Biobetters Market Report

Published Date: 31 January 2026 | Report Code: biobetters

Biobetters Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biobetters market from 2023 to 2033, focusing on market size, trends, and regional dynamics. Insights into key players, segmentation, and future forecasts are included to inform stakeholders and investors.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

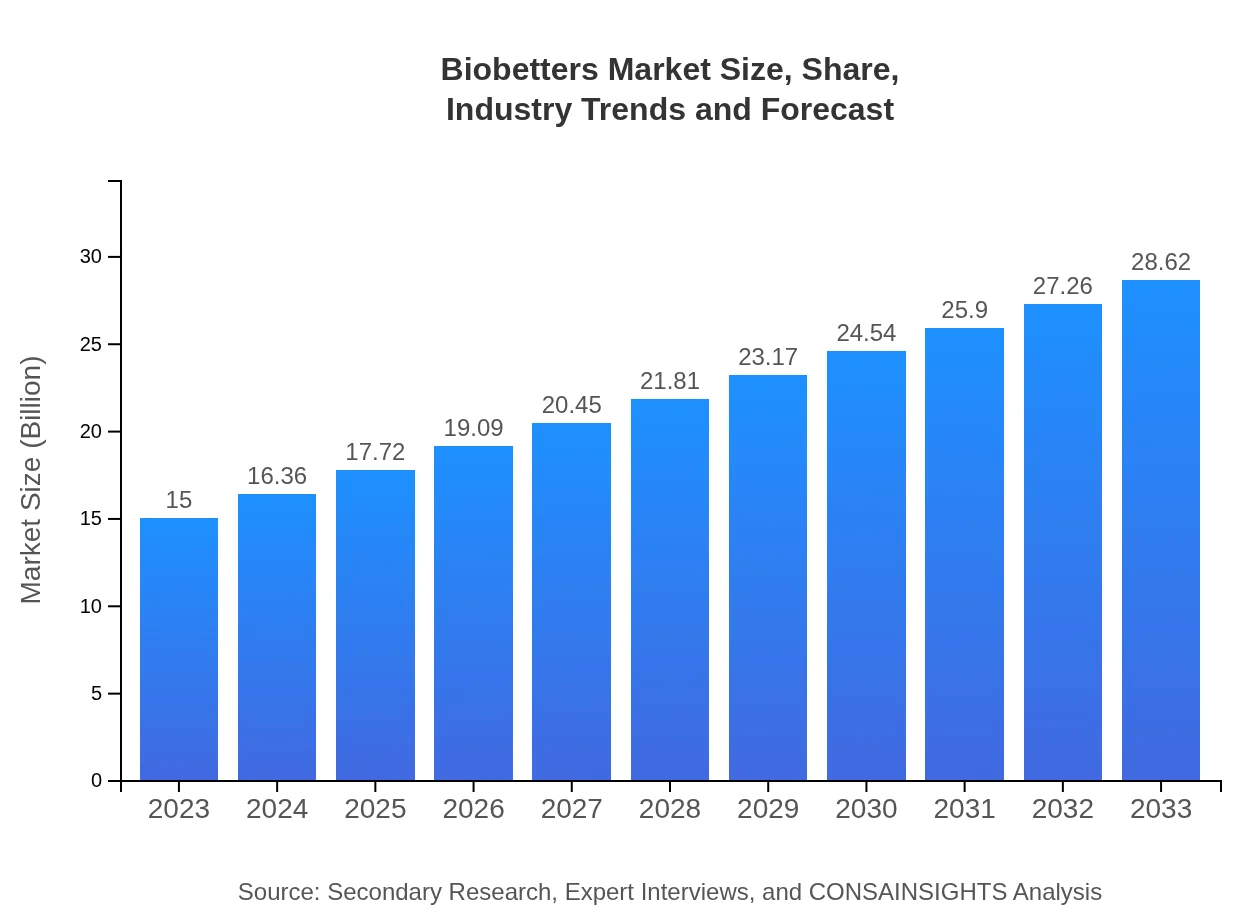

| 2023 Market Size | $15.00 Billion |

| CAGR (2023-2033) | 6.5% |

| 2033 Market Size | $28.62 Billion |

| Top Companies | Amgen Inc., Roche Holding AG, AbbVie Inc., Johnson & Johnson, Novartis AG |

| Last Modified Date | 31 January 2026 |

Biobetters Market Overview

Customize Biobetters Market Report market research report

- ✔ Get in-depth analysis of Biobetters market size, growth, and forecasts.

