Bfsi Security Market Report

Published Date: 24 January 2026 | Report Code: bfsi-security

Bfsi Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bfsi Security market from 2023 to 2033, including insights on market size, growth potential, and emerging trends across various regions and industry segments.

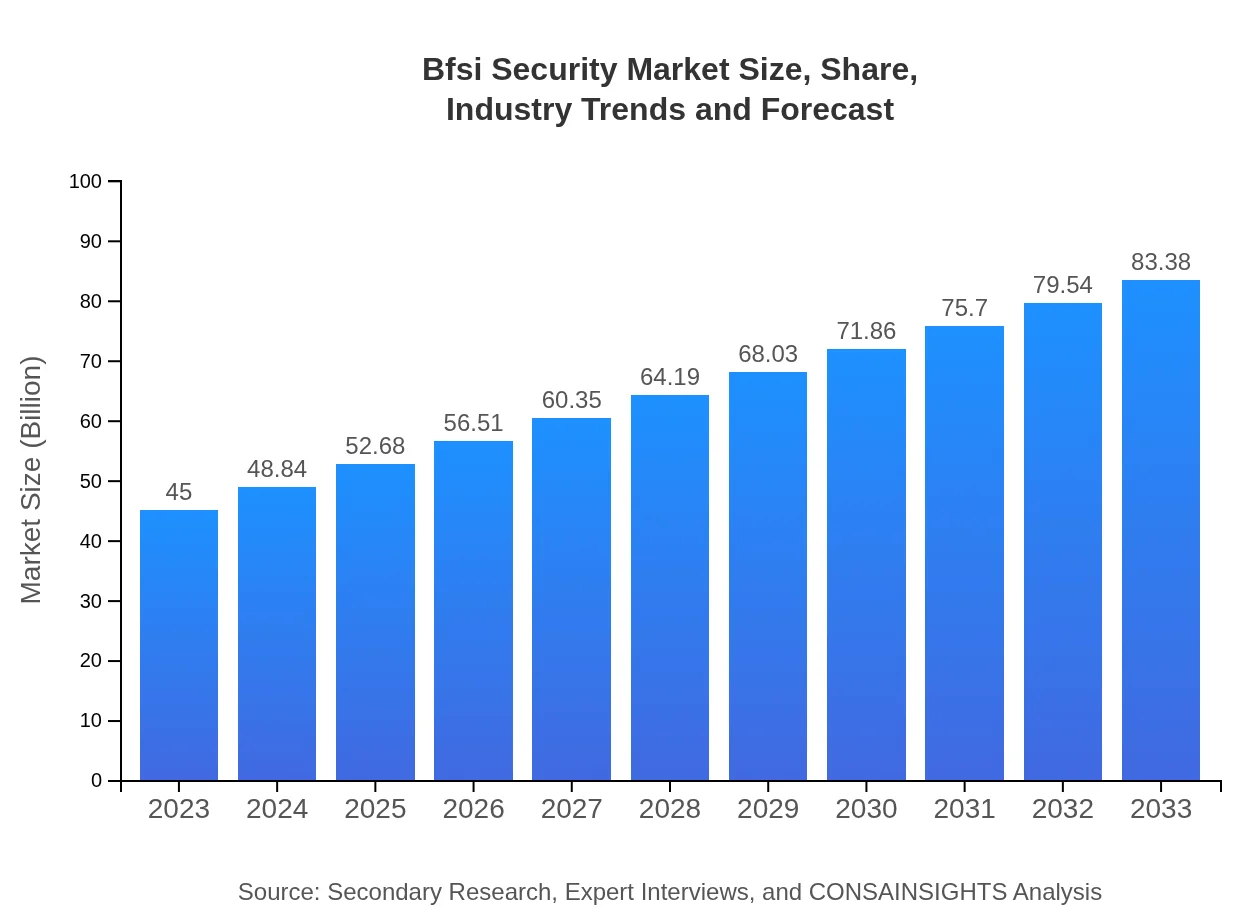

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 6.2% |

| 2033 Market Size | $83.38 Billion |

| Top Companies | IBM, McAfee, Palo Alto Networks, Cisco, Raytheon |

| Last Modified Date | 24 January 2026 |

Bfsi Security Market Overview

Customize Bfsi Security Market Report market research report

- ✔ Get in-depth analysis of Bfsi Security market size, growth, and forecasts.

