Beverage Packaging Market Report

Published Date: 02 February 2026 | Report Code: beverage-packaging

Beverage Packaging Market Size, Share, Industry Trends and Forecast to 2033

This report covers comprehensive insights into the Beverage Packaging market from 2023 to 2033, analyzing market trends, sizes, regional breakdowns, and leading industry players, providing valuable forecasts and assessments for stakeholders.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

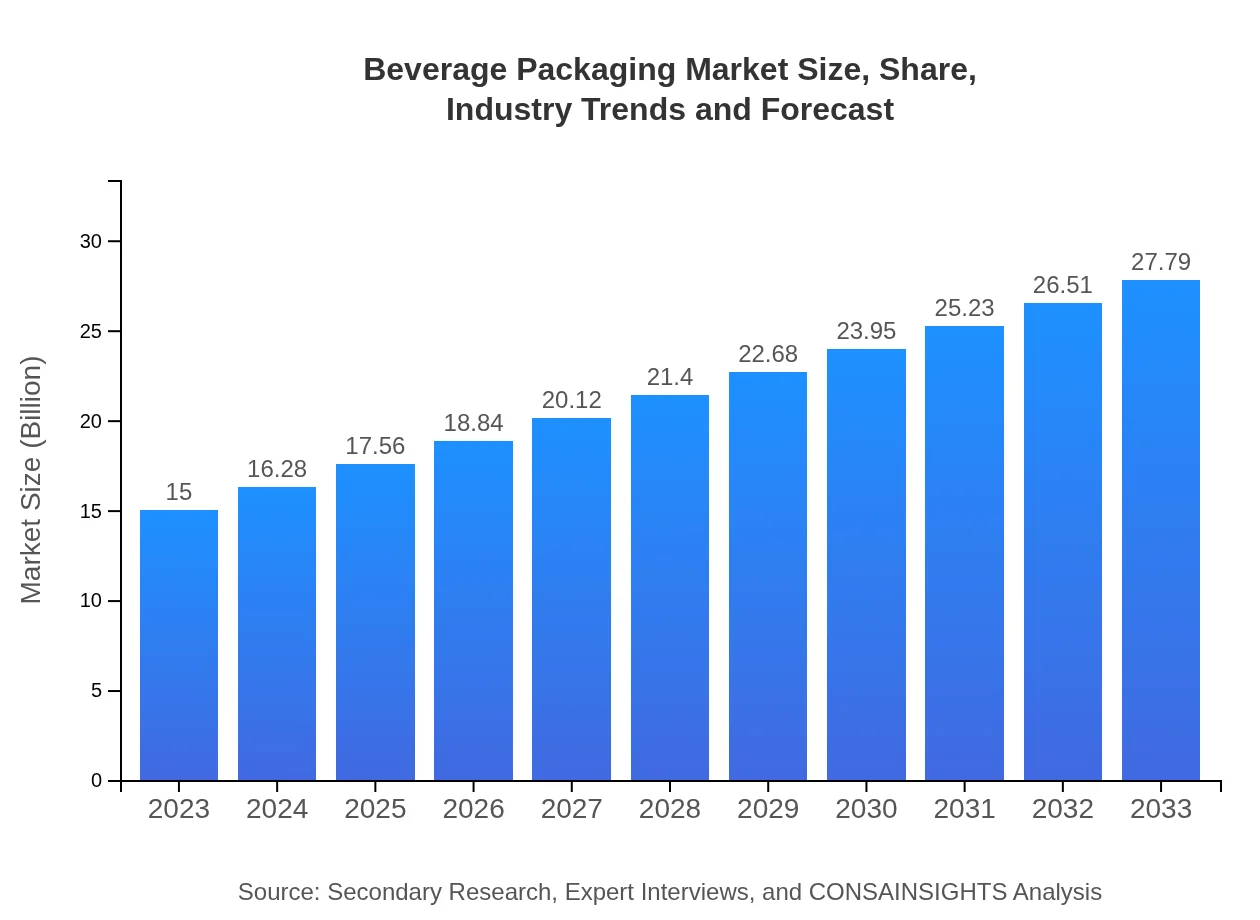

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $27.79 Billion |

| Top Companies | Crown Holdings Inc., Ball Corporation, Amcor, Tetra Pak |

| Last Modified Date | 02 February 2026 |

Beverage Packaging Market Overview

Customize Beverage Packaging Market Report market research report

- ✔ Get in-depth analysis of Beverage Packaging market size, growth, and forecasts.

