Biometric Scan Software Market Report

Published Date: 31 January 2026 | Report Code: biometric-scan-software

Biometric Scan Software Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biometric Scan Software market from 2023 to 2033, detailing market size, trends, forecasts, segmentation, and key players, helping stakeholders make informed decisions.

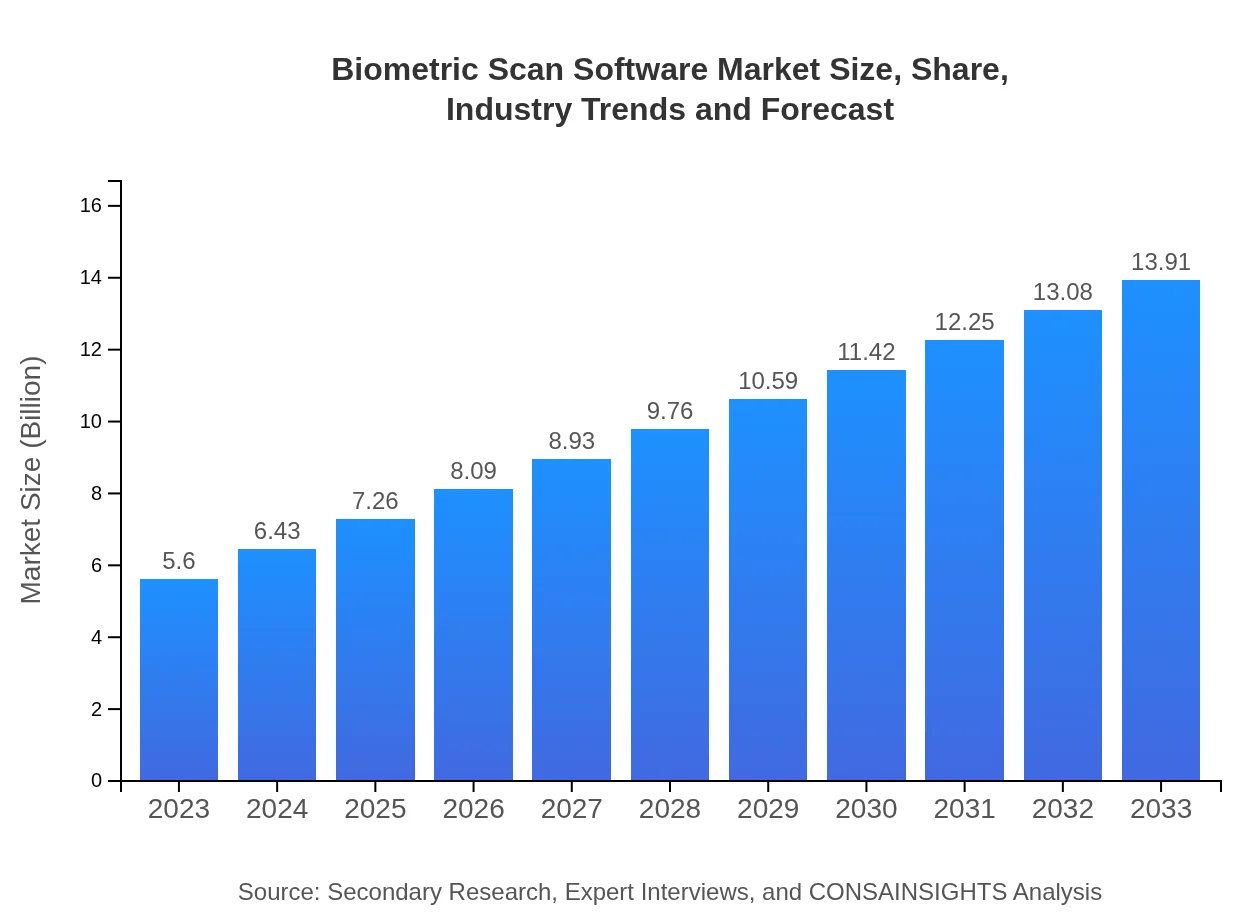

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $5.60 Billion |

| CAGR (2023-2033) | 9.2% |

| 2033 Market Size | $13.91 Billion |

| Top Companies | NEC Corporation, Thales Group, Gemalto, IDEMIA, Acuant |

| Last Modified Date | 31 January 2026 |

Biometric Scan Software Market Overview

Customize Biometric Scan Software Market Report market research report

- ✔ Get in-depth analysis of Biometric Scan Software market size, growth, and forecasts.