- ✔ Understand Bfsi Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bfsi Security

What is the Market Size & CAGR of Bfsi Security market in 2023 and 2033?

Bfsi Security Industry Analysis

Bfsi Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bfsi Security Market Analysis Report by Region

Europe Bfsi Security Market Report:

Europe's Bfsi Security market is anticipated to grow from $13.90 billion in 2023 to $25.75 billion by 2033, influenced by stringent regulatory requirements like GDPR and the growing need for comprehensive security strategies across financial sectors.Asia Pacific Bfsi Security Market Report:

The Asia Pacific region is witnessing robust growth in the Bfsi Security market, with a size of around $8.99 billion in 2023, expected to increase to $16.65 billion by 2033. The proliferation of online banking and a surge in fintech developments are driving investments in advanced security solutions.North America Bfsi Security Market Report:

North America leads the market with an estimated size of $15.30 billion in 2023, growing to $28.36 billion in 2033. The region's strong regulatory framework and heightened awareness of cybersecurity threats prompt significant investments in security technologies.South America Bfsi Security Market Report:

In South America, the Bfsi Security market, currently valued at $1.08 billion in 2023, is expected to grow to $2 billion by 2033. Increased cyber threats and a rise in the adoption of digital financial services are key factors catalyzing this growth.Middle East & Africa Bfsi Security Market Report:

The Middle East and Africa exhibit significant opportunities, with a market size of $5.73 billion in 2023 projected to rise to $10.62 billion by 2033. Increasing digitalization and investments in cybersecurity infrastructures are contributing to growth.Tell us your focus area and get a customized research report.

