Bio Polylactic Acid Pla Market Report

Published Date: 02 February 2026 | Report Code: bio-polylactic-acid-pla

Bio Polylactic Acid Pla Market Size, Share, Industry Trends and Forecast to 2033

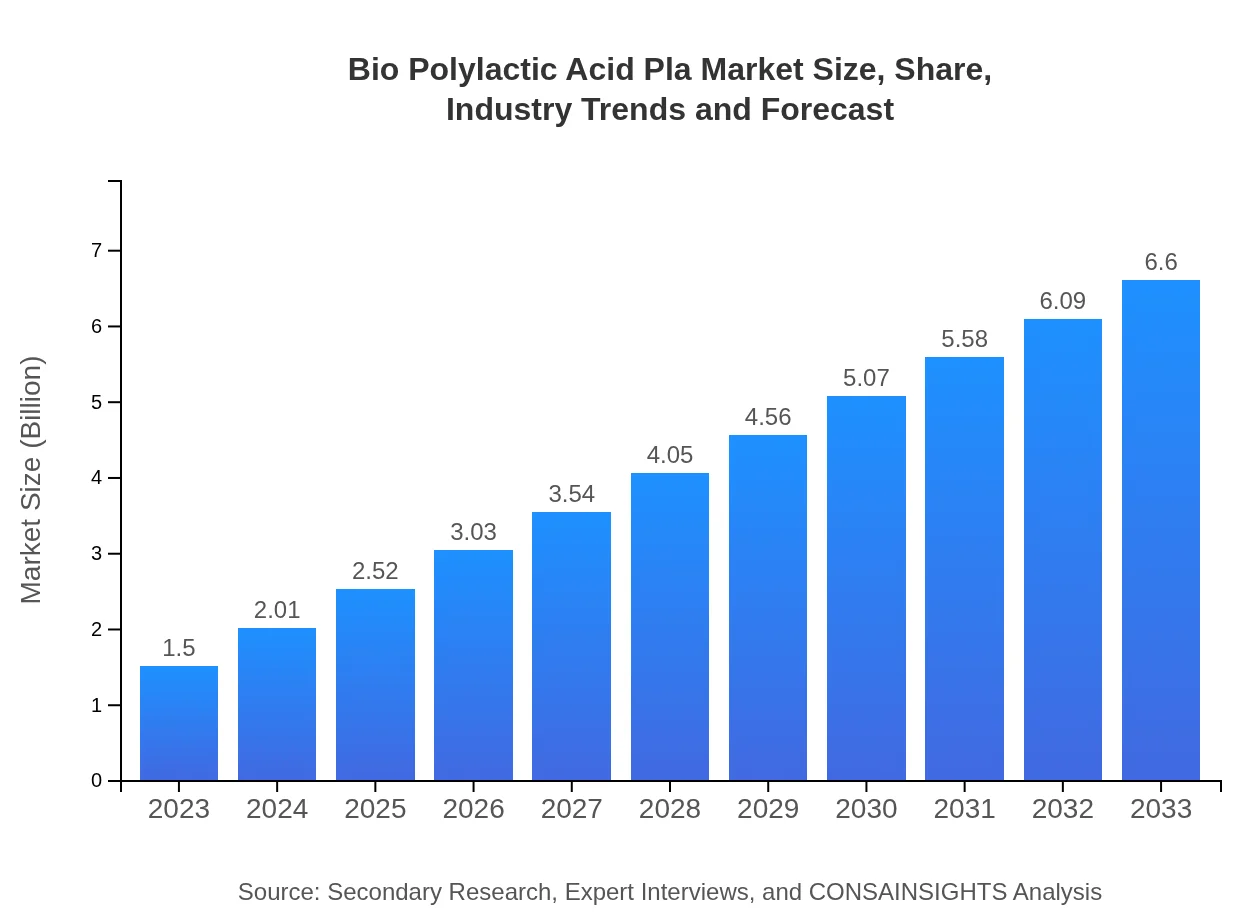

This report offers an in-depth analysis of the Bio Polylactic Acid PLA market, projecting growth from 2023 to 2033. It includes market size, trends, regional insights, and an overview of industry leaders to guide strategic decisions.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.50 Billion |

| CAGR (2023-2033) | 15.2% |

| 2033 Market Size | $6.60 Billion |

| Top Companies | NatureWorks LLC, BASF SE, Dupont, Novamont S.p.A. |

| Last Modified Date | 02 February 2026 |

Bio Polylactic Acid PLA Market Overview

Customize Bio Polylactic Acid Pla Market Report market research report

- ✔ Get in-depth analysis of Bio Polylactic Acid Pla market size, growth, and forecasts.

