Bioinsecticides Market Report

Published Date: 02 February 2026 | Report Code: bioinsecticides

Bioinsecticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the bioinsecticides market, covering key insights, market trends, and forecasts from 2023 to 2033, alongside regional and product-specific data driven by industry developments.

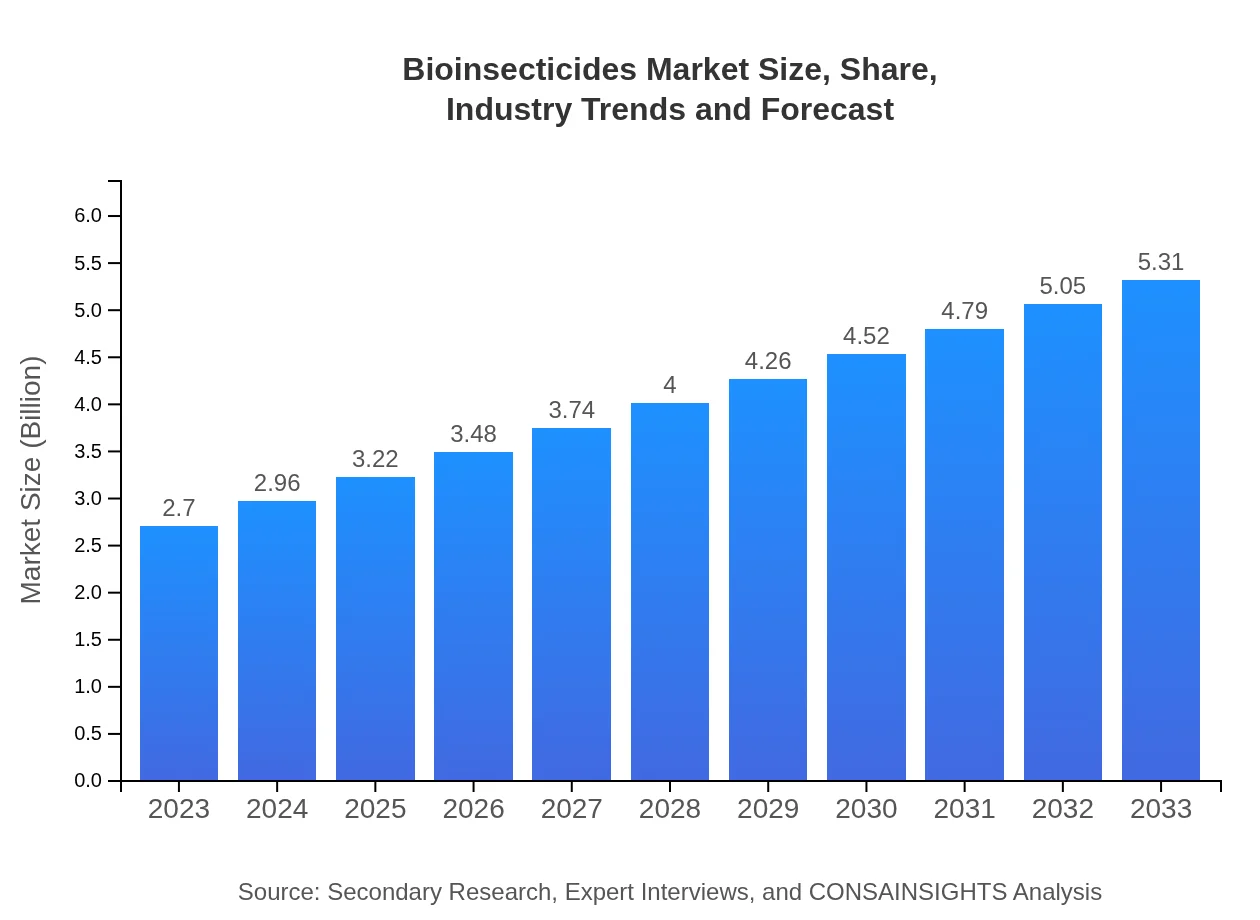

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.70 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $5.31 Billion |

| Top Companies | BASF SE, Bayer AG, Syngenta AG, Marrone Bio Innovations, Valent Biosciences |

| Last Modified Date | 02 February 2026 |

Bioinsecticides Market Overview

Customize Bioinsecticides Market Report market research report

- ✔ Get in-depth analysis of Bioinsecticides market size, growth, and forecasts.

