Bike And Scooter Rental Market Report

Published Date: 01 February 2026 | Report Code: bike-and-scooter-rental

Bike And Scooter Rental Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bike and Scooter Rental market, exploring current conditions, market size, growth trends, and forecasts from 2023 to 2033. Key insights, including technology and regional impacts, will be examined to guide stakeholders in decision-making.

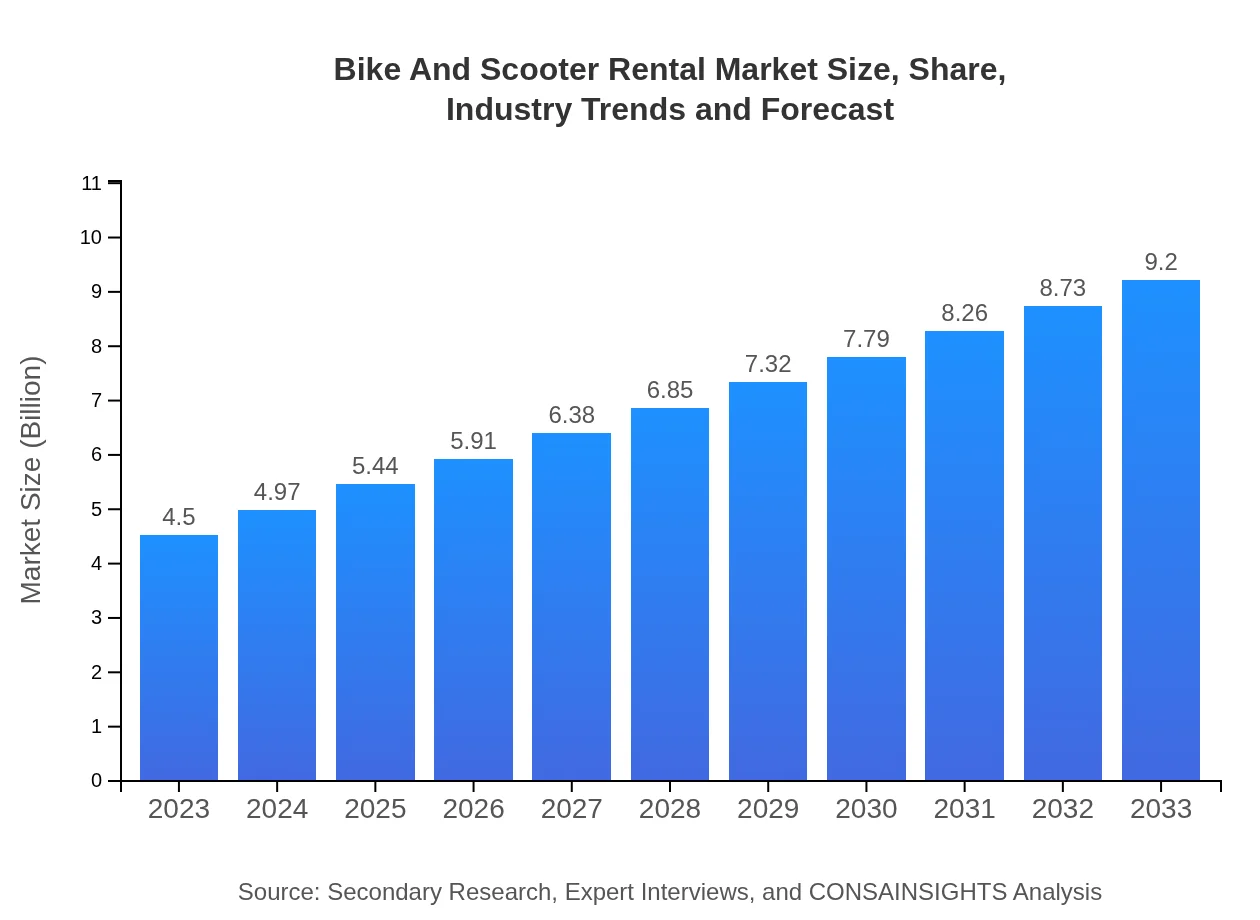

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.50 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $9.20 Billion |

| Top Companies | Lime, Spin, Citi Bike |

| Last Modified Date | 01 February 2026 |

Bike And Scooter Rental Market Overview

Customize Bike And Scooter Rental Market Report market research report

- ✔ Get in-depth analysis of Bike And Scooter Rental market size, growth, and forecasts.

