Bioinformatics Market Report

Published Date: 31 January 2026 | Report Code: bioinformatics

Bioinformatics Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the bioinformatics market, including market sizes, growth rates, technological advancements, and regional insights for the period 2023 to 2033.

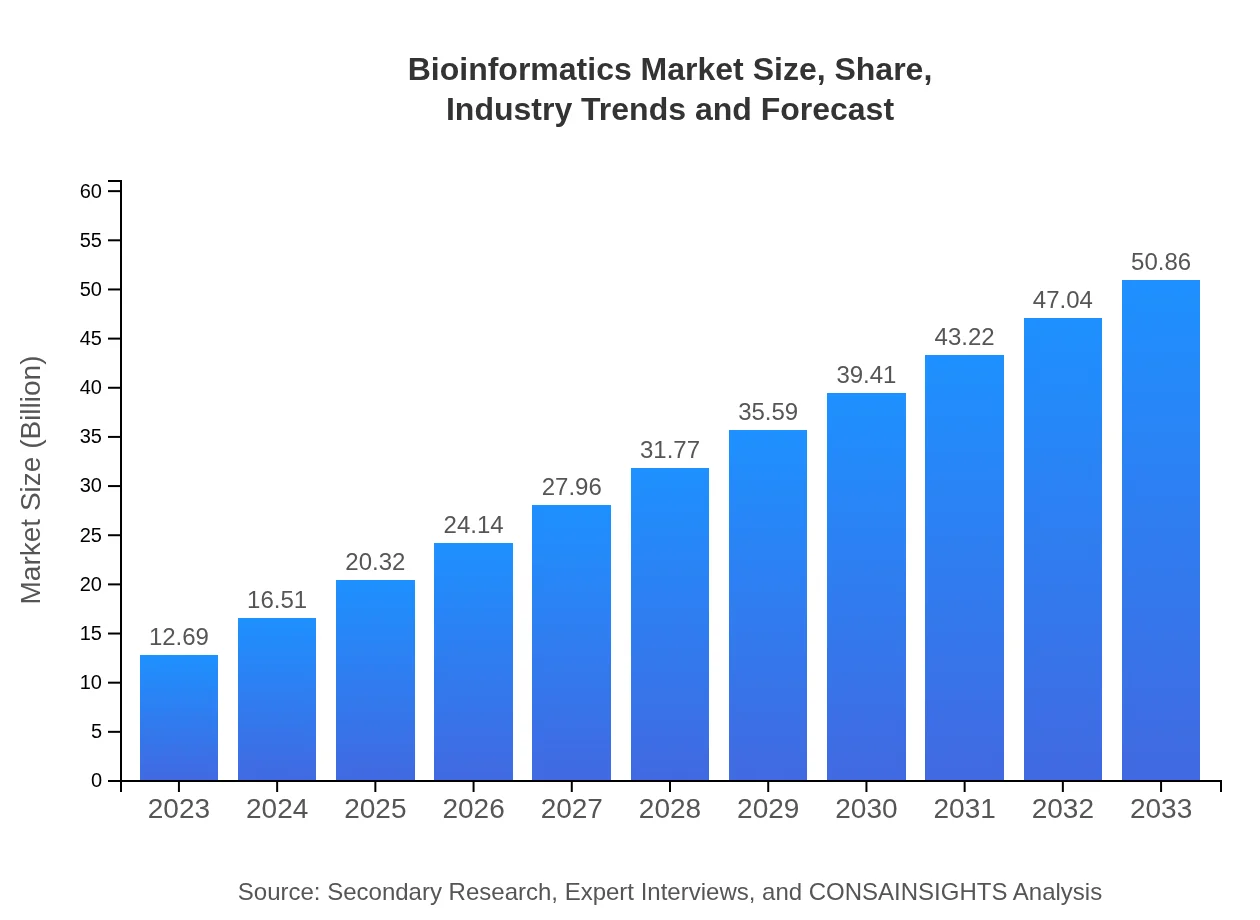

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $12.69 Billion |

| CAGR (2023-2033) | 14.2% |

| 2033 Market Size | $50.86 Billion |

| Top Companies | Illumina, Inc., Thermo Fisher Scientific Inc., Qiagen N.V., IBM Watson Health, Agilent Technologies, Inc. |

| Last Modified Date | 31 January 2026 |

Bioinformatics Market Overview

Customize Bioinformatics Market Report market research report

- ✔ Get in-depth analysis of Bioinformatics market size, growth, and forecasts.

