Beverage Processing Equipment Market Report

Published Date: 22 January 2026 | Report Code: beverage-processing-equipment

Beverage Processing Equipment Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Beverage Processing Equipment market, detailing key insights on market size, trends, and projections for 2023-2033. It covers regional performances, technology trends, and industry leaders, offering a comprehensive guide for stakeholders.

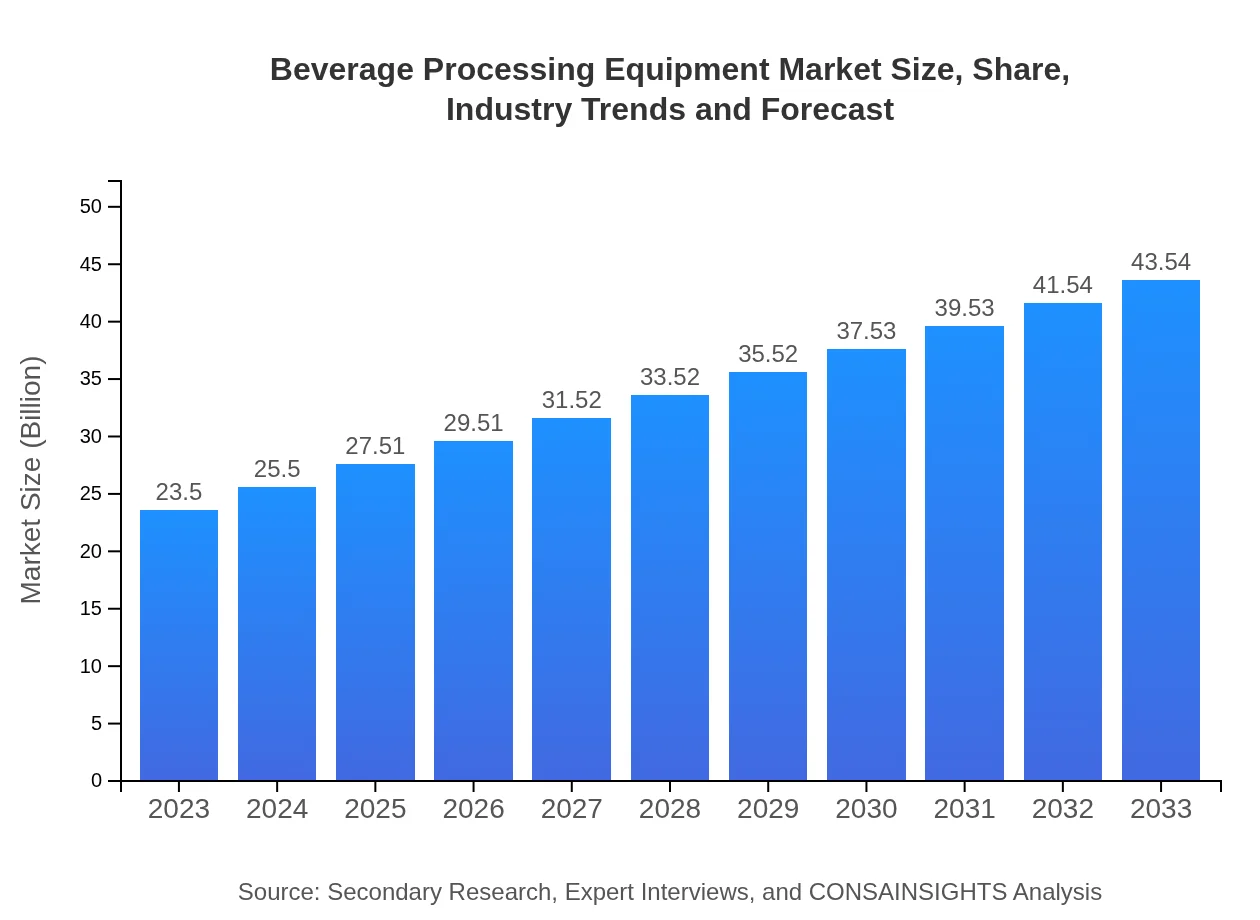

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $23.50 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $43.54 Billion |

| Top Companies | Danfoss, GEA Group, Tetra Pak, Krones AG |

| Last Modified Date | 22 January 2026 |

Beverage Processing Equipment Market Overview

Customize Beverage Processing Equipment Market Report market research report

- ✔ Get in-depth analysis of Beverage Processing Equipment market size, growth, and forecasts.

