Bio Implants Market Report

Published Date: 31 January 2026 | Report Code: bio-implants

Bio Implants Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bio Implants market, covering market trends, segmentation, and insights from 2023 to 2033, including detailed forecasts and competitive landscape assessments.

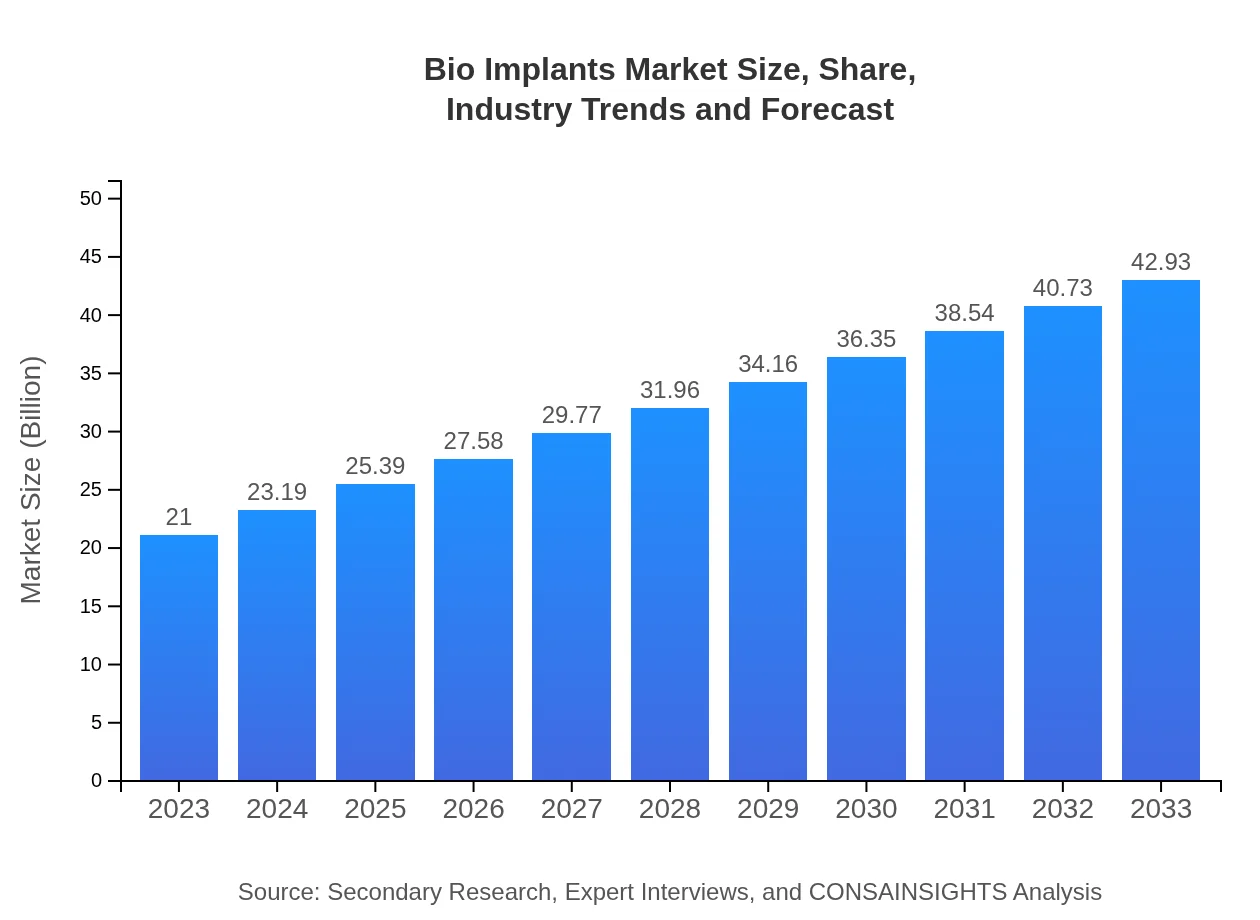

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $21.00 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $42.93 Billion |

| Top Companies | Medtronic , DePuy Synthes, Stryker Corporation, Zimmer Biomet, B. Braun |

| Last Modified Date | 31 January 2026 |

Bio Implants Market Overview

Customize Bio Implants Market Report market research report

- ✔ Get in-depth analysis of Bio Implants market size, growth, and forecasts.

