Big Data Analytics In Bfsi Market Report

Published Date: 31 January 2026 | Report Code: big-data-analytics-in-bfsi

Big Data Analytics In Bfsi Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Big Data Analytics in BFSI market, covering market trends, size, growth forecasts from 2023 to 2033, and key insights into regional performance and technology advancements.

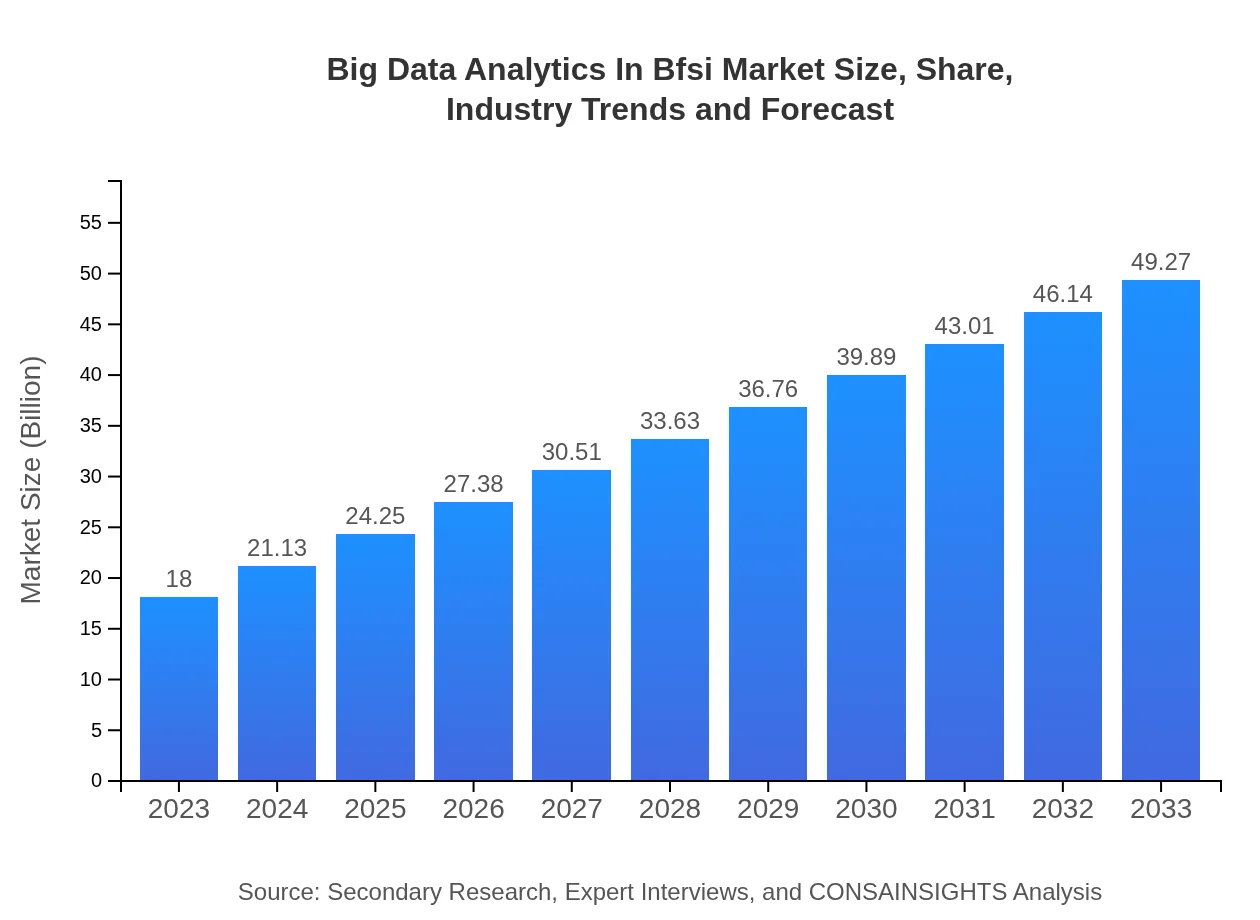

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $18.00 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $49.27 Billion |

| Top Companies | IBM, SAS Institute, Oracle, Microsoft, SAP |

| Last Modified Date | 31 January 2026 |

Big Data Analytics In Bfsi Market Overview

Customize Big Data Analytics In Bfsi Market Report market research report

- ✔ Get in-depth analysis of Big Data Analytics In Bfsi market size, growth, and forecasts.

