Big Data In Oil Gas Exploration And Production Market Report

Published Date: 22 January 2026 | Report Code: big-data-in-oil-gas-exploration-and-production

Big Data In Oil Gas Exploration And Production Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive examination of the Big Data in Oil and Gas Exploration and Production market from 2023 to 2033, highlighting trends, market size, and key player insights to guide investments and strategic planning.

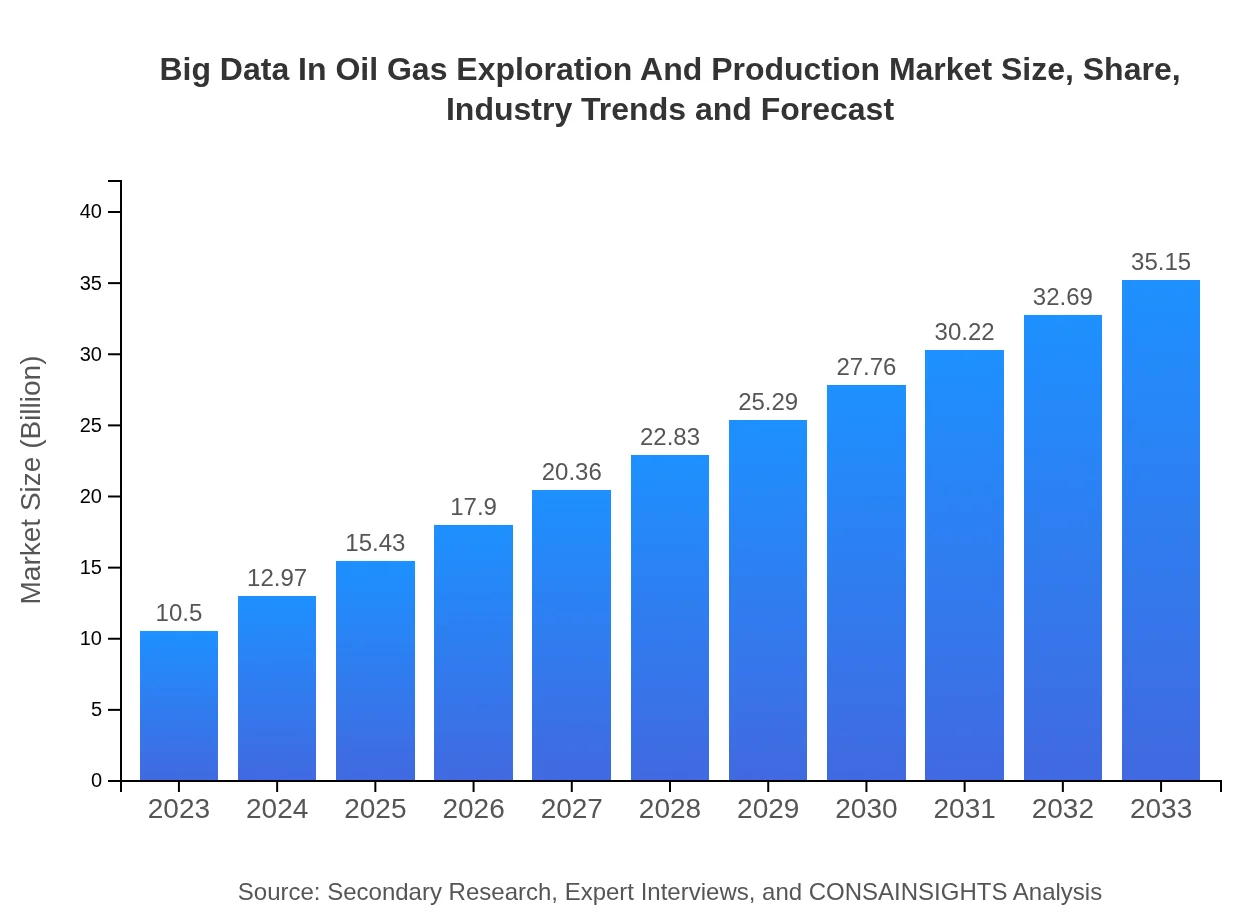

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $35.15 Billion |

| Top Companies | IBM, Schlumberger, Honeywell , Microsoft |

| Last Modified Date | 22 January 2026 |

Big Data In Oil Gas Exploration And Production Market Overview

Customize Big Data In Oil Gas Exploration And Production Market Report market research report

- ✔ Get in-depth analysis of Big Data In Oil Gas Exploration And Production market size, growth, and forecasts.