- ✔ Understand Bioinformatics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioinformatics

What is the Market Size & CAGR of Bioinformatics market in 2023?

Bioinformatics Industry Analysis

Bioinformatics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioinformatics Market Analysis Report by Region

Europe Bioinformatics Market Report:

Europe's bioinformatics market is projected to grow significantly, from an estimated $4.48 billion in 2023 to $17.97 billion by 2033. The region benefits from strong research collaboration across EU member states, contributing to innovative bioinformatics applications, particularly in healthcare and environmental studies.Asia Pacific Bioinformatics Market Report:

The Asia Pacific bioinformatics market is estimated at $2.31 billion in 2023 and projected to grow to $9.25 billion by 2033. Factors driving growth include significant investments in genomic research and increasing awareness of personalized medicine initiatives across countries such as China and India, which are becoming key players in the global biotechnology landscape.North America Bioinformatics Market Report:

North America holds a critical position with a market size of $4.23 billion in 2023, expected to grow to $16.97 billion by 2033. The region is characterized by significant research output, investment in advanced research tools, and the presence of leading biotechnology and pharmaceutical companies that heavily utilize bioinformatics solutions.South America Bioinformatics Market Report:

In South America, the bioinformatics market is valued at $1.08 billion in 2023, with projections reaching $4.34 billion by 2033. Growth is supported by rising government and private funding for health research, alongside breakthroughs in genomic and clinical data applications relevant to local health challenges.Middle East & Africa Bioinformatics Market Report:

The Middle East and Africa bioinformatics market is valued at $0.58 billion in 2023, with forecasts reaching $2.33 billion by 2033. The expansion in this region is facilitated by an increase in research initiatives and collaborations with international research institutions, alongside the establishment of bioinformatics infrastructure to support local health needs.Tell us your focus area and get a customized research report.

