Bio Based Polymers Market Report

Published Date: 02 February 2026 | Report Code: bio-based-polymers

Bio Based Polymers Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Bio Based Polymers market, offering insights into market size, growth rates, segmentation, and regional dynamics from 2023 to 2033. It aims to guide stakeholders in making informed decisions based on comprehensive data and trends.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

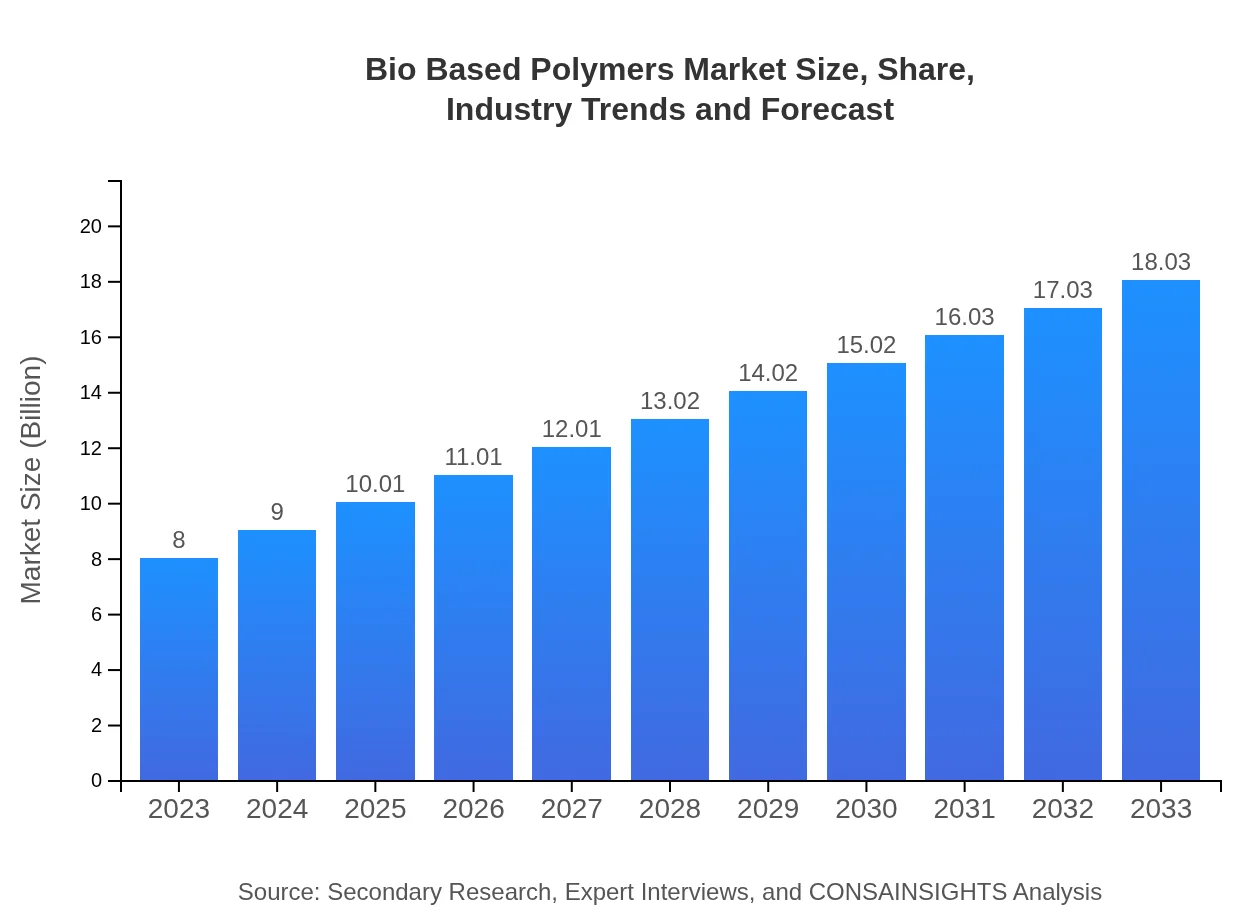

| 2023 Market Size | $8.00 Billion |

| CAGR (2023-2033) | 8.2% |

| 2033 Market Size | $18.03 Billion |

| Top Companies | NatureWorks LLC, BASF SE, Novamont S.p.A., Cargill Inc., BIO-Tec Environmental |

| Last Modified Date | 02 February 2026 |

Bio Based Polymers Market Overview

Customize Bio Based Polymers Market Report market research report

- ✔ Get in-depth analysis of Bio Based Polymers market size, growth, and forecasts.

