Big Data Market Report

Published Date: 31 January 2026 | Report Code: big-data

Big Data Market Size, Share, Industry Trends and Forecast to 2033

This report provides comprehensive insights into the Big Data market, including market size, CAGR forecasts from 2023 to 2033, and detailed analyses across various segments and regions.

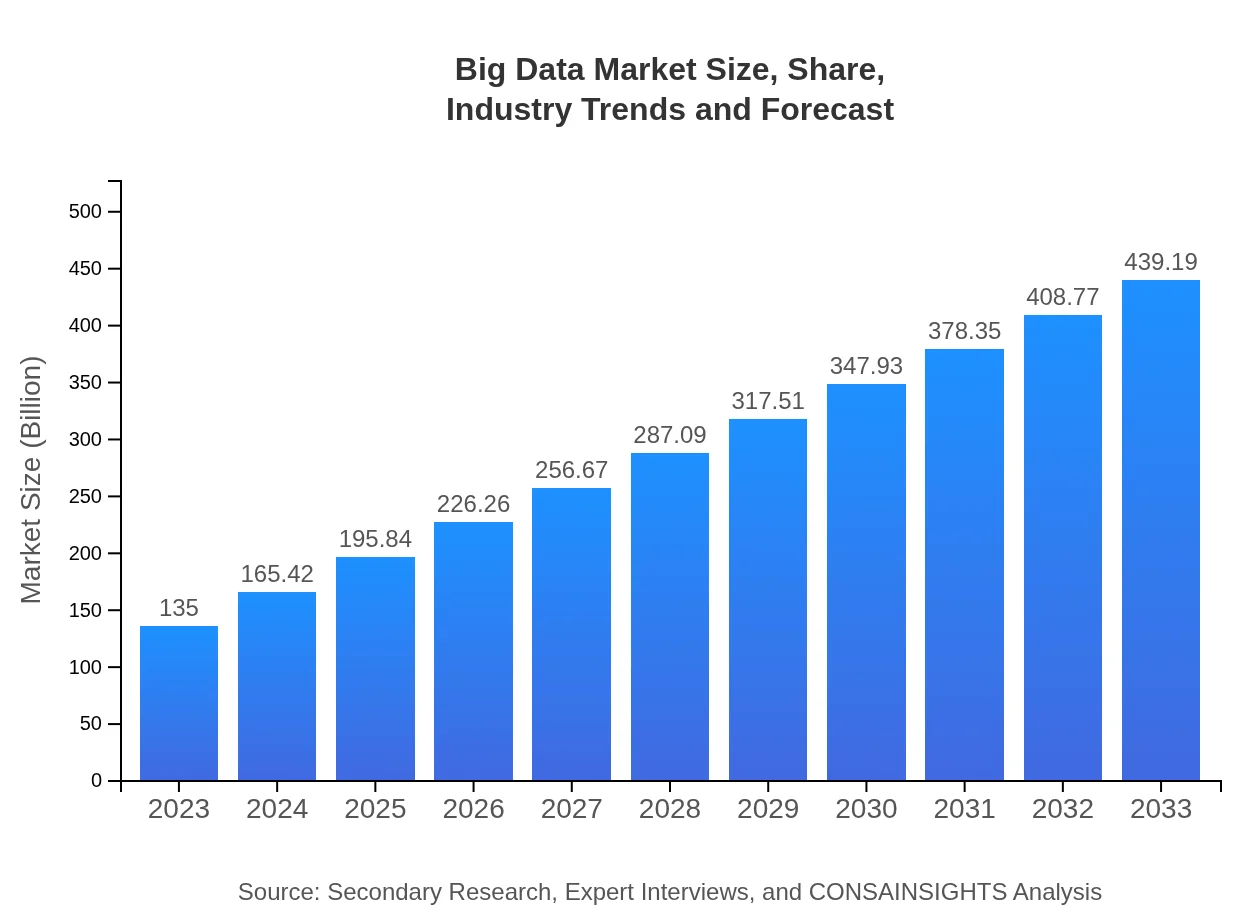

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $135.00 Billion |

| CAGR (2023-2033) | 12% |

| 2033 Market Size | $439.19 Billion |

| Top Companies | IBM, Microsoft, Amazon Web Services (AWS), SAP, Google Cloud |

| Last Modified Date | 31 January 2026 |

Big Data Market Overview

Customize Big Data Market Report market research report

- ✔ Get in-depth analysis of Big Data market size, growth, and forecasts.

