Biologics Market Report

Published Date: 31 January 2026 | Report Code: biologics

Biologics Market Size, Share, Industry Trends and Forecast to 2033

This report provides an insightful analysis of the Biologics market, covering key trends, market size and projections from 2023 to 2033, industry dynamics, and regional assessments.

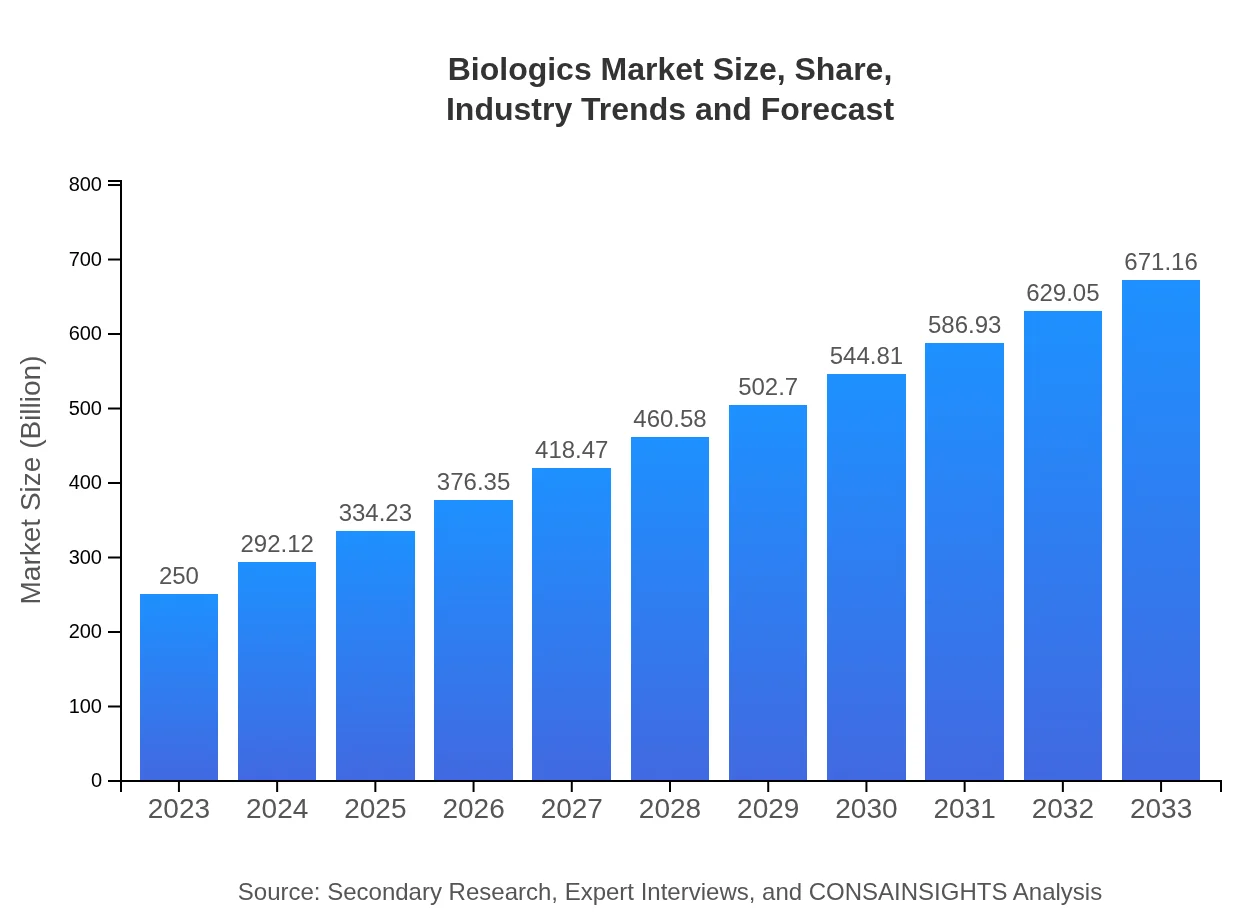

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $250.00 Billion |

| CAGR (2023-2033) | 10% |

| 2033 Market Size | $671.16 Billion |

| Top Companies | AbbVie Inc., Roche Holding AG, Amgen Inc., Johnson & Johnson, Pfizer Inc. |

| Last Modified Date | 31 January 2026 |

Biologics Market Overview

Customize Biologics Market Report market research report

- ✔ Get in-depth analysis of Biologics market size, growth, and forecasts.