- ✔ Understand Biometric Scan Software's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric Scan Software

What is the Market Size & CAGR of Biometric Scan Software market in 2023?

Biometric Scan Software Industry Analysis

Biometric Scan Software Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric Scan Software Market Analysis Report by Region

Europe Biometric Scan Software Market Report:

In Europe, the market size is expected to soar from $2.01 billion in 2023 to $4.99 billion by 2033, supported by increasing investments in security solutions, regulatory compliance needs, and advanced technology integration in consumer services.Asia Pacific Biometric Scan Software Market Report:

In the Asia Pacific region, the Biometric Scan Software market is expected to expand significantly from $0.96 billion in 2023 to $2.38 billion by 2033. Growth is driven by rising government initiatives towards digital identity systems and increased security needs, particularly in populous countries such as India and China.North America Biometric Scan Software Market Report:

North America remains one of the largest markets, projected to escalate from $1.81 billion in 2023 to $4.49 billion by 2033. The proliferation of banking and financial services leveraging biometric security, as well as stringent regulatory frameworks enhancing adoption, are key driving factors.South America Biometric Scan Software Market Report:

The South American market for Biometric Scan Software is anticipated to grow from $0.06 billion in 2023 to $0.14 billion by 2033. The growth momentum is fueled by the uptake of biometric solutions in law enforcement and border control, along with a growing emphasis on cybersecurity.Middle East & Africa Biometric Scan Software Market Report:

The Middle East and Africa market is set to expand from $0.77 billion in 2023 to $1.91 billion by 2033. This growth is propelled by heightened security concerns and initiatives for biometric identification within public sector applications.Tell us your focus area and get a customized research report.

