Bioceramics Market Report

Published Date: 02 February 2026 | Report Code: bioceramics

Bioceramics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Bioceramics market, detailing insights from 2023 to 2033. It covers market size, growth forecasts, trends, segmentation, and regional dynamics within the industry.

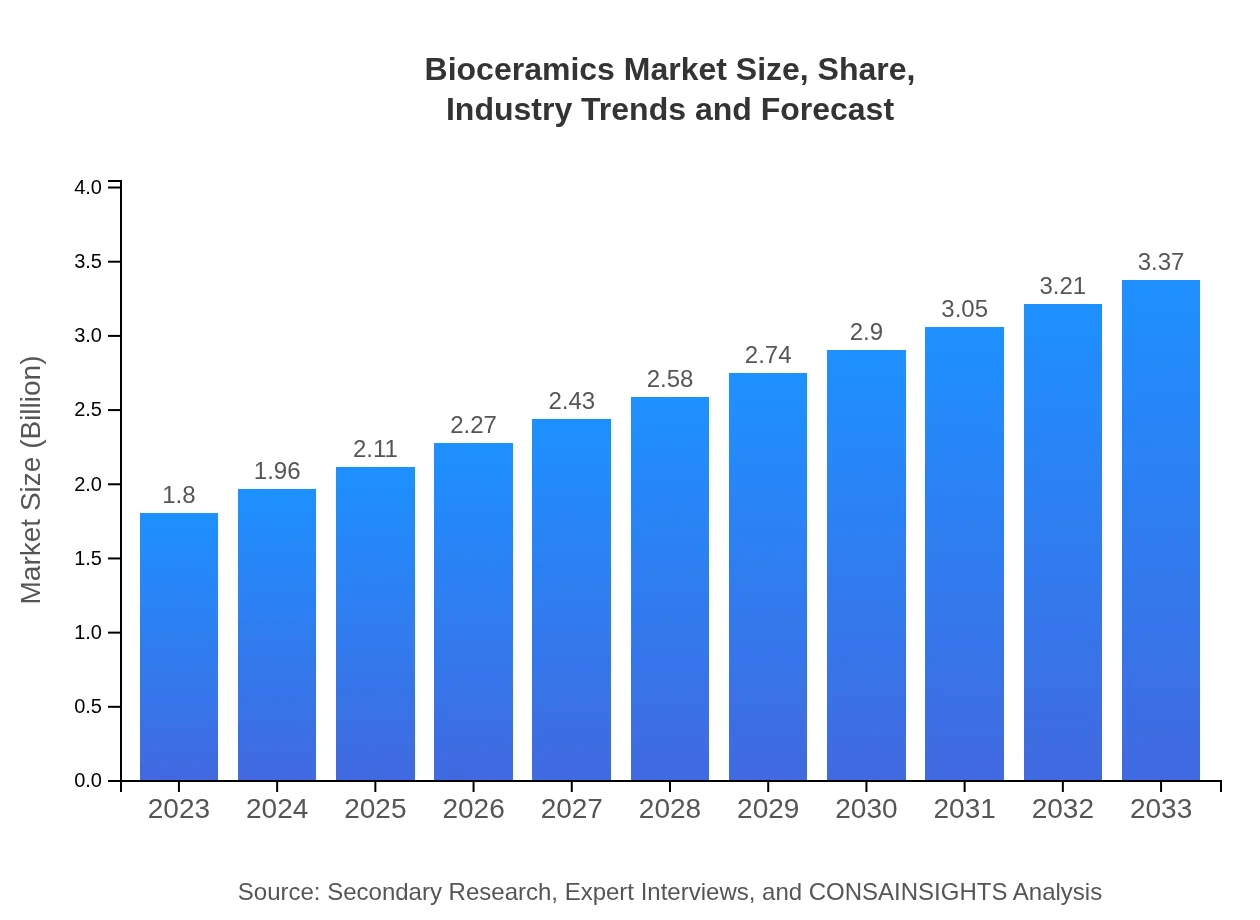

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.80 Billion |

| CAGR (2023-2033) | 6.3% |

| 2033 Market Size | $3.37 Billion |

| Top Companies | CeramTec, Collagen Solutions, Stryker Corporation, DENTSPLY Sirona |

| Last Modified Date | 02 February 2026 |

Bioceramics Market Overview

Customize Bioceramics Market Report market research report

- ✔ Get in-depth analysis of Bioceramics market size, growth, and forecasts.