- ✔ Understand Biologics's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biologics

What is the Market Size & CAGR of Biologics market in 2023?

Biologics Industry Analysis

Biologics Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biologics Market Analysis Report by Region

Europe Biologics Market Report:

The European market for biologics is valued at 62.27 billion USD in 2023 and is expected to reach 167.19 billion USD by 2033. Factors driving growth include rising chronic disease prevalence and improved access to biologic therapies across member states.Asia Pacific Biologics Market Report:

In the Asia Pacific region, the biologics market is valued at approximately 47.63 billion USD in 2023, projected to grow to 127.86 billion USD by 2033. The rapid expansion is driven by increasing healthcare expenditures, growing awareness of biologics, and supportive regulatory environments that facilitate drug approvals.North America Biologics Market Report:

North America holds the largest market share, with a valuation of 97.45 billion USD in 2023, anticipated to increase to 261.62 billion USD by 2033. This region benefits from a strong emphasis on R&D, advanced healthcare infrastructure, and the presence of key market players.South America Biologics Market Report:

The South American biologics market is currently valued at 15.32 billion USD and is expected to grow to 41.14 billion USD by 2033. The growth is supported by rising consumer demand for advanced therapies and investments in biopharmaceutical manufacturing.Middle East & Africa Biologics Market Report:

The Middle East and Africa have a current market value of 27.32 billion USD, which is projected to grow to 73.36 billion USD by 2033. The increasing burden of diseases and improving healthcare systems are propelling market growth in this region.Tell us your focus area and get a customized research report.