- ✔ Understand Beverage Processing Equipment's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Beverage Processing Equipment

What is the Market Size & CAGR of Beverage Processing Equipment market in 2023 and 2033?

Beverage Processing Equipment Industry Analysis

Beverage Processing Equipment Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Beverage Processing Equipment Market Analysis Report by Region

Europe Beverage Processing Equipment Market Report:

Europe's market is projected to grow from $6.02 billion in 2023 to approximately $11.16 billion in 2033. Factors influencing this growth include increasing health-consciousness and the shift toward organic beverages.Asia Pacific Beverage Processing Equipment Market Report:

In 2023, the Asia Pacific Beverage Processing Equipment market is valued at approximately $4.58 billion, expected to grow to $8.48 billion by 2033. The region benefits from robust industrial growth and rising disposable income, boosting beverage consumption.North America Beverage Processing Equipment Market Report:

North America's Beverage Processing Equipment market is set to expand from $8.63 billion in 2023 to $15.98 billion by 2033, driven by advancements in processing technology and a high demand for premium beverages.South America Beverage Processing Equipment Market Report:

The South American market is projected to experience growth from $2.13 billion in 2023 to an estimated $3.94 billion in 2033. The rising demand for packaged beverages and improved production methodologies will contribute to this growth.Middle East & Africa Beverage Processing Equipment Market Report:

The Middle East and Africa market for Beverage Processing Equipment is expected to grow from $2.14 billion in 2023 to about $3.97 billion by 2033. Growth prospects are supported by increasing investments in the food and beverage sector.Tell us your focus area and get a customized research report.

