Biological Safety Testing Market Report

Published Date: 31 January 2026 | Report Code: biological-safety-testing

Biological Safety Testing Market Size, Share, Industry Trends and Forecast to 2033

This report provides a detailed analysis of the Biological Safety Testing market, including insights on market size, regional performance, industry trends, and future forecasts for the period 2023 to 2033.

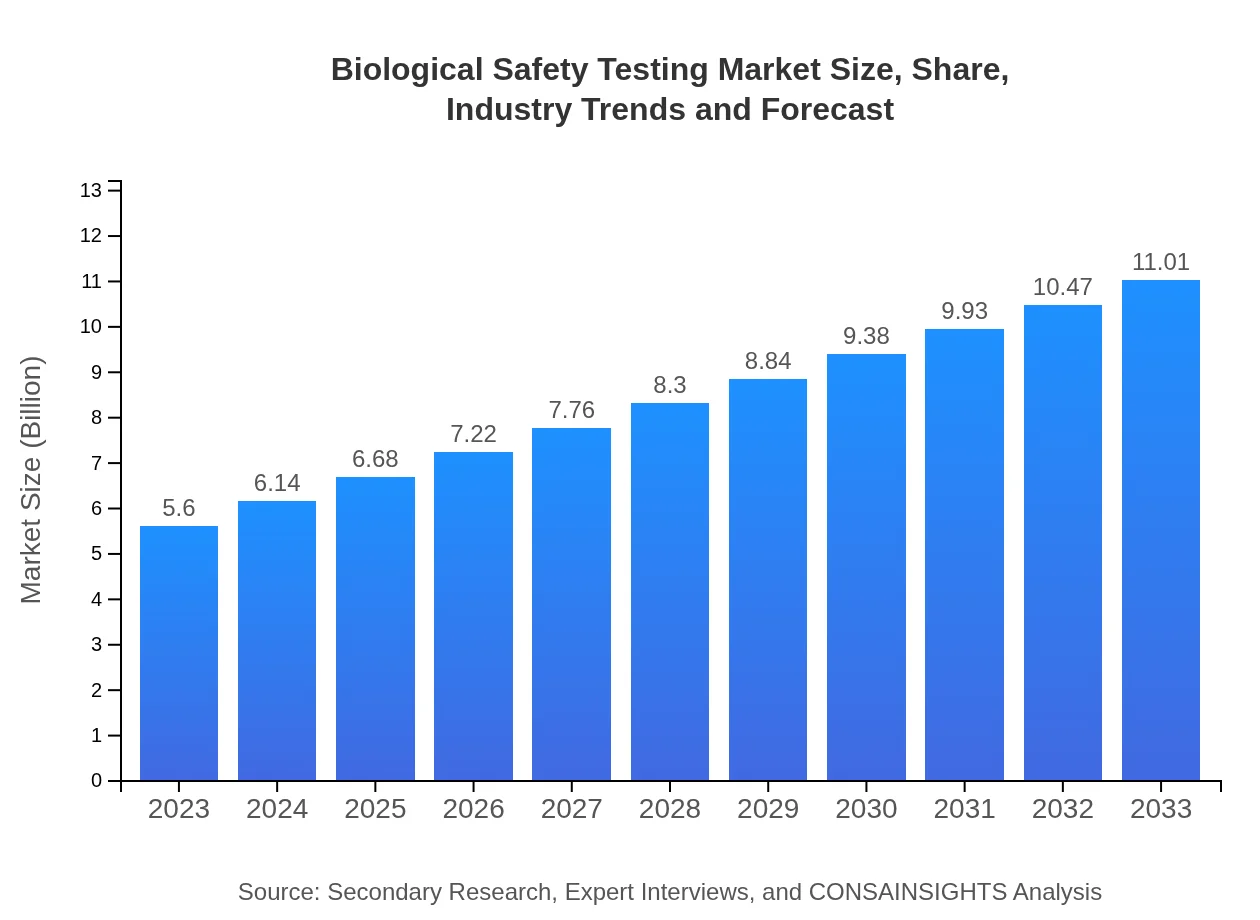

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 6.8% |

| 2033 Market Size | $11.01 Billion |

| Top Companies | SGS S.A., Charles River Laboratories, Eurofins Scientific, LGC Group |

| Last Modified Date | 31 January 2026 |

Biological Safety Testing Market Overview

Customize Biological Safety Testing Market Report market research report

- ✔ Get in-depth analysis of Biological Safety Testing market size, growth, and forecasts.