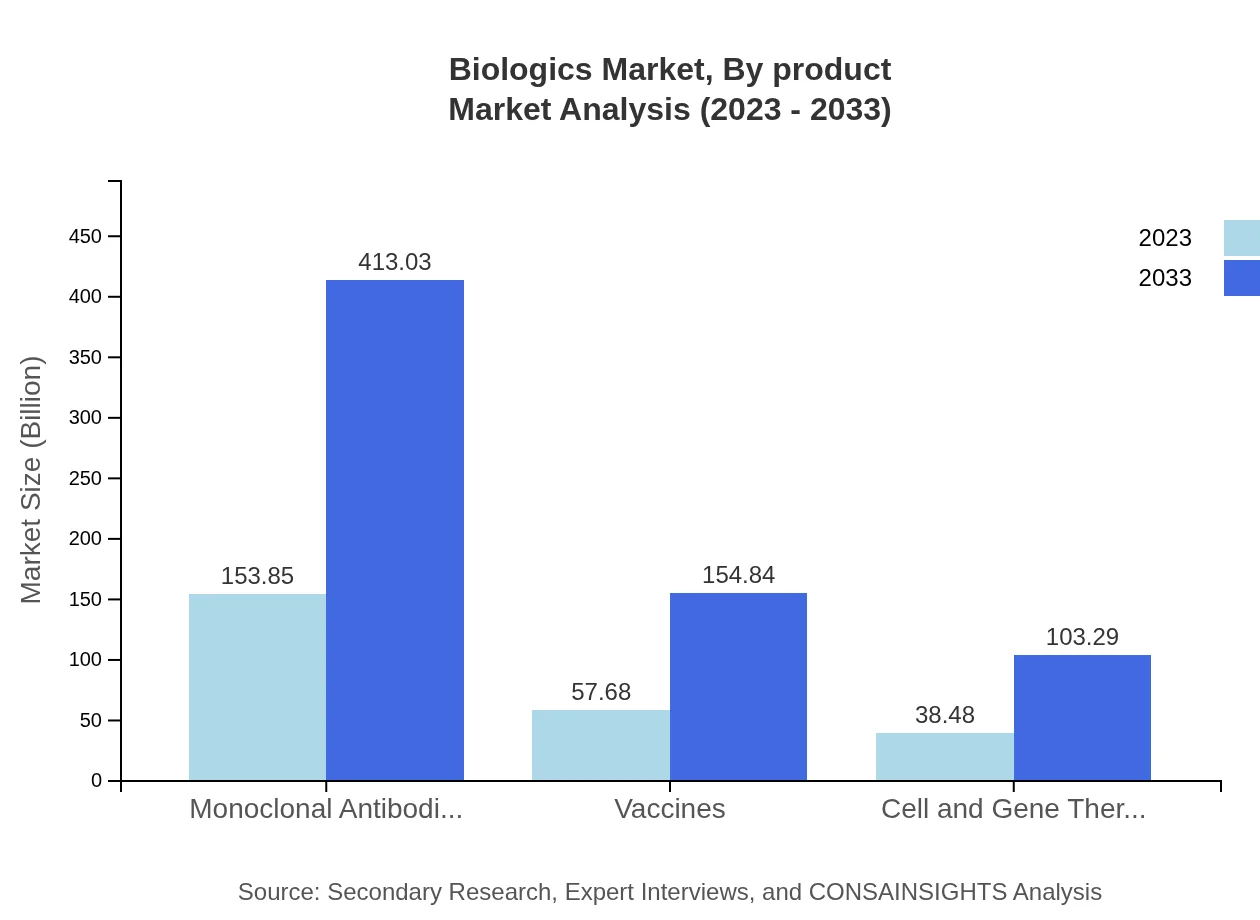

Biologics Market Analysis By Product

The market is further divided by product types, including monoclonal antibodies, vaccines, and recombinant proteins. Monoclonal antibodies dominate the market with a size of 153.85 billion USD in 2023, expected to reach 413.03 billion USD by 2033. Vaccines hold a market size of 57.68 billion USD in 2023, anticipated to grow to 154.84 billion USD by 2033.