- ✔ Understand Bio Implants's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bio Implants

What is the Market Size & CAGR of Bio Implants market in 2023?

Bio Implants Industry Analysis

Bio Implants Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bio Implants Market Analysis Report by Region

Europe Bio Implants Market Report:

Europe's market value is expected to increase from USD 6.21 billion in 2023 to USD 12.69 billion by 2033, driven by aging demographics and increasing surgical interventions.Asia Pacific Bio Implants Market Report:

The Asia Pacific Bio Implants market is predicted to expand from USD 3.91 billion in 2023 to USD 7.99 billion by 2033. The region benefits from increasing healthcare expenditure, a growing number of surgical procedures, and advances in medical technology.North America Bio Implants Market Report:

North America remains the largest market, projected to grow from USD 7.78 billion in 2023 to USD 15.90 billion by 2033. The major factors include high healthcare spending, technological advancements, and a strong focus on research and development.South America Bio Implants Market Report:

In South America, the market is set to rise from USD 1.92 billion in 2023 to USD 3.93 billion by 2033. Growth is attributed to a steady increase in healthcare access and the adoption of innovative implant technologies.Middle East & Africa Bio Implants Market Report:

The Middle East and Africa market is forecasted to grow from USD 1.18 billion in 2023 to USD 2.41 billion by 2033 as a result of rising healthcare investments and growing awareness regarding advanced medical procedures.Tell us your focus area and get a customized research report.