- ✔ Understand Biological Safety Testing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biological Safety Testing

What is the Market Size & CAGR of Biological Safety Testing market?

Biological Safety Testing Industry Analysis

Biological Safety Testing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

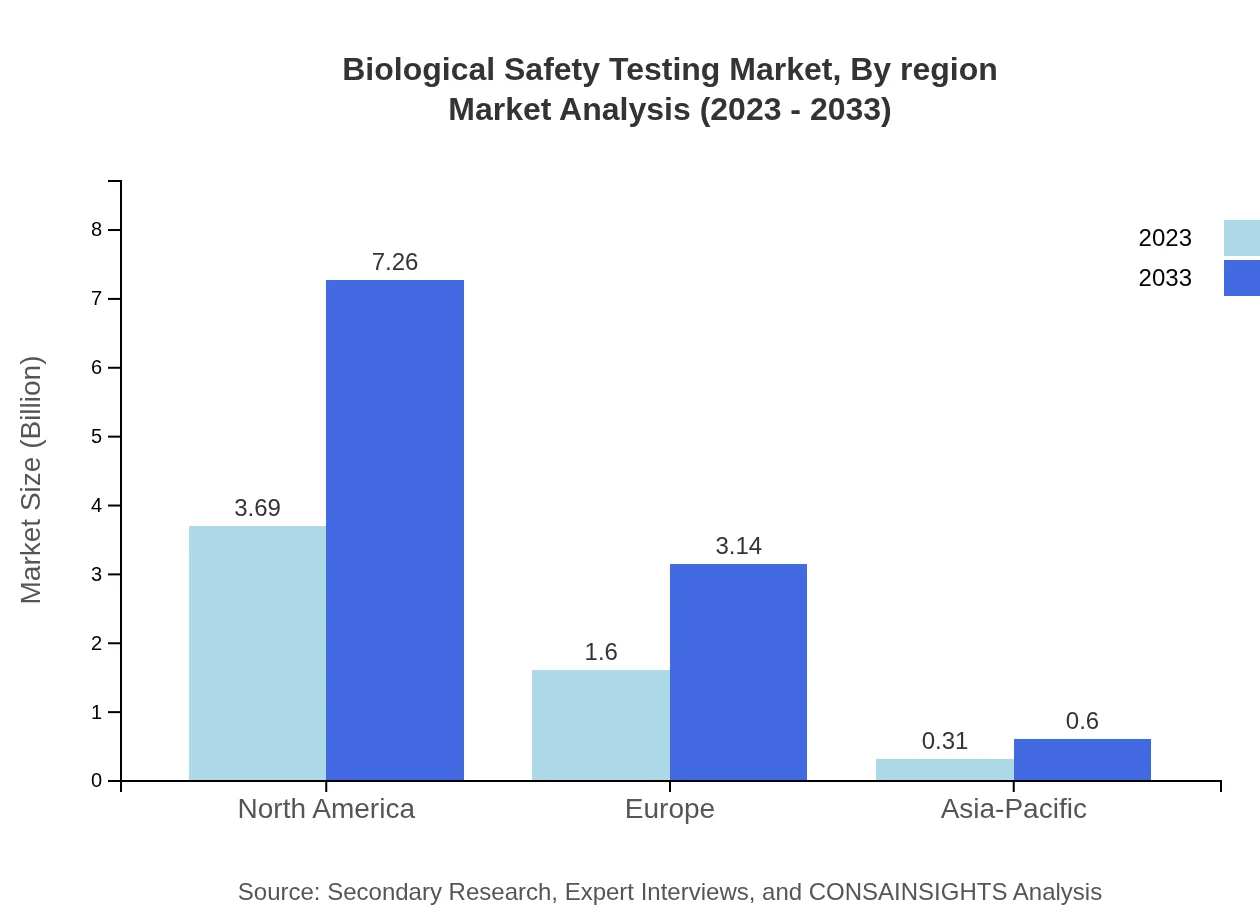

Biological Safety Testing Market Analysis Report by Region

Europe Biological Safety Testing Market Report:

The European Biological Safety Testing market is expected to grow from $1.44 billion in 2023 to $2.82 billion by 2033. The growth is driven by high regulations concerning product safety and efficacy, as well as an increase in biopharmaceutical developments.Asia Pacific Biological Safety Testing Market Report:

In Asia Pacific, the Biological Safety Testing market was valued at $1.20 billion in 2023 and is anticipated to double, reaching $2.36 billion by 2033. The region's growth is attributed to the increasing manufacturing output in biotechnology and pharmaceuticals, coupled with growing health awareness and regulatory frameworks supporting stringent safety measures.North America Biological Safety Testing Market Report:

North America dominates the Biological Safety Testing market, valued at $1.96 billion in 2023 and projected to reach $3.86 billion by 2033. This region's strong market presence is fueled by advanced healthcare technologies, substantial investments in R&D, and stringent regulatory guidelines.South America Biological Safety Testing Market Report:

The South American market for Biological Safety Testing stood at $0.40 billion in 2023 and is expected to grow to $0.78 billion by 2033. This growth is supported by an expanding healthcare infrastructure and increased investment in biopharmaceutical development, driving the need for effective safety testing.Middle East & Africa Biological Safety Testing Market Report:

The Middle East and Africa market had a value of $0.60 billion in 2023 and is projected to grow to $1.19 billion by 2033. Growth in this region is primarily driven by increasing healthcare expenditure and strategic investments in pharmaceutical safety initiatives.Tell us your focus area and get a customized research report.

