Biometric Atm Market Report

Published Date: 31 January 2026 | Report Code: biometric-atm

Biometric Atm Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biometric ATM market from 2023 to 2033, covering market size, growth trends, regional insights, and key players shaping the industry.

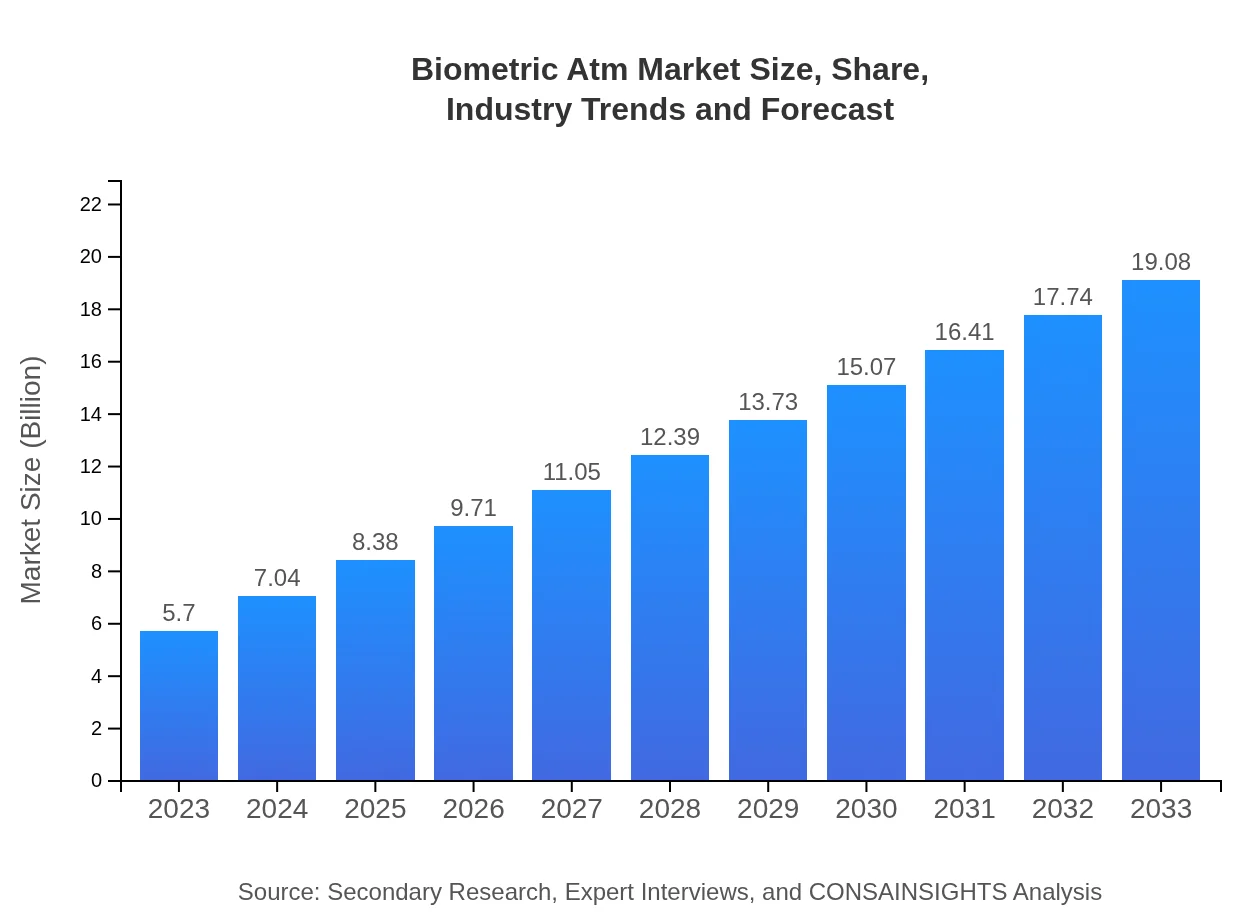

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.70 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $19.08 Billion |

| Top Companies | NCR Corporation, Diebold Nixdorf, Hitachi, Fujitsu, Gemalto NV |

| Last Modified Date | 31 January 2026 |

Biometric ATM Market Overview

Customize Biometric Atm Market Report market research report

- ✔ Get in-depth analysis of Biometric Atm market size, growth, and forecasts.