- ✔ Understand Bio Polylactic Acid Pla's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bio Polylactic Acid Pla

What is the Market Size & CAGR of Bio Polylactic Acid PLA market in 2023?

Bio Polylactic Acid PLA Industry Analysis

Bio Polylactic Acid PLA Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bio Polylactic Acid PLA Market Analysis Report by Region

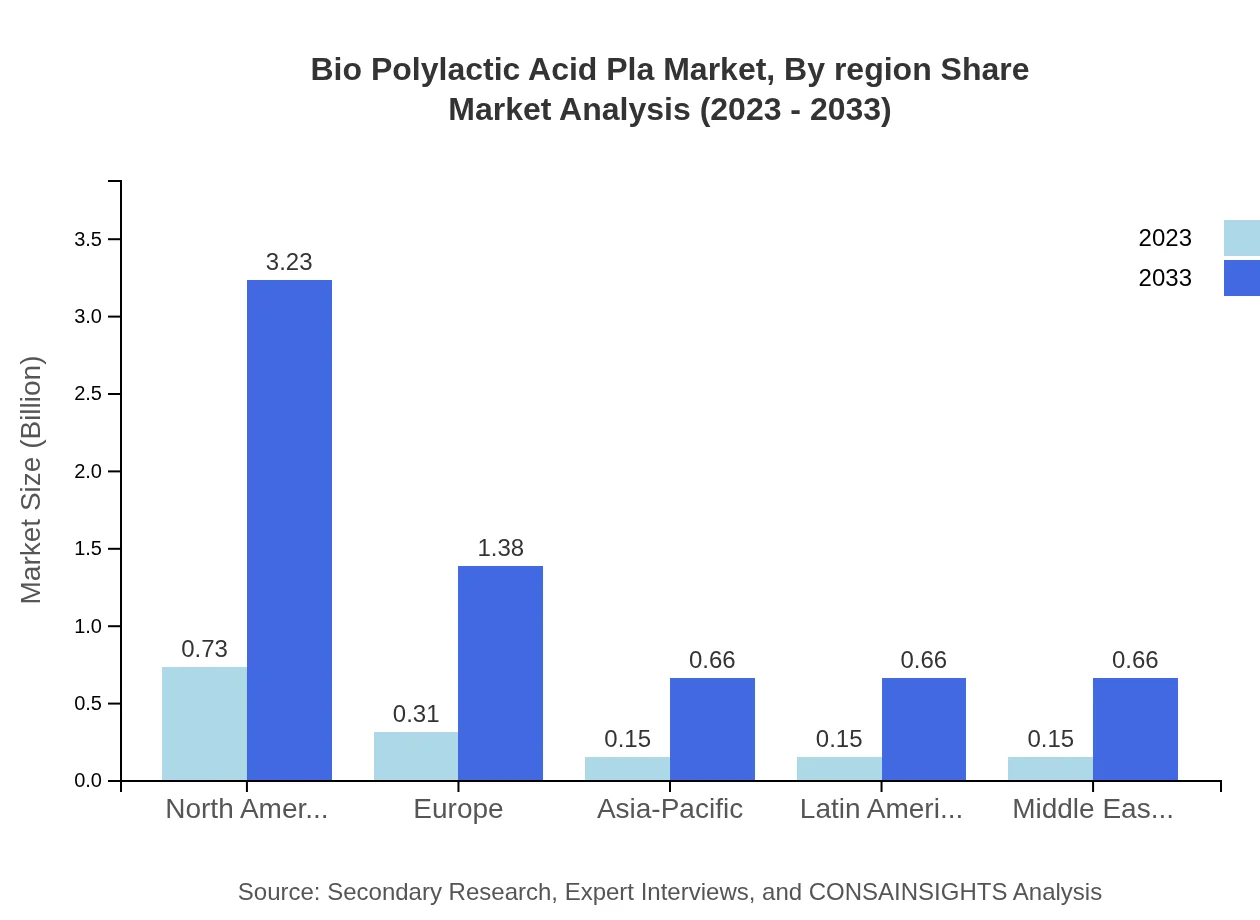

Europe Bio Polylactic Acid Pla Market Report:

Europe represents a critical market for Bio Polylactic Acid, expecting to grow from $0.48 billion in 2023 to $2.12 billion by 2033. This is driven by strong governmental policies advocating for sustainable materials and high consumer demand in the packaging and textile industries.Asia Pacific Bio Polylactic Acid Pla Market Report:

The Asia-Pacific region is poised for substantial growth in the Bio Polylactic Acid market, projected to increase from $0.27 billion in 2023 to $1.18 billion by 2033. This growth is attributed to rising industrialization, demand for sustainable packaging, and significant investments in bioplastics production.North America Bio Polylactic Acid Pla Market Report:

The North American market for Bio Polylactic Acid is estimated to grow from $0.54 billion in 2023 to $2.36 billion by 2033. This growth is fueled by stringent regulations on plastic consumption and an upsurge in the adoption of eco-friendly packaging solutions mainly in the U.S. and Canada.South America Bio Polylactic Acid Pla Market Report:

In South America, the market for Bio Polylactic Acid is expected to reach $0.26 billion by 2033, showcasing solid growth from $0.06 billion in 2023. Increased consumer awareness leading to a push for sustainable alternatives, particularly in Brazil and Argentina, is driving this trend.Middle East & Africa Bio Polylactic Acid Pla Market Report:

In the Middle East and Africa, the Bio Polylactic Acid market is projected to expand from $0.16 billion in 2023 to $0.69 billion by 2033. Growth in this region is supported by increasing investments in sustainable manufacturing technologies and rising demand for green materials.Tell us your focus area and get a customized research report.