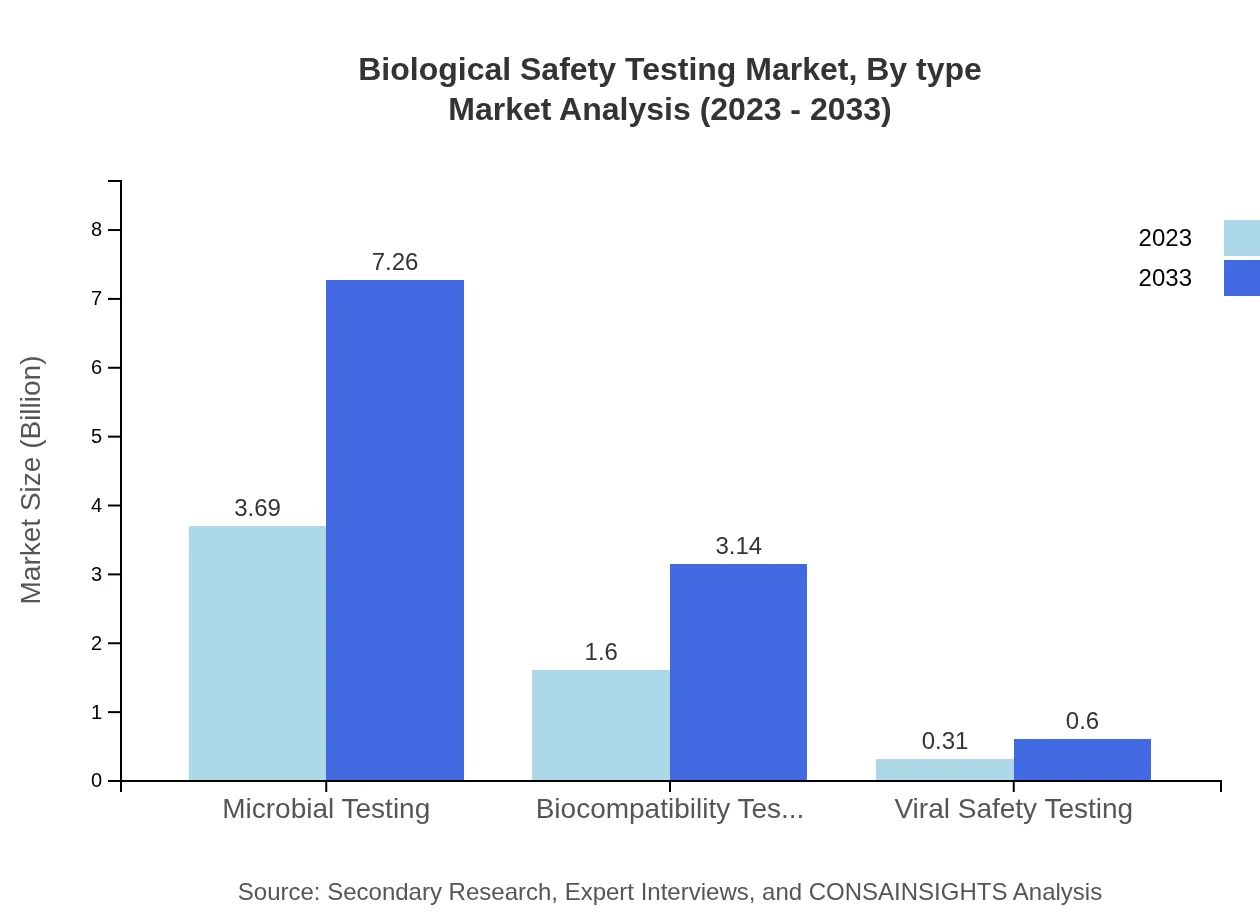

Biological Safety Testing Market Analysis By Type

Microbial Testing accounted for a significant market size of approximately $3.69 billion in 2023, projected to reach $7.26 billion by 2033. This segment represents 65.97% market share, driven by the high demand for microbial control in pharmaceuticals. Biocompatibility Testing, currently valued at $1.60 billion, is expected to grow to $3.14 billion (28.57% share). Viral Safety Testing, while smaller, remains essential, with insights projecting growth from $0.31 billion to $0.60 billion.

