Biomaterial Wound Dressing Market Report

Published Date: 31 January 2026 | Report Code: biomaterial-wound-dressing

Biomaterial Wound Dressing Market Size, Share, Industry Trends and Forecast to 2033

This report offers an extensive analysis of the Biomaterial Wound Dressing market, detailing current trends, market size, regional insights, and future forecasts from 2023 to 2033. It aims to provide stakeholders with valuable insights regarding market dynamics, segmentation, and technological advancements.

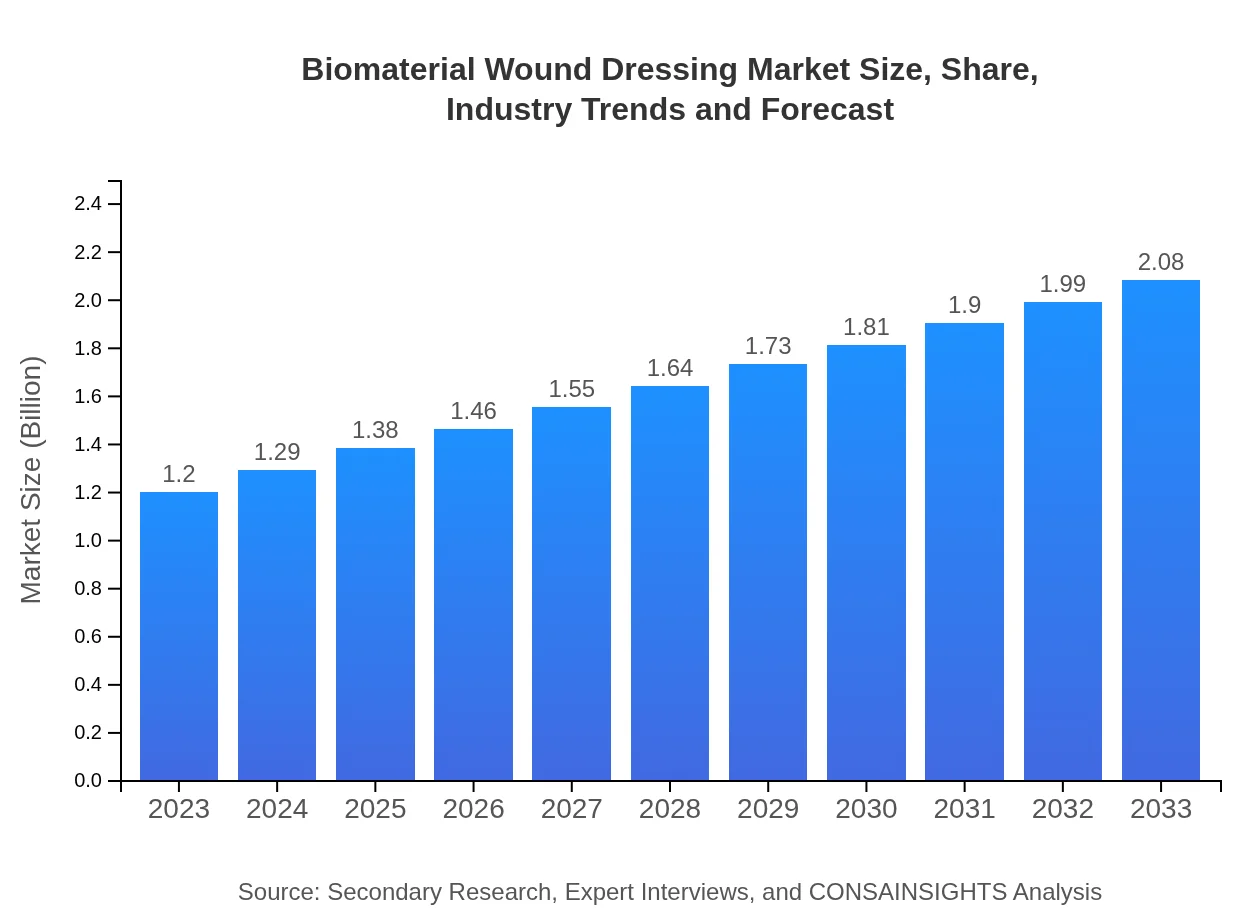

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $1.20 Billion |

| CAGR (2023-2033) | 5.5% |

| 2033 Market Size | $2.08 Billion |

| Top Companies | Smith & Nephew, Johnson & Johnson, Mölnlycke Health Care, ConvaTec Group, 3M Health Care |

| Last Modified Date | 31 January 2026 |

Biomaterial Wound Dressing Market Overview

Customize Biomaterial Wound Dressing Market Report market research report

- ✔ Get in-depth analysis of Biomaterial Wound Dressing market size, growth, and forecasts.

