Biometric Card Market Report

Published Date: 31 January 2026 | Report Code: biometric-card

Biometric Card Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biometric Card market, offering insights on market size, trends, and regional performance from 2023 to 2033. It encompasses industry analysis and key players shaping the landscape of biometric technology in cards.

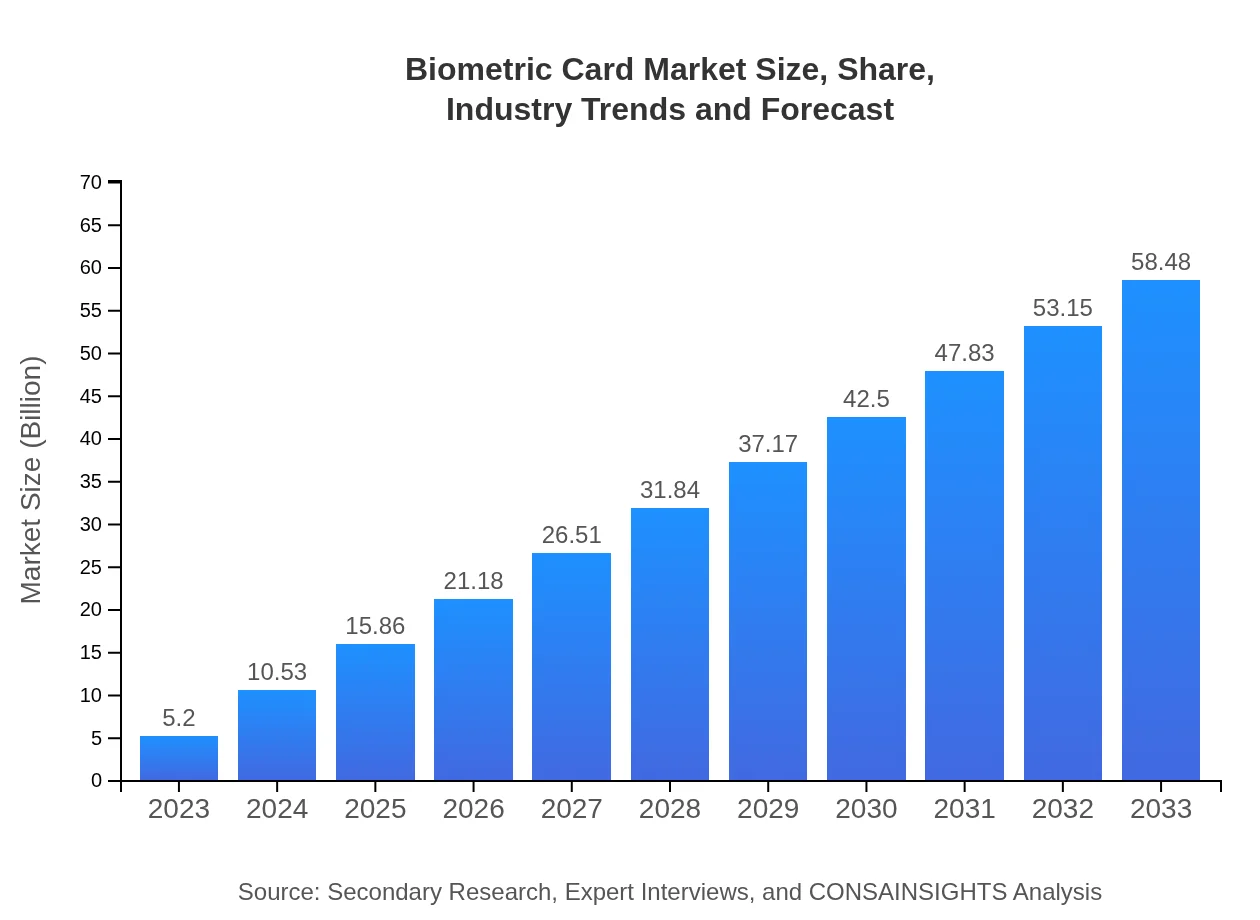

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.20 Billion |

| CAGR (2023-2033) | 25.6% |

| 2033 Market Size | $58.48 Billion |

| Top Companies | Gemalto NV, Entrust Datacard, HID Global Corporation, VeriSign, Inc. |

| Last Modified Date | 31 January 2026 |

Biometric Card Market Overview

Customize Biometric Card Market Report market research report

- ✔ Get in-depth analysis of Biometric Card market size, growth, and forecasts.