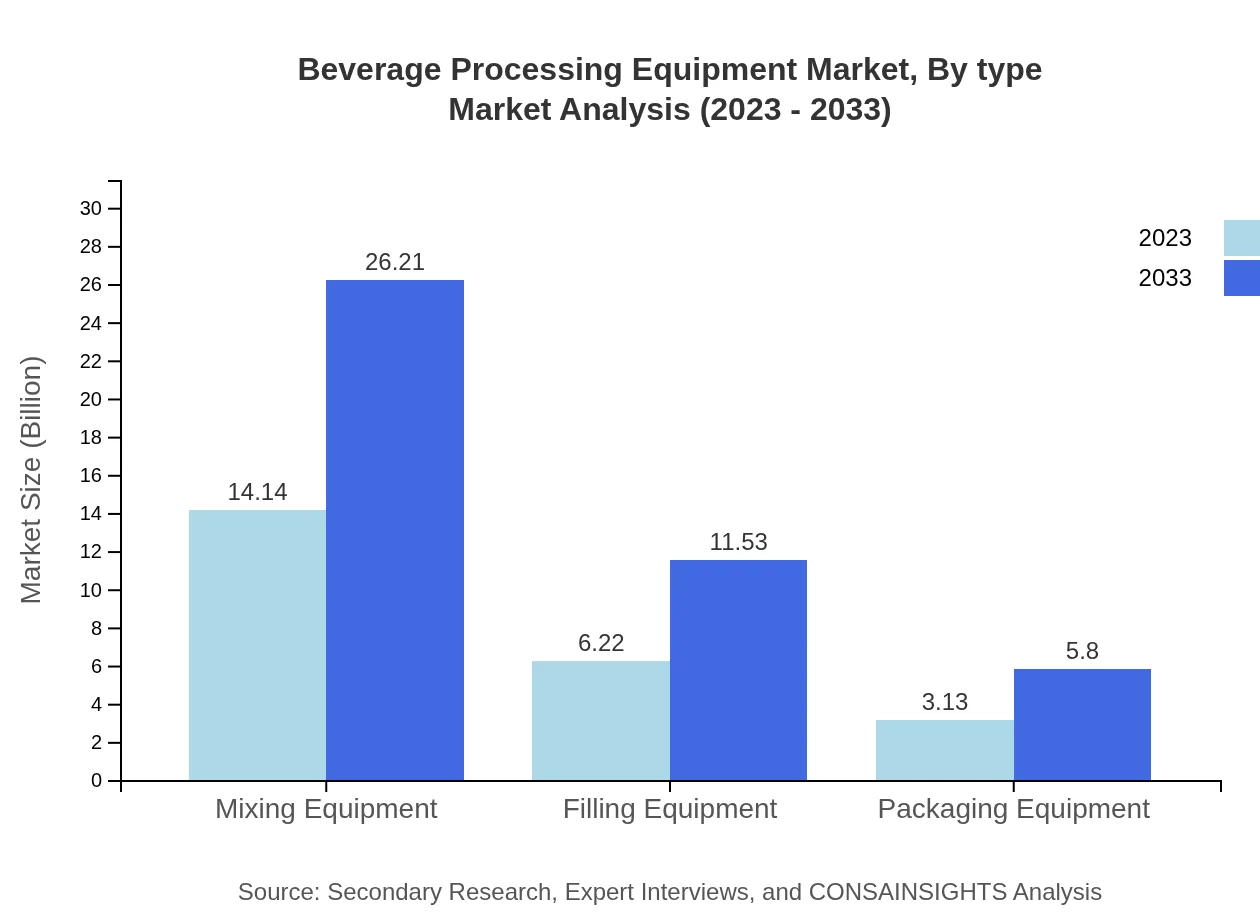

Beverage Processing Equipment Market Analysis By Type

The Beverage Processing Equipment market encompasses various types such as mixing, filling, and packaging equipment. For instance, mixing equipment holds a significant portion of the market with a size of $14.14 billion in 2023 and expected to reach $26.21 billion by 2033. Filling equipment follows with a size of $6.22 billion in 2023 projected to reach $11.53 billion by 2033. The importance of each category stems from their essential roles in ensuring effective beverage production.

