Biologics And Biosimilars Market Report

Published Date: 31 January 2026 | Report Code: biologics-and-biosimilars

Biologics And Biosimilars Market Size, Share, Industry Trends and Forecast to 2033

This report provides an extensive overview of the Biologics and Biosimilars market, including market size, growth trends, and forecasts from 2023 to 2033. It analyzes regional markets, industry dynamics, key players, and emerging trends to offer strategic insights for businesses involved in this sector.

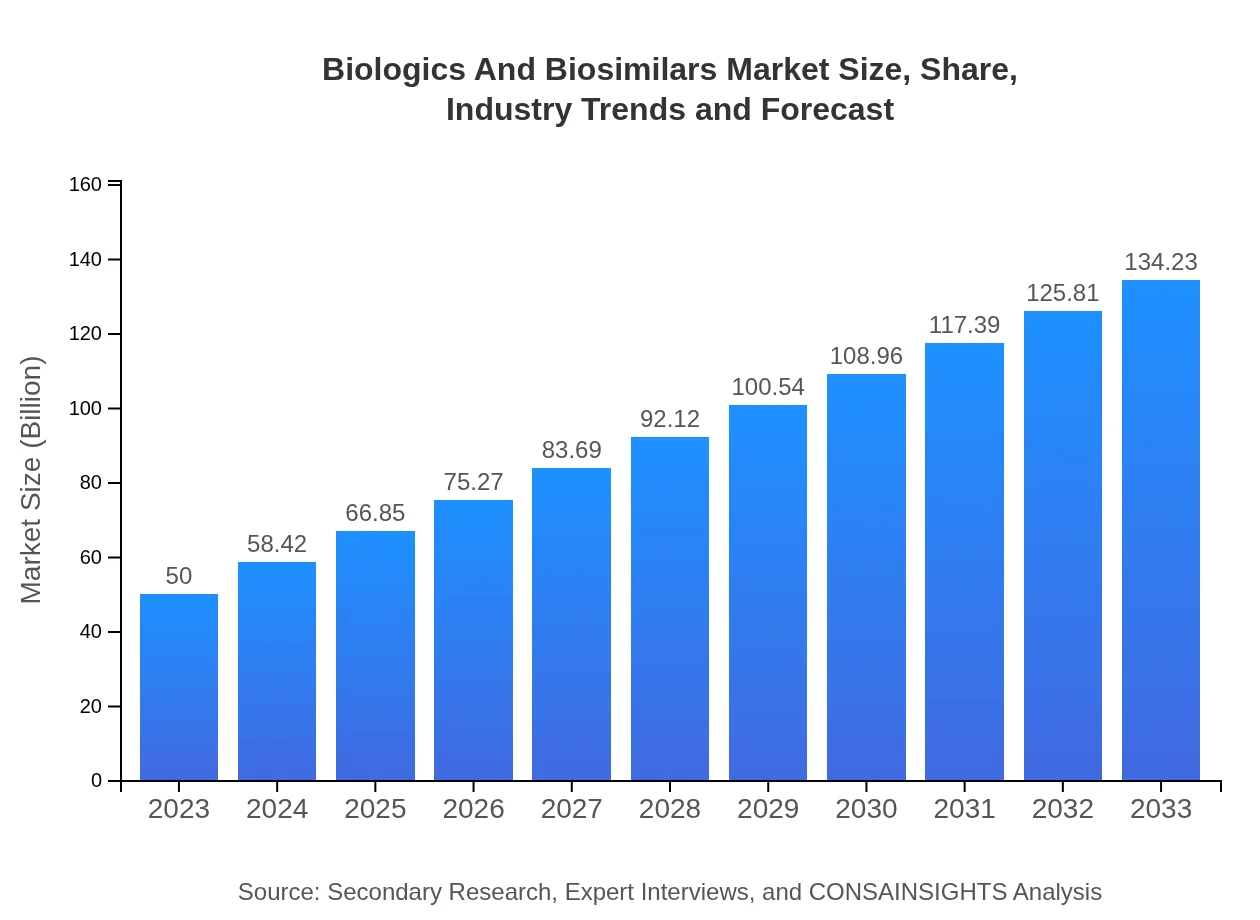

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $50.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $134.23 Billion |

| Top Companies | Amgen Inc., Roche Holding AG, Biogen Inc., Sandoz (Novartis) , Pfizer Inc. |

| Last Modified Date | 31 January 2026 |

Biologics And Biosimilars Market Overview

Customize Biologics And Biosimilars Market Report market research report

- ✔ Get in-depth analysis of Biologics And Biosimilars market size, growth, and forecasts.

