Biological Control Market Report

Published Date: 02 February 2026 | Report Code: biological-control

Biological Control Market Size, Share, Industry Trends and Forecast to 2033

This report offers a comprehensive analysis of the Biological Control market, focusing on key insights, trends, and forecasts from 2023 to 2033. It provides data on market size, regional dynamics, key players, and future challenges in the biological pest control sector.

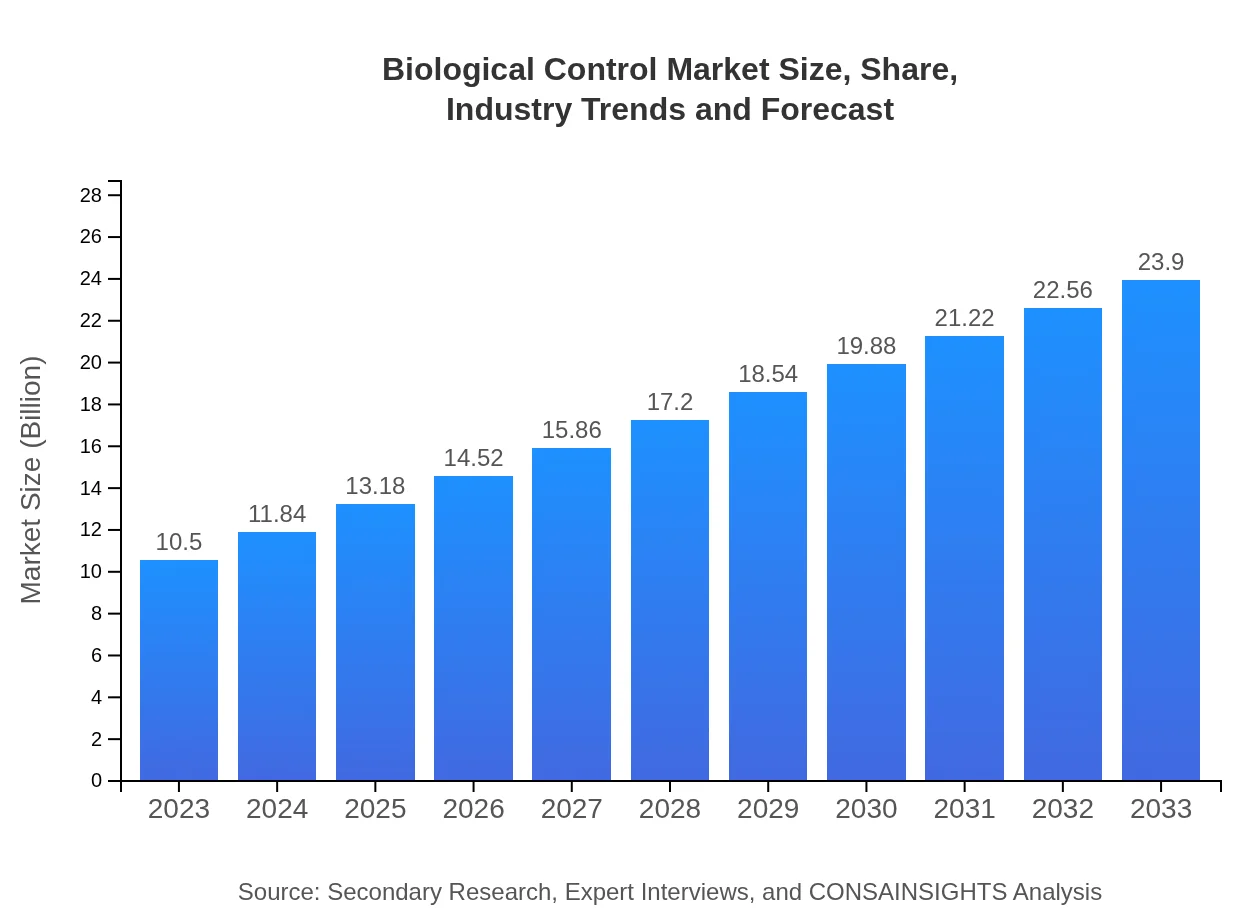

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $10.50 Billion |

| CAGR (2023-2033) | 8.3% |

| 2033 Market Size | $23.90 Billion |

| Top Companies | BASF SE, Syngenta, Monsanto, Valent BioSciences, BioWorks, Inc. |

| Last Modified Date | 02 February 2026 |

Biological Control Market Overview

Customize Biological Control Market Report market research report

- ✔ Get in-depth analysis of Biological Control market size, growth, and forecasts.