- ✔ Understand Big Data In Oil Gas Exploration And Production's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Big Data In Oil Gas Exploration And Production

What is the Market Size & CAGR of Big Data In Oil Gas Exploration And Production market in 2023?

Big Data In Oil Gas Exploration And Production Industry Analysis

Big Data In Oil Gas Exploration And Production Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Big Data In Oil Gas Exploration And Production Market Analysis Report by Region

Europe Big Data In Oil Gas Exploration And Production Market Report:

Europe's market for Big Data in oil and gas is valued at $3.37 billion in 2023, projected to reach $11.29 billion by 2033. The European Union's push for energy transition and sustainability drives investments in big data analytics, particularly in renewable integration within oil and gas sectors.Asia Pacific Big Data In Oil Gas Exploration And Production Market Report:

In 2023, the Big Data market in the Asia-Pacific region is valued at $1.95 billion with an anticipated growth to $6.52 billion by 2033. Growth factors include increasing investments in energy infrastructure and digital transformation initiatives in countries like China and India, aimed at enhancing exploration efficiency and production safety.North America Big Data In Oil Gas Exploration And Production Market Report:

North America accounts for a market value of $3.74 billion in 2023, projected to grow to $12.51 billion by 2033. Technological advancements and significant shale oil production in the U.S. fueled this growth, notably with big data applications enhancing operational efficiencies and increasing productivity.South America Big Data In Oil Gas Exploration And Production Market Report:

The South American market size in 2023 is approximately $0.38 billion, expected to grow to $1.28 billion by 2033. The oil and gas sector's development in Brazil and Argentina, paired with the region's rich hydrocarbon resources, drive big data adoption in exploration initiatives.Middle East & Africa Big Data In Oil Gas Exploration And Production Market Report:

In 2023, the market size for the Middle East and Africa is valued at $1.06 billion, with projections to grow to $3.55 billion by 2033. Countries like Saudi Arabia and UAE are emphasizing technology adoption to enhance production and streamline operations amid fluctuating oil prices.Tell us your focus area and get a customized research report.