- ✔ Understand Biologics And Biosimilars's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biologics And Biosimilars

What is the Market Size & CAGR of Biologics And Biosimilars market in 2033?

Biologics And Biosimilars Industry Analysis

Biologics And Biosimilars Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biologics And Biosimilars Market Analysis Report by Region

Europe Biologics And Biosimilars Market Report:

The European market size for Biologics and Biosimilars is forecasted to grow from $15.15 billion in 2023 to $40.69 billion by 2033. Stringent regulatory guidelines and a rapidly aging population contribute to the increasing demand for these therapies.Asia Pacific Biologics And Biosimilars Market Report:

The Asia-Pacific region is experiencing significant growth in the Biologics and Biosimilars market, projected to escalate from $10.47 billion in 2023 to $28.11 billion by 2033. Factors such as increasing healthcare expenditure, a burgeoning patient population, and rapid advancements in biotechnology are driving this trend.North America Biologics And Biosimilars Market Report:

North America dominates the Biologics and Biosimilars market, with an expected rise from $16.07 billion in 2023 to $43.16 billion by 2033. The presence of major pharma companies and a strong regulatory framework enhances innovation and product approvals.South America Biologics And Biosimilars Market Report:

In South America, the market is anticipated to grow from $2.15 billion in 2023 to $5.79 billion by 2033. Economic improvement and increased access to healthcare are pivotal factors facilitating this growth.Middle East & Africa Biologics And Biosimilars Market Report:

In the Middle East and Africa, the market is set to expand from $6.14 billion in 2023 to $16.50 billion by 2033. Growing awareness regarding chronic diseases and initiatives to strengthen healthcare infrastructure are instrumental in this growth.Tell us your focus area and get a customized research report.

