Biomedical Temperature Sensors Market Report

Published Date: 31 January 2026 | Report Code: biomedical-temperature-sensors

Biomedical Temperature Sensors Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biomedical Temperature Sensors market, covering market size, trends, segmentation, and regional insights from 2023 to 2033.

| Metric | Value |

|---|---|

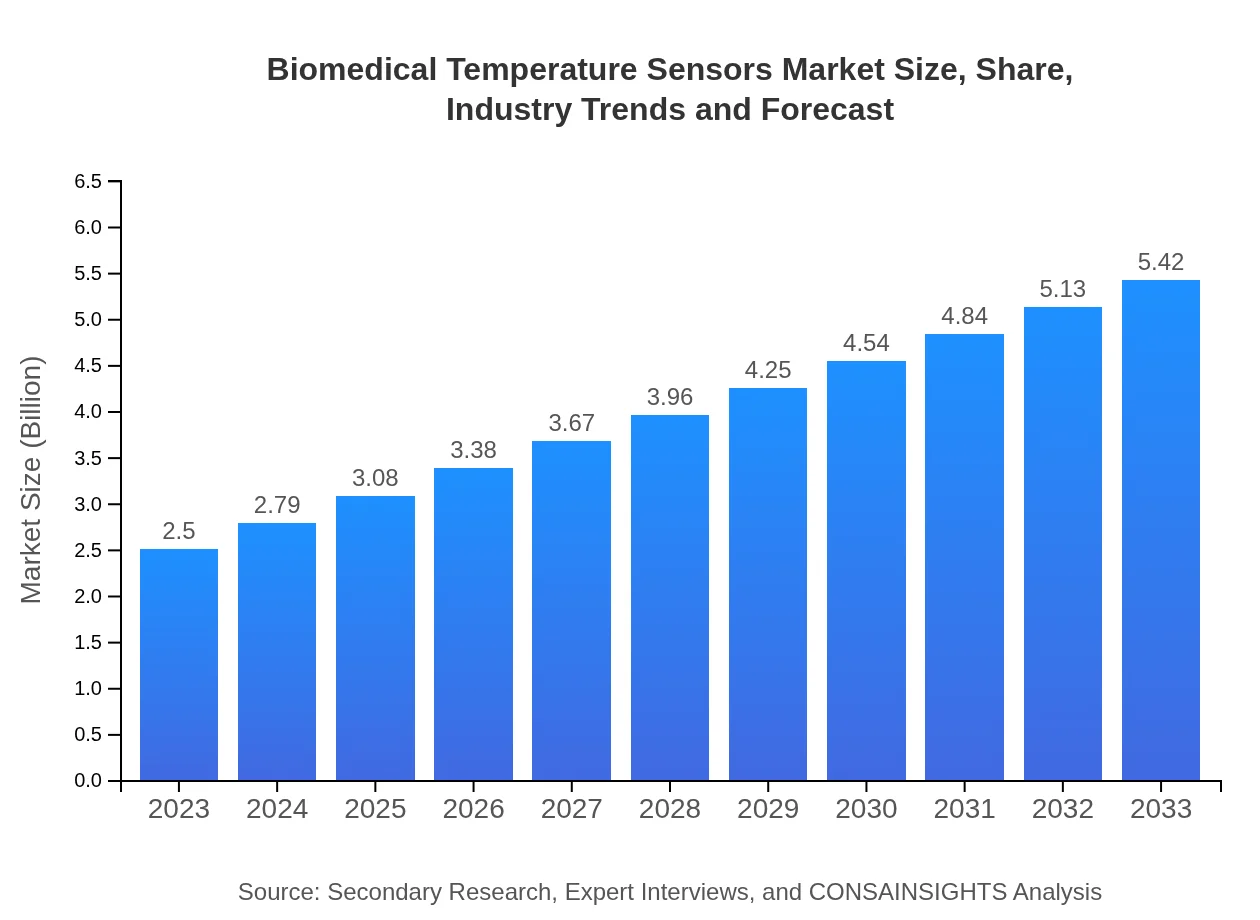

| Study Period | 2023 - 2033 |

| 2023 Market Size | $2.50 Billion |

| CAGR (2023-2033) | 7.8% |

| 2033 Market Size | $5.42 Billion |

| Top Companies | Medtronic , Thermo Fisher Scientific, Honeywell , Siemens Healthineers, Omron |

| Last Modified Date | 31 January 2026 |

Biomedical Temperature Sensors Market Overview

Customize Biomedical Temperature Sensors Market Report market research report

- ✔ Get in-depth analysis of Biomedical Temperature Sensors market size, growth, and forecasts.

