Biomaterials Market Report

Published Date: 31 January 2026 | Report Code: biomaterials

Biomaterials Market Size, Share, Industry Trends and Forecast to 2033

This report covers a comprehensive analysis of the Biomaterials market, providing insights into market size, trends, and forecasts from 2023 to 2033. It explores key segments and regional performances, backed by industry analysis and technology advancements.

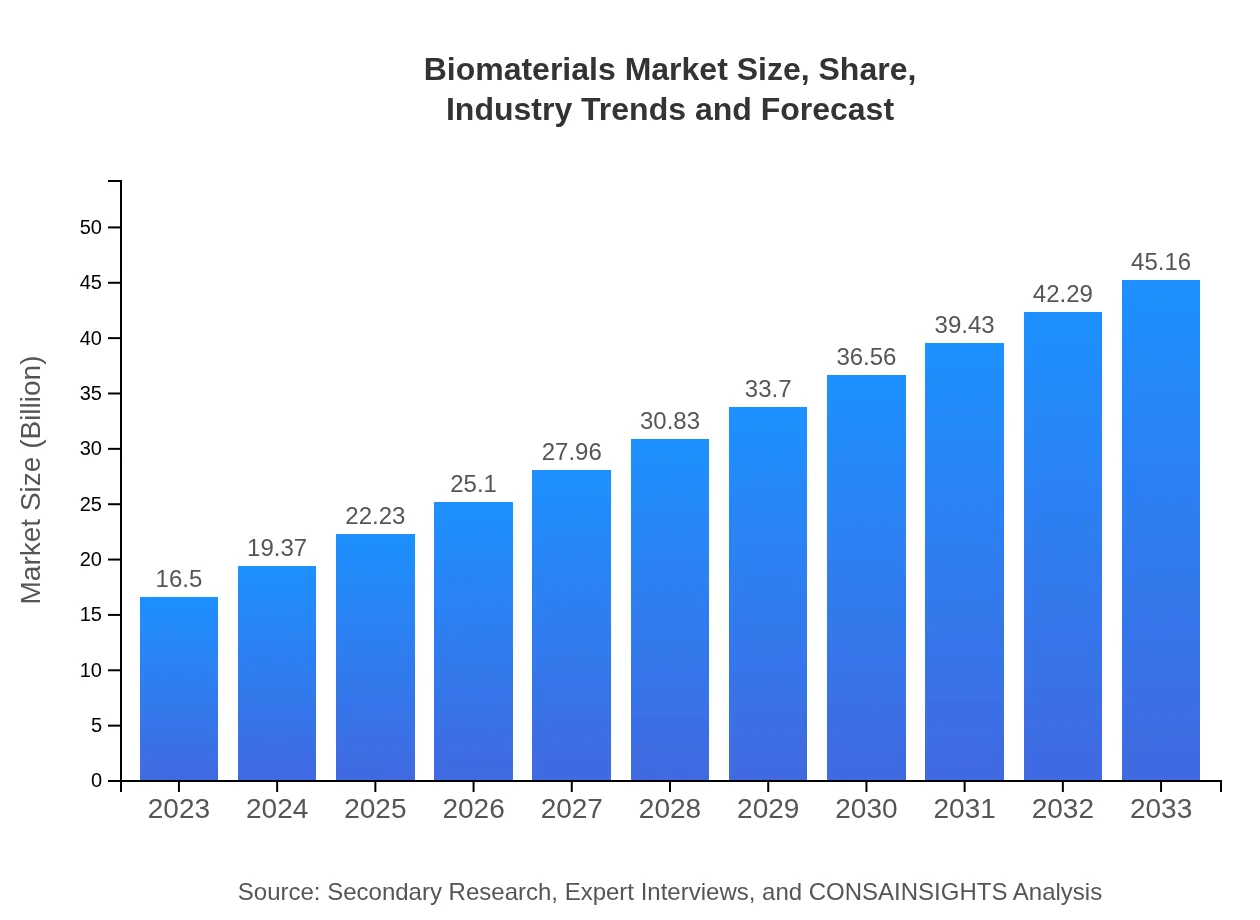

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $16.50 Billion |

| CAGR (2023-2033) | 10.2% |

| 2033 Market Size | $45.16 Billion |

| Top Companies | Corbion, Medtronic , BASF, Mitsubishi Chemical |

| Last Modified Date | 31 January 2026 |

Biomaterials Market Overview

Customize Biomaterials Market Report market research report

- ✔ Get in-depth analysis of Biomaterials market size, growth, and forecasts.