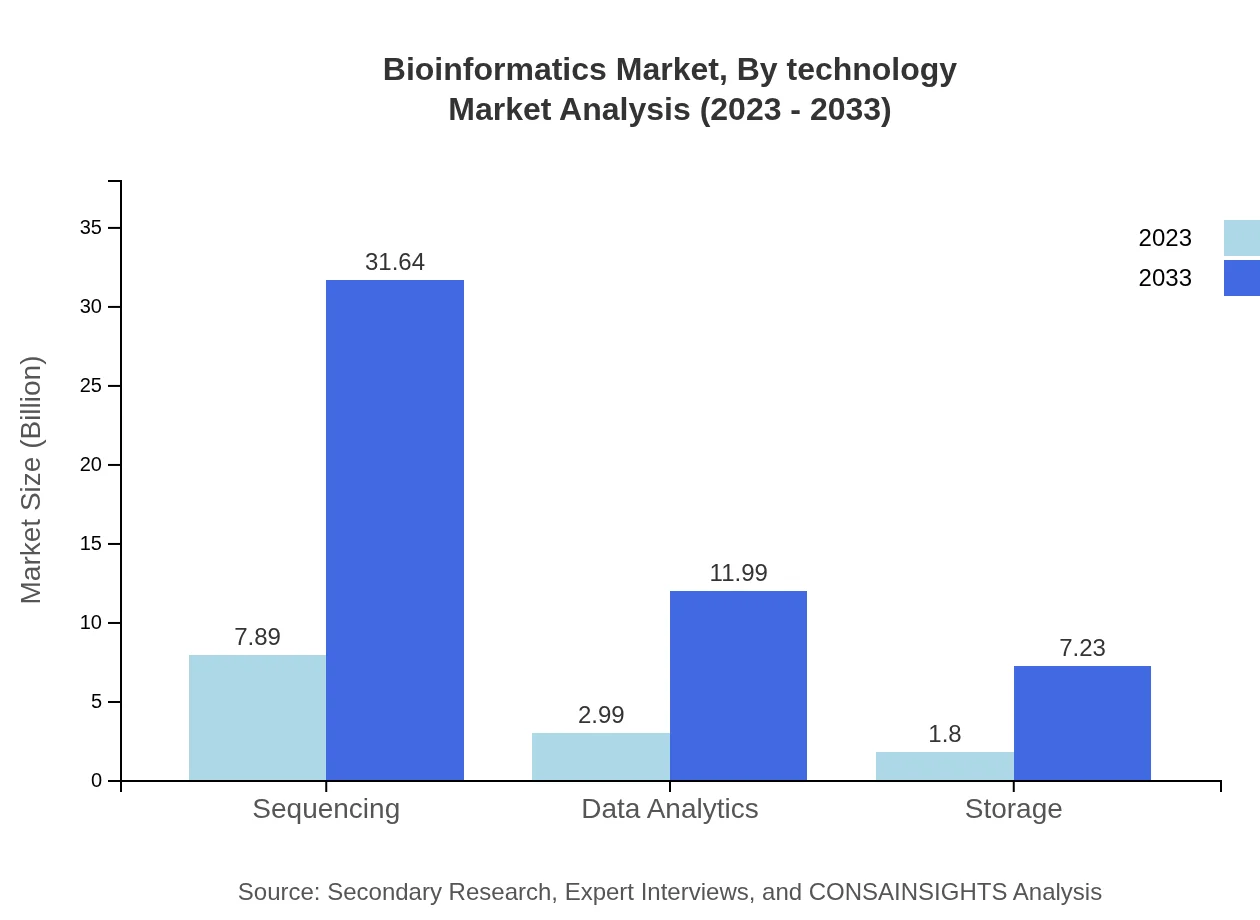

Bioinformatics Market Analysis By Technology

The bioinformatics market segmented by technology comprises components such as software, sequencing, data analytics, and hardware. Sequencing holds the largest market share due to advancements in next-generation sequencing technologies. Data analytics tools are vital for managing complex data sets in genomics and personalized medicine. The emergence of cloud-based solutions is also reshaping how bioinformatics services are delivered, enabling scalable and cost-effective data management.