- ✔ Understand Big Data's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Big Data

What is the Market Size & CAGR of Big Data market in 2023?

Big Data Industry Analysis

Big Data Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Big Data Market Analysis Report by Region

Europe Big Data Market Report:

Europe’s Big Data market is anticipated to grow from $42.92 billion in 2023 to approximately $139.62 billion by 2033. Innovative technologies, coupled with strict regulations on data privacy and security, drive the demand for sophisticated analytics solutions and adherence to compliance, making it a pivotal market for growth.Asia Pacific Big Data Market Report:

The Asia Pacific region is expected to witness substantial growth in the Big Data market, with projections indicating a market size of $83.84 billion by 2033, up from $25.77 billion in 2023. The driving forces include the increasing digitalization of businesses and government initiatives to build smart cities, significantly boosting data generation and analytics needs.North America Big Data Market Report:

North America continues to lead the Big Data market, with a significant forecast increase from $45.82 billion in 2023 to $149.06 billion by 2033. The major factors include the high concentration of leading technology companies and data-driven organizations prioritizing analytics to gain competitive advantages in a rapidly evolving global market.South America Big Data Market Report:

In South America, the Big Data market is projected to grow from $10.41 billion in 2023 to $33.86 billion by 2033. The region shows a growing interest in leveraging data analytics to enhance decision-making in sectors like agriculture and retail, fostering investments in infrastructure and technology.Middle East & Africa Big Data Market Report:

The Middle East and Africa are expected to see an increase from $10.08 billion in 2023 to $32.81 billion by 2033. Growing investments in digital transformation initiatives from both government and private sectors are driving the adoption of Big Data solutions, especially in finance, retail, and telecommunications.Tell us your focus area and get a customized research report.