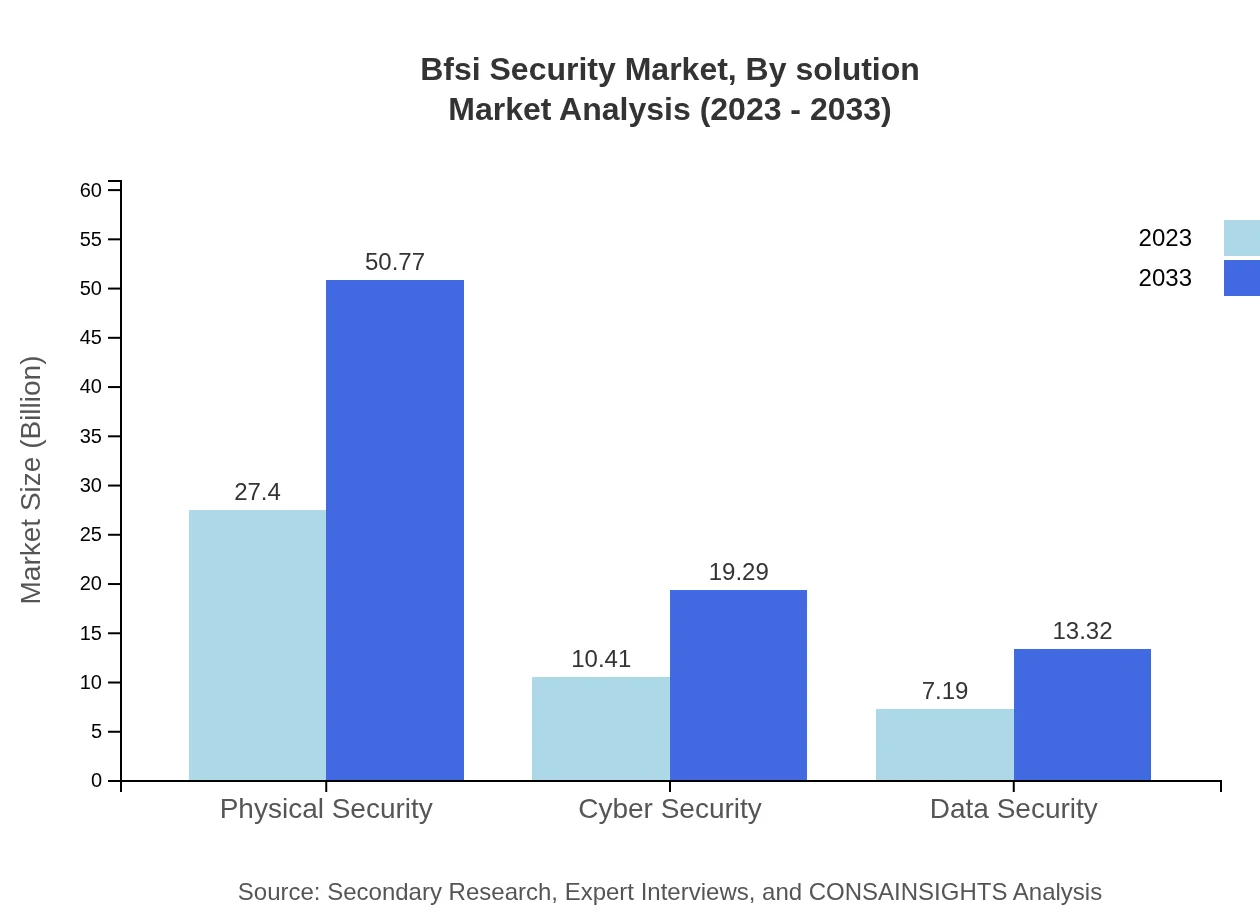

Bfsi Security Market Analysis By Solution

The BFSI Security market by solution highlights physical security, cybersecurity, data security, and biometric technologies. Each solution segment is critical, with cybersecurity leading as technological threats escalate across the financial landscape.