- ✔ Understand Big Data Analytics In Bfsi's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Big Data Analytics In Bfsi

What is the Market Size & CAGR of Big Data Analytics In Bfsi market in 2023?

Big Data Analytics In Bfsi Industry Analysis

Big Data Analytics In Bfsi Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Big Data Analytics In Bfsi Market Analysis Report by Region

Europe Big Data Analytics In Bfsi Market Report:

Europe maintains a strong position in this market with a size of USD 4.56 billion in 2023, projected to grow to USD 12.47 billion by 2033. Increasing regulatory compliance and stringent data protection laws significantly influence the adoption of analytics.Asia Pacific Big Data Analytics In Bfsi Market Report:

In the Asia Pacific region, the market size for Big Data Analytics in BFSI was estimated to be USD 3.58 billion in 2023, expected to grow to USD 9.79 billion by 2033. Rapid digitalization, coupled with increasing investments in technology infrastructure, drives this growth.North America Big Data Analytics In Bfsi Market Report:

North America dominates the Big Data Analytics in BFSI market, with an estimated size of USD 6.88 billion in 2023, expected to reach USD 18.82 billion by 2033. This significant growth is driven by the presence of major financial conglomerates and high technological adoption rates.South America Big Data Analytics In Bfsi Market Report:

The market in South America is initially smaller, with an estimated size of USD 0.98 billion in 2023, projected to grow to USD 2.68 billion by 2033. Limited but growing digital financial solutions indicate a budding opportunity for analytics solutions.Middle East & Africa Big Data Analytics In Bfsi Market Report:

In the Middle East and Africa, the market is valued at USD 2.01 billion in 2023, with expectations to reach USD 5.49 billion by 2033. The rising proliferation of digital banking and mobile financial services is fostering market growth.Tell us your focus area and get a customized research report.