- ✔ Understand Biomaterials's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biomaterials

What is the Market Size & CAGR of Biomaterials market in 2023?

Biomaterials Industry Analysis

Biomaterials Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biomaterials Market Analysis Report by Region

Europe Biomaterials Market Report:

Europe's market is projected to grow from USD 4.08 billion in 2023 to USD 11.16 billion by 2033. Stringent regulations regarding medical device safety and increasing healthcare expenditure are positive catalysts for market expansion.Asia Pacific Biomaterials Market Report:

The Asia Pacific region is anticipated to exhibit rapid growth, projected to expand from USD 3.48 billion in 2023 to USD 9.54 billion by 2033. This growth is fueled by increasing healthcare infrastructure development and investments in biotechnology.North America Biomaterials Market Report:

North America is currently the largest market with a size of USD 5.32 billion in 2023, forecasted to reach USD 14.55 billion by 2033. The presence of major market players and robust R&D activities in the region contribute significantly to its market dominance.South America Biomaterials Market Report:

In South America, the Biomaterials market is expected to grow from USD 1.47 billion in 2023 to USD 4.03 billion by 2033. The rise in healthcare accessibility and improved manufacturing capabilities are key drivers of this growth.Middle East & Africa Biomaterials Market Report:

The Middle East and Africa market is estimated to grow from USD 2.15 billion in 2023 to USD 5.88 billion by 2033, with growing regional health expenditures and increasing interest in biomaterial applications fostering growth prospects.Tell us your focus area and get a customized research report.

