Big Data Security Market Report

Published Date: 31 January 2026 | Report Code: big-data-security

Big Data Security Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Big Data Security market, exploring insights and forecasts from 2023 to 2033. Key data on market size, growth trends, regional insights, segmentation, and leading industry players are included.

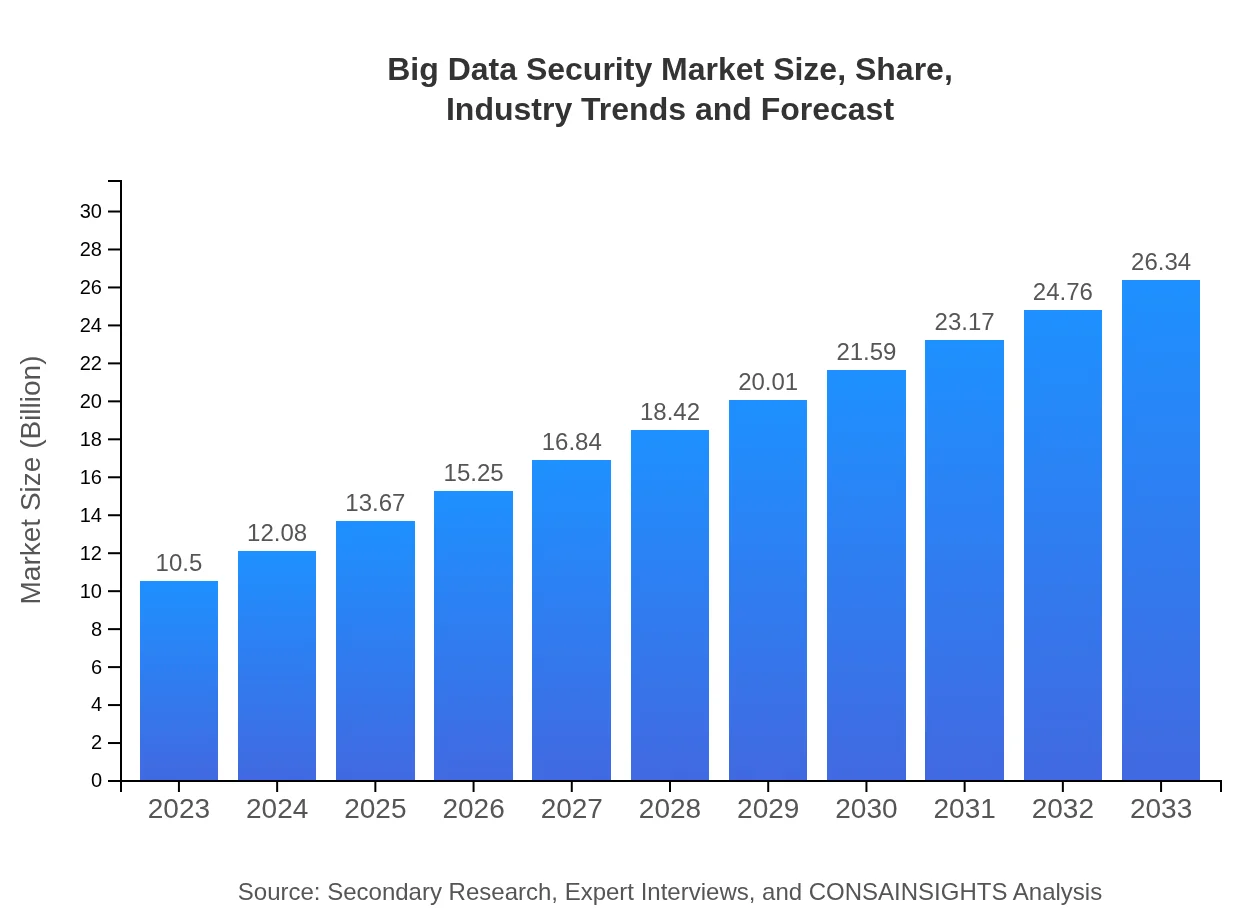

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 9.3% |

| 2033 Market Size | $26.34 Billion |

| Top Companies | IBM, Microsoft, Palo Alto Networks, Cisco |

| Last Modified Date | 31 January 2026 |

Big Data Security Market Overview

Customize Big Data Security Market Report market research report

- ✔ Get in-depth analysis of Big Data Security market size, growth, and forecasts.