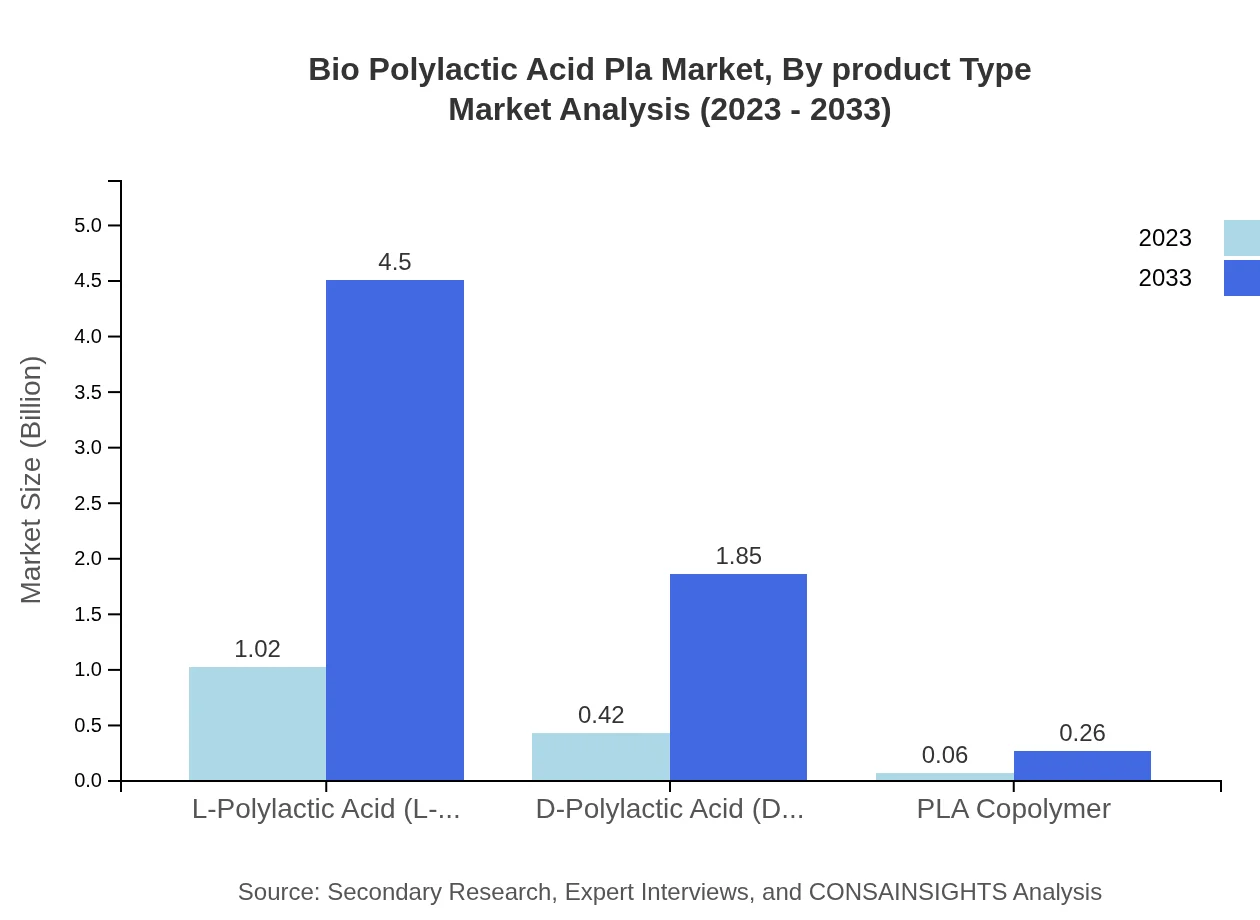

Bio Polylactic Acid Pla Market Analysis By Product Type

The Bio-Polylactic Acid market by product type is largely dominated by L-PLA and D-PLA. For instance, the market for L-PLA is expected to grow from $1.02 billion in 2023 to $4.50 billion in 2033, capturing approximately 68.09% market share. D-PLA, on the other hand, is anticipated to increase from $0.42 billion to $1.85 billion, holding a 28.02% share by 2033.