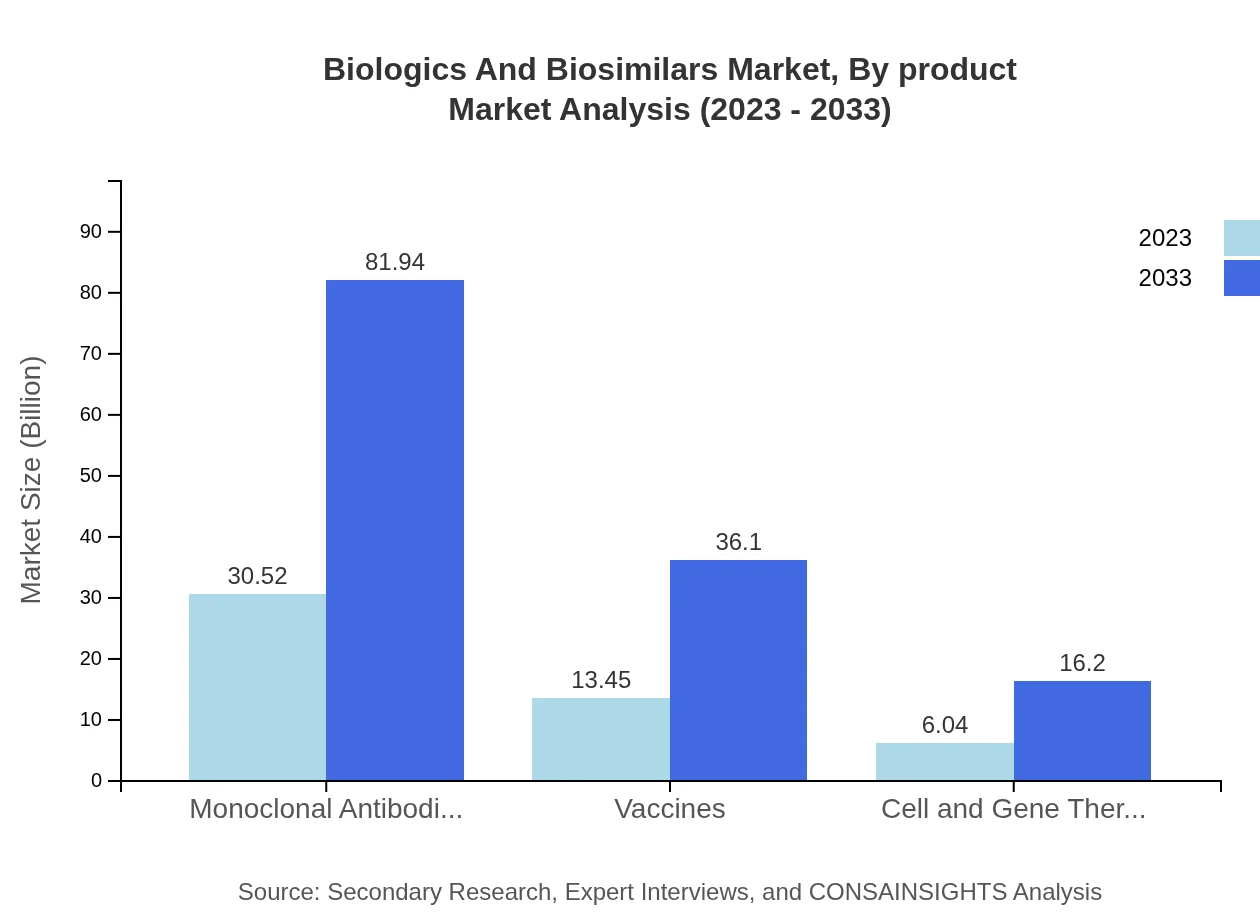

Biologics And Biosimilars Market Analysis By Product

Monoclonal antibodies are leading the market, projected to grow from $30.52 billion in 2023 to $81.94 billion by 2033. Vaccines also hold a significant position, expanding from $13.45 billion to $36.10 billion over the same period. The segments of cell and gene therapy, while smaller, show promise with expected growth from $6.04 billion to $16.20 billion.