- ✔ Understand Bio Based Polymers's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bio Based Polymers

What is the Market Size & CAGR of Bio Based Polymers market in 2023?

Bio Based Polymers Industry Analysis

Bio Based Polymers Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bio Based Polymers Market Analysis Report by Region

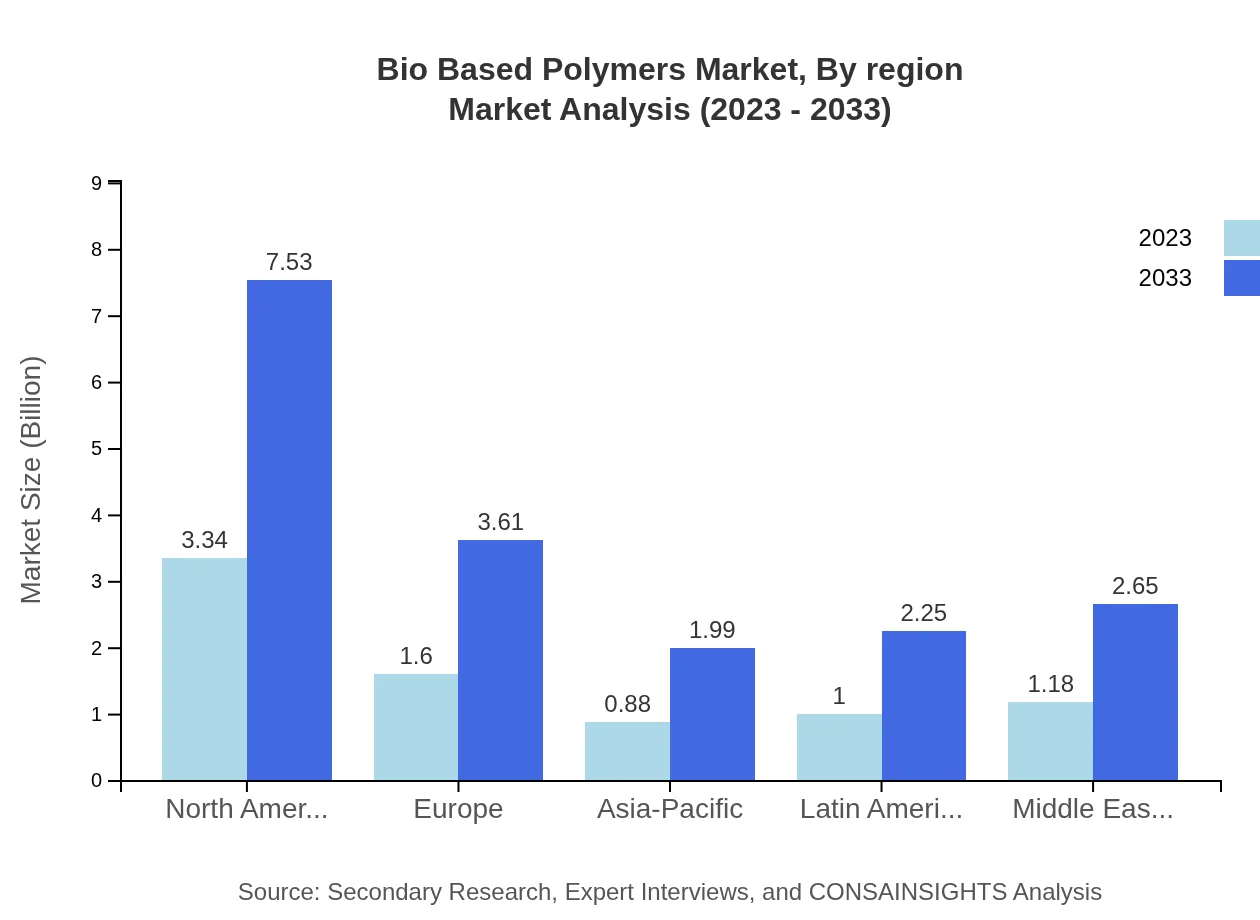

Europe Bio Based Polymers Market Report:

Europe’s market for bio-based polymers, valued at $2.96 billion in 2023 and projected to grow to $6.68 billion by 2033, is primarily driven by stringent environmental regulations and a strong consumer inclination toward eco-friendly products, bolstered by government incentives for sustainable sourcing.Asia Pacific Bio Based Polymers Market Report:

The Asia Pacific region is expected to witness substantial growth, transitioning from a market size of $1.48 billion in 2023 to $3.33 billion by 2033. This growth is propelled by increasing consumer awareness regarding sustainability and substantial investment in R&D for bio-based materials by key countries including China and India.North America Bio Based Polymers Market Report:

North America, with a market size of $2.58 billion in 2023 projected to reach $5.82 billion by 2033, remains a frontrunner in the bio-based polymers market. The burgeoning demand for sustainable packaging solutions in the food and beverage sector will considerably fuel growth in this region.South America Bio Based Polymers Market Report:

South America's bio-based polymers market is anticipated to grow from $0.62 billion in 2023 to $1.39 billion in 2033. This growth will be driven by improvements in agricultural practices, with bio-based polymers offering eco-friendly alternatives to traditional plastic products.Middle East & Africa Bio Based Polymers Market Report:

In the Middle East and Africa, the market for bio-based polymers is forecasted to expand from $0.36 billion in 2023 to $0.81 billion by 2033. The gradual adoption of sustainable practices, coupled with diverse agricultural bio-waste availability, is expected to support market growth.Tell us your focus area and get a customized research report.