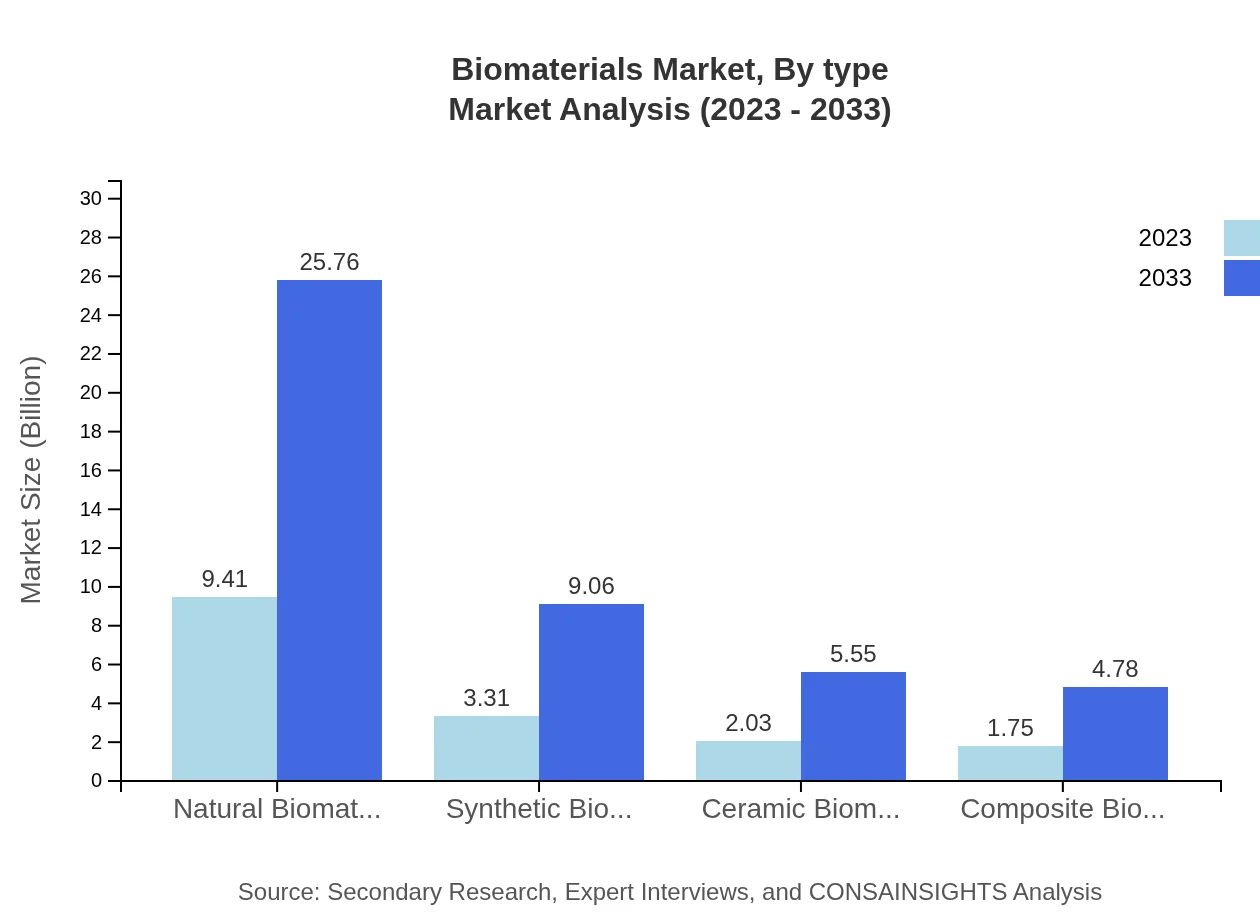

Biomaterials Market Analysis By Type

Natural Biomaterials dominate the market with a size of USD 9.41 billion in 2023, projected to reach USD 25.76 billion by 2033, holding a 57.05% market share. Synthetic Biomaterials are also gaining traction, anticipated to increase from USD 3.31 billion in 2023 to USD 9.06 billion by 2033. Ceramic Biomaterials represent USD 2.03 billion in 2023 and are expected to grow to USD 5.55 billion by 2033. Composite Biomaterials, though smaller at USD 1.75 billion, show a promising growth trend, indicating a diversified market dynamism.