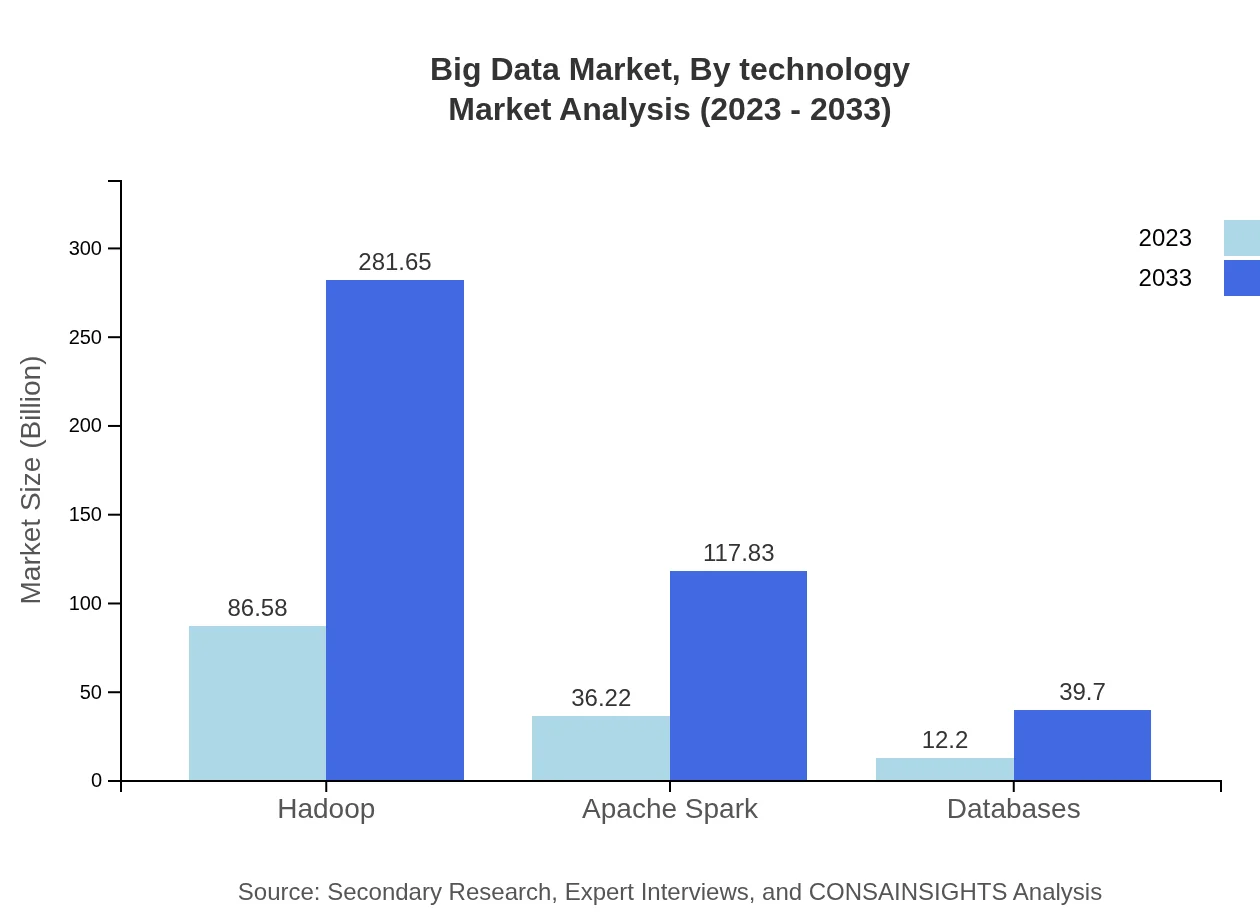

Big Data Market Analysis By Technology

The Big Data market by technology shows significant growth, with Hadoop projected to mark a size increase from $86.58 billion in 2023 to $281.65 billion by 2033. Apache Spark is also gaining traction, growing from $36.22 billion to $117.83 billion. The shift towards advanced data processing tools reflects the increased demand for real-time analytics and the processing of unstructured data.

