Biodegradable Electronics

Published Date: 31 January 2026 | Report Code: biodegradable-electronics

Biodegradable Electronics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biodegradable Electronics market, focusing on market size, growth trends, segmentation, and key players. The insights cover a forecast period from 2024 to 2033, providing valuable data for stakeholders in the industry.

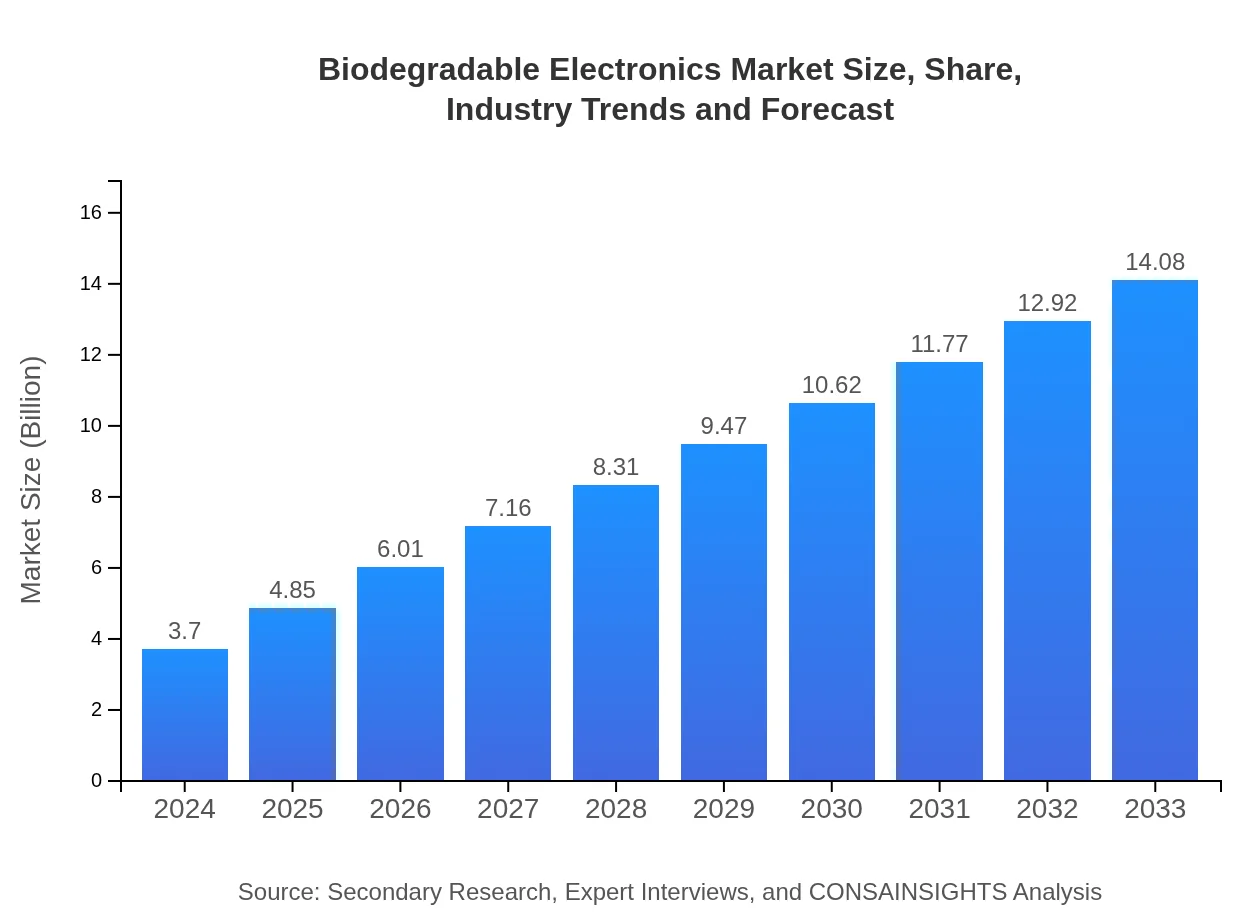

| Metric | Value |

|---|---|

| Study Period | 2024 - 2033 |

| 2024 Market Size | $3.70 Billion |

| CAGR (2024-2033) | 15.2% |

| 2033 Market Size | $14.08 Billion |

| Top Companies | Material ConneXion, Avery Dennison, LG Chem, BASF SE, Electrolux |

| Last Modified Date | 31 January 2026 |

Biodegradable Electronics Market Overview

Customize Biodegradable Electronics market research report

- ✔ Get in-depth analysis of Biodegradable Electronics market size, growth, and forecasts.