- ✔ Understand Biological Control's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biological Control

What is the Market Size & CAGR of Biological Control market in 2023?

Biological Control Industry Analysis

Biological Control Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biological Control Market Analysis Report by Region

Europe Biological Control Market Report:

Europe's Biological Control market, growing from $3.06 billion in 2023 to $6.96 billion in 2033, is driven by the EU's Green Deal, which emphasizes the use of environmentally friendly pest control methods to achieve carbon neutrality.Asia Pacific Biological Control Market Report:

In the Asia Pacific region, the Biological Control market is projected to grow from $1.98 billion in 2023 to $4.51 billion by 2033. This significant growth is driven by agricultural innovation, government support for sustainable practices, and increasing pest resistance to chemicals.North America Biological Control Market Report:

The North American market, valued at $4.01 billion in 2023, is projected to reach $9.13 billion by 2033. The U.S. leads in the development and adoption of biological control agents, supported by stringent regulations on chemical pesticides and increasing public awareness about the benefits of sustainable practices.South America Biological Control Market Report:

South America is expected to see a rise from $0.83 billion in 2023 to $1.89 billion in 2033. Countries like Brazil and Argentina are leading the charge with enhanced adoption of sustainable farming practices as consumer demand for organic products surges.Middle East & Africa Biological Control Market Report:

The Middle East and Africa are set to grow from $0.62 billion in 2023 to $1.42 billion by 2033. The adoption of biological control methods is gradually rising, mainly due to water scarcity issues that encourage more sustainable agricultural practices.Tell us your focus area and get a customized research report.

