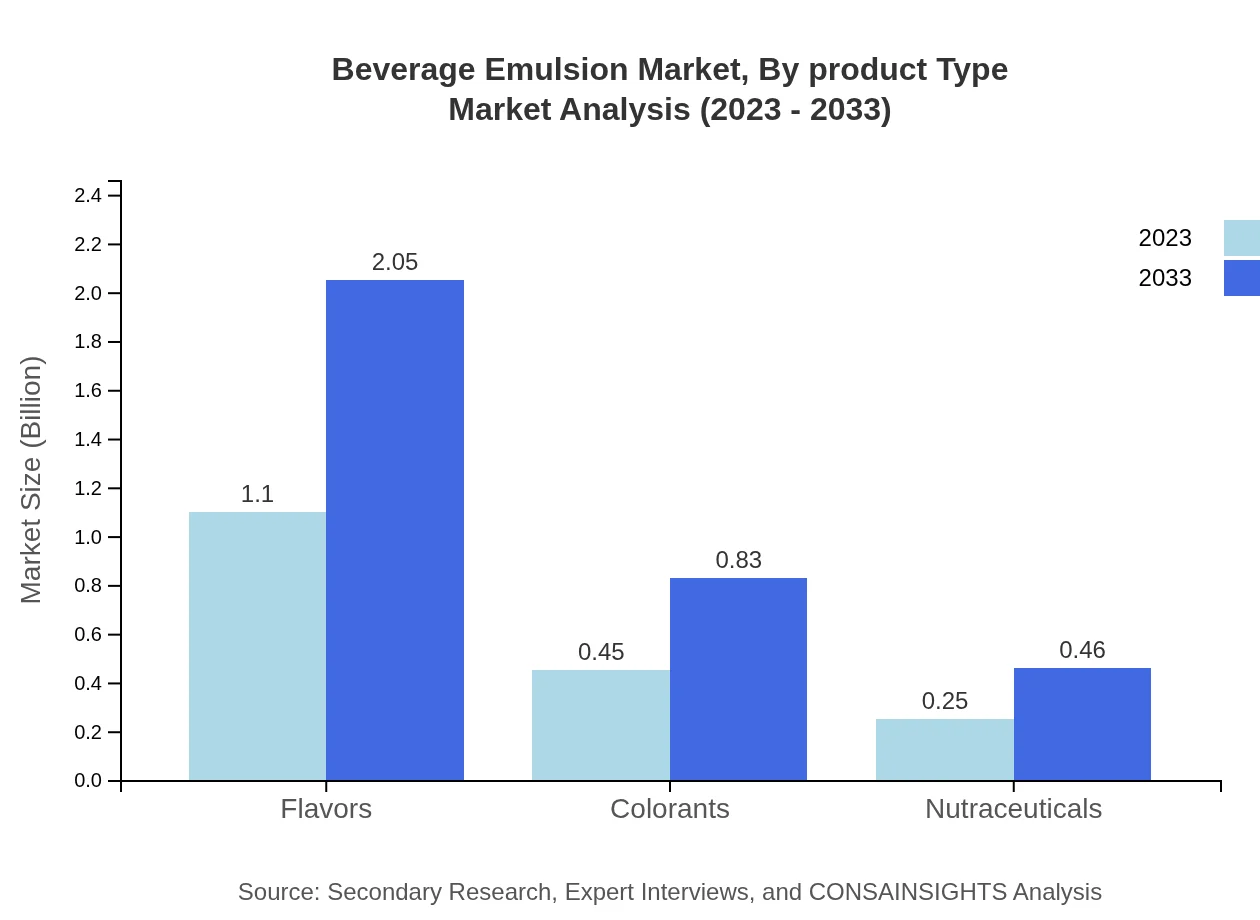

Beverage Emulsion Market Analysis By Product Type

The Beverage Emulsion market is segmented into Oil Soluble, Water Soluble, and Powdered emulsions. In 2023, Water Soluble holds the largest market share, valued at $1.10 billion, and expected to grow to $2.05 billion by 2033. Oil Soluble emulsions, valued at $0.45 billion in 2023, are anticipated to grow to $0.83 billion. Powdered emulsions contribute around $0.25 billion, reaching $0.46 billion by 2033.