- ✔ Understand Biodegradable Electronics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biodegradable Electronics

What is the Market Size & CAGR of Biodegradable Electronics market in 2024?

Biodegradable Electronics Industry Analysis

Biodegradable Electronics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biodegradable Electronics Market Analysis Report by Region

Europe Biodegradable Electronics:

The European market is estimated to increase from $1.23 billion in 2024 to $4.66 billion by 2033. Europe leads in regulatory initiatives towards waste management and sustainability, which propels the demand for biodegradable electronic solutions across various industries, particularly in healthcare and consumer electronics.Asia Pacific Biodegradable Electronics:

The Asia Pacific region is expected to witness significant growth in the biodegradable electronics market, with an estimated market size of $0.70 billion in 2024, rising to $2.68 billion by 2033. Factors such as increasing industrialization, a burgeoning tech scene, and rising consumer awareness about environmental issues are driving growth. Many governments in the region are also implementing policies to promote sustainable practices in technology manufacturing.North America Biodegradable Electronics:

North America is projected to see a substantial increase in the biodegradable electronics market, anticipated to grow from $1.21 billion in 2024 to $4.61 billion by 2033. There is a strong trend toward eco-friendly technologies, supported by consumer demand and substantial research investments from both private and governmental sectors focused on sustainable alternatives.South America Biodegradable Electronics:

In South America, the market is relatively nascent but shows promising potential, growing from $0.09 billion in 2024 to $0.33 billion by 2033. Supportive regulations and a greater emphasis on sustainability are expected to spur interest and investment in biodegradable electronics in the region.Middle East & Africa Biodegradable Electronics:

The Middle East and Africa region is also witnessing growth, with market size expected to rise from $0.47 billion in 2024 to $1.80 billion by 2033. The incorporation of biodegradable materials in various sectors and an increase in partnerships focusing on sustainable technology are essential drivers in this region.Tell us your focus area and get a customized research report.