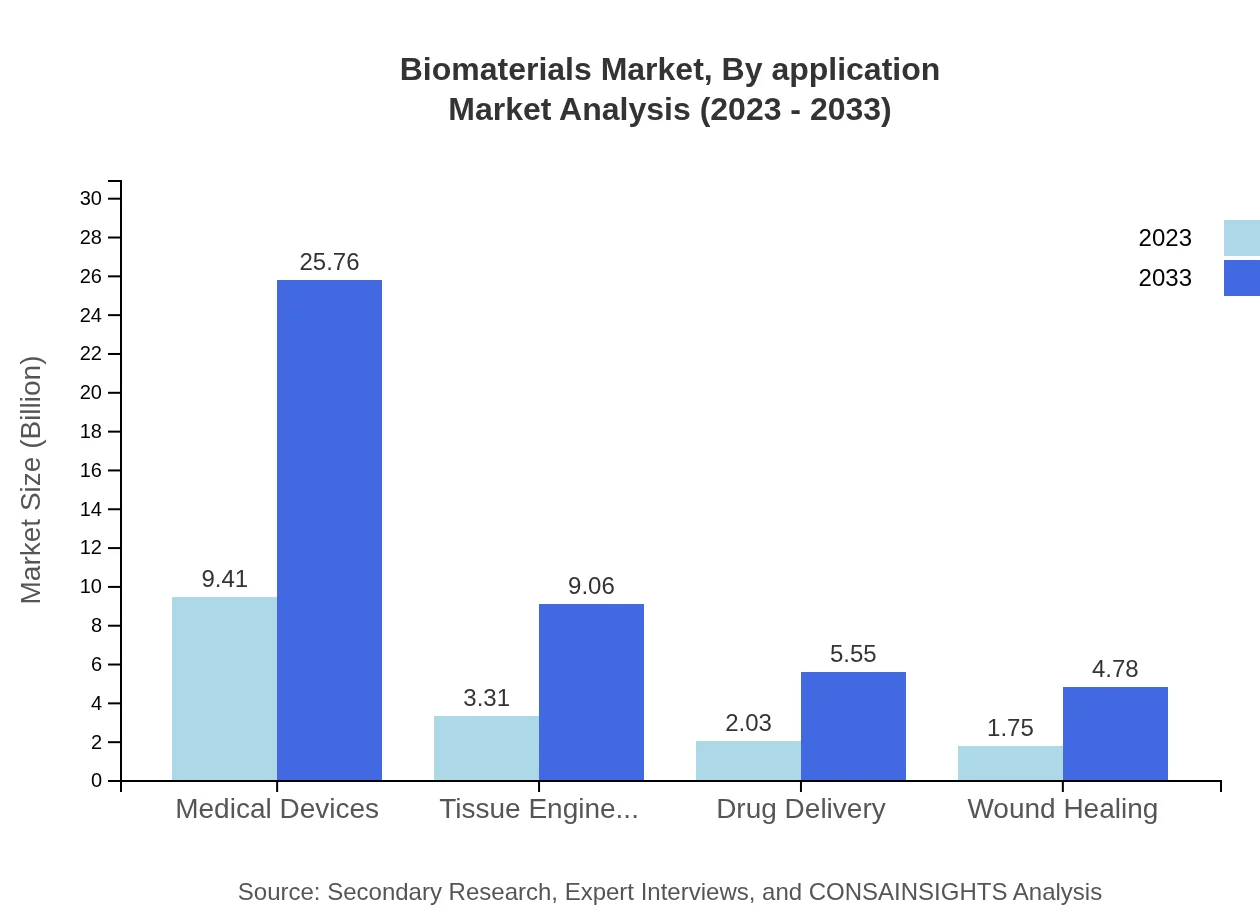

Biomaterials Market Analysis By Application

Applications of Biomaterials span healthcare, biotechnology, pharmaceuticals, and more. The healthcare segment is the largest, projected to reach USD 25.76 billion by 2033 from USD 9.41 billion in 2023. The biotechnology sector is also significant, expected to grow from USD 3.31 billion in 2023 to USD 9.06 billion by 2033.

