Biofungicides Market Report

Published Date: 02 February 2026 | Report Code: biofungicides

Biofungicides Market Size, Share, Industry Trends and Forecast to 2033

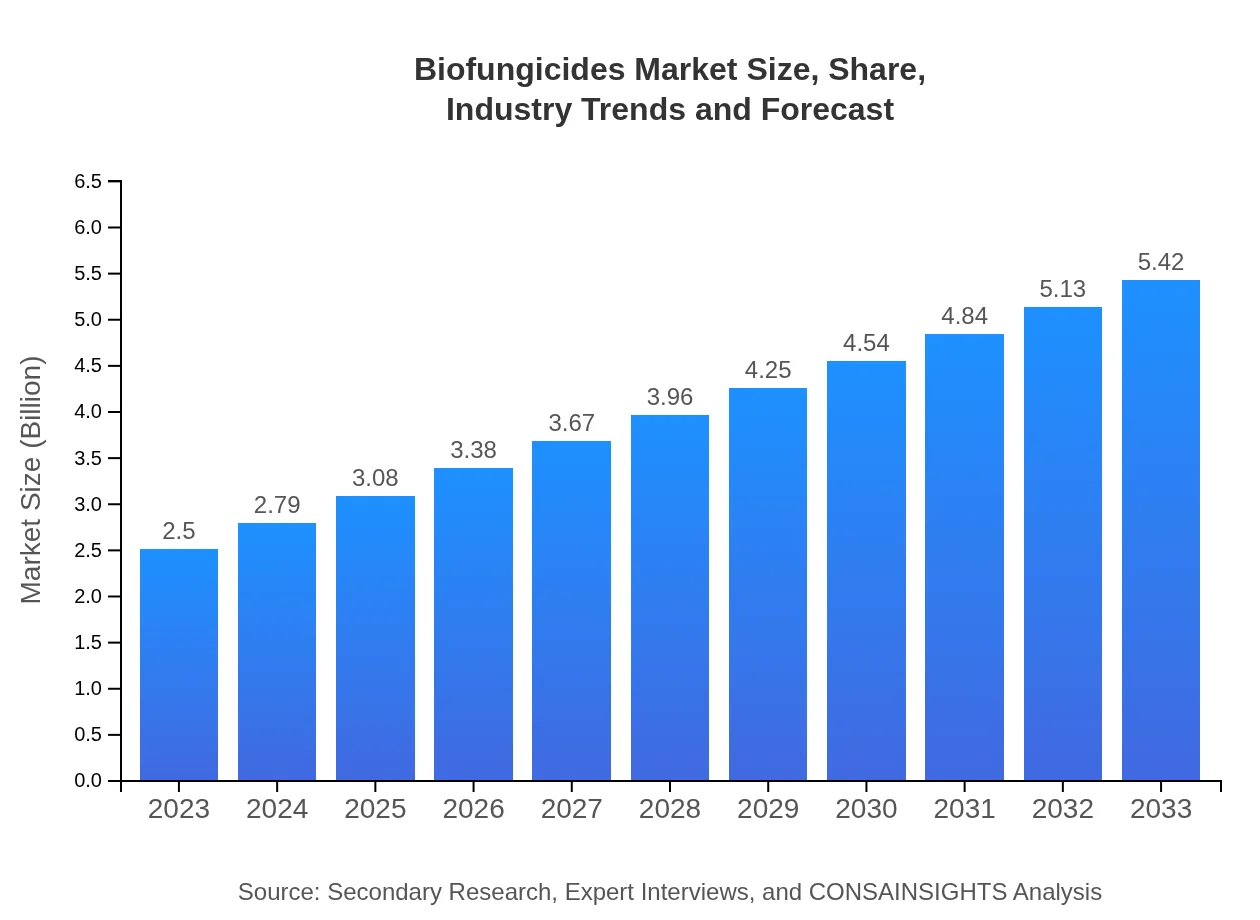

This report presents a comprehensive analysis of the Biofungicides market, offering insights into market size, growth rate, regional segments, and industry trends. The forecast period covers 2023 to 2033, focusing on market behavior, key players, and future prospects.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | BASF SE, Syngenta AG, Certis USA LLC, FMC Corporation, Valent Biosciences LLC |

| Last Modified Date | 02 February 2026 |

Biofungicides Market Overview

Customize Biofungicides Market Report market research report

- ✔ Get in-depth analysis of Biofungicides market size, growth, and forecasts.