- ✔ Understand Beverage Packaging's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Packaging

What is the Market Size & CAGR of Beverage Packaging market in 2023?

Beverage Packaging Industry Analysis

Beverage Packaging Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Packaging Market Analysis Report by Region

Europe Beverage Packaging Market Report:

In Europe, the Beverage Packaging market is projected to grow from 3.72 billion USD in 2023 to 6.89 billion USD by 2033. Factors such as stringent regulations on single-use plastics and the rise of sustainable packaging solutions are shaping the market's trajectory, driving growth across various packaging materials.Asia Pacific Beverage Packaging Market Report:

In 2023, the Beverage Packaging market in the Asia Pacific region is valued at approximately 2.88 billion USD, with a projected increase to 5.34 billion USD by 2033. The growth is driven by urbanization, increasing disposable incomes, and the rising demand for both alcoholic and non-alcoholic beverages, creating a significant opportunity for packaging innovations.North America Beverage Packaging Market Report:

The North American market, currently valued at 5.85 billion USD in 2023, is expected to reach 10.84 billion USD by 2033. The region shows substantial growth due to innovations in smart packaging, sustainability initiatives, and rising demand for lightweight packaging solutions in both the retail and e-commerce sectors.South America Beverage Packaging Market Report:

The South American Beverage Packaging market is forecasted to grow from 0.96 billion USD in 2023 to 1.78 billion USD by 2033. This growth is attributed to the burgeoning beverage industry and increasing health consciousness among consumers driving demand for better packaging solutions.Middle East & Africa Beverage Packaging Market Report:

The Middle East and Africa Beverage Packaging market is anticipated to rise from 1.59 billion USD in 2023 to 2.95 billion USD by 2033. The increase is attributed to a young population and rising urbanization, leading to higher consumption rates of beverages that necessitate efficient packaging solutions.Tell us your focus area and get a customized research report.