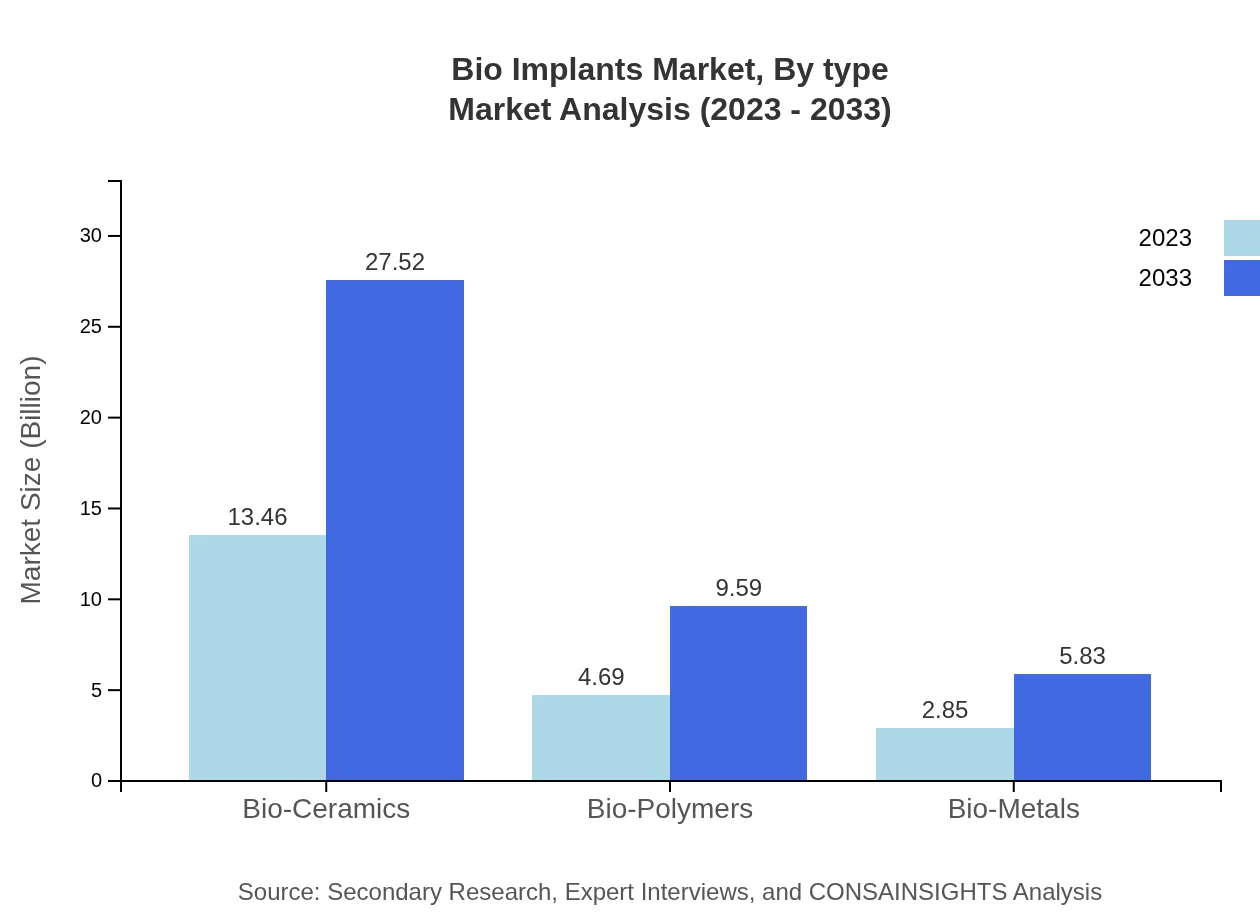

Bio Implants Market Analysis By Type

The Bio-Implants market is segmented into three primary types: Bio-Ceramics, Bio-Polymers, and Bio-Metals. Bio-Ceramics dominate the market with a share of 64.1% in 2023, showcasing remarkable resilience and growth potential, expected to reach USD 27.52 billion by 2033. Bio-Polymers also show significant promise, with a size of USD 4.69 billion in 2023, doubling by 2033, while Bio-Metals exhibit steady growth from USD 2.85 billion to USD 5.83 billion within the same timeframe.