- ✔ Understand Big Data Security's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Big Data Security

What is the Market Size & CAGR of Big Data Security market in 2023?

Big Data Security Industry Analysis

Big Data Security Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Big Data Security Market Analysis Report by Region

Europe Big Data Security Market Report:

Europe's market value is expected to grow from $2.74 billion in 2023 to $6.87 billion by 2033, spurred by stringent data protection regulations and increasing adoption of cloud services, which necessitate effective security measures.Asia Pacific Big Data Security Market Report:

The Asia Pacific region shows significant growth potential, with the market growing from $2.14 billion in 2023 to an estimated $5.36 billion by 2033. Governments and private sectors in countries like China and India are increasingly investing in big data analytics and associated security measures, making it a key area of focus.North America Big Data Security Market Report:

North America dominates the Big Data Security market, with its size projected to rise from $3.68 billion in 2023 to $9.23 billion by 2033. The presence of major technology firms and increased spending on security solutions due to high-profile data breaches are key drivers of this trend.South America Big Data Security Market Report:

In South America, the market for Big Data Security is expected to increase from $0.54 billion in 2023 to $1.36 billion by 2033. Growing awareness of data privacy and protection issues alongside the increasing number of cybersecurity incidents are driving this growth.Middle East & Africa Big Data Security Market Report:

The Middle East and Africa region is also witnessing growth, with a market size increasing from $1.40 billion in 2023 to $3.52 billion by 2033. The rise in digital transformation initiatives across various industries is pushing the demand for effective big data security solutions.Tell us your focus area and get a customized research report.