- ✔ Understand Bioceramics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioceramics

What is the Market Size & CAGR of the Bioceramics market in 2023?

Bioceramics Industry Analysis

Bioceramics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioceramics Market Analysis Report by Region

Europe Bioceramics Market Report:

Europe's bioceramics market is projected to increase from $0.52 billion in 2023 to $0.96 billion by 2033. The demand for bioceramics is driven by technological advancements in dental and orthopedic applications, as well as the strong presence of leading manufacturers in the region.Asia Pacific Bioceramics Market Report:

In the Asia Pacific region, the bioceramics market is poised to grow from $0.34 billion in 2023 to $0.63 billion by 2033. Factors driving this growth include an expanding population, increasing healthcare access, and rising investments in advanced medical technologies.North America Bioceramics Market Report:

North America leads the bioceramics market, growing from $0.68 billion in 2023 to $1.28 billion by 2033. The region benefits from advanced healthcare systems, high disposable income, and increasing demand for orthopedic and dental procedures.South America Bioceramics Market Report:

The South American bioceramics market, although smaller in scale, is expected to grow from $0.09 billion in 2023 to $0.17 billion by 2033. Growth will be primarily observed in Brazil and Argentina due to improving healthcare infrastructure and rising disposable incomes.Middle East & Africa Bioceramics Market Report:

The Middle East and Africa market is expected to grow from $0.17 billion in 2023 to $0.32 billion by 2033. The growth is attributed to improving healthcare facilities and increasing awareness of advanced medical solutions.Tell us your focus area and get a customized research report.