- ✔ Understand Biobetters's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biobetters

What is the Market Size & CAGR of Biobetters market in 2023?

Biobetters Industry Analysis

Biobetters Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biobetters Market Analysis Report by Region

Europe Biobetters Market Report:

The European Biobetters market is expected to increase from $3.66 billion in 2023 to $6.98 billion by 2033. The region benefits from a consolidated regulatory framework that supports innovation along with comprehensive healthcare systems poised to adopt biobetters for chronic disease management.Asia Pacific Biobetters Market Report:

In the Asia Pacific region, the Biobetters market is set to grow from approximately $3.03 billion in 2023 to $5.77 billion by 2033, reflecting a significant increase driven by rising healthcare expenditures and the adoption of advanced biopharmaceutical technologies. The increasing prevalence of chronic diseases and government initiatives to improve healthcare access are pivotal trends shaping this expansion.North America Biobetters Market Report:

North America, the largest market for Biobetters, is anticipated to expand from $4.99 billion in 2023 to $9.53 billion by 2033. High adoption rates of advanced therapies, extensive R&D investments, and a strong pipeline of innovative biopharmaceutical products are key contributors to robust market dynamics in this region.South America Biobetters Market Report:

The South American market for Biobetters, starting at $1.24 billion in 2023 and projected to reach $2.37 billion by 2033, shows moderate growth. The increasing investment from global pharmaceutical companies and rising awareness about advanced therapeutics mark significant growth drivers in this region as healthcare systems improve and access expands.Middle East & Africa Biobetters Market Report:

The Middle East and Africa market is projected to grow from $2.08 billion in 2023 to $3.97 billion by 2033. Factors such as rising healthcare spending, improved access to biopharmaceuticals, and increasing awareness of treatment options are expected to fuel market growth in this region.Tell us your focus area and get a customized research report.