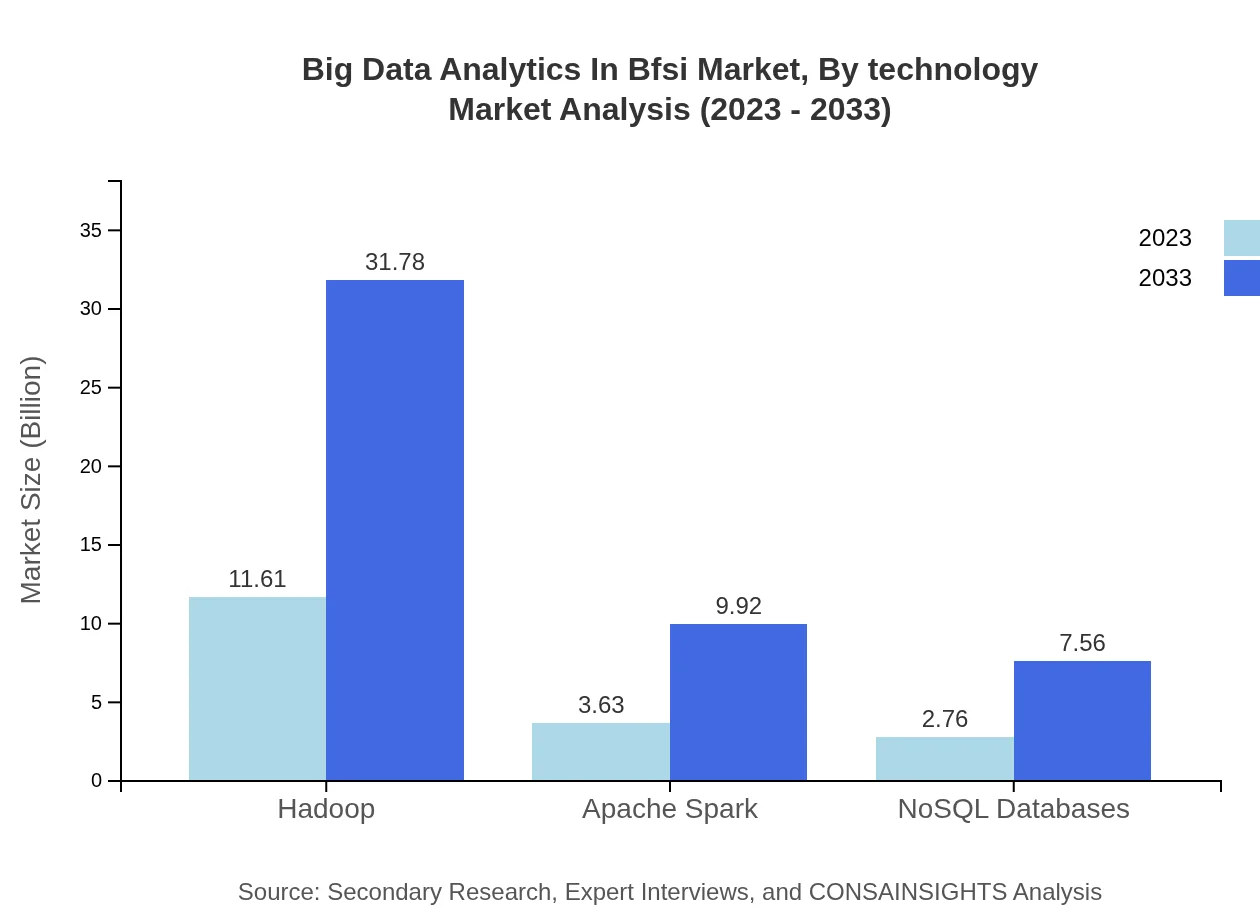

Big Data Analytics In Bfsi Market Analysis By Technology

The market is primarily driven by technologies such as Hadoop and Apache Spark. The Hadoop ecosystem, whose market size is USD 11.61 billion in 2023, is projected to grow to USD 31.78 billion by 2033. Apache Spark follows closely with a current market size of USD 3.63 billion projected to rise to USD 9.92 billion. The relevance of NoSQL databases, supporting critical analytics tasks, is also evident in their expected growth from USD 2.76 billion in 2023 to USD 7.56 billion by 2033, showcasing the critical role of diverse technologies in enhancing data handling capabilities.