- ✔ Understand Biofungicides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biofungicides

What is the Market Size & CAGR of the Biofungicides market in 2023?

Biofungicides Industry Analysis

Biofungicides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biofungicides Market Analysis Report by Region

Europe Biofungicides Market Report:

Europe showcases a robust demand for Biofungicides, with a market size of $0.62 billion in 2023, anticipated to reach $1.34 billion by 2033. This growth is propelled by legislative support for organic farming and heightened awareness of environmental sustainability.Asia Pacific Biofungicides Market Report:

In the Asia Pacific region, the Biofungicides market was valued at $0.51 billion in 2023 and is projected to reach $1.11 billion by 2033, showing significant growth prospects. This region is witnessing a booming demand for organic products and is increasingly focusing on sustainable farming practices.North America Biofungicides Market Report:

North America holds a considerable share of the Biofungicides market, valued at $0.83 billion in 2023 and expected to rise to $1.79 billion by 2033. The increase is attributed to stringent regulatory frameworks favoring bio-based products and a growing consumer preference for organic and clean-label foods.South America Biofungicides Market Report:

South America is steadily developing within the Biofungicides market, starting at $0.23 billion in 2023 and predicted to grow to $0.51 billion by 2033. The demand in this region is driven by the agricultural sector's efforts to mitigate disease impact on crops and promote organic cultivation.Middle East & Africa Biofungicides Market Report:

The Middle East and Africa region presents an emerging market for Biofungicides, with a 2023 market size of $0.31 billion projected to increase to $0.67 billion by 2033. Factors such as the need for improved agricultural outputs and growing adoption of eco-friendly practices are driving this market.Tell us your focus area and get a customized research report.