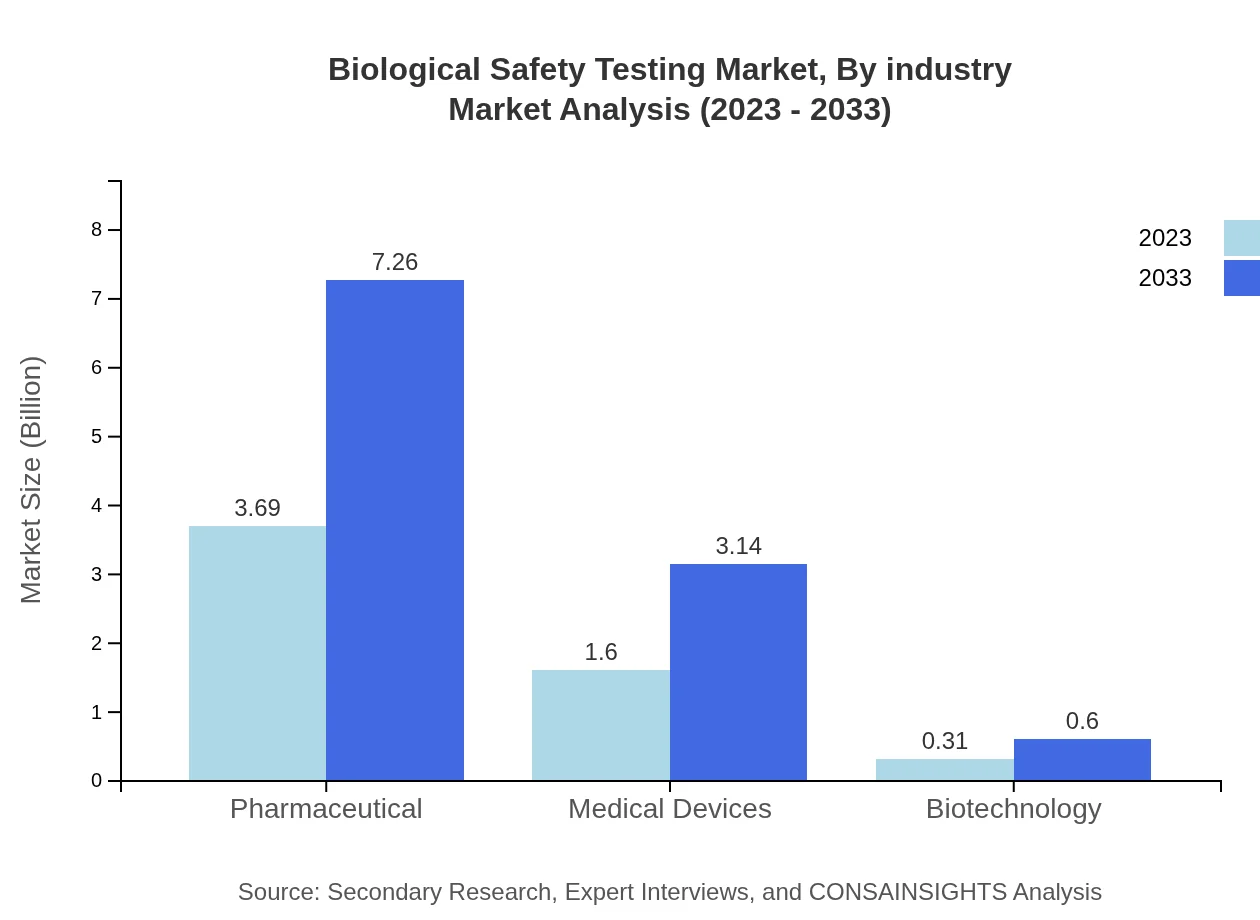

Biological Safety Testing Market Analysis By Industry

The segment includes Pharmaceuticals, which leads with a market size of $3.69 billion expected to rise to $7.26 billion by 2033, and is indicative of the industry's reliance on safety testing protocols due to regulatory requirements. Medical Devices follow with a market size of $1.60 billion growing to $3.14 billion, representing vital compliance needs, while Biotechnology, currently at $0.31 billion, is also expected to scale up similarly, reaching $0.60 billion by 2033.

Biological Safety Testing Market Analysis By Region

The regional analysis emphasizes North America's dominance, forecasted to retain its leading position through 2033 due to strong investments in healthcare and safety measures. Europe and Asia Pacific follow closely behind, leveraging regulatory frameworks to bolster their growth perspectives. South America and Middle East & Africa provide emerging opportunities aligning with increased healthcare demands and safety assurances.

Biological Safety Testing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biological Safety Testing Industry

SGS S.A.:

SGS S.A. is a global leader in inspection, verification, testing, and certification, providing biological safety testing services that cater to various industries. Their commitment to quality and innovation makes them a trusted partner for product safety.Charles River Laboratories:

As a renowned entity in preclinical and clinical laboratory services, Charles River Laboratories offers extensive biological safety testing solutions crucial for the development of new pharmaceuticals and medical devices.Eurofins Scientific:

Eurofins is a global group of laboratories that provides innovative biosafety testing services, serving the pharmaceutical and biopharmaceutical sectors, with a strong emphasis on high-quality processes and customer satisfaction.LGC Group:

LGC is known for its comprehensive biological safety testing services and high standards of quality and accuracy, ensuring products meet regulatory requirements efficiently.We're grateful to work with incredible clients.

FAQs

What is the market size of biological safety testing?

The biological safety testing market is projected to reach approximately $5.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.8% from 2023, when it is valued at about $5.0 billion.

What are the key market players or companies in the biological safety testing industry?

Key players in the biological safety testing industry include major pharmaceutical companies, biotechnology firms, and specialized testing organizations, all contributing significantly to market growth and innovation through advanced testing methodologies.

What are the primary factors driving the growth in the biological safety testing industry?

Growth in the biological safety testing sector is driven by rising demand for biopharmaceuticals, stringent regulatory guidelines, increased investment in pharmaceuticals and biotechnology research, and growing awareness regarding product safety among consumers.

Which region is the fastest Growing in the biological safety testing market?

In the biological safety testing market, North America is projected to be the fastest-growing region, expected to expand from $1.96 billion in 2023 to $3.86 billion by 2033, indicating robust growth due to advanced healthcare infrastructures.

Does ConsaInsights provide customized market report data for the biological safety testing industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs, allowing clients to gain deep insights into market trends, forecasts, and competitive landscapes in the biological safety testing industry.

What deliverables can I expect from this biological safety testing market research project?

Expect comprehensive deliverables including detailed market analysis reports, segmentation insights, growth forecasts, competitive landscape assessments, and customer insights specifically geared towards the biological safety testing sector.

What are the market trends of biological safety testing?

Current trends in biological safety testing include increased automation, the integration of advanced technologies, a shift towards personalized medicine, and a strong focus on compliance with international safety standards to enhance testing effectiveness.