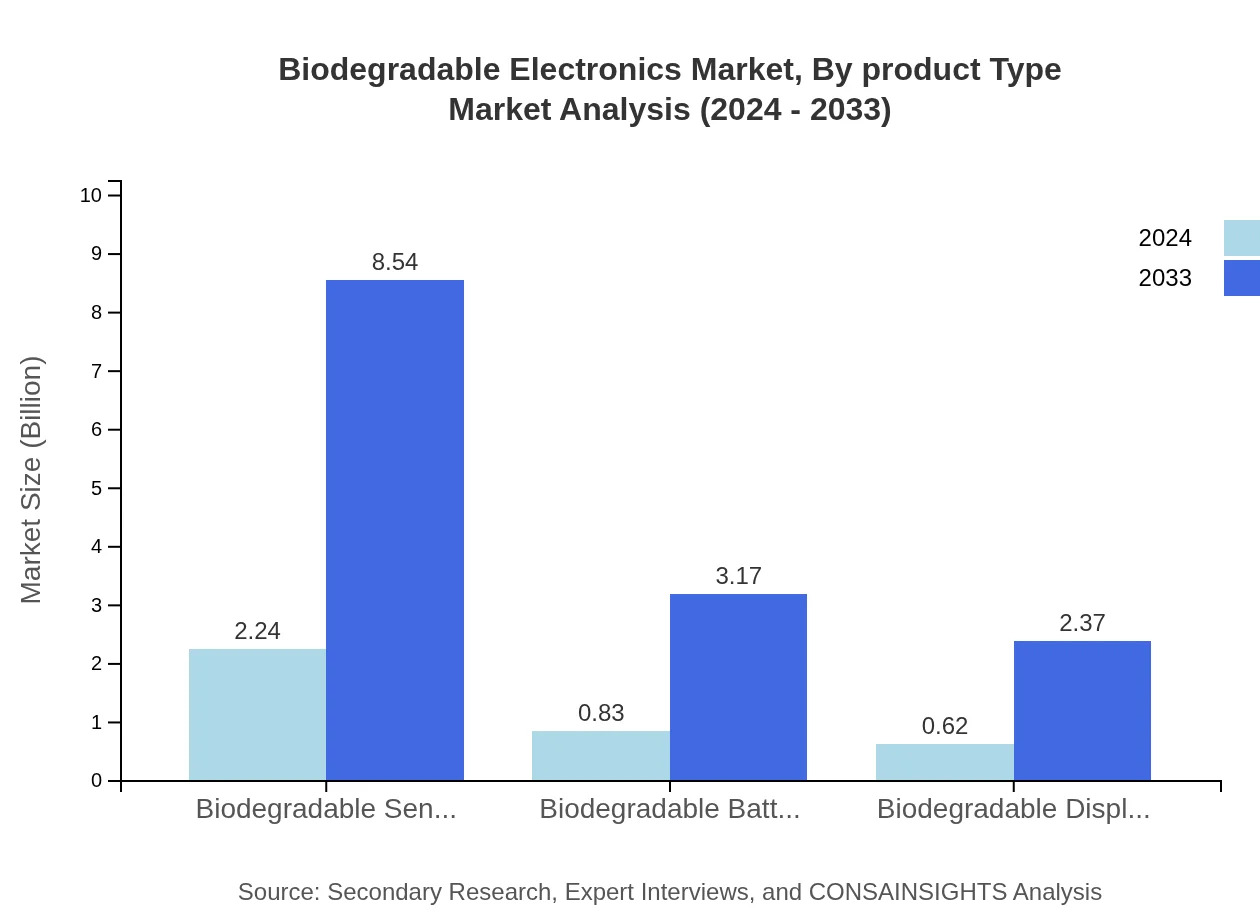

Biodegradable Electronics Market Analysis By Product Type

In 2024, the market size for biodegradable products such as bioplastics is projected at $2.24 billion, expanding to $8.54 billion by 2033, largely driven by demand in consumer electronics and healthcare. Biodegradable batteries and displays contribute significantly to this growth.