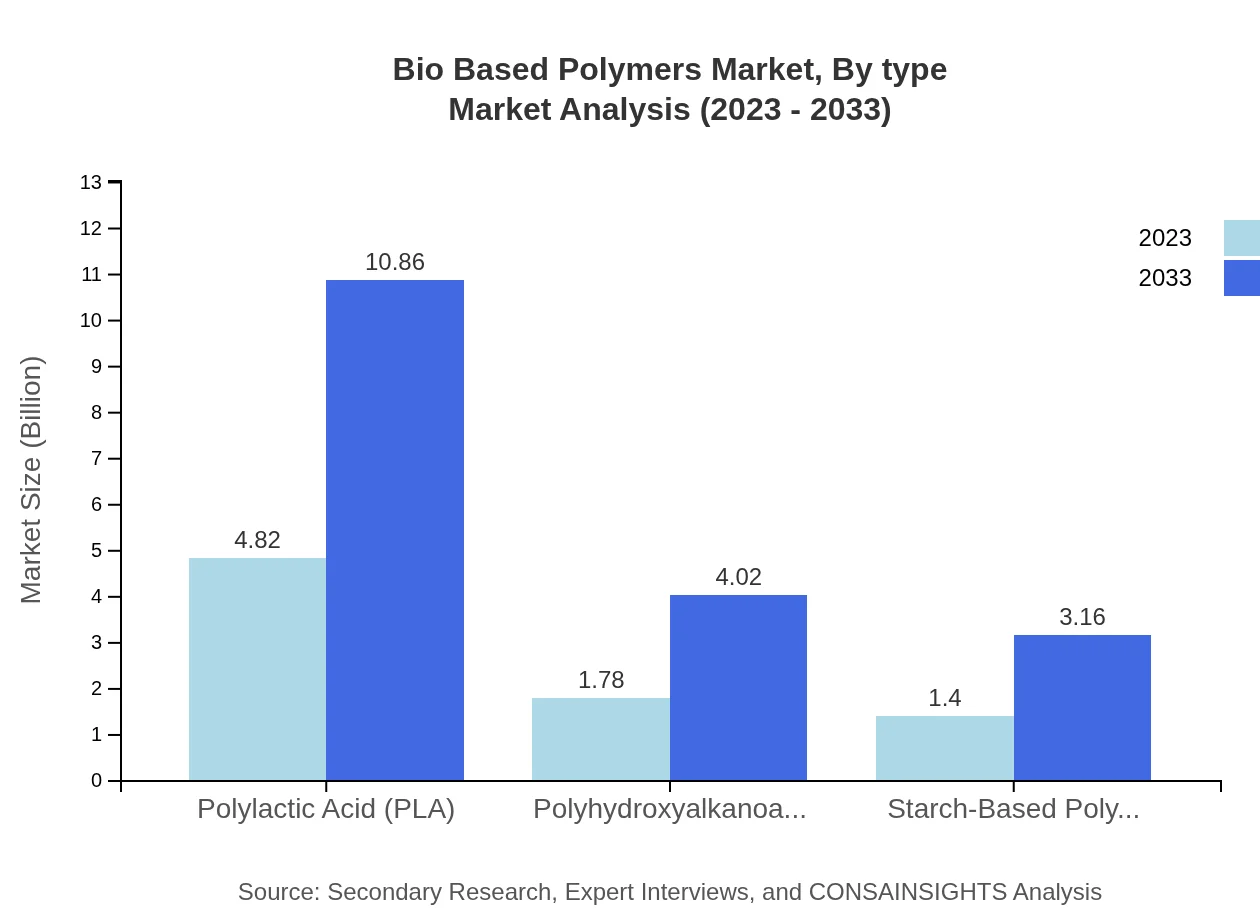

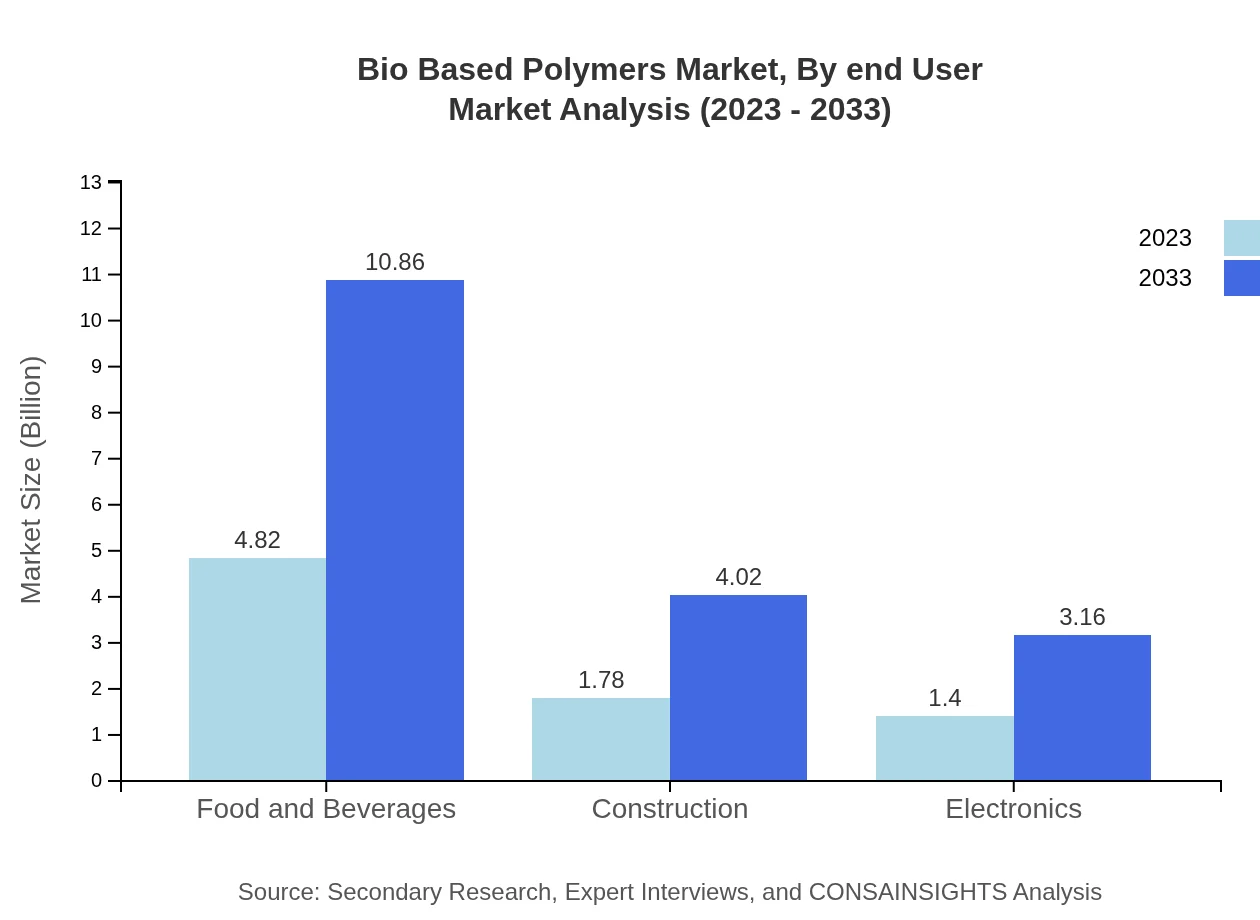

Bio Based Polymers Market Analysis By Type

The primary types of bio-based polymers include Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), and starch-based polymers. In 2023, PLA holds the largest market share, valued at $4.82 billion, expected to rise to $10.86 billion by 2033. PHA represents a smaller segment yet is gaining traction due to its versatility and biodegradability. Starch-based polymers are valued at $1.40 billion and expected to grow to $3.16 billion, reflecting their extensive use in applications such as packaging and consumer goods.