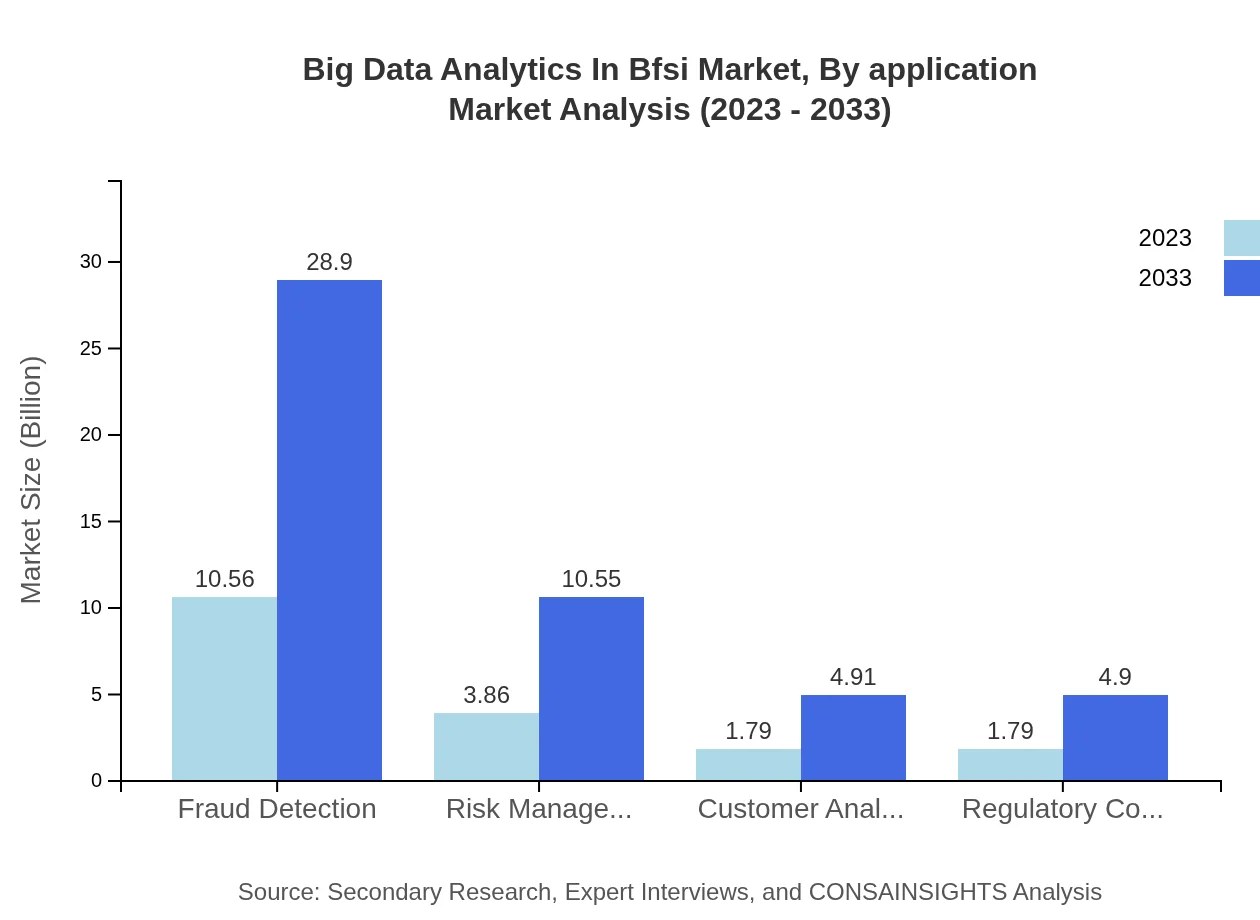

Big Data Analytics In Bfsi Market Analysis By Application

The application landscape illustrates significant potential, particularly in Fraud Detection, which commands a market of USD 10.56 billion in 2023, expected to grow to USD 28.90 billion by 2033. Risk Management applications follow with a market of USD 3.86 billion in 2023 growing to USD 10.55 billion. Moreover, Customer Analytics and Regulatory Compliance both show promising growth trajectories, signifying the diverse applicability of data analytics across financial services.