- ✔ Understand Biomaterial Wound Dressing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biomaterial Wound Dressing

What is the Market Size & CAGR of Biomaterial Wound Dressing market in 2023?

Biomaterial Wound Dressing Industry Analysis

Biomaterial Wound Dressing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biomaterial Wound Dressing Market Analysis Report by Region

Europe Biomaterial Wound Dressing Market Report:

The European market for Biomaterial Wound Dressing is anticipated to grow from $0.32 billion in 2023 to $0.56 billion by 2033. Factors such as improved regulatory standards, innovative product development, and a greater emphasis on wound care in clinical settings are fostering this market's expansion and competitive landscape.Asia Pacific Biomaterial Wound Dressing Market Report:

The Asia Pacific region is experiencing rapid expansion in the Biomaterial Wound Dressing market, expected to grow from $0.23 billion in 2023 to $0.40 billion by 2033. The growth is supported by increasing healthcare expenditure, advancements in wound management technologies, and a rising elderly population seeking effective wound care solutions.North America Biomaterial Wound Dressing Market Report:

North America is poised to lead the Biomaterial Wound Dressing market, with a projected growth from $0.39 billion in 2023 to $0.68 billion by 2033. This growth is driven by advanced healthcare infrastructure, significant investments in healthcare technology, and the increasing occurrence of chronic wounds requiring specialized care.South America Biomaterial Wound Dressing Market Report:

In South America, the Biomaterial Wound Dressing market is projected to rise from $0.09 billion in 2023 to $0.15 billion in 2033. Increasing awareness about advanced wound care treatments and the growing prevalence of diabetes are notably impacting this market segment, making it crucial for continued investment and innovation within the region.Middle East & Africa Biomaterial Wound Dressing Market Report:

The Middle East and Africa region is also seeing promising growth, with the Biomaterial Wound Dressing market anticipated to rise from $0.17 billion in 2023 to $0.29 billion in 2033. This growth reflects the rising prevalence of wound-related disorders and the strengthening of healthcare systems across several countries.Tell us your focus area and get a customized research report.