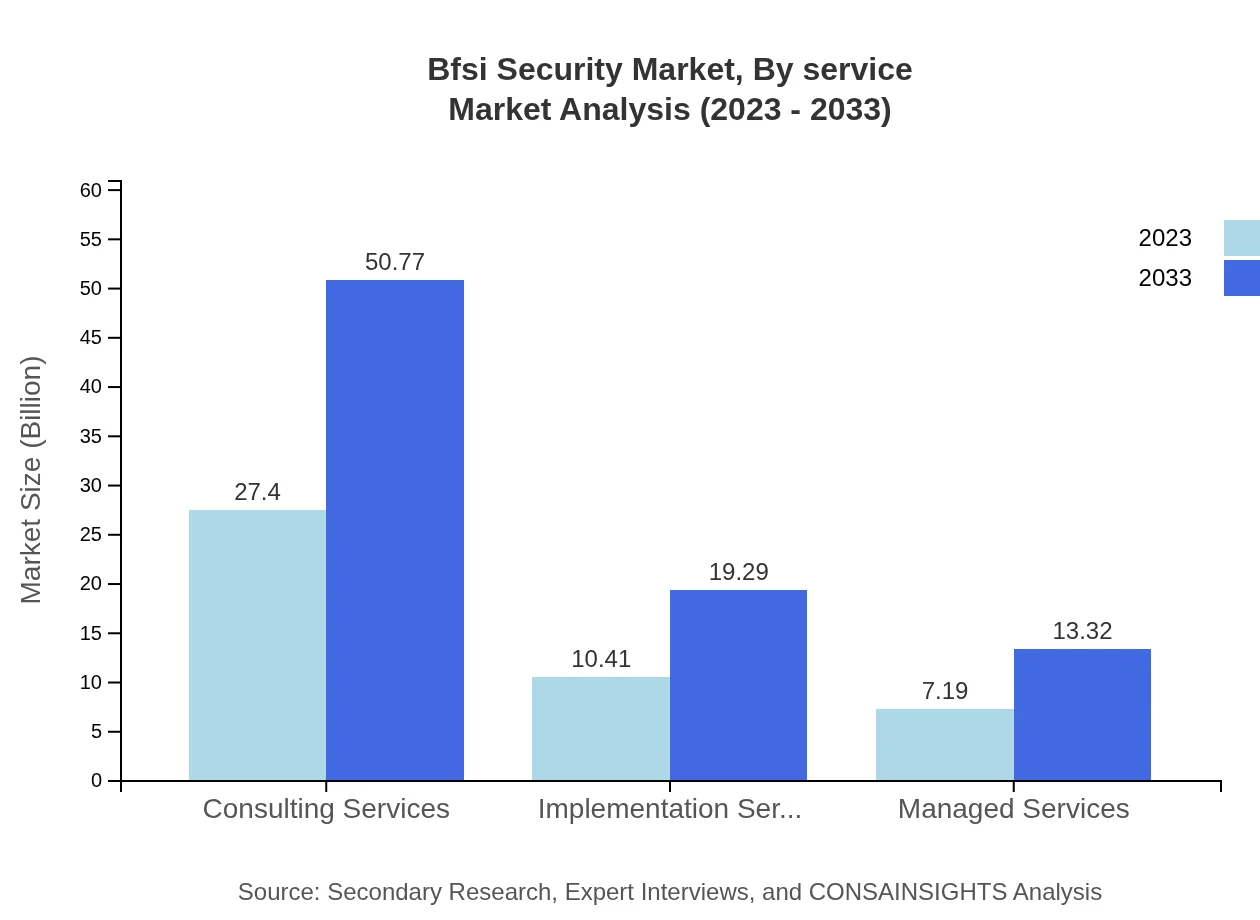

Bfsi Security Market Analysis By Service

Service offerings in the BFSI Security market include consulting services, implementation services, and managed services. Consulting services are projected to dominate due to the increasing need for strategic security assessments and compliance guidance.