- ✔ Understand Biomedical Temperature Sensors's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biomedical Temperature Sensors

What is the Market Size & CAGR of Biomedical Temperature Sensors market in 2023?

Biomedical Temperature Sensors Industry Analysis

Biomedical Temperature Sensors Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biomedical Temperature Sensors Market Analysis Report by Region

Europe Biomedical Temperature Sensors Market Report:

In Europe, the market was valued at $0.63 billion in 2023 and is projected to grow to $1.36 billion by 2033. The demand for advanced temperature monitoring solutions in medical settings, together with stringent regulations regarding medical devices, bolsters market growth.Asia Pacific Biomedical Temperature Sensors Market Report:

In the Asia Pacific region, the Biomedical Temperature Sensors market was valued at $0.52 billion in 2023 and is expected to reach $1.12 billion by 2033. The rapid growth in healthcare infrastructure, increased government spending on healthcare, and rising health awareness contribute significantly to this growth.North America Biomedical Temperature Sensors Market Report:

North America holds a substantial share in the Biomedical Temperature Sensors market, being valued at $0.95 billion in 2023, with expectations to reach $2.06 billion by 2033. The presence of key industry players, high healthcare expenditures, and technological advancements underpin this robust growth.South America Biomedical Temperature Sensors Market Report:

The South American market stood at $0.15 billion in 2023 and is anticipated to grow to $0.33 billion by 2033. Factors such as the expansion of healthcare facilities and the rising adoption of telemedicine are likely to drive this growth.Middle East & Africa Biomedical Temperature Sensors Market Report:

The Middle East and Africa region recorded a market size of $0.26 billion in 2023, expected to grow to $0.55 billion by 2033. Growing healthcare investments, coupled with the increasing prevalence of chronic diseases, are contributing to market expansion.Tell us your focus area and get a customized research report.