- ✔ Understand Biometric Card's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric Card

What is the Market Size & CAGR of Biometric Card market in 2023?

Biometric Card Industry Analysis

Biometric Card Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric Card Market Analysis Report by Region

Europe Biometric Card Market Report:

The European market is on track to increase significantly, expanding from $1.89 billion in 2023 to approximately $21.22 billion by 2033. Stringent privacy regulations and increased focus on security across sectors like banking and government are fuelling this growth. Innovative practices and investment in research also contribute substantially to the advancement of biometric technologies.Asia Pacific Biometric Card Market Report:

The Asia-Pacific region is anticipated to experience substantial growth, with the market size anticipated to grow from $0.88 billion in 2023 to $9.86 billion by 2033. Factors driving this growth include the increasing population, rising disposable incomes, and heightened security concerns across various industries, particularly in populous nations like India and China. Moreover, advancements in payment systems and digital identities are further enhancing market penetration.North America Biometric Card Market Report:

North America, leading the market, is projected to rise from $1.75 billion in 2023 to $19.63 billion by 2033. The region benefits from significant investments in technology and a high rate of technological adoption. The financial sector's demand for biometric authentication and regulatory compliance is driving growth, alongside consumer preferences for secure payment methods.South America Biometric Card Market Report:

In South America, the Biometric Card market is expected to grow from $0.03 billion in 2023 to $0.38 billion by 2033. Economic challenges are urging governments and institutions to adopt more secure identity verification processes. The gradual shift towards digital payments and biometric identification is likely to provide a moderate growth outlook in this region.Middle East & Africa Biometric Card Market Report:

In the Middle East and Africa, the market is anticipated to grow from $0.66 billion in 2023 to around $7.39 billion by 2033. The focus on enhancing security in various sectors such as aviation and banking, paired with government initiatives for smart identification solutions, is promoting growth in the region.Tell us your focus area and get a customized research report.