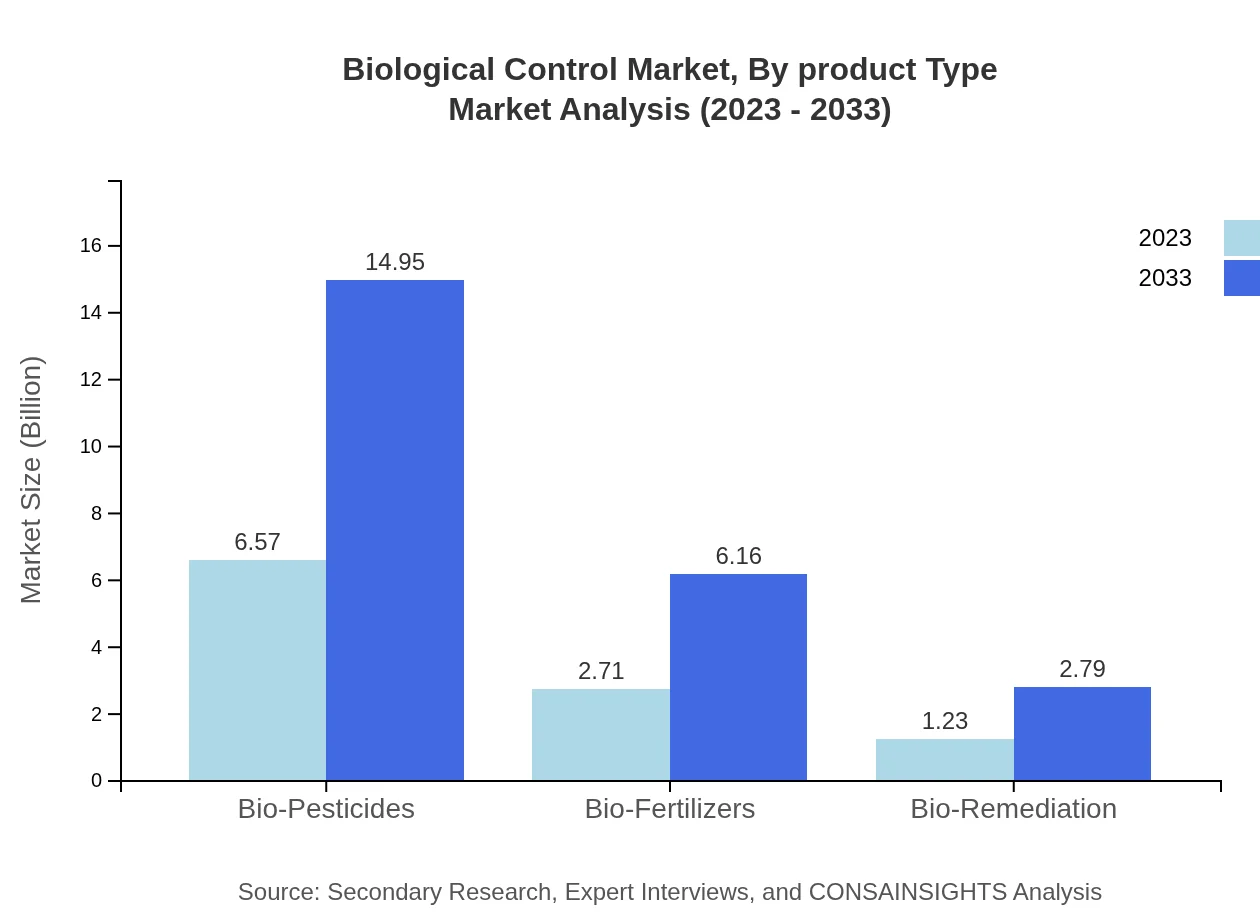

Biological Control Market Analysis By Product Type

In 2023, bio-pesticides dominate the market with a size of $6.57 billion, expected to grow to $14.95 billion by 2033. Bio-fertilizers and bio-remediation follow, with sizes of $2.71 billion and $1.23 billion and growing to $6.16 billion and $2.79 billion respectively. Liquids account for 62.54% of the product type market share, showcasing their popularity among farmers.