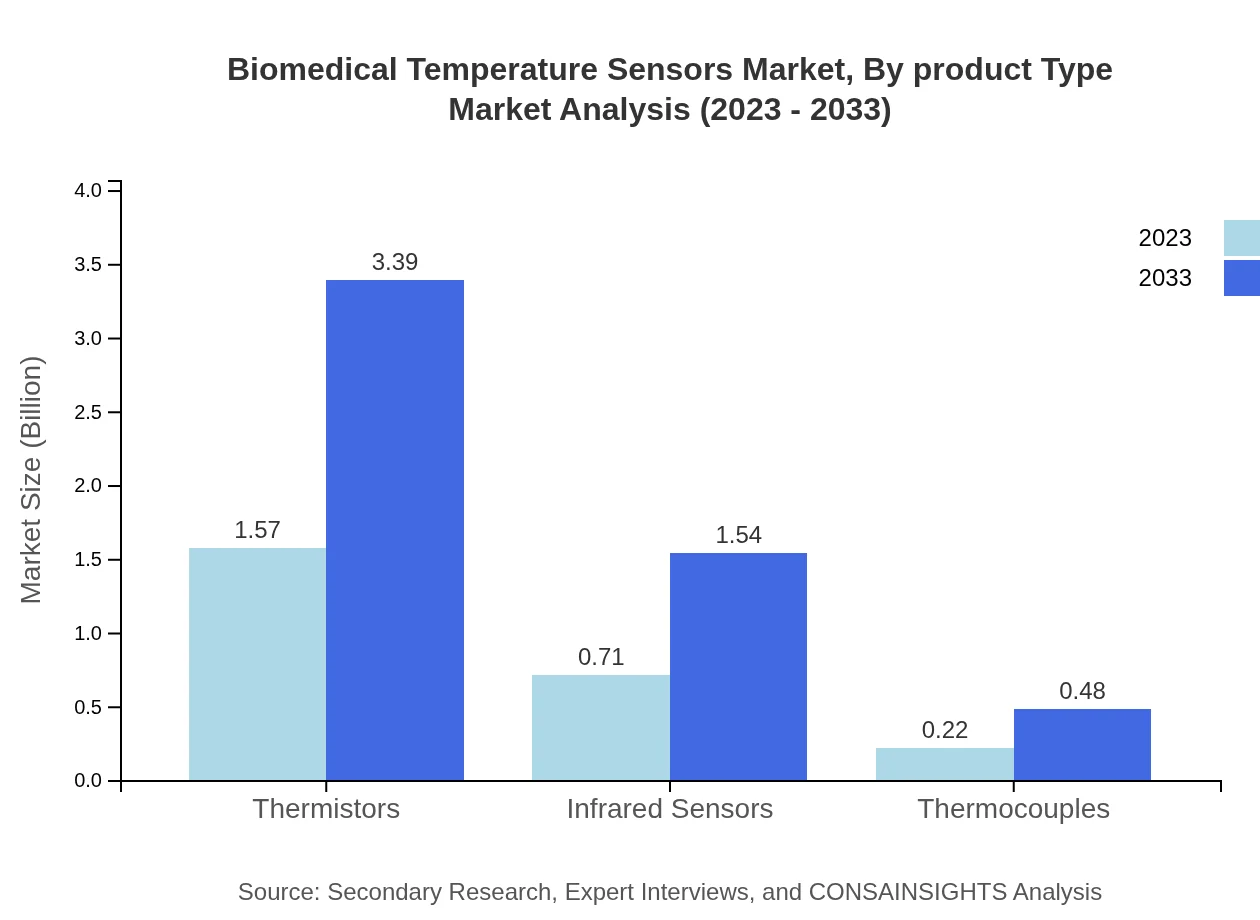

Biomedical Temperature Sensors Market Analysis By Product Type

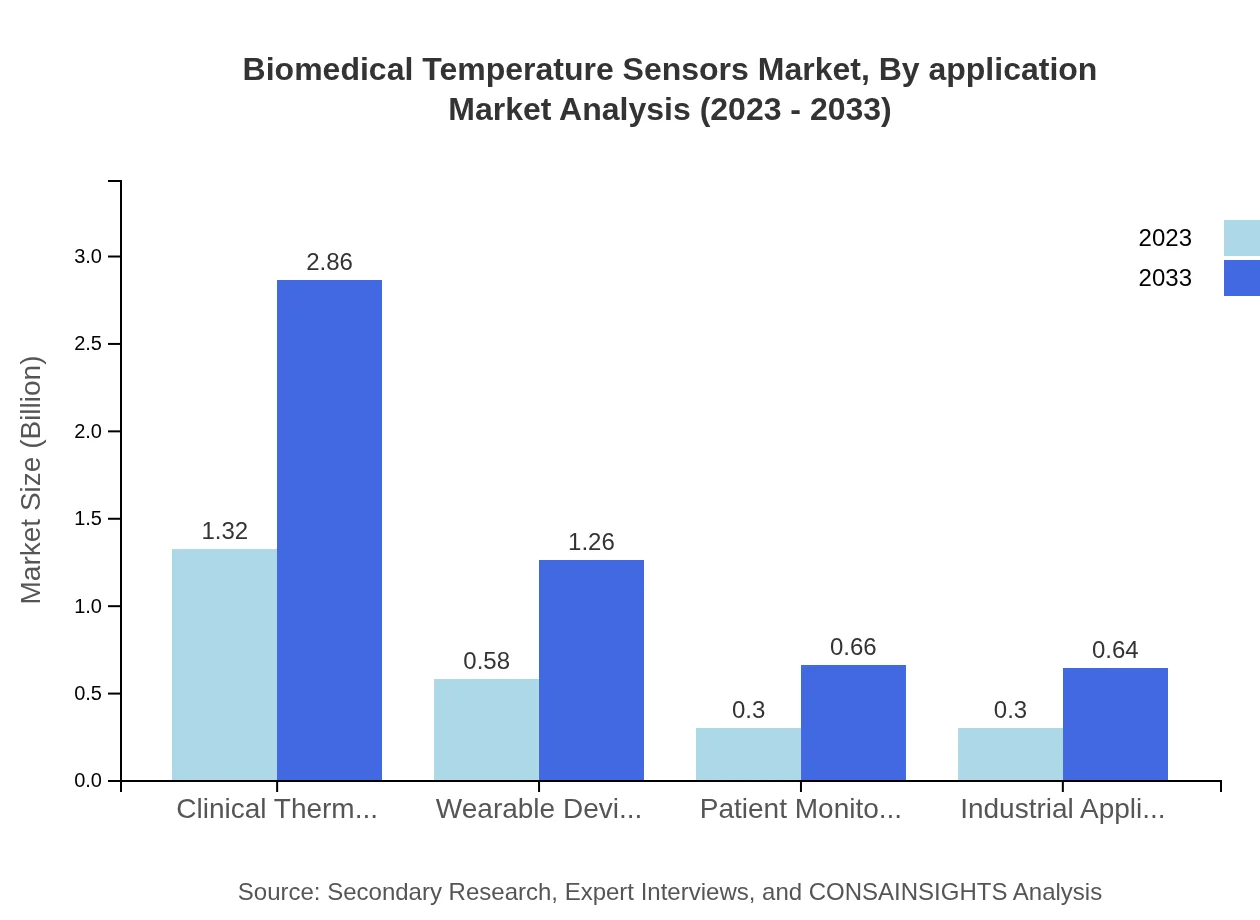

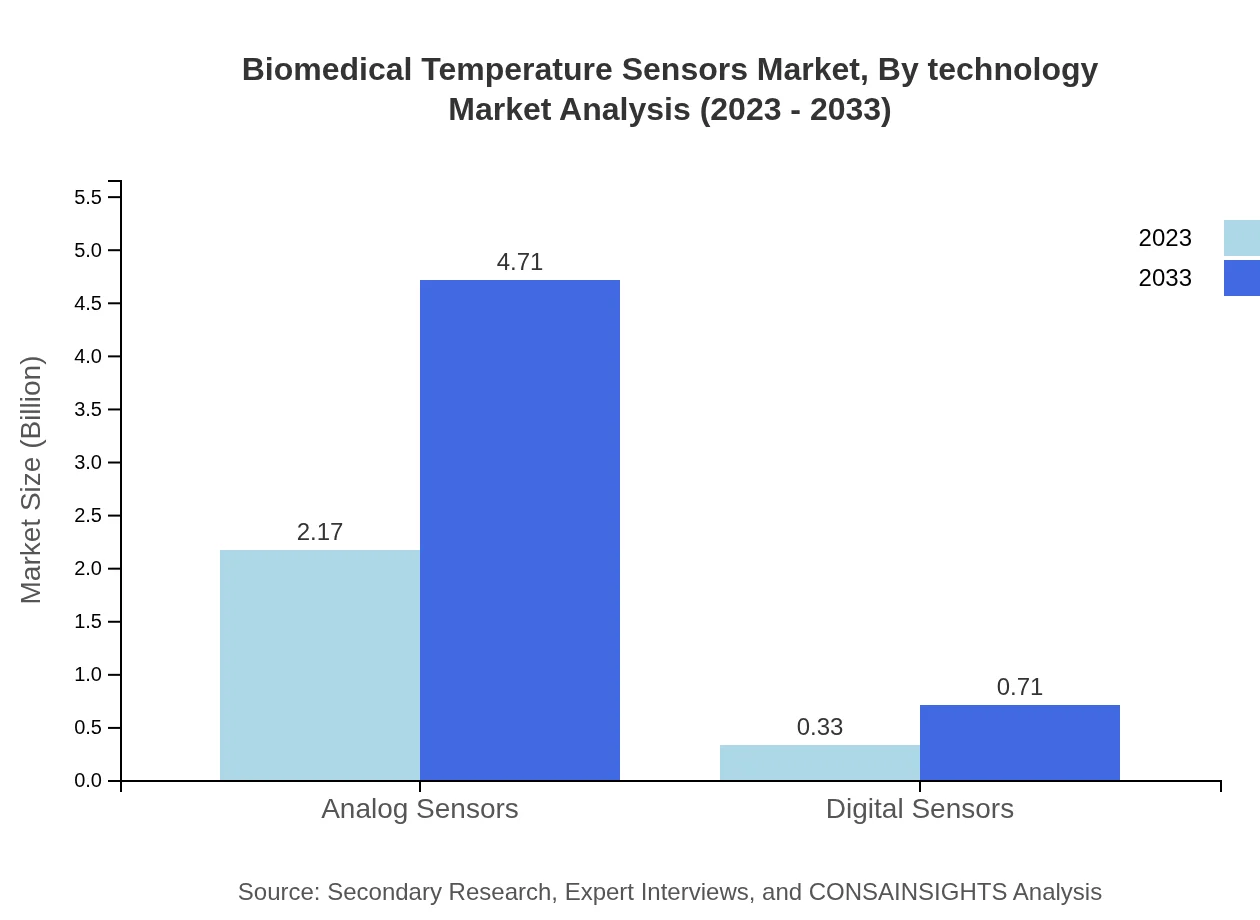

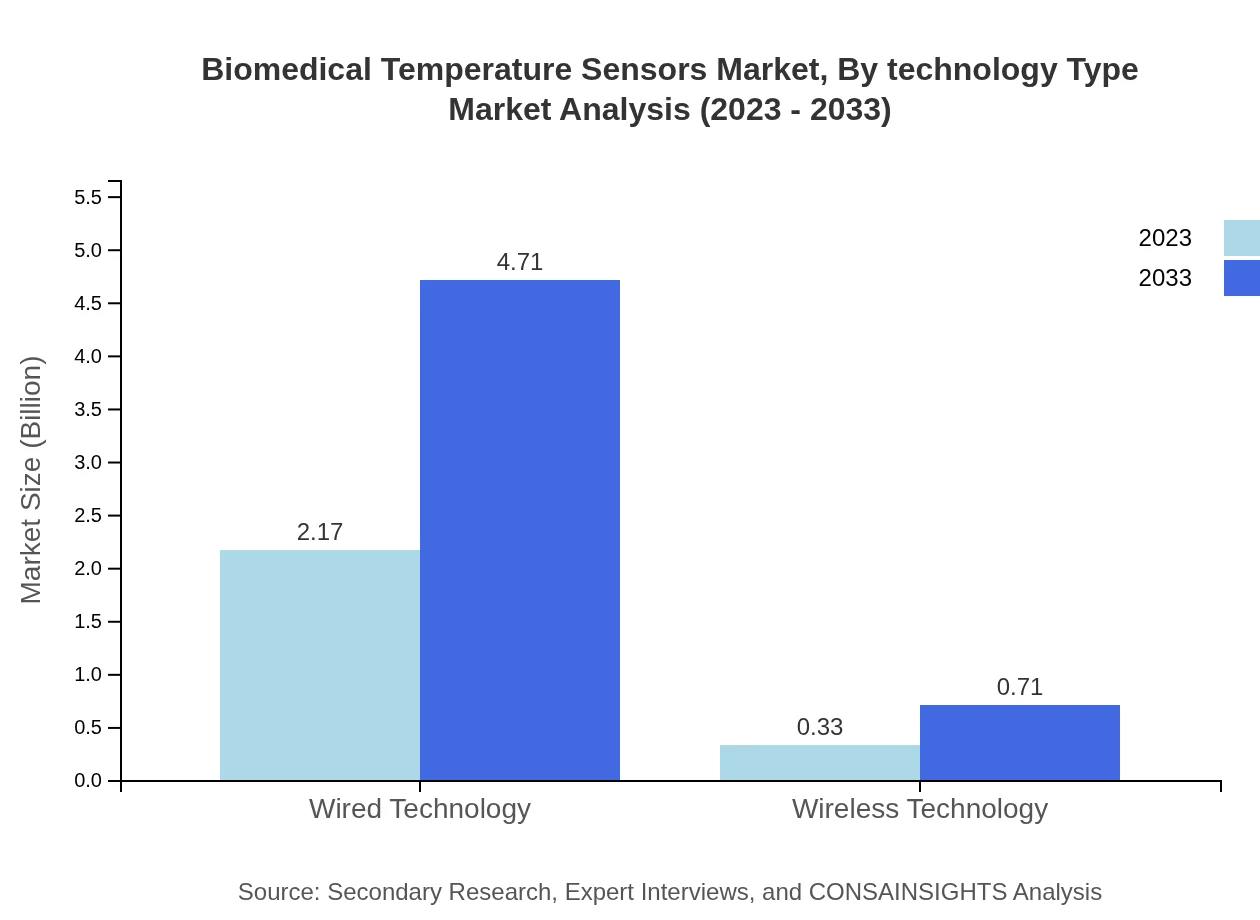

The market is dominated by analog sensors, which