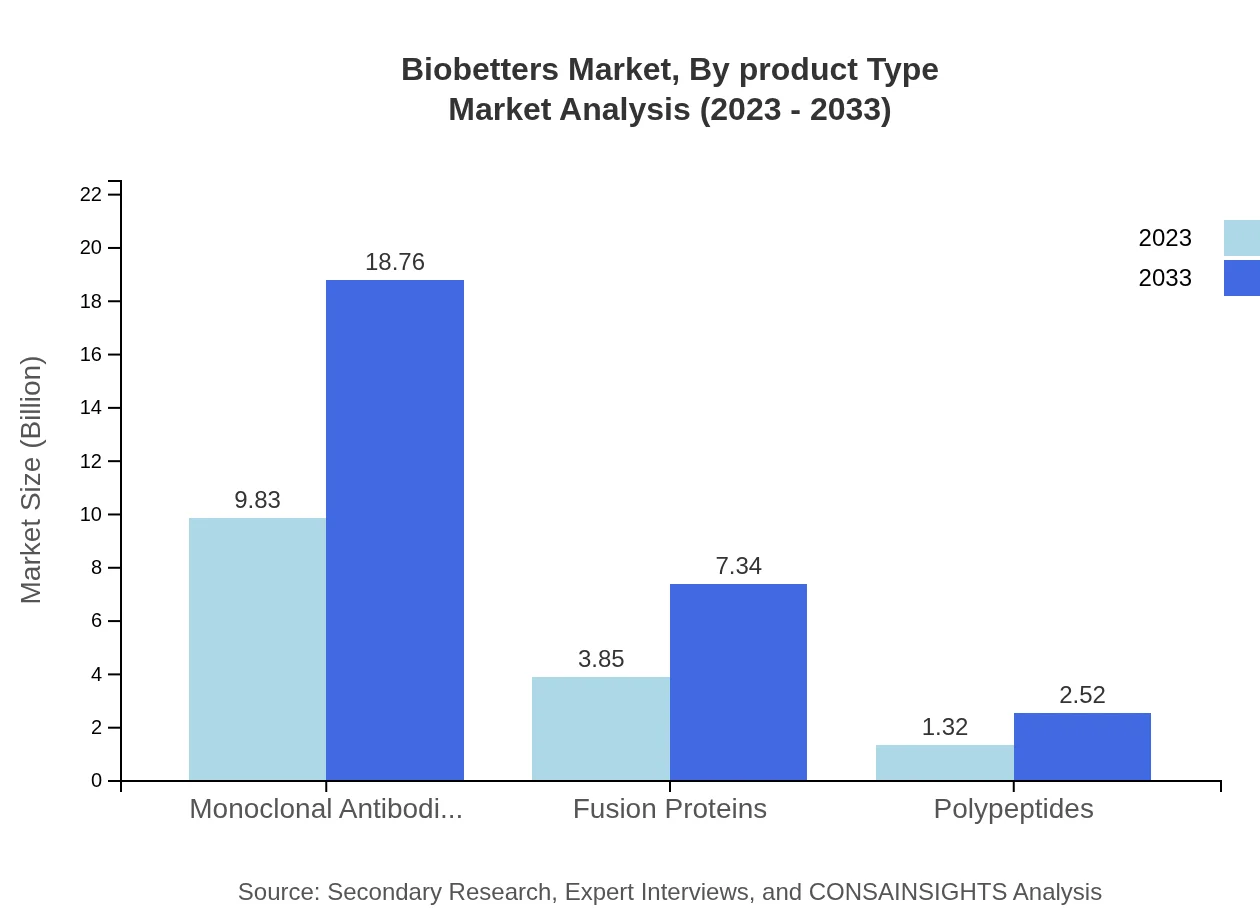

Biobetters Market Analysis By Product Type

The product type segment of Biobetters indicates that Monoclonal Antibodies lead with a market size of $9.83 billion in 2023, projected to reach $18.76 billion by 2033, which represents a substantial share of the overall market at 65.53%. Fusion proteins and polypeptides also show significant potential, particularly in targeted therapies for specific diseases.