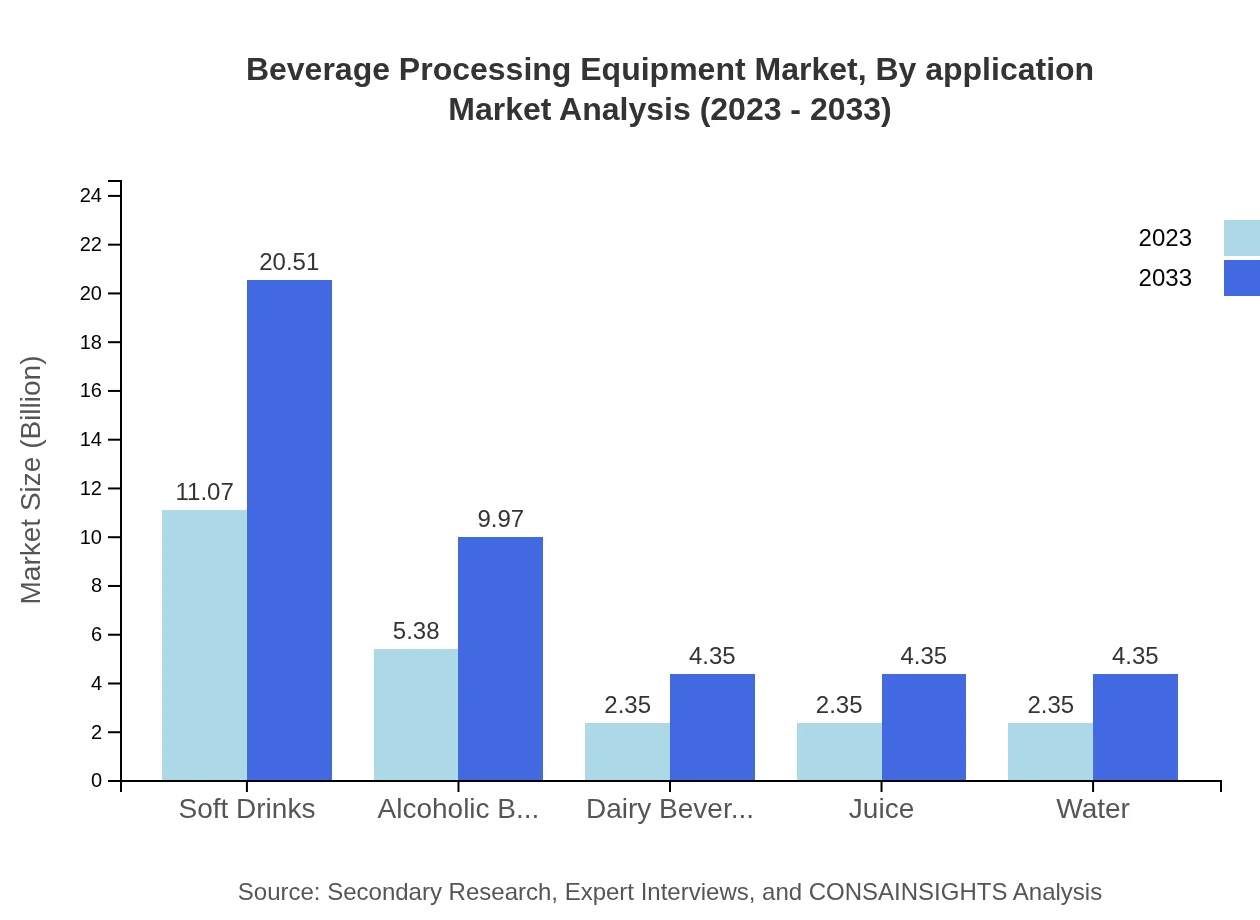

Beverage Processing Equipment Market Analysis By Application

Applications such as soft drinks, alcoholic beverages, and dairy beverages drive the Beverage Processing Equipment market. Soft drinks segment accounted for a market size of $11.07 billion in 2023, expected to grow to $20.51 billion by 2033. The alcoholic beverages segment is also notable, growing from $5.38 billion to $9.97 billion within the same period. This indicates robust demand for technologies tailored to create diverse beverage offerings.