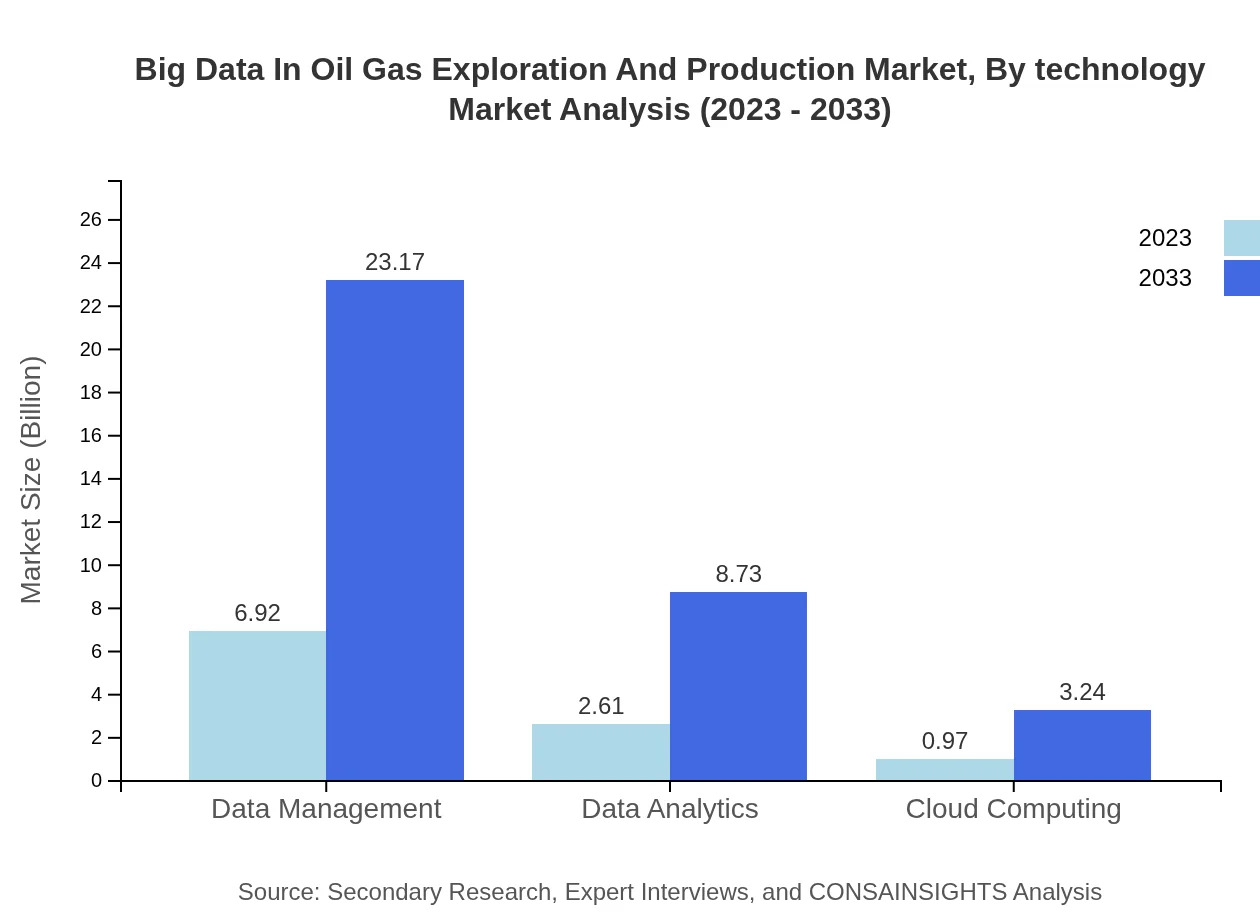

Big Data In Oil Gas Exploration And Production Market Analysis By Technology

Data management remains the largest segment in 2023, valued at $6.92 billion and expected to reach $23.17 billion by 2033, capturing a 65.93% market share. Data analytics follows with $2.61 billion growing to $8.73 billion at a 24.84% share. Cloud computing, though smaller at $0.97 billion in 2023, is anticipated to grow significantly to $3.24 billion.