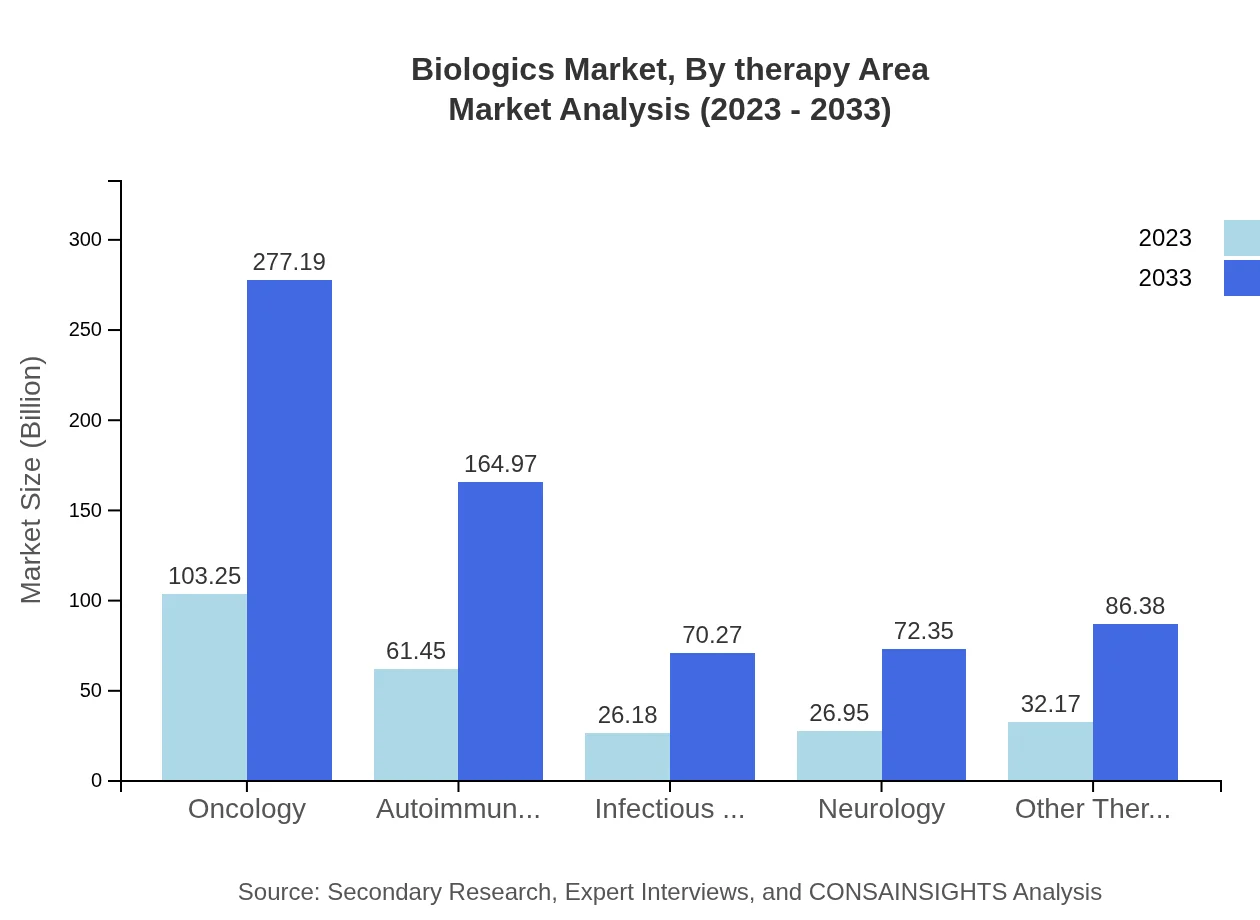

Biologics Market Analysis By Therapy Area

This segment showcases therapy areas like oncology, where the market size is 103.25 billion USD in 2023, projected to grow to 277.19 billion USD by 2033. Autoimmunity therapies also constitute a significant share, with expected growth from 61.45 billion USD in 2023 to 164.97 billion USD by 2033.

