Bioactive Ingredients Market Report

Published Date: 31 January 2026 | Report Code: bioactive-ingredients

Bioactive Ingredients Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the bioactive ingredients market, offering insights on market size, growth forecasts, trends, and competitive landscape for the forecast period from 2023 to 2033.

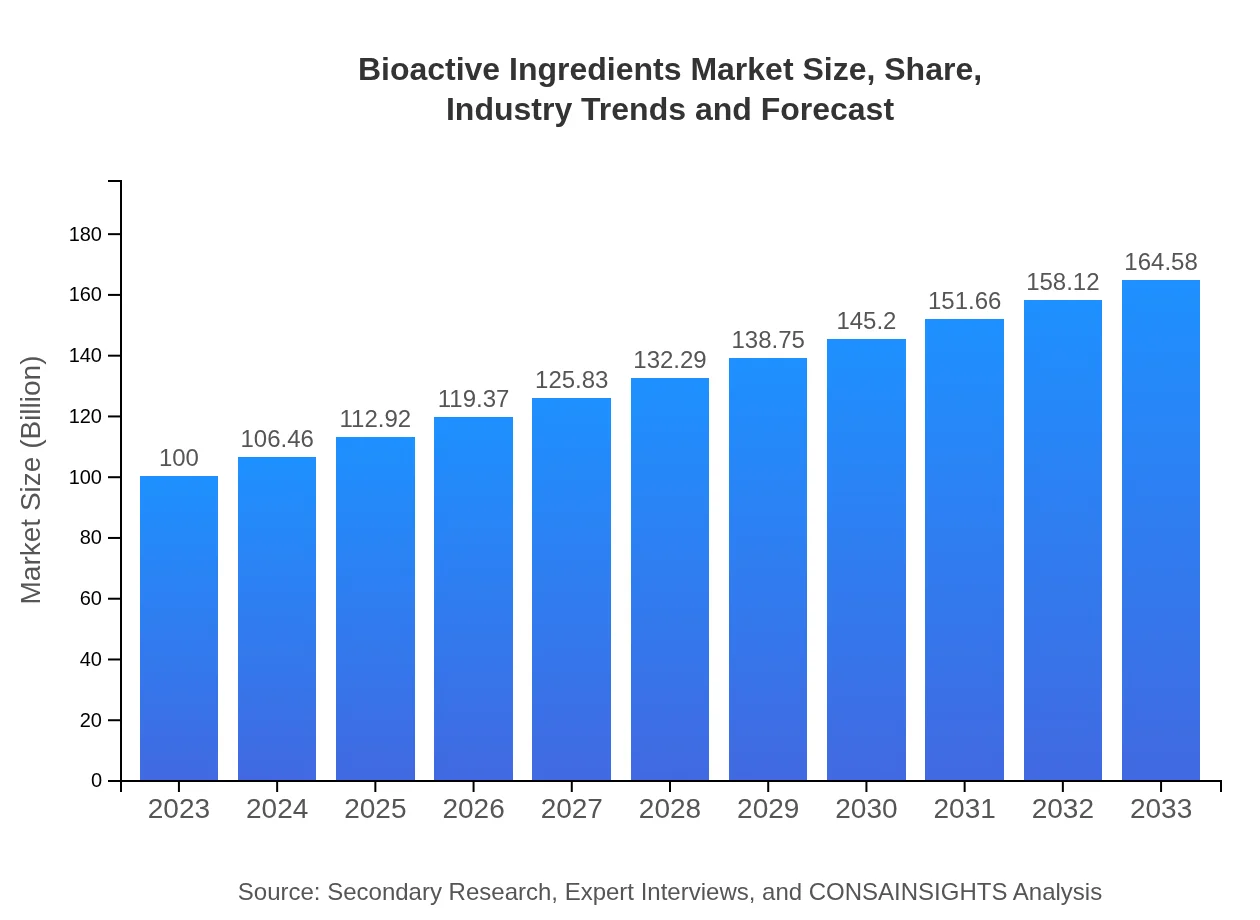

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $100.00 Million |

| CAGR (2023-2033) | 5% |

| 2033 Market Size | $164.58 Million |

| Top Companies | DSM Nutritional Products, BASF SE, Archer Daniels Midland Company (ADM), DuPont de Nemours, Inc. |

| Last Modified Date | 31 January 2026 |

Bioactive Ingredients Market Overview

Customize Bioactive Ingredients Market Report market research report

- ✔ Get in-depth analysis of Bioactive Ingredients market size, growth, and forecasts.

