Big Data Analytics In Automotive Market Report

Published Date: 31 January 2026 | Report Code: big-data-analytics-in-automotive

Big Data Analytics In Automotive Market Size, Share, Industry Trends and Forecast to 2033

This market report provides an in-depth analysis of Big Data Analytics in the automotive sector, covering insights from 2023 to 2033, including market trends, regional dynamics, key players, and future forecasts.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

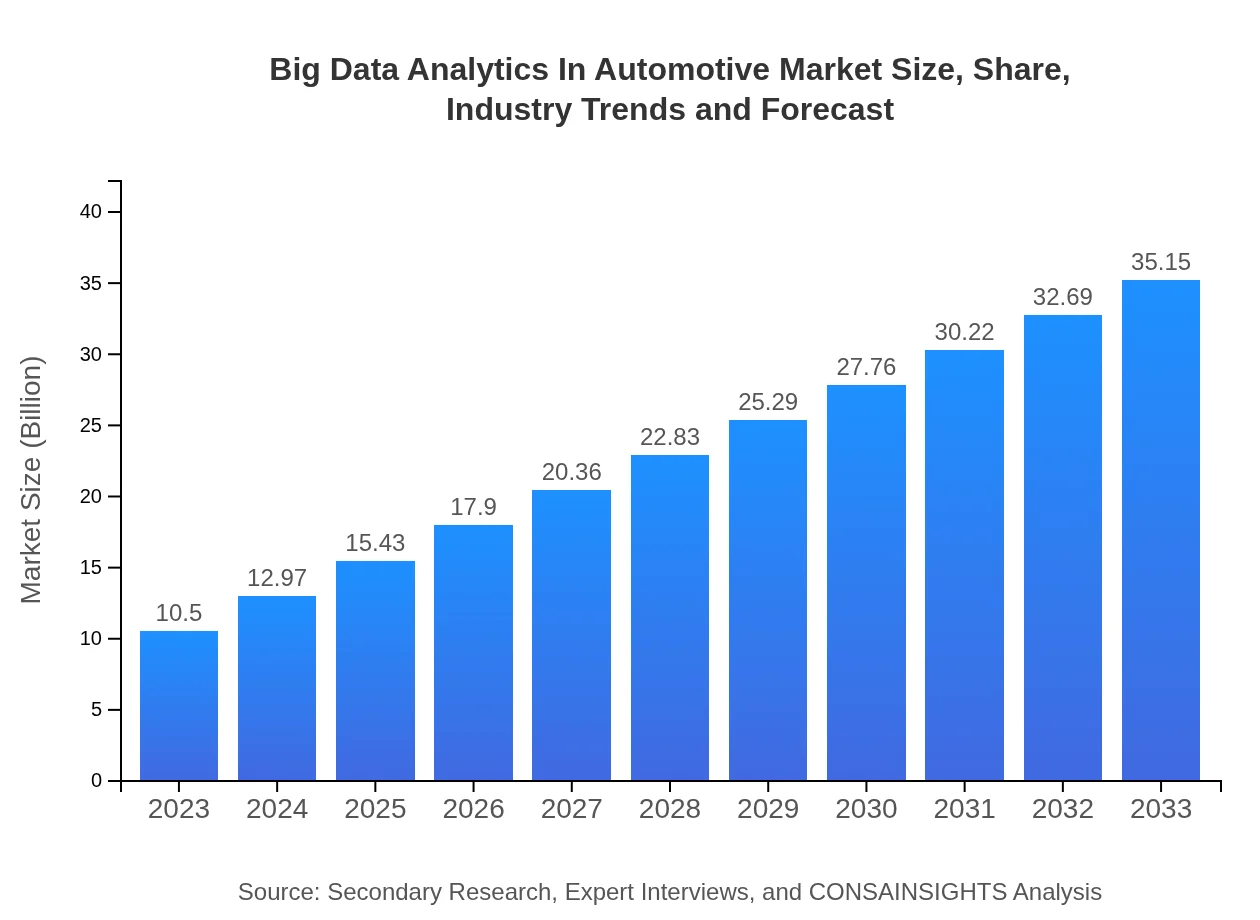

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $35.15 Billion |

| Top Companies | IBM, SAP, Microsoft, Oracle |

| Last Modified Date | 31 January 2026 |

Big Data Analytics In Automotive Market Overview

Customize Big Data Analytics In Automotive Market Report market research report

- ✔ Get in-depth analysis of Big Data Analytics In Automotive market size, growth, and forecasts.