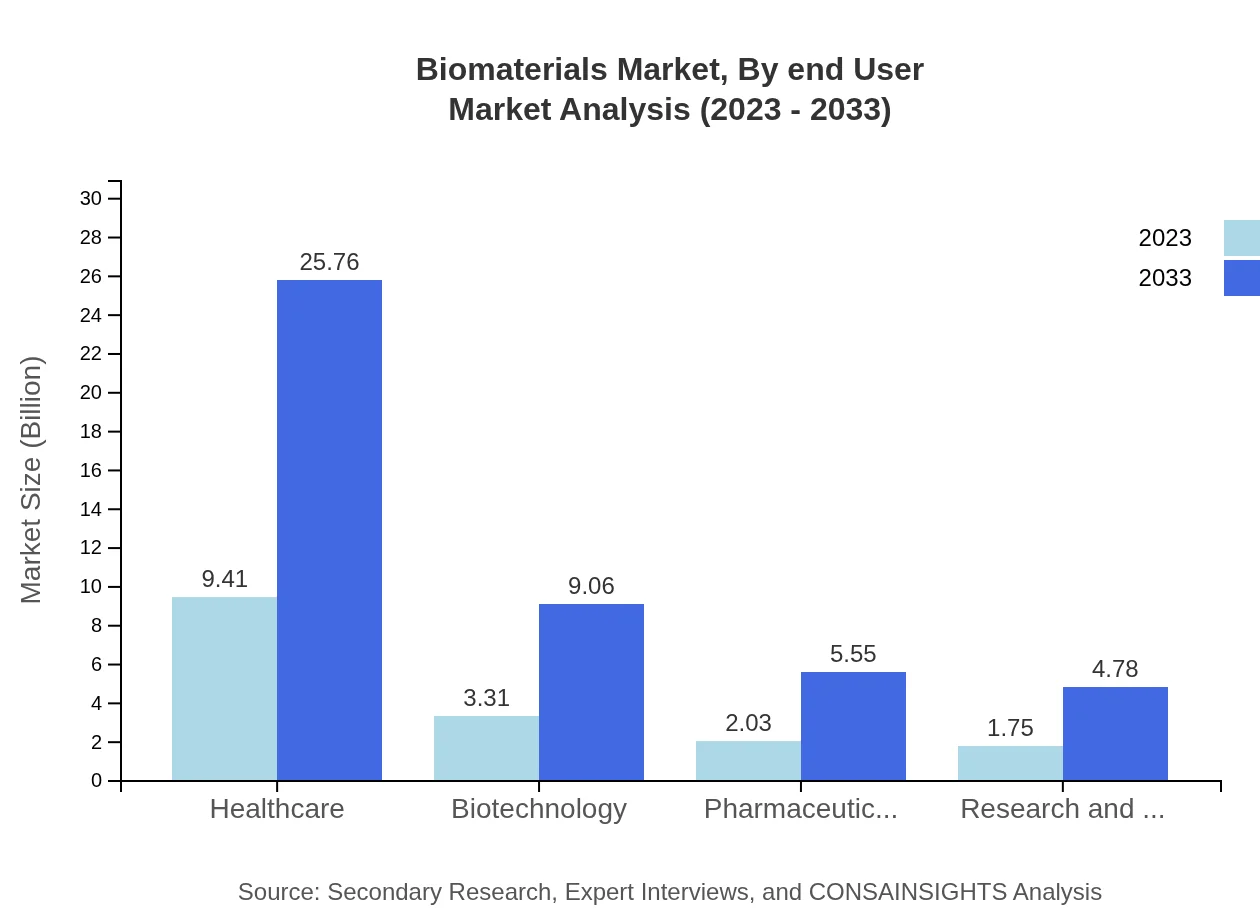

Biomaterials Market Analysis By End User

The medical devices sector is the primary end-user of Biomaterials, anticipated to grow from USD 9.41 billion in 2023 to USD 25.76 billion by 2033, signifying the reliance on biocompatible materials in device manufacturing. Other end-users such as research institutions and academia also contribute to market growth through ongoing research and innovation.