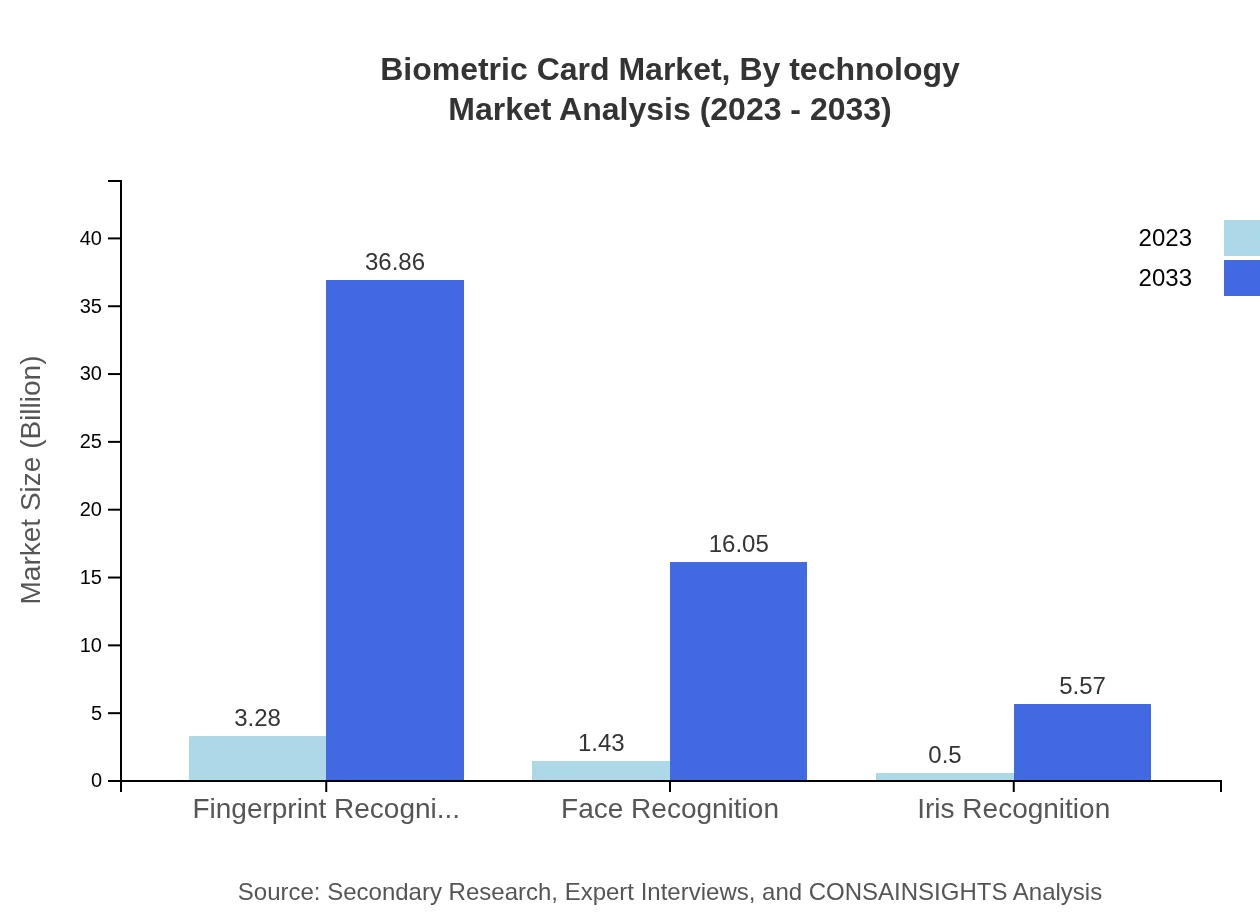

Biometric Card Market Analysis By Technology

The technology segment primarily comprises fingerprint recognition, face recognition, and iris recognition, with fingerprint recognition leading the market due to its widespread adoption across various applications. This segment is expected to see exponential growth, with fingerprint technology projected to rise from $3.28 billion in 2023 to $36.86 billion by 2033, capturing a large market share due to its effectiveness and customer familiarity. Face recognition and iris recognition follow as innovative technologies gaining traction in sectors requiring high-security measures.