accounted for approximately $2.17 billion in 2023 and is expected to reach $4.71 billion by 2033, maintaining an 86.89% market share. Clinical thermometers, contributing $1.32 billion in 2023 and expected to reach $2.86 billion, hold a 52.82% share. Other segments such as digital sensors and wearable devices also exhibit promising growth, responding to evolving healthcare needs.

Biomedical Temperature Sensors Market Analysis By Application

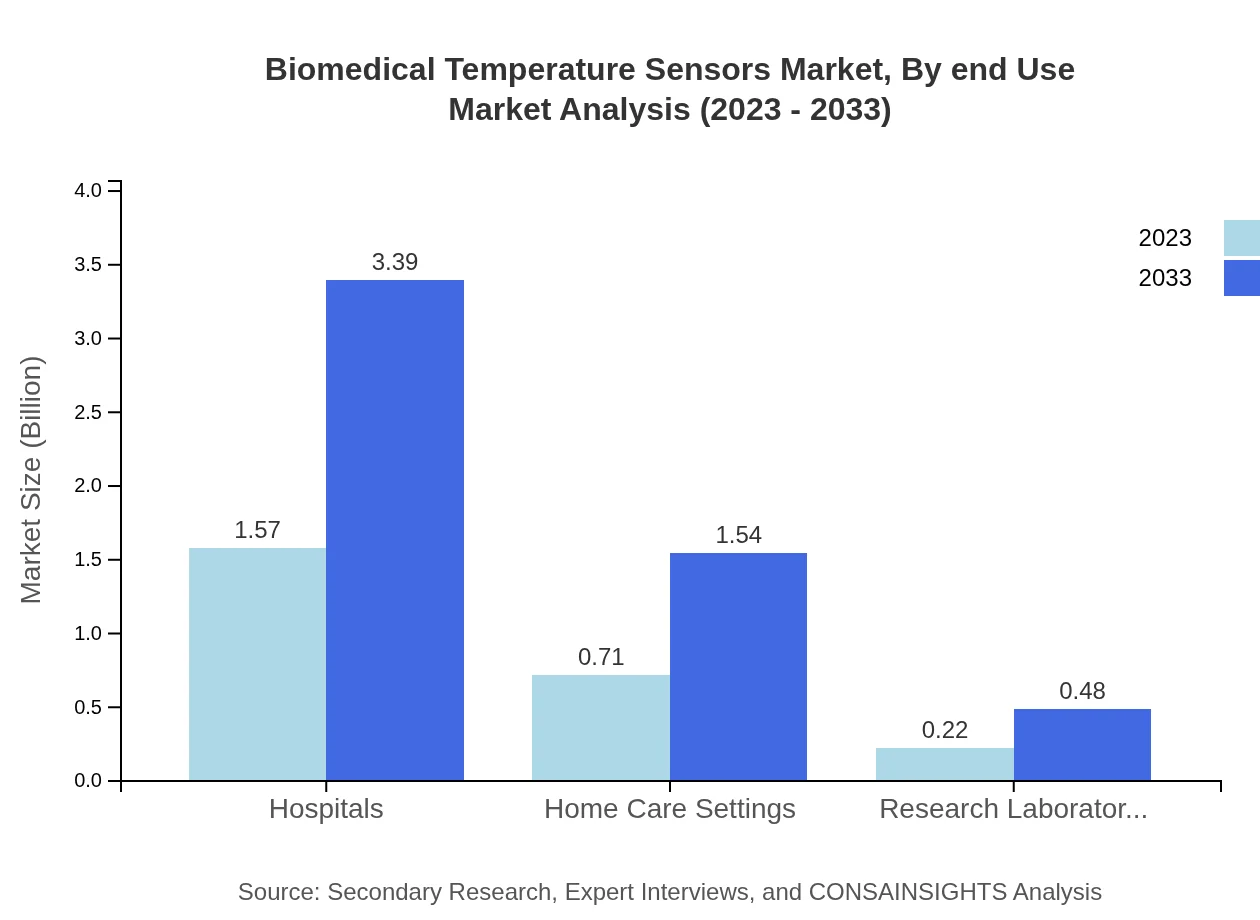

Hospitals represent the largest share of the market, with a size of $1.57 billion in 2023, anticipated to grow to $3.39 billion by 2033, maintaining a 62.63% share. Home care settings are also significant, projected to grow from $0.71 billion to $1.54 billion during the same period, accounting for 28.47% of the total market.