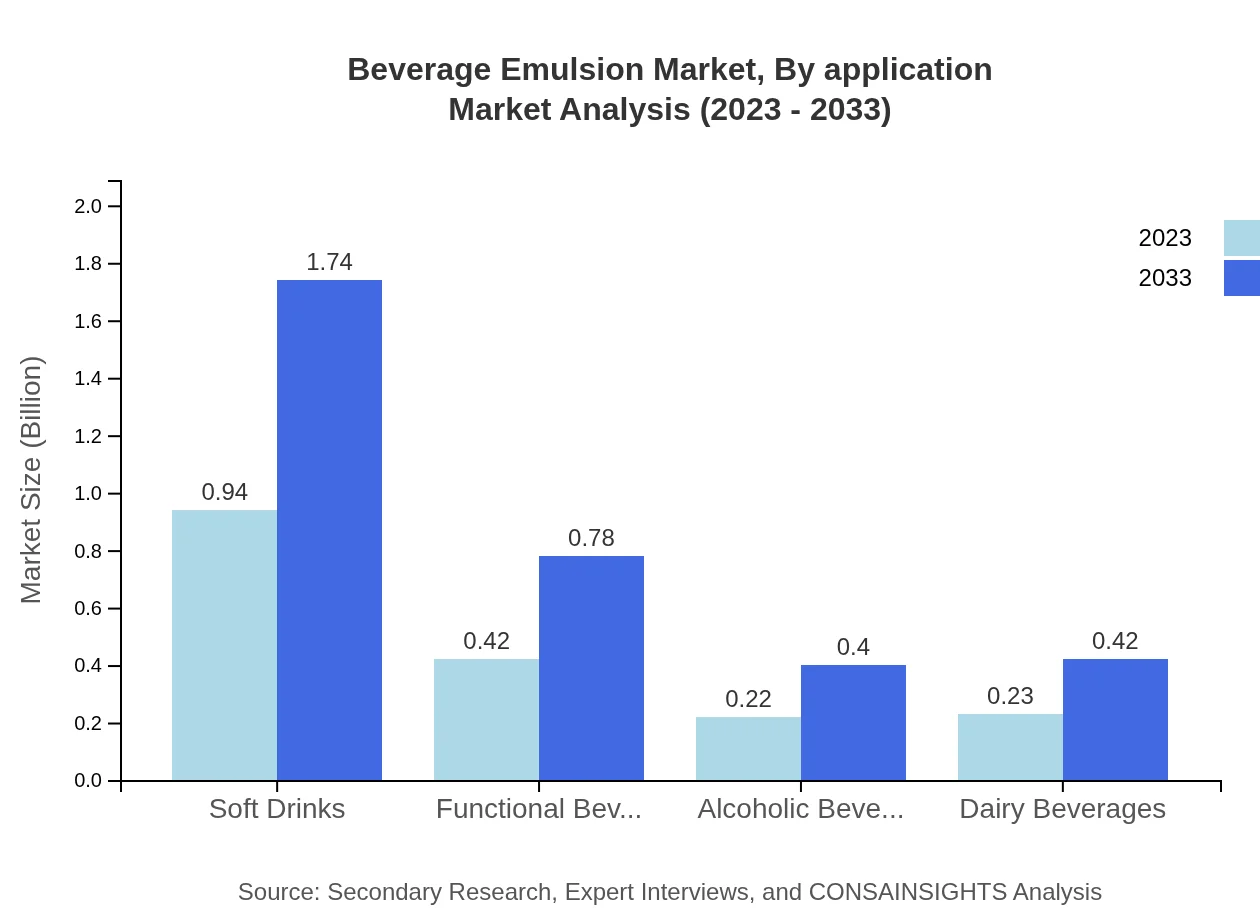

Beverage Emulsion Market Analysis By Application

The Beverage Emulsion market by application includes Soft Drinks, Functional Beverages, Alcoholic Beverages, and Dairy Beverages. Soft Drinks dominate with a market size of $0.94 billion in 2023, expanding to $1.74 billion. Functional Beverages follow with $0.42 billion, projected to reach $0.78 billion. Alcoholic Beverages are valued at $0.22 billion and will grow to $0.40 billion, while Dairy Beverages will expand from $0.23 billion to $0.42 billion.