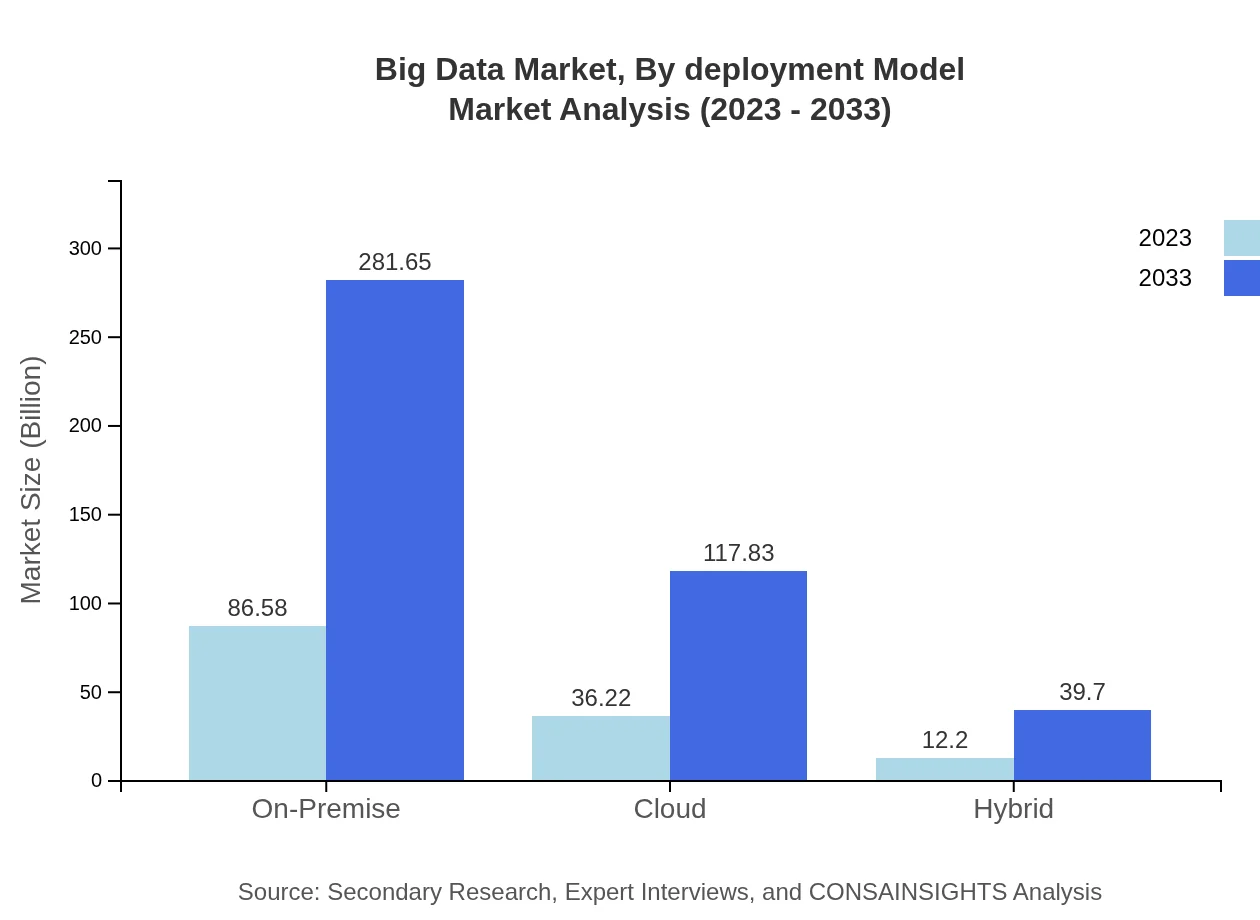

Big Data Market Analysis By Deployment Model

Deployment models illustrate varying preferences among enterprises, with on-premise solutions expected to hold considerable market share, advancing from $86.58 billion in 2023 to $281.65 billion by 2033. Cloud deployments are also gaining popularity, reflecting businesses' desires for flexibility and cost-effectiveness in managing their data assets.