- ✔ Understand Biometric Atm's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric Atm

What is the Market Size & CAGR of Biometric ATM market in 2023 and 2033?

Biometric ATM Industry Analysis

Biometric ATM Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric ATM Market Analysis Report by Region

Europe Biometric Atm Market Report:

Europe's market size is projected to grow from $2.05 billion in 2023 to $6.87 billion in 2033. The region is witnessing a surge in biometric ATMs across banks and retail outlets driven by stringent regulations surrounding customer data protection and security.Asia Pacific Biometric Atm Market Report:

In 2023, the Asia Pacific Biometric ATM market stood at $1.08 billion, projected to grow to $3.60 billion by 2033. The increasing adoption of digital banking and high investments in fintech innovation are key drivers in this region, particularly in countries like China and India, where the need for secure transaction methods is rapidly increasing.North America Biometric Atm Market Report:

North America’s Biometric ATM market was valued at $1.92 billion in 2023, forecasted to grow to $6.43 billion by 2033. High penetration of advanced banking technologies and growing demand for secure ATM transactions driven by increasing fraud rates make this region a significant market holder.South America Biometric Atm Market Report:

The South American market, valued at $0.19 billion in 2023, is expected to reach $0.64 billion by 2033. Growth is stimulated by the rise of fintech companies and banks implementing biometric systems to strengthen security in the face of growing ATM fraud concerns across the region.Middle East & Africa Biometric Atm Market Report:

In the Middle East and Africa, the Biometric ATM market size was $0.46 billion in 2023 and is expected to increase to $1.53 billion by 2033. The growing focus on digital banking and securing financial transactions supports rapid adoption of biometric ATMs in several countries within this region.Tell us your focus area and get a customized research report.