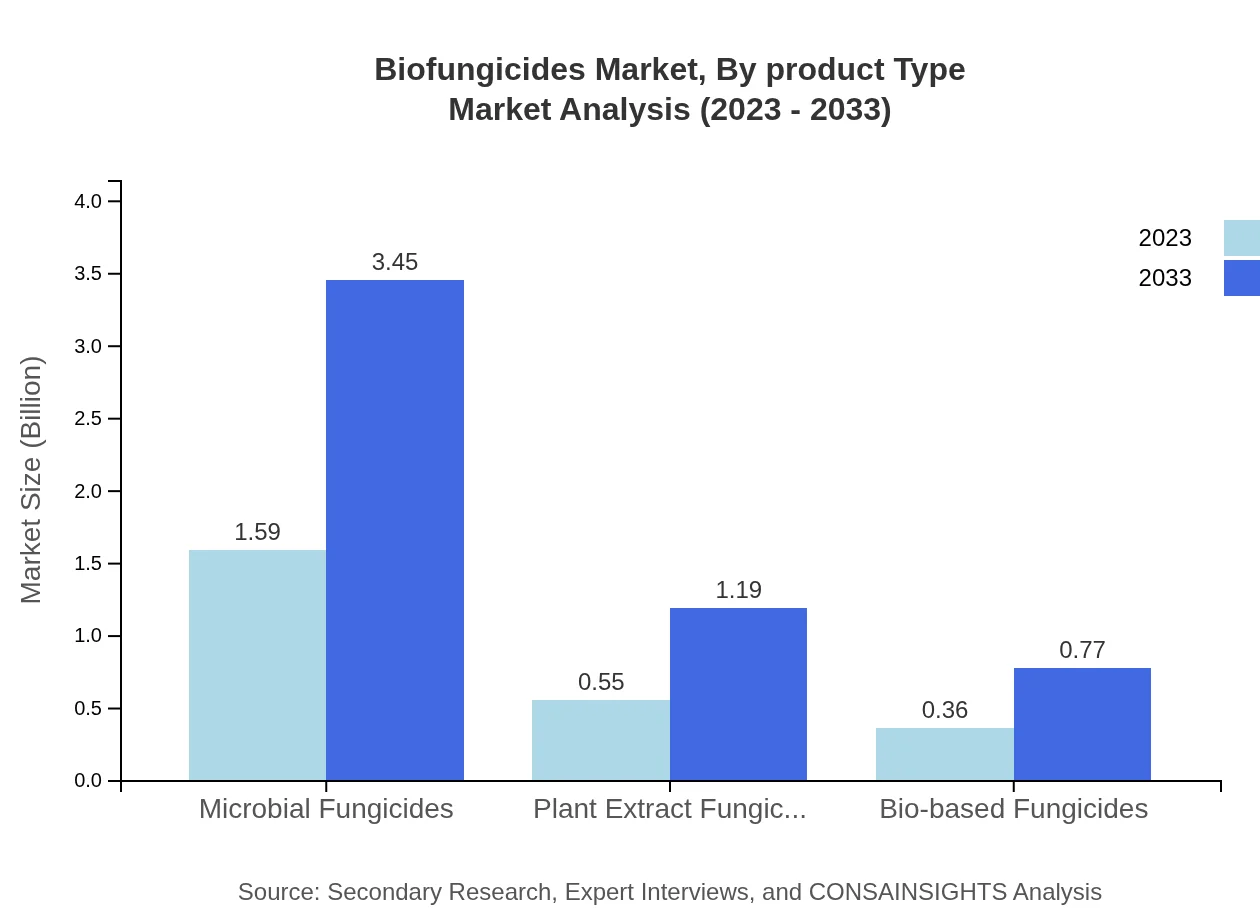

Biofungicides Market Analysis By Product Type

The biofungicides segment is varied, showcasing different product types, including Microbial Fungicides, Plant Extract Fungicides, and Bio-based Fungicides. Microbial fungicides are the leading category, representing a significant portion of the market size in both 2023 ($1.59 billion) and projected future growth ($3.45 billion). Plant Extract Fungicides account for about 21.98% of the market share, with $0.55 billion in 2023, and are expected to grow to $1.19 billion by 2033.