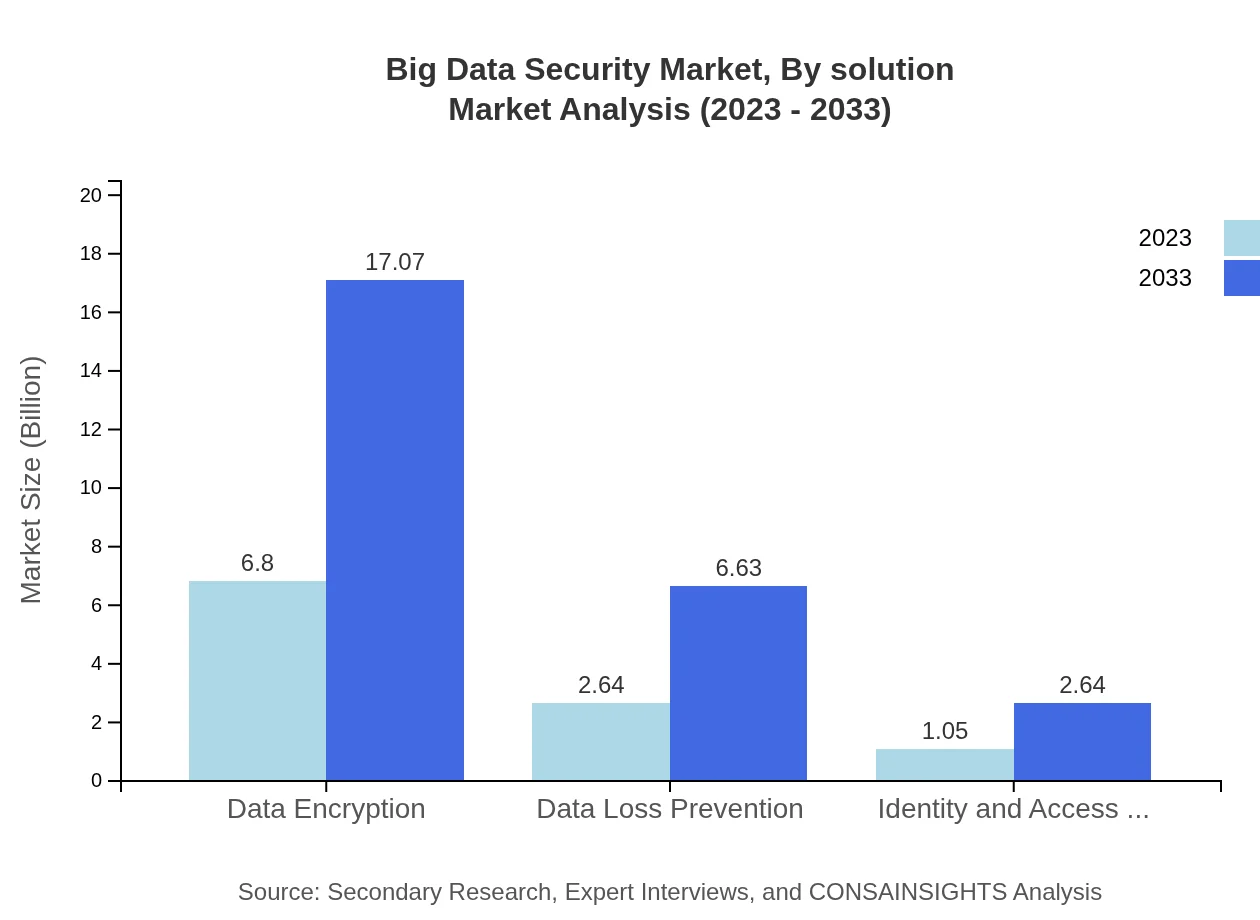

Big Data Security Market Analysis By Solution

The Big Data Security market segmented by solution includes notable segments such as Data Encryption, Data Loss Prevention, and Identity and Access Management. For instance, the Data Encryption segment alone accounts for a market size of $6.80 billion in 2023, projected to reach $17.07 billion by 2033, representing a critical component in securing sensitive data.