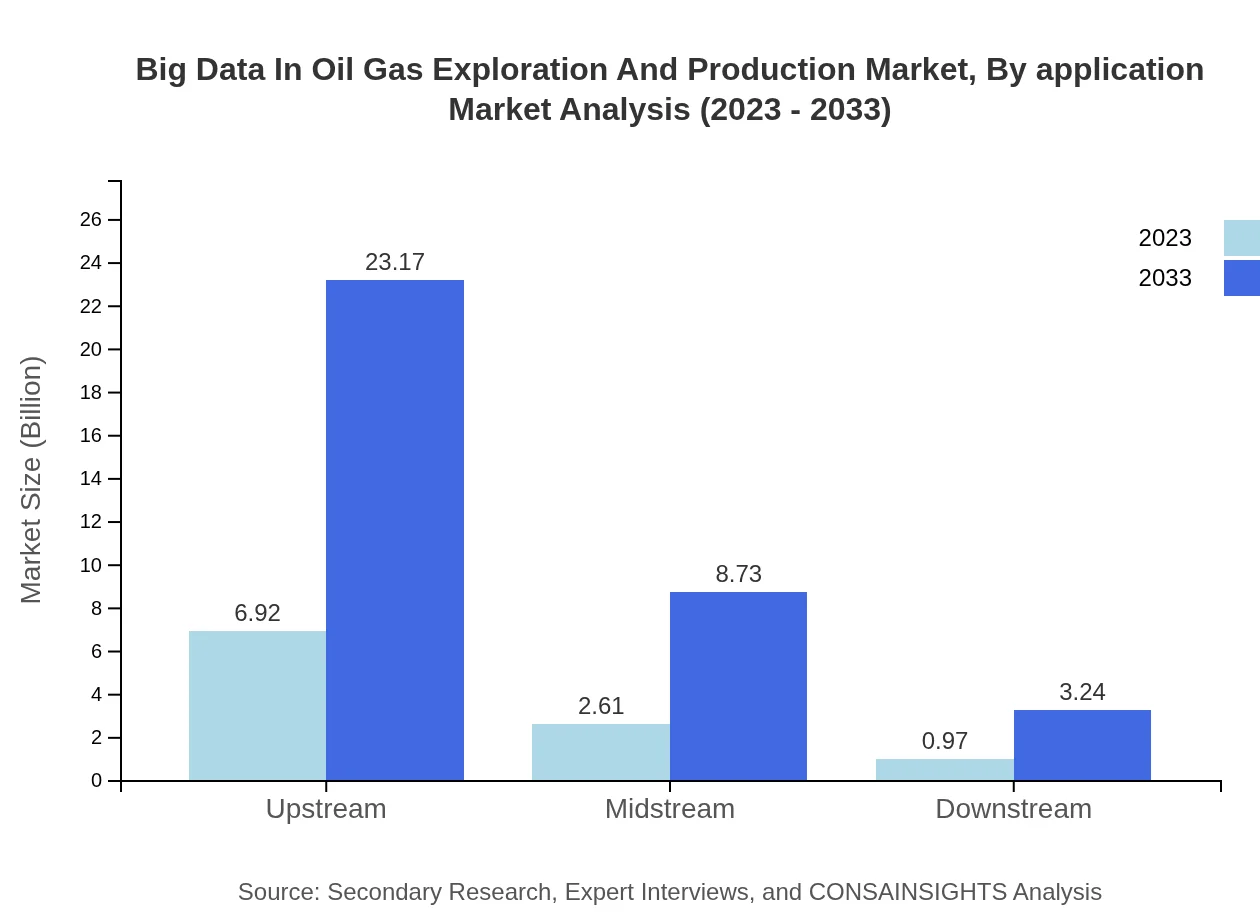

Big Data In Oil Gas Exploration And Production Market Analysis By Application

The upstream segment garners the largest market share of 65.93% in 2023, valued at $6.92 billion, and is expected to grow to $23.17 billion by 2033. Midstream and downstream applications also show positive growth trajectories, albeit at smaller market shares of 24.84% and 9.23% respectively. These applications are critical for enhancing efficiency and reducing operational costs.