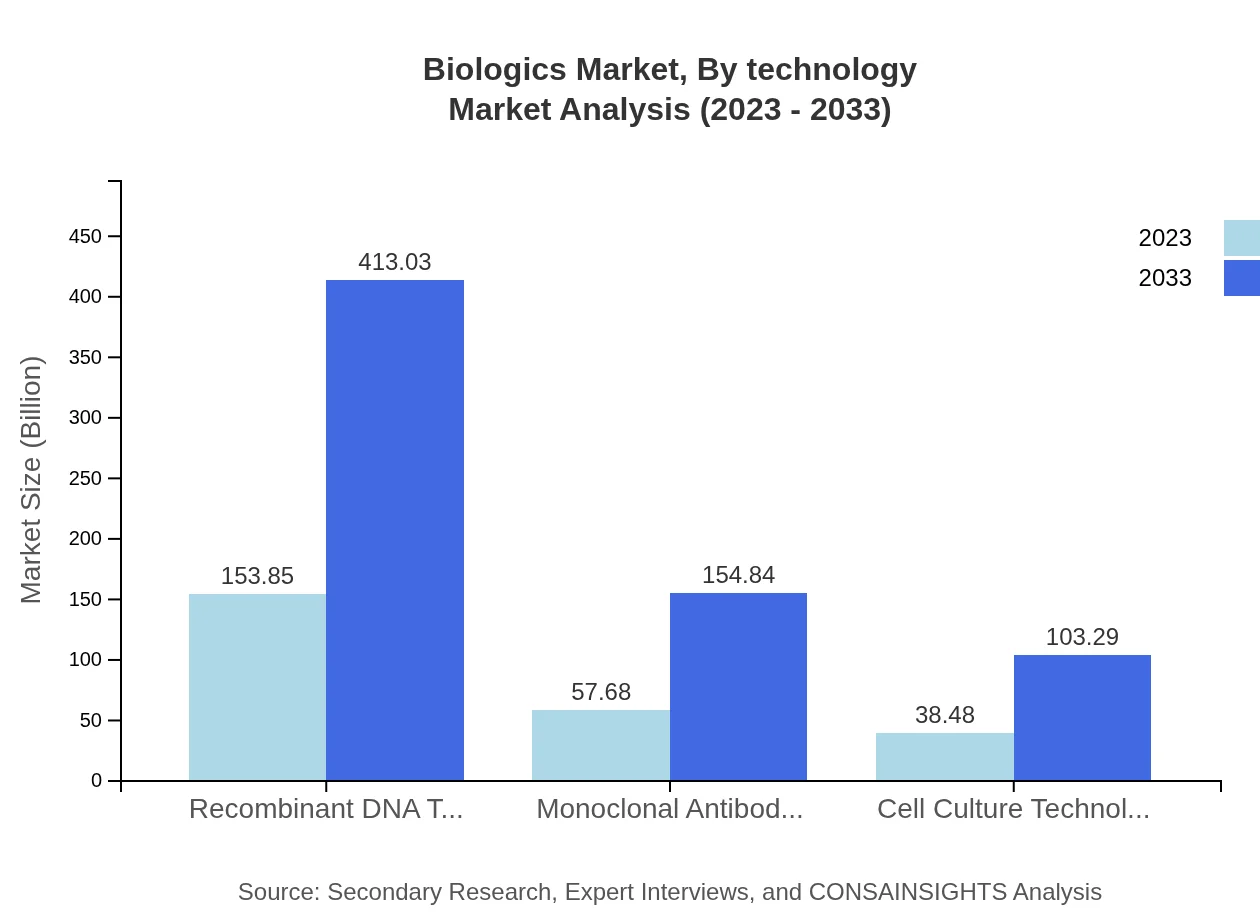

Biologics Market Analysis By Technology

Technological advancements in the sector include recombinant DNA technology, monoclonal antibody technology, and cell culture technology. The recombinant DNA technology segment alone is projected to increase from 153.85 billion USD in 2023 to 413.03 billion USD by 2033.