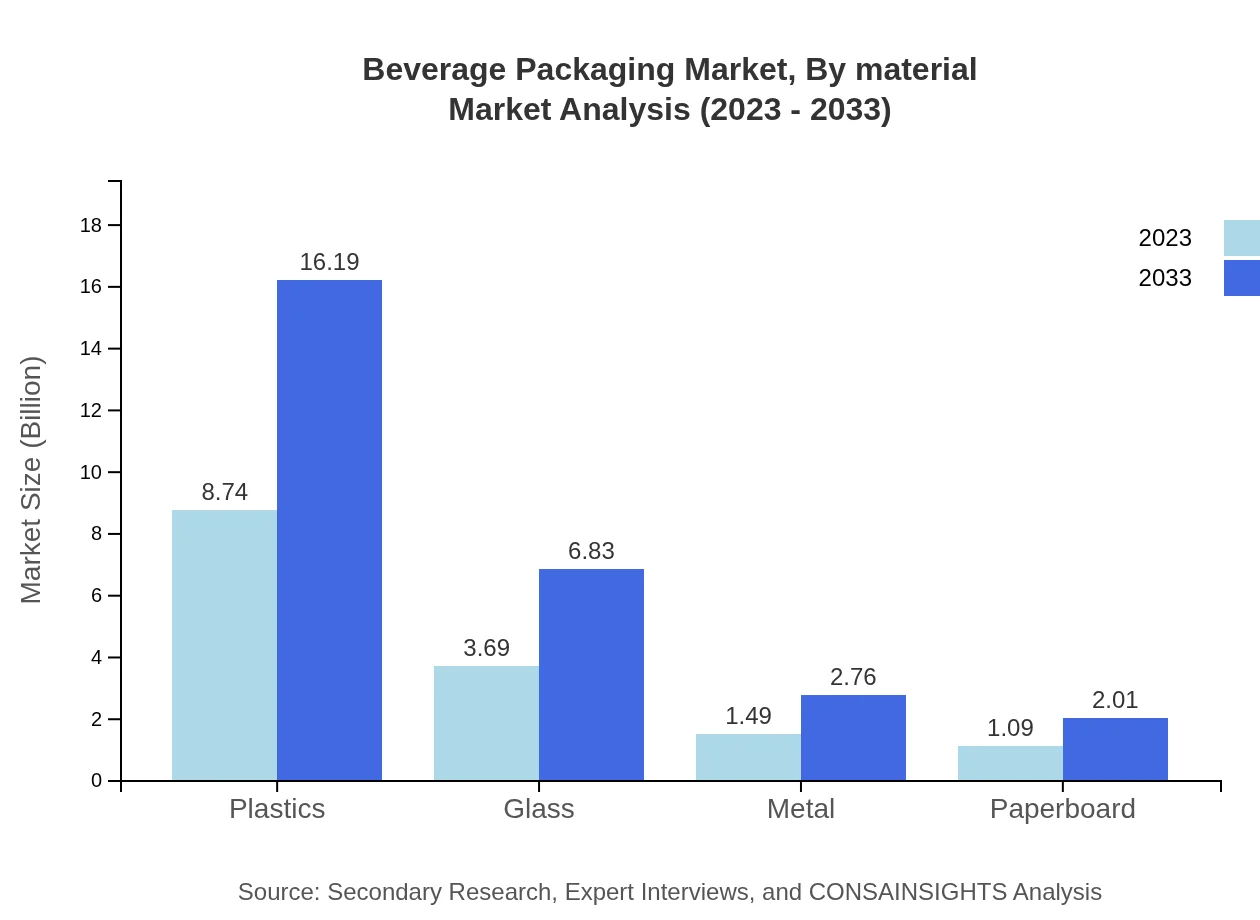

Beverage Packaging Market Analysis By Material

The material segment of the Beverage Packaging market shows distinct characteristics with plastics dominating at 58.24% share in 2023, projected to grow to 58.24% by 2033, driven by their versatility and cost-effectiveness. Glass follows with a 24.57% share, expected to expand due to trends towards premium packaging. Metal and eco-friendly materials are gaining traction as brands transition to more sustainable options, thereby reshaping the competitive landscape.