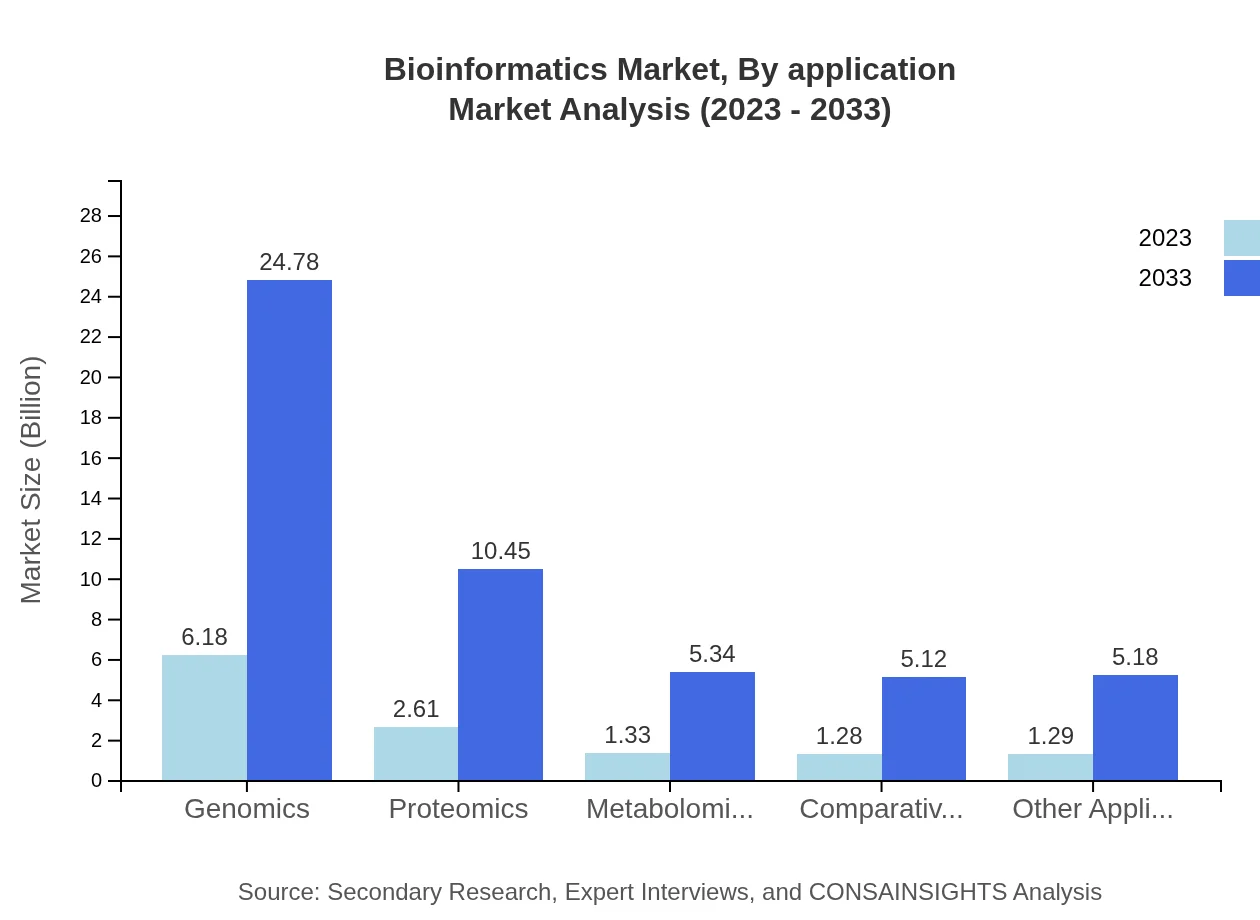

Bioinformatics Market Analysis By Application

Key applications in the bioinformatics market include pharmaceuticals, clinical diagnostics, agriculture, and biotechnology. The pharmaceutical sector leads with a market size of $6.18 billion in 2023 and an anticipated growth to $24.78 billion by 2033, driven by the need for efficiency in drug discovery and development processes. Clinical diagnostics is also critical, focusing on enhancing testing processes and disease management through integrated bioinformatics solutions.