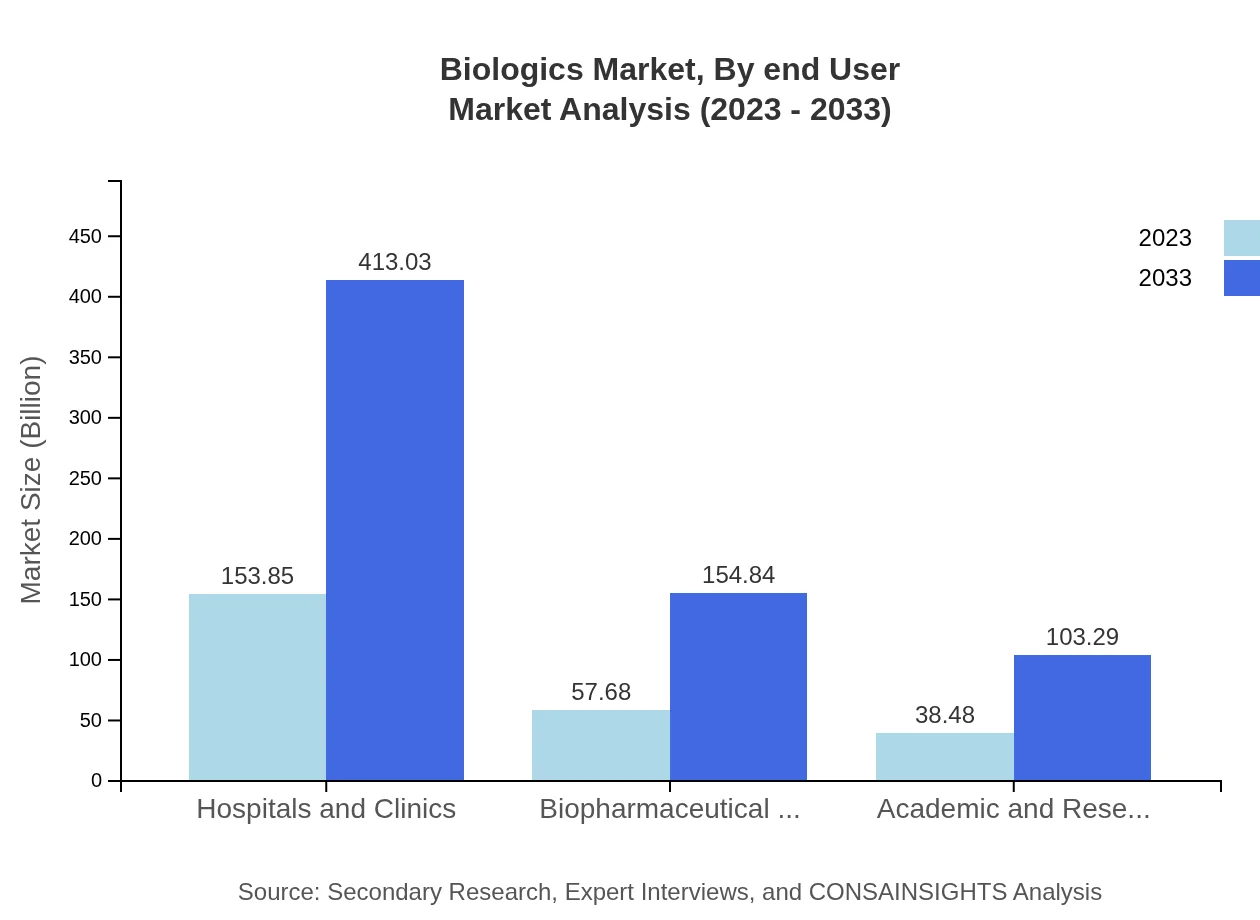

Biologics Market Analysis By End User

End-users include hospitals and clinics that will account for 153.85 billion USD in 2023, with a projection to reach 413.03 billion USD by 2033. Biopharmaceutical companies also show significant market engagement, with sizes expected to move from 57.68 billion USD to 154.84 billion USD in the same time frame.