- ✔ Understand Bioinsecticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Bioinsecticides

What is the Market Size & CAGR of Bioinsecticides market in 2023?

Bioinsecticides Industry Analysis

Bioinsecticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Bioinsecticides Market Analysis Report by Region

Europe Bioinsecticides Market Report:

In Europe, the market is expected to grow from $0.76 billion in 2023 to $1.50 billion by 2033, as the region emphasizes environmentally friendly pest control solutions and organic farming practices.Asia Pacific Bioinsecticides Market Report:

The Asia Pacific bioinsecticides market is anticipated to grow from $0.49 billion in 2023 to $0.97 billion by 2033, benefiting from increasing adoption of sustainable agriculture practices and government initiatives for organic farming.North America Bioinsecticides Market Report:

The North American bioinsecticides market, currently valued at $1.04 billion in 2023, is projected to reach $2.05 billion by 2033, mainly driven by strict regulations on chemical pesticides and rising consumer demand for organic produce.South America Bioinsecticides Market Report:

In South America, the market is expected to rise from $0.11 billion in 2023 to $0.22 billion in 2033, owing to increasing investments in agriculture and remarkable growth in organic farming sectors.Middle East & Africa Bioinsecticides Market Report:

The Middle East and Africa market is projected to expand from $0.29 billion in 2023 to $0.57 billion by 2033, driven by increasing agricultural activities and awareness regarding sustainable pest management solutions.Tell us your focus area and get a customized research report.