Biomedical Temperature Sensors Market Analysis By Technology

Wired technology dominates the market, valued at $2.17 billion in 2023 and expected to reach $4.71 billion by 2033, representing a significant 86.89% market share. Wireless technology, while smaller at $0.33 billion in 2023 and expected to grow to $0.71 billion, is gaining traction due to rising demand for portable and remote monitoring solutions.

Biomedical Temperature Sensors Market Analysis By End Use

The Biomedical Temperature Sensors market finds key applications in hospitals and home care settings, driven by the increasing need for reliable patient monitoring solutions. The home care segment's size is expected to double in the next decade, indicating a marked shift towards at-home healthcare services.

Biomedical Temperature Sensors Market Analysis By Technology Type

Thermistors are the leading technology type in the market, accounting for $1.57 billion in 2023 and expected to grow to $3.39 billion by 2033, with a steady share of 62.63%. Infrared sensors and thermocouples, though smaller in size, exhibit growth potential as innovative solutions for non-invasive and rapid temperature measurements.

Biomedical Temperature Sensors Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biomedical Temperature Sensors Industry

Medtronic :

A leader in medical technology, Medtronic develops advanced surgical and monitoring solutions, including high-precision temperature sensors used in patient care.Thermo Fisher Scientific:

A prominent player in laboratory equipment, Thermo Fisher Scientific offers a variety of biomedical temperature sensors that enhance clinical accuracy and reliability.Honeywell :

Honeywell provides a range of temperature sensors for industrial and healthcare applications, focusing on innovation and integration with smart technologies.Siemens Healthineers:

Siemens Healthineers develops cutting-edge healthcare solutions, including temperature sensors that are pivotal in patient monitoring systems.Omron:

Omron specializes in healthcare and wellness products, providing a diverse portfolio of high-quality temperature measurement devices.We're grateful to work with incredible clients.

FAQs

What is the market size of biomedical Temperature Sensors?

The biomedical temperature sensors market is valued at approximately $2.5 billion in 2023, with a projected growth at a CAGR of 7.8%. By 2033, it is expected to significantly expand, indicating a robust demand in healthcare applications.

What are the key market players or companies in the biomedical Temperature Sensors industry?

Key players in the biomedical temperature sensors market include major companies known for their innovative technologies. These dominant firms drive competition and advancements, contributing to the market's overall growth and innovation in sensor technologies.

What are the primary factors driving the growth in the biomedical temperature sensors industry?

Growth in the biomedical temperature sensors industry is driven by technological advancements, increasing healthcare applications, and rising investments in medical devices. Moreover, the growing trend of remote patient monitoring and wearables further amplifies the demand for innovative temperature measuring solutions.

Which region is the fastest Growing in the biomedical temperature sensors market?

North America is anticipated to be the fastest-growing region in the biomedical temperature sensors market, reaching approximately $2.06 billion by 2033. This expansion is fueled by advanced healthcare infrastructure and increased adoption of temperature monitoring technologies.

Does ConsaInsights provide customized market report data for the biomedical temperature sensors industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the biomedical temperature sensors industry. Clients can request detailed insights based on particular segments or regional analyses to meet their strategic requirements.

What deliverables can I expect from this biomedical temperature sensors market research project?

From the biomedical temperature sensors market research project, deliverables typically include comprehensive reports featuring market size, growth forecasts, segment analysis, and competitive landscape assessments, along with actionable insights for strategic planning.

What are the market trends of biomedical Temperature Sensors?

Current market trends in the biomedical temperature sensors space highlight the growth of wearable devices and increased usage in home care settings. The integration of digital technology for real-time monitoring is also on the rise, reshaping healthcare practices.