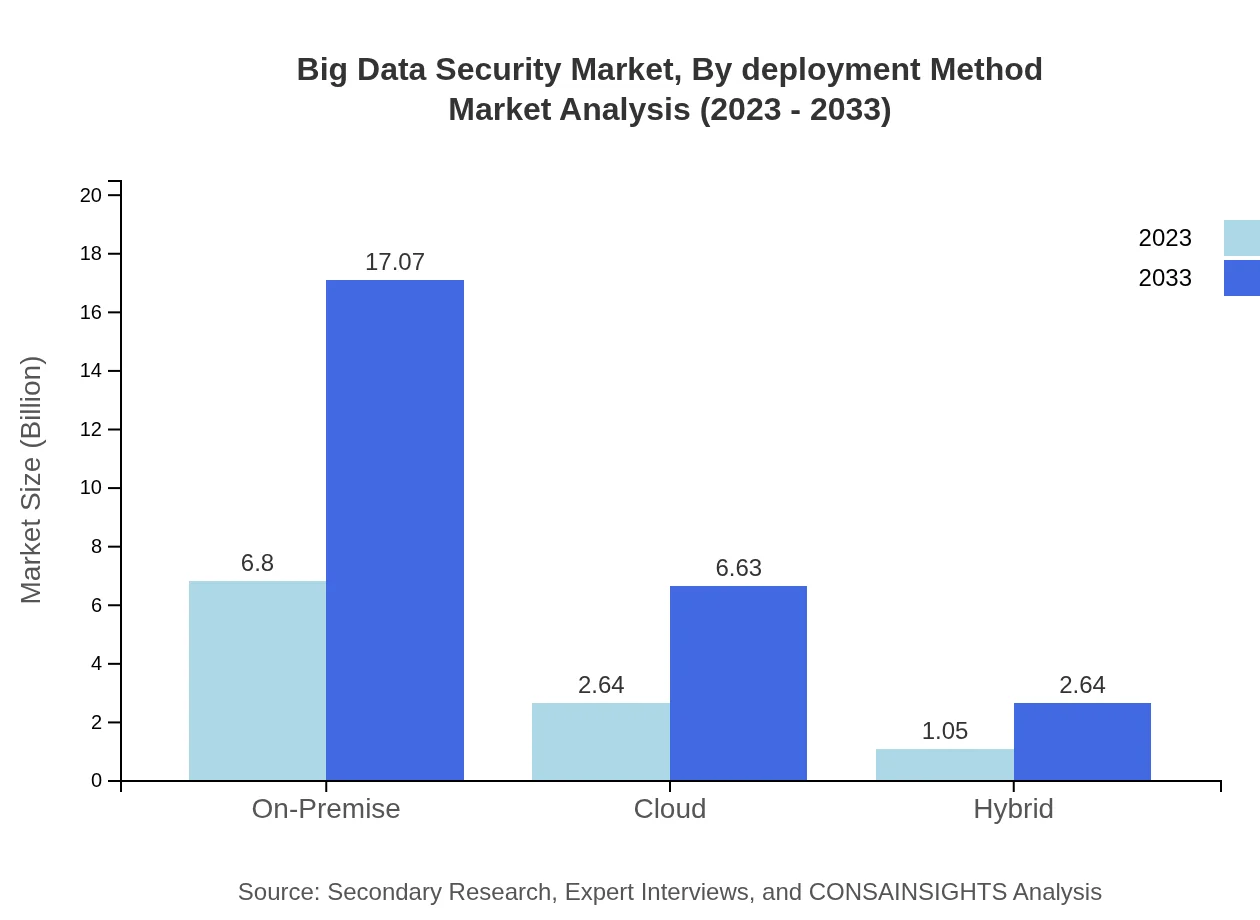

Big Data Security Market Analysis By Deployment Method

This market is also segmented by deployment methods, including On-Premise, Cloud, and Hybrid solutions. On-Premise solutions are currently the most significant segment, with a market size of $6.80 billion in 2023, expected to grow to $17.07 billion by 2033.