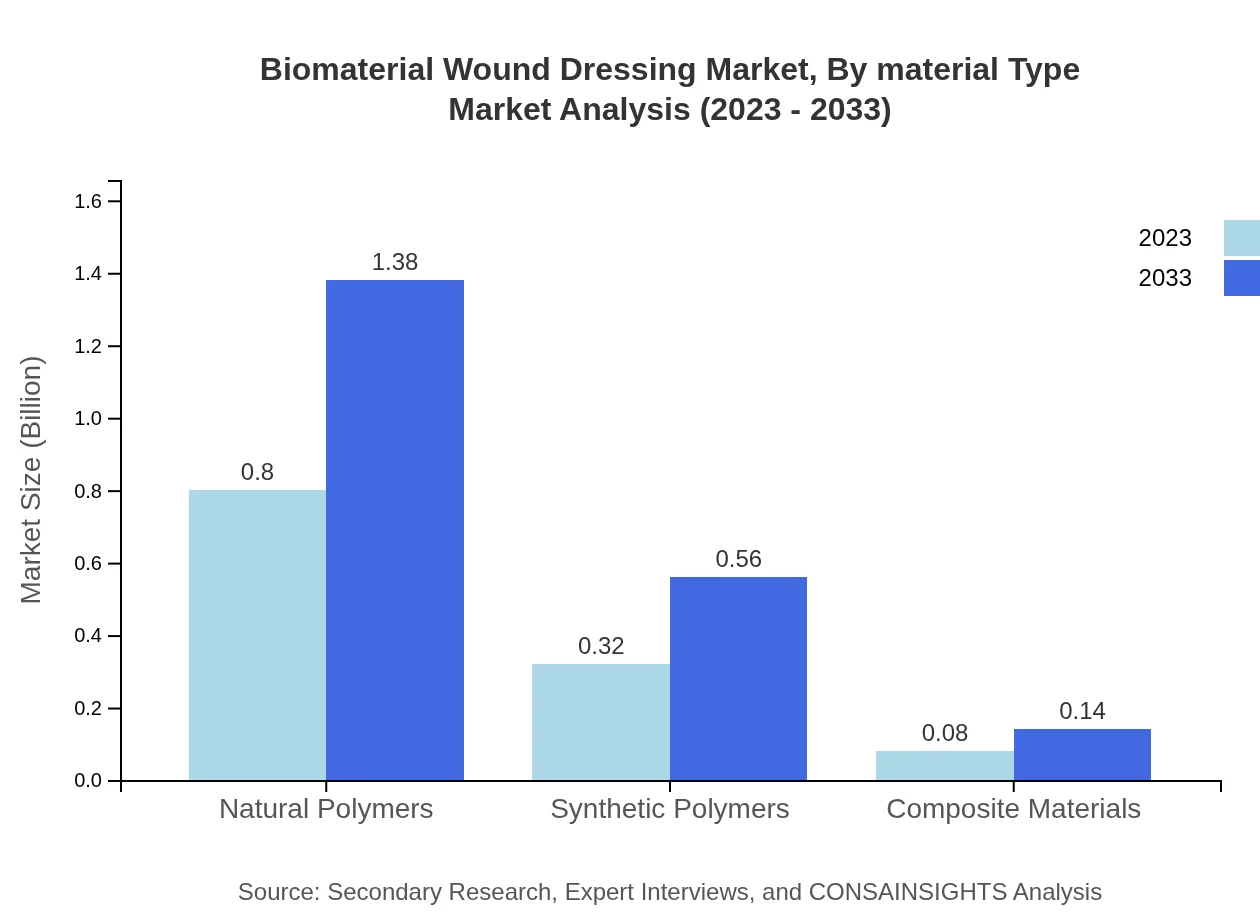

Biomaterial Wound Dressing Market Analysis By Material Type

The Biomaterial Wound Dressing market segmentation by material type indicates significant prospects for natural polymers, anticipating growth from $0.80 billion in 2023 to $1.38 billion by 2033, holding a 66.52% market share. Synthetic polymers are expected to rise from $0.32 billion to $0.56 billion, maintaining a 26.78% share. Composite materials, though smaller, are projected to grow from $0.08 billion to $0.14 billion, indicating niche opportunities in specialized applications.