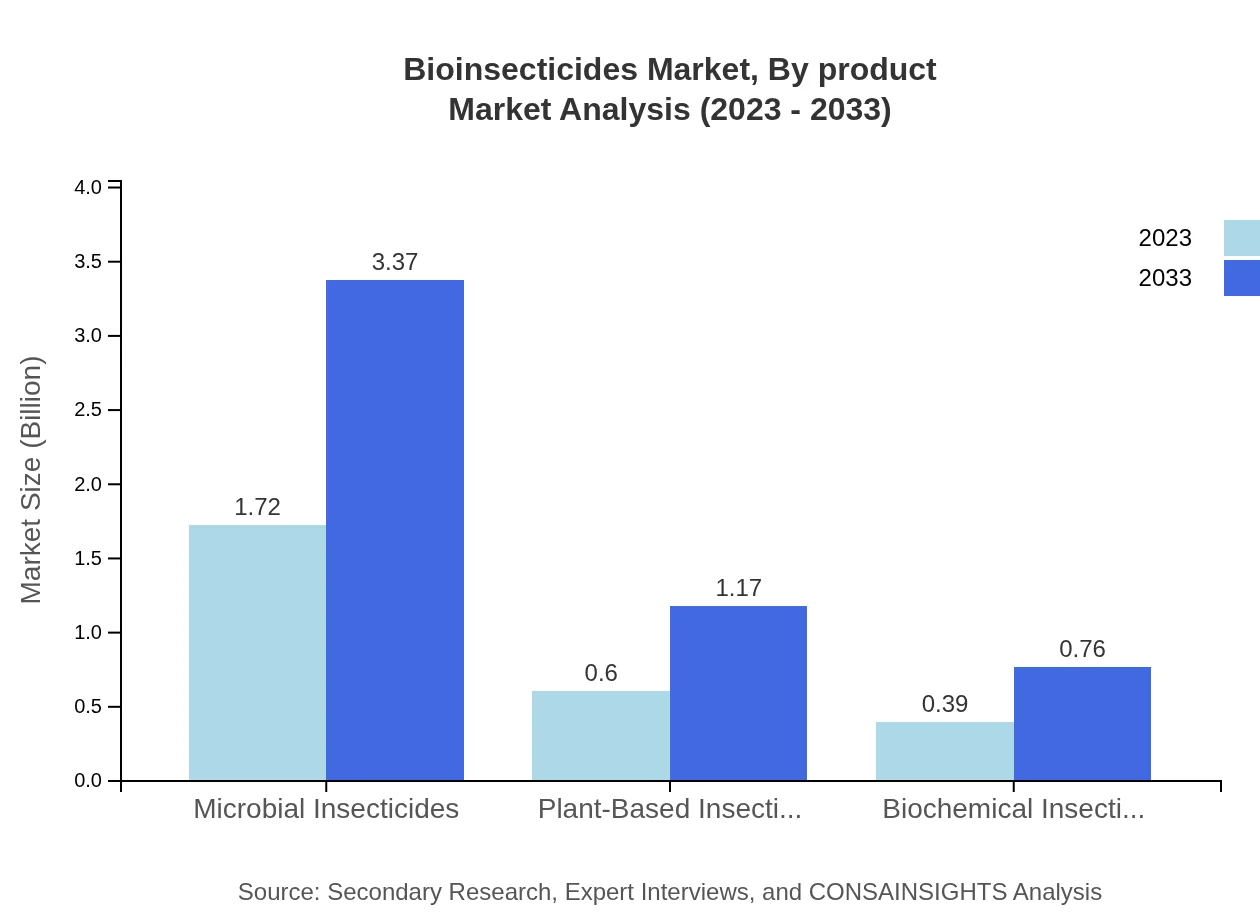

Bioinsecticides Market Analysis By Product

The bioinsecticides market is primarily segmented into microbial insecticides, plant-based insecticides, and biochemical insecticides. Microbial insecticides dominate the market, with an estimated size of $1.72 billion in 2023 and projected to reach $3.37 billion by 2033, capturing a significant market share of 63.55%. Plant-based insecticides follow, with a market size of $0.60 billion in 2023, expected to grow to $1.17 billion in 2033.