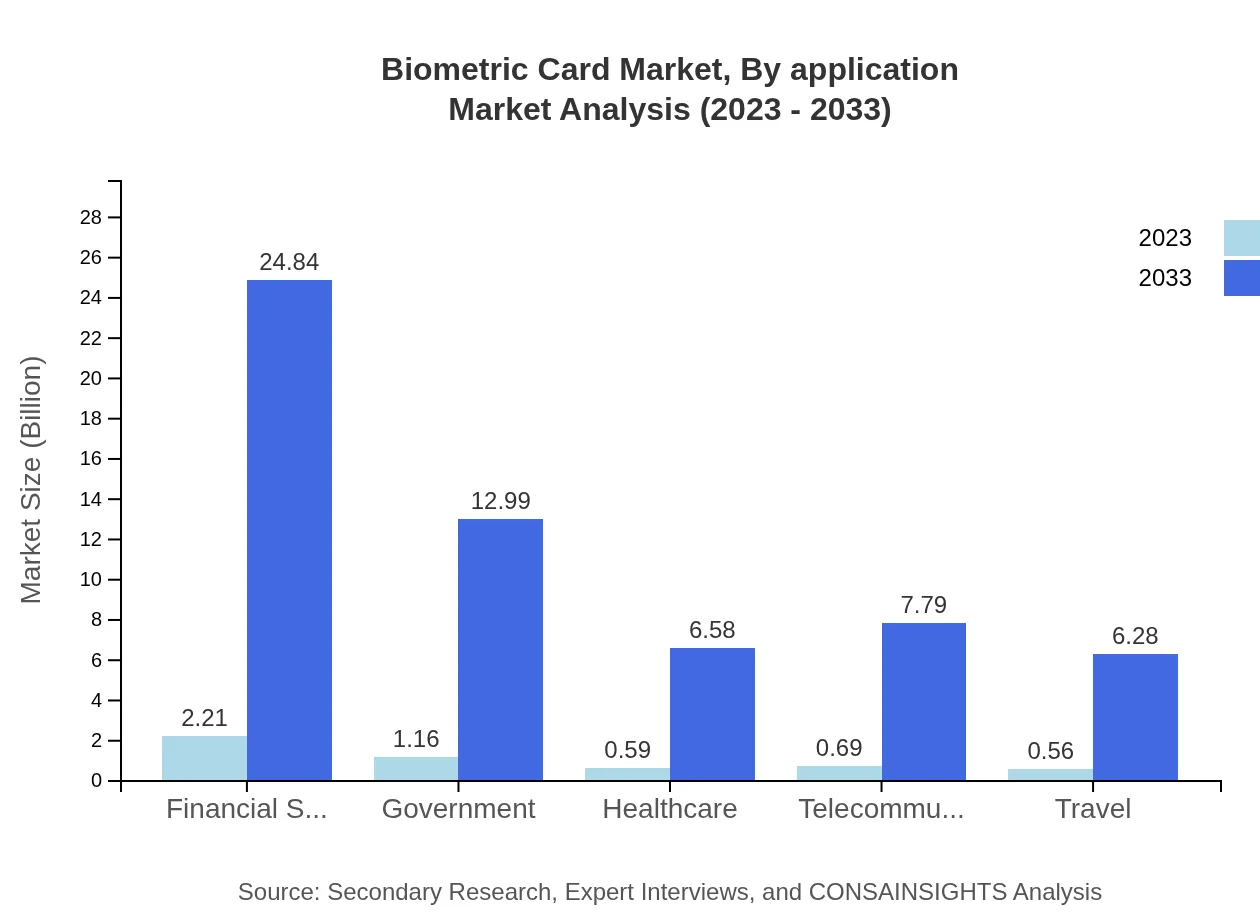

Biometric Card Market Analysis By Application

Among applications, financial services dominate the market, projected to expand from $2.21 billion in 2023 to $24.84 billion by 2033, driven by the demand for secure transactions and identity verification. The government sector closely follows, from $1.16 billion to $12.99 billion, influenced by regulations mandating secure identification processes. Other sectors like healthcare and telecommunications also contribute significantly, reflecting the technology's versatility.