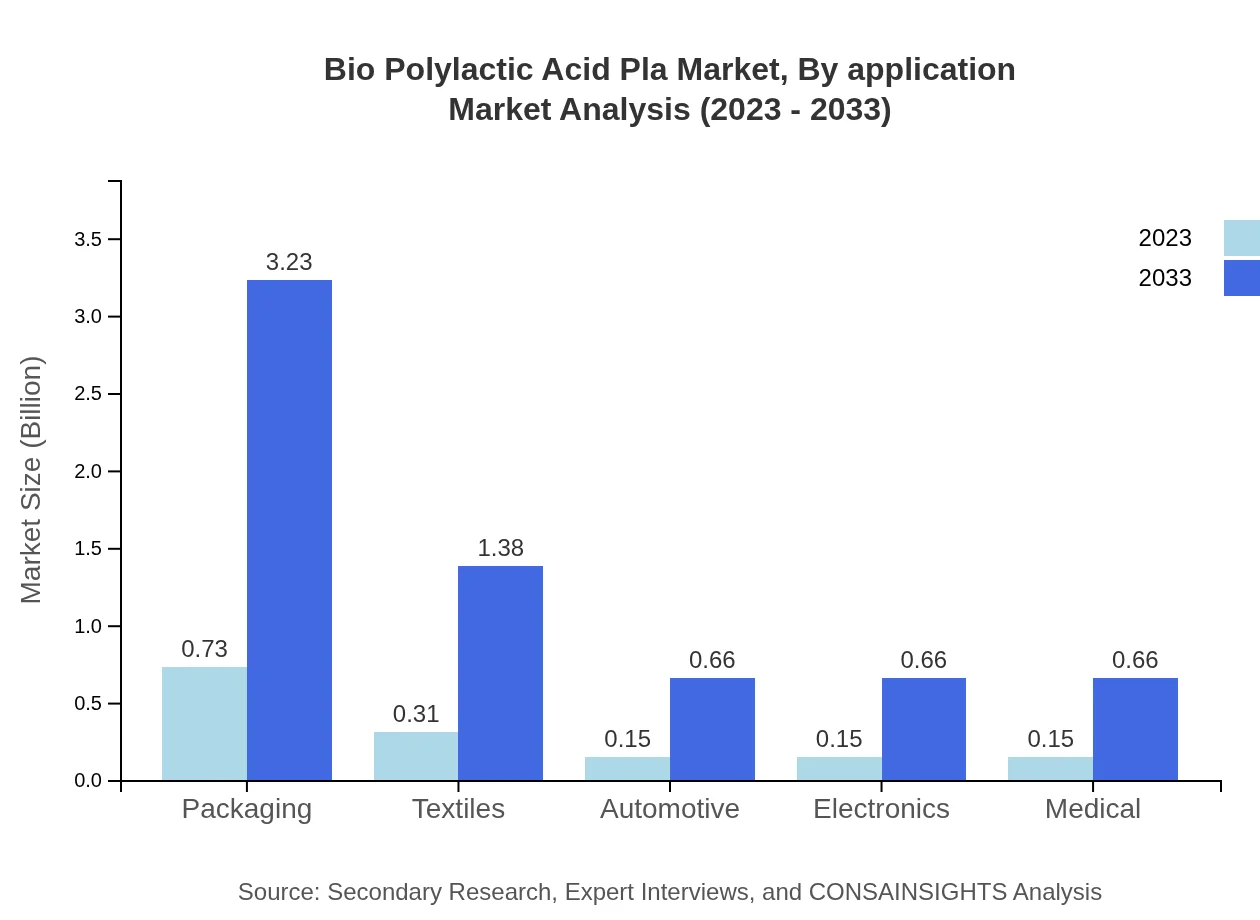

Bio Polylactic Acid Pla Market Analysis By Application

In terms of application, the food industry shares the largest portion, expected to account for $0.73 billion in 2023 and rise to $3.23 billion by 2033, representing 48.9% of the market. The packaging sector also shows strong potential, growing significantly from $0.73 billion to $3.23 billion during this period.