- ✔ Understand Big Data Analytics In Automotive's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Big Data Analytics In Automotive

What is the Market Size & CAGR of Big Data Analytics In Automotive market in 2023 and 2033?

Big Data Analytics In Automotive Industry Analysis

Big Data Analytics In Automotive Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Big Data Analytics In Automotive Market Analysis Report by Region

Europe Big Data Analytics In Automotive Market Report:

The European market, worth approximately $3.12 billion in 2023, is anticipated to rise to $10.44 billion by 2033. Stricter regulations promoting vehicle safety and emissions reduction are spurring investments in data analytics to meet compliance and improve features.Asia Pacific Big Data Analytics In Automotive Market Report:

In 2023, the Big Data Analytics market in the Asia-Pacific region is valued at approximately $2.23 billion, with expectations to grow to $7.47 billion by 2033. The growth is driven by rapid urbanization, a surge in vehicle ownership, and increasing investment in automotive technologies.North America Big Data Analytics In Automotive Market Report:

North America holds a significant market presence at approximately $3.50 billion in 2023, expected to grow to $11.73 billion by 2033. The growth is attributed to robust technological infrastructure, a high concentration of automotive manufacturers, and aggressive initiatives toward autonomous driving.South America Big Data Analytics In Automotive Market Report:

South America's Big Data Analytics in Automotive market was valued at $0.46 billion in 2023 with projections to reach $1.54 billion by 2033. The region faces challenges such as economic fluctuations, but steady growth is noted with increased connectivity and technological adoption.Middle East & Africa Big Data Analytics In Automotive Market Report:

In 2023, the Middle East and Africa market is valued at $1.19 billion, with forecasts indicating growth to $3.97 billion by 2033. Factors such as increasing digitalization and government support for smart transportation systems drive this development.Tell us your focus area and get a customized research report.