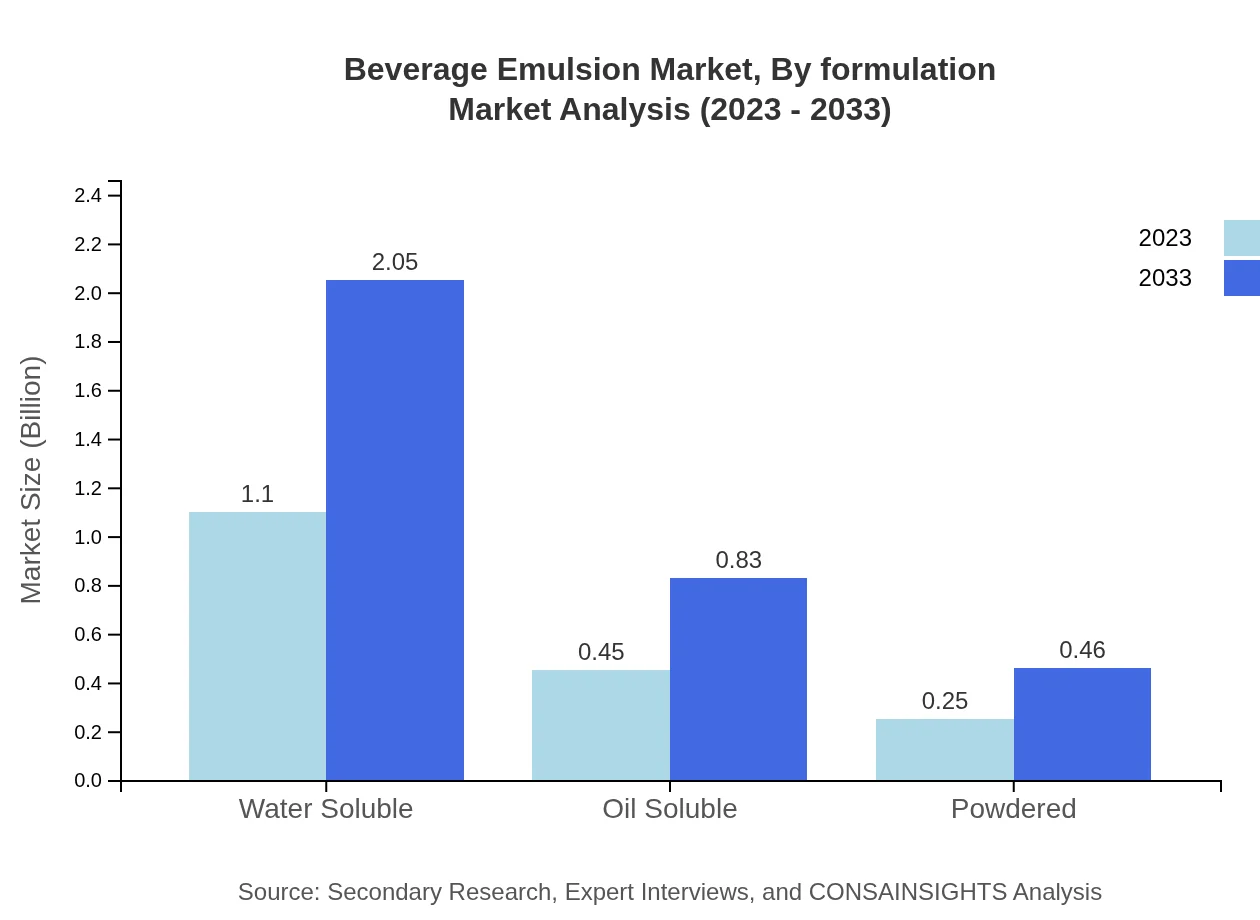

Beverage Emulsion Market Analysis By Formulation

The market by formulation is categorized into Liquid and Powdered emulsions. Liquid formulations are currently more prevalent, primarily used in readiness-to-drink beverages. This segment is growing due to innovations in flavors and functional ingredients, indicating a trend towards customization in beverage making.