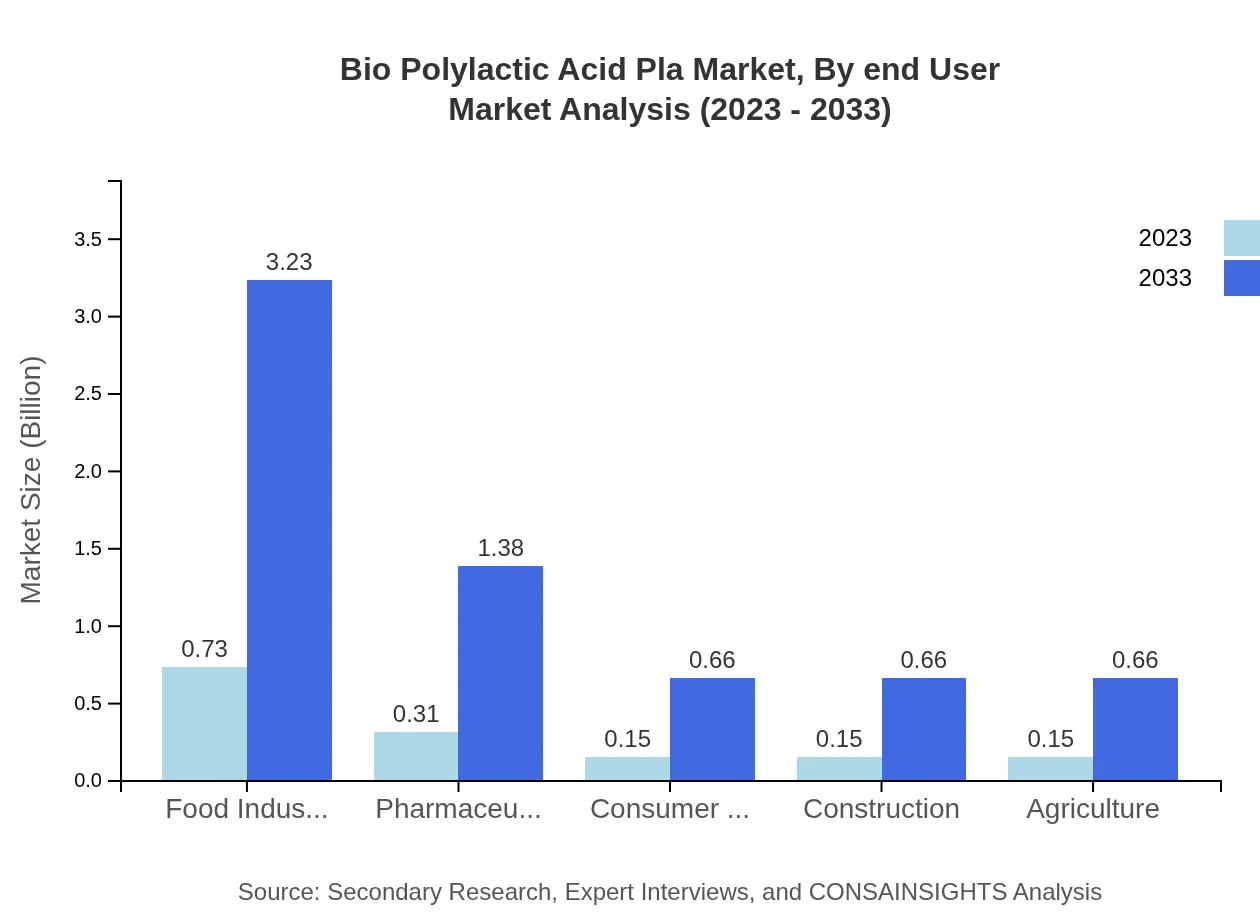

Bio Polylactic Acid Pla Market Analysis By End User

The end-user analysis reveals the food industry, pharmaceuticals, and consumer goods to be major contributors. The food sector is expected to grow from $0.73 billion to $3.23 billion, while the pharmaceutical sector shows a substantial increase from $0.31 billion to $1.38 billion.