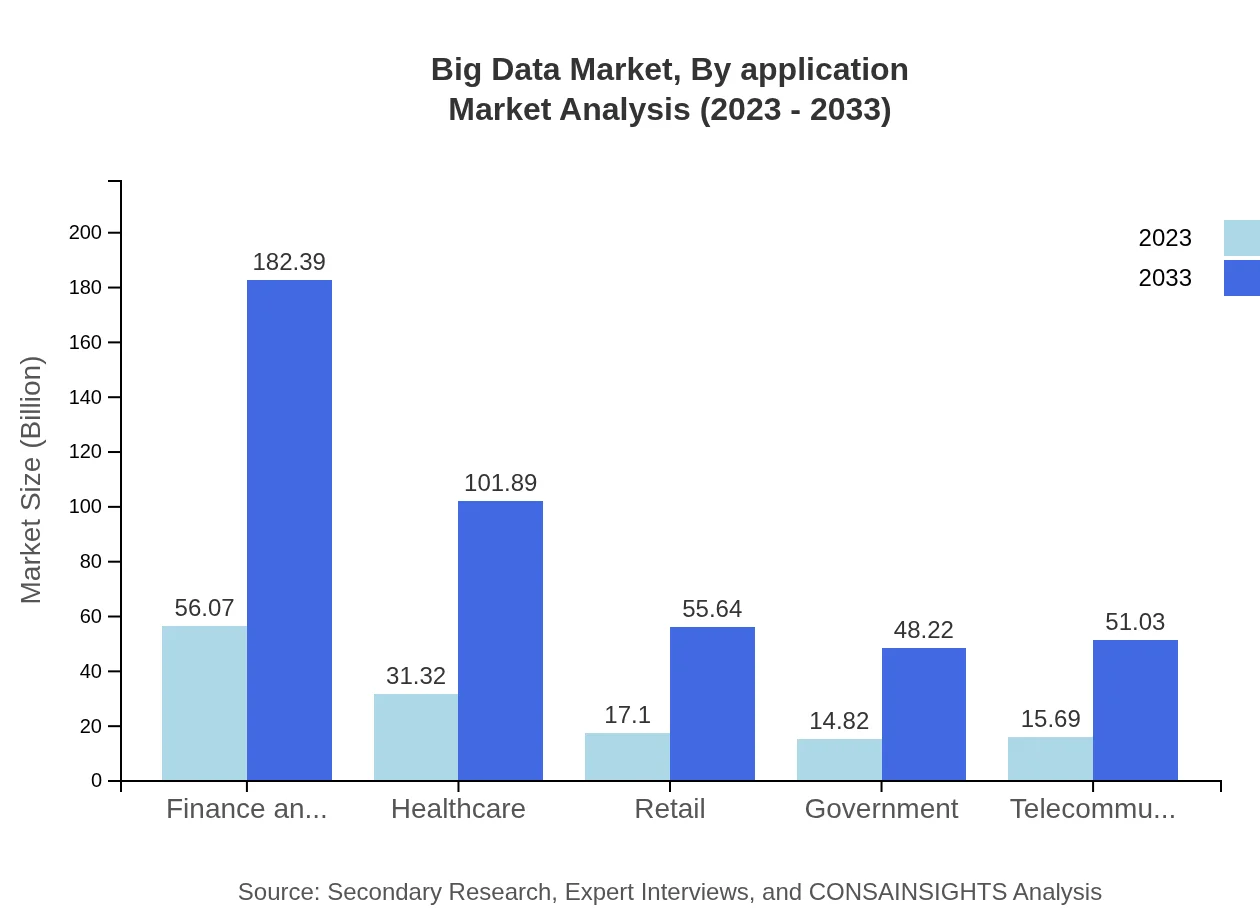

Big Data Market Analysis By Application

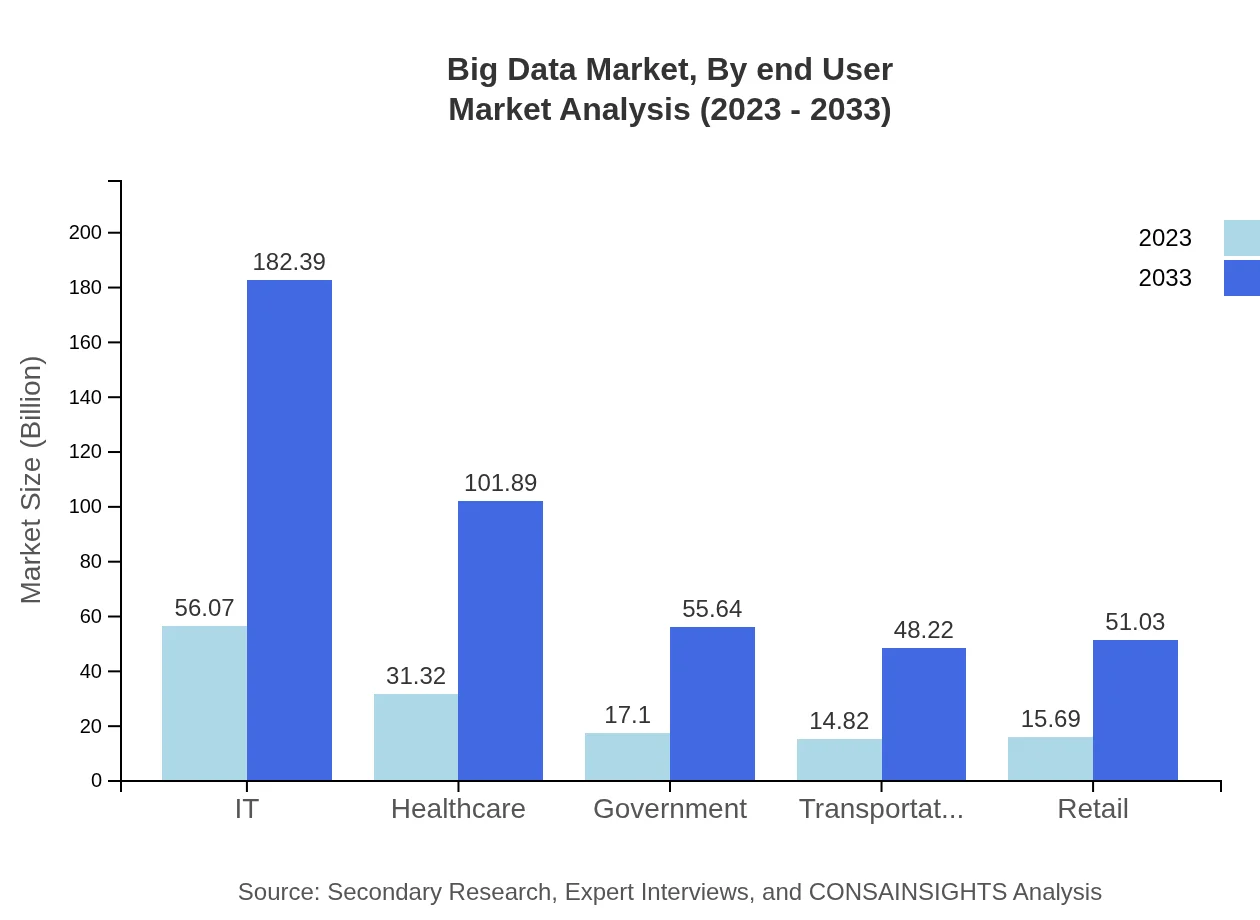

The application segment of the Big Data market encompasses finance, healthcare, retail, and more. The healthcare sector is projected to grow from $31.32 billion to $101.89 billion, highlighting increasing adoption for patient data management and operational efficiencies. The finance sector is also showing significant growth, with projections indicating a rise from $56.07 billion to $182.39 billion by 2033.