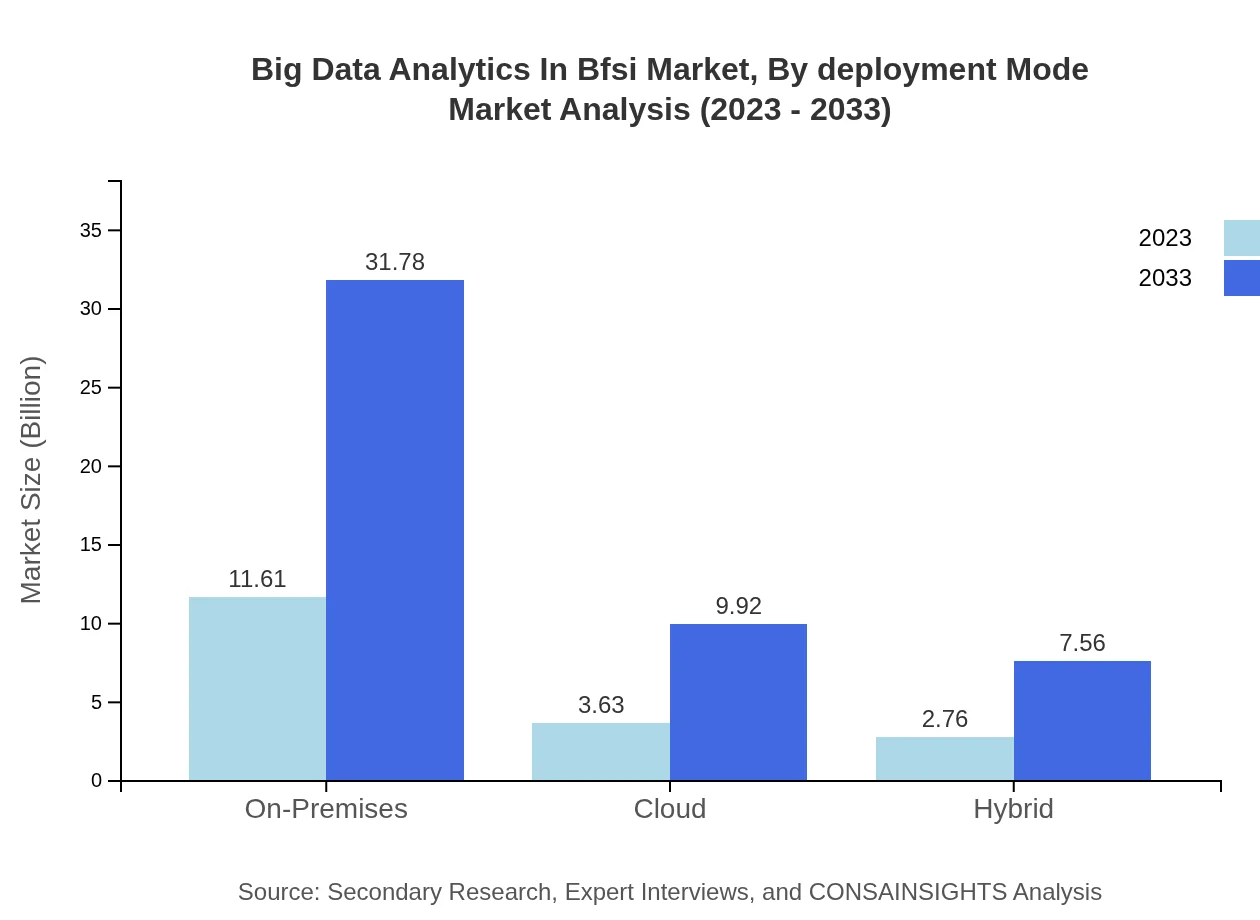

Big Data Analytics In Bfsi Market Analysis By Deployment Mode

Deployment modes differ significantly, with On-Premises solutions accounting for the largest share, valued at USD 11.61 billion in 2023 and expected to reach USD 31.78 billion by 2033. Cloud-based solutions are also thriving, starting at a market size of USD 3.63 billion in 2023 and projected to grow to USD 9.92 billion. Hybrid models are gaining traction as organizations seek flexibility in data handling, with expected growth from USD 2.76 billion to USD 7.56 billion.