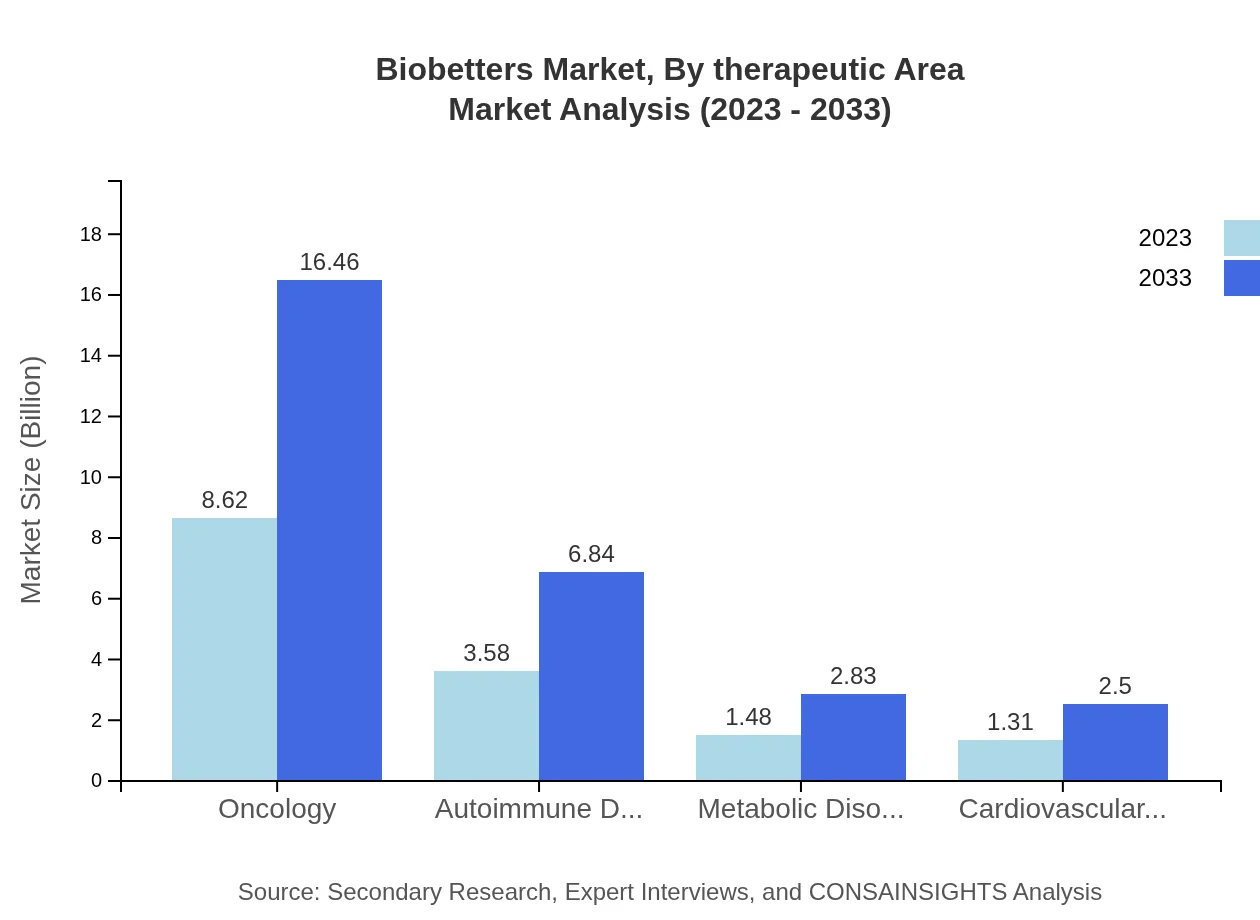

Biobetters Market Analysis By Therapeutic Area

Oncology represents the largest therapeutic area for Biobetters, projected to increase from $8.62 billion in 2023 to $16.46 billion in 2033, maintaining a share of 57.49%. Autoimmune disorders also play a crucial role, expected to grow from $3.58 billion to $6.84 billion, reflecting an increased focus on patient management in chronic diseases.