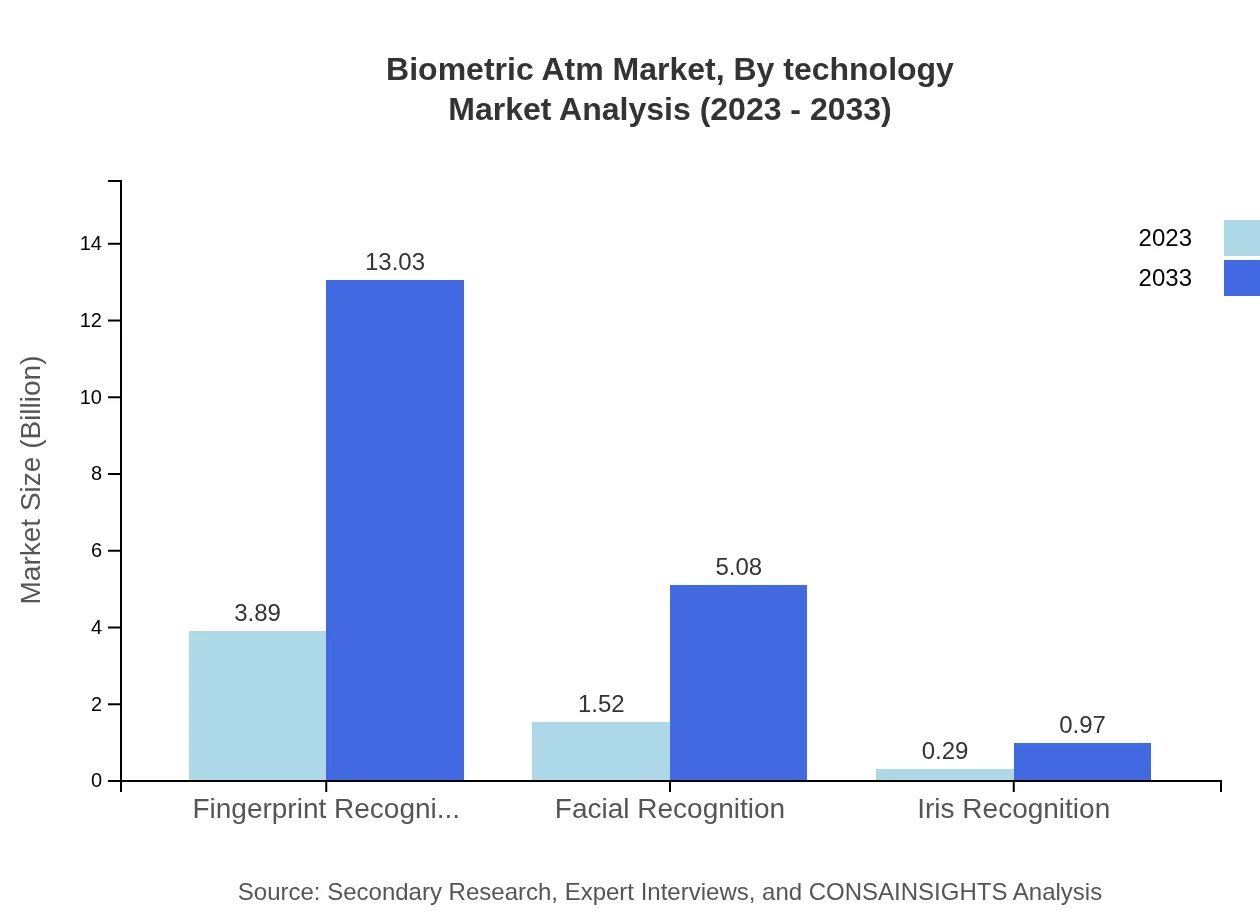

Biometric Atm Market Analysis By Technology

The Biometric ATM market technology segmentation focuses on fingerprint recognition, facial recognition, and iris recognition. Fingerprint recognition dominates the market with a size of $3.89 billion in 2023, growing to $13.03 billion by 2033, capturing 68.29% of the market share. In contrast, facial recognition accounted for $1.52 billion in 2023, with estimates of reaching $5.08 billion by 2033, maintaining a 26.64% share. Iris recognition remains at a smaller scale, projected to increase from $0.29 billion in 2023 to $0.97 billion in 2033.