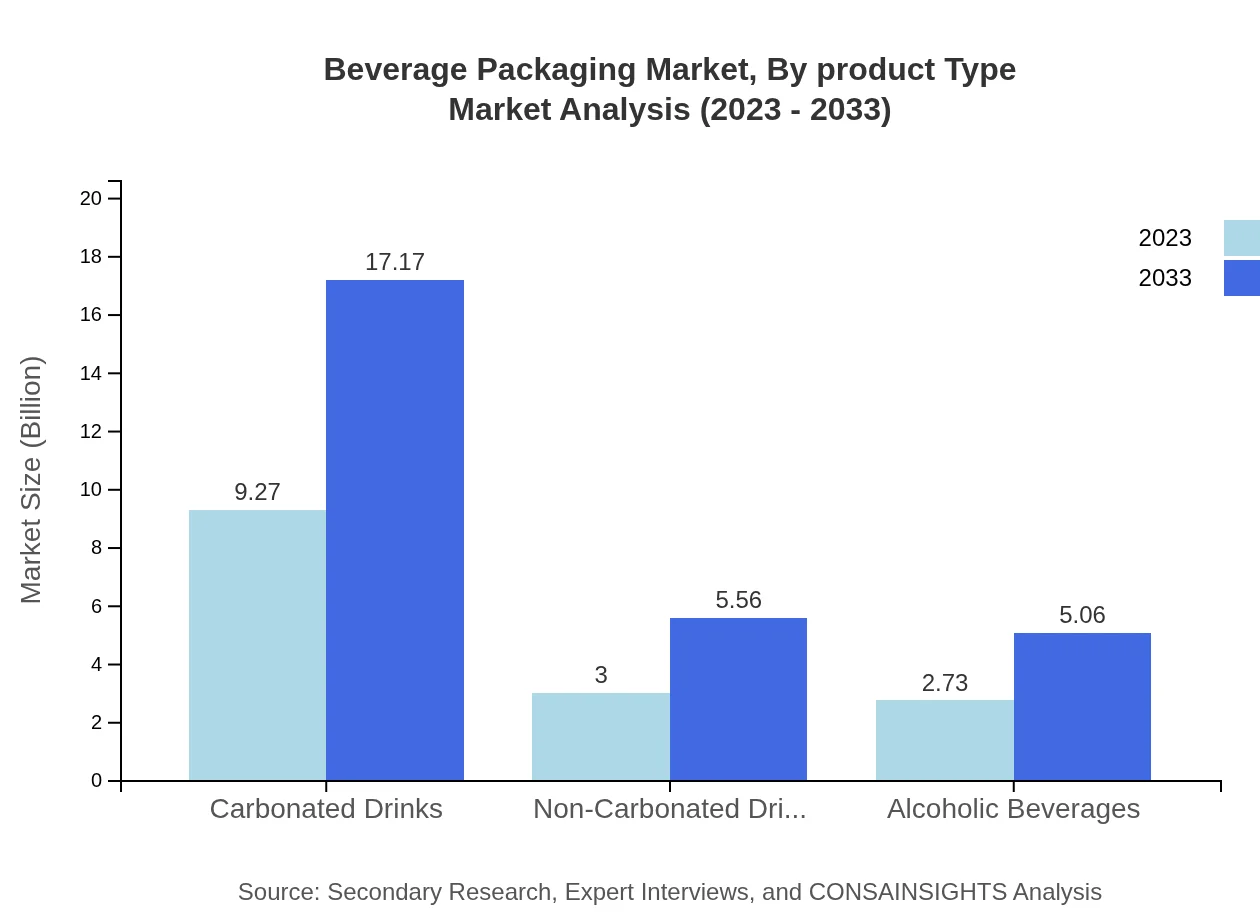

Beverage Packaging Market Analysis By Product Type

The product type analysis reveals carbonated drinks hold a significant share of 61.77% in 2023, expected to remain stable through 2033. Non-carbonated drinks follow, holding a 20.02% share, with growth powered by health-conscious choices among consumers. Alcoholic beverages capture 18.21% of share, emphasizing the evolving beverage preferences across different regions.