- ✔ Understand Bike And Scooter Rental's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bike And Scooter Rental

What is the Market Size & CAGR of Bike And Scooter Rental market in 2023?

Bike And Scooter Rental Industry Analysis

Bike And Scooter Rental Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bike And Scooter Rental Market Analysis Report by Region

Europe Bike And Scooter Rental Market Report:

Europe represents a leading market with a size of $1.09 billion in 2023, growing to $2.24 billion by 2033. Countries like Germany and France are fostering a biking culture and investment in public bike systems further innovates the rental ecosystem.Asia Pacific Bike And Scooter Rental Market Report:

The Asia Pacific region accounted for approximately $0.96 billion in 2023, with expectations to grow to $1.97 billion by 2033, driven by increasing urban populations and supportive government policies on sustainable transport. Cities like Beijing and Tokyo have seen exponential growth in e-scooter rentals, attracting both local commuters and tourists.North America Bike And Scooter Rental Market Report:

North America shows a significant growth trajectory, projected to expand from $1.73 billion in 2023 to $3.53 billion by 2033. The popularity of bike-share programs in cities like New York and San Francisco is enhancing the market as more people opt for biking and shared mobility.South America Bike And Scooter Rental Market Report:

In South America, the market size is projected to grow from $0.28 billion in 2023 to $0.58 billion by 2033. Demand in cities like São Paulo and Buenos Aires is rising, fueled by urban congestion and the need for more efficient transportation options.Middle East & Africa Bike And Scooter Rental Market Report:

The Middle East and Africa market is anticipated to grow from $0.43 billion in 2023 to $0.88 billion by 2033. Investments in urban mobility infrastructure and a burgeoning tourism sector are likely to stimulate market growth.Tell us your focus area and get a customized research report.