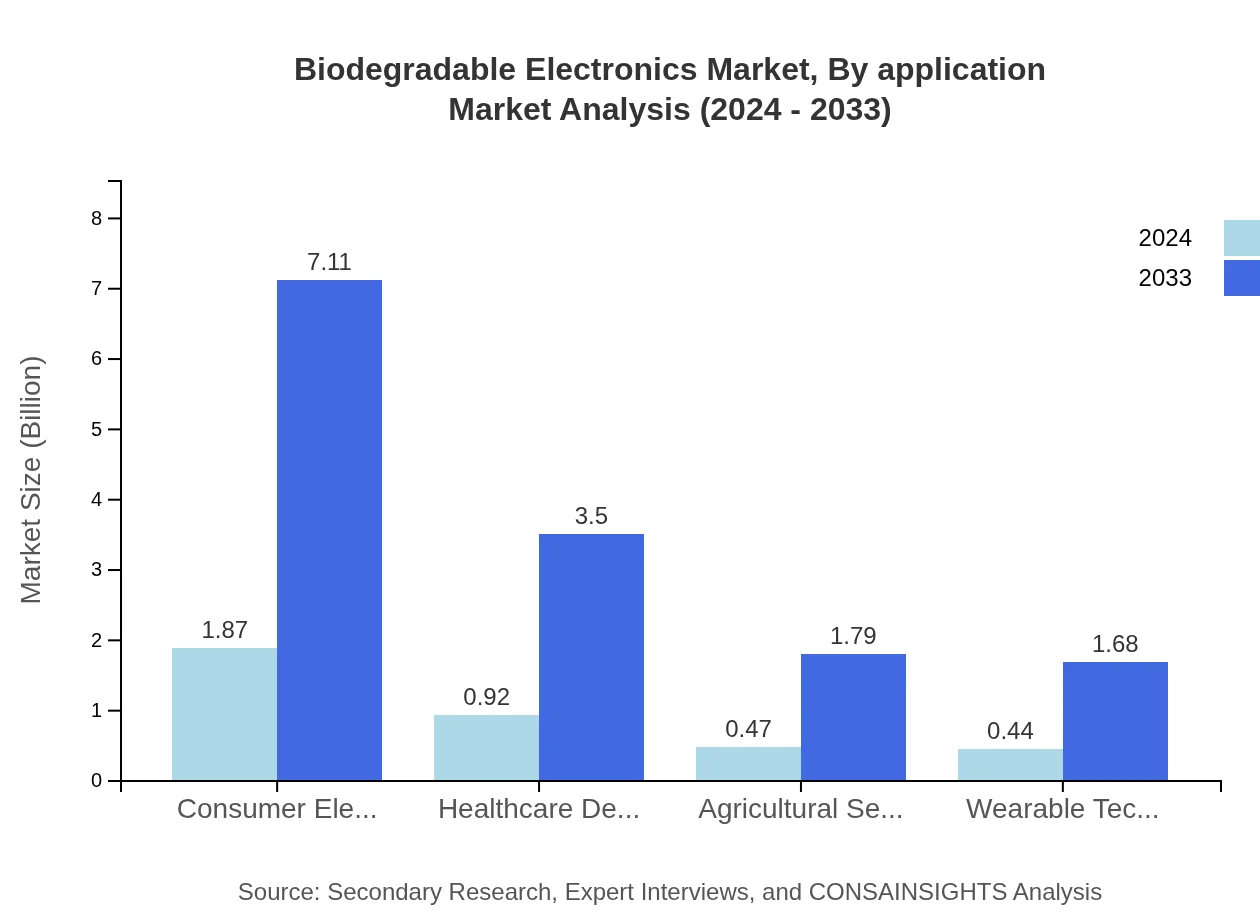

Biodegradable Electronics Market Analysis By Application

The consumer electronics segment accounts for 50.54% of the market share in 2024, remaining stable by 2033. The medical industry follows closely with a share of 24.85%, showcasing the growing trend of sustainable solutions in healthcare applications.