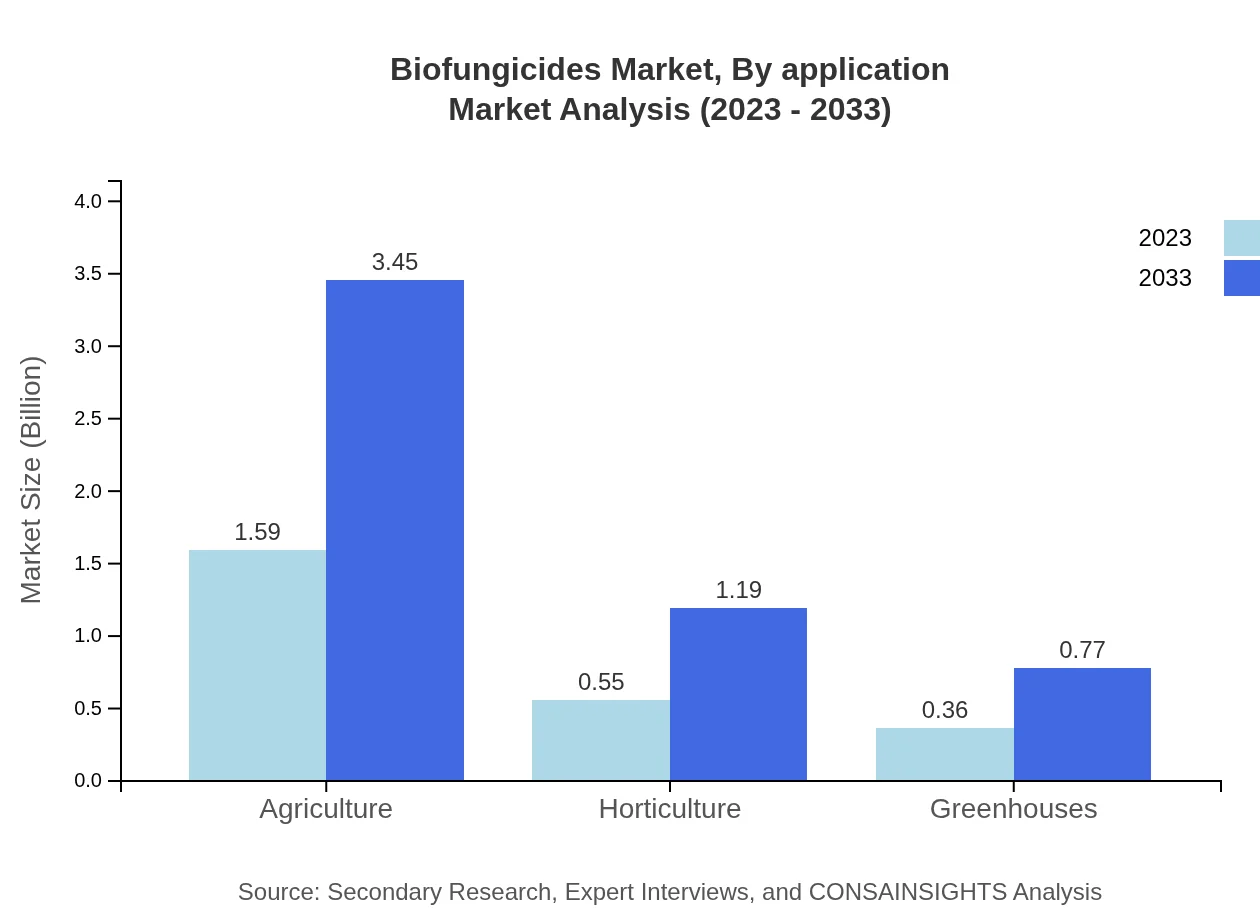

Biofungicides Market Analysis By Application

In terms of application, Agriculture dominates the market with a size of $1.59 billion in 2023, expected to rise to $3.45 billion by 2033, holding a consistent share of approximately 63.74%. Horticulture, followed by Greenhouses, also depict growth trends, emphasizing the demand for biofungicides in diverse agricultural practices.