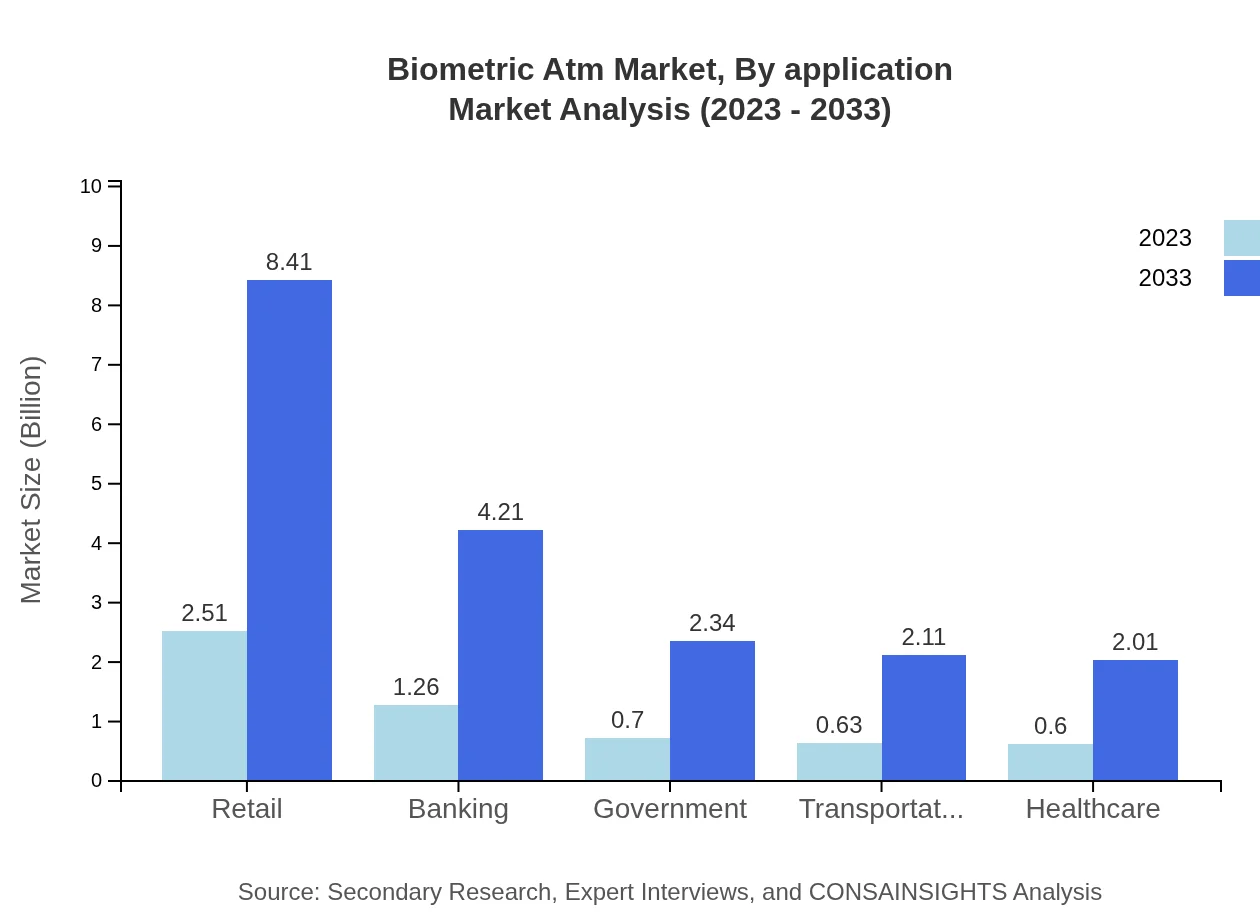

Biometric Atm Market Analysis By Application

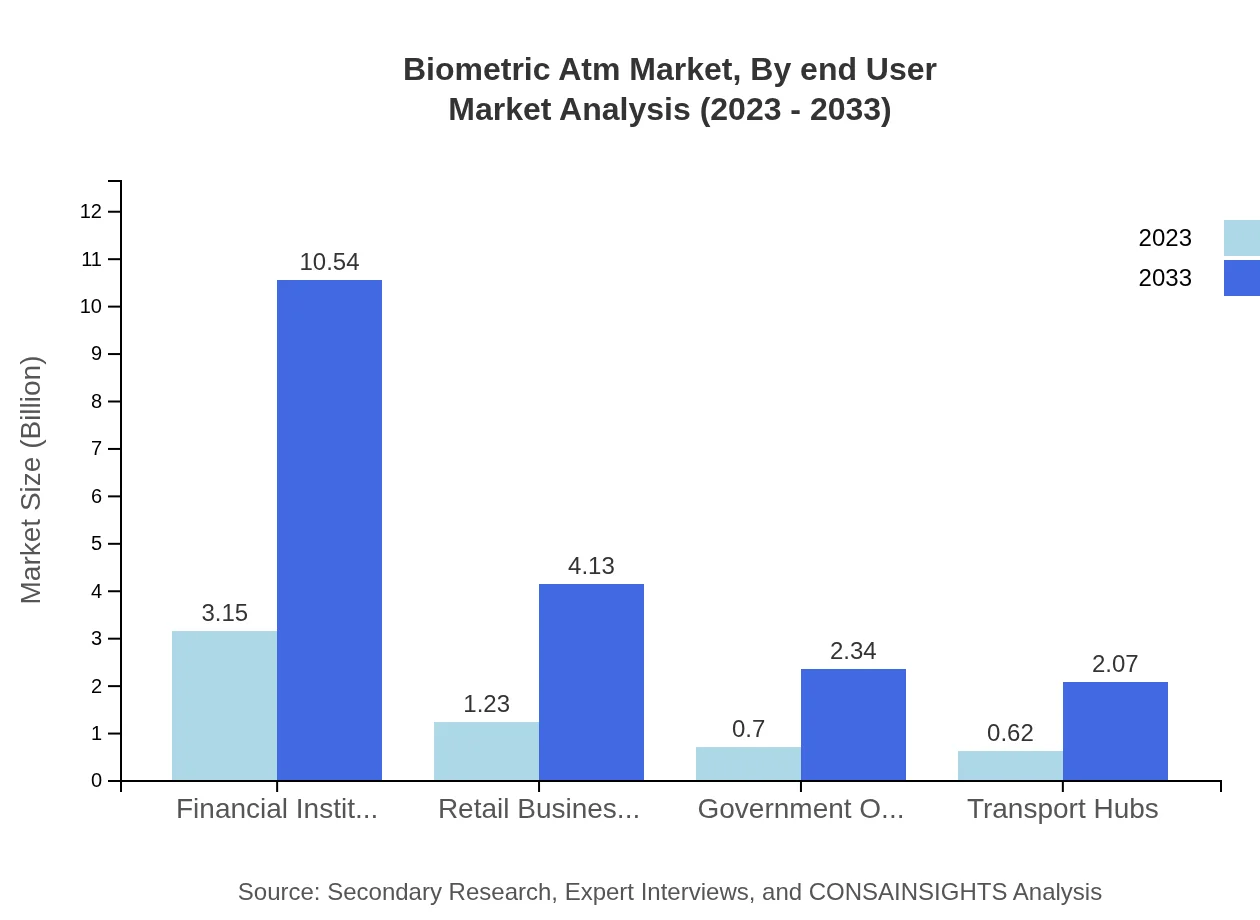

The Biometric ATM market by application is categorized into financial institutions, retail businesses, and government organizations. Financial institutions dominate the market with a projected size of $3.15 billion in 2023, expected to rise to $10.54 billion by 2033, holding a 55.25% share. Retail businesses also show significant growth, expecting to expand from $1.23 billion in 2023 to $4.13 billion in 2033, capturing 21.63% of the market.