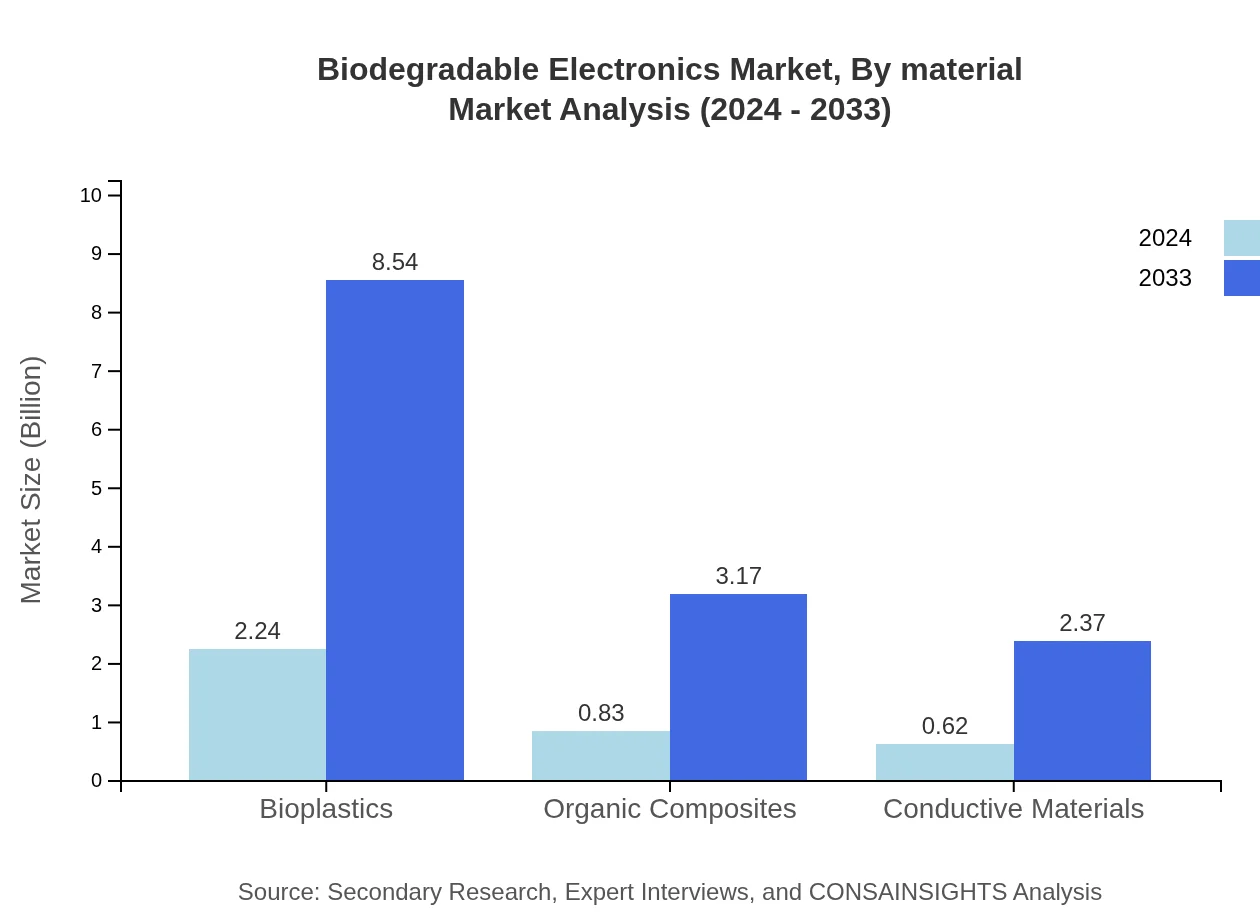

Biodegradable Electronics Market Analysis By Material

Bioplastics dominate the material segment with a market share of 60.65% in 2024, continuing to thrive with innovations in material development. Organic composites (22.5%) and conductive materials (16.85%) are also gaining traction as viable alternatives.