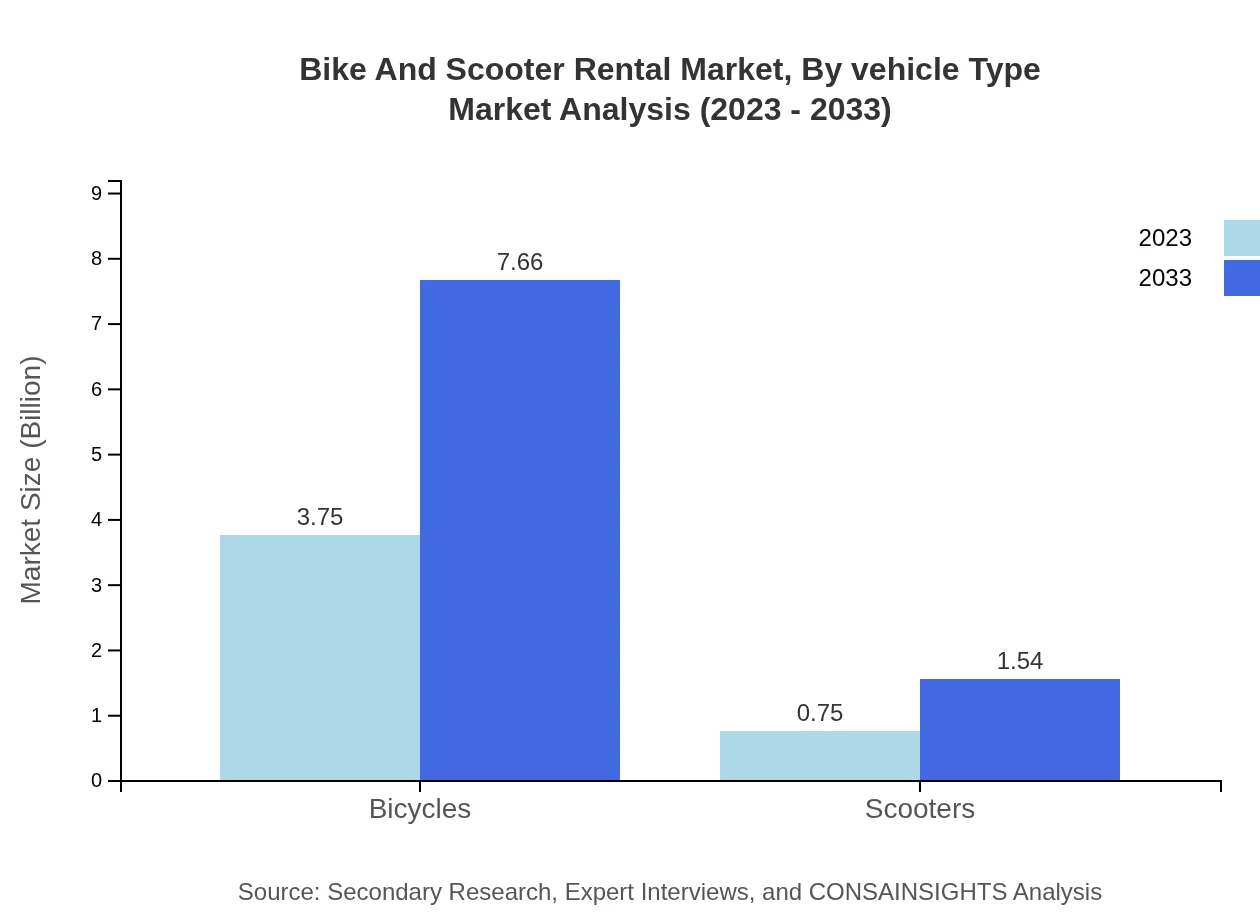

Bike And Scooter Rental Market Analysis By Vehicle Type

In 2023, bicycles dominate the Bike and Scooter Rental market, accounting for a significant share of 83.31% or approximately $3.75 billion. The scooter segment represents 16.69% of the market, valued at $0.75 billion. By 2033, bicycles are projected to grow to $7.66 billion, maintaining an 83.31% market share, while scooters will increase to $1.54 billion, retaining a 16.69% share.