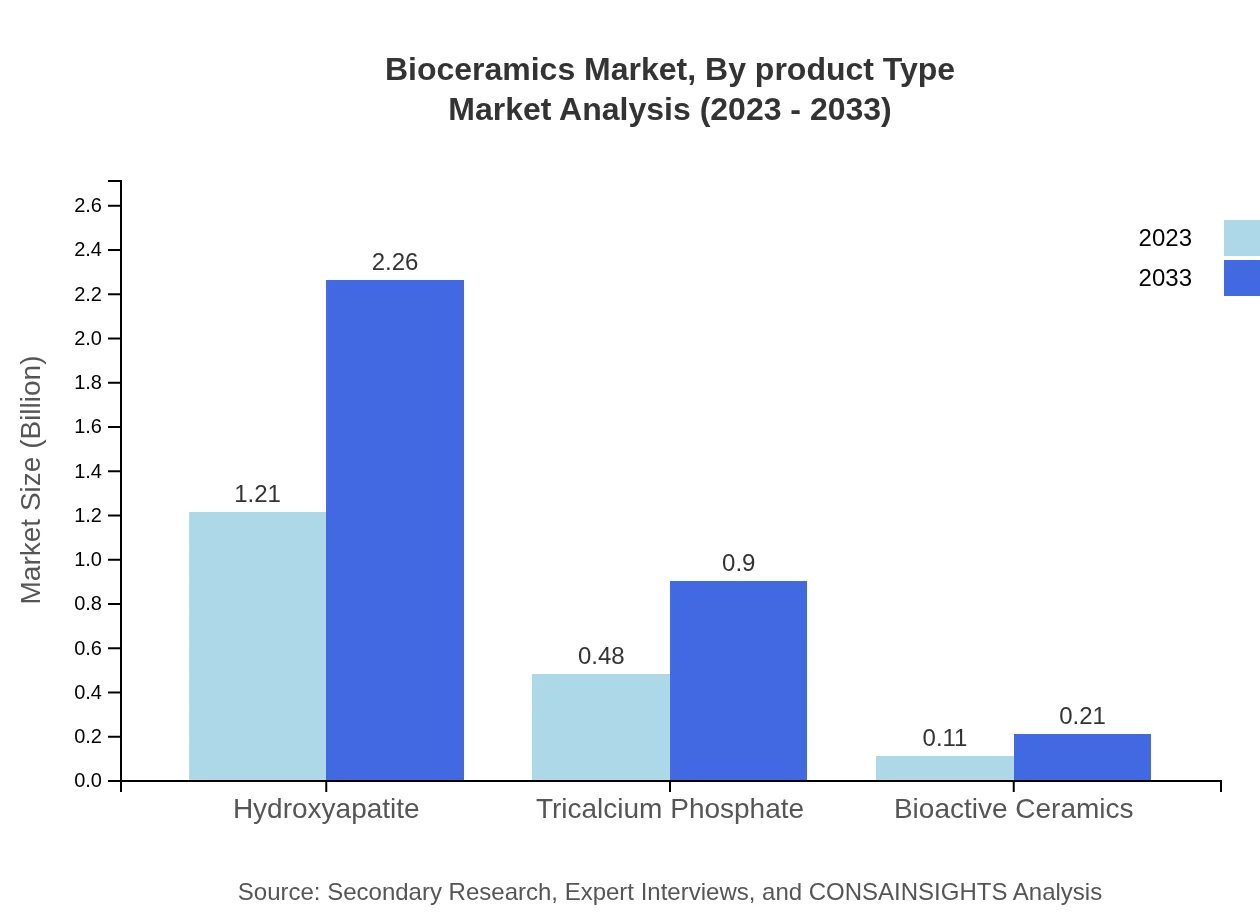

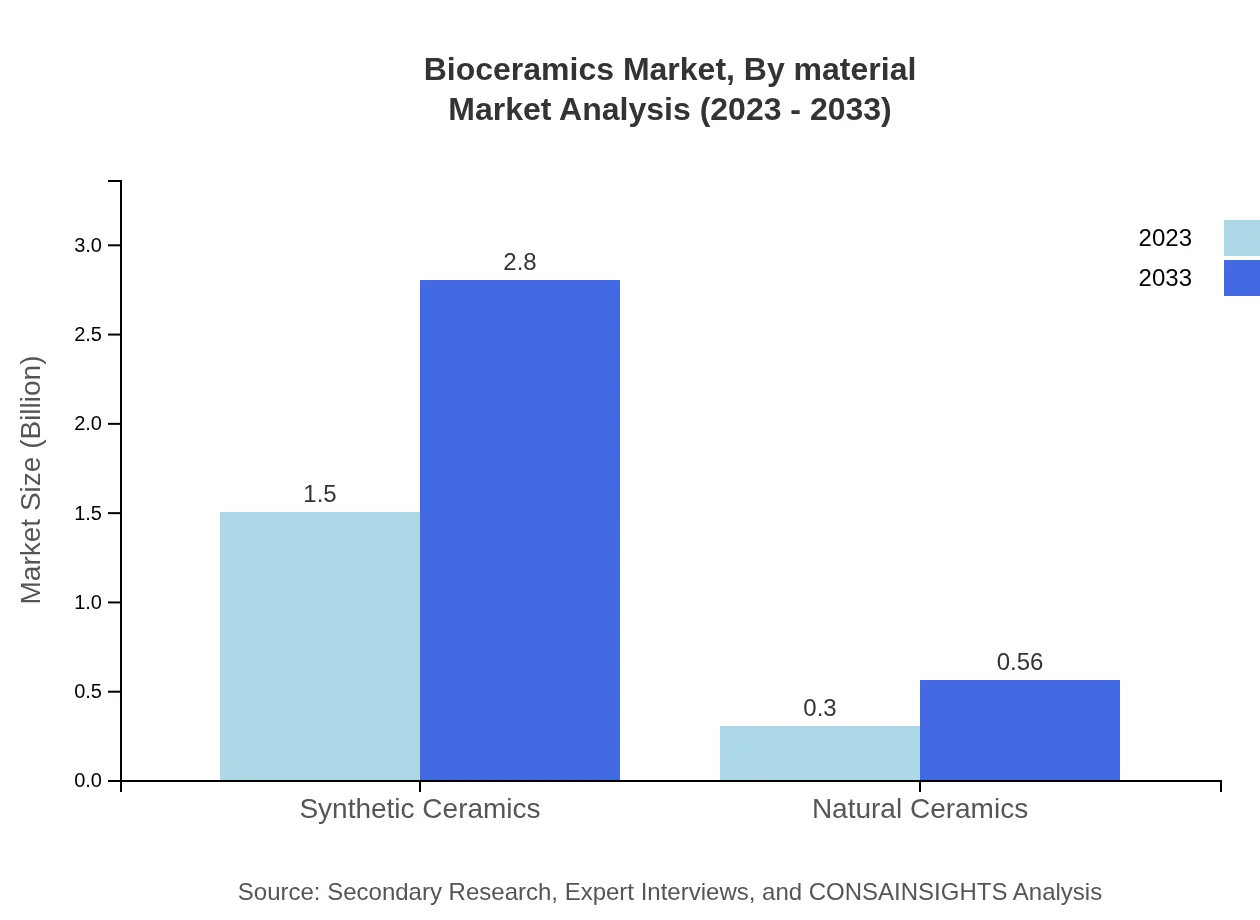

Bioceramics Market Analysis By Product Type

Synthetic ceramics dominate the bioceramics market, with a value of $1.50 billion in 2023, projected to rise to $2.80 billion by 2033, maintaining an 83.27% market share. Natural ceramics represent the remaining share, valued at $0.30 billion in 2023, expected to increase to $0.56 billion by 2033.