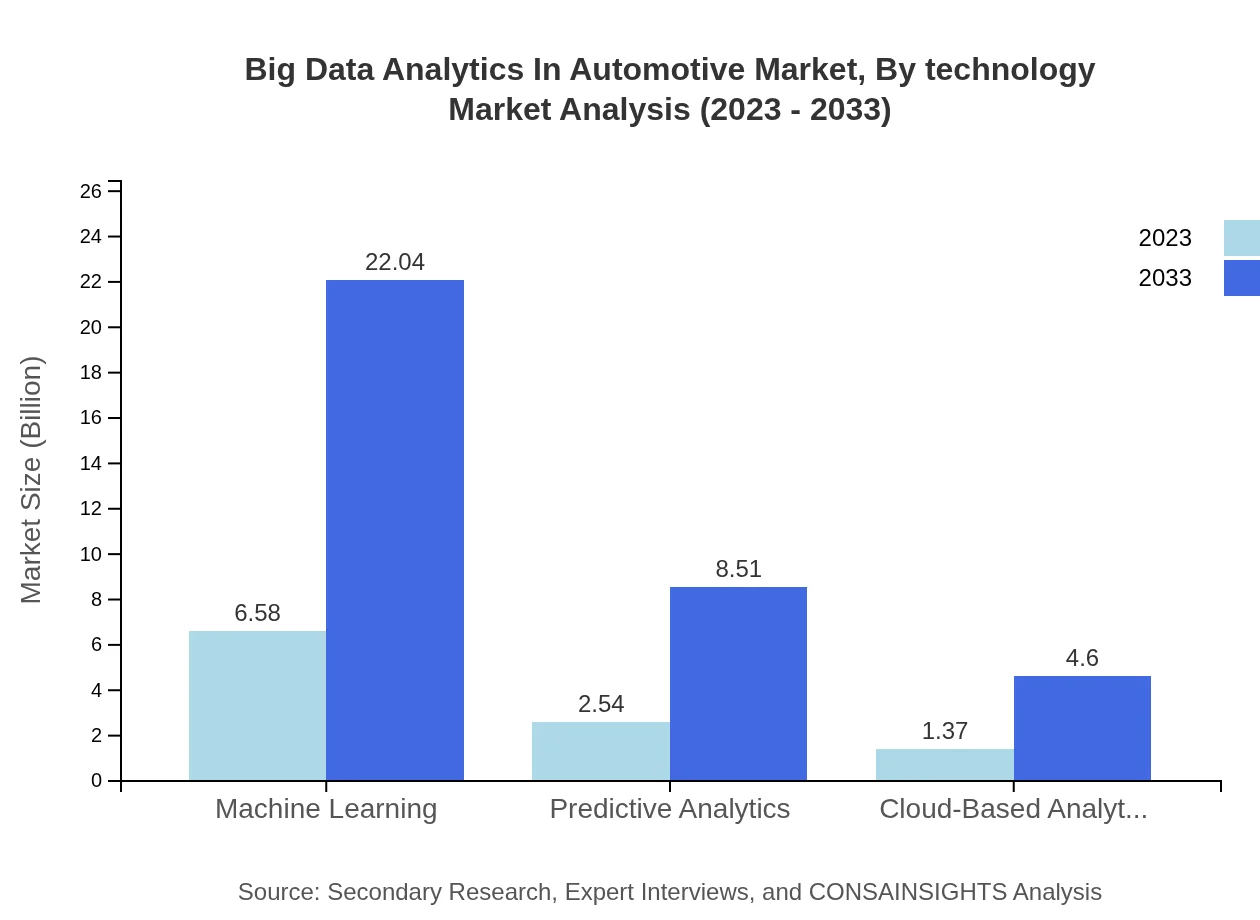

Big Data Analytics In Automotive Market Analysis By Technology

Machine Learning is the dominant technology segment, valued at $6.58 billion in 2023 with projections to $22.04 billion by 2033. Other important technologies include Predictive Analytics and Cloud-Based Analytics with robust growth potential in the coming years.