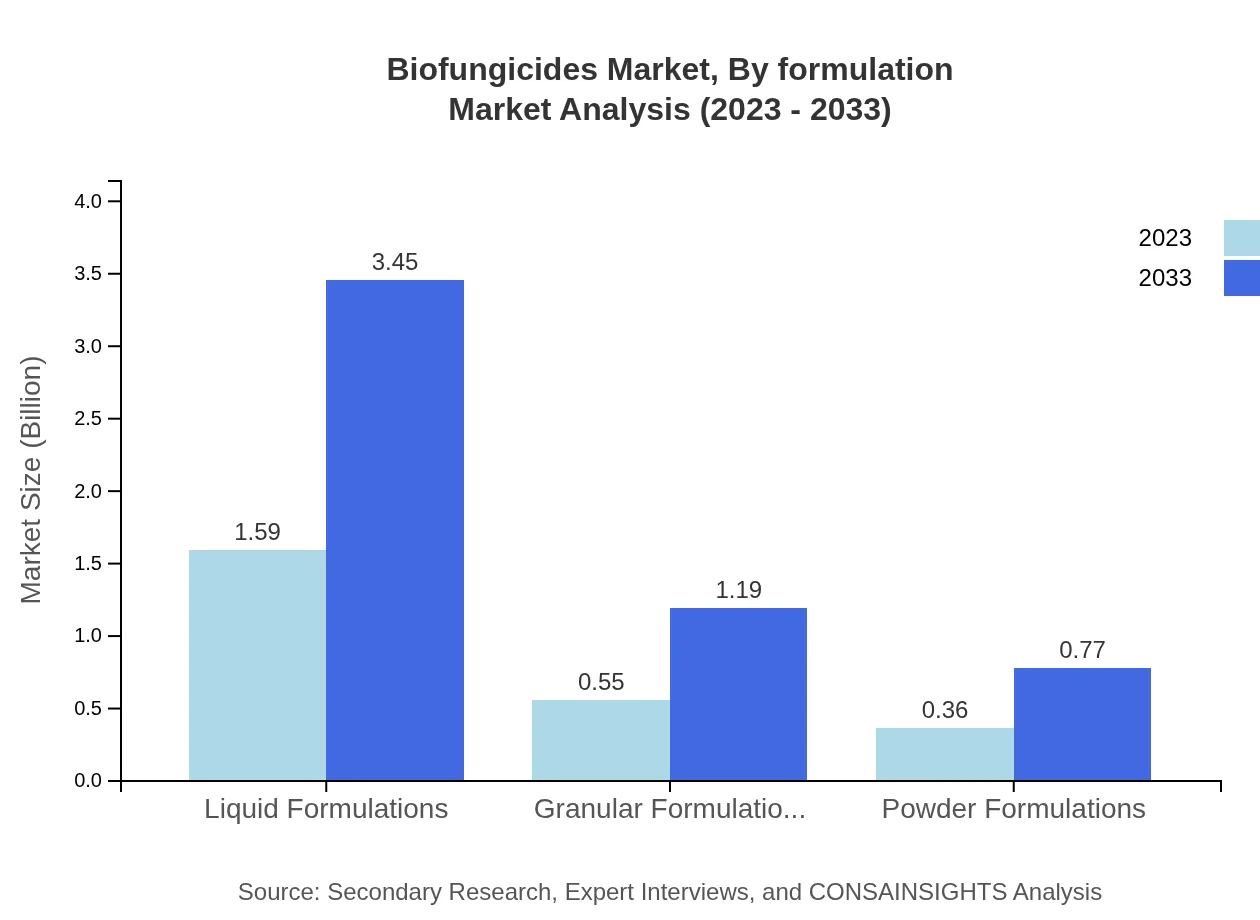

Biofungicides Market Analysis By Formulation

Various formulations characterize the Biofungicides market, with Liquid formulations being the most prominent, commanding a market size of $1.59 billion in 2023 with a projected growth to $3.45 billion by 2033. Granular formulations follow, accounting for a similar trend, indicating the importance of delivery method in solution efficacy.