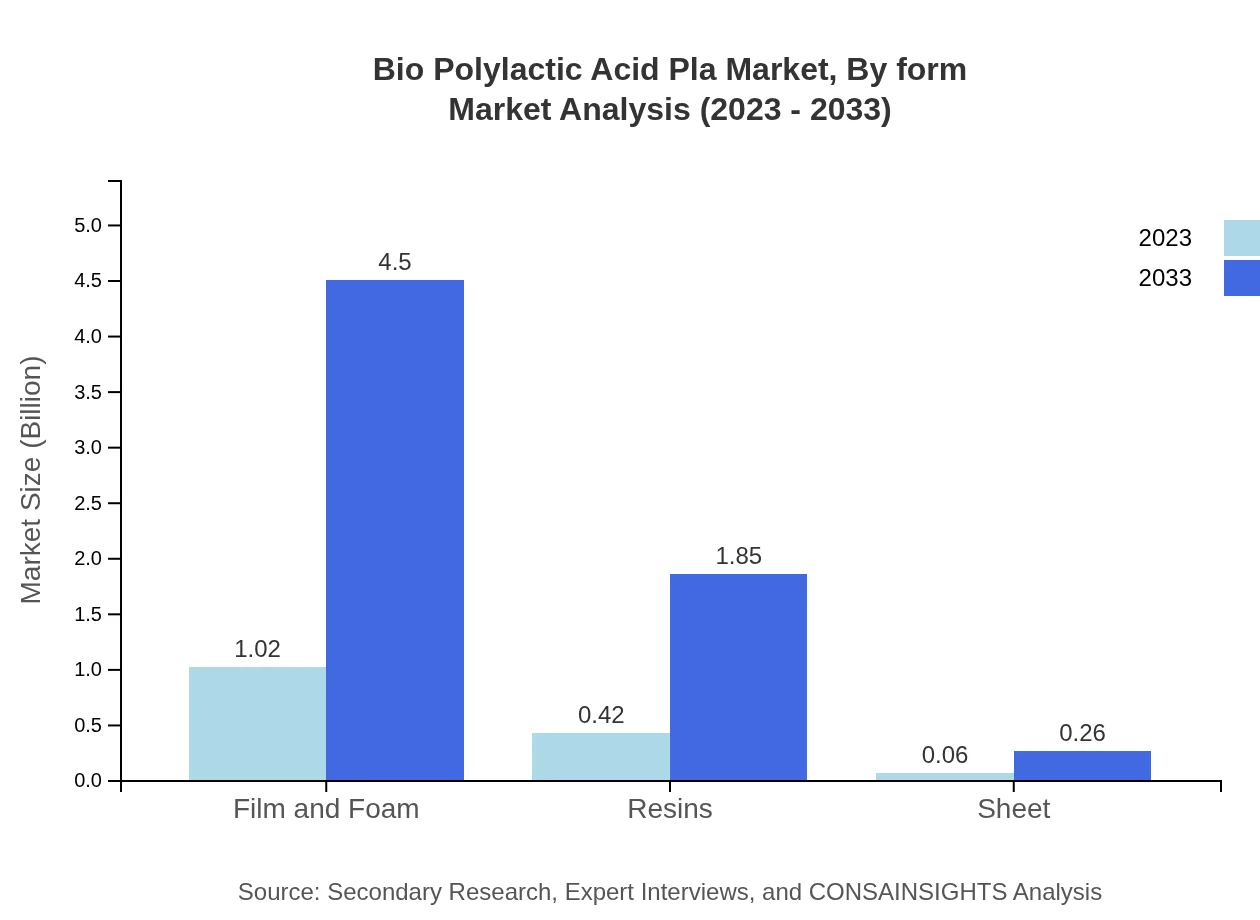

Bio Polylactic Acid Pla Market Analysis By Form

Market entries by form showcase a significant preference for films and foams, capturing the largest segment of $1.02 billion in 2023, projected to rise to $4.50 billion by 2033, making up 68.09% of the market.

Bio Polylactic Acid PLA Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bio Polylactic Acid PLA Industry

NatureWorks LLC:

NatureWorks is a pioneer in the field of bioplastics, specializing in the production of Ingeo biopolymer, made from renewable resources and used in a variety of applications including packaging and medical products.BASF SE:

BASF SE offers a diverse portfolio of products including biodegradable polymers and is committed to advancing sustainable and innovative solutions in the materials sector.Dupont:

Dupont is a key player in the bioplastics market, focusing on research and application development for PLA materials across various sectors including automotive and electronics.Novamont S.p.A.:

An Italian company specializing in bioplastics, Novamont is known for its compostable and biodegradable products that meet high-performance standards, suited for various applications.We're grateful to work with incredible clients.

FAQs

What is the market size of bio Polylactic Acid Pla?

The bio-polylactic acid (PLA) market is currently valued at approximately 1.5 billion dollars in 2023, with expected growth leading to a projection of substantial market expansion, demonstrating a compound annual growth rate (CAGR) of 15.2% over the next decade.

What are the key market players or companies in this bio Polylactic Acid Pla industry?

Key players in the bio-polylactic acid (PLA) industry include established companies specializing in bioplastics production, research, and innovation, alongside emerging players contributing to sustainable packaging solutions and biodegradable materials contributing to market competition and advancements.

What are the primary factors driving the growth in the bio Polylactic Acid Pla industry?

Growth in the bio-polylactic acid market is primarily driven by increasing demand for biodegradable and sustainable materials across multiple industries, government regulations favoring eco-friendly options, rising consumer awareness regarding environmental issues, and advancements in production technologies.

Which region is the fastest Growing in the bio Polylactic Acid Pla?

Europe is the fastest-growing region in the bio-polylactic acid market, expected to grow from 0.48 billion to 2.12 billion dollars from 2023 to 2033, showcasing significant investment in sustainable materials and increased application across various sectors.

Does ConsaInsights provide customized market report data for the bio Polylactic Acid Pla industry?

Yes, ConsaInsights offers customized market report data for the bio-polylactic acid (PLA) industry, tailoring research insights and projections to meet specific client needs, helping businesses navigate the unique challenges and opportunities within the bioplastics market.

What deliverables can I expect from this bio Polylactic Acid Pla market research project?

Deliverables from the bio-polylactic acid (PLA) market research project typically include comprehensive market analysis, segmentation insights, competitive landscape assessment, growth forecasts, and strategic recommendations tailored to drive business growth in the bioplastics sector.

What are the market trends of bio Polylactic Acid Pla?

Current trends in the bio-polylactic acid market include an increasing shift towards sustainable packaging solutions, growth in alternative applications within the food and pharmaceuticals industries, and advancements in product formulations that enhance performance while remaining environmentally friendly.