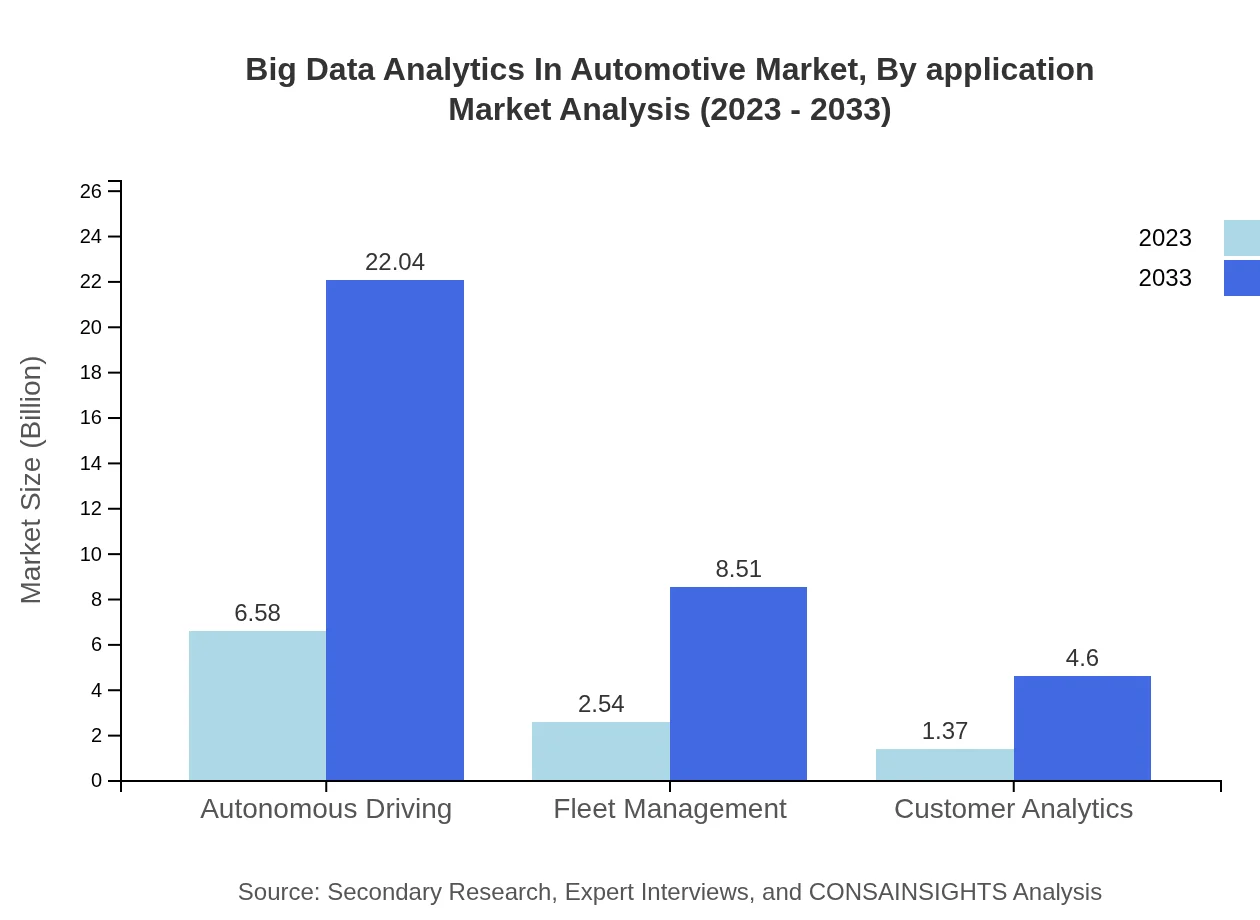

Big Data Analytics In Automotive Market Analysis By Application

Applications such as Autonomous Driving and Customer Analytics are gaining traction, with Autonomous Driving projected to grow from $6.58 billion in 2023 to $22.04 billion by 2033, highlighting the industry's shift towards automation.