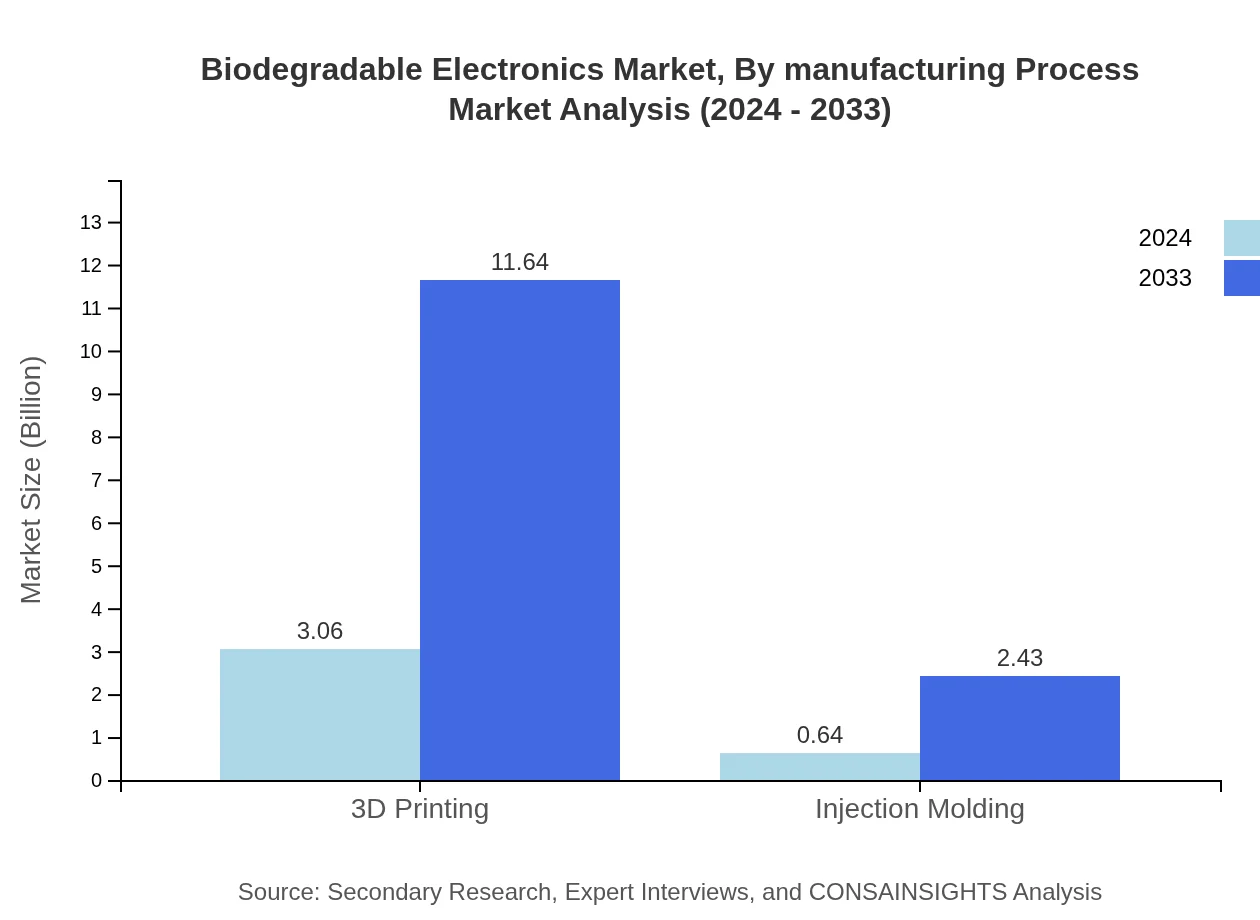

Biodegradable Electronics Market Analysis By Manufacturing Process

The 3D printing process holds a significant market share of 82.71% in the manufacturing of biodegradable electronics by 2024, as it allows for customization and sustainable production methods that align with eco-friendly initiatives.