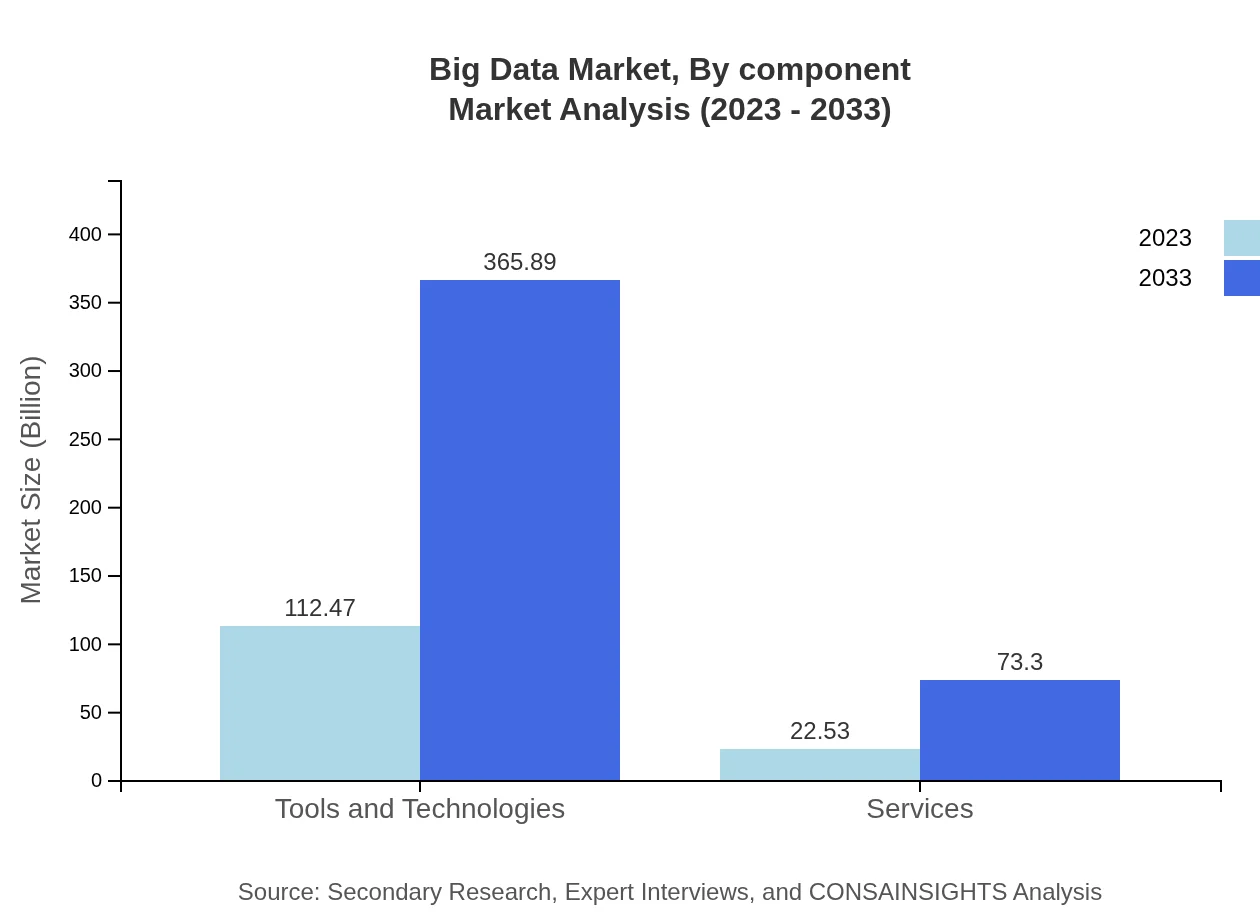

Big Data Market Analysis By Component

Components of the Big Data market, including tools and technologies, fund a significant portion of the market with an anticipated growth from $112.47 billion in 2023 to $365.89 billion by 2033. This growth reflects increasing investments in data processing technologies and analytics tools necessary for managing vast data streams.

Big Data Market Analysis By End User

In the end-user segment, industries such as IT, healthcare, government, and transportation are relying on Big Data analytics to enhance their operational performance, with transportation projected to grow from $14.82 billion to $48.22 billion by 2033. This growth emphasizes the critical role of data in optimizing logistics and supply chain management.

Big Data Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Big Data Industry

IBM:

IBM is a leader in Big Data and analytics, providing innovative solutions that help businesses manage complex data sets and derive actionable insights.Microsoft:

Microsoft offers cloud-based Big Data technologies and analytics tools, empowering organizations to harness data and enhance decision-making processes.Amazon Web Services (AWS):

AWS provides comprehensive cloud services for Big Data processing and analysis, driving adoption through scalable and cost-effective solutions.SAP:

SAP specializes in enterprise software and analytics solutions that integrate Big Data to optimize business operations and improve productivity.Google Cloud:

Google Cloud services include powerful data analytics and machine learning tools enabling users to transform vast data into actionable insights.We're grateful to work with incredible clients.

FAQs

What is the market size of Big Data?

The Big Data market size is projected to reach $135 billion by 2033, growing at a CAGR of 12% from its current valuation. The demand for data-driven insights is notably fueling this market expansion, positioning Big Data as an essential component of modern business strategies.

What are the key market players or companies in this Big Data industry?

Key players in the Big Data industry include globally recognized firms such as IBM, Microsoft, Amazon Web Services, SAS Institute, and Oracle. These companies are innovators in technology and provide essential tools for data analytics and management.

What are the primary factors driving the growth in the Big Data industry?

The growth in the Big Data industry is driven by increasing digitization, the rise of IoT devices, demand for real-time data analytics, improving data storage technologies, and a growing need for predictive analytics across sectors such as finance, healthcare, and retail.

Which region is the fastest Growing in the Big Data market?

The Asia Pacific region is the fastest-growing in the Big Data market, projected to grow from $25.77 billion in 2023 to $83.84 billion by 2033. This growth is propelled by rapid technological adoption and investment in cloud computing solutions.

Does ConsaInsights provide customized market report data for the Big Data industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Big Data industry, allowing stakeholders to gain insights actionable for their unique contexts and strategic objectives.

What deliverables can I expect from this Big Data market research project?

From the Big Data market research project, you can expect comprehensive reports featuring market size, growth forecasts, segment analysis, competitive landscape, and actionable insights that assist in decision-making and strategy formulation.

What are the market trends of Big Data?

Current trends in the Big Data market include increasing adoption of AI and machine learning, expansion of cloud-based services, heightened focus on data security, and advancements in analytics tools that enhance user experience and data interpretation.