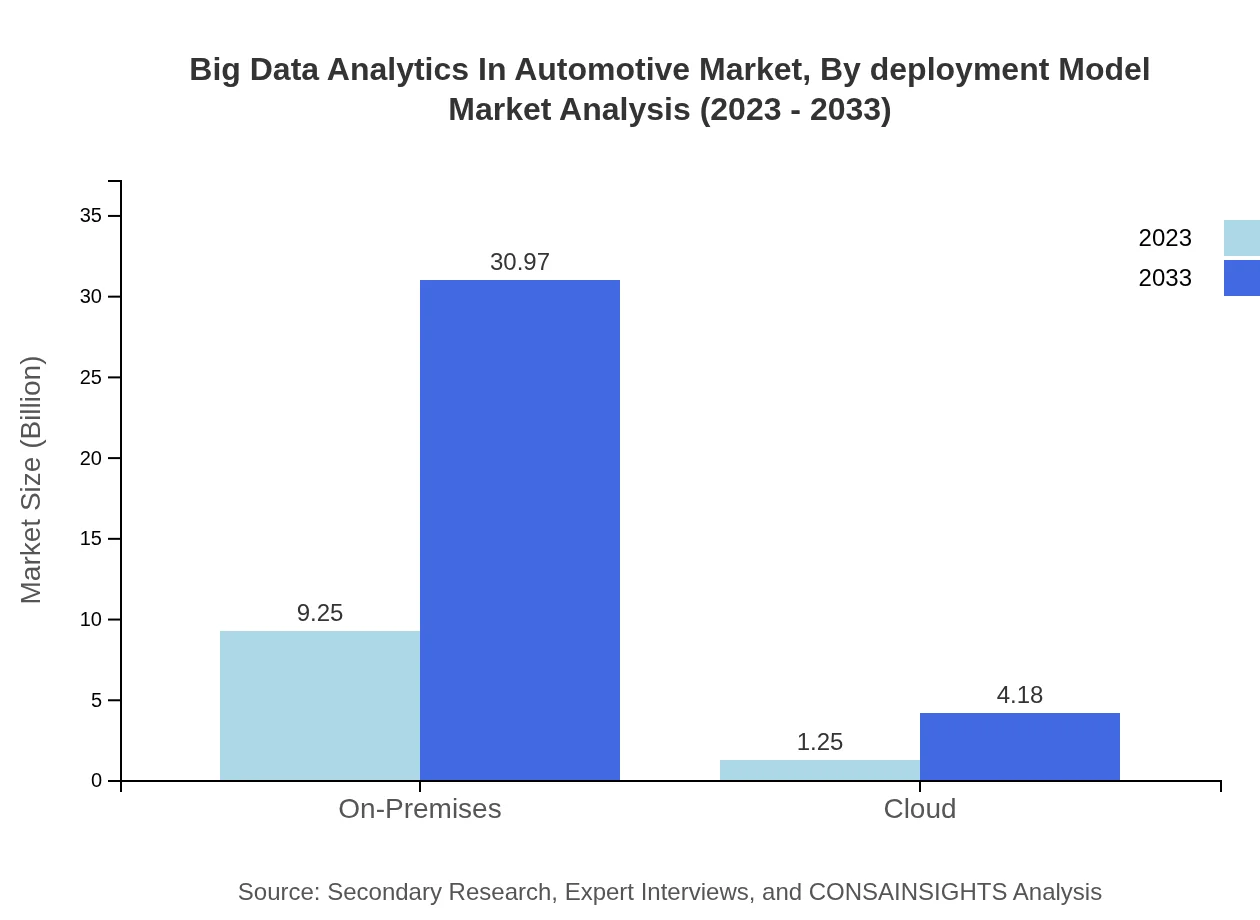

Big Data Analytics In Automotive Market Analysis By Deployment Model

On-Premises solutions continue to dominate the market, representing $9.25 billion in 2023, while Cloud solutions grow from $1.25 billion to $4.18 billion by 2033 as more automotive companies adopt flexible infrastructures.