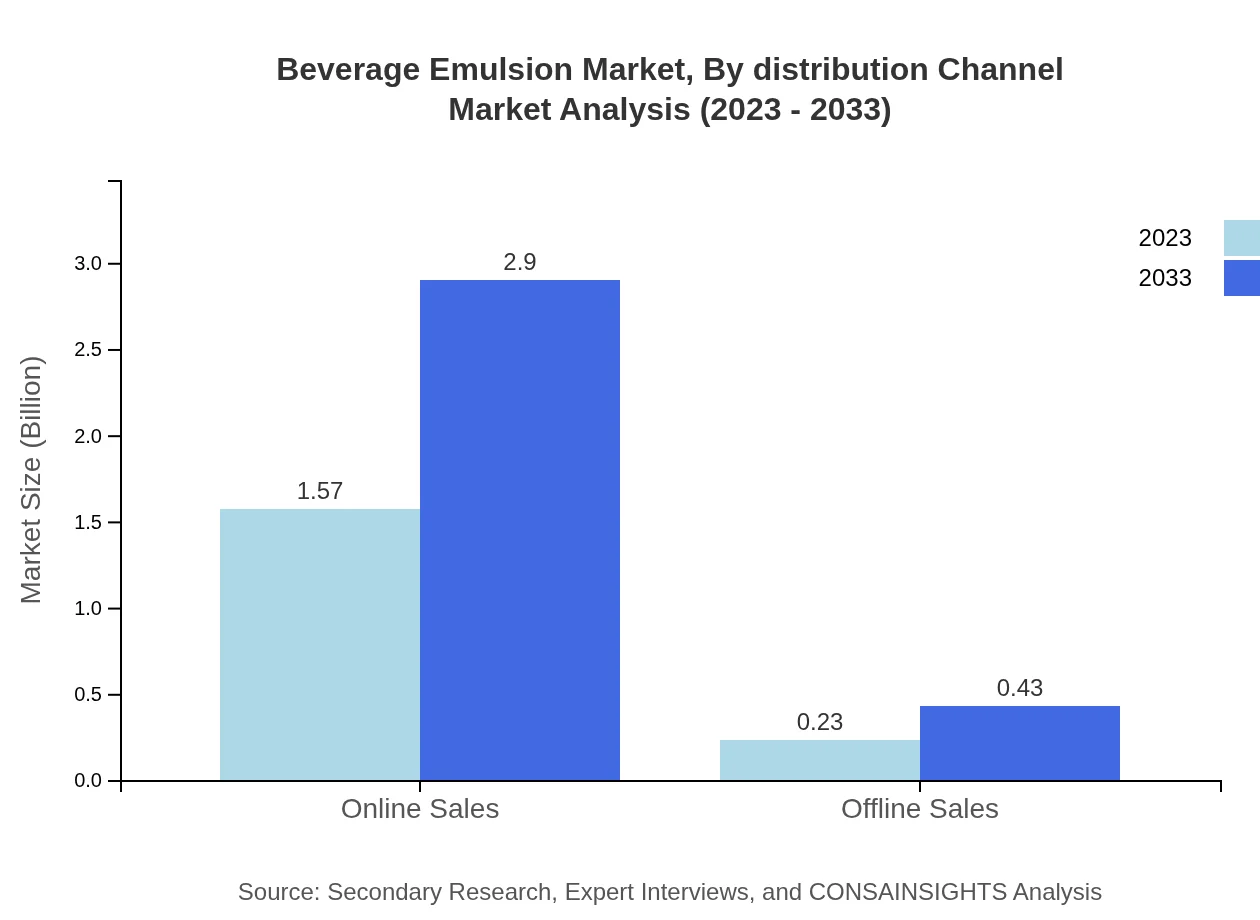

Beverage Emulsion Market Analysis By Distribution Channel

The market by distribution channel includes Online and Offline sales. Online sales account for a sizable market share, estimated at $1.57 billion in 2023, and set to increase to $2.90 billion by 2033. Offline sales are projected to grow from $0.23 billion to $0.43 billion, reflecting changing consumer shopping behaviors.

Beverage Emulsion Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Emulsion Industry

Ingredients Solutions, Inc.:

A leader in the development of innovative beverage emulsions, focusing on flavor and texture enhancement in various beverage applications.Givaudan:

A major producer of flavors and fragrances that plays a significant role in emulsion technology, catering to health-focused beverage formulations.Tate & Lyle:

A global provider of ingredient solutions and a pioneer in sweetening and thickening agents for beverage emulsions, committed to sustainability and innovation.DuPont:

A science and technology company offering advanced emulsifiers for the beverage industry to improve stability and sensory profiles.Kerry Group:

Known for its extensive range of beverage emulsions, Kerry Group focuses on creating functional and health-oriented beverages to meet consumer demand.We're grateful to work with incredible clients.

FAQs

What is the market size of beverage Emulsion?

The beverage emulsion market is currently valued at $1.8 billion, with a projected compound annual growth rate (CAGR) of 6.2%. By 2033, the market size is anticipated to experience significant growth due to increasing consumer demand.

What are the key market players or companies in this beverage Emulsion industry?

Key players in the beverage emulsion industry include major manufacturers and suppliers who specialize in producing ingredient solutions for various beverage categories such as soft drinks, functional beverages, and alcoholic beverages, driving market innovations and advancements.

What are the primary factors driving the growth in the beverage Emulsion industry?

The growth in the beverage-emulsion industry is primarily driven by rising consumer demand for innovative beverage products, health-conscious trends, the increasing popularity of functional beverages, and advancements in emulsion technology which enhance product formulations.

Which region is the fastest Growing in the beverage Emulsion market?

The Asia Pacific region is anticipated to be the fastest-growing market for beverage emulsion, projected to grow from $0.35 billion in 2023 to $0.64 billion by 2033, highlighting its burgeoning consumer base and rising disposable incomes.

Does ConsaInsights provide customized market report data for the beverage Emulsion industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the beverage-emulsion industry, allowing clients to gain personalized insights and strategies that align with their business objectives.

What deliverables can I expect from this beverage Emulsion market research project?

Deliverables from the beverage-emulsion market research project include comprehensive market analysis reports, regional insights, segment data, competitive landscape evaluations, and strategic recommendations to support informed decision-making.

What are the market trends of beverage Emulsion?

Current market trends in beverage-emulsion include a shift towards clean-label products, the integration of functional ingredients, growth in online sales channels, and rising investments in sustainable production practices across the beverage industry.