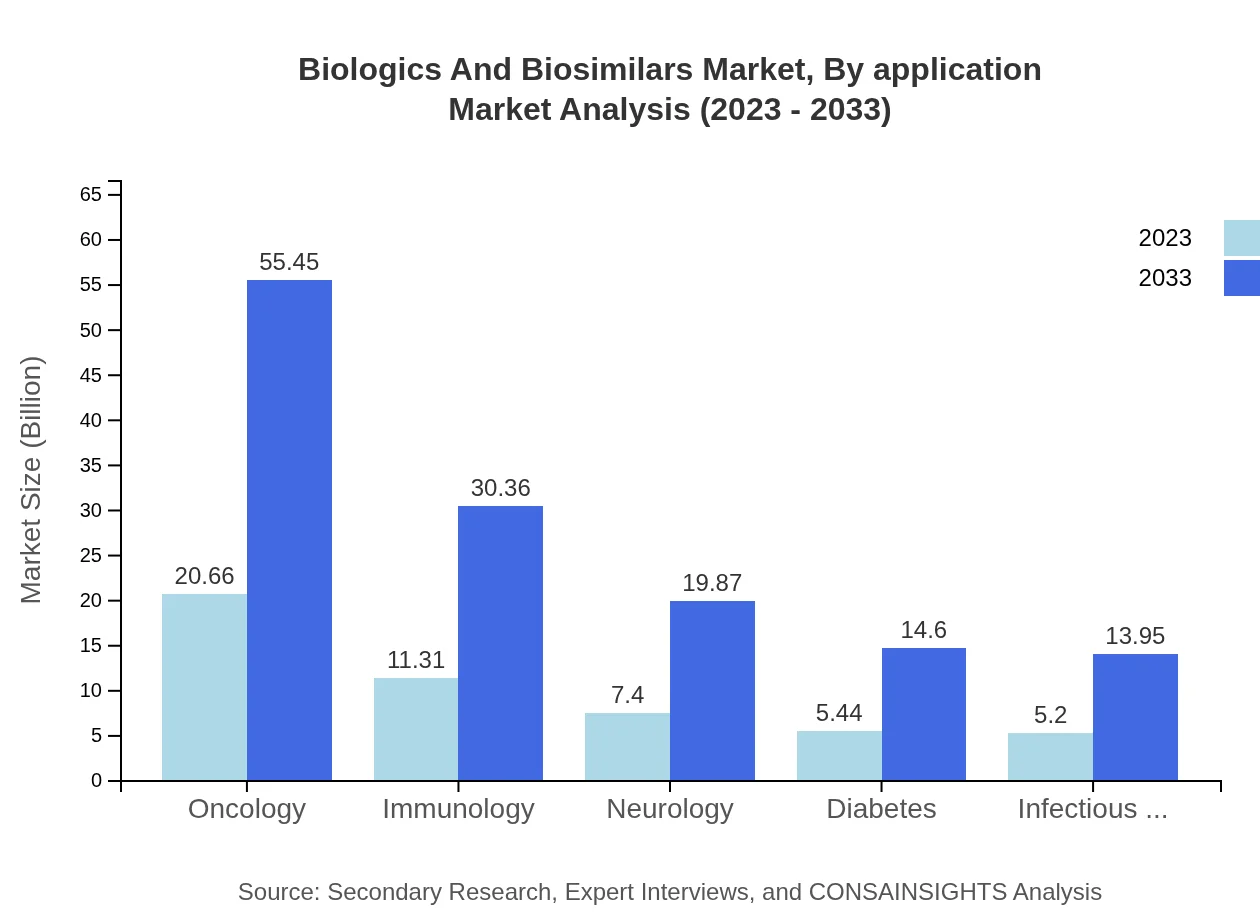

Biologics And Biosimilars Market Analysis By Application

The oncology segment is a major driver, growing from $20.66 billion to $55.45 billion, reflecting increased cancer incidence and innovations in targeted therapies. Immunology and neurology applications are also experiencing growth, indicative of rising demand for effective treatments in these therapeutic areas.