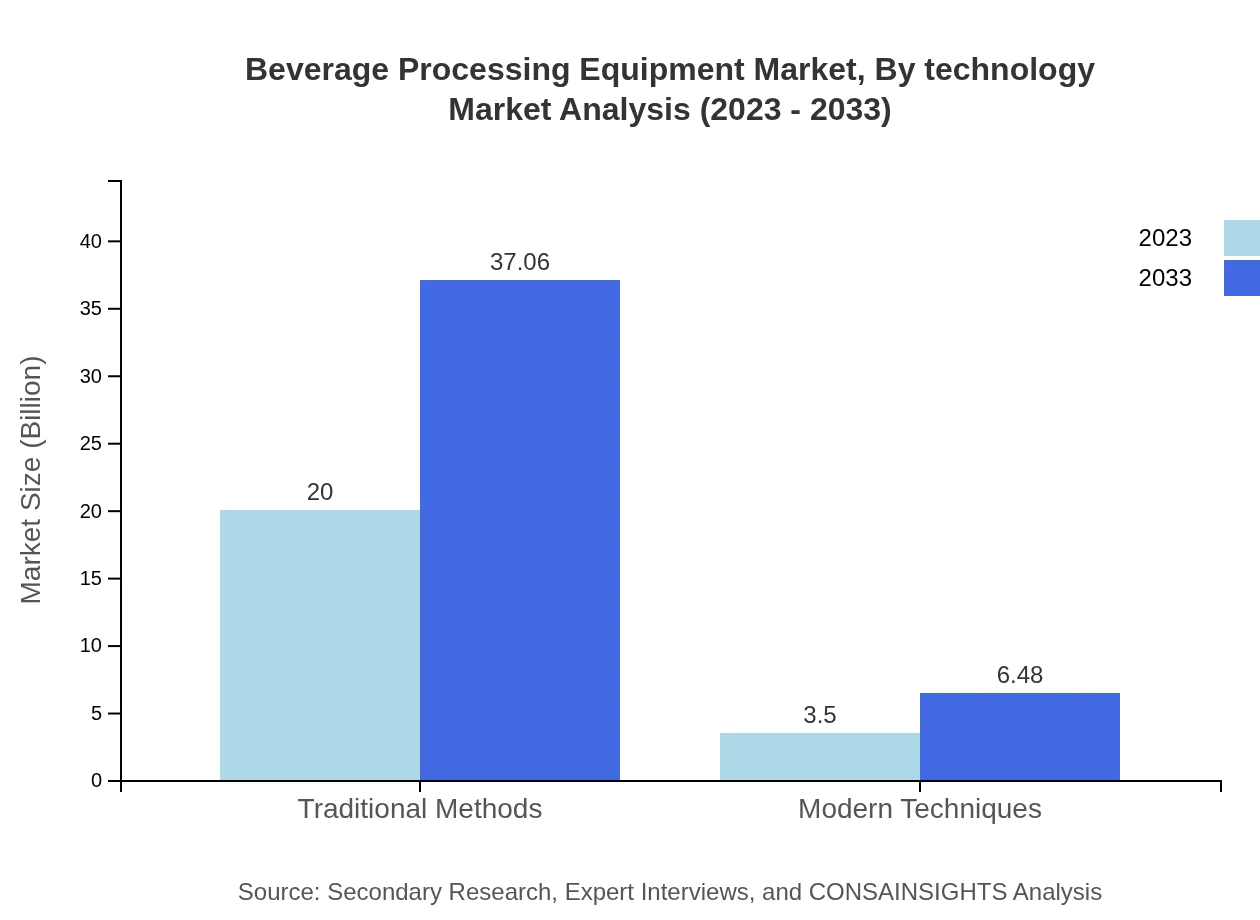

Beverage Processing Equipment Market Analysis By Technology

The Beverage Processing Equipment industry is evolving with modern techniques shaping the landscape. Traditional methods currently hold 85.12% market share, but modern techniques are also emerging, representing 14.88% of the market. Over the forecast period, the market for modern techniques is projected to grow significantly, emphasizing the importance of innovation in processing techniques.