- ✔ Understand Bioactive Ingredients's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioactive Ingredients

What is the Market Size & CAGR of Bioactive Ingredients market in 2023?

Bioactive Ingredients Industry Analysis

Bioactive Ingredients Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioactive Ingredients Market Analysis Report by Region

Europe Bioactive Ingredients Market Report:

Europe's bioactive ingredients market is expected to increase significantly from $36.01 billion in 2023 to $59.26 billion in 2033. The region's strict regulations concerning food safety and health claims alongside the growing trend of vegetarianism and veganism drive the adoption of bioactive compounds, particularly in the food and beverages sector.Asia Pacific Bioactive Ingredients Market Report:

In the Asia Pacific region, the market for bioactive ingredients is forecasted to grow from $18.80 billion in 2023 to $30.94 billion in 2033. The demand for organic food products and an increasing preference for health supplements are driving this growth. Additionally, emerging economies such as India and China are witnessing a rise in disposable incomes, leading to an uptick in consumer spending on health and wellness products.North America Bioactive Ingredients Market Report:

North America is projected to see the bioactive ingredients market expand from $32.34 billion in 2023 to $53.22 billion by 2033. The United States leads the region due to a robust health supplement sector and increasing consumer preference for functional foods. Regulatory frameworks promoting the use of bioactive compounds further foster market growth.South America Bioactive Ingredients Market Report:

The South American bioactive ingredients market is anticipated to increase from $3.64 billion in 2023 to $5.99 billion in 2033. The growth hinges on rising health awareness and the potential of agricultural biodiversity in the region. Brazil and Argentina are main contributors, with a focus on natural extracts in the cosmetics and food sectors.Middle East & Africa Bioactive Ingredients Market Report:

The Middle East and Africa market for bioactive ingredients is estimated to grow from $9.21 billion in 2023 to $15.16 billion in 2033. Rapid urbanization, increased disposable income, and a rise in health-conscious consumers contribute to this growth trajectory. There is also increasing demand for herbal products and functional foods in various countries, notably South Africa and the UAE.Tell us your focus area and get a customized research report.

