Bio Acetic Acid Market Report

Published Date: 02 February 2026 | Report Code: bio-acetic-acid

Bio Acetic Acid Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive analysis of the Bio Acetic Acid market, covering insights from market size to trends for the forecast period of 2023 to 2033. It includes detailed assessments of growth drivers, market segmentation, regional analysis, and key players in the industry.

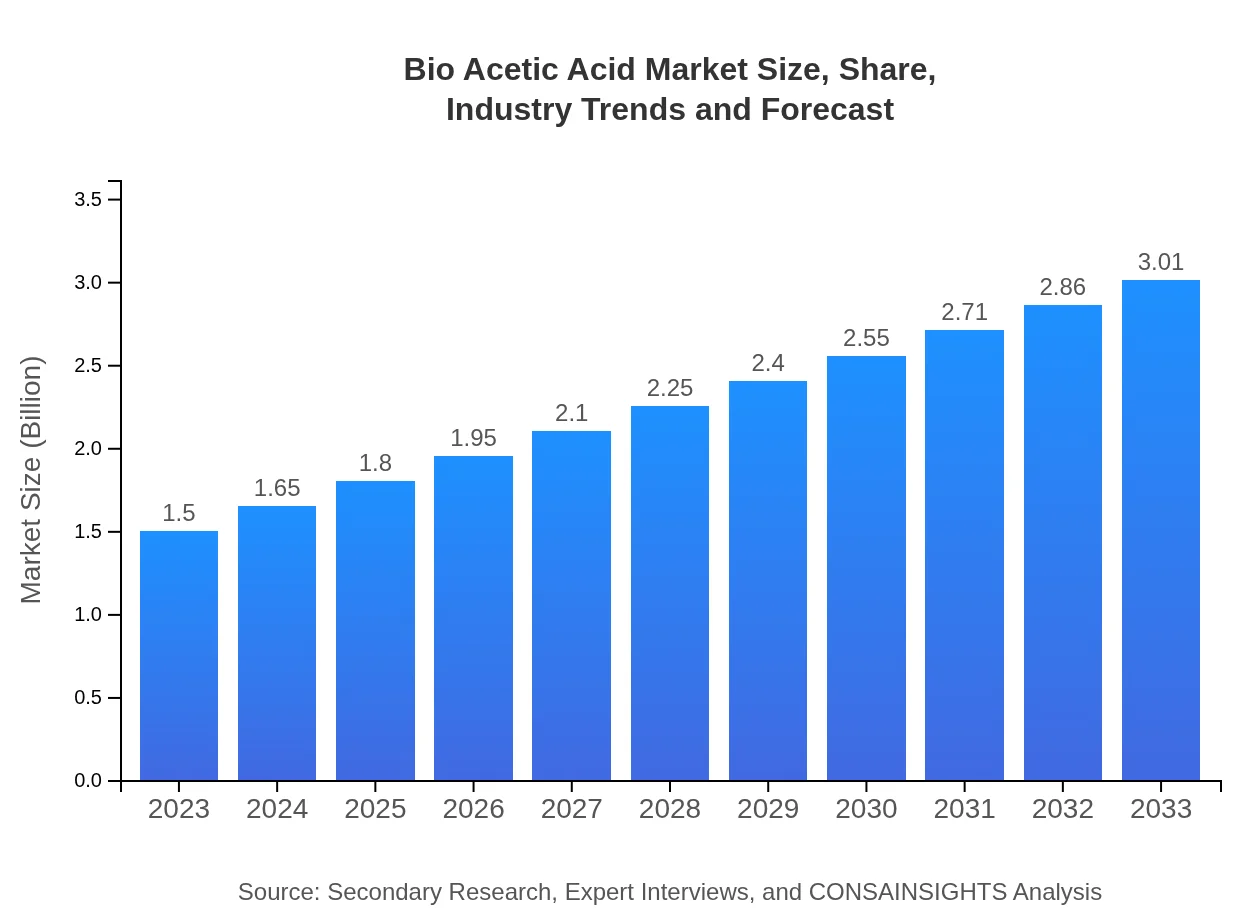

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 7% |

| 2033 Market Size | $3.01 Billion |

| Top Companies | BASF SE, NatureWorks LLC, Celanese Corporation |

| Last Modified Date | 02 February 2026 |

Bio Acetic Acid Market Overview

Customize Bio Acetic Acid Market Report market research report

- ✔ Get in-depth analysis of Bio Acetic Acid market size, growth, and forecasts.