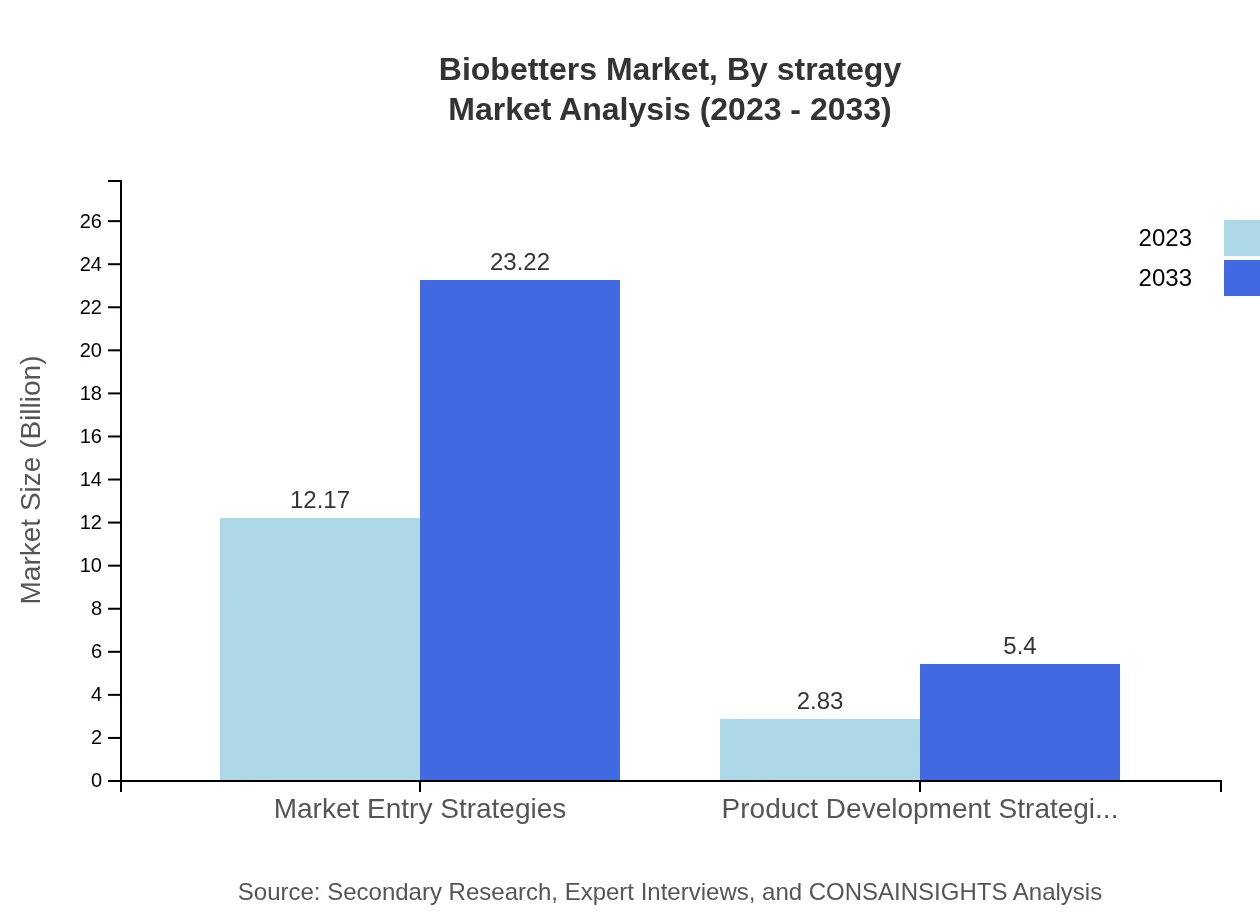

Biobetters Market Analysis By Strategy

The market entry strategy segment is expected to grow significantly, from $12.17 billion in 2023 to $23.22 billion by 2033, indicating strong interest from firms capitalizing on innovation and increasing therapeutic demands. The focus on product development strategies remains crucial, anticipated to increase from $2.83 billion to $5.40 billion.