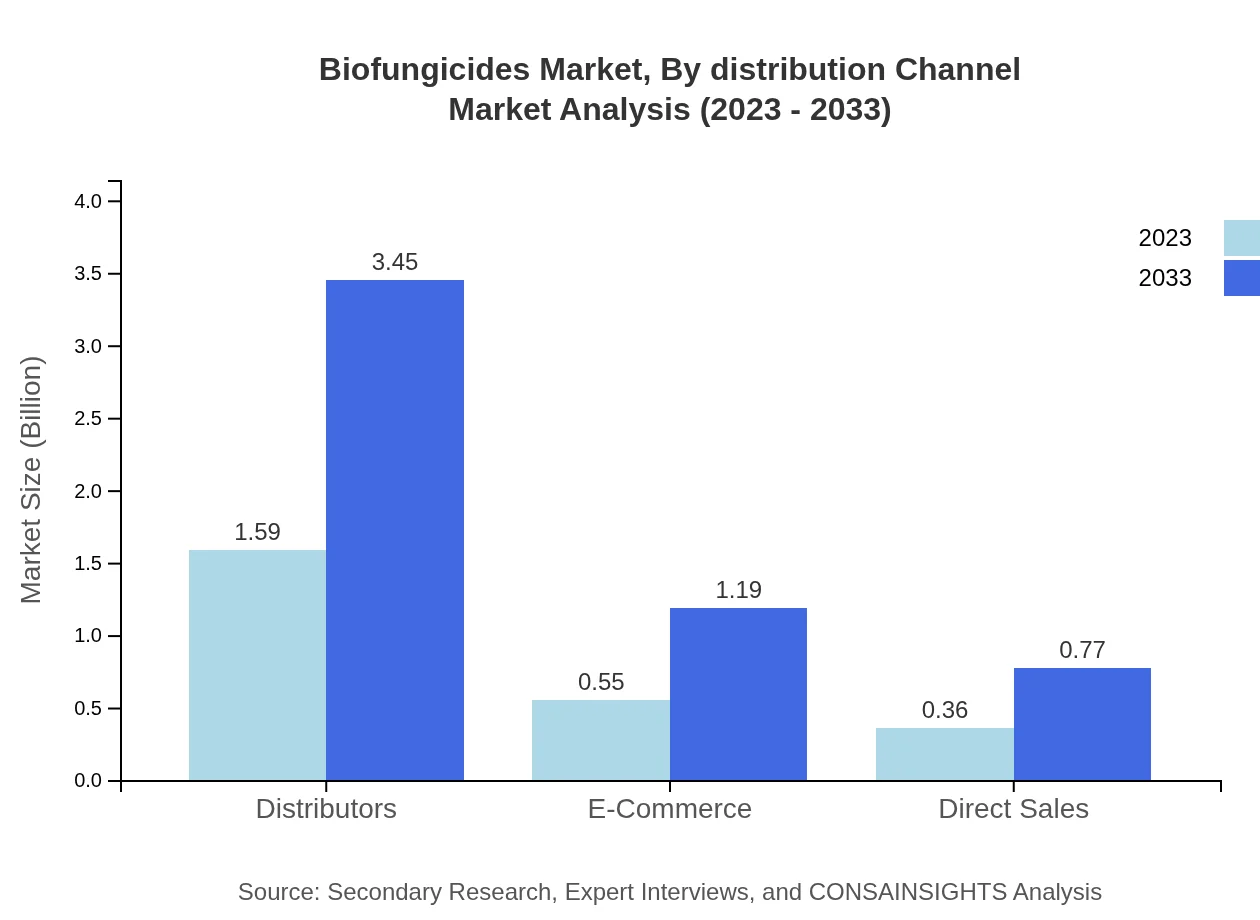

Biofungicides Market Analysis By Distribution Channel

Distribution channels for biofungicides are primarily through Distributors, representing 63.74% market share and a size of $1.59 billion in 2023. E-commerce is poised for significant growth, projected to reach $1.19 billion by 2033, showcasing the trend towards online purchasing in agricultural inputs.

Biofungicides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biofungicides Industry

BASF SE:

A leading chemical company involved in the production of bio-centric agricultural solutions, focusing on sustainable crop protection.Syngenta AG:

Known for its innovative agricultural products, Syngenta emphasizes developing biological solutions to enhance agricultural sustainability.Certis USA LLC:

A prominent player specializing in biofungicides, providing solutions that align with organic farming practices.FMC Corporation:

A global agricultural sciences company creating a wide range of bio-based products to meet the diverse needs of farmers.Valent Biosciences LLC:

Dedicated to enhancing agricultural production through biological solutions, Valent focuses on innovative and effective biofungicides.We're grateful to work with incredible clients.

FAQs

What is the market size of biofungicides?

The global biofungicides market size is projected to reach approximately $2.5 billion by 2033, growing at a CAGR of 7.8% from its current value. This reflects an increasing demand for sustainable agricultural solutions.

What are the key market players or companies in the biofungicides industry?

Key market players in the biofungicides industry include significant entities such as BASF SE, Bayer AG, and Syngenta, which contribute to innovation and development of eco-friendly fungicide solutions to meet growing agricultural demands.

What are the primary factors driving the growth in the biofungicides industry?

Primary factors driving growth in the biofungicides industry include rising awareness of sustainable agriculture, increasing adoption of organic farming, stringent regulations on chemical pesticides, and the growing demand for residue-free produce among consumers.

Which region is the fastest Growing in the biofungicides market?

The fastest-growing region in the biofungicides market is Europe, which is projected to grow from $0.62 billion in 2023 to $1.34 billion by 2033, highlighting a robust shift towards eco-friendly agricultural practices.

Does ConsaInsights provide customized market report data for the biofungicides industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the biofungicides industry, allowing clients to focus on relevant trends, regional insights, and market dynamics that match their strategic objectives.

What deliverables can I expect from this biofungicides market research project?

From the biofungicides market research project, you can expect detailed reports, empirical data analysis, trend insights, competitive landscape, and actionable recommendations to guide strategic decision-making and investment opportunities.

What are the market trends of biofungicides?

Current market trends in biofungicides include a shift towards liquid formulations leading at a size of $1.59 billion, consumer preference for microbial-based solutions, and a significant emphasis on sustainability driving innovation.