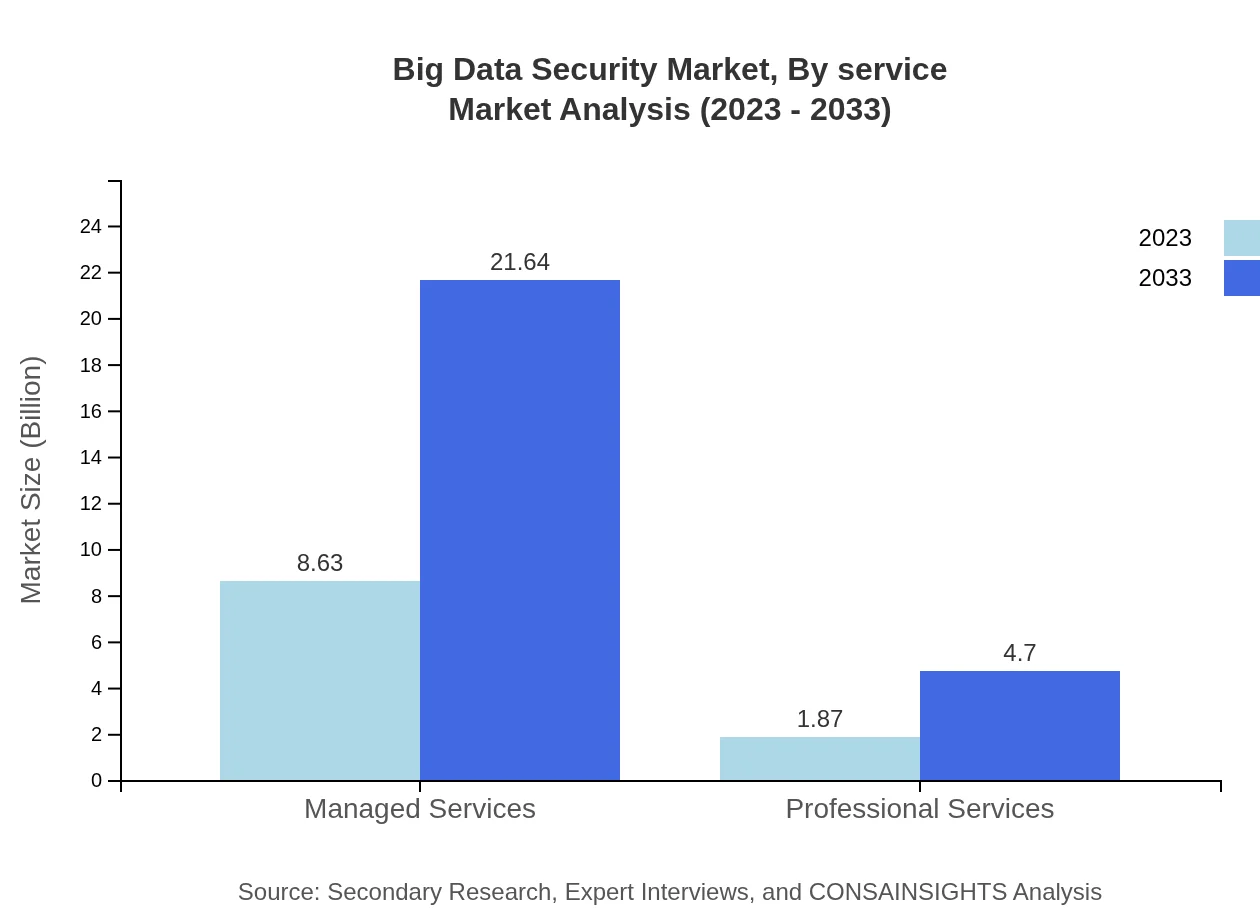

Big Data Security Market Analysis By Service

The Big Data Security market by service comprises Managed Services and Professional Services. Managed Services hold a significant position, with the market size projected to rise from $8.63 billion in 2023 to $21.64 billion by 2033.