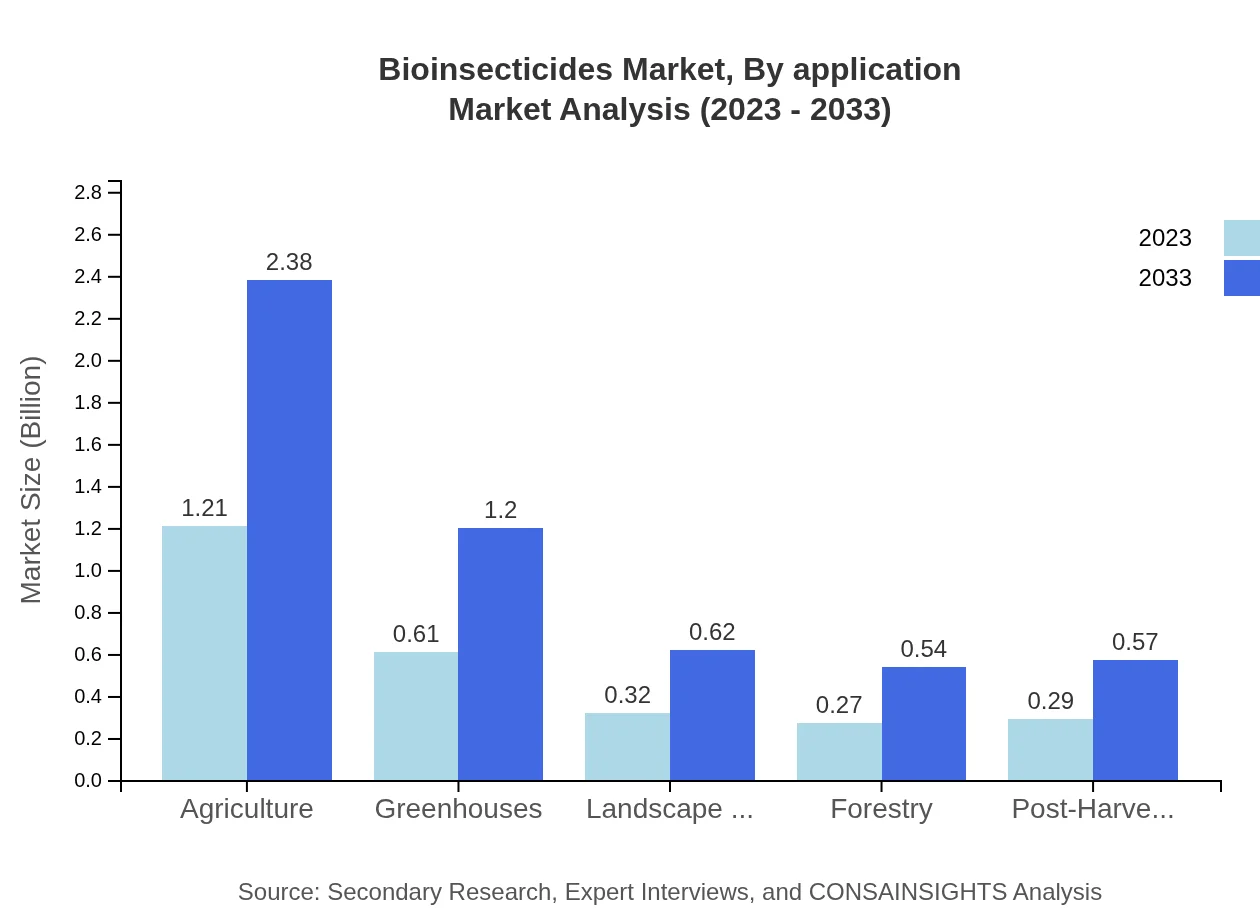

Bioinsecticides Market Analysis By Application

Applications of bioinsecticides are vast, including agriculture, greenhouses, landscape management, and post-harvest treatments. In agriculture, the market size as of 2023 stands at $1.21 billion and is expected to reach $2.38 billion by 2033, demonstrating its critical role in ensuring crop protection and yield enhancement.