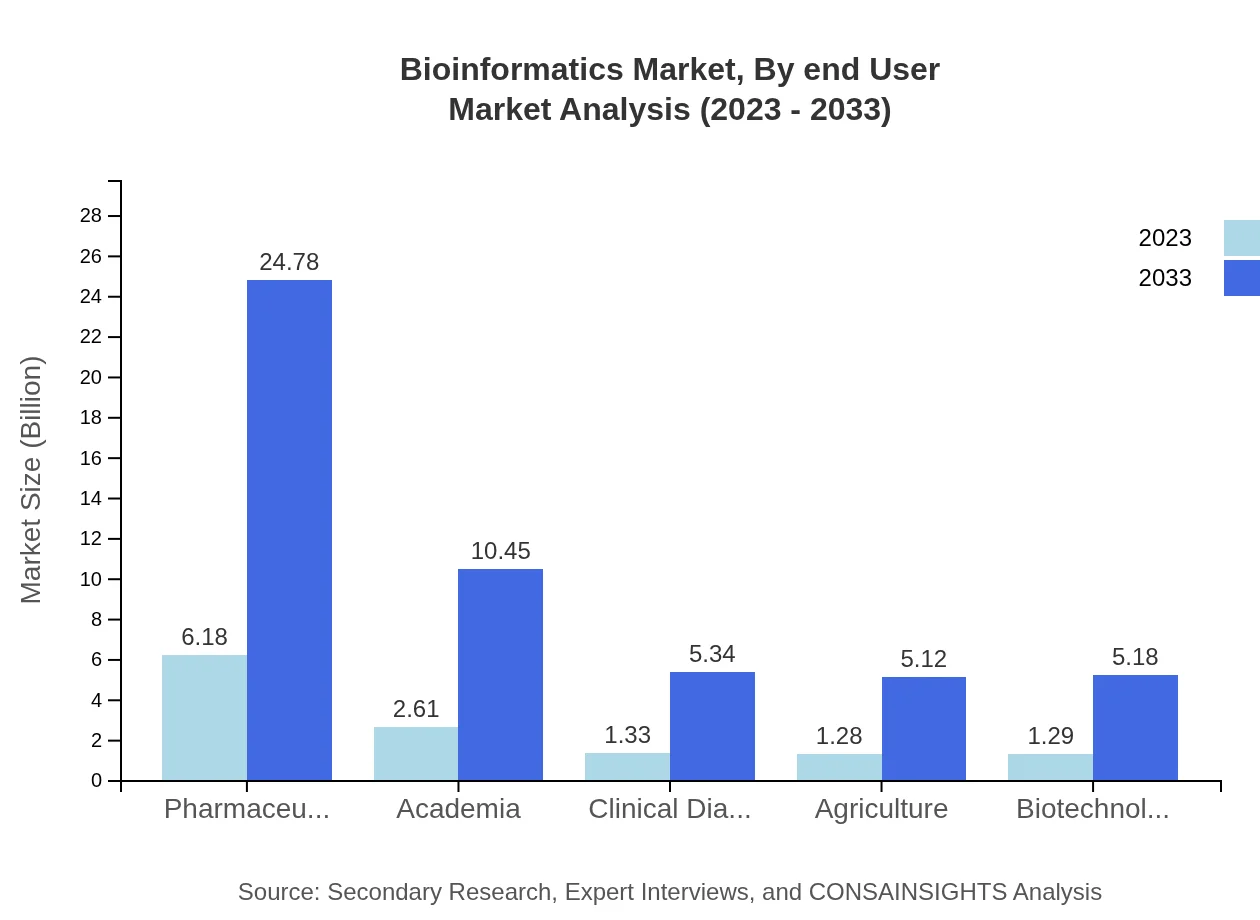

Bioinformatics Market Analysis By End User

End-users in the bioinformatics market encompass pharmaceuticals, academic institutions, biotech firms, and healthcare providers. The pharmaceutical industry is the most prominent end-user, responsible for significant market value due to ongoing research and regulatory requirements. Academia contributes through fundamental research and long-term projects, while biotech companies utilize bioinformatics for advanced therapeutic developments.