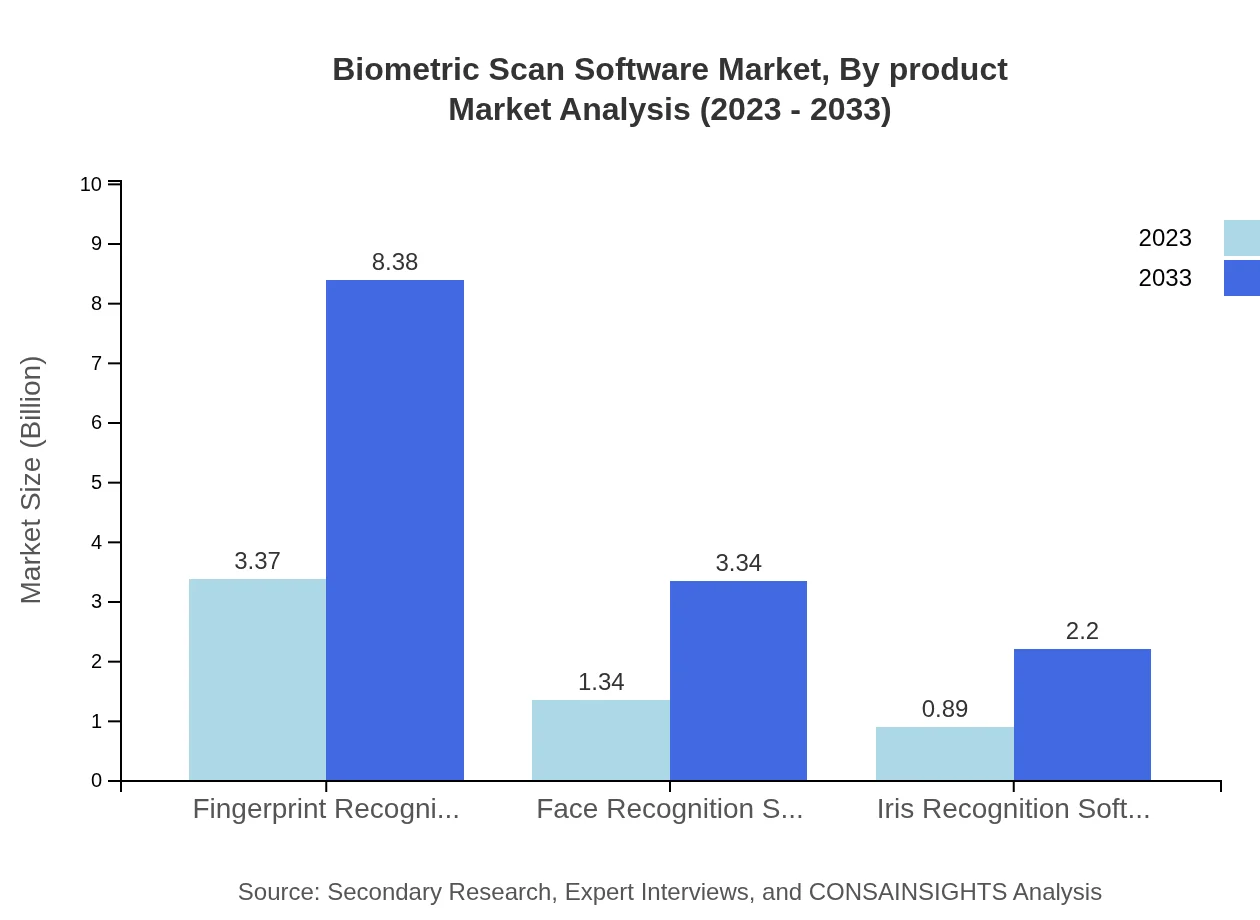

Biometric Scan Software Market Analysis By Product

The primary segments within the Biometric Scan Software market include Fingerprint Recognition Software, Face Recognition Software, and Iris Recognition Software. Fingerprint recognition, dominating with a market size of $3.37 billion in 2023 and projected to reach $8.38 billion by 2033, holds 60.2% market share, reflecting its widespread adoption in security systems. Face recognition accounts for $1.34 billion in 2023, expanding to $3.34 billion by 2033 (23.99% share), while iris recognition is rising from $0.89 billion to $2.20 billion (15.81% share), highlighting diverse application opportunities across various sectors.