Bio Based Polymers Market Analysis By Application

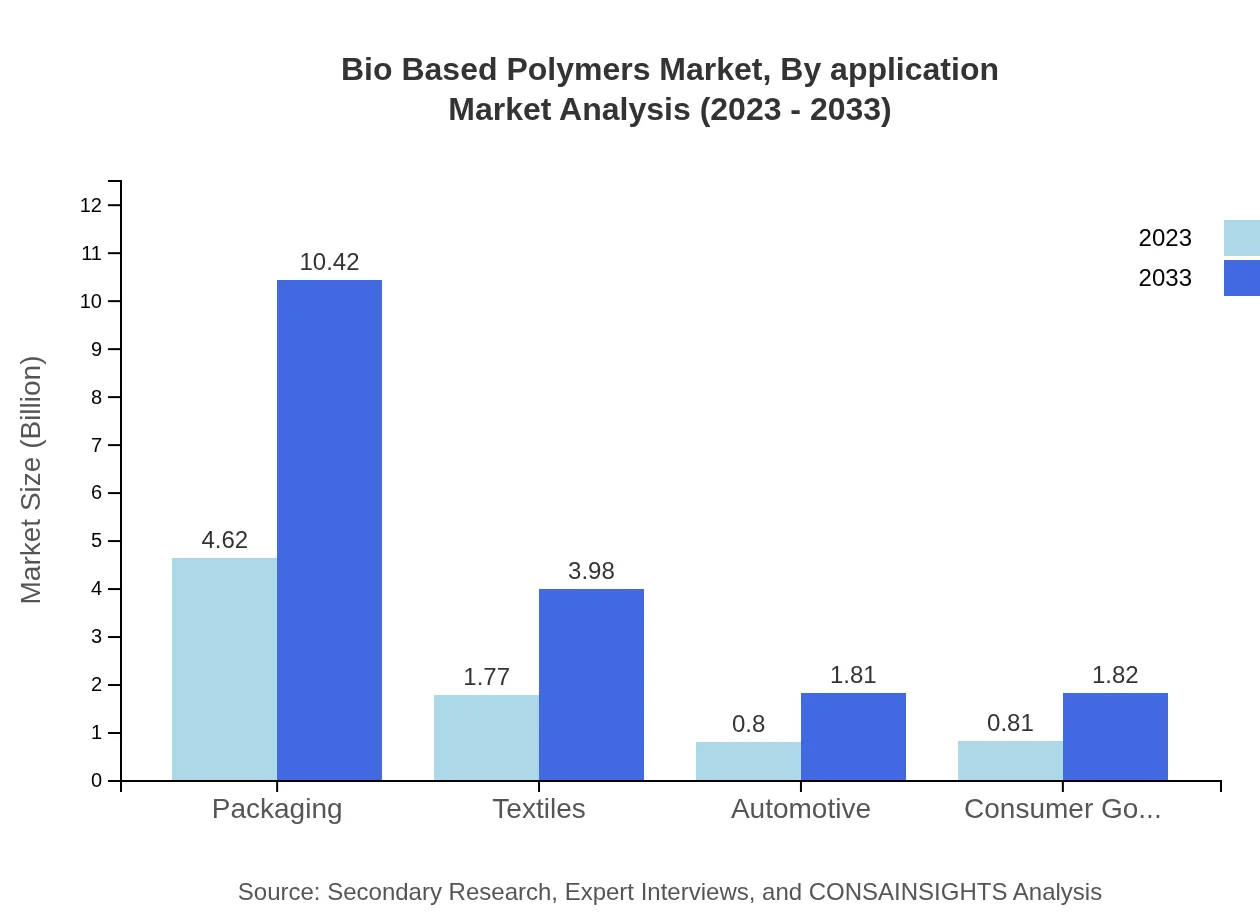

Key applications of bio-based polymers include packaging, textiles, automotive, and electronics. Packaging is the leading application segment, representing 57.79% of the market share in 2023, valued at $4.62 billion, projected to reach $10.42 billion by 2033. Other notable applications include textiles and automotive sectors, with significant growth prospects due to increasing adoption of sustainable materials.