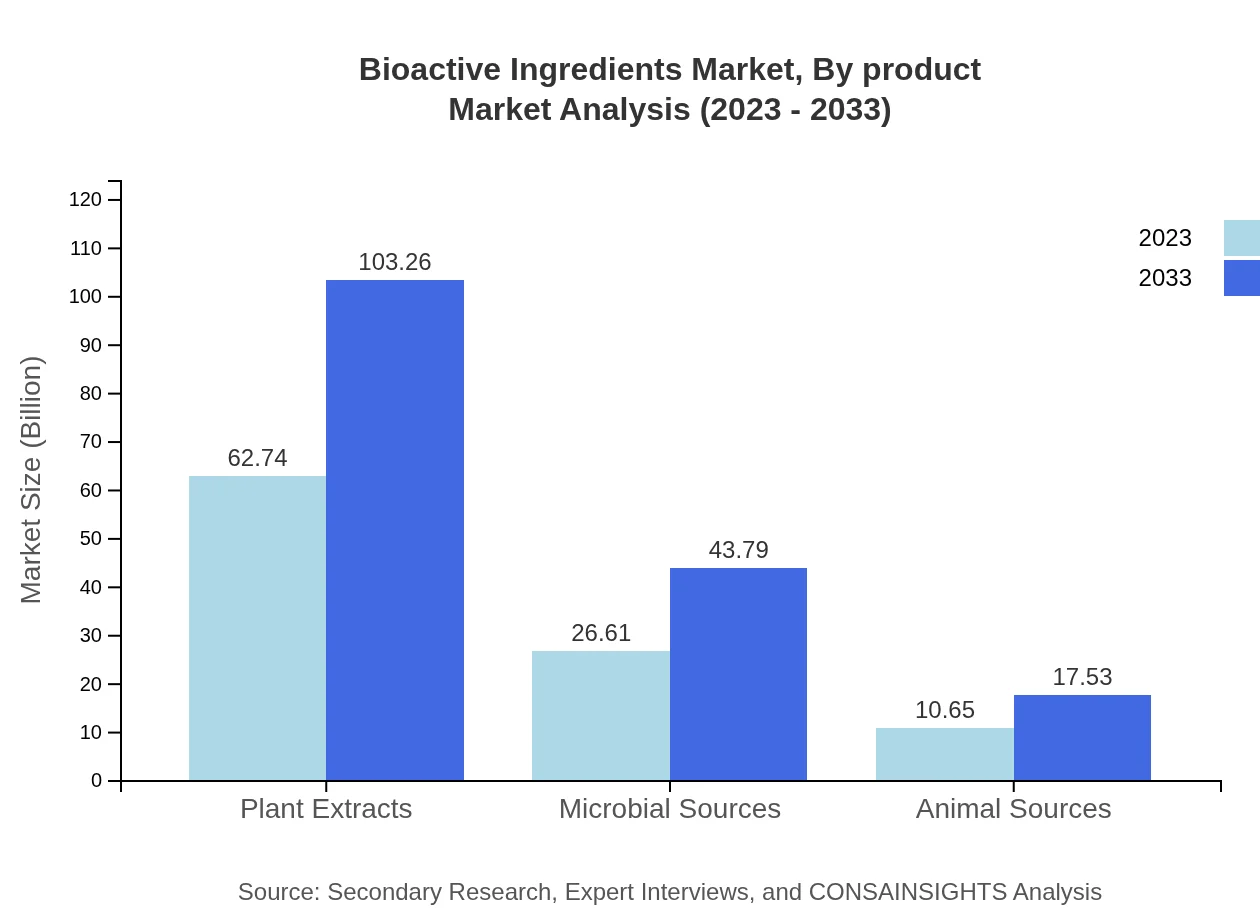

Bioactive Ingredients Market Analysis By Product

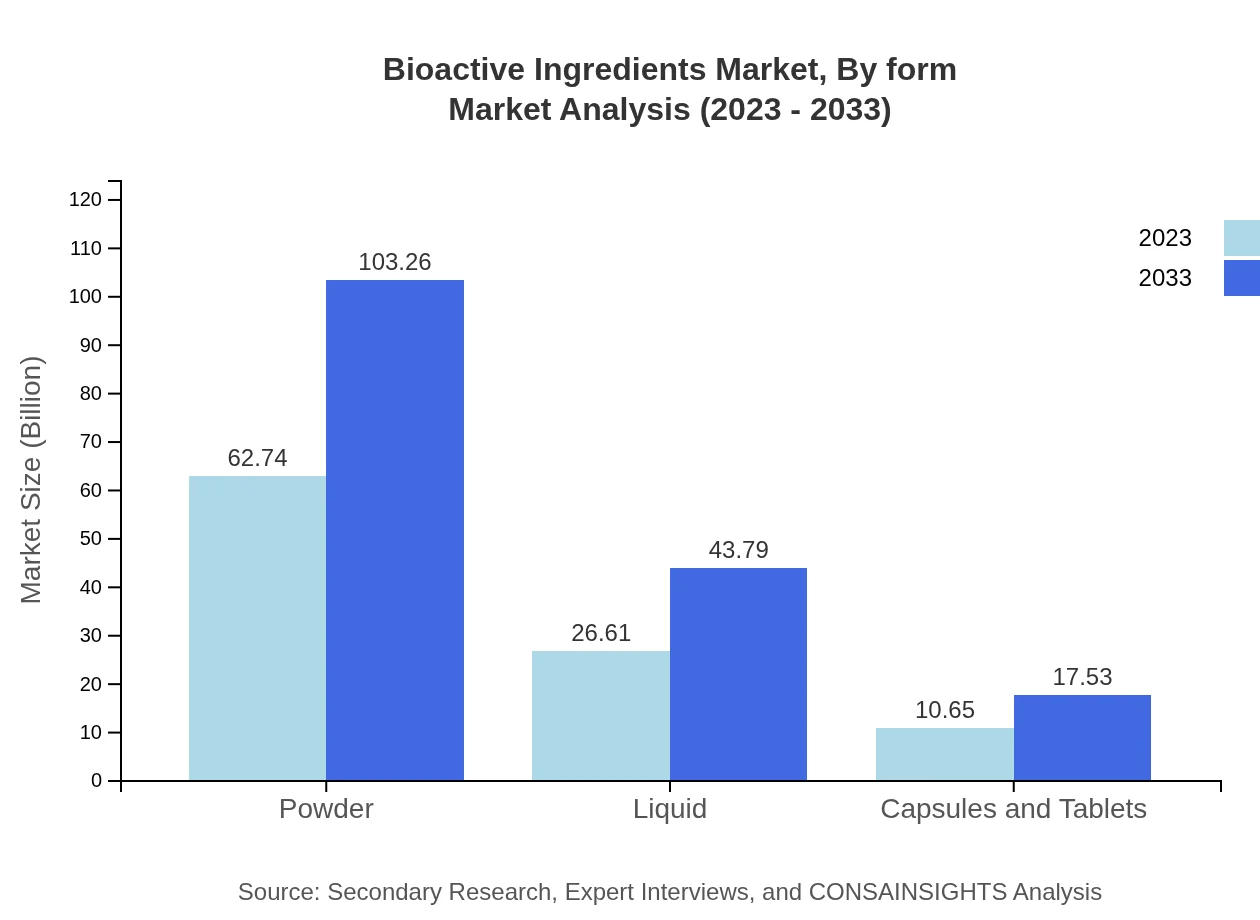

The market for bioactive ingredients by product segment is diverse, with powders leading at an estimated size of $62.74 billion in 2023, expected to reach $103.26 billion by 2033. Liquid forms are projected to grow from $26.61 billion to $43.79 billion, driven by their popularity in beverages. Capsules and tablets, alongside plant extracts, also contribute significantly, showcasing the versatility and adaptability of bioactive ingredients across diverse industries.