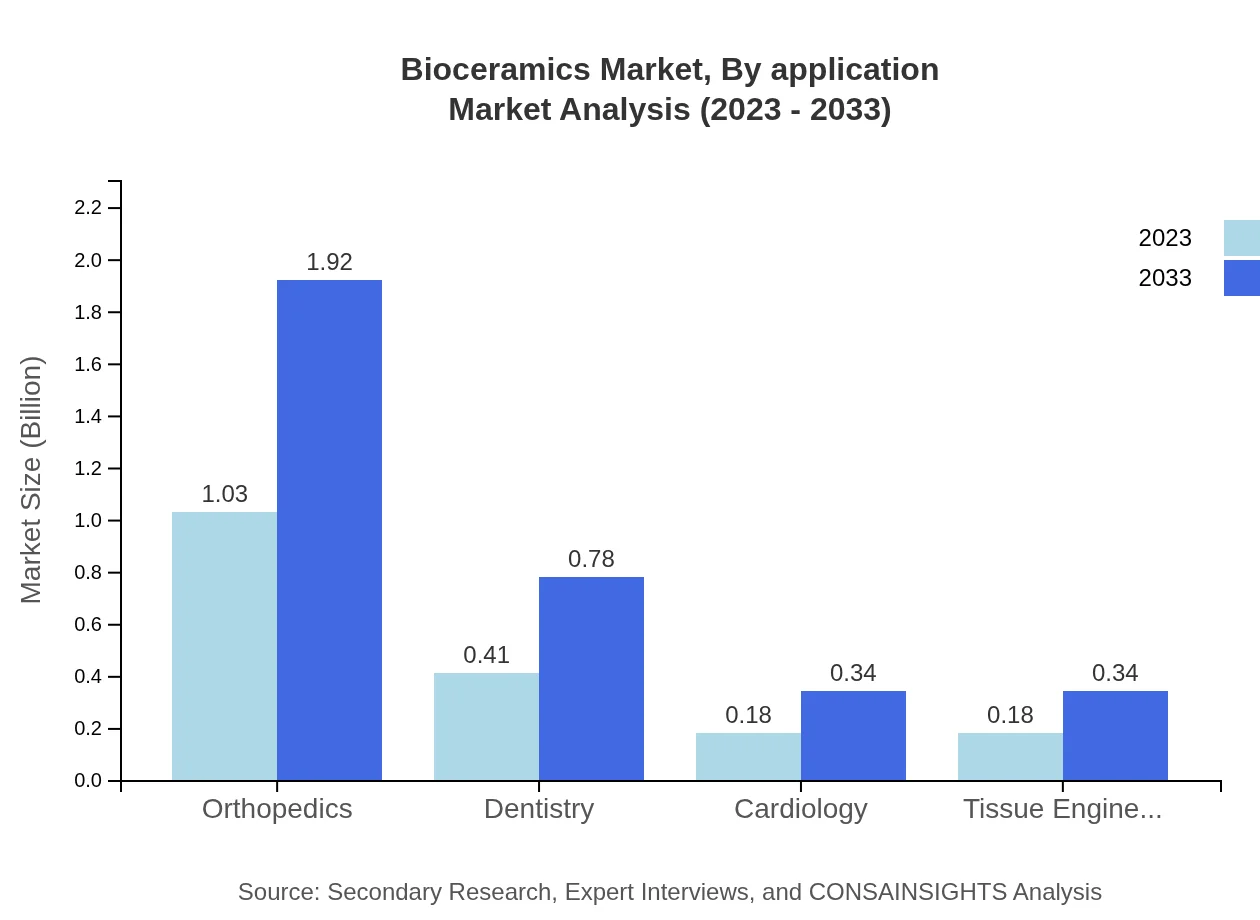

Bioceramics Market Analysis By Application

Orthopedics is the leading segment, valued at $1.03 billion in 2023 and forecasted to reach $1.92 billion by 2033. Dentistry also plays a significant role, with market values of $0.41 billion and projected growth to $0.78 billion over the same period. Other applications such as cardiology and tissue engineering are also experiencing growth.

