Beverage Flavoring Systems Market Report

Published Date: 31 January 2026 | Report Code: beverage-flavoring-systems

Beverage Flavoring Systems Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Beverage Flavoring Systems market, covering insights into market trends, size, segmentation, and regional forecasts from 2023 to 2033.

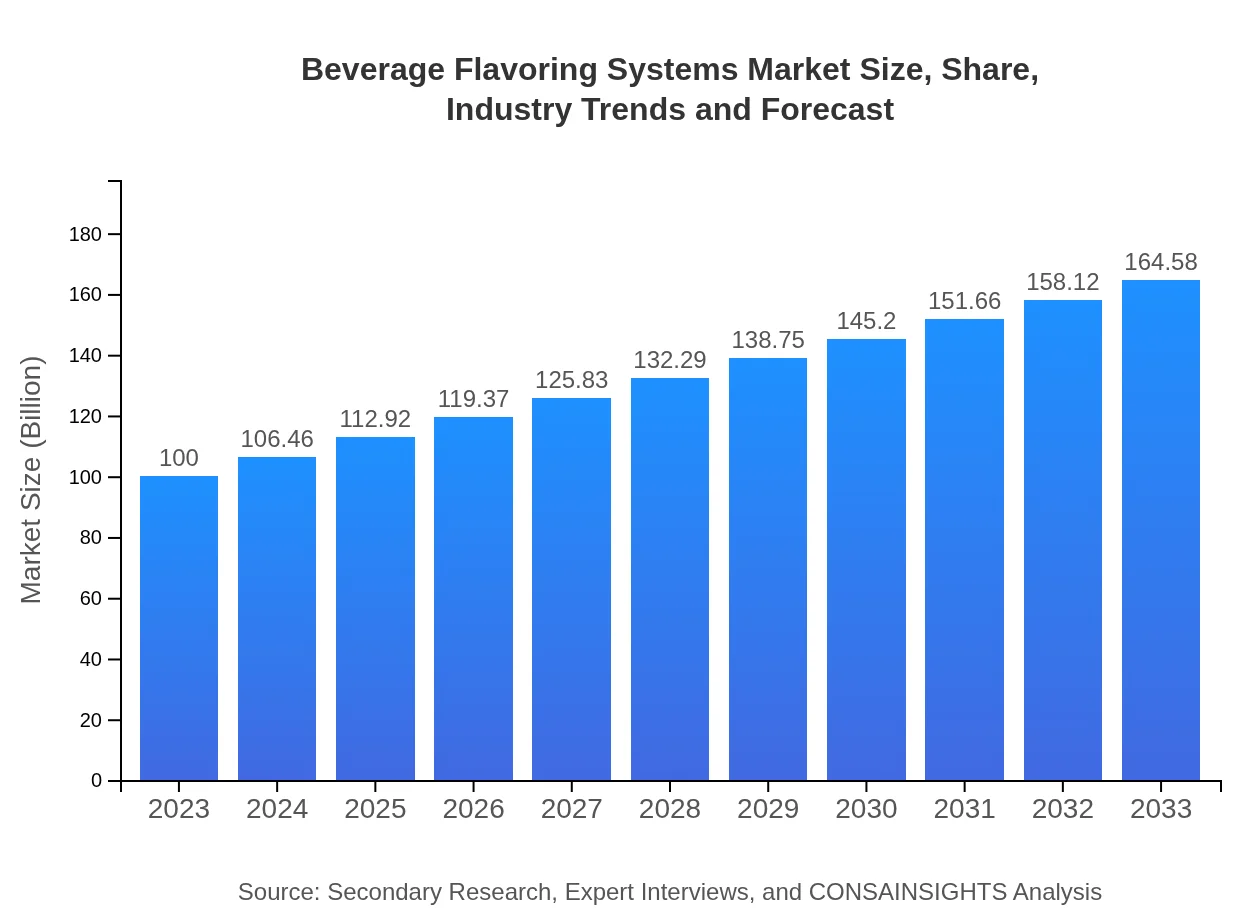

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | Sensient Technologies Corporation, Givaudan SA, Firmenich SA, International Flavors & Fragrances (IFF), Kerry Group |

| Last Modified Date | 31 January 2026 |

Beverage Flavoring Systems Market Overview

Customize Beverage Flavoring Systems Market Report market research report

- ✔ Get in-depth analysis of Beverage Flavoring Systems market size, growth, and forecasts.