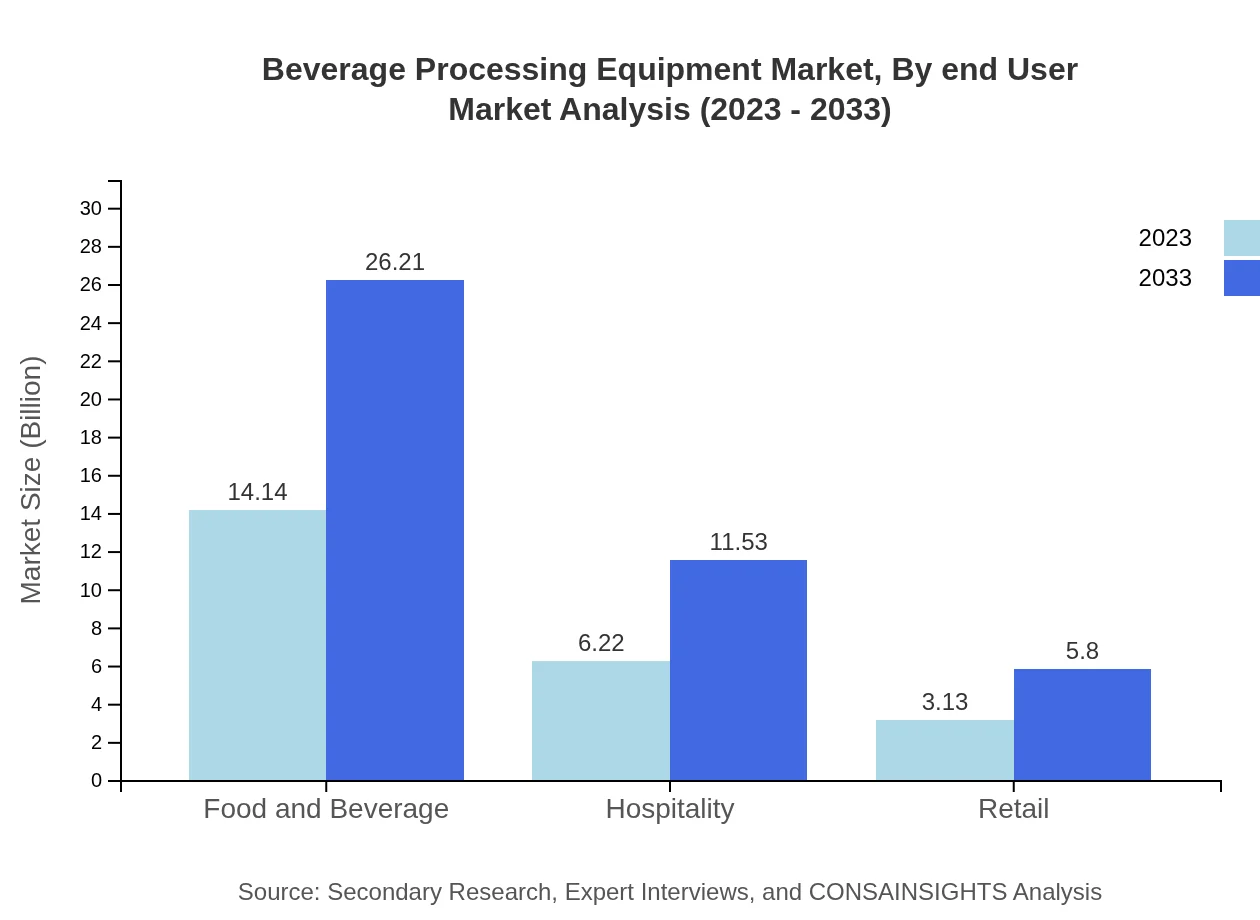

Beverage Processing Equipment Market Analysis By End User

End-user segments include food and beverage, hospitality, and retail sectors. The food and beverage industry dominates the market, contributing around 60% share in 2023 with a similar expectation in 2033. The hospitality sector, with its increasing demand for processed beverages, is also expanding notably.