- ✔ Understand Bio Acetic Acid's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bio Acetic Acid

What is the Market Size & CAGR of Bio Acetic Acid market in 2023?

Bio Acetic Acid Industry Analysis

Bio Acetic Acid Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bio Acetic Acid Market Analysis Report by Region

Europe Bio Acetic Acid Market Report:

Europe's Bio Acetic Acid market is forecast to expand from USD 0.50 billion in 2023 to USD 1.00 billion by 2033. The region benefits from strong governmental support for bio-based industries and consumer preference for eco-friendly products.Asia Pacific Bio Acetic Acid Market Report:

In the Asia Pacific region, the market for Bio Acetic Acid is anticipated to grow from USD 0.28 billion in 2023 to USD 0.56 billion by 2033, driven by rising consumer demand for food products and increased industrial applications. Countries like China and India are leading the charge due to their large population and growing industries.North America Bio Acetic Acid Market Report:

The North American market is projected to increase significantly, from USD 0.50 billion in 2023 to USD 1.01 billion by 2033, as a result of stringent environmental regulations and a surge in demand for renewable chemicals in various applications.South America Bio Acetic Acid Market Report:

The South American Bio Acetic Acid market is expected to grow from USD 0.14 billion in 2023 to USD 0.29 billion by 2033. The region's increasing focus on sustainable agricultural practices and food production is expected to enhance demand for bio-based products.Middle East & Africa Bio Acetic Acid Market Report:

The Middle East and Africa's market is anticipated to grow from USD 0.07 billion in 2023 to USD 0.15 billion by 2033. The growth is primarily driven by increasing investments in green technologies and rising awareness of the environmental impact of conventional acetic acids.Tell us your focus area and get a customized research report.