- ✔ Understand Beverage Flavoring Systems's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Flavoring Systems

What is the Market Size & CAGR of Beverage Flavoring Systems market in 2023?

Beverage Flavoring Systems Industry Analysis

Beverage Flavoring Systems Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Flavoring Systems Market Analysis Report by Region

Europe Beverage Flavoring Systems Market Report:

Europe shows promising growth, with market size expected to rise from USD 26.61 billion in 2023 to USD 43.79 billion in 2033. The region's preference for diverse and premium beverage flavors, combined with robust supply chains, supports this expansion amidst competitive dynamics.Asia Pacific Beverage Flavoring Systems Market Report:

In 2023, the Asia Pacific Beverage Flavoring Systems market size is estimated at USD 19.19 billion and is projected to grow to USD 31.58 billion by 2033, thanks to rising disposable incomes and changing food habits in emerging economies. Moreover, regional manufacturers are increasingly investing in product development, appealing to a younger demographic craving innovative flavors.North America Beverage Flavoring Systems Market Report:

North America leads the market with an estimated size of USD 38.20 billion in 2023, anticipated to reach USD 62.87 billion by 2033. The region's growth is driven by increasingly health-conscious consumers opting for flavored beverages that align with their lifestyle choices, alongside a thriving craft beverage industry.South America Beverage Flavoring Systems Market Report:

The South American market is expected to grow from USD 9.25 billion in 2023 to USD 15.22 billion by 2033, reflecting a shift towards flavored drinks as consumers explore diverse beverage options. This growth is bolstered by a stronger focus on local flavor profiles and natural ingredients.Middle East & Africa Beverage Flavoring Systems Market Report:

In the Middle East and Africa, the market size in 2023 is projected to be around USD 6.75 billion, expecting to grow to approximately USD 11.11 billion by 2033. Increasing urbanization and the rising trend for flavored beverages amongst millennials are primary factors driving the market in this region.Tell us your focus area and get a customized research report.