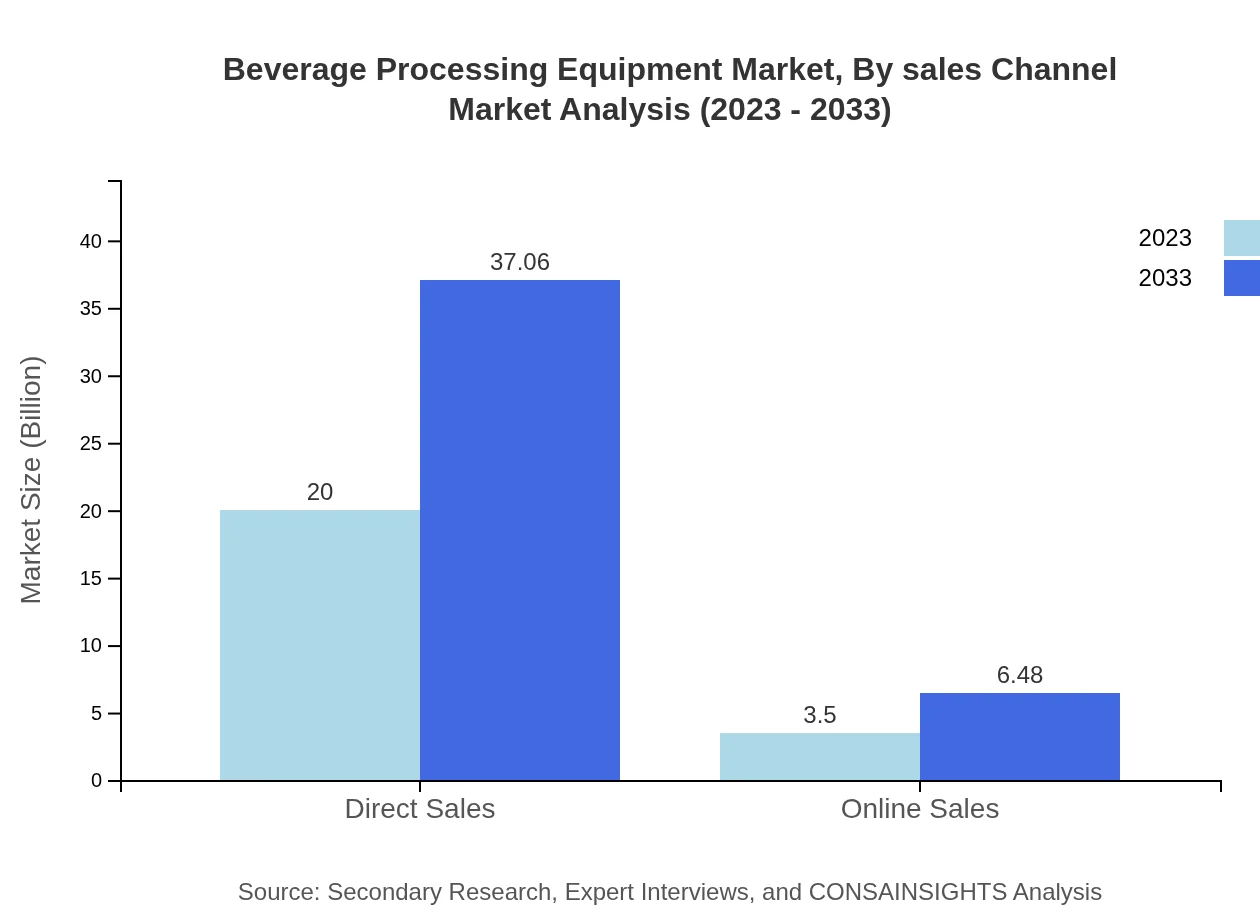

Beverage Processing Equipment Market Analysis By Sales Channel

Sales channels are categorized into direct and online sales. Direct sales account for 85.12% market share in 2023, strongly supported by established relationships with distributors. Online sales, while smaller, are rapidly gaining traction and are projected to expand significantly as e-commerce increasingly captures consumer demand.

Beverage Processing Equipment Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Beverage Processing Equipment Industry

Danfoss:

Danfoss provides advanced automation and control solutions for industrial processes, dramatically enhancing the efficiency of beverage processing systems.GEA Group:

GEA Group is a leading global supplier of food processing technologies, offering state-of-the-art equipment for beverage processing, known for innovation and sustainability.Tetra Pak:

A pioneer in food processing and packaging solutions, Tetra Pak ensures safe and efficient packaging for liquid foods and beverages.Krones AG:

Krones AG specializes in production and bottling technology, providing integrated solutions for beverage production, enhancing operational efficiency.We're grateful to work with incredible clients.

FAQs

What is the market size of Beverage Processing Equipment?

The global beverage processing equipment market is valued at approximately $23.5 billion in 2023, with an expected CAGR of 6.2%, projecting to grow significantly over the next decade, reaching new heights by 2033.

What are the key market players or companies in this Beverage Processing Equipment industry?

Key players in the beverage processing equipment market include companies like Tetra Pak, Alpha Laval, Krones AG, GEA Group, and Pentair, all of which have a strong market presence and contribute significantly to industry innovation and growth.

What are the primary factors driving the growth in the Beverage Processing Equipment industry?

Growth is driven by increasing consumer demand for processed beverages, technological advancements in processing equipment, and awareness of quality and sustainability, alongside the expanding global beverage market catering to diverse consumer preferences.

Which region is the fastest Growing in the Beverage Processing Equipment?

The North American region is the fastest-growing market for beverage processing equipment, projected to grow from $8.63 billion in 2023 to $15.98 billion by 2033, reflecting strong demand for innovative processing solutions.

Does ConsaInsights provide customized market report data for the Beverage Processing Equipment industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the beverage processing equipment industry, ensuring clients receive insights that are relevant and strategic for their business development.

What deliverables can I expect from this Beverage Processing Equipment market research project?

Clients can expect detailed reports including market analysis, trends, forecasts, competitive assessments, and segment data, as well as actionable insights for strategic decision-making in the beverage processing equipment field.

What are the market trends of Beverage Processing Equipment?

Current market trends include the rise of automation and smart technology in beverage processing, an emphasis on sustainable practices, and innovations in equipment design aimed at enhancing efficiency and product quality.