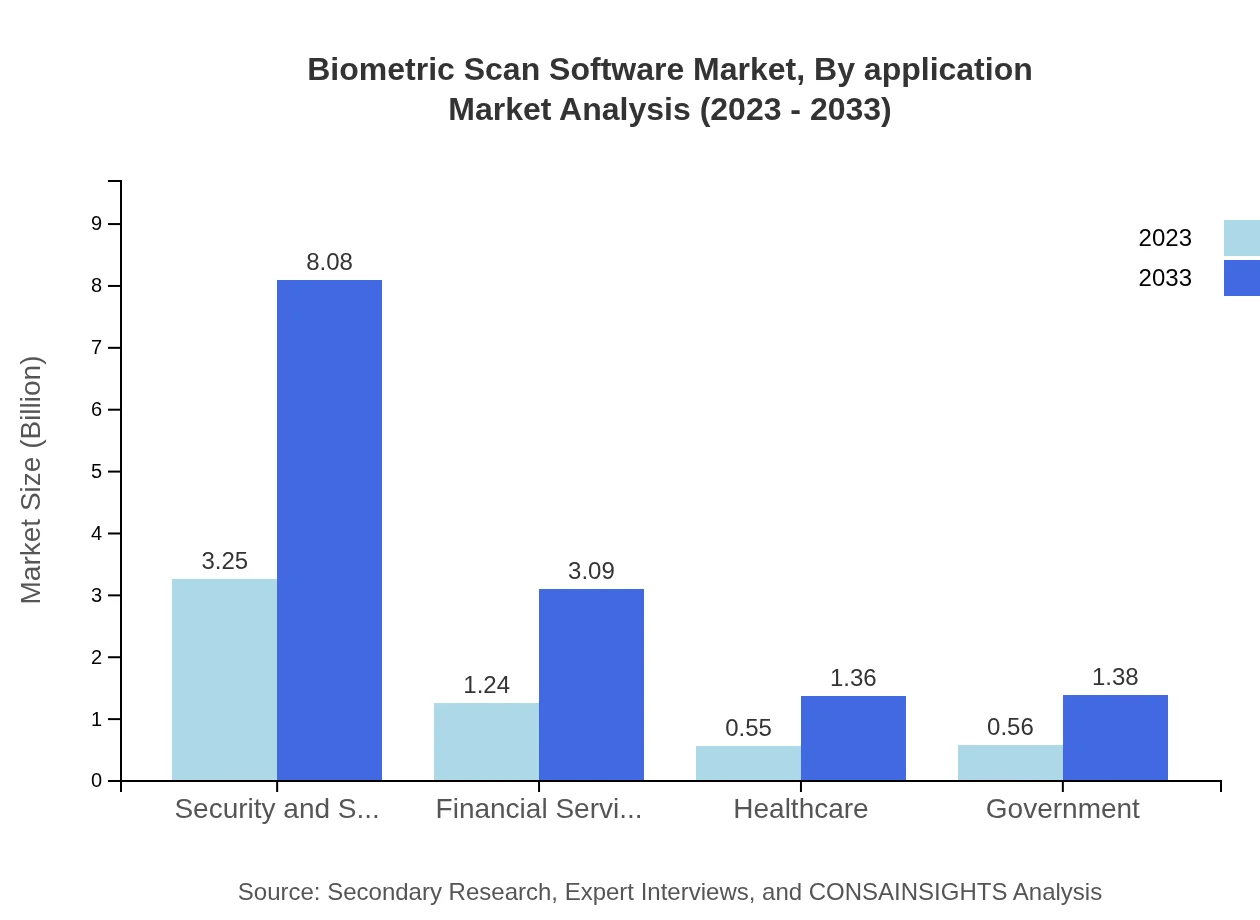

Biometric Scan Software Market Analysis By Application

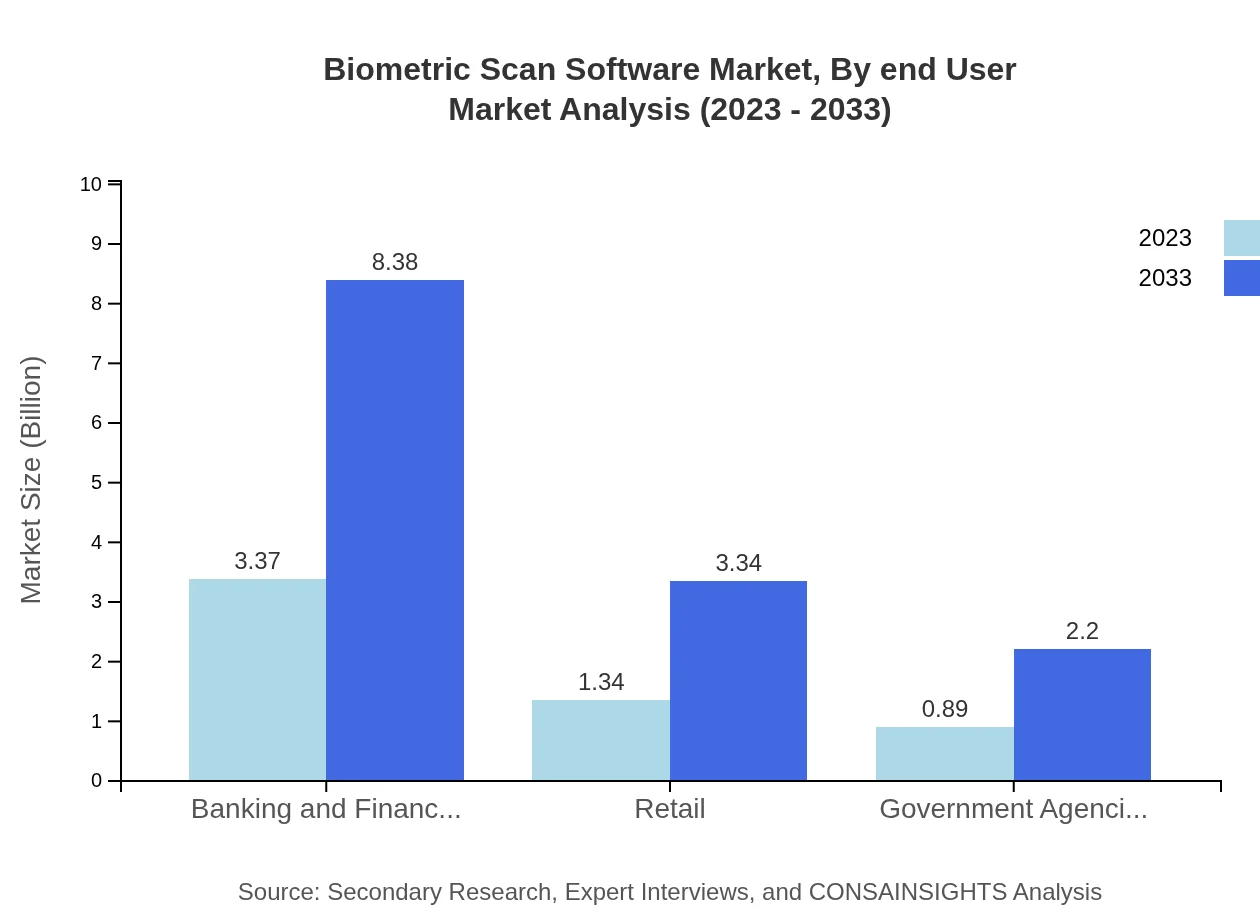

The application segments exhibit robust growth in areas such as Banking and Financial Services ($3.37 billion to $8.38 billion by 2033, 60.2% share), Retail ($1.34 billion to $3.34 billion, 23.99% share), and Government Agencies ($0.89 billion to $2.20 billion, 15.81% share). Each sector finds unique applications for biometric technology, ensuring secure transactions, identity verification, and customer convenience.