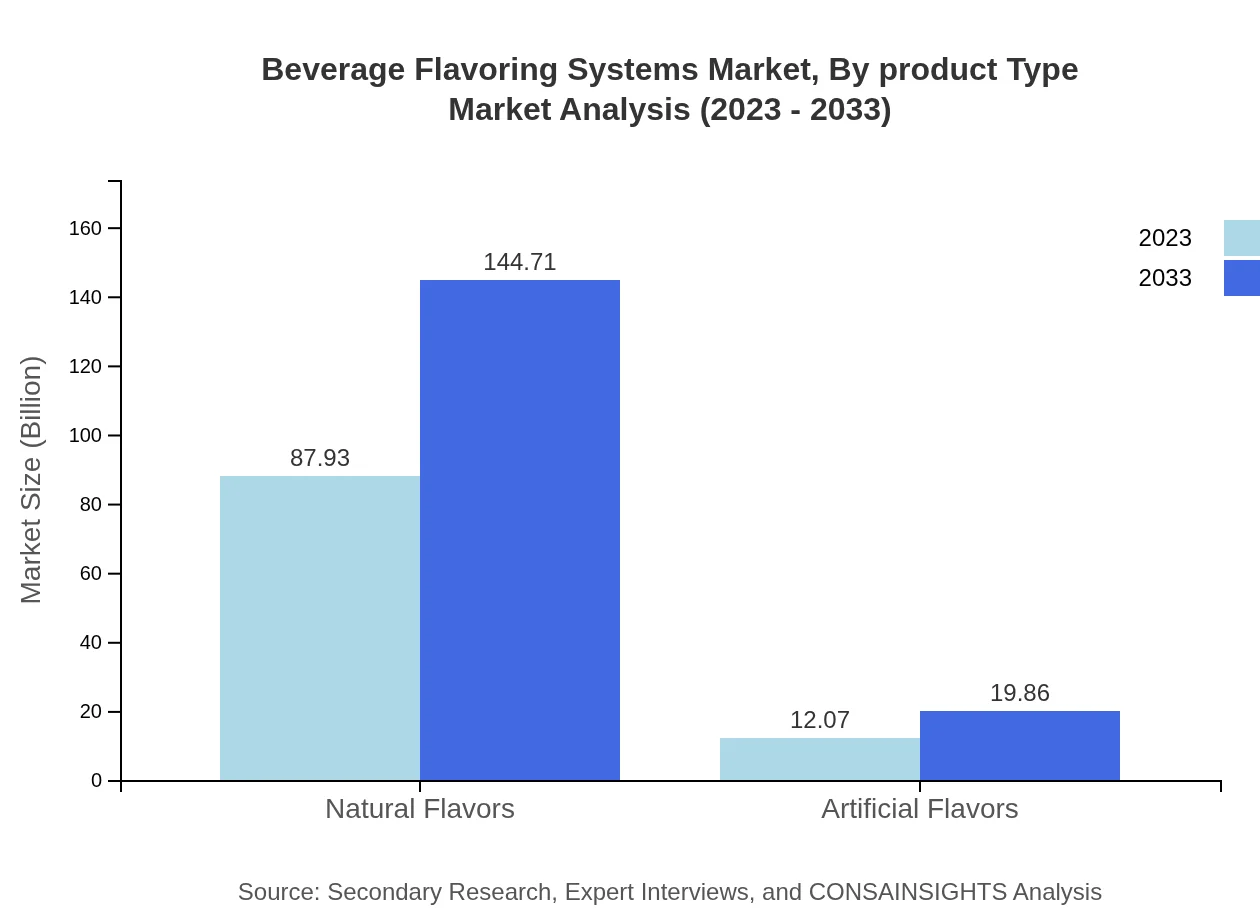

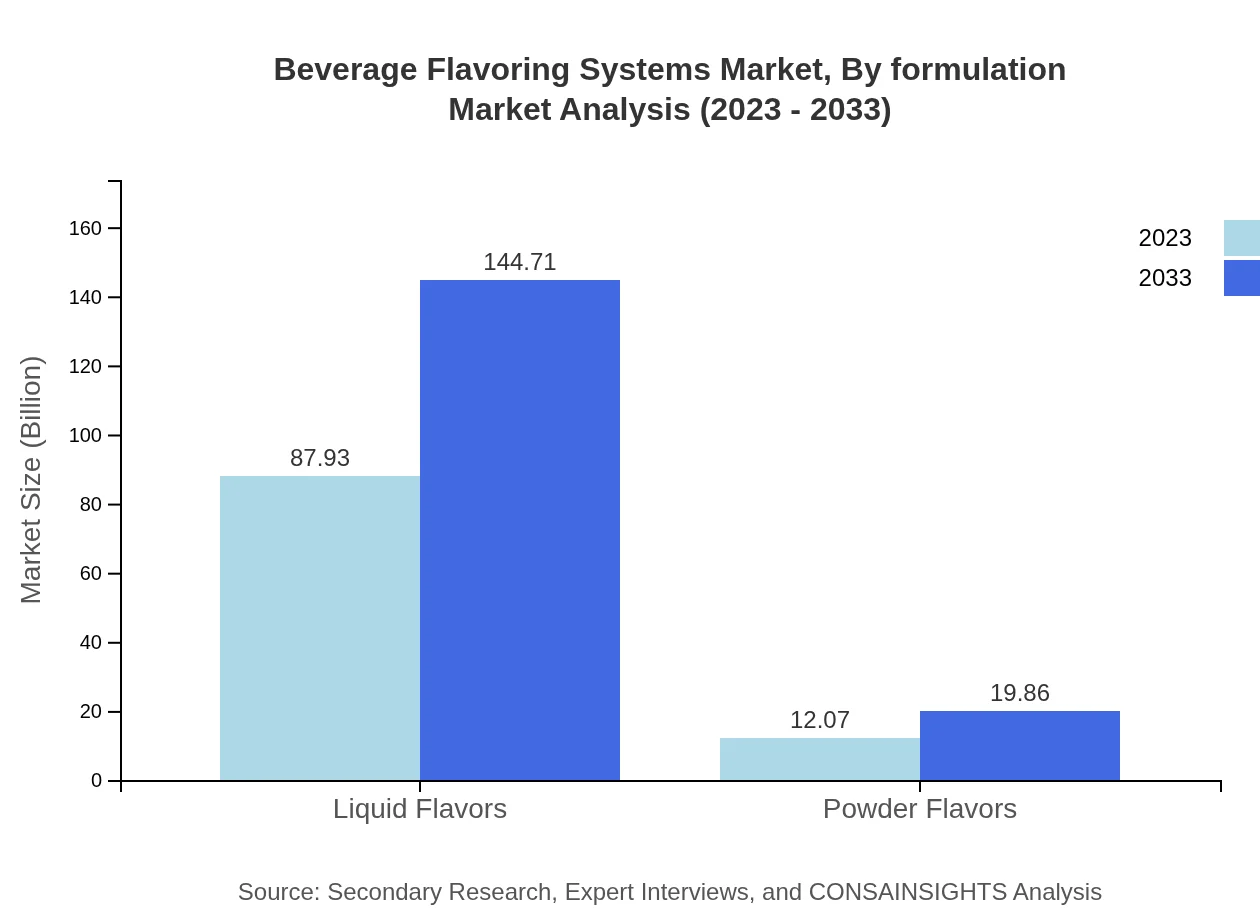

Beverage Flavoring Systems Market Analysis By Product Type

The Beverage Flavoring Systems market can be broken down into two primary product types: liquid flavors and powder flavors. As of 2023, liquid flavors dominate the market with a size of USD 87.93 billion, expanding to USD 144.71 billion by 2033. Conversely, powder flavors hold a smaller market share, increasing from USD 12.07 billion in 2023 to USD 19.86 billion by 2033, yet still reflecting a positive growth trajectory.