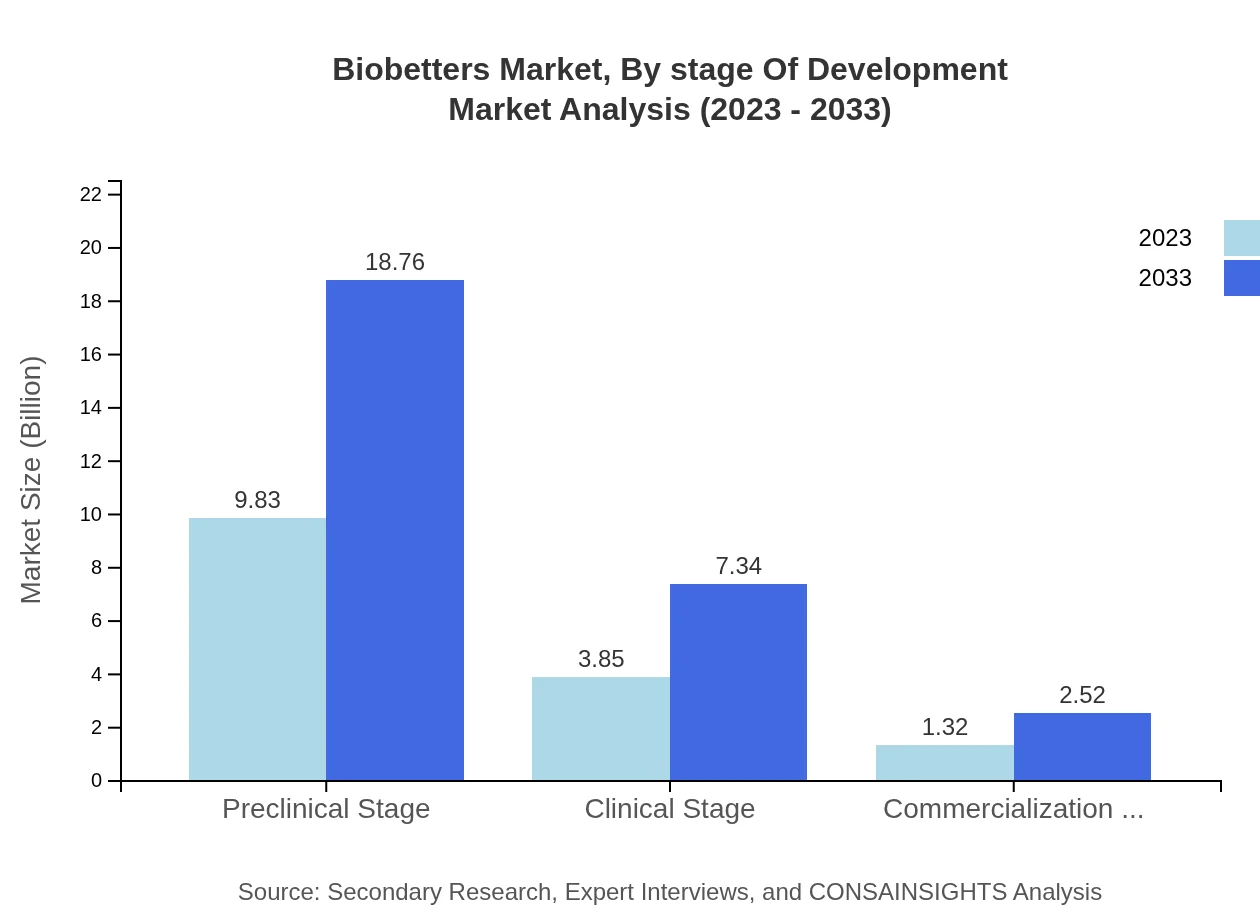

Biobetters Market Analysis By Stage Of Development

The preclinical stage dominates with expected growth from $9.83 billion in 2023 to $18.76 billion in 2033, holding a substantial share of the market. The clinical stage and commercialization stages also show growth potential, reflecting a robust pipeline of innovations.