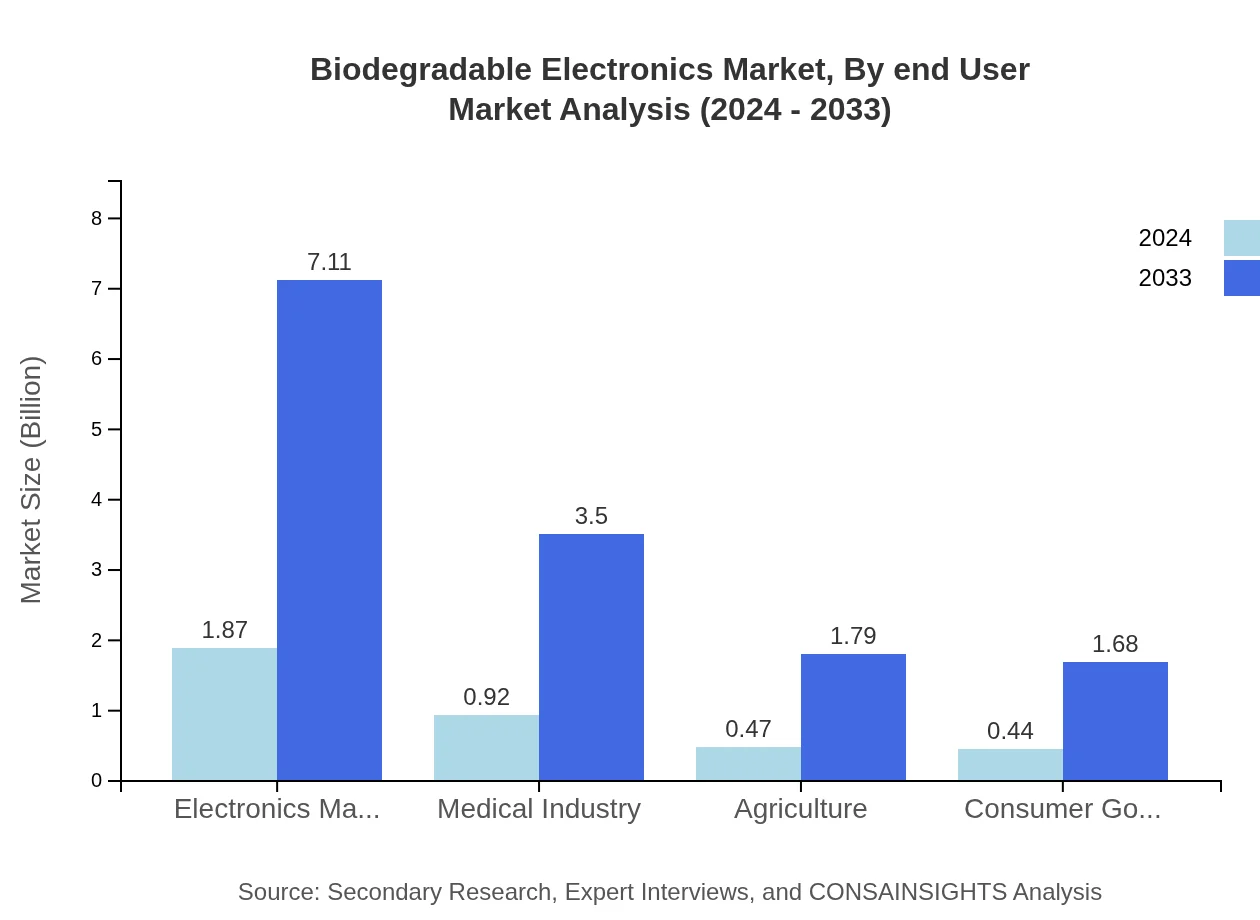

Biodegradable Electronics Market Analysis By End User

With the healthcare sector representing 24.85% of the market share in 2024, followed by agriculture and consumer goods, the demand for biodegradable electronics within these industries continues to evolve, fueled by sustainability efforts.

Biodegradable Electronics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biodegradable Electronics Industry

Material ConneXion:

A pioneering company in sustainable materials, Material ConneXion promotes the use of biodegradable substances in electronics manufacturing.Avery Dennison:

Known for innovative adhesive solutions, Avery Dennison is advancing the development of biodegradable labels and electronics components.LG Chem:

Leading in the production of bioplastics, LG Chem focuses on sustainable solutions for the electronics industry, contributing significantly to biodegradable materials.BASF SE:

BASF is a global leader in chemicals and materials, heavily investing in biodegradable technologies that support eco-friendly electronics.Electrolux:

As a prominent name in home appliances, Electrolux integrates biodegradable materials into its products to enhance sustainability efforts.We're grateful to work with incredible clients.

FAQs

What is the market size of biodegradable Electronics?

The biodegradable electronics market is valued at approximately $3.7 billion in 2024, with an expected compound annual growth rate (CAGR) of 15.2% through 2033. This growth reflects increasing consumer demand for sustainable electronics.

What are the key market players or companies in the biodegradable Electronics industry?

Key players in the biodegradable electronics industry include major electronics manufacturers specializing in sustainable products, startups focused on innovative biodegradable materials, and leading green technology firms investing in eco-friendly alternatives.

What are the primary factors driving the growth in the biodegradable Electronics industry?

The growth of the biodegradable electronics industry is driven by increasing environmental awareness, stricter regulations on electronic waste, technological advancements in biodegradable materials, and rising investments in sustainable product development by manufacturers.

Which region is the fastest Growing in biodegradable Electronics?

The fastest-growing region for biodegradable electronics is Europe, with market size projections growing from $1.23 billion in 2024 to $4.66 billion by 2033, reflecting the region's strong commitment to sustainability.

Does ConsaInsights provide customized market report data for the biodegradable Electronics industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the biodegradable electronics industry, helping businesses gain insights relevant to their operations and strategic planning.

What deliverables can I expect from this biodegradable Electronics market research project?

Deliverables include comprehensive market reports, trend analysis, competitive landscape assessments, segmentation insights, and forecasts that help businesses make informed decisions in the biodegradable electronics sector.

What are the market trends of biodegradable Electronics?

Market trends include the rise of bioplastics and organic composites, innovations in biodegradable components like sensors and batteries, increasing consumer demand for eco-friendly electronics, and growth in the healthcare and agriculture sectors.