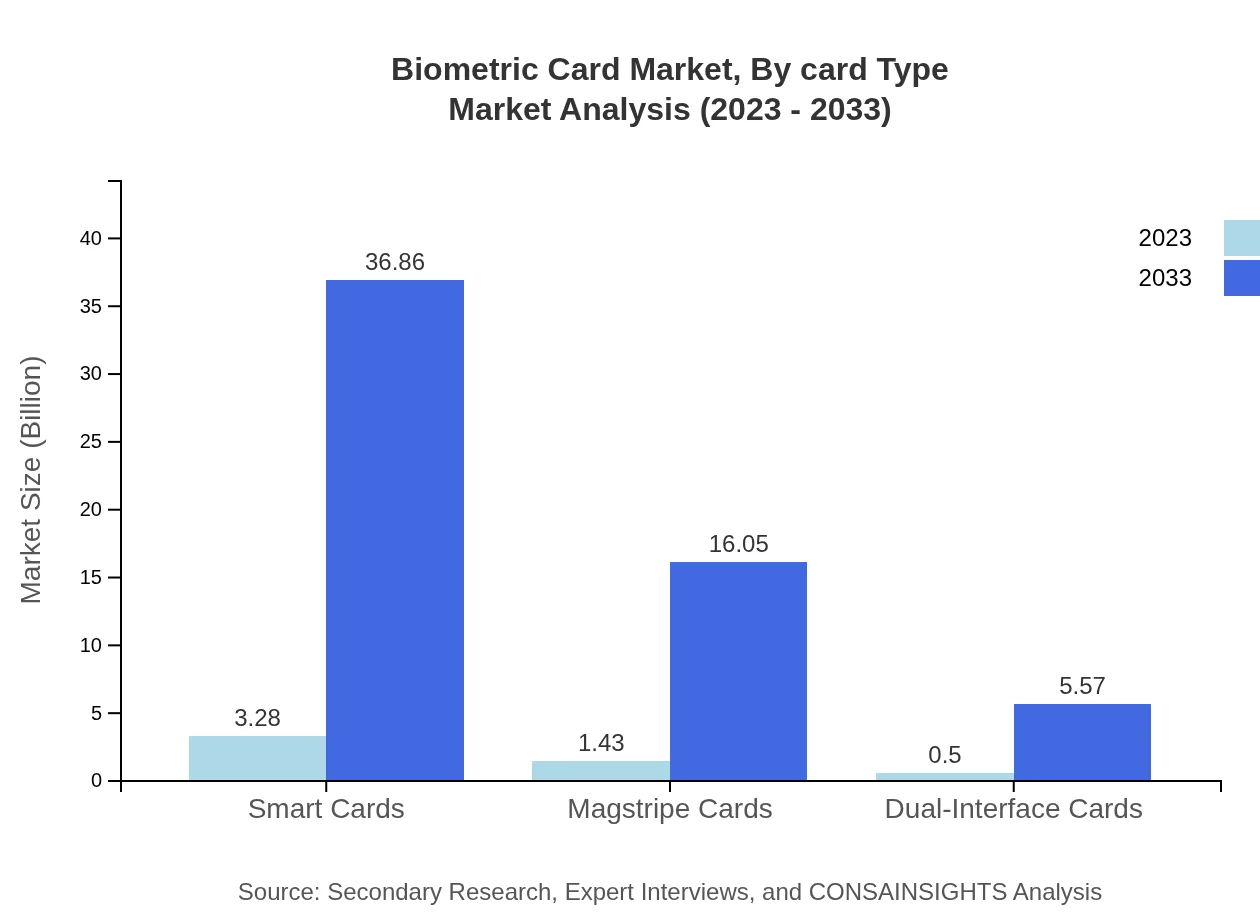

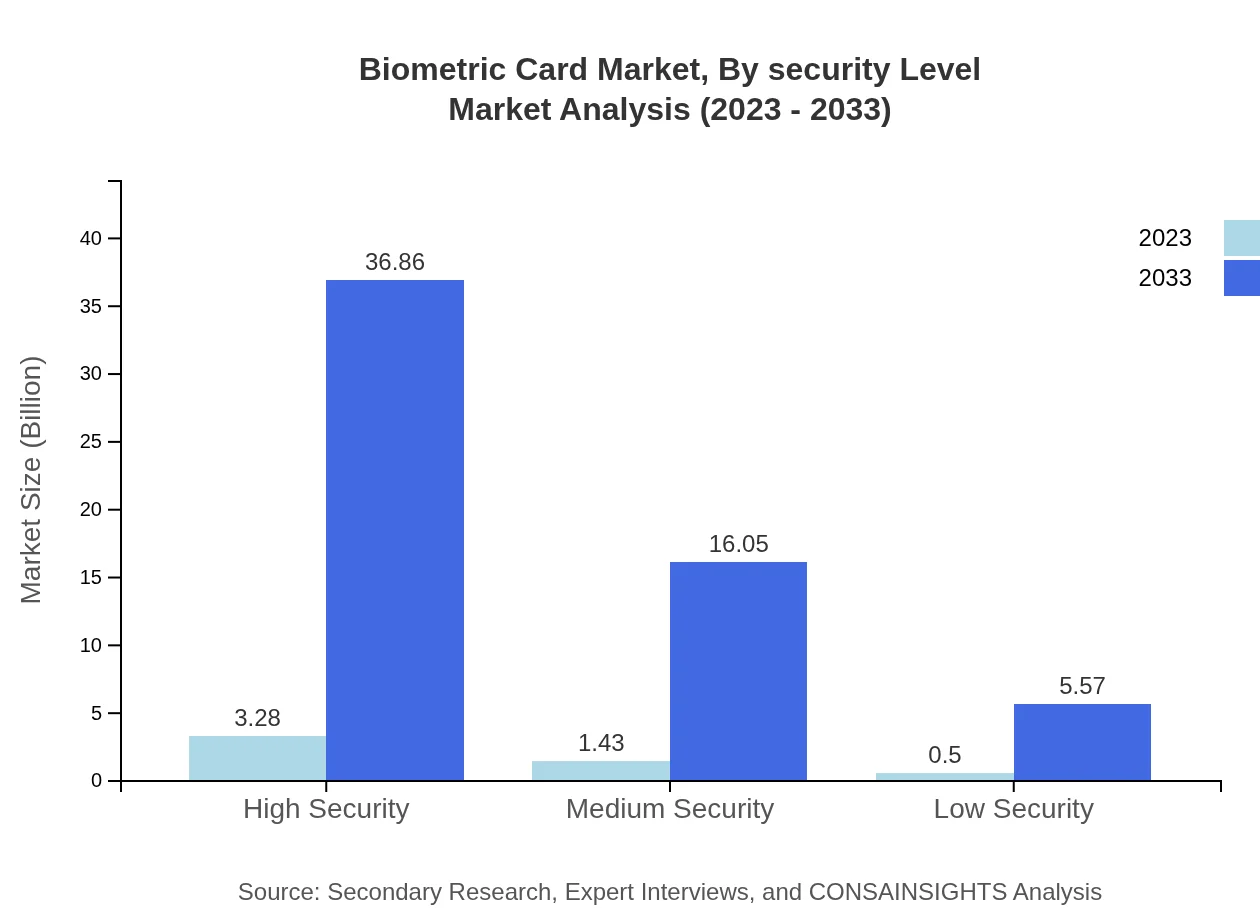

Biometric Card Market Analysis By Card Type

The market is segmented into smart cards, magstripe cards, and dual-interface cards. Smart cards are the frontrunners and will grow from $3.28 billion in 2023 to $36.86 billion by 2033, capturing an extensive market share of 63.03%. Magstripe cards are also prevalent, projected to reach $1.43 billion to $16.05 billion, while dual-interface cards are expected to gain traction with an increase from $0.50 billion to $5.57 billion, driven by a need for contactless capabilities.