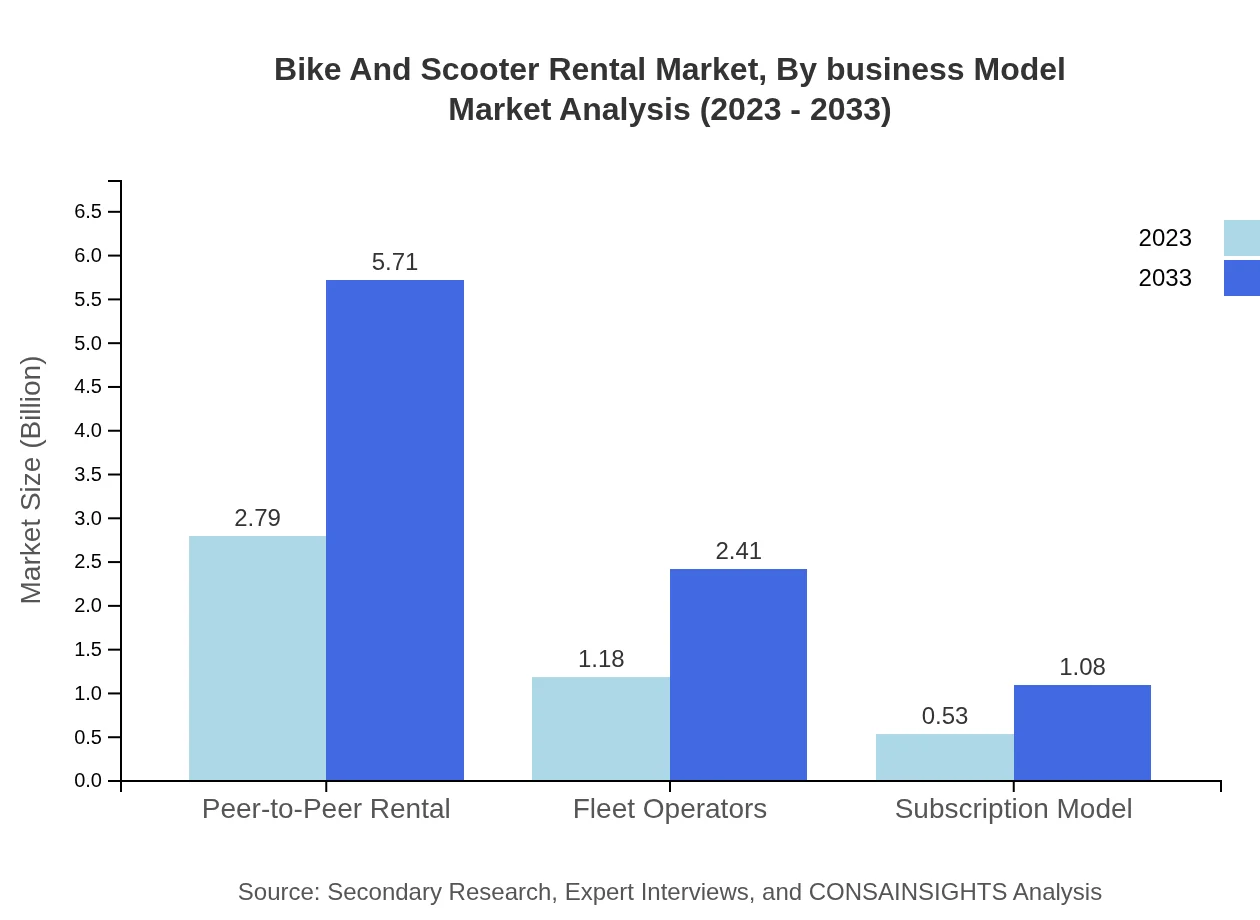

Bike And Scooter Rental Market Analysis By Business Model

The market can be bifurcated into traditional renting services and innovative models such as peer-to-peer rentals. Peer-to-peer rentals are gaining traction, with current evaluations around $2.79 billion in 2023. By 2033, this model is anticipated to grow significantly, reflecting the changing consumer behavior that favors shared economy platforms.