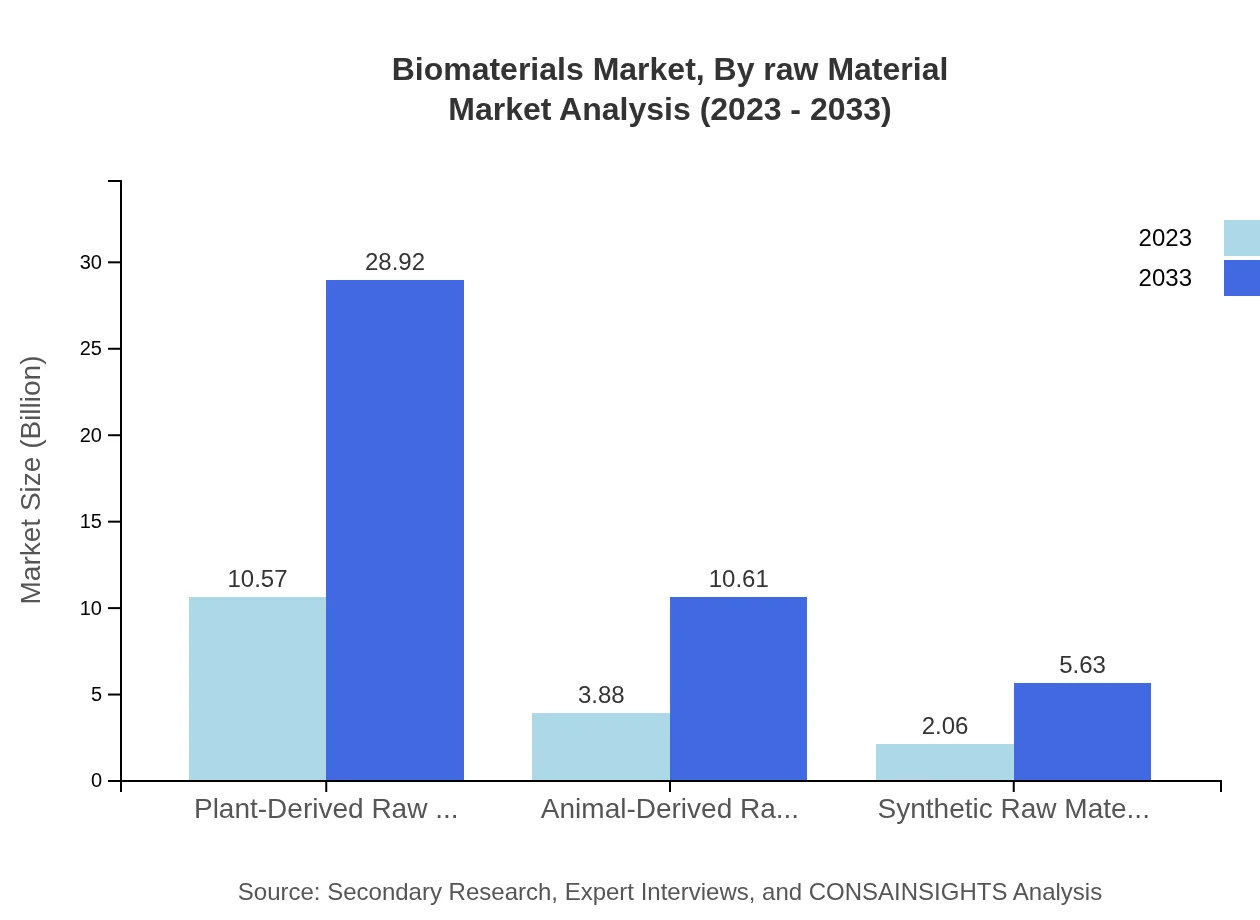

Biomaterials Market Analysis By Raw Material

Market analysis by raw materials reveals that plant-derived raw materials are the largest segment, valued at USD 10.57 billion in 2023, set to grow to USD 28.92 billion by 2033. Conversely, animal-derived and synthetic raw materials also hold market shares of 23.49% and 12.47%, respectively, reflecting the broad application of diverse biomaterials.

Biomaterials Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biomaterials Industry

Corbion:

Corbion is a global leader in the bio-based products and biomaterials sector, specializing in sustainable practices and innovative material solutions.Medtronic :

Medtronic is a pioneering company in the biomedical field, focusing on advanced medical devices and solution analytics utilizing biomaterials.BASF:

BASF operates across various sectors and has a significant biomaterials unit dedicated to developing biodegradable polymers and composites.Mitsubishi Chemical:

Mitsubishi Chemical is involved in the development of biomaterials for medical applications, providing customized biomaterial solutions and innovations.We're grateful to work with incredible clients.

FAQs

What is the market size of biomaterials?

The biomaterials market is currently valued at $16.5 billion with a remarkable CAGR of 10.2%. It is expected to grow significantly over the next decade, driven by advancements in healthcare and biotechnology sectors.

What are the key market players or companies in the biomaterials industry?

Key players in the biomaterials industry include prominent companies like Medtronic, Johnson & Johnson, Corbion, and BASF. These companies are recognized for their innovative contributions to the development of new biomaterial technologies.

What are the primary factors driving the growth in the biomaterials industry?

The growth in the biomaterials industry is primarily driven by increasing demand for medical implants, advancements in biotechnology, and a rising focus on sustainable materials. Additionally, the growing need for innovative healthcare solutions further fuels market expansion.

Which region is the fastest Growing in the biomaterials market?

The Asia Pacific region is expected to witness the fastest growth in the biomaterials market, with an increase from $3.48 billion in 2023 to $9.54 billion by 2033. This growth is attributed to rising healthcare investments and improving medical infrastructure.

Does ConsaInsights provide customized market report data for the biomaterials industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs in the biomaterials industry. Clients can request tailored insights to better understand market dynamics and develop effective strategies.

What deliverables can I expect from this biomaterials market research project?

Deliverables from the biomaterials market research project may include comprehensive market analysis reports, regional insights, segment details, and forecasts, providing stakeholders a clear pathway for strategic decision-making.

What are the market trends of biomaterials?

Key trends in the biomaterials market include a shift towards sustainable materials, innovation in 3D printing technologies, and the integration of biomaterials into drug delivery systems and tissue engineering solutions.