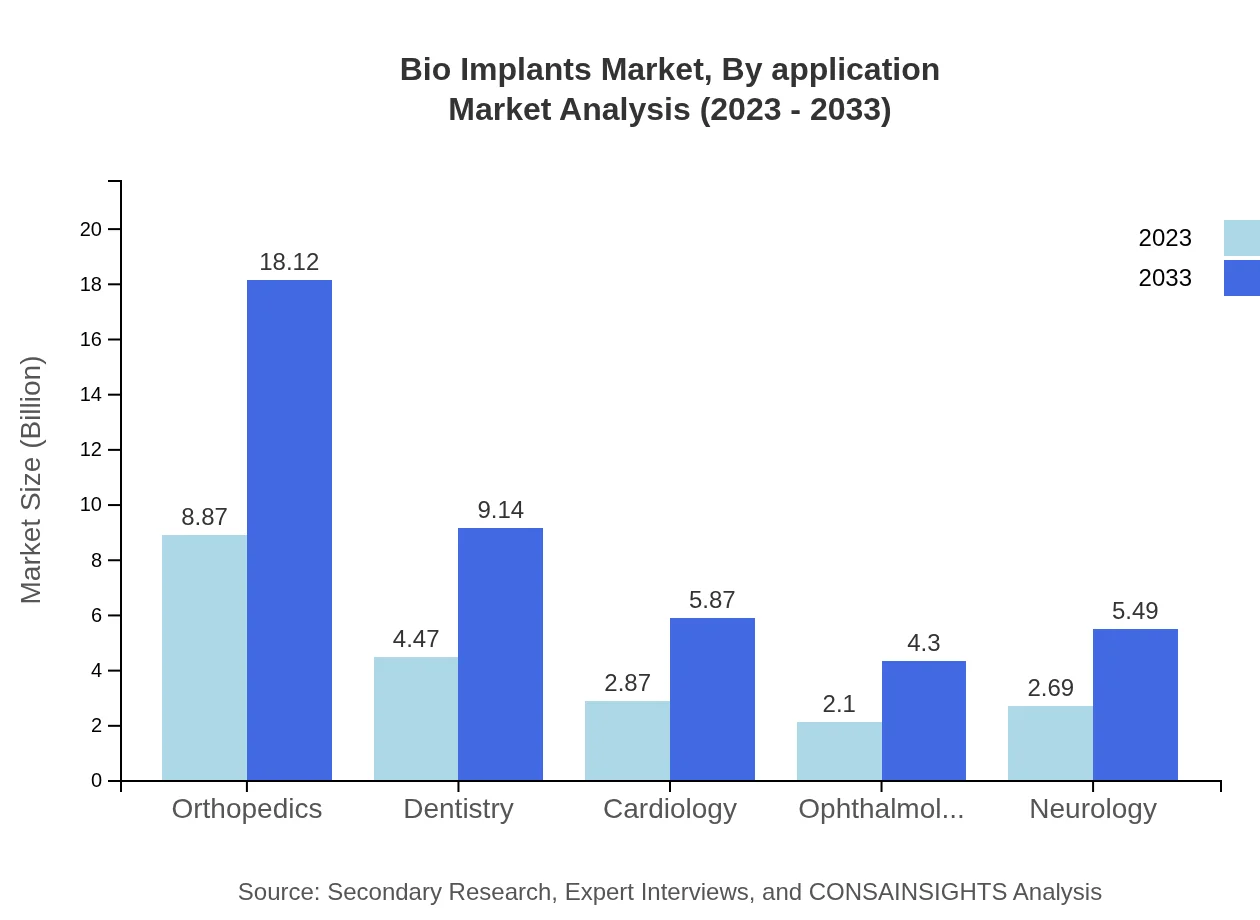

Bio Implants Market Analysis By Application

Applications of bio-implants span several medical specialties including Orthopedics, Dentistry, Cardiology, Ophthalmology, and Neurology. Orthopedics leads the market with a significant share of 42.22%, driven by the rising incidence of bone-related disorders. Dentistry comes next with a notable market share of 21.29%, increasingly fueled by cosmetic procedures. Other sectors, such as Cardiology and Ophthalmology, exhibit consistent growth, reflecting the expanding applications of bio-implants.