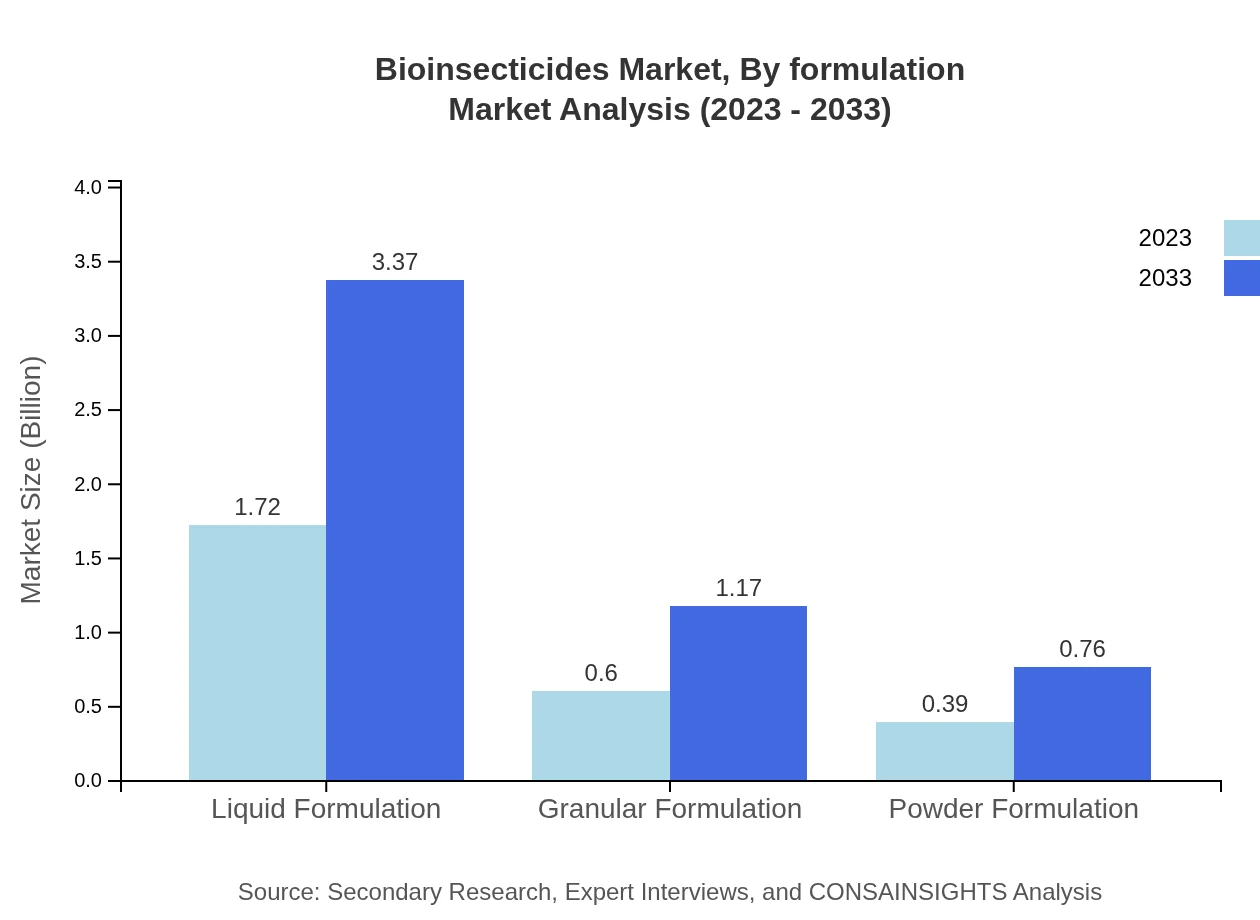

Bioinsecticides Market Analysis By Formulation

Formulations of bioinsecticides include liquid, granular, and powder formulations. Liquid formulations dominate the market, growing from $1.72 billion in 2023 to $3.37 billion in 2033. Granular and powder formulations also show substantial growth, addressing specific application needs across various sectors.