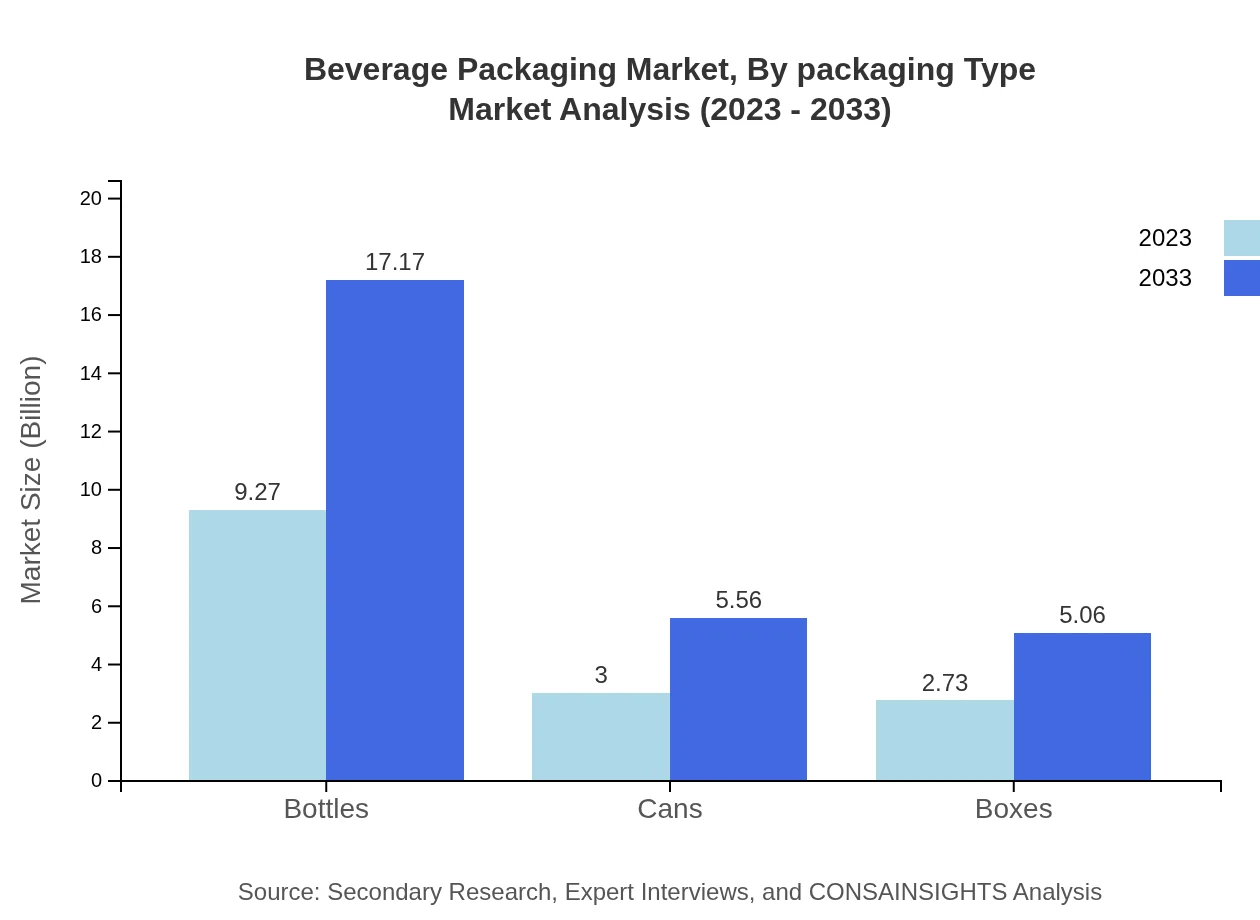

Beverage Packaging Market Analysis By Packaging Type

Bottles dominate the packaging type segment at 61.77% share, reflecting ongoing consumer preference for packaged beverages. Cans and boxes follow, together comprising a considerable share of the market, highlighting diverse consumer choices in beverage packaging formats as brands innovate to meet consumer demands.