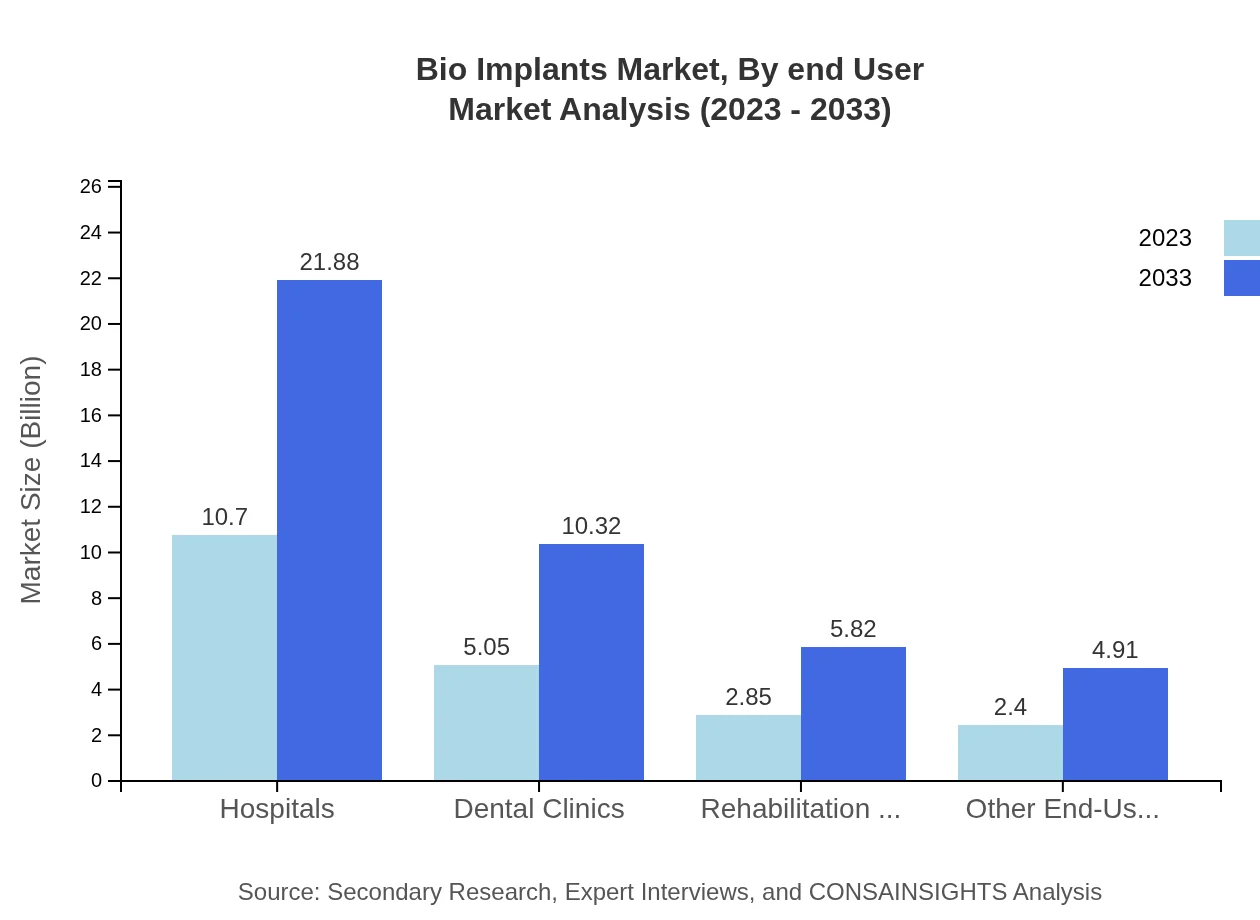

Bio Implants Market Analysis By End User

Hospitals account for a substantial share of the bio-implants market at 50.97% in 2023. This is attributed to the high volume of surgeries performed. Dental clinics and rehabilitation centers also remain significant contributors, with market shares of 24.04% and 13.55% respectively, reflecting the increased adoption of bio-implants in various clinical settings.