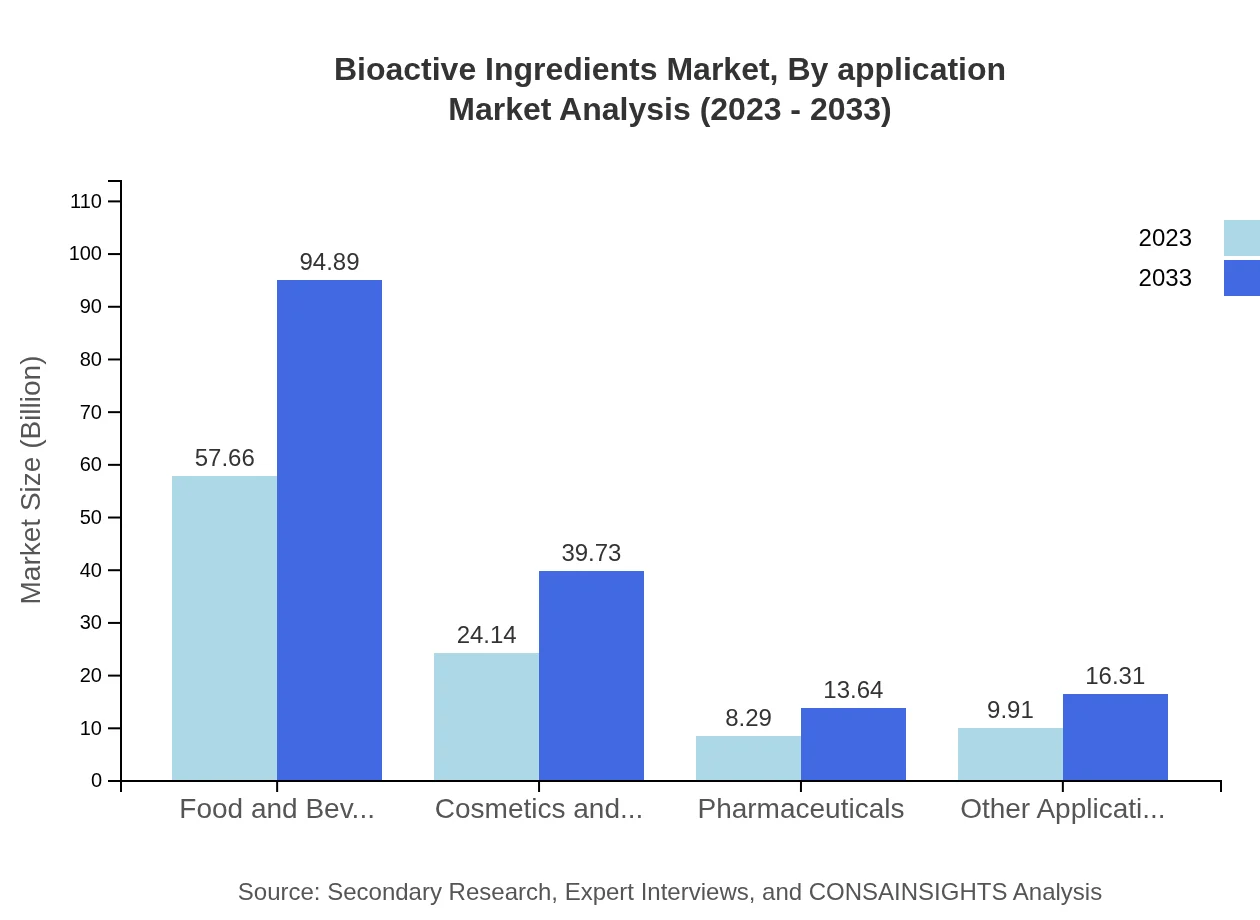

Bioactive Ingredients Market Analysis By Application

The application of bioactive ingredients spans various sectors, with food and beverages accounting for the largest share at $57.66 billion in 2023, projected to grow to $94.89 billion by 2033. The pharmaceutical and cosmetics sectors also play critical roles in market development, driven by the demand for natural and effective solutions, accounting for respective market sizes of $8.29 billion and $24.14 billion in the same period.