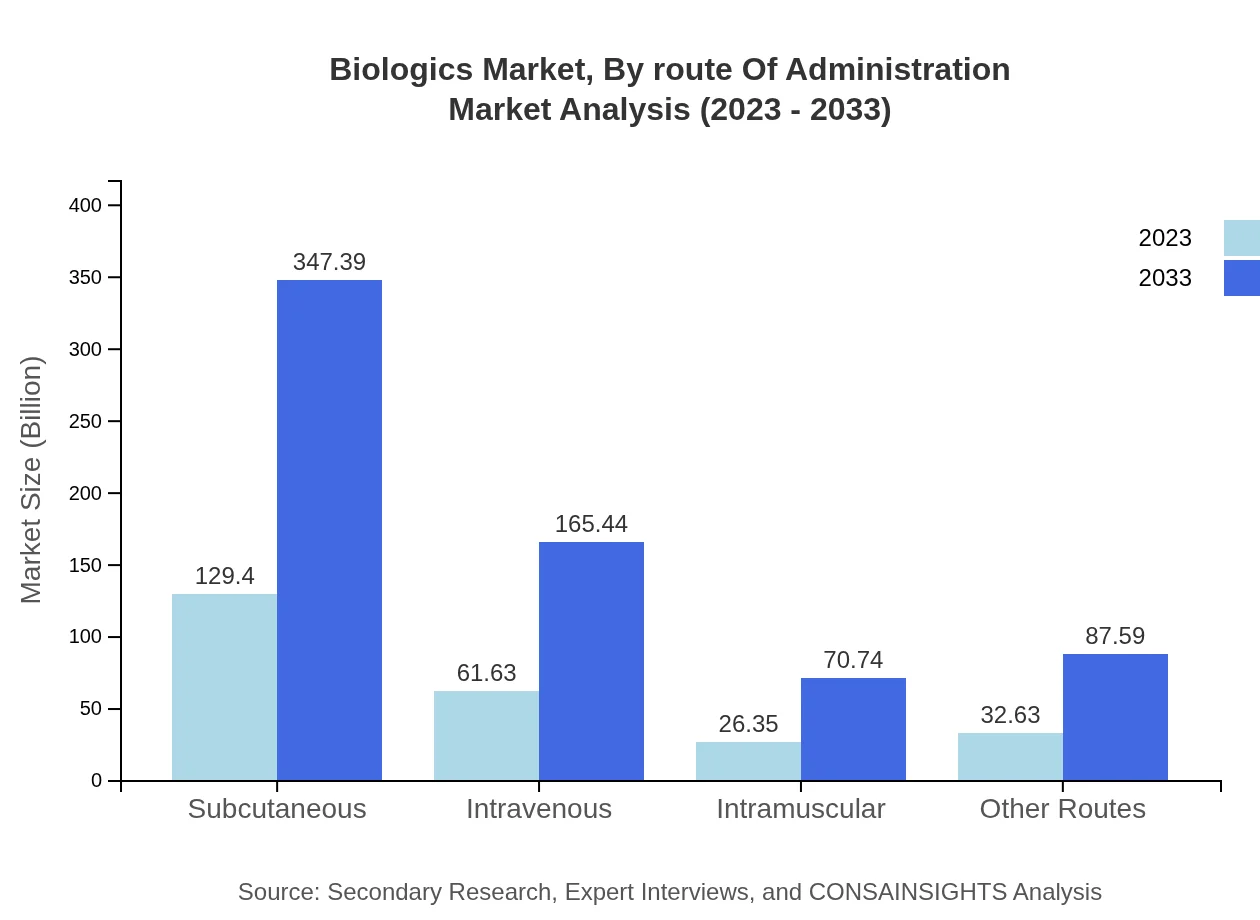

Biologics Market Analysis By Route Of Administration

Routes of administration are categorized into subcutaneous, intravenous, intramuscular, and others. Subcutaneous administration leads the market at 129.40 billion USD in 2023, projected to rise to 347.39 billion USD by 2033.

Biologics Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biologics Industry

AbbVie Inc.:

AbbVie is a global biopharmaceutical company known for developing and marketing advanced biologic therapies, especially in immunology and oncology.Roche Holding AG:

Roche is a pioneer in personalized medicine, known for its extensive range of monoclonal antibodies targeting cancer and autoimmune diseases.Amgen Inc.:

Amgen is one of the world’s largest biotechnology companies, with leading products in oncology and nephrology, focusing on innovative biologic therapies.Johnson & Johnson:

Johnson & Johnson, through its pharmaceutical division, develops biologics in various therapeutic areas, particularly oncology and immunology.Pfizer Inc.:

Pfizer is renowned for its biologic drugs across an extensive range of conditions, emphasizing research in vaccines and cancer treatments.We're grateful to work with incredible clients.

FAQs

What is the market size of biologics?

The global biologics market is projected to reach $250 billion by 2033 from $100 billion in 2023, reflecting a CAGR of 10%. This growth underscores the increasing reliance on biologics for therapeutic solutions.

What are the key market players or companies in this biologics industry?

Key players in the biologics industry include major biopharmaceutical companies like Amgen, Roche, AbbVie, and Johnson & Johnson. These companies dominate market segments with innovative products and extensive research infrastructures.

What are the primary factors driving the growth in the biologics industry?

Driving factors in the biologics market include increasing prevalence of chronic diseases, advancements in biotechnology, and heightened investment in research and development. Additionally, personalized medicine trends are gaining momentum, contributing to market expansion.

Which region is the fastest Growing in the biologics?

The fastest-growing region in the biologics market is North America, expected to grow from $97.45 billion in 2023 to $261.62 billion in 2033. Other notable growth areas include Asia Pacific, showing rapid development driven by increasing healthcare demands.

Does ConsaInsights provide customized market report data for the biologics industry?

Yes, ConsaInsights offers customized market research reports tailored to specific needs in the biologics industry, ensuring relevant data and insights that meet unique business objectives.

What deliverables can I expect from this biologics market research project?

Deliverables from the biologics market research project include comprehensive market analysis reports, segmented data insights, competitive landscape assessments, and forecasts for various market trends spanning a 10-year timeline.

What are the market trends of biologics?

Key trends in the biologics market include innovation in monoclonal antibodies, growth in cell and gene therapies, expansion of vaccine development, and shift towards personalized medicine. These trends reflect ongoing advancements in pharmaceutical technologies.