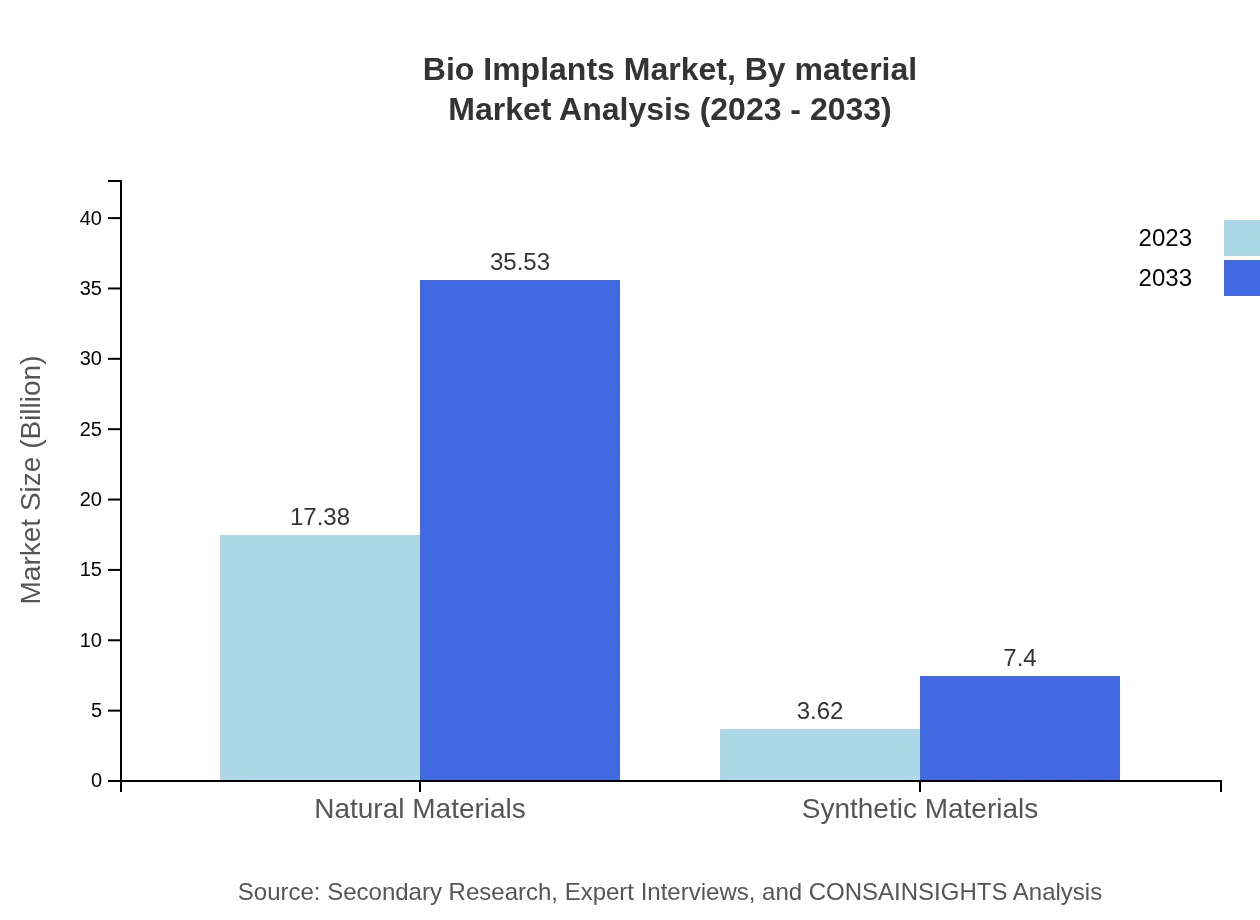

Bio Implants Market Analysis By Material

The Bio-Implants market is categorized into Natural and Synthetic materials, with Natural materials dominating the landscape at 82.77% share in 2023. The preference for biocompatible and biodegradable options drives this trend. Synthetic materials, while smaller in size, are gaining traction, reflecting ongoing innovations in medical technology and new product developments that enhance patient outcomes.

Bio Implants Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bio Implants Industry

Medtronic :

A leader in medical technology, Medtronic focuses on various solutions including bio-implants, advancing healthcare solutions globally.DePuy Synthes:

Specializing in orthopedic bio-implants, DePuy Synthes is known for innovative products that enhance surgical outcomes and patient lives.Stryker Corporation:

With a broad portfolio in surgical instruments and bio-implants, Stryker Corporation is committed to advancing medical device technologies.Zimmer Biomet:

Zimmer Biomet, recognized for its expertise in musculoskeletal health, provides a wide array of bio-implants tailored for various medical applications.B. Braun:

B. Braun is an established player in the bio-implants market, offering innovative solutions for surgery and healthcare through reliable bio-implants.We're grateful to work with incredible clients.

FAQs

What is the market size of bio Implants?

The global bio-implants market is valued at approximately $21 billion in 2023, with a projected growth at a CAGR of 7.2% through 2033, indicating robust demand and expansion in this industry.

What are the key market players or companies in this bio Implants industry?

Key players in the bio-implants industry include major medical device manufacturers such as Medtronic, Stryker, Johnson & Johnson, Zimmer Biomet, and Boston Scientific, which are recognized for their innovative bio-implant solutions and extensive research in the field.

What are the primary factors driving the growth in the bio Implants industry?

The growth in the bio-implants industry is driven by increasing demand for minimally invasive surgeries, advancements in biotechnology, rising geriatric population, and the expanding prevalence of chronic diseases that require bio-implant interventions.

Which region is the fastest Growing in the bio Implants?

North America is the fastest-growing region in the bio-implants market, expanding from $7.78 billion in 2023 to $15.90 billion by 2033. Other notable growth regions include Europe and Asia Pacific, with significant market shares.

Does ConsaInsights provide customized market report data for the bio Implants industry?

Yes, ConsaInsights offers customized market reports for the bio-implants industry, tailoring insights to specific client needs, sectors, and geographic regions to provide comprehensive and actionable data.

What deliverables can I expect from this bio Implants market research project?

From the bio-implants market research project, clients can expect detailed market analysis, forecasts, competitive landscape assessments, regional insights, and segmented data across different bio-implant types and applications.

What are the market trends of bio Implants?

Market trends in bio-implants indicate a shift towards advanced biomaterials, increasing investments in research and development, increasing adoption of 3D printing technologies, and a growing emphasis on personalized medicine within the sector.