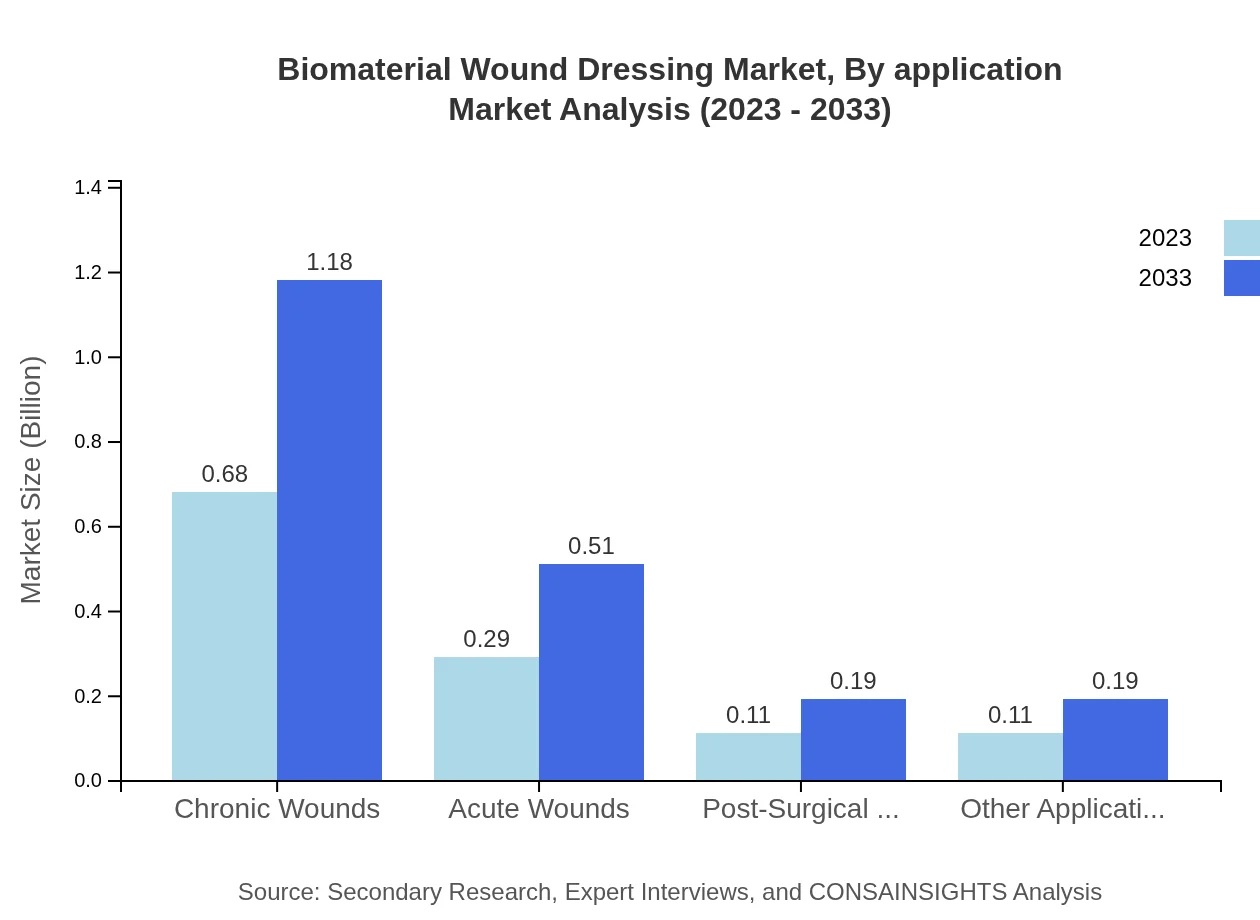

Biomaterial Wound Dressing Market Analysis By Application

When segmented by application, chronic wounds are leading the market, slated to expand from $0.68 billion in 2023 to $1.18 billion by 2033, capturing a 56.65% share. Acute wounds and post-surgical wounds follow, with expected growth from $0.29 billion to $0.51 billion (24.58% share) and from $0.11 billion to $0.19 billion (9.39% share), respectively. Other applications demonstrate stable demand as well, supporting continued product innovation.