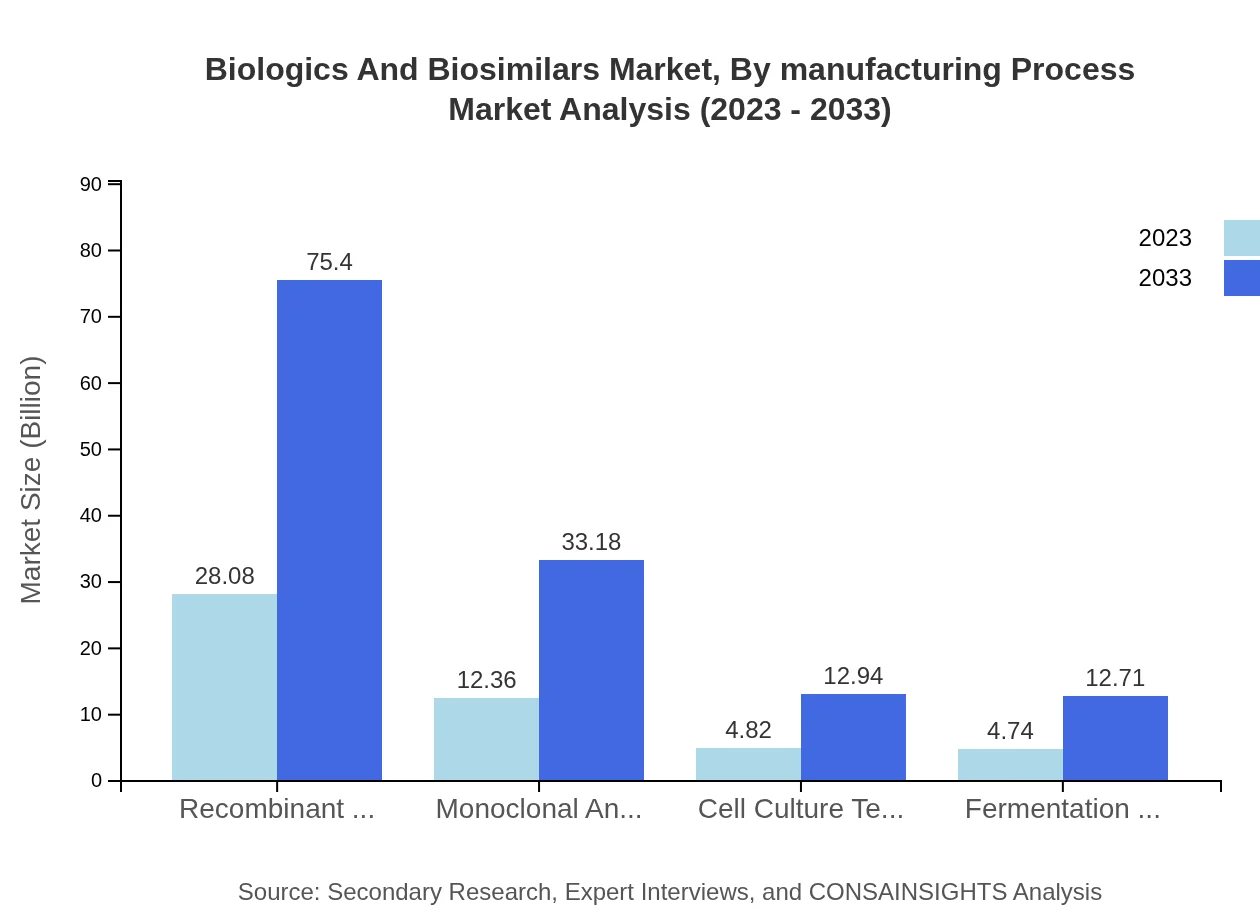

Biologics And Biosimilars Market Analysis By Manufacturing Process

Recombinant DNA technology remains a dominant manufacturing technique, expected to increase market size from $28.08 billion to $75.40 billion. Monoclonal antibody production is also significant, growing between $12.36 billion and $33.18 billion.