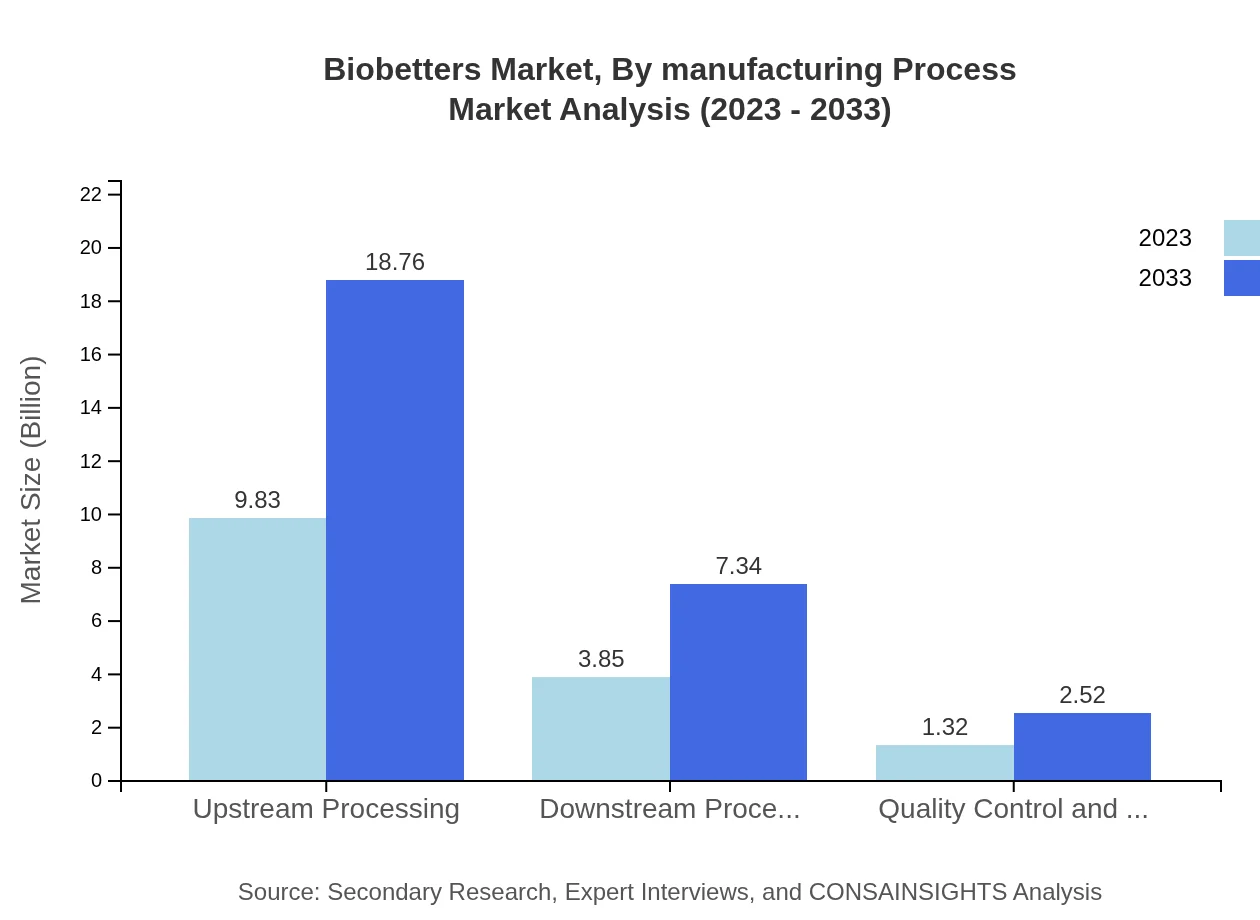

Biobetters Market Analysis By Manufacturing Process

Focusing on the manufacturing process, upstream processing leads with a market size of $9.83 billion in 2023, anticipated to retain its dominance through 2033. Downstream processing, however, is also important, with a projected growth reflecting ongoing advancements in manufacturing technologies.

Biobetters Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biobetters Industry

Amgen Inc.:

A leading biotechnology company that focuses on developing and delivering innovative human therapeutics, especially biobetters targeting cancer and autoimmune diseases.Roche Holding AG:

A global leader in biotechnology with extensive experience in monoclonal antibody development, Roche is recognized for its biobetter strategies in treating chronic conditions.AbbVie Inc.:

Known for its strong pipeline of therapies, AbbVie focuses on improving patient outcomes through the development of enhanced biologics and biobetters.Johnson & Johnson:

A major player in the pharmaceutical industry, with a focus on innovation in biologics, contributing significantly to the biobetters market.Novartis AG:

Invested heavily in biotechnological advancements, Novartis continues to drive growth in the biobetters segment through strategic partnerships and innovation.We're grateful to work with incredible clients.

FAQs

What is the market size of biobetters?

The biobetters market is valued at approximately $15 billion in 2023, with a projected CAGR of 6.5% leading to an anticipated market size in 2033 that reflects strong growth potential and increasing demand.

What are the key market players or companies in this biobetters industry?

Key players in the biobetters industry include major pharmaceutical companies focused on biologics, biotechnology firms, and specialized biotech startups working on innovative therapies, particularly in oncology and autoimmune disorders.

What are the primary factors driving the growth in the biobetters industry?

Key growth drivers include increasing prevalence of chronic diseases, advancements in biopharmaceutical technologies, rising investments in R&D, and the demand for more effective therapies that address unmet medical needs.

Which region is the fastest Growing in the biobetters?

Among the regions, North America is the fastest-growing market, expected to grow from $4.99 billion in 2023 to $9.53 billion by 2033, showcasing strong investment and innovation in biobetter therapeutics.

Does ConsaInsights provide customized market report data for the biobetters industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, providing insights into segmentation, regional trends, and competitive analysis to support strategic decision-making.

What deliverables can I expect from this biobetters market research project?

Deliverables include comprehensive market analysis reports, data on market size and growth projections, competitive landscape assessments, trend analysis, and recommendations for market entry and product development strategies.

What are the market trends of biobetters?

Trends in the biobetters market include increased focus on personalized medicine, growth in monoclonal antibodies, advancements in fusion proteins, and a rising shift towards biologically-driven therapies for chronic diseases.