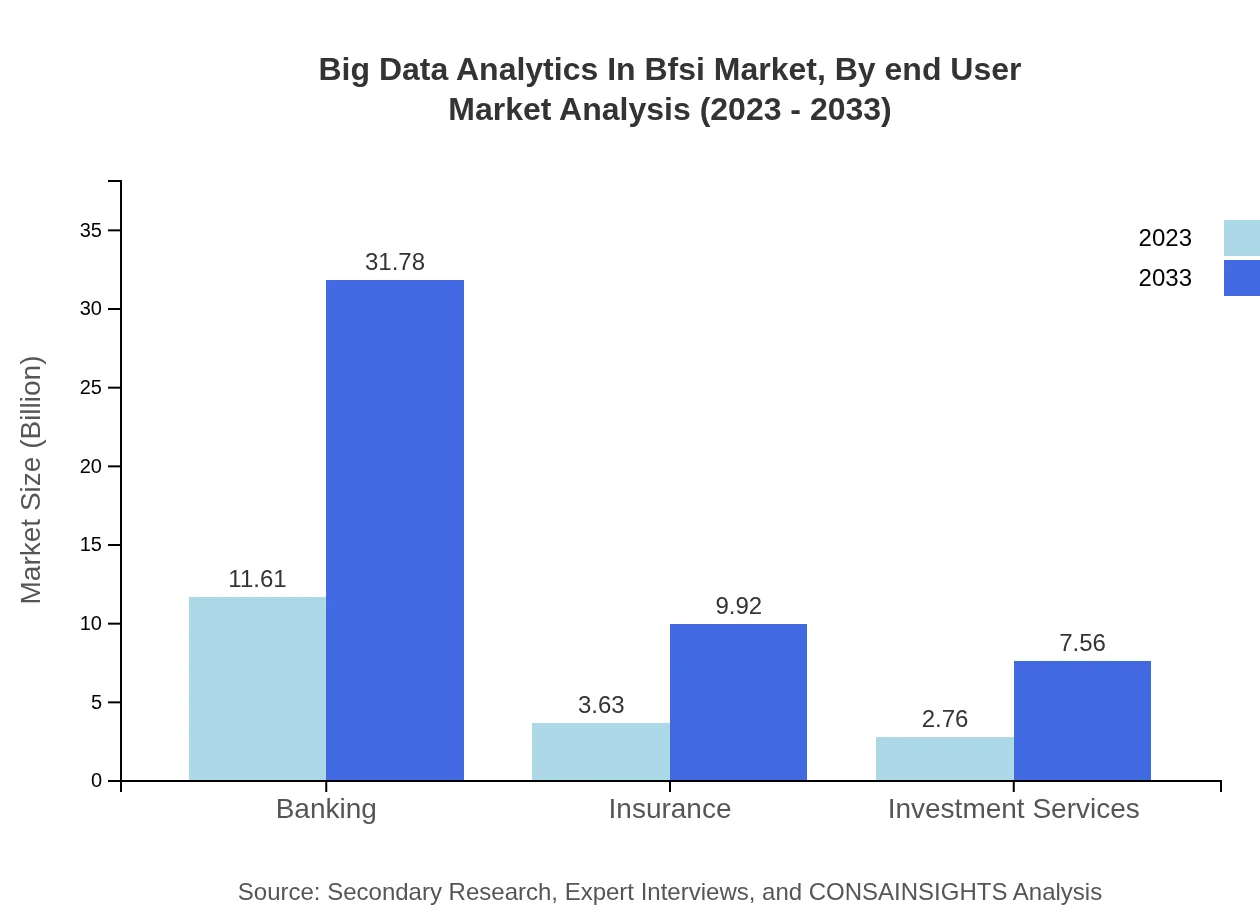

Big Data Analytics In Bfsi Market Analysis By End User

The BFSI sector prominently features Banking, which is a significant consumer of big data analytics, constituting a market size of USD 11.61 billion in 2023 and expected to reach USD 31.78 billion by 2033. Insurance and Investment Services are also key sectors, with sizes of USD 3.63 billion and USD 2.76 billion respectively in 2023, both showing robust growth forecasts as organizations increasingly harness data insights.