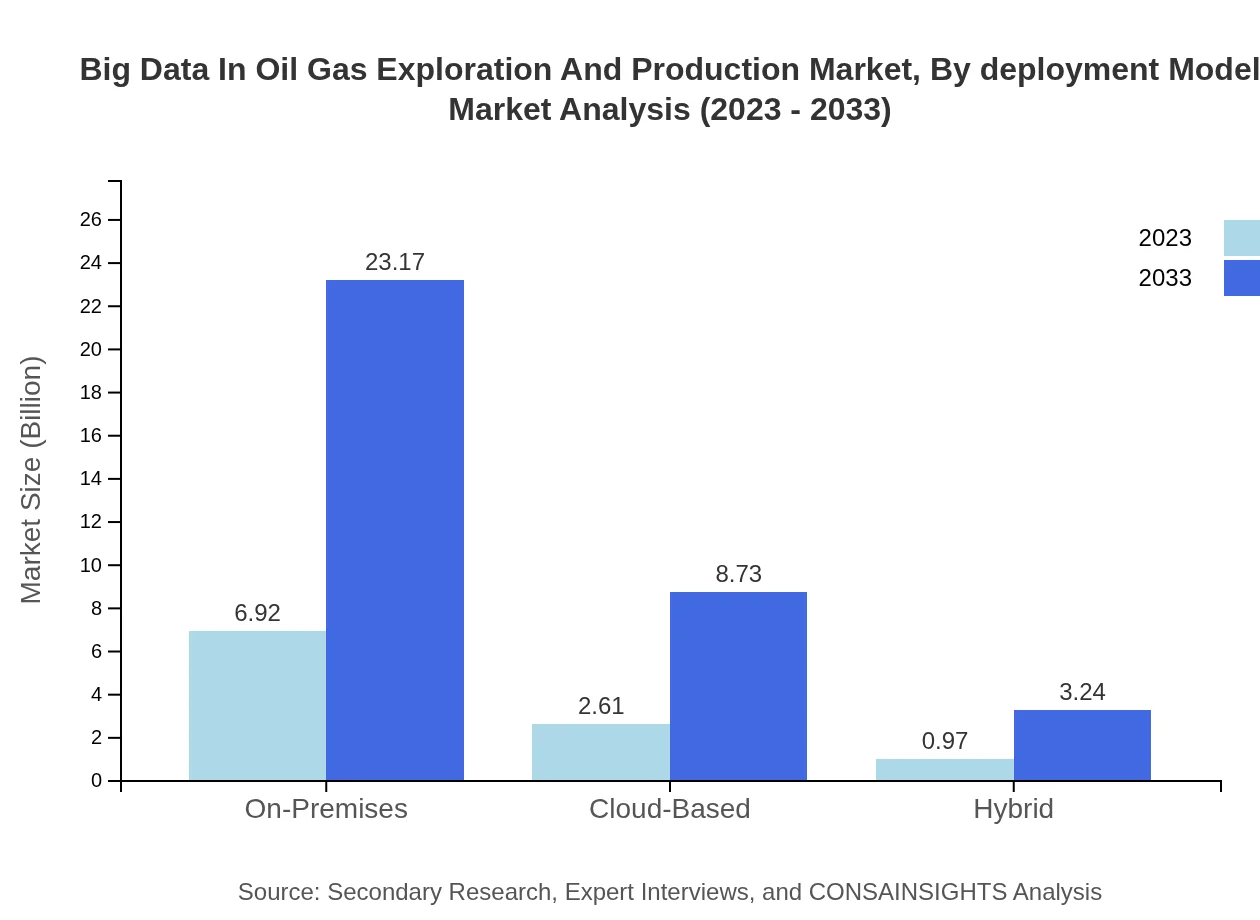

Big Data In Oil Gas Exploration And Production Market Analysis By Deployment Model

On-premises deployment leads with a market size of $6.92 billion in 2023, projected to reach $23.17 billion by 2033, owing to existing infrastructure in many companies. Cloud-based solutions show robust growth from $2.61 billion to $8.73 billion as companies embrace flexibility and scalability in operations, with hybrid models capturing an additional $0.97 billion market share.