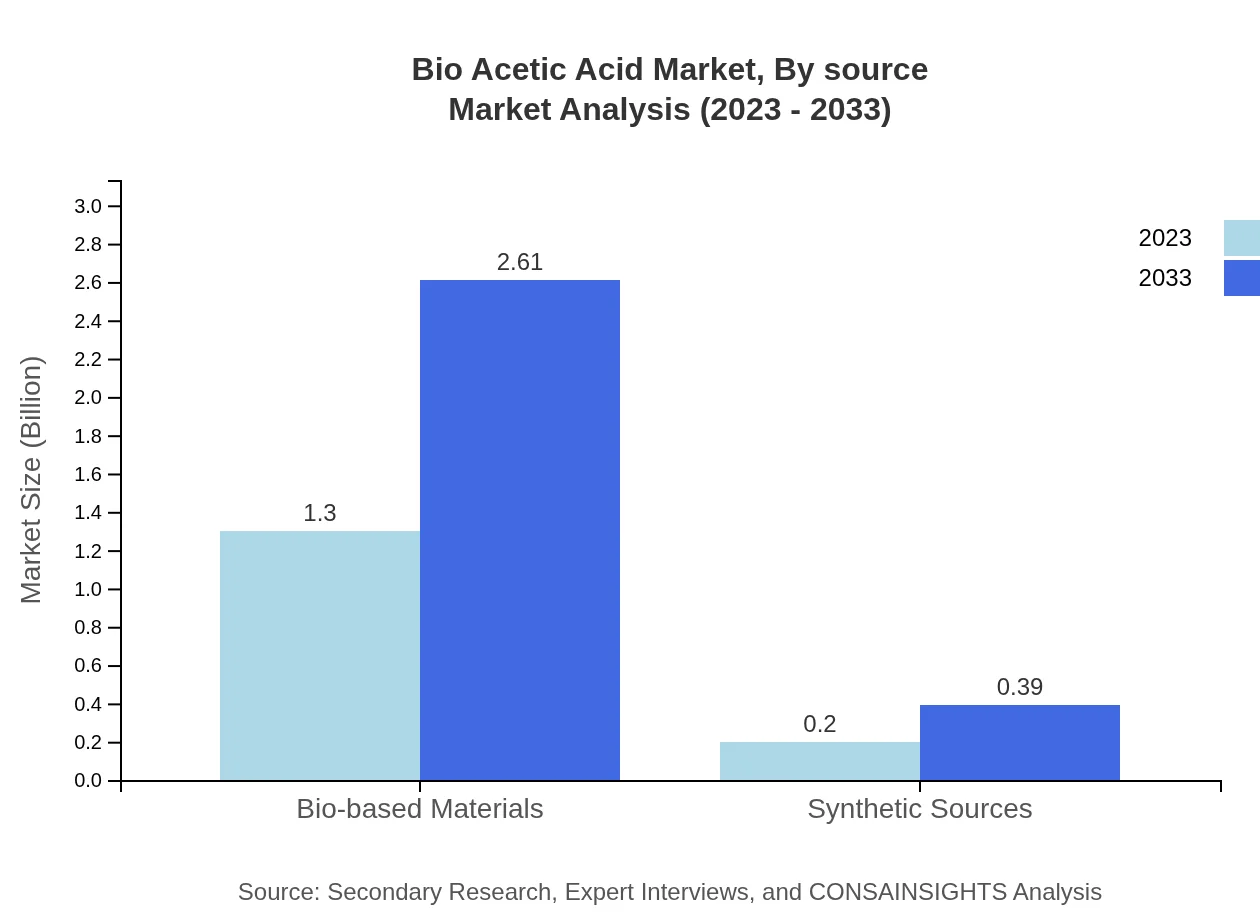

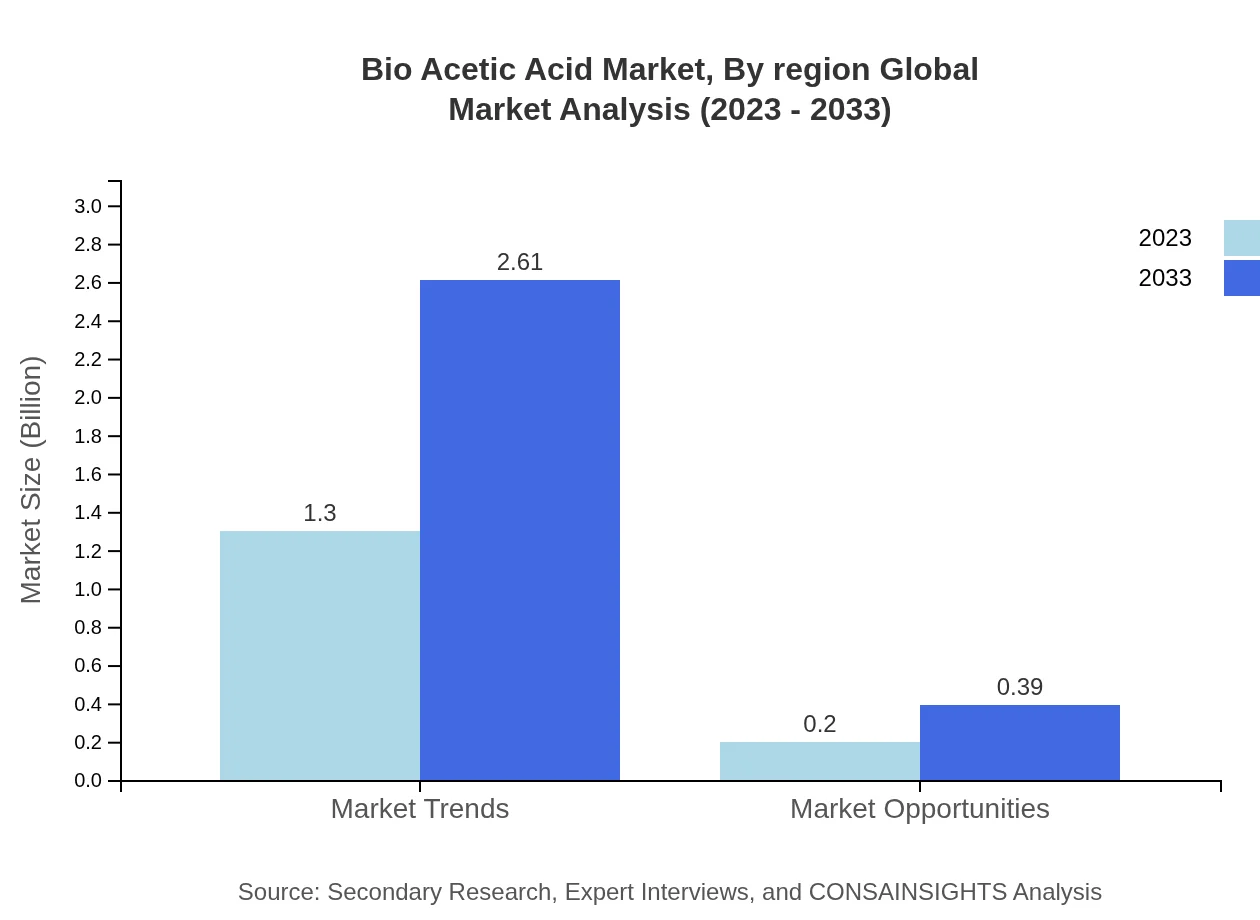

Bio Acetic Acid Market Analysis By Source

The Bio Acetic Acid market by source is dominated by bio-based materials, which accounted for USD 1.30 billion (86.87% share) in 2023, forecasted to reach USD 2.61 billion (86.87% share) by 2033. Synthetic sources, while smaller in market size, are expected to grow from USD 0.20 billion (13.13% share) to USD 0.39 billion (13.13% share) during the same period.