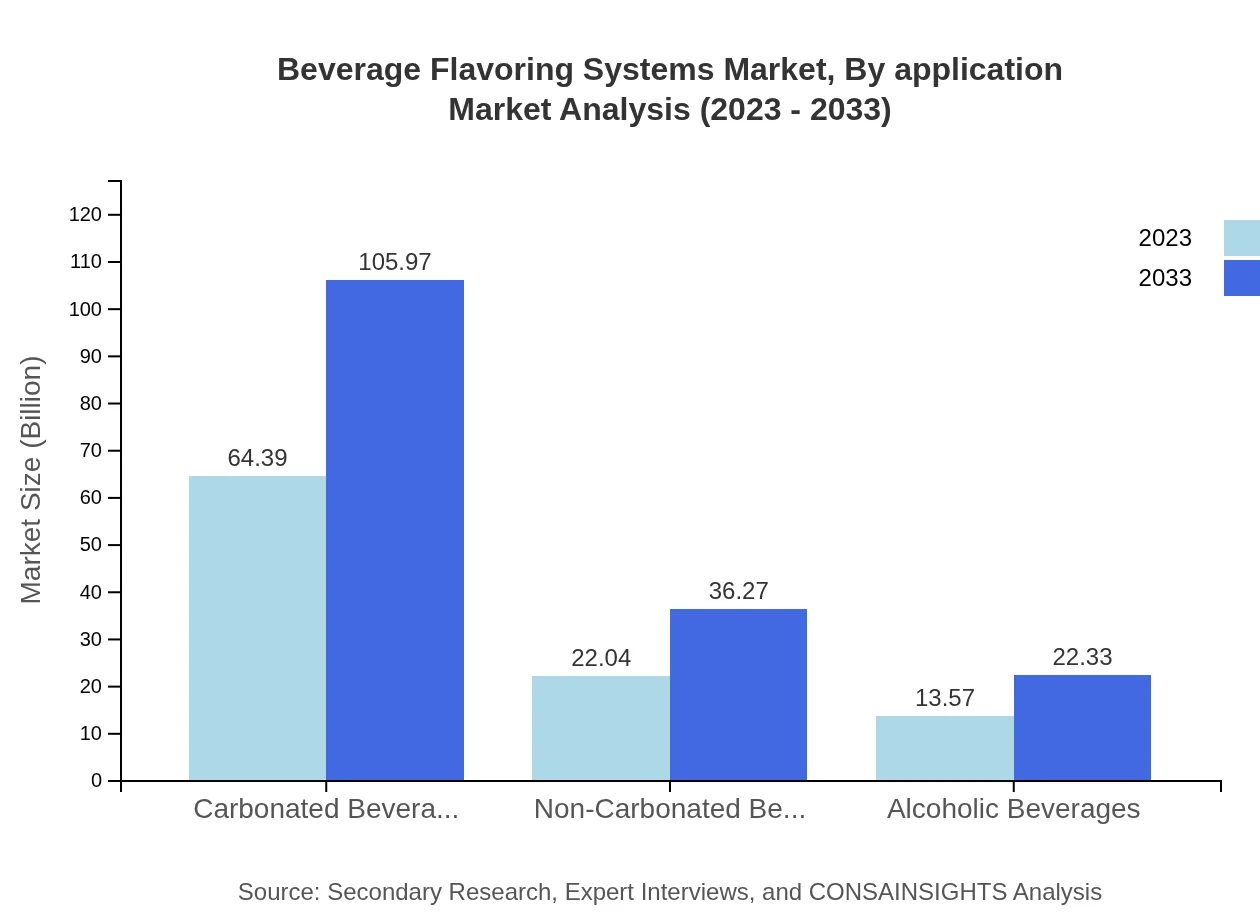

Beverage Flavoring Systems Market Analysis By Application

In terms of application, the Beverage Flavoring Systems market has significant segments: carbonated beverages, non-carbonated beverages, and alcoholic beverages. The carbonated beverages segment leads, with a market size of USD 64.39 billion in 2023, anticipated to grow to USD 105.97 billion by 2033. Non-carbonated beverages display a strong growth pattern as well, with sizes of USD 22.04 billion and USD 36.27 billion in the respective years.