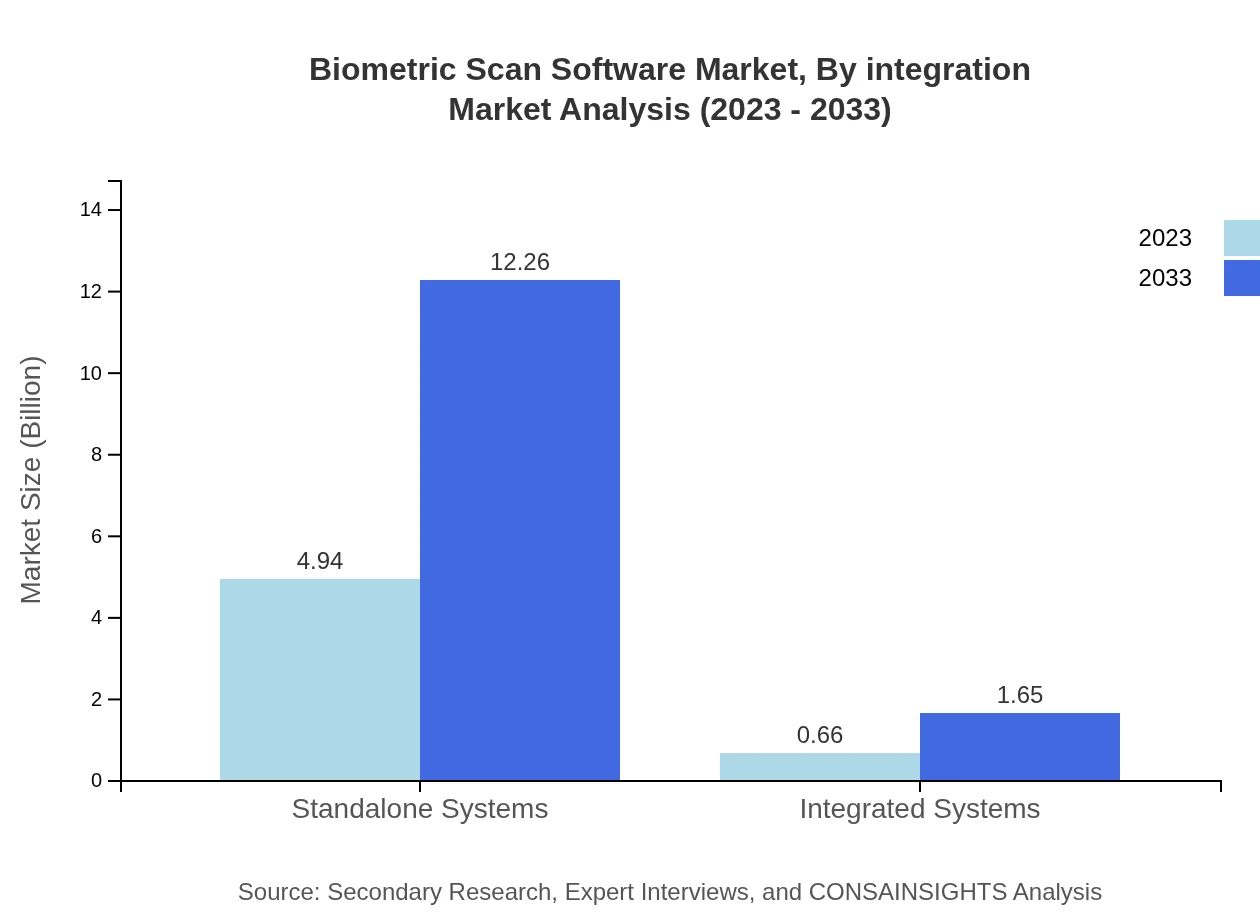

Biometric Scan Software Market Analysis By Integration

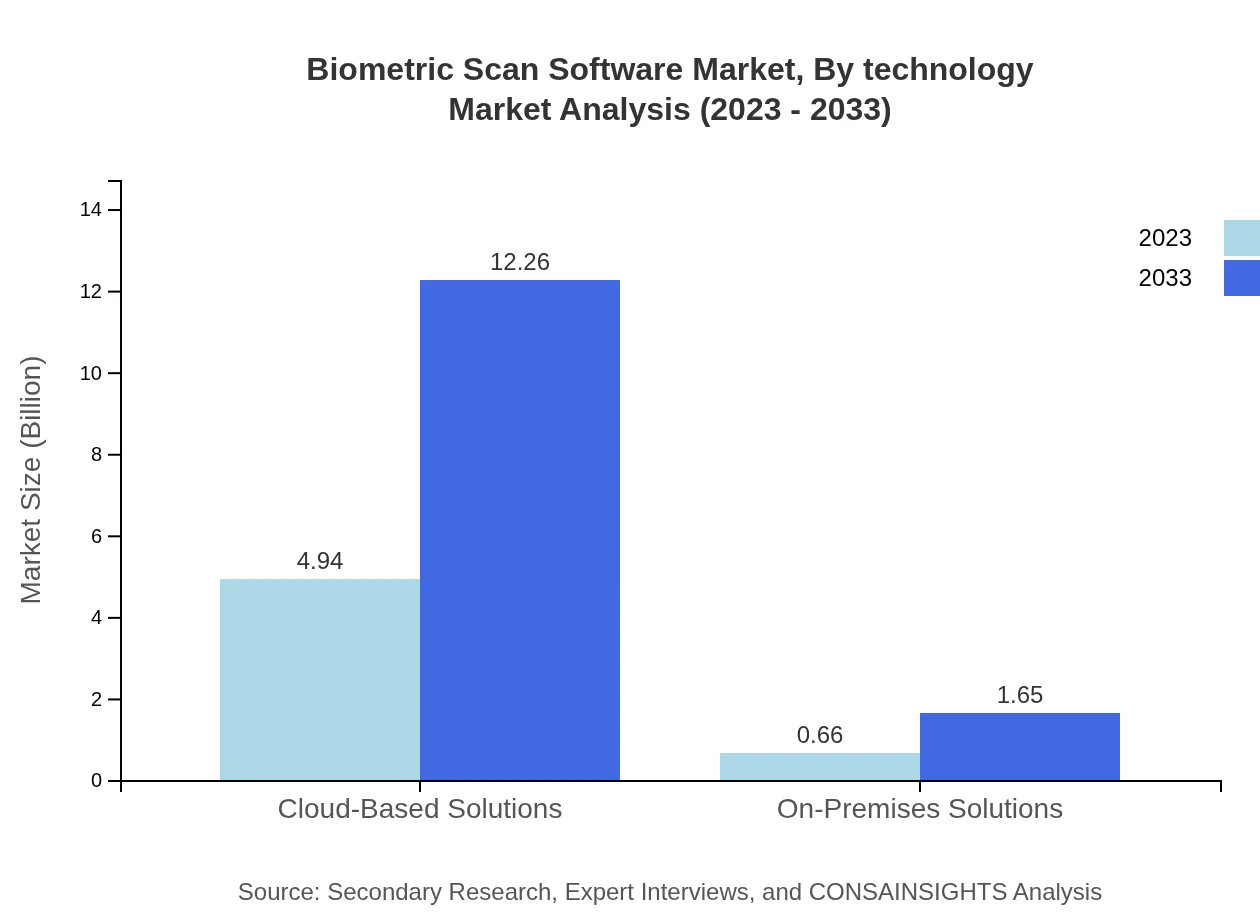

The market can be analyzed across integration types including Cloud-Based Solutions and On-Premises Solutions. Cloud-based solutions dominate with a significant market share of 88.14%, rising from $4.94 billion in 2023 to $12.26 billion by 2033, largely due to their scalability and cost-effectiveness. Conversely, on-premises solutions, while smaller in market share (11.86%) increase from $0.66 billion to $1.65 billion, appealing to sectors requiring stringent data security.

Biometric Scan Software Market Analysis By End User

The end-user market shows extensive engagement from sectors like Security and Surveillance ($3.25 billion to $8.08 billion by 2033, 58.09% share), Financial Services ($1.24 billion to $3.09 billion, 22.18% share), and Healthcare ($0.55 billion to $1.36 billion, 9.8% share). This diversity reflects the critical demand for biometric technologies across vital industries.

Biometric Scan Software Market Analysis By Technology

Technologically, the market is leaning towards advanced AI integrations that improve biometric recognition accuracy and speed. Innovations are evident in standalone systems (88.14% share, expected growth from $4.94 billion to $12.26 billion) compared to integrated systems, which are growing from $0.66 billion to $1.65 billion. The adoption of cutting-edge technologies signals ongoing transformation within the biometric landscape.

Biometric Scan Software Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric Scan Software Industry

NEC Corporation:

NEC is a pioneer in biometric solutions, offering extensive facial recognition technology used in various sectors worldwide, enhancing security and operational efficiencies.Thales Group:

Thales specializes in identity management systems and biometric solutions, developing comprehensive platforms utilized in government and security applications.Gemalto:

Gemalto, now part of Thales, delivers advanced biometric solutions recognized for their innovation in securing personal identities in commercial and public sectors.IDEMIA:

IDEMIA is a global leader in augmented identity solutions, focusing on biometric security technologies that enhance user convenience and safety.Acuant:

Acuant provides identity verification solutions leveraging biometric technology aimed at enhancing security across various industries.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric Scan Software?

The biometric scan software market is valued at approximately $5.6 billion in 2023 and is projected to grow at a CAGR of 9.2%, reaching substantial numerical growth by 2033.

What are the key market players or companies in this biometric Scan Software industry?

Key players in the biometric scan software market include major technology firms known for their innovations in security solutions, identity management, and software development, continuously enhancing the competitive landscape.

What are the primary factors driving the growth in the biometric scan software industry?

Major growth drivers include increasing demand for enhanced security measures, growing need for identity verification across sectors, and technological advancements improving biometric accuracy and user acceptance.

Which region is the fastest Growing in the biometric scan software market?

The Europe region leads with significant growth, expected to escalate from $2.01 billion in 2023 to $4.99 billion by 2033, driven by adoption across various sectors.

Does ConsaInsights provide customized market report data for the biometric Scan Software industry?

Yes, ConsaInsights offers tailored market report data for the biometric scan software industry, addressing specific client needs with detailed insights and customization options.

What deliverables can I expect from this biometric Scan Software market research project?

Deliverables typically include detailed market analysis reports, segment-wise breakdowns, competitive landscape overviews, and actionable insights tailored to client requirements.

What are the market trends of biometric Scan Software?

Trends include increased integration of cloud-based solutions, enhanced security measures in financial services, and growing acceptance of biometric systems in healthcare and retail sectors.

What are the segments in the biometric Scan Software market?

Key market segments include fingerprint recognition, face recognition, and iris recognition software, with fingerprint solutions holding a market size of $3.37 billion in 2023.