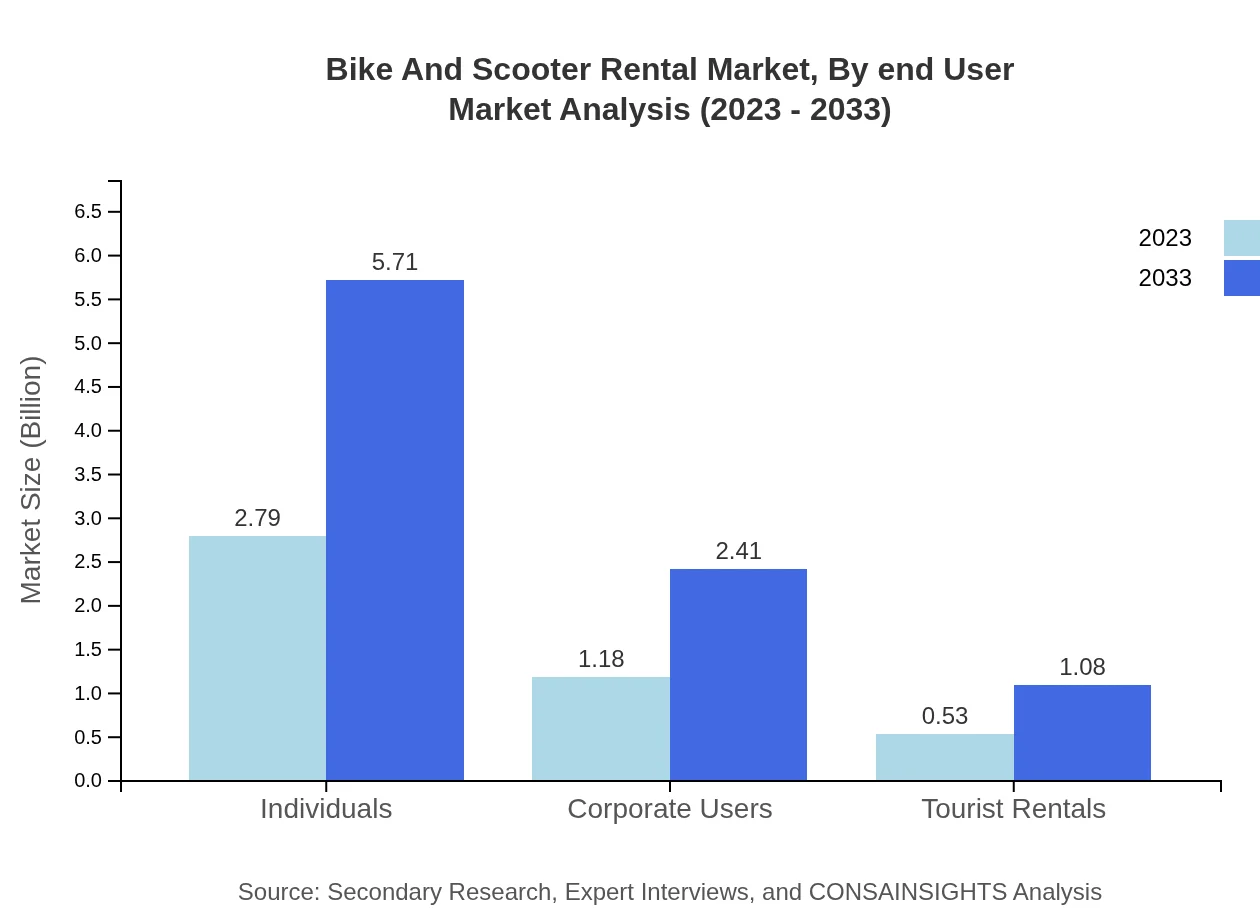

Bike And Scooter Rental Market Analysis By End User

End-users are segmented into individuals, corporate users, and tourists. Individuals dominate the market with a share of 62.06% translating to a size of $2.79 billion. Corporate users contribute 26.16% ($1.18 billion), while tourist rentals account for 11.78% ($0.53 billion). By 2033, individual users are projected to maintain the lead, while corporate and tourist segments also reflect similar growth trajectories.