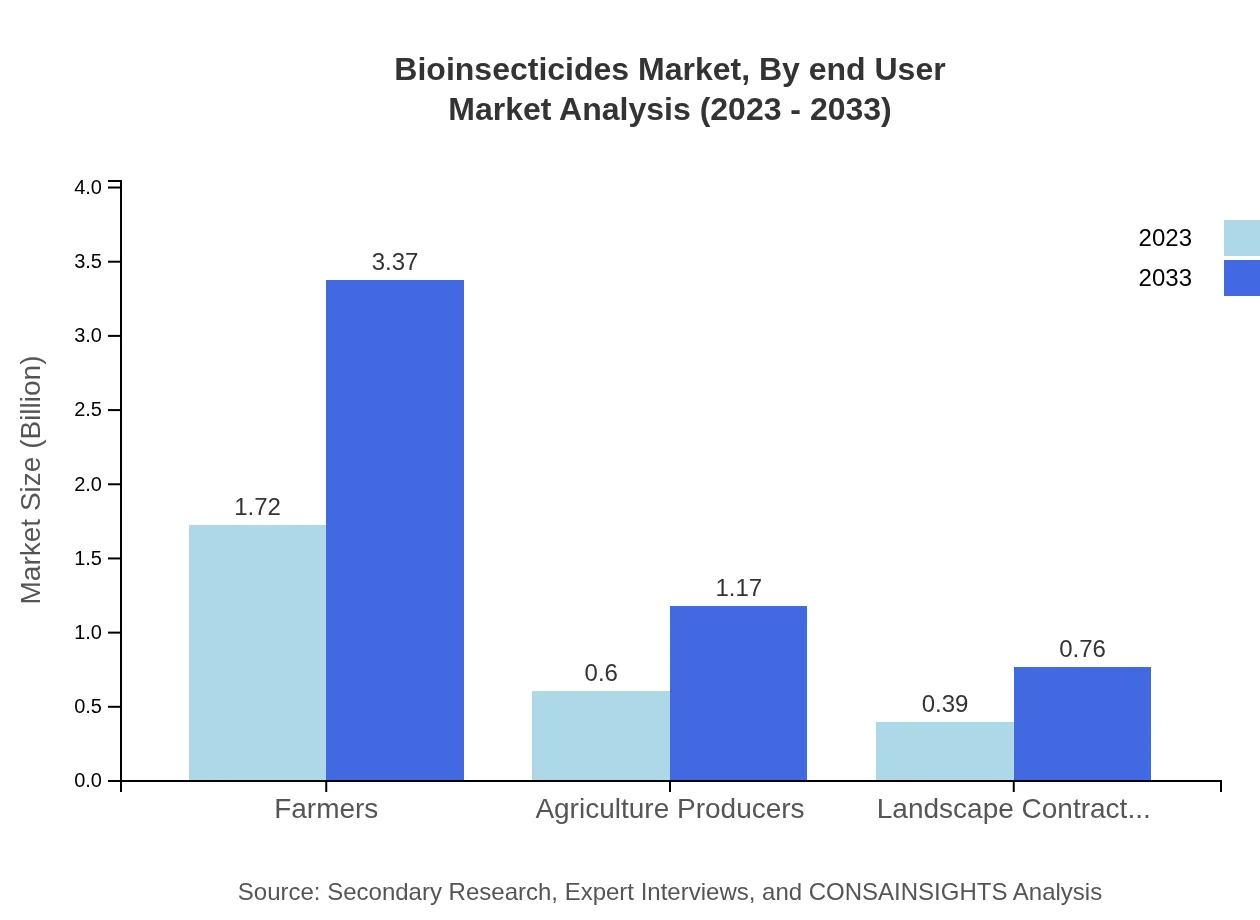

Bioinsecticides Market Analysis By End User

Key end-users of bioinsecticides include farmers, utility contractors, and industry stakeholders. Farmers account for a significant market share, with sizes of $1.72 billion in 2023 and anticipated growth to $3.37 billion by 2033. This highlights the critical role of farmers in adopting bioinsecticides due to increasing regulatory measures against chemical pesticides.