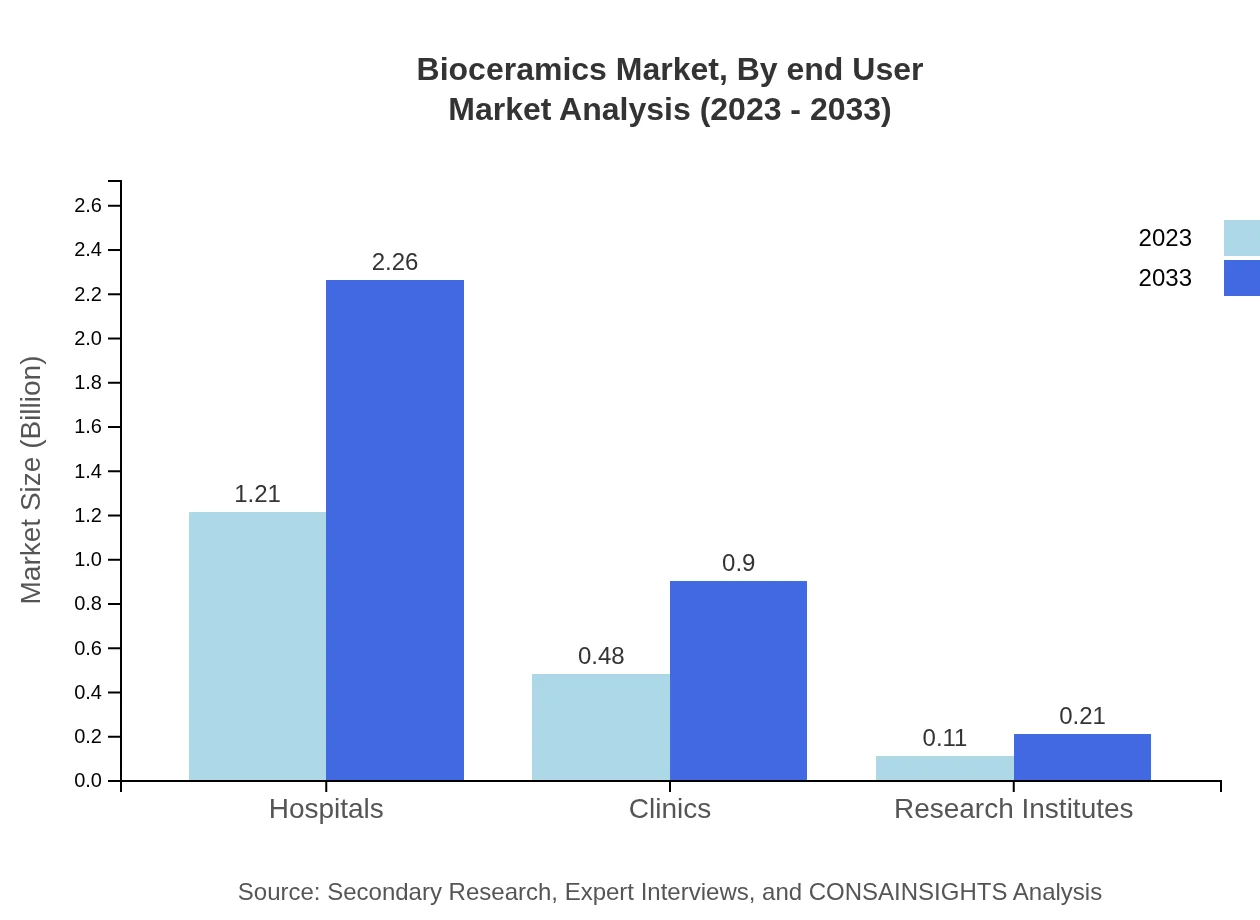

Bioceramics Market Analysis By End User

Hospitals are the leading end-users of bioceramics, with a market value of $1.21 billion in 2023 and projected growth to $2.26 billion by 2033, representing a share of 67.19%. Clinics and research institutes also contribute significantly to the market.

Bioceramics Market Analysis By Material

Hydroxyapatite is the most widely used material in bioceramics, holding a market value of $1.21 billion in 2023 and projected to grow to $2.26 billion by 2033. Other materials, such as tricalcium phosphate and bioactive ceramics, also contribute to the market but on a smaller scale.