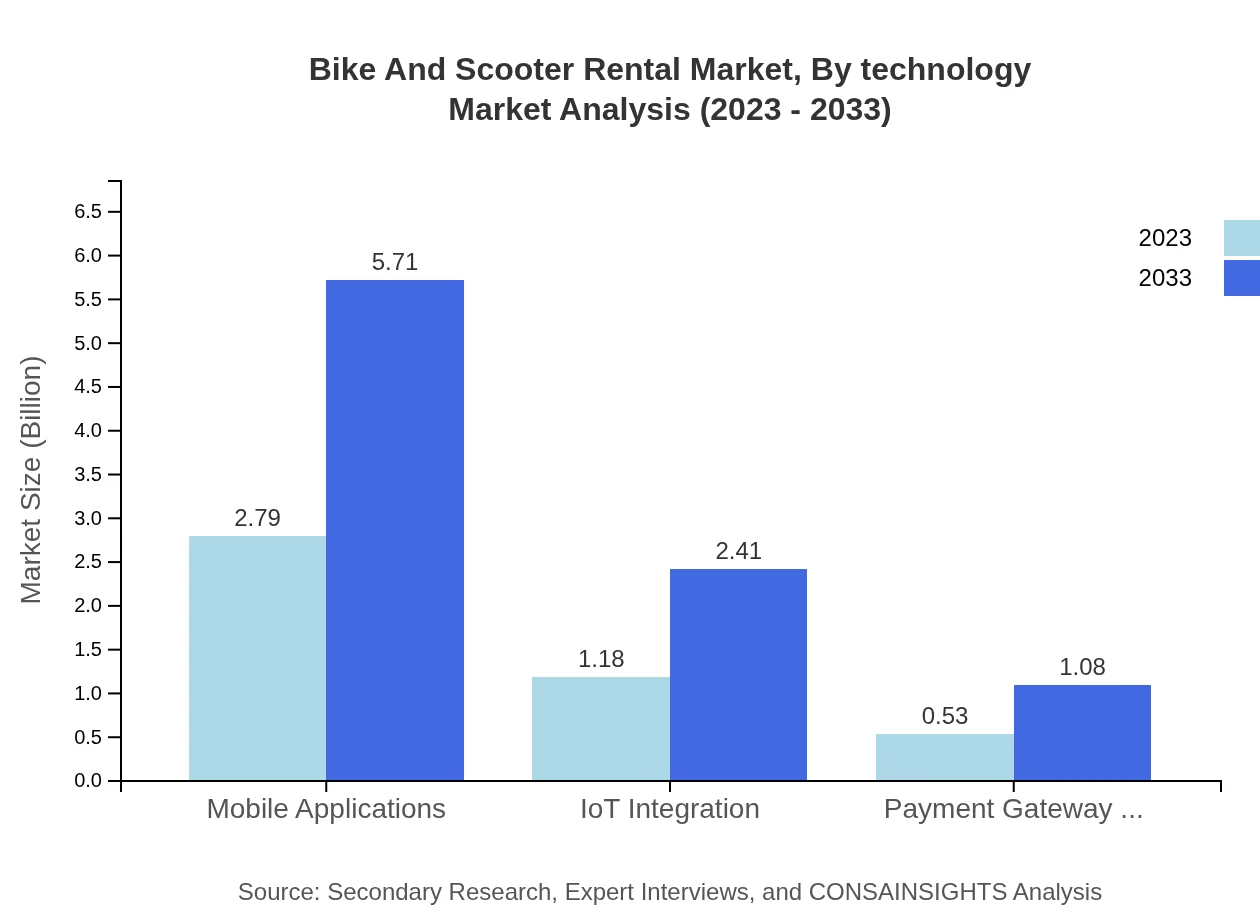

Bike And Scooter Rental Market Analysis By Technology

Technological innovation plays a crucial role in enhancing rental platforms. The integration of mobile applications is pivotal, accounting for a share of 62.06% valued at $2.79 billion in 2023. Technological trends including IoT integration and advanced payment gateways are also gaining momentum, with projected significant growth by 2033.