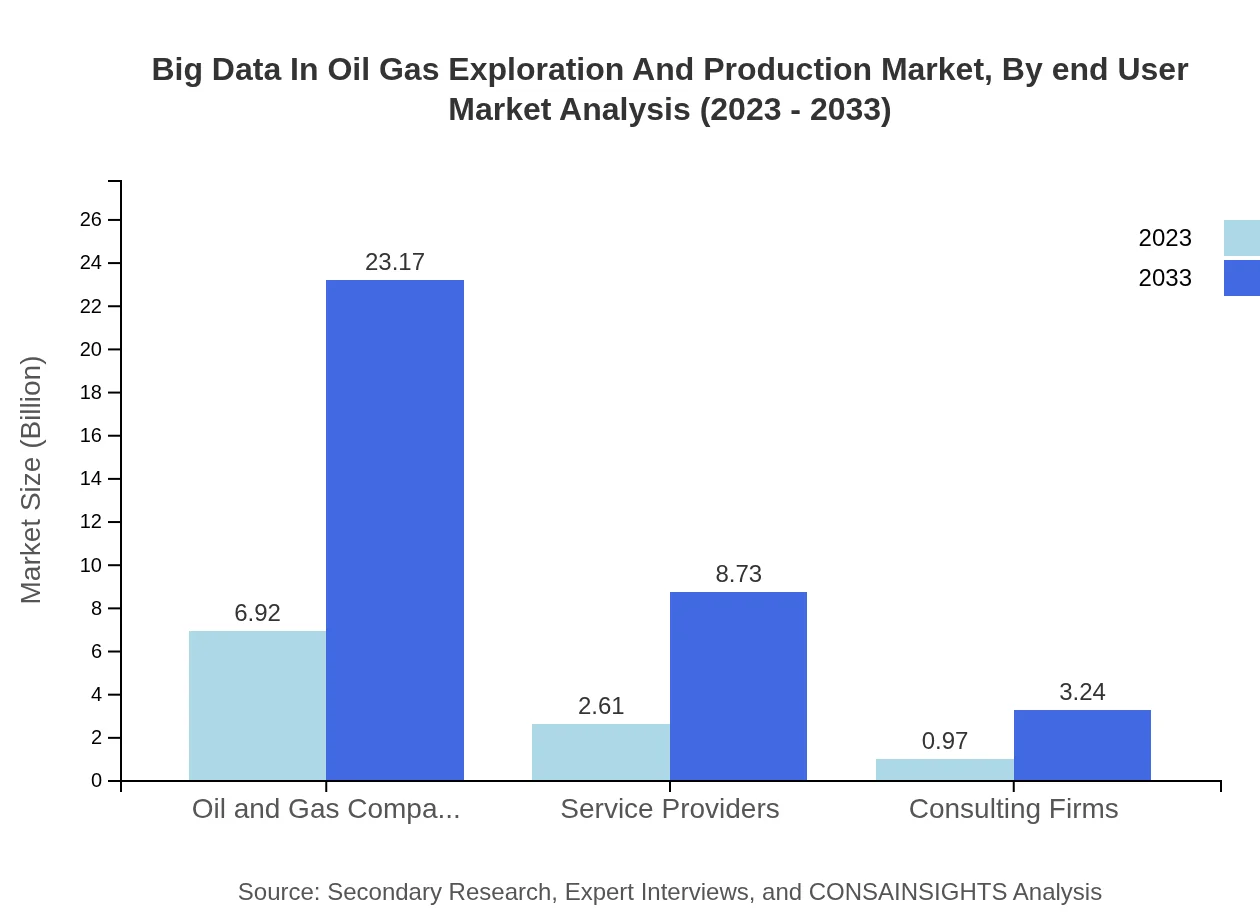

Big Data In Oil Gas Exploration And Production Market Analysis By End User

Oil and gas companies are predominant end-users, commanding a market size of $6.92 billion in 2023, doubling to $23.17 billion by 2033. Service providers and consulting firms contribute significantly with shares of approximately 24.84% and 9.23% respectively, helping organizations leverage big data for strategic advantages.