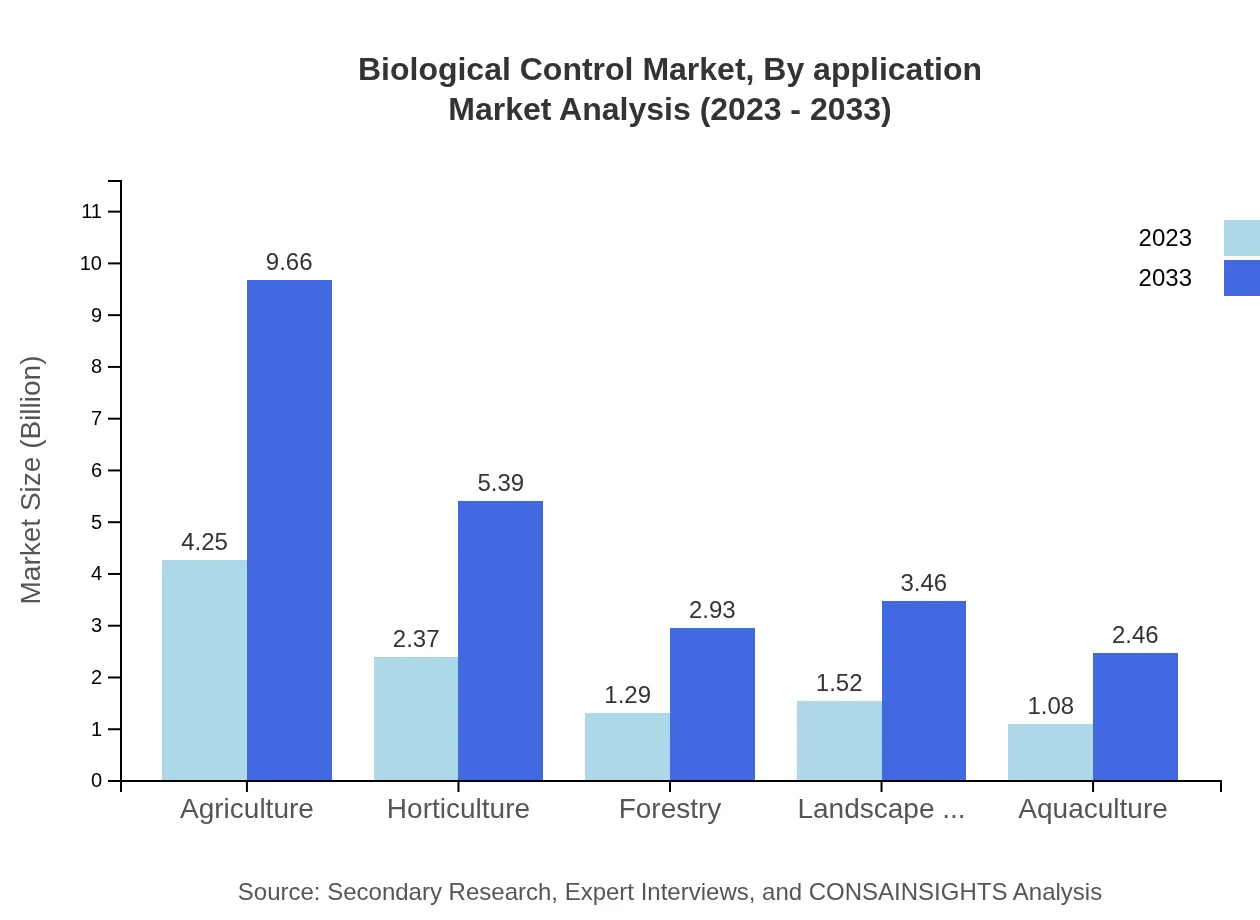

Biological Control Market Analysis By Application

Agriculture leads application segments, with a market size of $4.25 billion in 2023, expanding to $9.66 billion by 2033. Horticulture follows with $2.37 billion to $5.39 billion, while forestry and aquaculture lag but show promising growth rates. Organic farmers increasingly utilize biological control to improve yields and reduce costs related to chemical inputs.