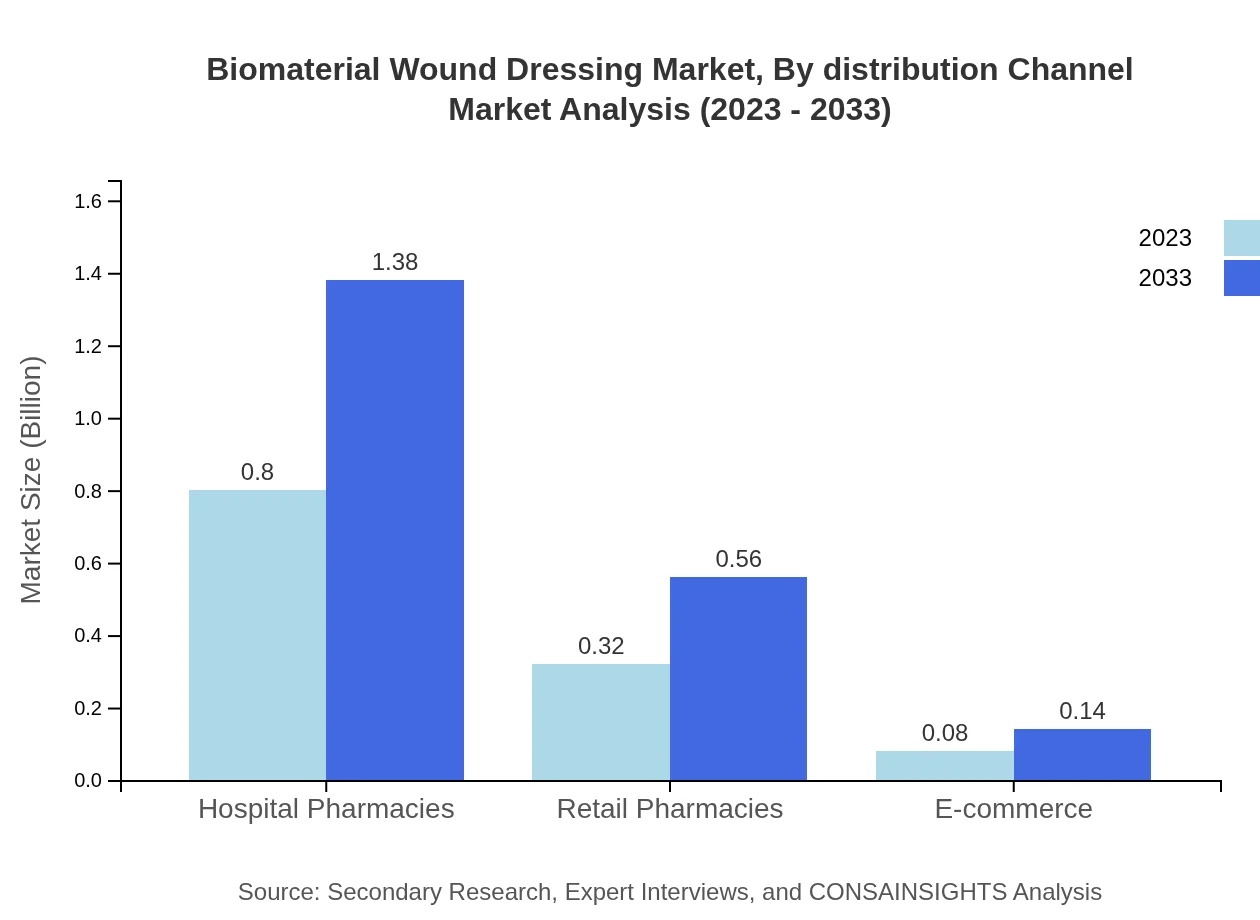

Biomaterial Wound Dressing Market Analysis By Distribution Channel

In terms of distribution channels, hospital pharmacies command the market with a robust share of 66.52%, anticipated to grow from $0.80 billion in 2023 to $1.38 billion by 2033. Retail pharmacies and e-commerce are also crucial, with retail projected to increase from $0.32 billion to $0.56 billion (26.78% share) and e-commerce from $0.08 billion to $0.14 billion (6.7% share), highlighting the diversification of sales platforms.