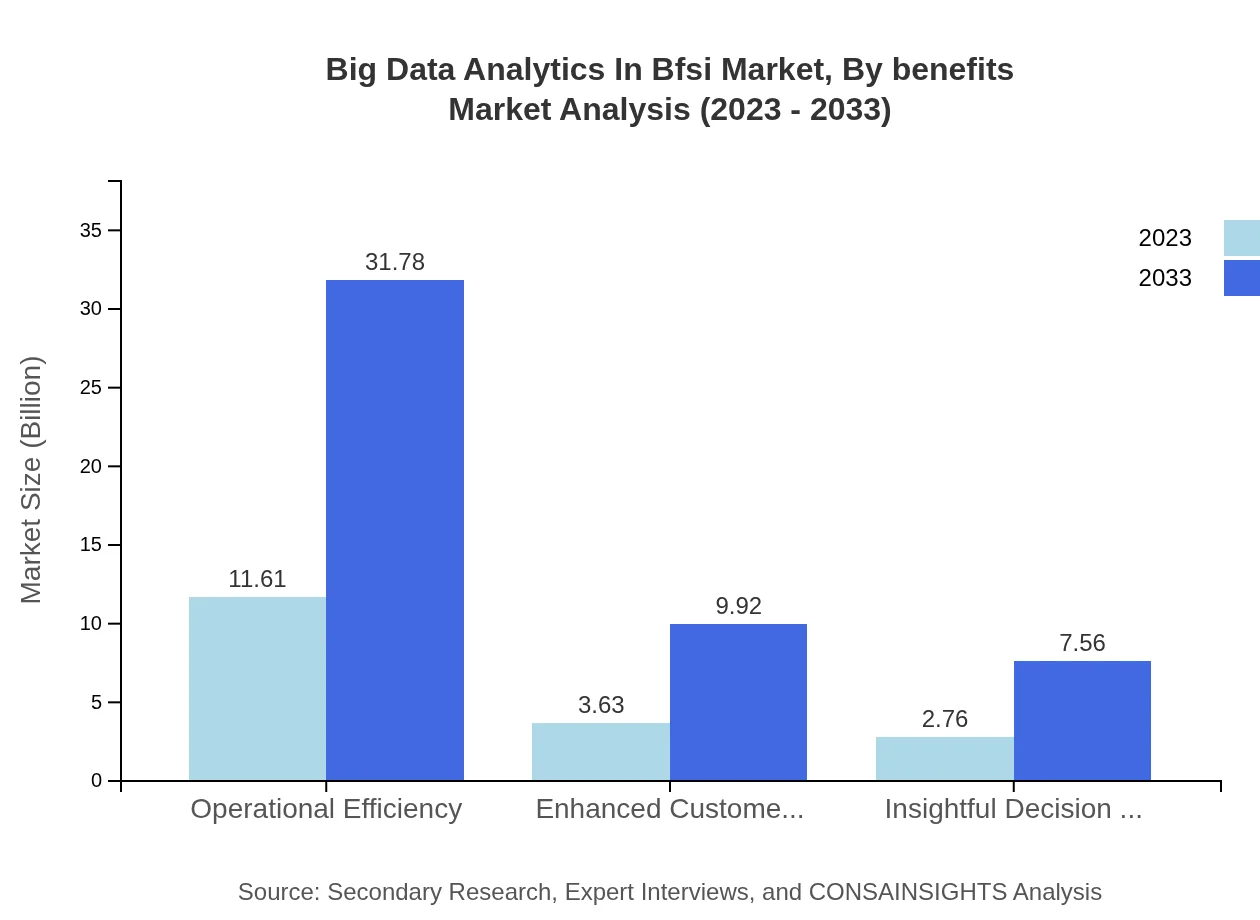

Big Data Analytics In Bfsi Market Analysis By Benefits

The benefits of Big Data Analytics are substantial for BFSI institutions, notably in Operational Efficiency, which commands a market of USD 11.61 billion in 2023, projected to expand to USD 31.78 billion by 2033. Enhanced Customer Experience is another key benefit, currently valued at USD 3.63 billion and projected to grow significantly, highlighting the various advantages of leveraging big data analytics for improved financial service delivery.

Big Data Analytics In Bfsi Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Big Data Analytics In Bfsi Industry

IBM:

IBM offers a comprehensive suite of analytic and cognitive services, leveraging AI to transform data into actionable insights for financial services.SAS Institute:

SAS specializes in advanced analytics capabilities, providing banks and insurance companies with tools to enhance decision-making and operational efficiency.Oracle:

Oracle provides a holistic platform for data-driven insights, focusing on optimizing banking and risk management through powerful analytics solutions.Microsoft:

Microsoft’s Azure cloud services empower financial institutions with robust big data analytics capabilities, enhancing their operational agility and customer analytics.SAP:

SAP delivers integrated analytics solutions tailored for banks and insurers, focusing on predictive analytics for improved customer engagement and operational insights.We're grateful to work with incredible clients.

FAQs

What is the market size of Big Data Analytics in BFSI?

The Big Data Analytics market in BFSI is currently valued at approximately $18 billion. It is projected to grow at a CAGR of 10.2%, showcasing substantial potential for growth in the upcoming years.

What are the key market players or companies in this Big Data Analytics in BFSI industry?

Key players in the Big Data Analytics in BFSI industry include IBM, SAS Institute, Oracle, Microsoft, and SAP. These companies are significant due to their impactful technologies and solutions tailored for the banking, insurance, and financial services sectors.

What are the primary factors driving the growth in the Big Data Analytics in BFSI industry?

Primary factors driving growth in Big Data Analytics in BFSI include increasing data generation, the need for operational efficiency, enhanced customer experience, robust fraud detection mechanisms, and regulatory compliance necessities. These factors push institutions to invest in advanced analytics.

Which region is the fastest Growing in the Big Data Analytics in BFSI?

The fastest-growing region in the Big Data Analytics in BFSI market is North America, with a forecast increase from $6.88 billion in 2023 to $18.82 billion by 2033, driven by high demand for advanced analytics solutions.

Does ConsaInsights provide customized market report data for the Big Data Analytics in BFSI industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the Big Data Analytics in BFSI industry, enabling clients to understand market dynamics, emerging trends, and competitive landscapes effectively.

What deliverables can I expect from this Big Data Analytics in BFSI market research project?

From this market research project, expect detailed reports including market size, growth forecasts, segmentation analysis, competitive insights, trends, and strategic recommendations for stakeholders in the Big Data Analytics in BFSI domain.

What are the market trends of Big Data Analytics in BFSI?

Current market trends in Big Data Analytics for BFSI include a shift towards cloud and hybrid solutions, increasing adoption of AI and machine learning for analytics, a focus on customer-centric services, and robust strategies for risk management and fraud detection.