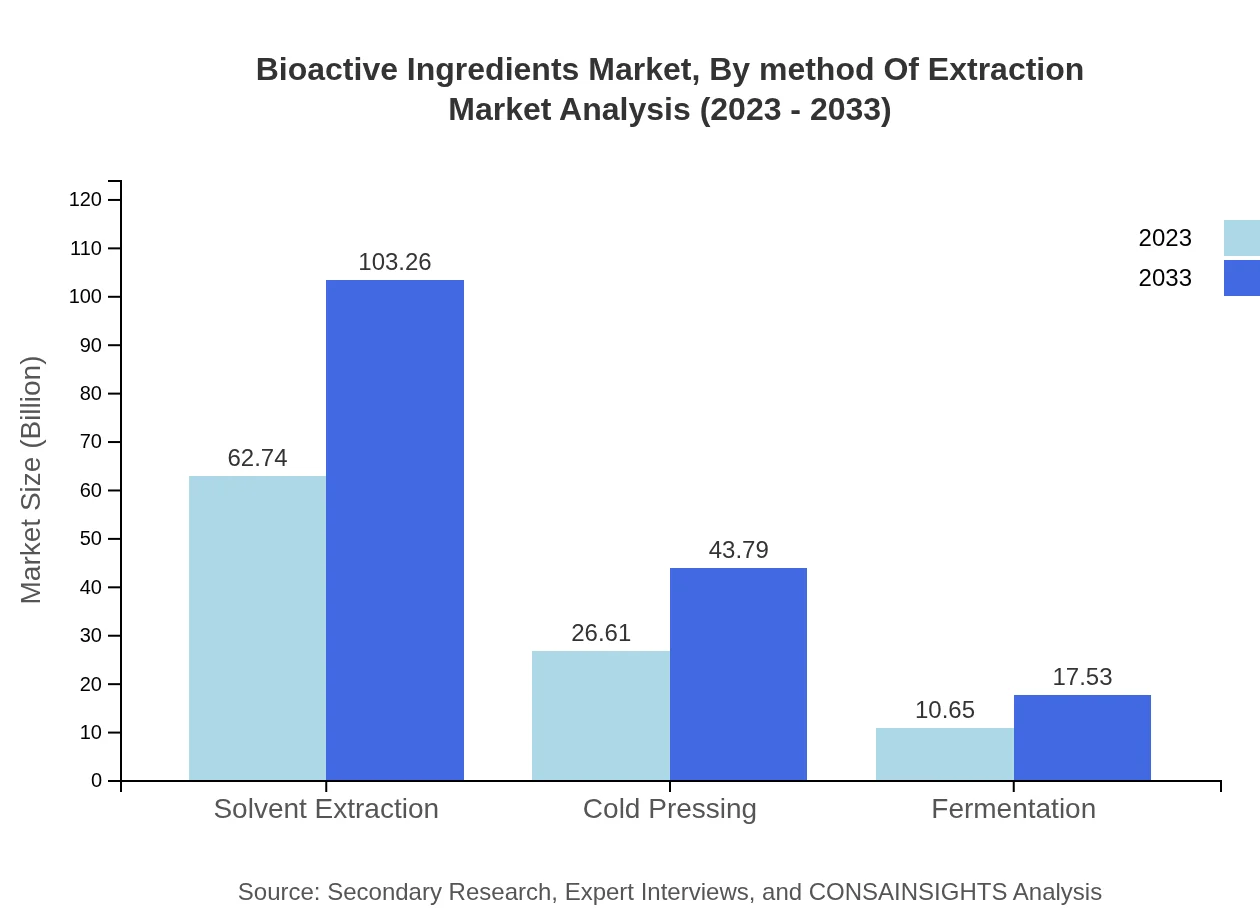

Bioactive Ingredients Market Analysis By Method Of Extraction

Extraction methods are pivotal in determining the quality and efficiency of bioactive ingredients. The solvent extraction method currently dominates the market, with expected sizes of $62.74 billion in 2023, rising to $103.26 billion by 2033. Cold pressing and fermentation methods also contribute significantly to market growth and innovation, supporting the industry's drive toward sustainability and efficiency.