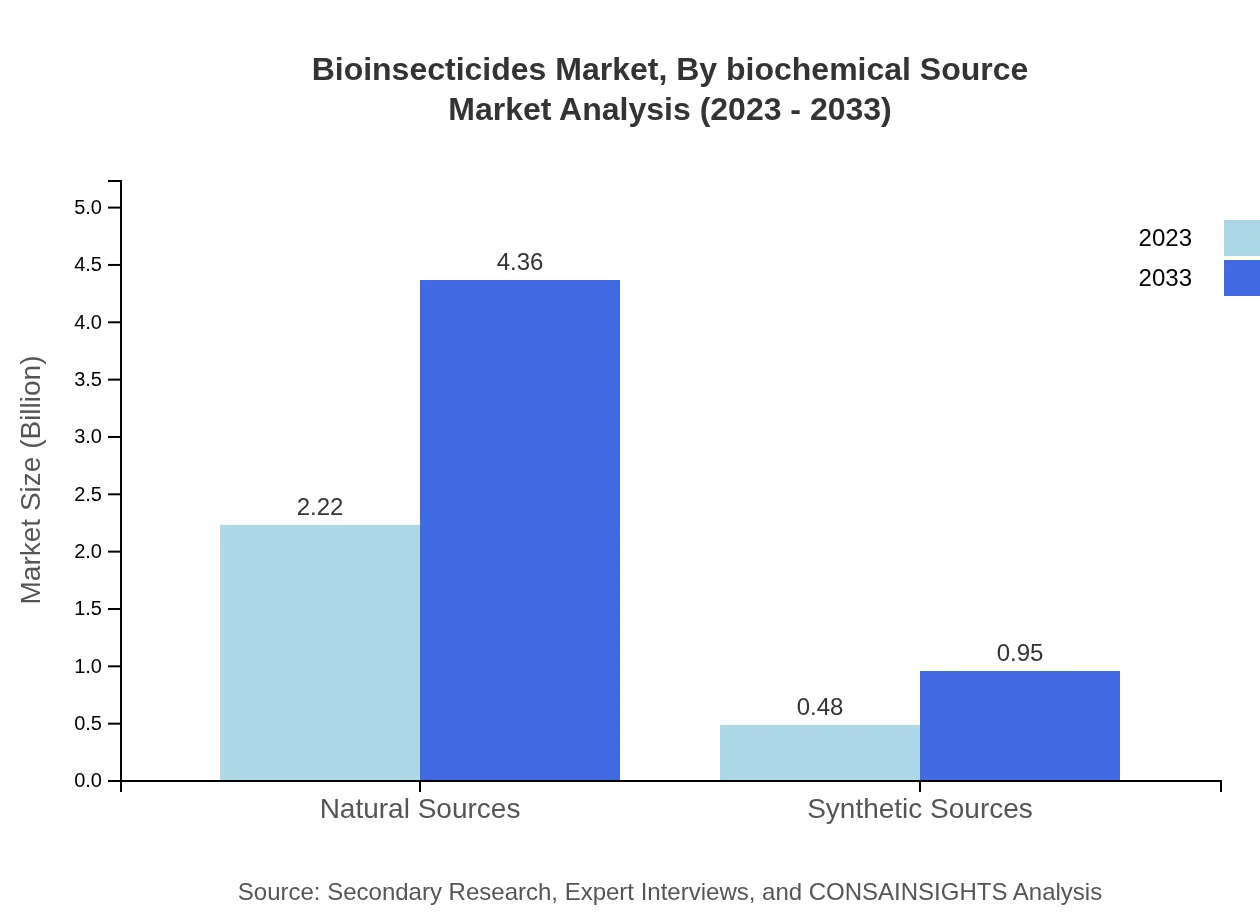

Bioinsecticides Market Analysis By Biochemical Source

Sources of bioinsecticides are classified into natural and synthetic sources, with natural sources contributing significantly to the market. In 2023, the natural source market size is estimated at $2.22 billion, expected to grow to $4.36 billion by 2033, driven by the demand for organic and environmentally safe pest control alternatives.

Bioinsecticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Bioinsecticides Industry

BASF SE:

A leading chemical company, BASF SE is heavily invested in innovative agriculture solutions, developing effective bioinsecticides to support sustainable farming.Bayer AG:

Bayer AG focuses on sustainable agriculture and prominently features bioinsecticides in its portfolio to provide farmers with healthier pest control solutions.Syngenta AG:

Syngenta AG excels in bioinsecticides development, prioritizing product efficiency and farmer support as critical components of its growth strategy.Marrone Bio Innovations:

Marrone Bio Innovations is dedicated to offering organic pest control solutions, emphasizing its expertise in developing bioinsecticides derived from natural ingredients.Valent Biosciences:

Valent Biosciences focuses on biocontrol products, playing a significant role in advancing bioinsecticides aimed at sustainable agricultural practices.We're grateful to work with incredible clients.

FAQs

What is the market size of bioinsecticides?

The global bioinsecticides market was valued at approximately $2.7 billion in 2023, with a projected CAGR of 6.8% from 2023 to 2033. This growth reflects increasing demand for sustainable agricultural solutions.

What are the key market players or companies in the bioinsecticides industry?

Key players in the bioinsecticides market include major corporations involved in pest management, biotechnology, and agriculture. These companies focus on innovation and R&D to enhance product effectiveness and sustainable practices.

What are the primary factors driving the growth in the bioinsecticides industry?

Factors driving growth include rising consumer demand for organic produce, increasing regulatory support for bio-based solutions, and escalating concerns over chemical pesticide safety. These elements contribute to the growing popularity of bioinsecticides.

Which region is the fastest Growing in the bioinsecticides?

North America is the fastest-growing region for bioinsecticides, with the market expected to increase from $1.04 billion in 2023 to $2.05 billion by 2033. This growth is driven by strong agricultural practices and increasing adoption of sustainable farming.

Does ConsaInsights provide customized market report data for the bioinsecticides industry?

Yes, ConsaInsights offers customized market report data tailored to specific client needs within the bioinsecticides industry, ensuring insights reflect unique market dynamics and trends.

What deliverables can I expect from this bioinsecticides market research project?

Deliverables from the bioinsecticides market research project may include comprehensive reports, data analysis, market forecasts, and insights into regional trends and competitive landscapes, tailored to strategic decision-making.

What are the market trends of bioinsecticides?

Current market trends in bioinsecticides include increasing adoption of microbial insecticides, the growing importance of sustainable agricultural practices, and technological advancements in product formulations, which collectively drive market innovation.