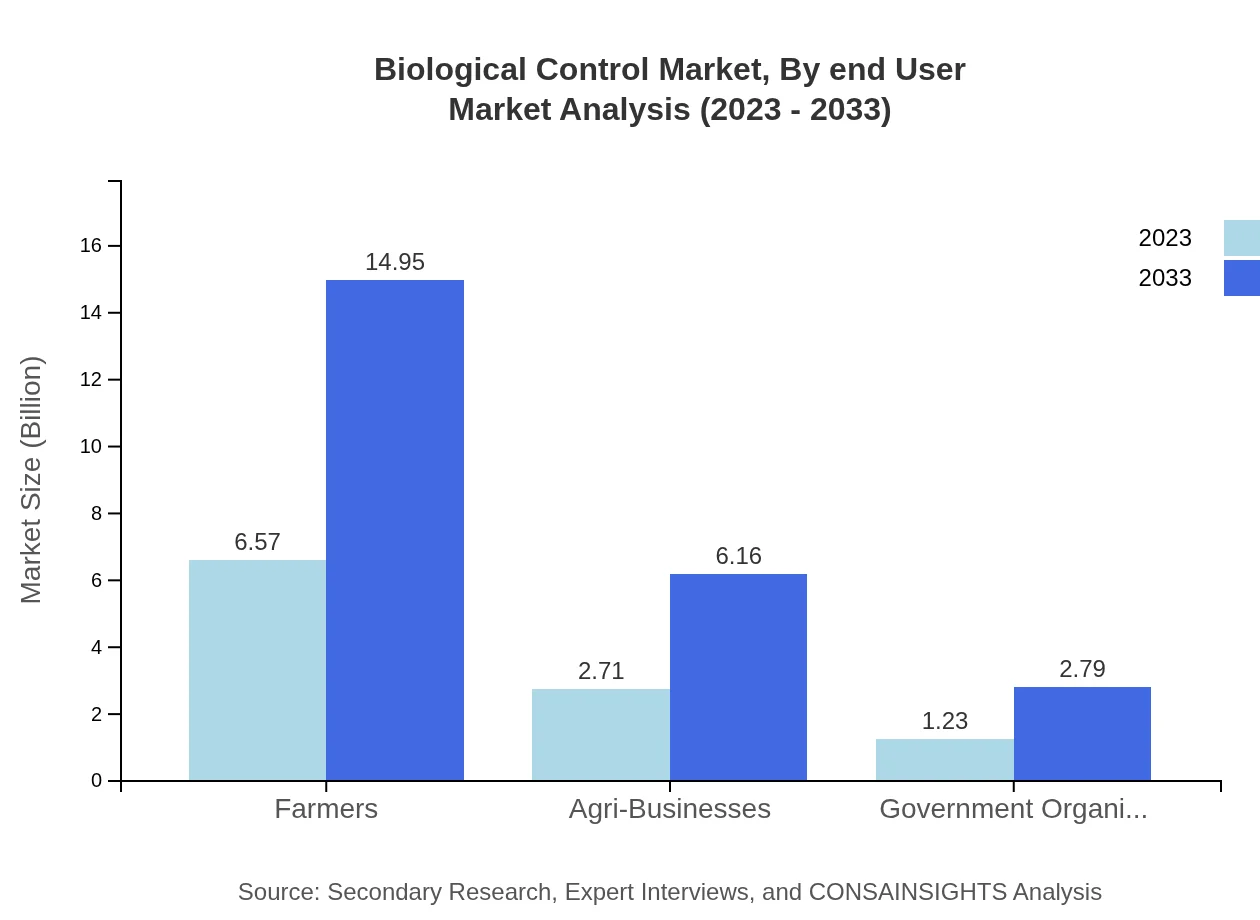

Biological Control Market Analysis By End User

Farmers seek biological control methods to enhance productivity and sustainability, commanding a 62.54% market share with a size of $6.57 billion in 2023, forecasted to reach $14.95 billion. Agribusinesses and government organizations also contribute, with market sizes expanding from $2.71 billion to $6.16 billion and from $1.23 billion to $2.79 billion respectively.