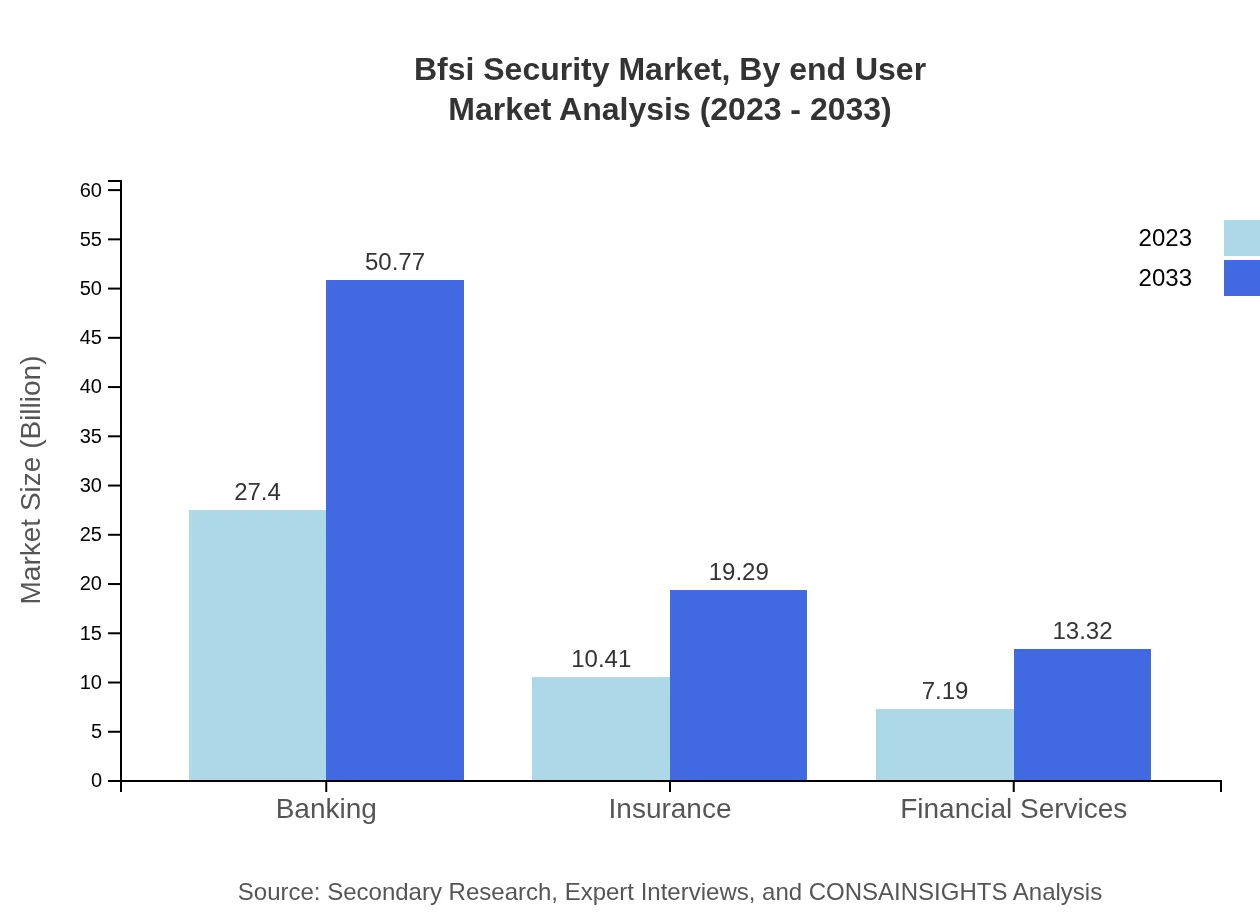

Bfsi Security Market Analysis By End User

Key end-users in the BFSI Security market include banking, insurance, and financial services. Banking remains the largest segment due to its vast online operations and transaction volumes, warranting extensive security measures.