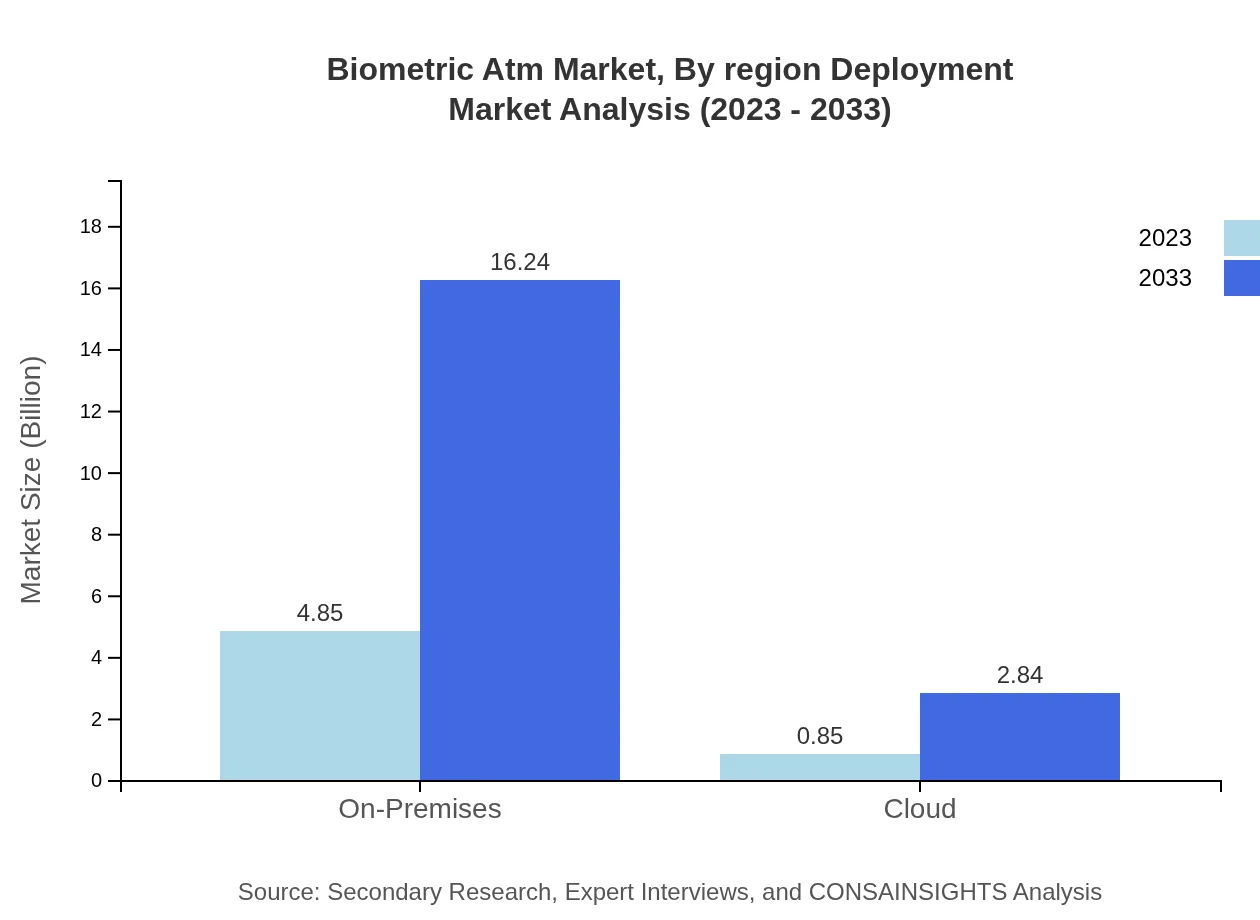

Biometric Atm Market Analysis By Region Deployment

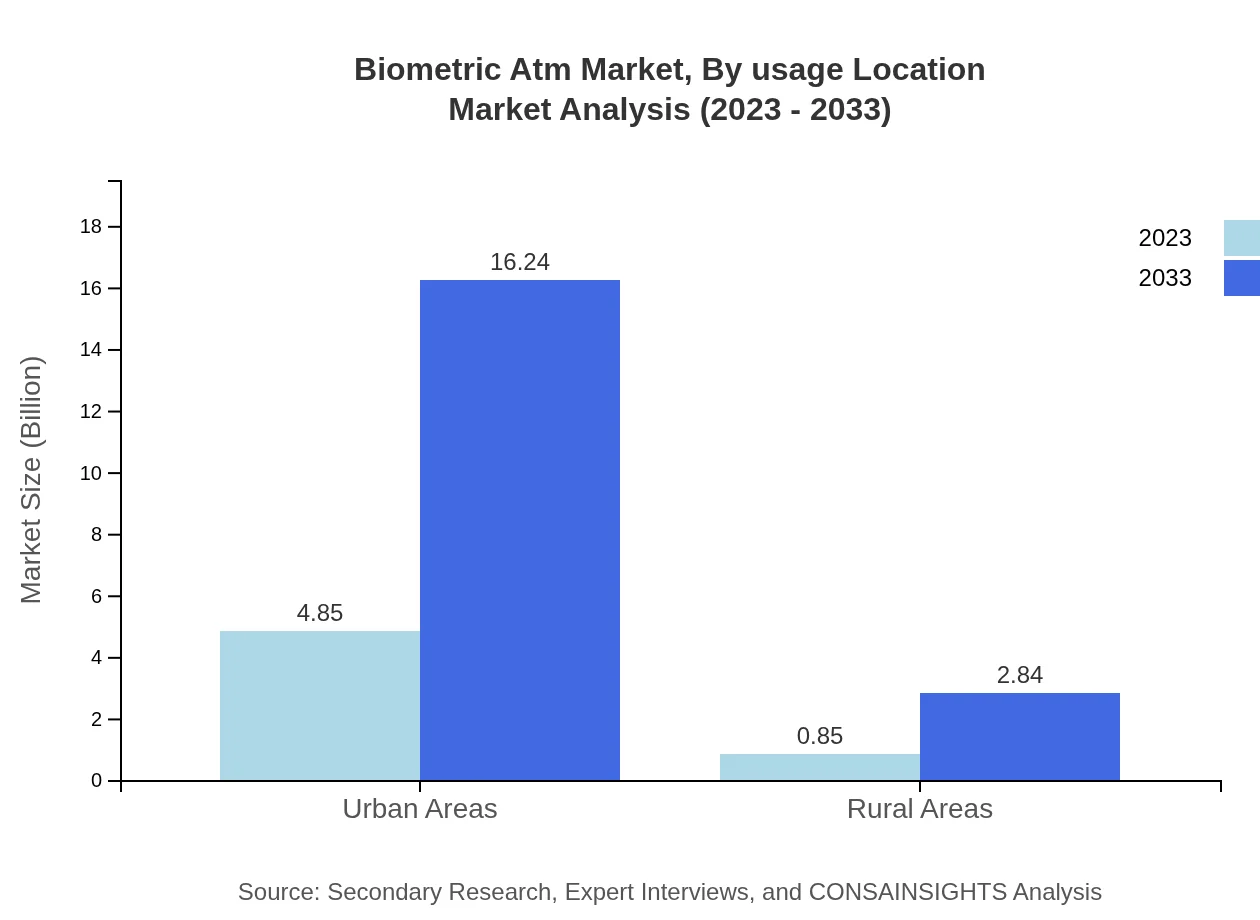

The market segmentation by deployment encompasses on-premises and cloud-based solutions. The on-premises segment leads with a size of $4.85 billion in 2023 and a forecast to increase to $16.24 billion by 2033, representing an 85.11% share. Meanwhile, the cloud segment is anticipated to grow from $0.85 billion in 2023 to $2.84 billion by 2033, holding 14.89% of the market.

Biometric Atm Market Analysis By Usage Location

Segmentation by usage location reveals urban and rural areas. Urban areas present a larger market scope with a size of $4.85 billion in 2023, projected to rise to $16.24 billion by 2033 (85.11% share). Conversely, rural areas are expected to increase from $0.85 billion in 2023 to $2.84 billion by 2033, capturing a share of 14.89%.

Biometric Atm Market Analysis By End User

This segment includes banking, government, healthcare, and transportation. The banking sector reported a size of $1.26 billion in 2023 with projections of $4.21 billion by 2033 (22.08% share). In contrast, government use is slated to grow from $0.70 billion in 2023 to $2.34 billion by 2033, maintaining a 12.27% share.

Biometric ATM Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric ATM Industry

NCR Corporation:

A leading global technology company providing ATMs and biometric solutions to improve banking and retail transactions.Diebold Nixdorf:

An American multinational financial and retail technology company known for innovating ATM technologies, including biometric systems for enhanced security.Hitachi:

A diversified multinational that specializes in various technologies, including advanced biometric authentication solutions for automated banking.Fujitsu:

Technological services powerhouse that manufactures biometric ATMs that leverage fingerprint, optical, and facial recognition technologies.Gemalto NV:

Global leader in digital security providing advanced biometric authentication solutions used in financial transactions.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric Atm?

The biometric ATM market is valued at approximately $5.7 billion in 2023, with a projected CAGR of 12.3% over the next decade. This growth reflects the increasing adoption of biometric technologies in financial transactions.

What are the key market players or companies in this biometric Atm industry?

Key players in the biometric ATM market include prominent financial institutions, technology providers, and security firms focusing on biometric solutions. Their collaborations enhance product innovation and market reach.

What are the primary factors driving the growth in the biometric Atm industry?

Factors driving growth in the biometric ATM industry include the rising need for enhanced security, increasing fraudulent activities, and consumer demand for faster transactions and technology integration in banking.

Which region is the fastest Growing in the biometric Atm?

The European region is the fastest growing in the biometric ATM market, expected to grow from $2.05 billion in 2023 to $6.87 billion in 2033, with strong advancements in financial technology driving adoption.

Does ConsaInsights provide customized market report data for the biometric Atm industry?

Yes, ConsaInsights offers customized market report data tailored for the biometric ATM industry. Clients can request specific insights based on their strategic needs and market requirements.

What deliverables can I expect from this biometric Atm market research project?

Deliverables include detailed market analysis reports, forecasts, competitive landscape assessments, and tailored insights focusing on trends, opportunities, and segmentation within the biometric ATM industry.

What are the market trends of biometric Atm?

Current trends in the biometric ATM market include the emergence of advanced biometric authentication technologies, increased investments in security infrastructures, and growing consumer preferences towards cashless transactions.