Bio Based Polymers Market Analysis By Production Method

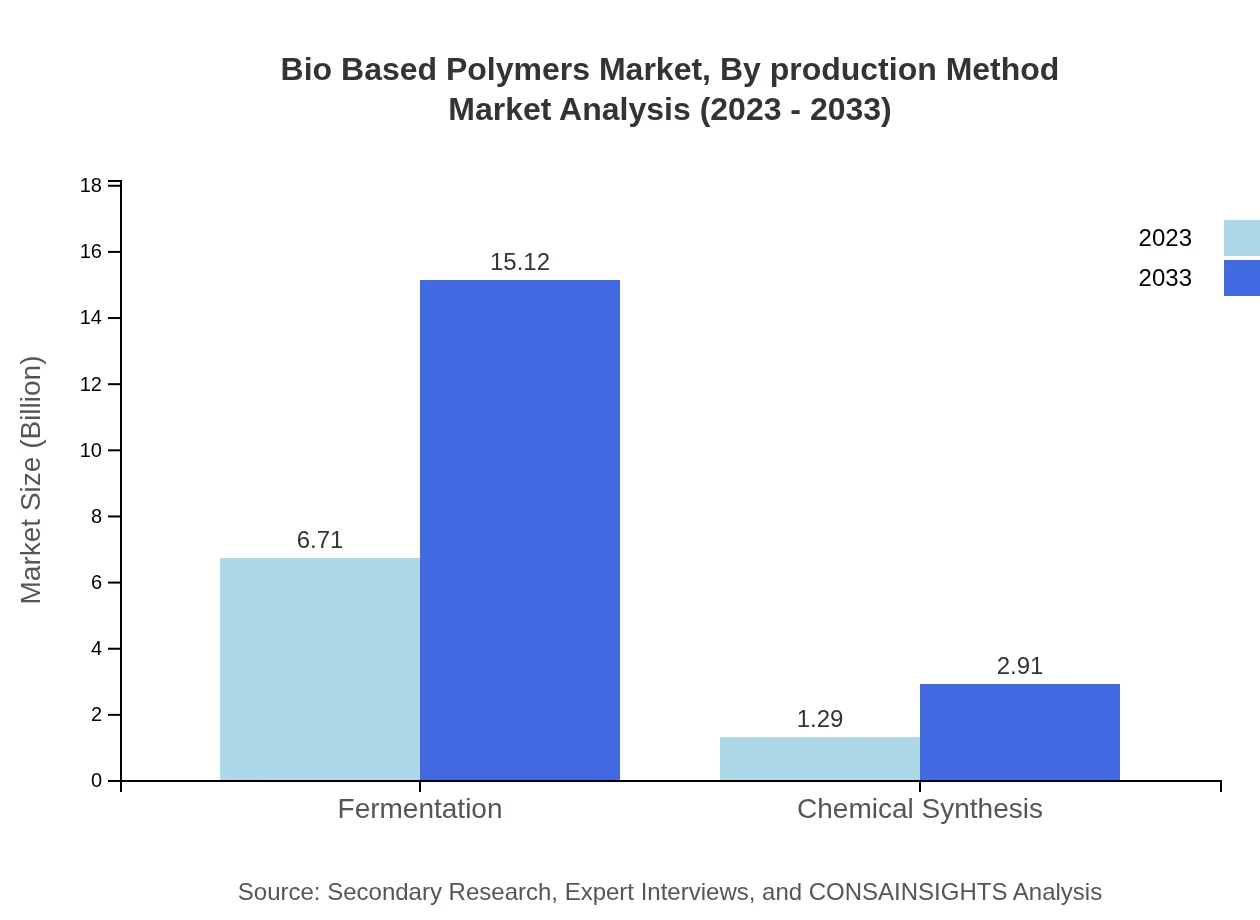

Major production methods for bio-based polymers include fermentation and chemical synthesis. Fermentation dominates the market with an 83.87% share in 2023, thanks to its efficient conversion of biomass into biopolymers. In contrast, chemical synthesis accounts for 16.13% of the market, with applications in producing certain specialized polymers.

Bio Based Polymers Market Analysis By End User

Bio-based polymers cater to diverse end-user industries, including food and beverages, construction, and consumer goods. The food and beverage sector accounts for the largest share at 60.23%, driven by sustainable packaging solutions. Other crucial industries also embrace bio-based polymers, anticipating significant growth as sustainability becomes a key factor.

Bio Based Polymers Market Analysis By Region

The regional dynamics of the bio-based polymers market reveal substantial variations in growth trajectories. North America and Europe are expected to lead the market, driven by regulatory frameworks favoring eco-friendly materials. The Asia Pacific region is emerging as a new powerhouse for production and consumption due to increasing investments and environmental awareness.

Bio Based Polymers Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bio Based Polymers Industry

NatureWorks LLC:

A leading provider of biopolymer solutions, NatureWorks specializes in the production of Ingeo™ biopolymer made from renewable plant materials.BASF SE:

BASF is a global chemical company that emphasizes sustainability, offering a range of bio-based products under its portfolio to meet growing market needs.Novamont S.p.A.:

An Italian company that leads in the development of biodegradable and compostable bioplastics, Novamont focuses on integrating sustainability into product design.Cargill Inc.:

Cargill supplies renewable ingredients for bio-based polymer production, investing heavily in R&D to innovate sustainable solutions.BIO-Tec Environmental:

Specializes in compostable products, creating advanced formulations of bio-based polymers for various applications in the consumer goods market.We're grateful to work with incredible clients.

FAQs

What is the market size of bio Based Polymers?

The bio-based polymers market was valued at approximately $8.0 billion in 2023, with an impressive CAGR of 8.2% projected until 2033. This growth reflects an increasing demand for sustainable materials across various industries, including packaging, textiles, and automotive.

What are the key market players or companies in the bio Based Polymers industry?

Key players in the bio-based polymers industry include BASF, NatureWorks, and Braskem. These companies drive innovation in sustainable polymer production and are pivotal in the growing adoption of bioplastics across multiple sectors.

What are the primary factors driving the growth in the bio Based Polymers industry?

Major growth drivers in the bio-based polymers industry include environmental concerns, government regulations promoting sustainable materials, and increased consumer demand for eco-friendly products. Additionally, advancements in technology and production processes bolster market expansion.

Which region is the fastest Growing in the bio Based Polymers market?

The fastest-growing region in the bio-based polymers market is Europe, projected to grow from $2.96 billion in 2023 to $6.68 billion by 2033. This region leads in sustainability regulations and innovative product development.

Does ConsaInsights provide customized market report data for the bio Based Polymers industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the bio-based polymers industry. This includes detailed analyses on market trends, key players, and growth opportunities.

What deliverables can I expect from this bio Based Polymers market research project?

Deliverables from the bio-based polymers market research project include comprehensive market analysis reports, competitor insights, segmentation data, trend forecasts, and customized recommendations that align with your business goals.

What are the market trends of bio Based Polymers?

Current market trends in bio-based polymers include an increase in the use of Polylactic Acid (PLA), which commands a significant market share. There is also a rising interest in sustainable materials within packaging, textiles, and construction sectors.