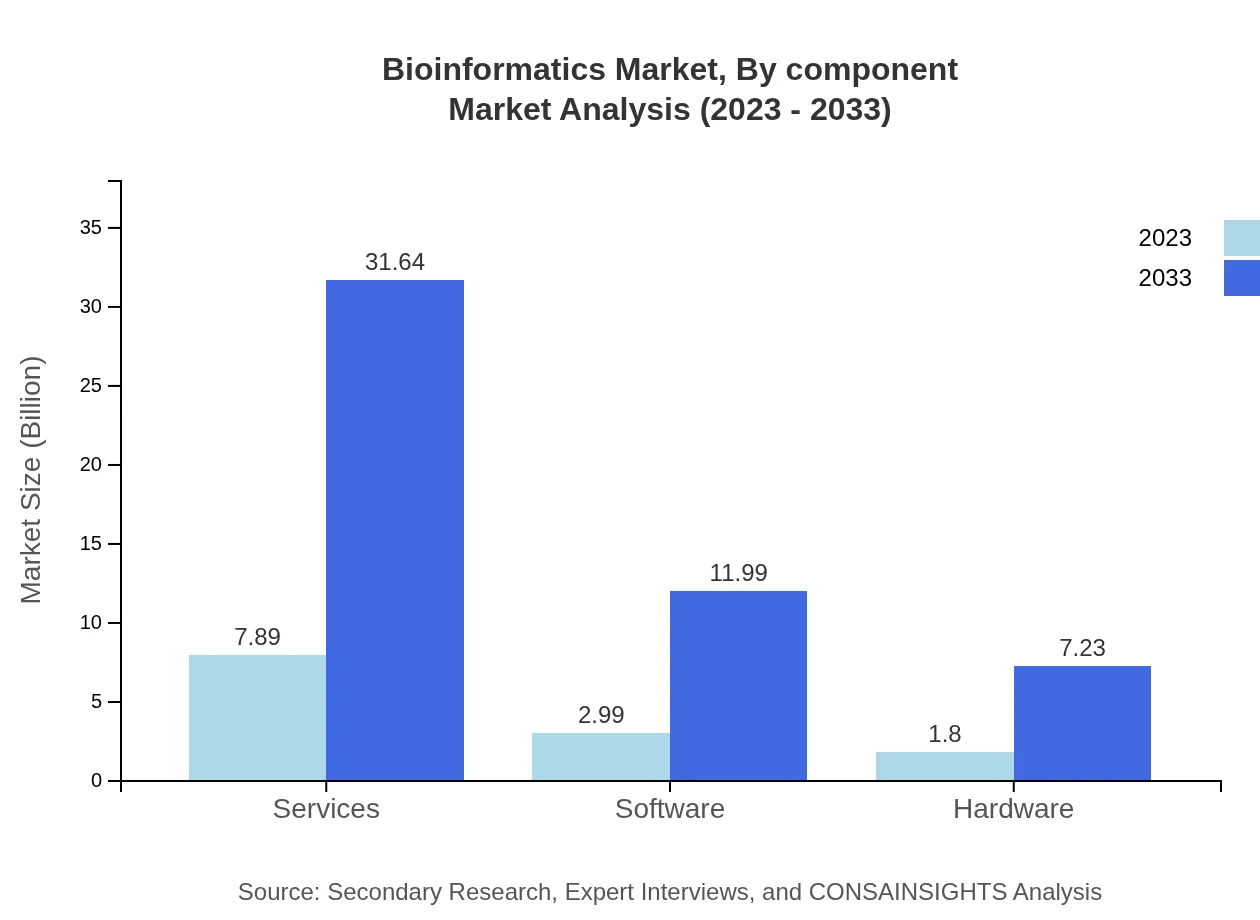

Bioinformatics Market Analysis By Component

The bioinformatics market segmented by component includes services, software, and hardware. Services lead in market size at $7.89 billion in 2023, growing to $31.64 billion by 2033. The shift towards software and analysis services is notable, as organizations seek efficient data processing and management solutions to handle the massive influx of biological data.

Bioinformatics Market Analysis By Region

Global Bioinformatics Market, By Region (Excluded) Market Analysis (2023 - 2033)

Regions outside of traditional bioinformatics hubs are showing increasing adoption rates. Emerging markets are realizing the potential of bioinformatics to enhance agricultural productivity and healthcare management. Collaborations between international companies and local players are expected to bridge capabilities, driving forward the application of bioinformatics across diverse contexts.

Bioinformatics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioinformatics Industry

Illumina, Inc.:

Illumina is a pioneer in genomics technology, providing sequencing and genotyping products that drive advancements in the field of bioinformatics.Thermo Fisher Scientific Inc.:

Offering a comprehensive range of bioinformatics tools and software, Thermo Fisher supports scientists in harnessing genetic insights for research and clinical applications.Qiagen N.V.:

Qiagen specializes in sample and assay technologies, delivering essential bioinformatics solutions for molecular diagnostics and research.IBM Watson Health:

IBM's Watson Health integrates AI capabilities for data interpretation, providing insights that aid in personalized medicine and drug discovery.Agilent Technologies, Inc.:

Agilent provides analytical instruments and software solutions that enhance laboratory workflows and bioinformatics processes to optimize research.We're grateful to work with incredible clients.

FAQs

What is the market size of bioinformatics?

The global bioinformatics market is valued at approximately $12.69 billion in 2023, with a projected compound annual growth rate (CAGR) of 14.2%. This growth reflects increasing investments in healthcare and life sciences.

What are the key market players or companies in the bioinformatics industry?

Key players in the bioinformatics industry include Illumina, Thermo Fisher Scientific, Agilent Technologies, and Qiagen. These companies significantly contribute to the market through innovations in genomic technologies and bioinformatics solutions.

What are the primary factors driving the growth in the bioinformatics industry?

Growth in the bioinformatics industry is propelled by rising demand for personalized medicine, advancements in genomic research, and increasing investments by governments and private sectors in biotechnology and healthcare innovations.

Which region is the fastest Growing in the bioinformatics market?

The Asia-Pacific region is currently the fastest-growing area in the bioinformatics market, projected to expand from $2.31 billion in 2023 to $9.25 billion by 2033, highlighting its emerging biotechnology sector.

Does ConsaInsights provide customized market report data for the bioinformatics industry?

Yes, ConsaInsights offers customized market report data for the bioinformatics industry to cater to specific client needs, enabling insightful analysis tailored to unique business requirements.

What deliverables can I expect from this bioinformatics market research project?

Expect comprehensive deliverables, including market size analysis, forecasts, trends, segmented insights, and competitive landscape assessments, equipping you with strategic intelligence for decision-making.

What are the market trends of bioinformatics?

Current trends in bioinformatics involve increased focus on artificial intelligence in data analytics, integration of big data technologies, and growing importance of collaboration between academia and industry to advance research.