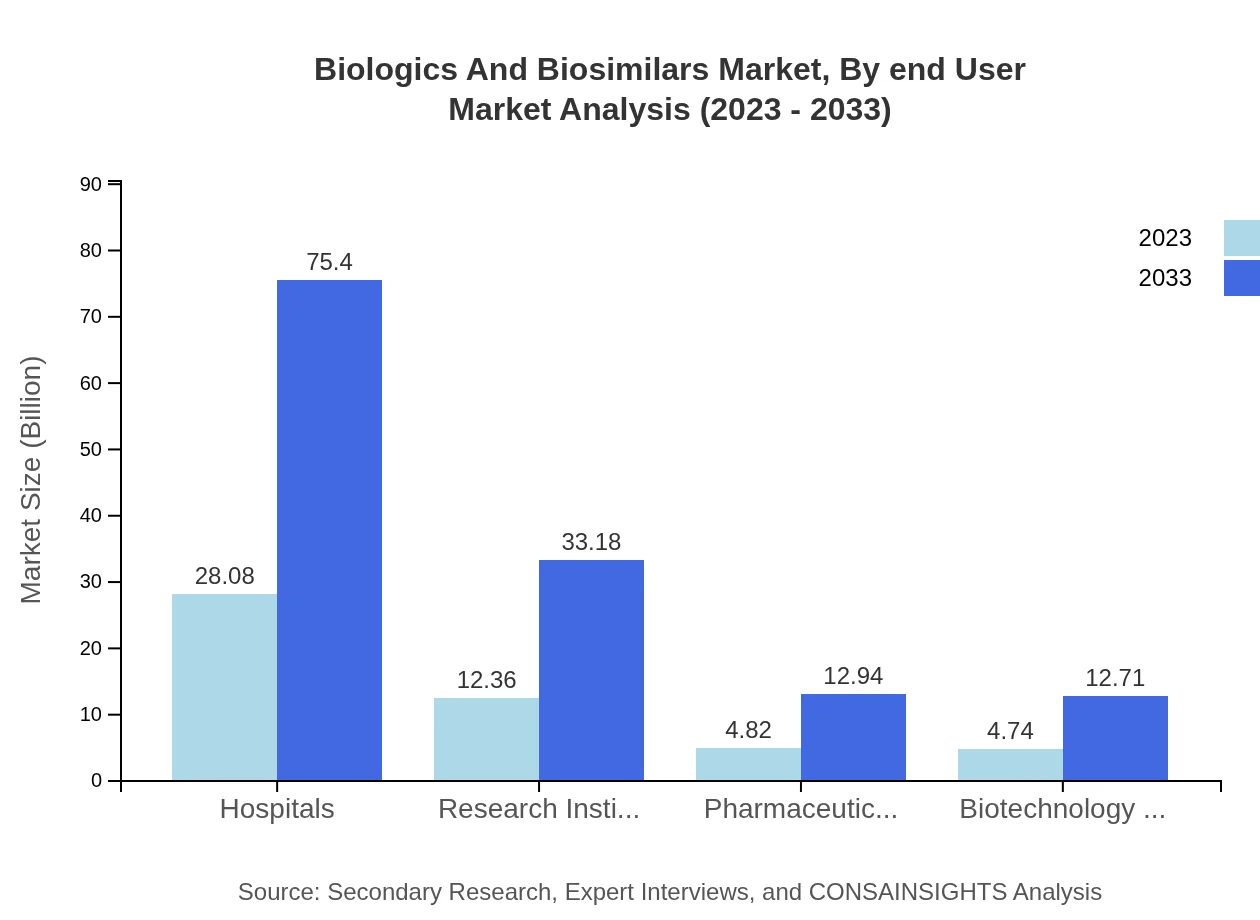

Biologics And Biosimilars Market Analysis By End User

Hospitals are the primary end-users of biologics and biosimilars, anticipated to grow from $28.08 billion to $75.40 billion. Research institutes and pharmacies are also pivotal, reflecting the diverse applications of these products across healthcare settings.