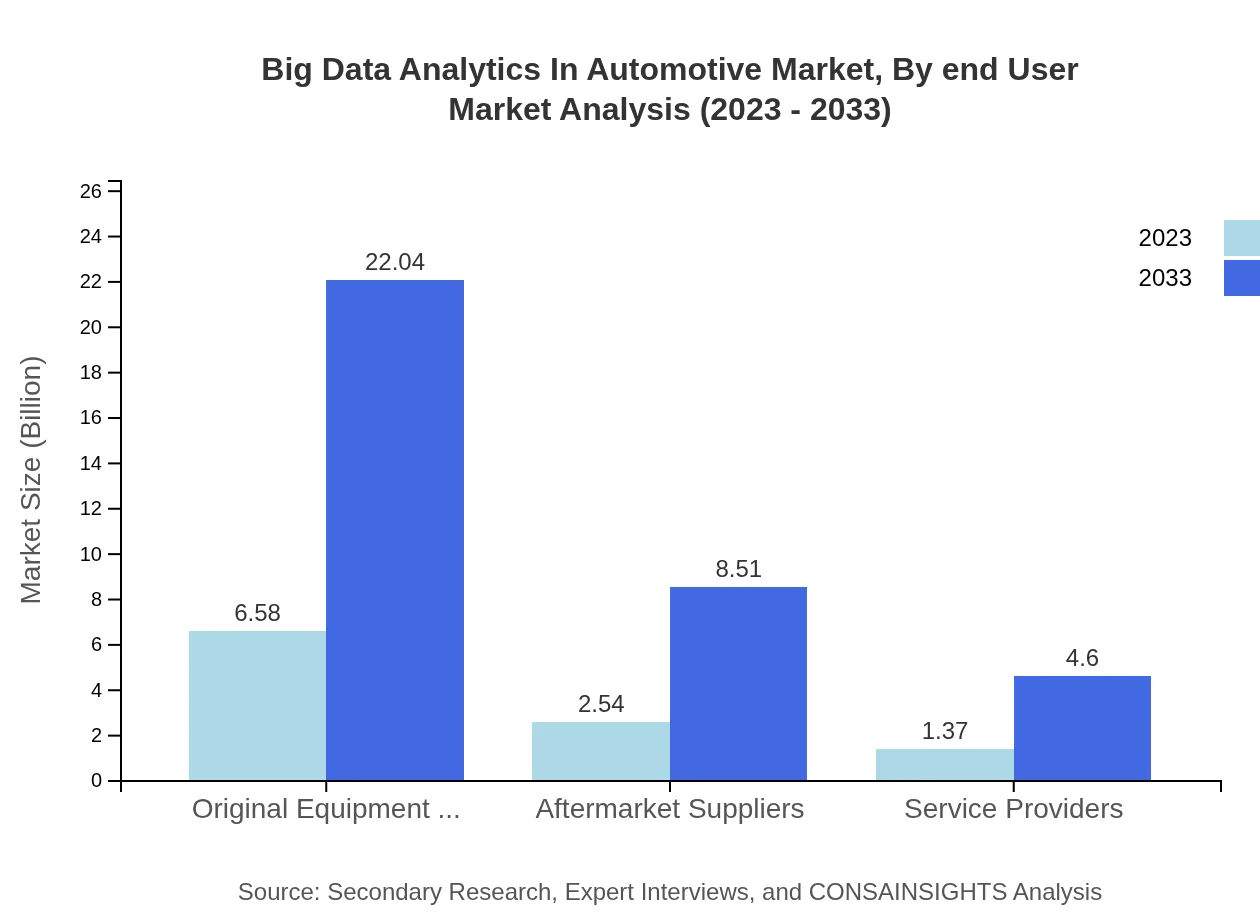

Big Data Analytics In Automotive Market Analysis By End User

Original Equipment Manufacturers (OEMs) hold the largest share of the market, with sizes growing from $6.58 billion in 2023 to $22.04 billion by 2033. Aftermarket suppliers and service providers also contribute significantly to the analytics landscape.