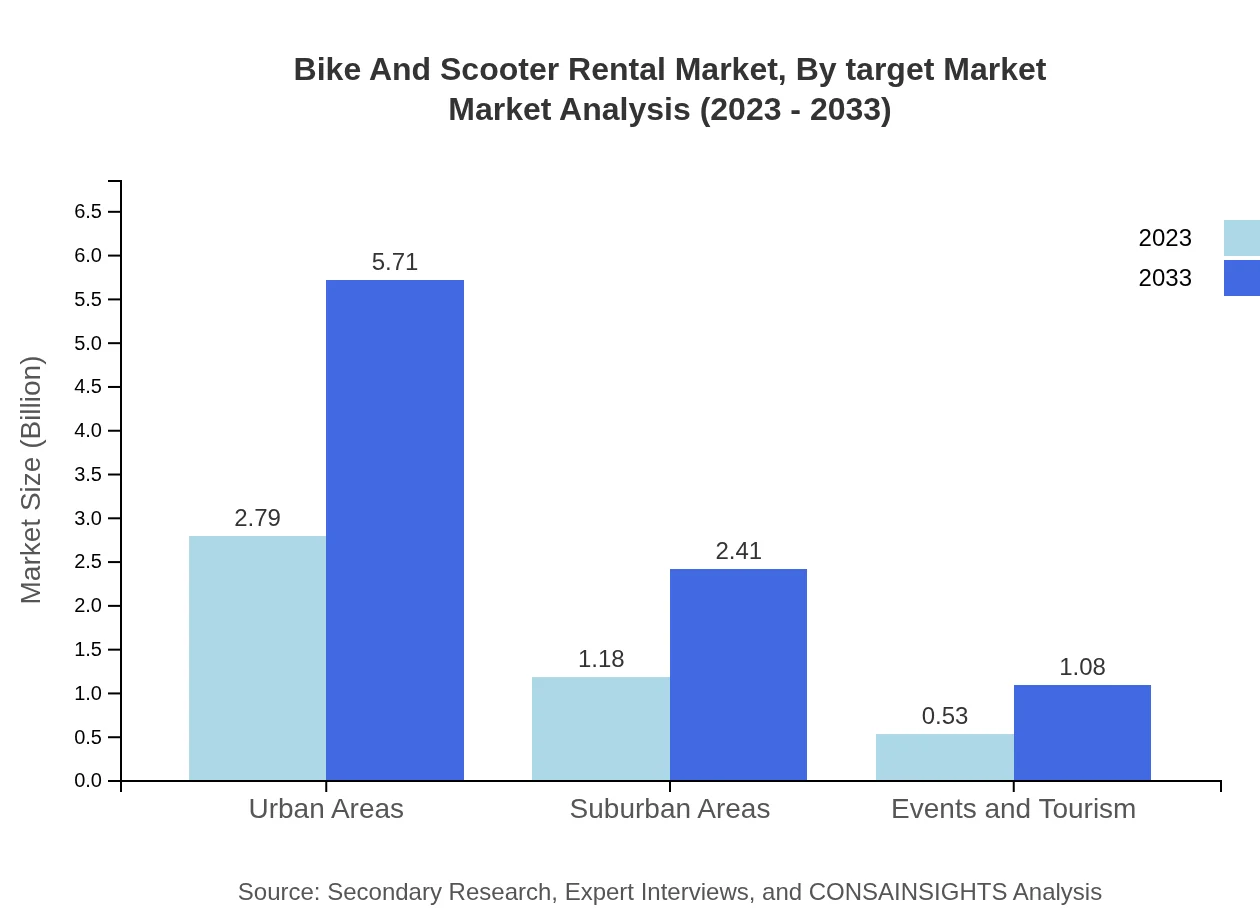

Bike And Scooter Rental Market Analysis By Target Market

Target markets range from urban areas, suburban regions, events, and tourism segments. Urban areas, representing 62.06% of the market share in 2023, emphasize the preference for bike rentals in city centers. By 2033, all target segments are expected to grow, reflecting a shift towards urban mobility solutions.

Bike And Scooter Rental Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bike And Scooter Rental Industry

Lime:

Lime is a leading provider of electric scooters and bikes, offering convenient and eco-friendly mobility options. Their integrated app allows users to find, unlock, and pay for rentals effortlessly.Spin:

Spin focuses on electric scooters and offers services across various U.S. cities. The company emphasizes safety and sustainability while promoting micro-mobility solutions.Citi Bike:

Citi Bike is one of the largest bike-share programs in the United States, providing a user-friendly service that allows for easy rentals in urban settings, enhancing access and convenience for commuters.We're grateful to work with incredible clients.

FAQs

What is the market size of bike And Scooter Rental?

The global bike-and-scooter rental market is projected to reach approximately $4.5 billion by 2033, with a CAGR of 7.2% from 2023 to 2033. This growth reflects increasing urbanization and the demand for convenient, sustainable transport solutions.

What are the key market players or companies in this bike And Scooter Rental industry?

Key players in the bike-and-scooter rental market include major companies such as Lime, Bird, Spin, and CitiBike. These companies are leading the way in terms of technology innovation and market presence within the bike rental segment.

What are the primary factors driving the growth in the bike and scooter rental industry?

Growth in the bike and scooter rental industry is driven by increased urban congestion, rising demand for eco-friendly transportation, advancements in mobile app technology, and supportive government policies promoting sustainable transport options, creating more rental opportunities.

Which region is the fastest Growing in the bike And Scooter Rental?

The fastest-growing region in the bike-and-scooter rental market is North America, expected to grow from $1.73 billion in 2023 to $3.53 billion by 2033. Europe follows closely, doubling its market size from $1.09 billion to $2.24 billion during the same period.

Does ConsaInsights provide customized market report data for the bike And Scooter Rental industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs of clients within the bike-and-scooter rental industry. This allows stakeholders to gain insights relevant to their unique market dynamics.

What deliverables can I expect from this bike And Scooter Rental market research project?

Deliverables for the bike-and-scooter rental market research project typically include a comprehensive market report, segmentation analysis, regional insights, key player profiles, and trend analysis to aid strategic decision-making.

What are the market trends of bike And Scooter Rental?

Current market trends include a shift towards mobile app integration for rentals, increased investment in IoT technologies, rising demand for subscription models, and a growing focus on corporate user engagement, especially within urban areas.