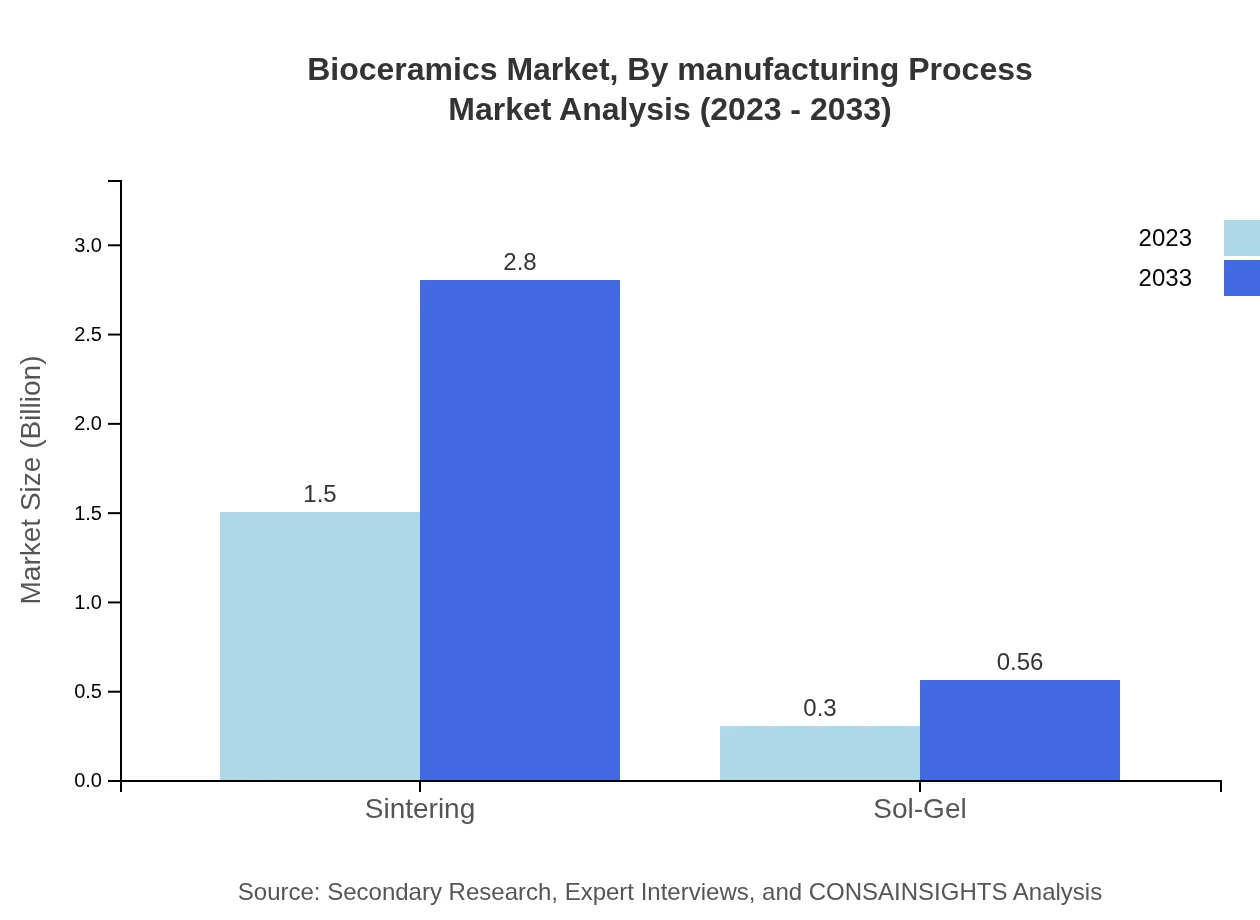

Bioceramics Market Analysis By Manufacturing Process

The sintering process leads the manufacturing techniques utilized in bioceramics, with a value of $1.50 billion in 2023, expected to rise to $2.80 billion by 2033. Sol-gel methods follow, representing a smaller but growing segment as technology advances.

Bioceramics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioceramics Industry

CeramTec:

CeramTec is a leading global manufacturer of advanced ceramics and bioceramics, recognized for its innovative solutions in orthopedic and dental applications. The company focuses on high-quality product development and partnerships with healthcare professionals.Collagen Solutions:

Collagen Solutions specializes in the development and supply of medical-grade collagen and bioceramic materials for regenerative medicine, focusing on sustainable solutions and manufacturing excellence.Stryker Corporation:

Stryker Corporation is a prominent medical technology company renowned for its orthopedic implants and devices, including a range of bioceramic products aimed at enhancing patient outcomes.DENTSPLY Sirona:

DENTSPLY Sirona holds a strong position in dental technology, providing an array of bioceramic-based materials for restorative and preventive dental procedures, aiming for high performance and quality.We're grateful to work with incredible clients.

FAQs

What is the market size of bioceramics?

The bioceramics market is projected to reach approximately $1.8 billion by 2033, with a CAGR of 6.3%. The market is driven by increasing applications in orthopedics, dentistry, and tissue engineering.

What are the key market players or companies in the bioceramics industry?

Key players in the bioceramics industry include Medtronic, Stryker Corporation, and Dentsply Sirona. These companies are leaders in innovations and advancements in bioceramic technologies, particularly for healthcare applications.

What are the primary factors driving the growth in the bioceramics industry?

Growth in the bioceramics sector is driven by rising healthcare expenditures, advancements in material science, and growing applications in dental and orthopedic surgeries, enhancing patient outcomes with improved biocompatibility.

Which region is the fastest Growing in the bioceramics market?

North America is anticipated to be the fastest-growing region, with market projections rising from $0.68 billion in 2023 to $1.28 billion by 2033. Increased investment in healthcare and technological advancements drive this growth.

Does ConsaInsights provide customized market report data for the bioceramics industry?

Yes, ConsaInsights offers customized market report data tailored to specific business needs, including detailed analysis on market size, future projections, and competitive landscape in the bioceramics industry.

What deliverables can I expect from this bioceramics market research project?

Deliverables include comprehensive market analysis, regional breakdown, competitive intelligence, trend forecasts, and segmentation data, enabling stakeholders to make informed decisions in the bioceramics landscape.

What are the market trends of bioceramics?

Current trends in the bioceramics market involve the integration of advanced manufacturing techniques, a focus on bioactivity in product development, and rising demand for personalized medical solutions across various healthcare applications.