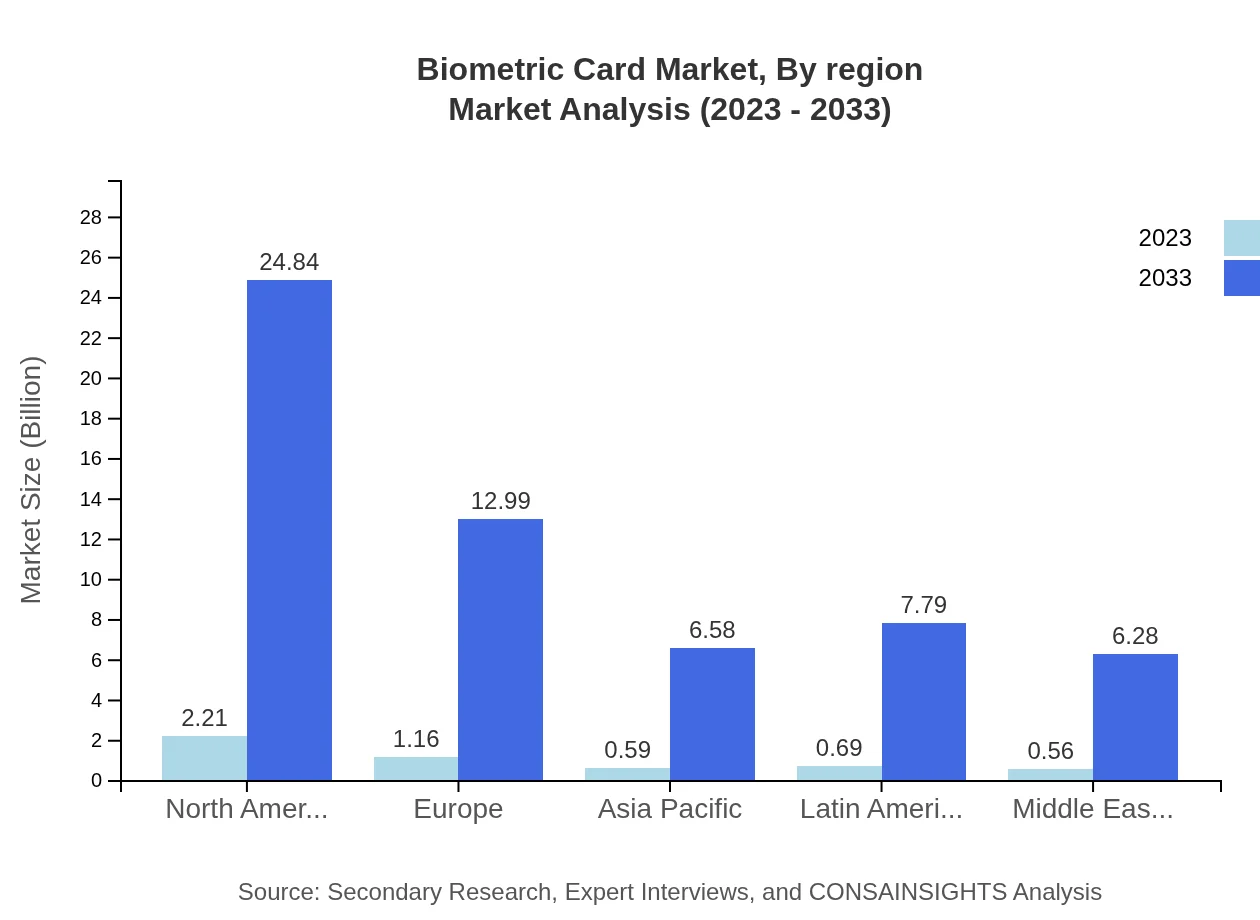

Biometric Card Market Analysis By Region

The regional analysis showcases North America as the largest market, expected to grow from $2.21 billion to $24.84 billion, accounting for 42.47% of the market share. Europe follows with anticipated growth from $1.16 billion to $12.99 billion (22.22% share), while Asia Pacific and South America are earmarked for expansion, from $0.59 billion to $6.58 billion (11.25%) and from $0.03 billion to $0.38 billion (13.32%), respectively. The Middle East and Africa are set to grow significantly fuelled by enhancing security demands.

Biometric Card Market Analysis By Security Level

The segmentation by security level reveals significant demand for high-security biometric cards, projected to rise from $3.28 billion in 2023 to $36.86 billion by 2033 (63.03% share). Medium security cards will grow from $1.43 billion to $16.05 billion (27.44% share), and low security cards will experience growth from $0.50 billion to $5.57 billion (9.53% share), reflecting a varied customer base prioritizing different security needs.

Biometric Card Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric Card Industry

Gemalto NV:

A global leader in digital security, Gemalto provides secure and innovative biometric card solutions catering to diverse industries, including banking and government.Entrust Datacard:

Entrust Datacard specializes in identity and credentialing solutions, developing biometric cards aiming at enhancing fraud prevention and improving customer experiences.HID Global Corporation:

HID Global is recognized for providing advanced identity solutions, including biometric card technology, fostering secure identification across sectors.VeriSign, Inc.:

VeriSign focuses on cybersecurity and biometric authentication methods, contributing to the integration of biometrics with card-based technology for secure transactions.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric Card?

The Biometric Card market is projected to reach approximately $5.2 billion by 2033, with a compound annual growth rate (CAGR) of 25.6%. This rapid growth is fueled by increasing adoption of biometric technology across various sectors.

What are the key market players or companies in the biometric Card industry?

Key players in the Biometric Card market include companies specializing in security solutions, biometric technology, and digital identity management. Their innovations and product launches significantly contribute to the growth and competitiveness of the market.

What are the primary factors driving the growth in the biometric Card industry?

The growth of the Biometric Card industry is driven by advancements in biometric technologies, the increasing need for secure identification methods, and a rising awareness of identity theft risks among consumers and organizations.

Which region is the fastest Growing in the biometric Card market?

The fastest-growing region in the Biometric Card market is Europe, with projections indicating growth from $1.89 billion in 2023 to $21.22 billion by 2033, reflecting a substantial increase in demand for biometric solutions.

Does ConsaInsights provide customized market report data for the biometric Card industry?

Yes, ConsaInsights specializes in providing customized market report data tailored to specific needs within the Biometric Card industry, allowing clients to gain targeted insights and make informed decisions.

What deliverables can I expect from this biometric Card market research project?

Deliverables from the Biometric Card market research project typically include comprehensive market analysis reports, detailed competitive analysis, growth forecasts, and segmentation insights, tailored to the client's requirements.

What are the market trends of biometric Card?

Current trends in the Biometric Card market include increased integration of artificial intelligence in biometric systems, enhanced focus on contactless technologies, and widespread adoption across sectors such as finance, healthcare, and government.