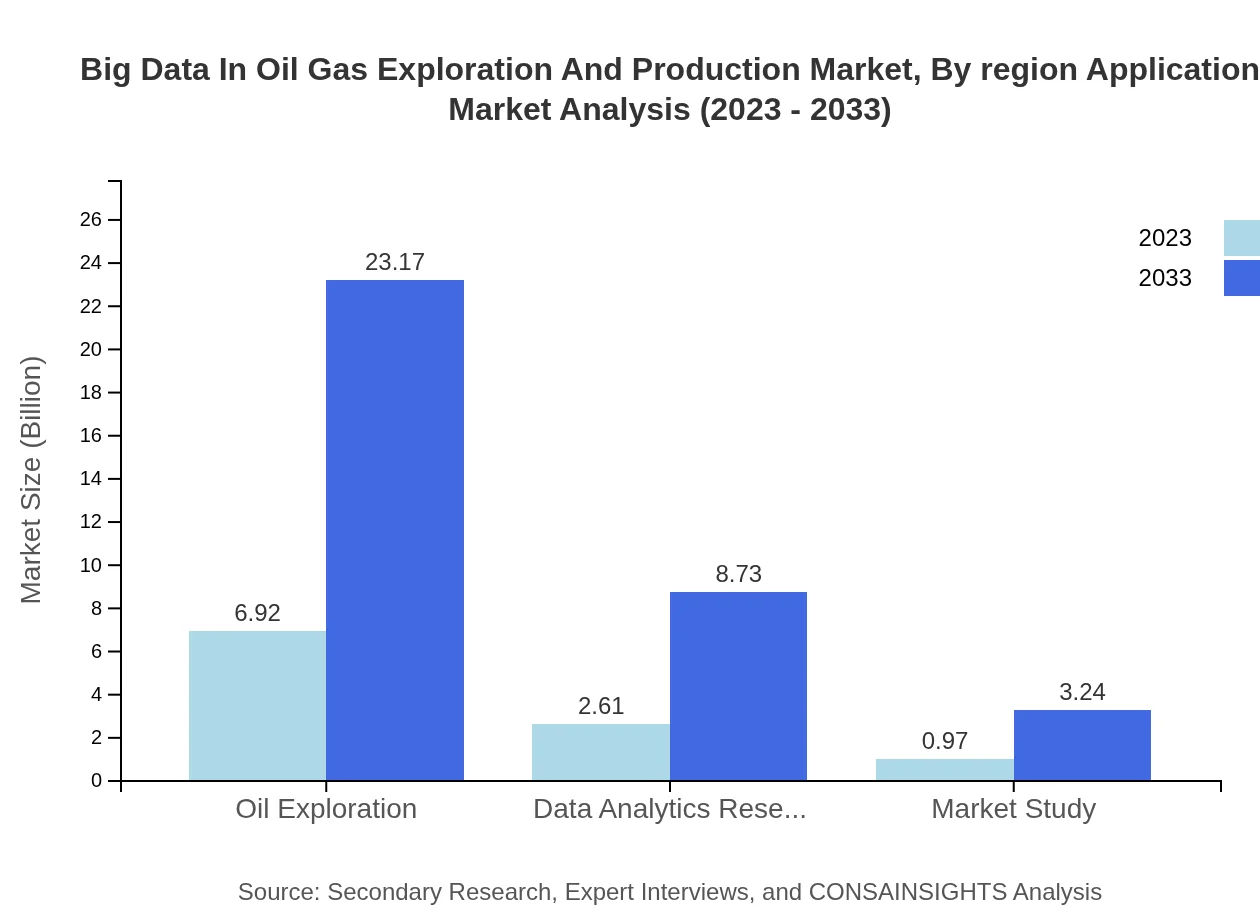

Big Data In Oil Gas Exploration And Production Market Analysis By Region Application

Regionally, North America leads in application growth within upstream operations, while Europe focuses on data analytics for efficiency. The Asia-Pacific region adapts big data insights for both exploration and production optimization, reflecting diverse regional strategies that cater to local energy dynamics.

Big Data In Oil Gas Exploration And Production Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Big Data In Oil Gas Exploration And Production Industry

IBM:

IBM offers comprehensive analytics solutions tailored for the oil and gas industry, enhancing predictive maintenance and operational efficiency through advanced big data technologies.Schlumberger:

As a leading oilfield services company, Schlumberger integrates big data analytics in exploration and production, providing innovative solutions that maximize reservoir recovery while reducing costs.Honeywell :

Honeywell delivers data-driven expertise and advanced analytics solutions that optimize operations in the oil and gas domain, aiding companies in ensuring safety and efficiency.Microsoft:

Microsoft provides cloud solutions and AI capabilities that enhance the management of oil and gas data, driving operational insights for smarter decision-making.We're grateful to work with incredible clients.

FAQs

What is the market size of Big Data in Oil & Gas Exploration and Production?

The market size for Big Data in Oil & Gas Exploration and Production is projected to reach $10.5 billion by 2033, growing at a CAGR of 12.3% from current levels. This represents a significant growth opportunity in the industry over the next decade.

What are the key market players or companies in the Big Data in Oil & Gas Exploration and Production industry?

Key players in this industry include major oil companies, technology firms specializing in data analytics, and service providers. Prominent names often observed include Schlumberger, Halliburton, IBM, and smaller specialized startups focused on innovative data solutions.

What are the primary factors driving the growth in the Big Data in Oil & Gas Exploration and Production industry?

Drivers of growth include the increasing demand for operational efficiency, rising global energy consumption, advancements in technology, regulatory requirements, and the need for enhanced decision-making capabilities through data insights.

Which region is the fastest Growing in the Big Data in Oil & Gas Exploration and Production?

The fastest-growing region is Europe, projected to increase from $3.37 billion in 2023 to $11.29 billion by 2033. North America also shows strong growth, expected to rise from $3.74 billion to $12.51 billion in the same period.

Does ConsaInsights provide customized market report data for the Big Data in Oil & Gas Exploration and Production industry?

Yes, ConsaInsights offers tailored market report data for the Big Data in Oil & Gas Exploration and Production industry to meet specific client needs. This includes focused insights on niche segments and customized data analytics.

What deliverables can I expect from this Big Data in Oil & Gas Exploration and Production market research project?

Deliverables typically include comprehensive market analysis reports, regional assessments, competitive landscape evaluations, forecasts, and actionable insights tailored to enhance strategic decision-making.

What are the market trends of Big Data in Oil & Gas Exploration and Production?

Trends include increased adoption of cloud-based solutions, integration of AI and machine learning for predictive analytics, a shift towards data-centric operational models, and more collaboration between technology firms and oil companies.