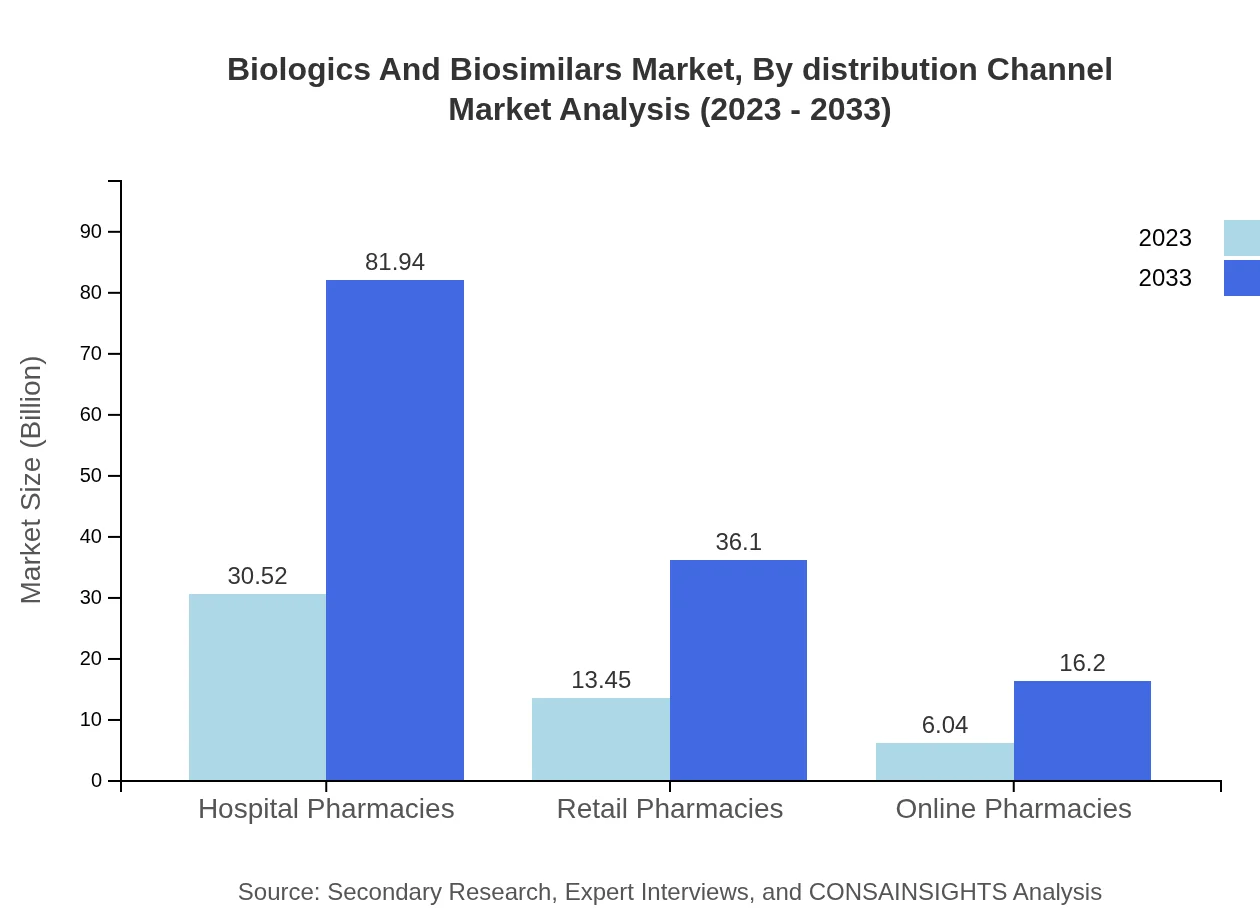

Biologics And Biosimilars Market Analysis By Distribution Channel

Hospital pharmacies will continue to dominate with a projected market value from $30.52 billion in 2023 to $81.94 billion in 2033. Online pharmacies show significant growth potential, increasing from $6.04 billion to $16.20 billion as e-commerce in healthcare expands.

Biologics And Biosimilars Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biologics And Biosimilars Industry

Amgen Inc.:

A leading global biotechnology company known for its innovative biological products, especially in oncology and immunology.Roche Holding AG:

A pioneer in the field of personalized healthcare and biopharmaceuticals, renowned for its monoclonal antibodies and diagnostics.Biogen Inc.:

Specializes in therapies for neurological diseases, with significant investments in biosimilar development.Sandoz (Novartis) :

A major player in generics and biosimilars, delivering a diverse portfolio of affordable medications.Pfizer Inc.:

One of the largest pharmaceutical companies globally, actively involved in developing and commercializing biosimilars.We're grateful to work with incredible clients.

FAQs

What is the market size of biologics And Biosimilars?

The global market size for biologics and biosimilars is projected to reach approximately $50 billion by 2033, growing at a CAGR of 10% from its current size in 2023.

What are the key market players or companies in the biologics And Biosimilars industry?

Key players in the biologics and biosimilars market include major pharmaceutical companies and biotechnology firms, engaged in research and development and commercialization of innovative therapeutics and biosimilars.

What are the primary factors driving the growth in the biologics And Biosimilars industry?

The growth of the biologics and biosimilars market is driven by several factors, including increasing prevalence of chronic diseases, advancements in biotechnology, and the growing demand for affordable healthcare solutions.

Which region is the fastest Growing in the biologics And Biosimilars market?

The Asia Pacific region is poised to be the fastest-growing market for biologics and biosimilars, expanding from $10.47 billion in 2023 to $28.11 billion by 2033.

Does ConsaInsights provide customized market report data for the biologics And Biosimilars industry?

Yes, ConsaInsights offers customized market reports tailored to specific needs within the biologics and biosimilars industry, providing precise data and insights for informed decision-making.

What deliverables can I expect from this biologics And Biosimilars market research project?

From the biologics and biosimilars market research project, expect detailed reports featuring market analysis, growth forecasts, competitive landscape, and regional insights, alongside segmented data on various therapeutic areas.

What are the market trends of biologics And Biosimilars?

Current trends in the biologics and biosimilars market include increasing investment in R&D, a rise in strategic partnerships, and a focus on regulatory approvals to enhance market penetration.