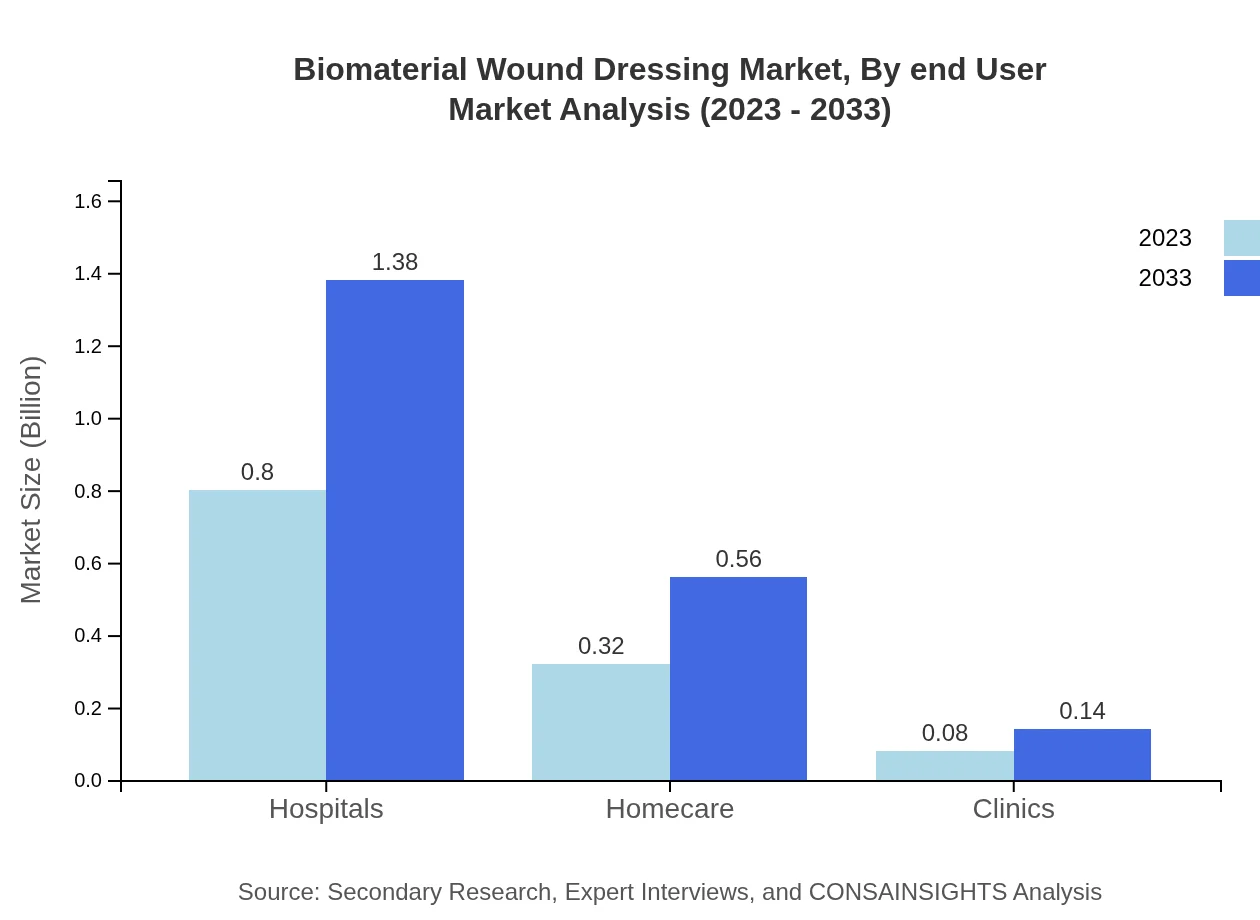

Biomaterial Wound Dressing Market Analysis By End User

The segmentation by end-users reveals a strong inclination toward hospitals, comprising a predominant 66.52% share, anticipated to grow significantly from $0.80 billion to $1.38 billion. Homecare is also noteworthy, projecting growth from $0.32 billion to $0.56 billion (26.78% share). Clinics maintain a smaller share of 6.7%, expected to rise from $0.08 billion to $0.14 billion, indicating potential for tailored wound care products in diverse settings.

Biomaterial Wound Dressing Market Analysis By Region

Global Biomaterial Wound Dressing Market, By Region Market Analysis (2023 - 2033)

Regional analysis indicates North America leading the market by value, followed closely by Europe. Innovations and increasing healthcare needs drive robust growth in the Asia Pacific region as well. South America and the Middle East and Africa represent emerging markets with expanding potential, requiring targeted strategies for market penetration.

Biomaterial Wound Dressing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biomaterial Wound Dressing Industry

Smith & Nephew:

A leading global medical technology company specializing in advanced wound management and biomaterial technology.Johnson & Johnson:

Offers a comprehensive range of products, focusing on innovative biomaterials for efficient wound healing and recovery.Mölnlycke Health Care:

Renowned for its wound care solutions, specializing in materials that enhance healing outcomes for patients.ConvaTec Group:

Provides advanced wound care products with a focus on biomaterials, driving successful wound healing processes.3M Health Care:

Innovative leader in health technology, focusing on quality products that cater to diverse wound care needs.We're grateful to work with incredible clients.

FAQs

What is the market size of biomaterial Wound Dressing?

The global biomaterial wound dressing market is valued at approximately $1.2 billion in 2023, with a projected CAGR of 5.5% over the next decade, indicating significant potential for growth and expansion in the industry.

What are the key market players or companies in the biomaterial Wound Dressing industry?

Key players in the biomaterial wound dressing industry include Medtronic, Johnson & Johnson, 3M, Smith & Nephew, and Coloplast, who are instrumental in driving innovation and market competitiveness in this growing sector.

What are the primary factors driving the growth in the biomaterial Wound Dressing industry?

Growth in the biomaterial wound dressing market is driven by the increasing incidence of chronic wounds, advancements in wound care technology, an aging population, and rising healthcare expenditures focused on effective wound management solutions.

Which region is the fastest Growing in the biomaterial Wound Dressing market?

The North American region is currently the fastest-growing segment in the biomaterial wound dressing market, expected to reach $0.68 billion by 2033, representing increased demand for innovative wound care products.

Does ConsaInsights provide customized market report data for the biomaterial Wound Dressing industry?

Yes, ConsaInsights offers tailored market report data for the biomaterial wound dressing industry, catering to specific client needs to ensure comprehensive insights and strategic decision-making.

What deliverables can I expect from this biomaterial Wound Dressing market research project?

Expected deliverables from the biomaterial wound dressing market research project include comprehensive market analysis, data on key players, growth drivers, regional market insights, trends, and forecasts for informed decision-making.

What are the market trends of biomaterial Wound Dressing?

Current trends in the biomaterial wound dressing market include increasing use of advanced materials, emphasis on antimicrobial properties, growth in e-commerce sales, and a move towards personalized wound care solutions.