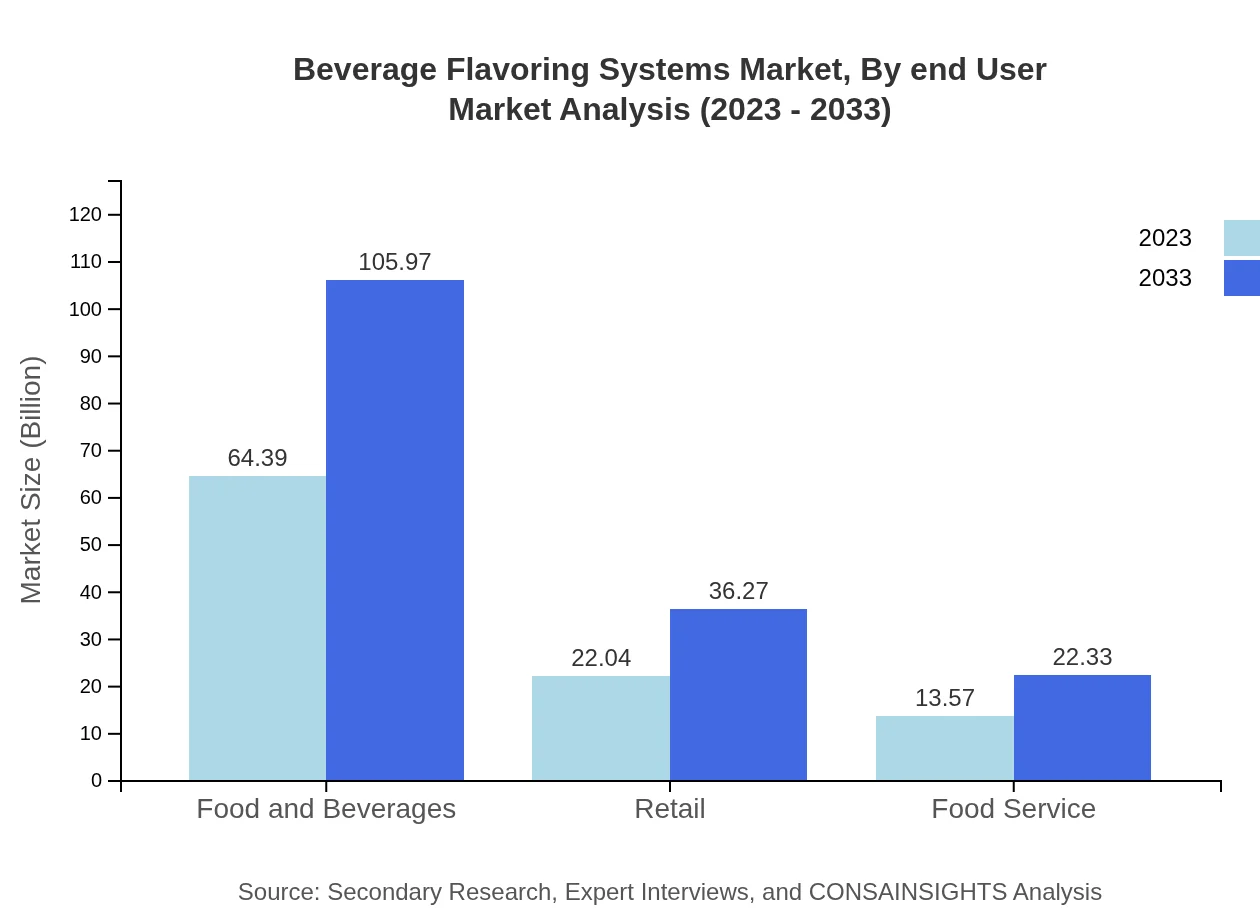

Beverage Flavoring Systems Market Analysis By End User

Examining the Beverage Flavoring Systems market by end-user, notable segments include retail and food services. The retail segment is projected to expand from USD 22.04 billion in 2023 to USD 36.27 billion by 2033. Meanwhile, food services constitute an essential portion of the market, with currents sizes of USD 13.57 billion in 2023 and an anticipated rise to USD 22.33 billion by 2033.

Beverage Flavoring Systems Market Analysis By Formulation

The Beverage Flavoring Systems can also be categorized by formulation into natural and artificial flavors. Natural flavors account for a significant share of the market, valued at USD 87.93 billion in 2023 and expected to reach USD 144.71 billion by 2033. Artificial flavors, while smaller in size, grow from USD 12.07 billion in 2023 to USD 19.86 billion by 2033, as companies explore diverse formulations to cater to consumer preferences.

Beverage Flavoring Systems Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Flavoring Systems Industry

Sensient Technologies Corporation:

A leading global supplier of flavors, colors, and ingredients, Sensient specializes in innovative and natural flavor solutions for the beverage industry, focusing on product differentiation and customized offerings.Givaudan SA:

As one of the largest flavor and fragrance companies globally, Givaudan provides an extensive range of beverage flavoring systems, emphasizing sustainability and innovation to cater to evolving consumer demands.Firmenich SA:

Known for its premium taste and scent innovations, Firmenich is a renowned leader in flavor solutions, dedicated to enhancing beverage products while maintaining quality and sustainability.International Flavors & Fragrances (IFF):

IFF is a major player in the flavoring systems market, offering diverse beverage flavor solutions that resonate with contemporary consumer trends for health and wellness.Kerry Group:

Kerry Group excels in the development of taste and nutrition solutions across various industries, including beverages, emphasizing clean label products and organic flavoring systems.We're grateful to work with incredible clients.

FAQs

What is the market size of beverage Flavoring Systems?

The global beverage flavoring systems market is currently valued at approximately $100 million with a projected compound annual growth rate (CAGR) of 5%. The market is anticipated to reach about $162 million by 2033.

What are the key market players or companies in this beverage Flavoring Systems industry?

Key players in the beverage flavoring systems industry include industry leaders who contribute significantly to product innovation and market share. Their collaboration with beverage companies often shapes market trends and consumer preferences.

What are the primary factors driving the growth in the beverage Flavoring Systems industry?

Growth in the beverage flavoring systems market is primarily driven by increasing consumer demand for flavored beverages, the rise of health-conscious alternatives, and innovations in flavor technology that enhance beverage experiences.

Which region is the fastest Growing in the beverage Flavoring Systems?

North America is the fastest-growing region for beverage flavoring systems, with market growth from $38.20 million in 2023 to $62.87 million by 2033. Other regions, like Europe and Asia Pacific, also show significant growth.

Does ConsaInsights provide customized market report data for the beverage Flavoring Systems industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the beverage flavoring systems industry, enabling businesses to make informed decisions based on unique market dynamics.

What deliverables can I expect from this beverage Flavoring Systems market research project?

Deliverables from the beverage flavoring systems market research project include comprehensive reports detailing market size, segment analysis, regional insights, and trend forecasts to assist strategic planning.

What are the market trends of beverage Flavoring Systems?

Key trends in the beverage flavoring systems market include the increasing demand for natural flavors over artificial options, the rise of zero-sugar drinks, and innovative flavor combinations that enhance consumer appeal.