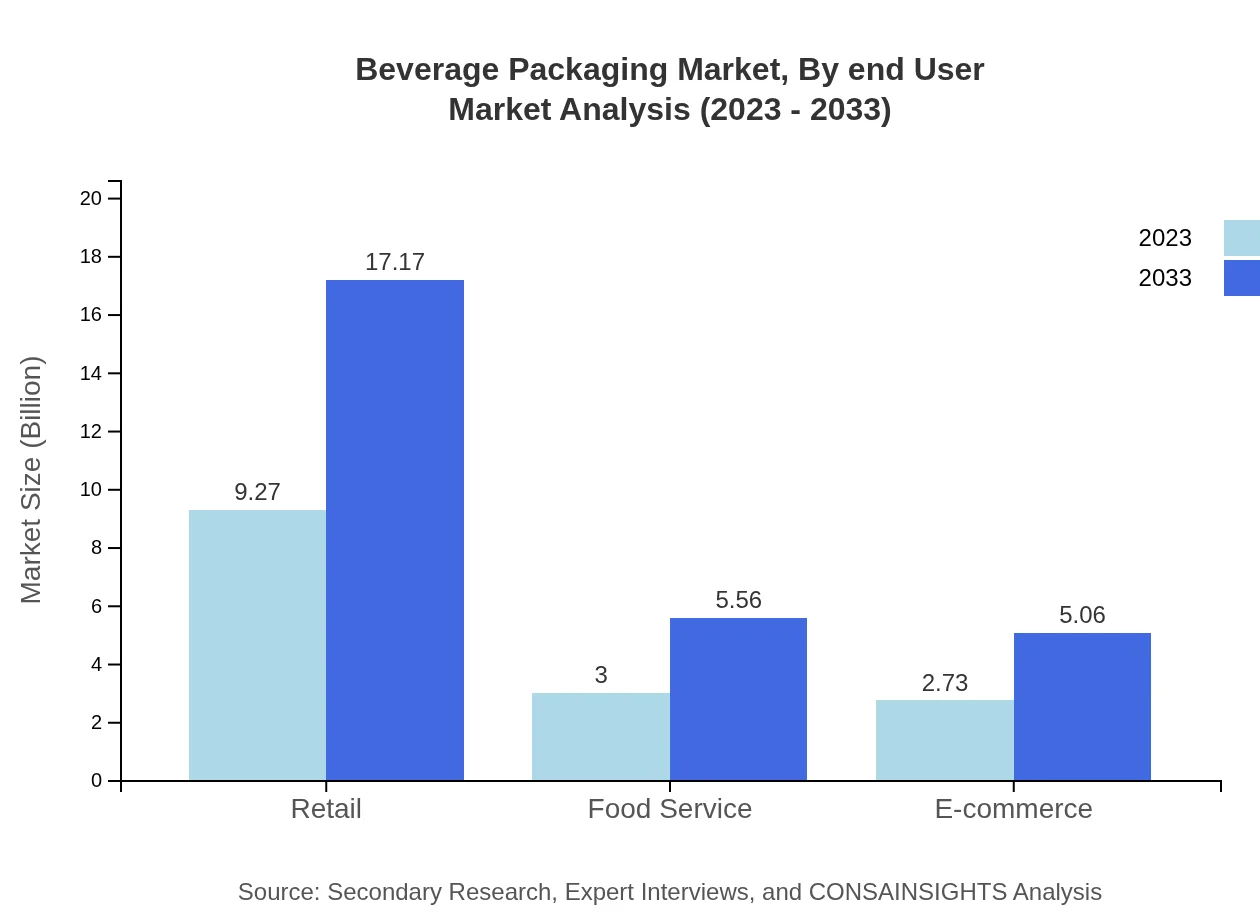

Beverage Packaging Market Analysis By End User

The retail segment accounts for the majority share at 61.77%, driven by consumer demand in offline and online groceries. The food service sector follows with a significant share, driven by the need for convenience in food offerings. E-commerce is also rapidly growing, reflecting changing shopping behaviors of consumers and necessitating robust packaging solutions for delivery.