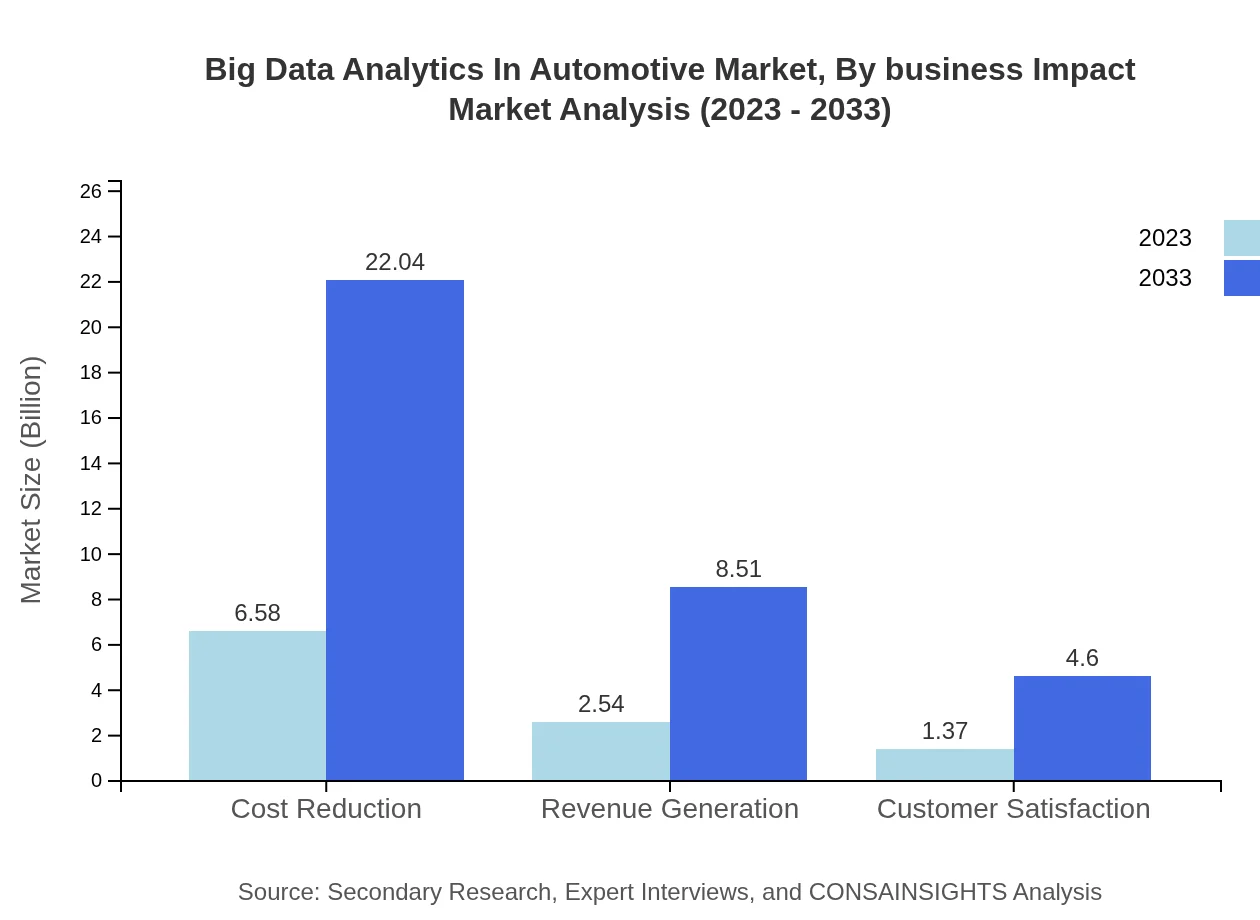

Big Data Analytics In Automotive Market Analysis By Business Impact

Key business impacts such as Cost Reduction and Revenue Generation are critical in this market segment, both predicted to show strong growth, enhancing profitability and efficiencies for automotive enterprises.

Big Data Analytics In Automotive Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Big Data Analytics In Automotive Industry

IBM:

IBM provides advanced analytics and AI technologies that support manufacturers in transforming their data into actionable insights.SAP:

SAP enables automotive companies to integrate data sources and utilize robust analytics solutions to enhance operational efficiencies and customer engagement.Microsoft:

Microsoft's Azure platform offers powerful data analytic tools and cloud services designed explicitly for the automotive industry.Oracle:

Oracle offers comprehensive data solutions that help automotive businesses manage vast amounts of data while delivering insightful analytics.We're grateful to work with incredible clients.

FAQs

What is the market size of Big Data Analytics in Automotive?

The Big Data Analytics in Automotive market is projected to reach approximately $10.5 billion by 2033, growing at a CAGR of 12.3% from 2023. In 2023, the market is valued at $10.5 billion.

What are the key market players or companies in this Big Data Analytics in Automotive industry?

Key players in the Big Data Analytics in Automotive industry include major OEMs, aftermarket suppliers, and service providers. Companies specializing in machine learning, predictive analytics, and cloud-based analytics are also pivotal in driving technological advancements.

What are the primary factors driving the growth in the Big Data Analytics in Automotive industry?

Growth is driven by factors like increased demand for predictive analytics, advancements in autonomous driving technologies, and greater focus on customer analytics. The need for effective fleet management solutions and cost reduction strategies also boost market expansion.

Which region is the fastest Growing in the Big Data Analytics in Automotive?

The Asia Pacific region is the fastest-growing area, expected to increase from $2.23 billion in 2023 to $7.47 billion by 2033. Europe also shows significant growth potential, rising from $3.12 billion to $10.44 billion in the same period.

Does ConsaInsights provide customized market report data for the Big Data Analytics in Automotive industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs in the Big Data Analytics in Automotive sector. Clients can request detailed insights, focusing on particular regions or market segments.

What deliverables can I expect from this Big Data Analytics in Automotive market research project?

Expect comprehensive deliverables such as detailed market analysis reports, growth forecasts, regional insights, and segment identification. Reports will include visual aids to effectively communicate data findings.

What are the market trends of Big Data Analytics in Automotive?

Current trends include increasing adoption of cloud-based analytics, enhanced predictive analytics capabilities, and a shift towards machine learning techniques. Additionally, the focus on customer satisfaction and operational efficiency continues to be key drivers.