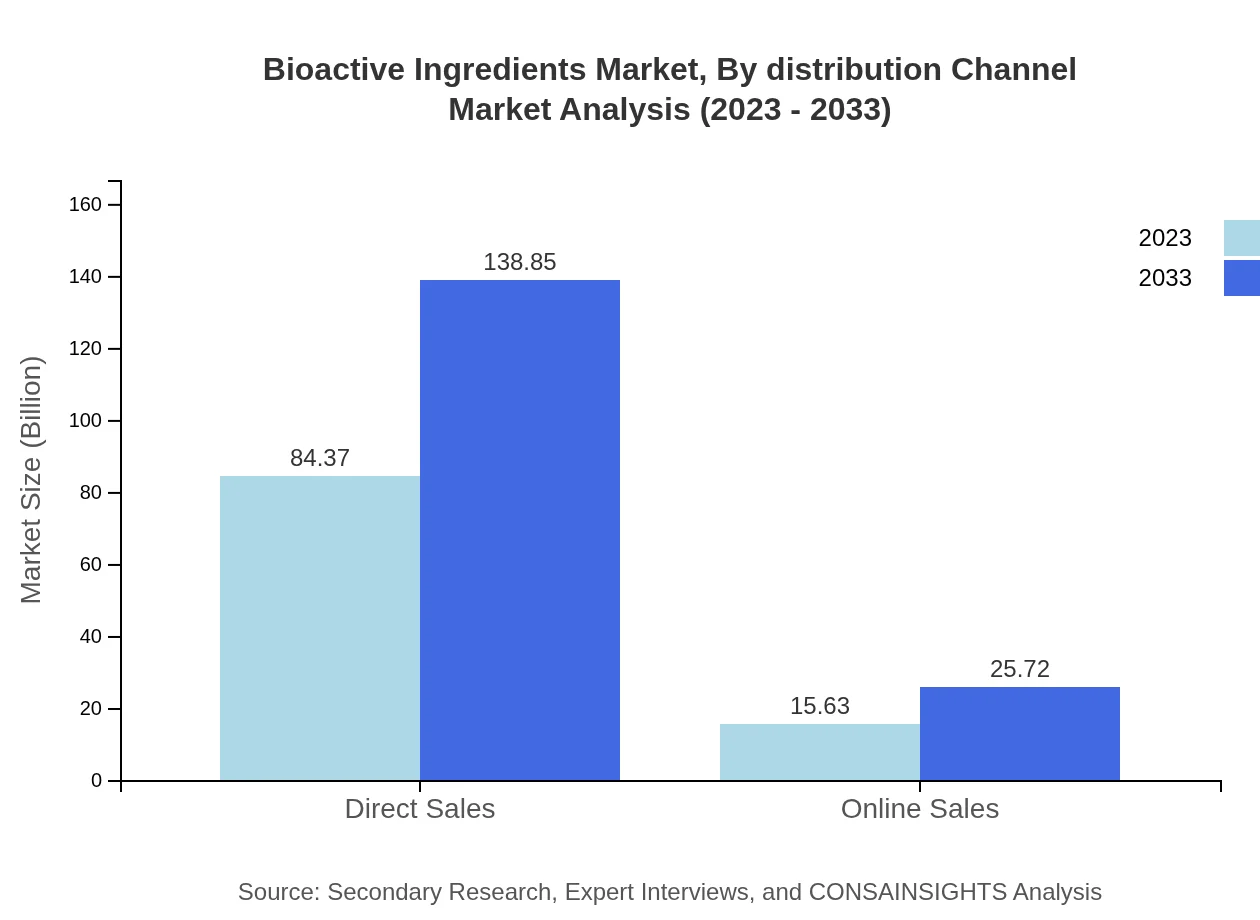

Bioactive Ingredients Market Analysis By Distribution Channel

In the bioactive ingredients market, the distribution channels are crucial for reaching consumers effectively. Direct sales currently dominate with a market value of $84.37 billion in 2023, anticipated to rise to $138.85 billion by 2033. Online sales, an increasingly important channel, are also witnessing growth from $15.63 billion to $25.72 billion during the same timeframe, reflecting the shift in consumer purchasing habits.

Bioactive Ingredients Market Analysis By Form

The form of bioactive ingredients plays a critical role in consumer acceptance and usage rates. Powdered forms are currently leading, making up significant market sizes, alongside liquids, which show promising growth. The versatility of these forms in applications such as nutritional supplements and functional foods showcases their importance in the overall market strategy.

Bioactive Ingredients Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioactive Ingredients Industry

DSM Nutritional Products:

A leading innovator in vitamins and nutritional ingredients, DSM Nutritional Products has made significant contributions to the bioactive ingredients sector with a focus on sustainable practices and premium quality.BASF SE:

BASF is a multi-disciplinary chemical company that specializes in providing bioactive compounds, with strong investments in research and development to continuously enhance their ingredient portfolio.Archer Daniels Midland Company (ADM):

ADM leads in the production and supply of bioactive ingredients, particularly in plant-based extracts and nutraceutical solutions, strengthening its market position through strategic acquisitions.DuPont de Nemours, Inc.:

DuPont specializes in biotechnology, providing bioactive ingredients across various applications such as food, supplements, and personal care, emphasizing innovation and sustainability.We're grateful to work with incredible clients.

FAQs

What is the market size of bioactive ingredients?

The global bioactive ingredients market is projected to reach 100 million USD by 2033, with a CAGR of 5% from 2023. This growth reflects increasing consumer demand for health-enhancing products enriched with bioactive compounds.

What are the key market players or companies in the bioactive ingredients industry?

Key players in the bioactive ingredients market include major international corporations and specialized suppliers. These companies invest significantly in R&D to foster innovation and capture market share, though specific names were not provided in the data.

What are the primary factors driving the growth in the bioactive ingredients industry?

The growth of the bioactive ingredients market is primarily driven by rising health consciousness, demand for natural products, and increasing applications in functional foods, nutraceuticals, and personal care products. Regulatory support also plays a pivotal role.

Which region is the fastest Growing in the bioactive ingredients market?

The fastest-growing region for bioactive ingredients is Europe, with market growth expected from 36.01 million USD in 2023 to 59.26 million USD in 2033. Asia Pacific also shows significant growth potential due to increasing consumer demand.

Does ConsaInsights provide customized market report data for the bioactive ingredients industry?

Yes, ConsaInsights offers customized market reports tailored to specific requirements within the bioactive ingredients industry. These reports can include in-depth insights on trends, market size forecasts, and competitive analyses.

What deliverables can I expect from this bioactive ingredients market research project?

Expect comprehensive deliverables including detailed market analysis, segmented data, trends analysis, and competitive landscape reports. ConsaInsights ensures all insights are actionable and relevant to help clients make informed business decisions.

What are the market trends of bioactive ingredients?

Current market trends in bioactive ingredients include a rising preference for plant-based formulations, innovations in extraction techniques, and growing integration of bioactives in cosmetics and nutraceuticals, reflecting consumer shifts towards healthier lifestyle choices.