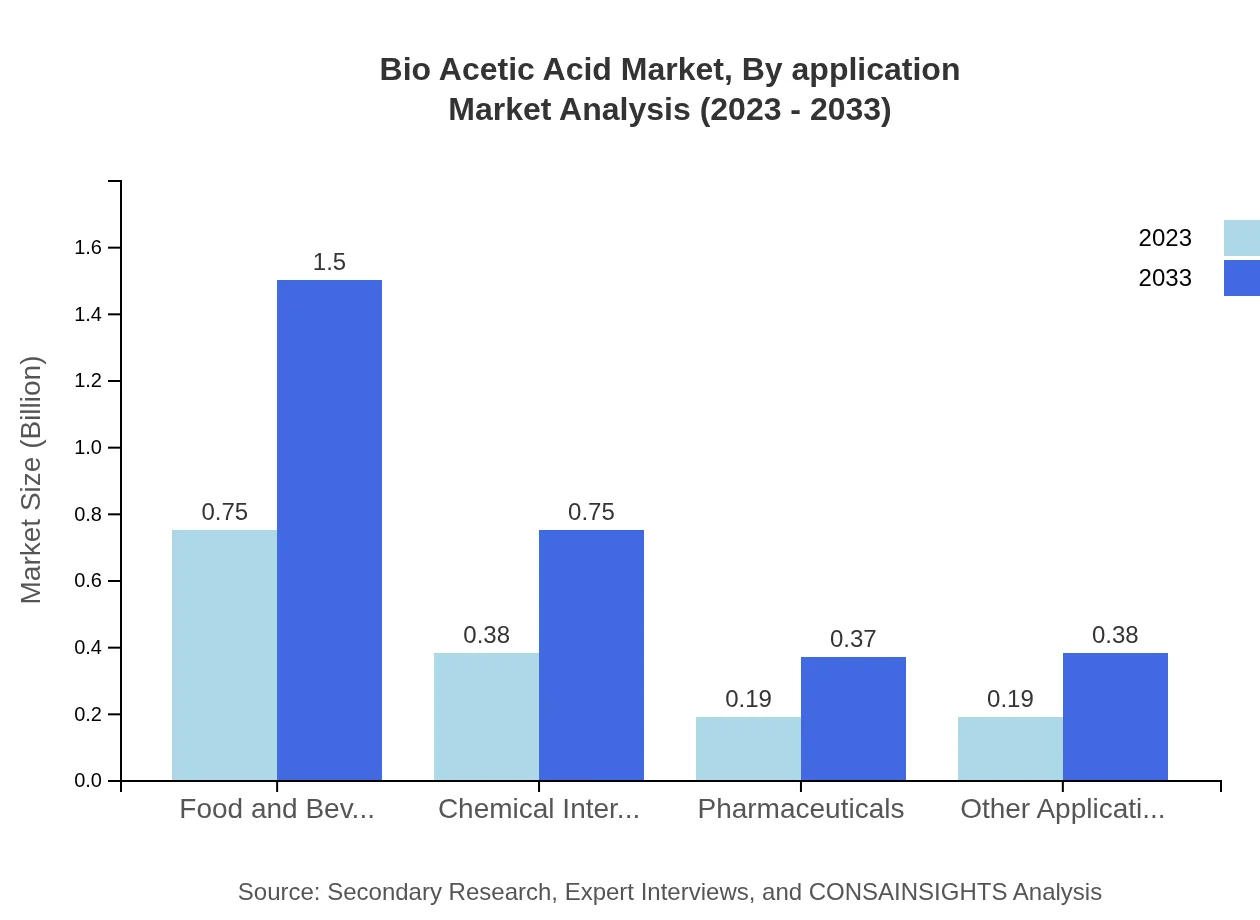

Bio Acetic Acid Market Analysis By Application

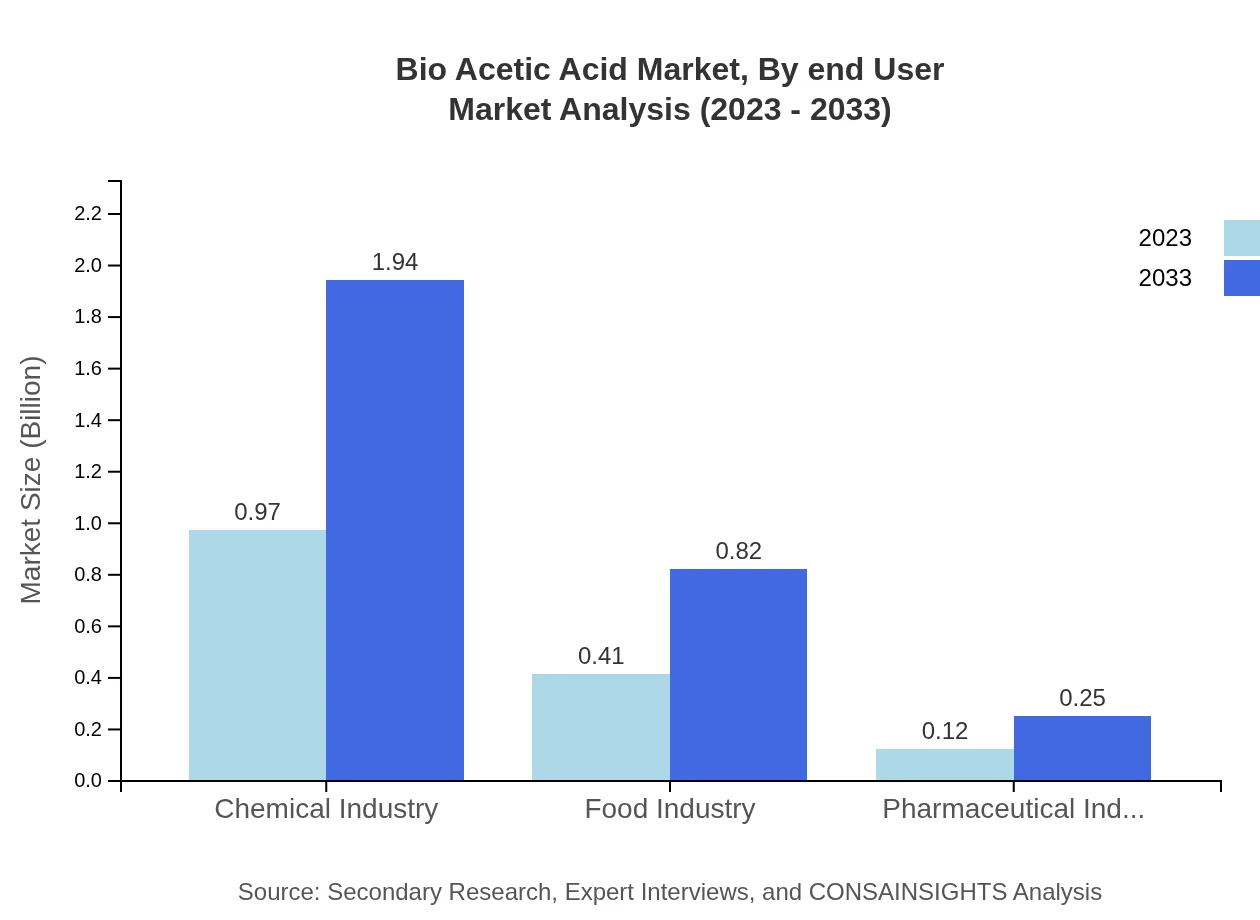

In terms of application, the food and beverage sector leads, with a size of USD 0.75 billion (50% share) in 2023, anticipated to grow to USD 1.50 billion (50% share) by 2033. The chemical industry follows, representing USD 0.97 billion (64.45% share) in 2023, expected to reach USD 1.94 billion (64.45% share) by 2033.