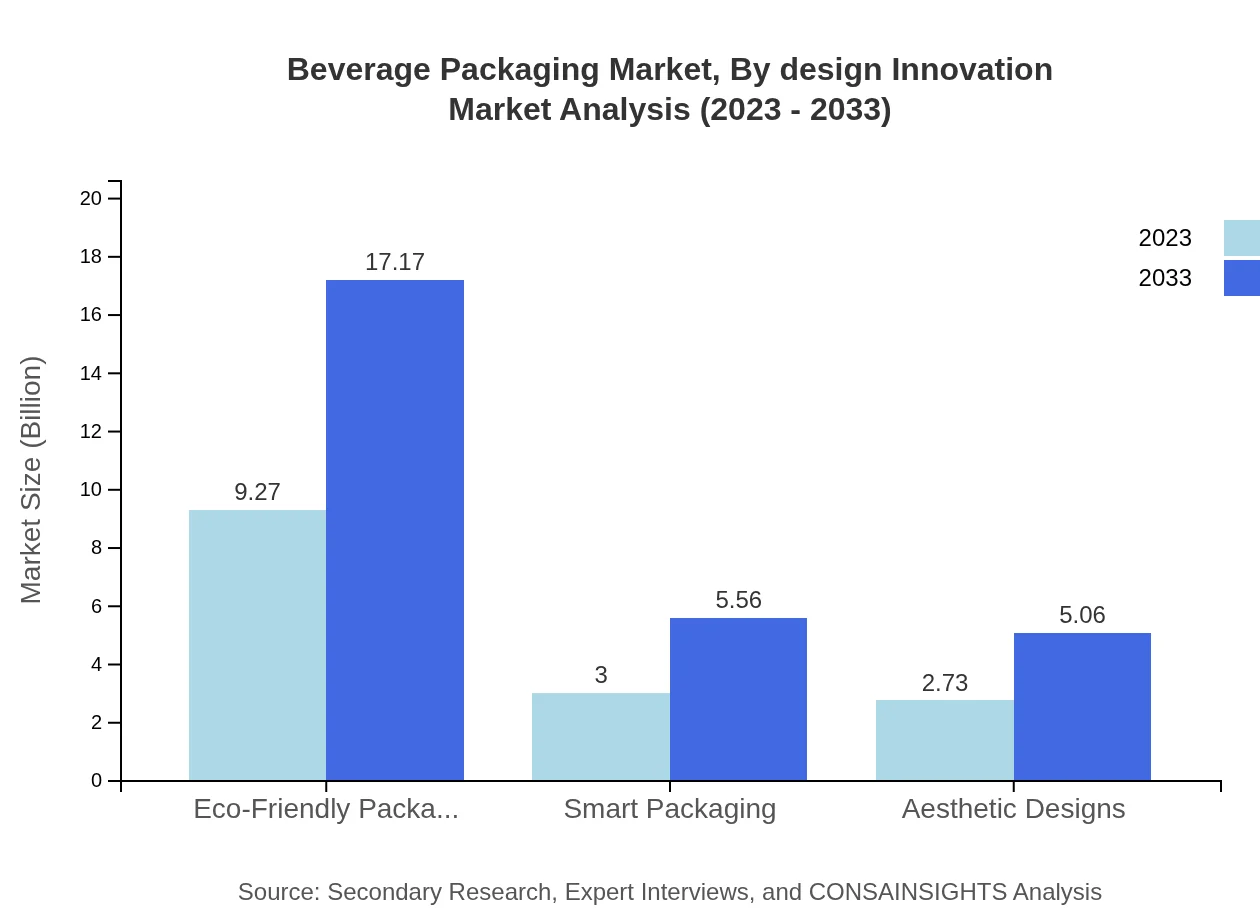

Beverage Packaging Market Analysis By Design Innovation

Innovations in design, including eco-friendly packaging that enhances sustainability while ensuring product safety and freshness, account for a notable share. Smart packaging solutions that enhance user engagement and provide brand value to consumers are trending, showcasing the intersection of technology and material advancements.

Beverage Packaging Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Packaging Industry

Crown Holdings Inc.:

A world leader in metal packaging technology, Crown Holdings manufactures aluminum cans and glass bottles, focusing on sustainability initiatives and innovative design.Ball Corporation:

An industry pioneer in metal packaging solutions, Ball Corporation offers aluminum cans and is committed to environmental stewardship through its sustainable practices.Amcor:

Amcor provides flexible and rigid packaging solutions, leading the way in sustainable innovation within the packaging industry.Tetra Pak:

Renowned for its pioneering work in carton packaging, Tetra Pak specializes in dairy, juice, and non-carbonated beverages with an emphasis on sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of beverage Packaging?

The global beverage packaging market is currently valued at approximately $15 billion in 2023, with an anticipated compound annual growth rate (CAGR) of 6.2% through 2033, indicating robust growth driven by consumer demand and innovative packaging solutions.

What are the key market players or companies in the beverage Packaging industry?

The beverage packaging industry consists of prominent players such as Crown Holdings, Ball Corporation, Amcor, and Tetra Pak. These companies lead the market with their innovative solutions and extensive distribution networks across various regions.

What are the primary factors driving the growth in the beverage packaging industry?

Key factors contributing to the growth of the beverage packaging industry include rising consumer demand for convenient and sustainable packaging, increasing investments in innovative packaging technologies, and the expansion of the beverage industry itself across various segments.

Which region is the fastest Growing in the beverage packaging?

The fastest-growing region in the beverage packaging market is Asia Pacific, projected to grow from $2.88 billion in 2023 to $5.34 billion by 2033, driven by increasing urbanization and rising disposable incomes.

Does ConsaInsights provide customized market report data for the beverage packaging industry?

Yes, ConsaInsights offers customized market report data specifically tailored for the beverage packaging industry, allowing businesses to acquire insights unique to their strategic objectives and market conditions.

What deliverables can I expect from this beverage packaging market research project?

From this beverage packaging market research project, you can expect comprehensive reports including market size analysis, growth forecasts, competitive landscape insights, regional data breakdowns, and trends in consumer preferences and technology.

What are the market trends of beverage packaging?

Current trends in the beverage packaging market include a shift towards eco-friendly packaging solutions, the rise of smart packaging technologies, and a strong focus on aesthetic design and consumer engagement strategies.