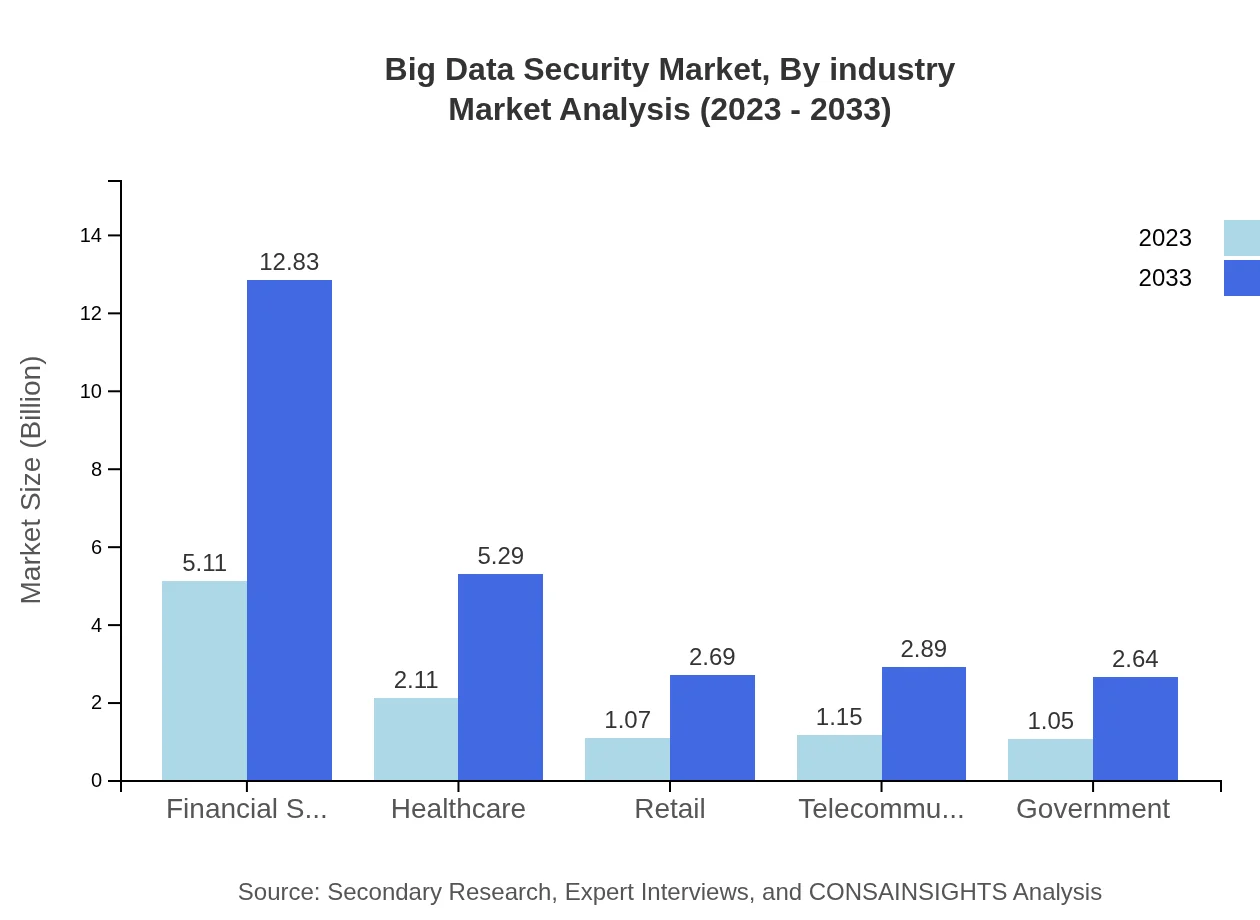

Big Data Security Market Analysis By Industry

Industries leveraging Big Data Security include Financial Services, Healthcare, Retail, Telecommunications, and Government. The Financial Services sector leads with a market size of $5.11 billion in 2023, forecasted to expand to $12.83 billion by 2033.