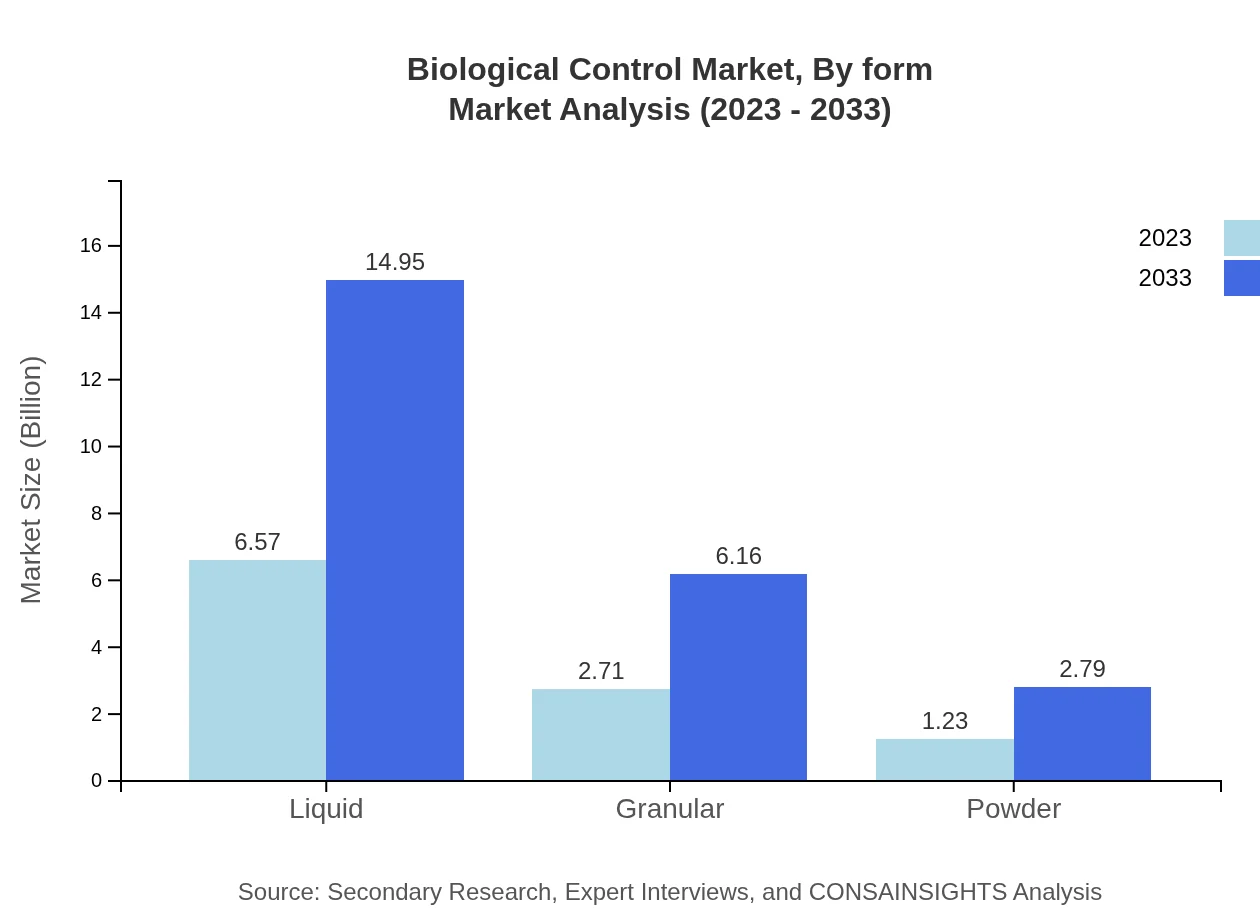

Biological Control Market Analysis By Form

Liquid formulations dominate the market, holding a size of $6.57 billion and a share of 62.54% in 2023, expected to reach $14.95 billion by 2033. Granular and powder forms offer alternative solutions that cater to niche applications, with granular expected to grow from $2.71 billion to $6.16 billion and powder from $1.23 billion to $2.79 billion.