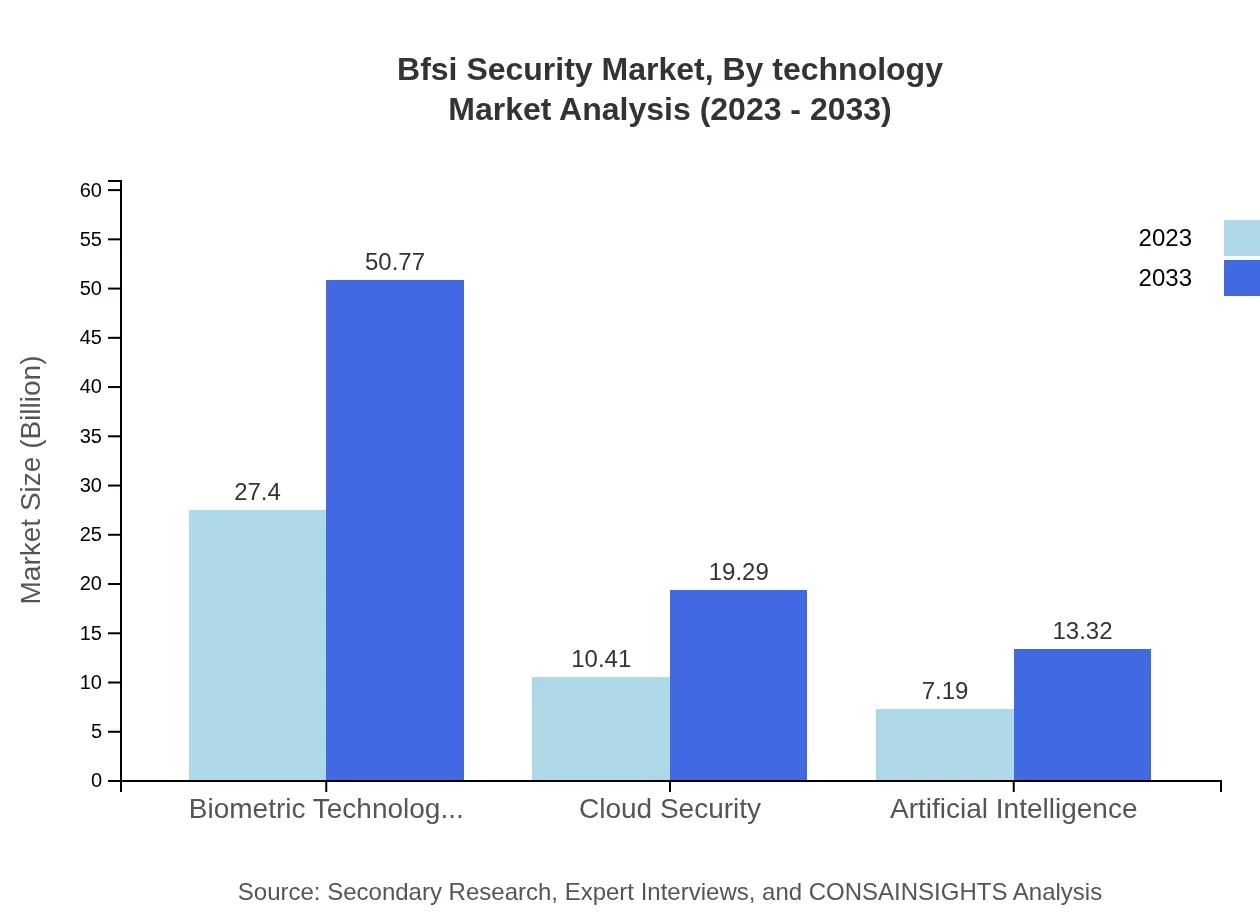

Bfsi Security Market Analysis By Technology

Technologies driving the BFSI Security market include cloud security, artificial intelligence, and biometry technologies. The integration of AI for threat detection and response enhances the overall security posture of financial organizations.

Bfsi Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in BFSI Security Industry

IBM:

IBM provides leading security solutions for financial institutions, focusing on AI-driven security analytics and comprehensive risk management frameworks.McAfee:

McAfee offers advanced cybersecurity products tailored for BFSI operations, protecting sensitive information and ensuring compliance with industry regulations.Palo Alto Networks:

Specializing in cybersecurity, Palo Alto Networks delivers next-gen firewall and security solutions crucial for safeguarding banking infrastructures.Cisco:

Cisco is renowned for its security solutions that enhance security in cloud environments and protect against evolving cyber threats.Raytheon:

Raytheon provides comprehensive security services, focusing on defense against cyber threats, ensuring risk management for BFSI operations.We're grateful to work with incredible clients.

FAQs

What is the market size of bfsi Security?

The BFSI security market is projected to reach $45 billion by 2033, growing at a CAGR of 6.2% from 2023. This growth reflects increasing security demands in the banking, financial services, and insurance sectors.

What are the key market players or companies in this bfsi Security industry?

Key players in the BFSI security industry include major technology firms and cybersecurity companies that offer solutions tailored for banking, insurance, and financial services, although specific company names may vary based on market dynamics.

What are the primary factors driving the growth in the bfsi Security industry?

Growth in BFSI security is driven by increased cyber threats, regulatory requirements, and demand for advanced technological solutions to protect sensitive financial data and ensure compliance in a rapidly evolving digital landscape.

Which region is the fastest Growing in the bfsi Security?

The fastest-growing region in the BFSI security market is expected to be North America, with the market projected to grow from $15.30 billion in 2023 to $28.36 billion by 2033, driven by advanced technology adoption.

Does ConsaInsights provide customized market report data for the bfsi Security industry?

Yes, ConsaInsights offers customized market report data for the BFSI security industry, allowing clients to access specific insights tailored to their business needs and strategic objectives.

What deliverables can I expect from this bfsi Security market research project?

Deliverables from this BFSI security market research project include comprehensive reports, market analysis, growth forecasts, competitive landscapes, and strategic recommendations tailored for effective decision-making.

What are the market trends of bfsi Security?

Current trends in the BFSI security market include increasing investments in cybersecurity solutions, the integration of AI for fraud detection, and a shift towards cloud security measures to enhance data protection.