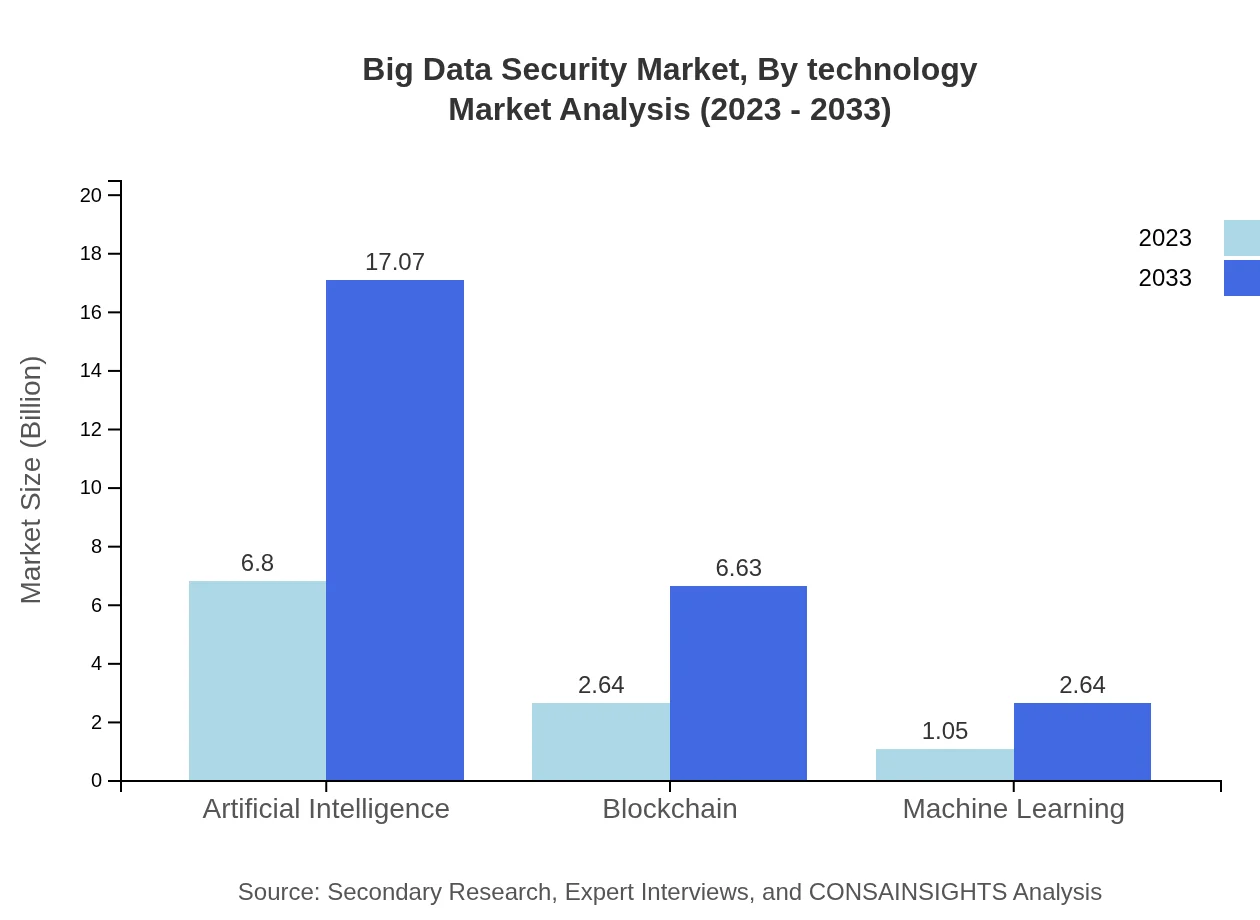

Big Data Security Market Analysis By Technology

Key technologies enabling Big Data Security include Artificial Intelligence, Blockchain, and Machine Learning. The Artificial Intelligence segment is notable, projected to reach a market size of $17.07 billion by 2033, fueling innovations in data protection and threat detection.

Big Data Security Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Big Data Security Industry

IBM:

IBM is a leader in developing comprehensive data security solutions, offering a range of products such as IBM Cloud Pak for Security which integrates advanced analytics and artificial intelligence.Microsoft:

Microsoft provides extensive Big Data Security solutions with Azure Security Center and Microsoft Defender, addressing data security comprehensively across cloud and on-premises environments.Palo Alto Networks:

Palo Alto Networks specializes in cybersecurity solutions enhancing network security, focusing on integrating AI-powered protection for big data infrastructures.Cisco:

Cisco's extensive portfolio includes data security tools designed to protect data through advanced firewalls and secure access technologies.We're grateful to work with incredible clients.

FAQs

What is the market size of big Data Security?

The Big Data Security market is valued at $10.5 billion in 2023 with a compound annual growth rate (CAGR) of 9.3%. It is projected to increase significantly by 2033, highlighting a robust growth trajectory driven by the rising data security concerns globally.

What are the key market players or companies in this big Data Security industry?

Key players in the Big Data Security industry include leading technology firms such as IBM, Cisco, Microsoft, and Oracle. These companies are leveraging advanced technologies to enhance security offerings and provide comprehensive solutions for protecting sensitive data.

What are the primary factors driving the growth in the big Data Security industry?

Growth in the Big Data Security industry is primarily driven by the increasing volume of data being generated, regulatory compliance requirements, and a rising awareness of cybersecurity threats. Moreover, the integration of advanced technologies like AI and machine learning is enhancing security capabilities.

Which region is the fastest Growing in the big Data Security?

North America is currently the fastest-growing region in the Big Data Security market, with a market size projected to grow from $3.68 billion in 2023 to $9.23 billion by 2033. This growth is fueled by high adoption rates of advanced security technologies and escalating cyber threats.

Does ConsaInsights provide customized market report data for the big Data Security industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients in the Big Data Security industry. This allows businesses to gain insights into niche segments and competitive dynamics that are relevant to their operations.

What deliverables can I expect from this big Data Security market research project?

From the Big Data Security market research project, clients can expect detailed reports including market size analysis, growth forecasts, competitive landscapes, and insights into customer preferences and trends, providing a comprehensive understanding of the market dynamics.

What are the market trends of big Data Security?

Current trends in the Big Data Security market include increasing investments in data encryption, the adoption of AI-driven security solutions, and a shift towards cloud-based services. Organizations are prioritizing data privacy, integrating innovative technologies to thwart evolving cyber threats.