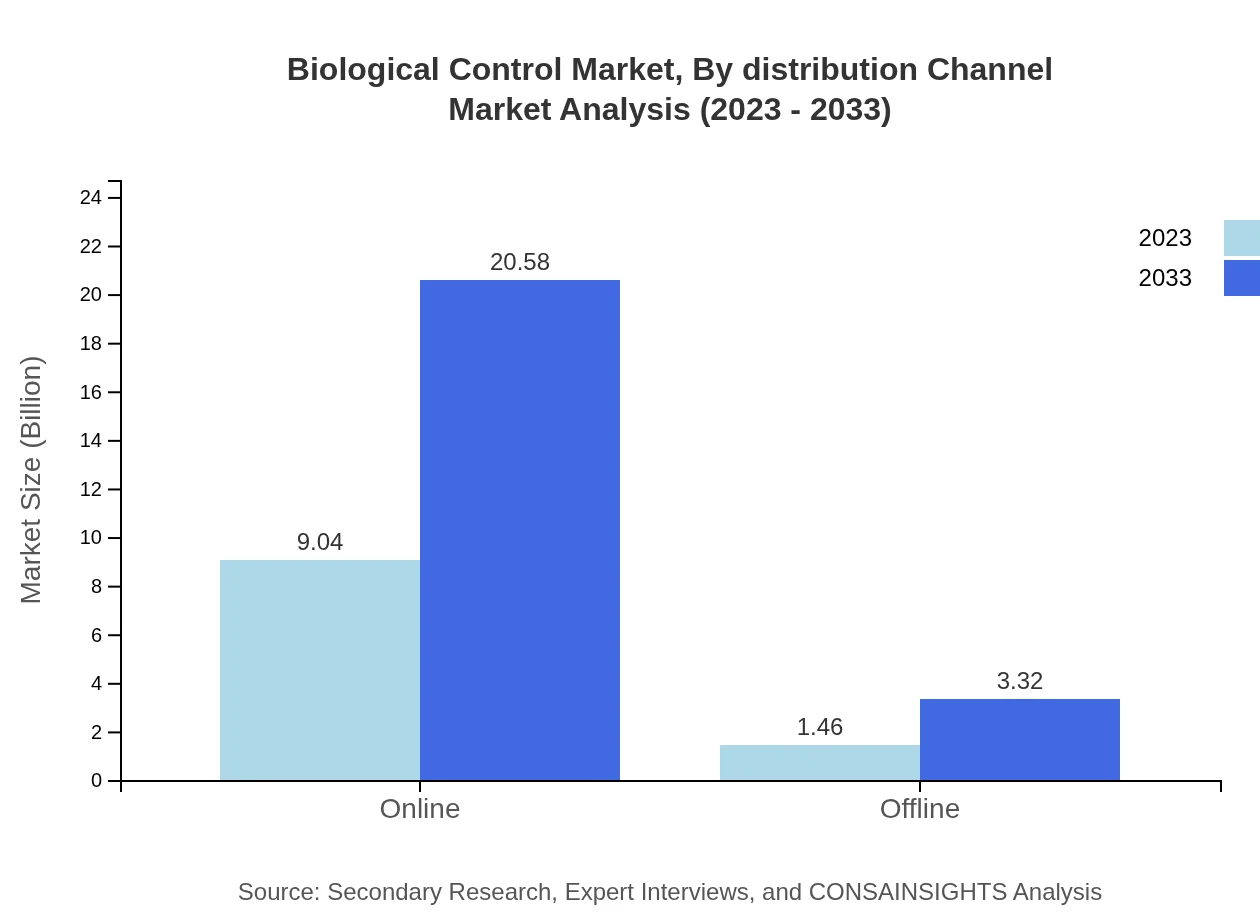

Biological Control Market Analysis By Distribution Channel

The distribution of biological control products is shifting towards online channels, which represent 86.09% of the market share in 2023. Online sales are anticipated to grow from $9.04 billion to $20.58 billion by 2033. Offline channels remain relevant but contribute lesser market size and share growth.

Biological Control Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biological Control Industry

BASF SE:

A leading chemical company known for developing advanced biological solutions, contributing significantly to sustainable agriculture.Syngenta:

A global player in the agricultural sector, focusing on science-based innovations in biological crop protection.Monsanto:

Part of Bayer AG, it integrates biotechnology with biological control methods to enhance yield while promoting environmental sustainability.Valent BioSciences:

Specializes in bio-controlled solutions, with innovative approaches to pest management and agronomic efficiency.BioWorks, Inc.:

Provides natural pest control products and solutions aimed at sustainable horticulture and agriculture.We're grateful to work with incredible clients.

FAQs

What is the market size of biological Control?

The global biological control market is currently valued at approximately $10.5 billion, with a robust projected CAGR of 8.3% from 2023 to 2033. This signifies a growing recognition of sustainable agricultural practices.

What are the key market players or companies in the biological Control industry?

Key players in the biological control industry include large multinational corporations and innovative startups. They focus on developing effective biopesticides, beneficial insects, and biological fertilizers, driving market competition and product diversity.

What are the primary factors driving the growth in the biological Control industry?

Key growth factors include the increasing demand for organic produce, rising awareness about environmental sustainability, and stricter regulations on chemical pesticides. Additionally, innovations in biotechnology and integrated pest management strategies further contribute to market expansion.

Which region is the fastest Growing in the biological Control market?

The fastest-growing region in the biological control market is Europe, anticipated to grow from $3.06 billion in 2023 to $6.96 billion by 2033. This reflects a strong shift toward eco-friendly agricultural practices across the continent.

Does ConsaInsights provide customized market report data for the biological Control industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the biological control industry. This service allows stakeholders to acquire precise insights and data that support informed decision-making.

What deliverables can I expect from this biological Control market research project?

From the market research project, clients can expect comprehensive reports featuring market trends, forecasts, regional analyses, competitive landscapes, and segment data. Tailored insights ensure actionable recommendations for business growth.

What are the market trends of biological Control?

Current trends in the biological control market include a significant shift towards biopesticides, increased investment in R&D, and growing adoption of integrated pest management. These trends signify a long-term commitment to sustainable agriculture.