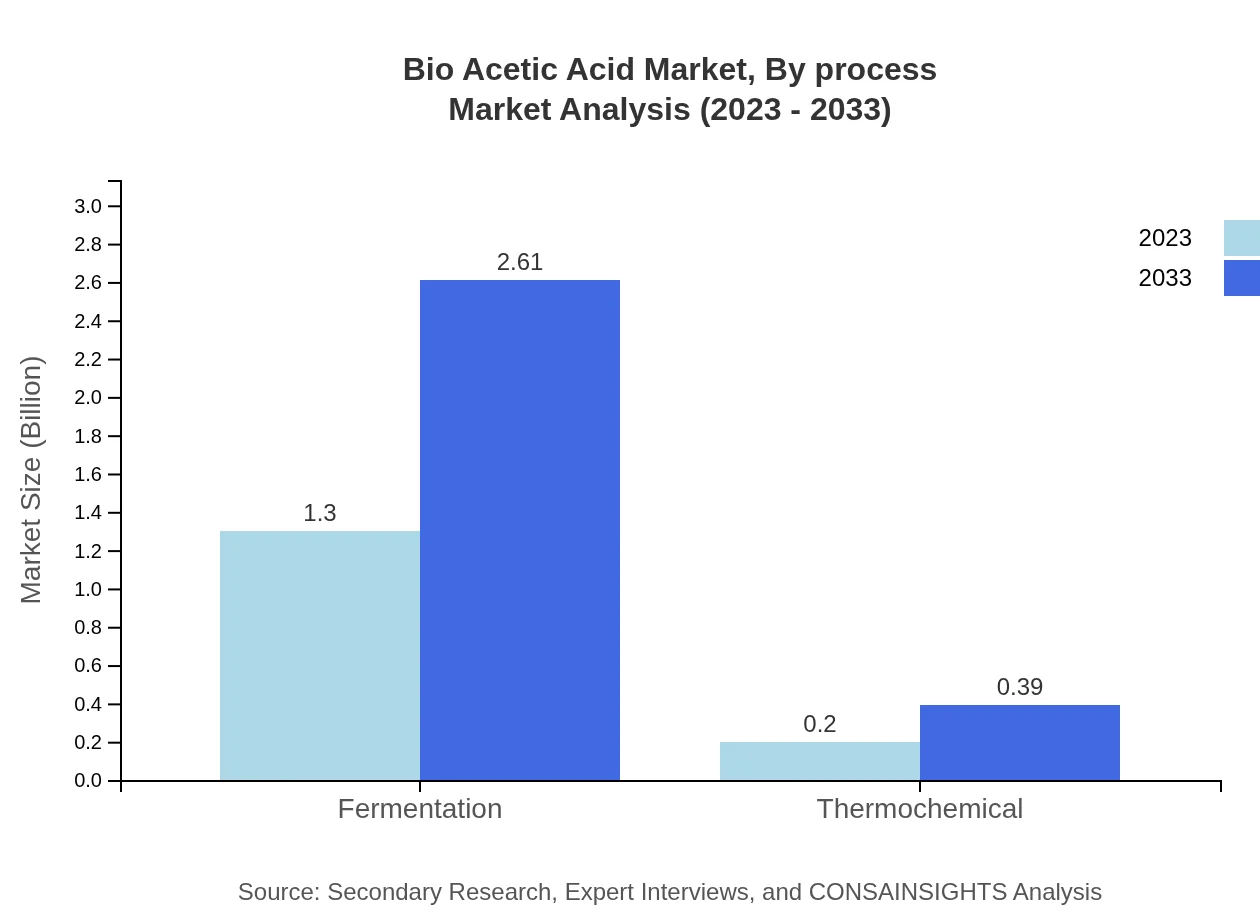

Bio Acetic Acid Market Analysis By Process

Fermentation processes dominate the market with an expected increase from USD 1.30 billion (86.87% share) in 2023 to USD 2.61 billion (86.87% share) by 2033, while thermochemical processes remain a niche segment contributing USD 0.20 billion (13.13% share) in 2023, growing to USD 0.39 billion (13.13% share) by 2033.

Bio Acetic Acid Market Analysis By End User

The pharmaceutical industry, while smaller in market share, is set to grow from USD 0.12 billion (8.32% share) in 2023 to USD 0.25 billion (8.32% share) by 2033, highlighting the increasing importance of bio-based products in healthcare applications.

Bio Acetic Acid Market Analysis By Region Global

Globally, the Bio Acetic Acid market is expected to align closely with trends in sustainability and green technology adoption across industries. With a robust growth rate and region-specific strengths driving demand, the market is well-positioned to meet future needs while contributing to environmental sustainability.

Bio Acetic Acid Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bio Acetic Acid Industry

BASF SE:

A leader in chemical manufacturing, BASF SE has been at the forefront of developing sustainable and bio-based products. Their commitment to innovation in acetic acid production is contributing significantly to market growth.NatureWorks LLC:

Known for its pioneering work in bioplastics, NatureWorks LLC focuses on bio-based materials, including acetic acid derivatives, thus enhancing environmental sustainability in the chemical industry.Celanese Corporation:

Celanese Corporation operates in multiple sectors and has initiated efforts to develop acetic acid from renewable resources, positioning it as a major player in the bio acetic acid market.We're grateful to work with incredible clients.

FAQs

What is the market size of bio Acetic Acid?

The bio-acetic acid market is projected to reach approximately $1.5 billion by 2033, growing from $1.5 billion in 2023, reflecting a compound annual growth rate (CAGR) of 7% over the period.

What are the key market players or companies in this bio Acetic Acid industry?

Key players in the bio-acetic acid market include major chemical manufacturers and innovative biotech firms that focus on sustainable production methods and developing new applications for bio-acetic acid.

What are the primary factors driving the growth in the bio Acetic Acid industry?

Key growth drivers include increasing environmental regulations, the rising demand for bio-based chemicals, and growing applications in diverse industries, such as food, pharmaceuticals, and biodegradable plastics.

Which region is the fastest Growing in the bio Acetic Acid?

The Asia Pacific region is anticipated to be the fastest-growing market for bio-acetic acid, with growth driven by increasing industrial applications and substantial investments in the bioplastics sector.

Does ConsaInsights provide customized market report data for the bio Acetic Acid industry?

Yes, ConsaInsights offers tailored market reports, providing specific insights based on unique client requirements, including detailed analysis of market trends, competitive landscape, and forecasts.

What deliverables can I expect from this bio Acetic Acid market research project?

Deliverables include comprehensive market analysis, segmented data by application and region, competitive landscapes, trends, forecasts, and strategic recommendations for stakeholders.

What are the market trends of bio Acetic Acid?

Market trends indicate a shift towards bio-based materials, with fermentation methods dominating growth. By 2033, the market for bio-acetic acid from fermentation is expected to reach 2.61 billion, comprising 86.87% of the market.