Biometric Technology Market Report

Published Date: 31 January 2026 | Report Code: biometric-technology

Biometric Technology Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the Biometric Technology market, covering market size, trends, regional insights, and forecasts from 2023 to 2033. It aims to equip stakeholders with valuable data to make informed decisions in a rapidly evolving industry.

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

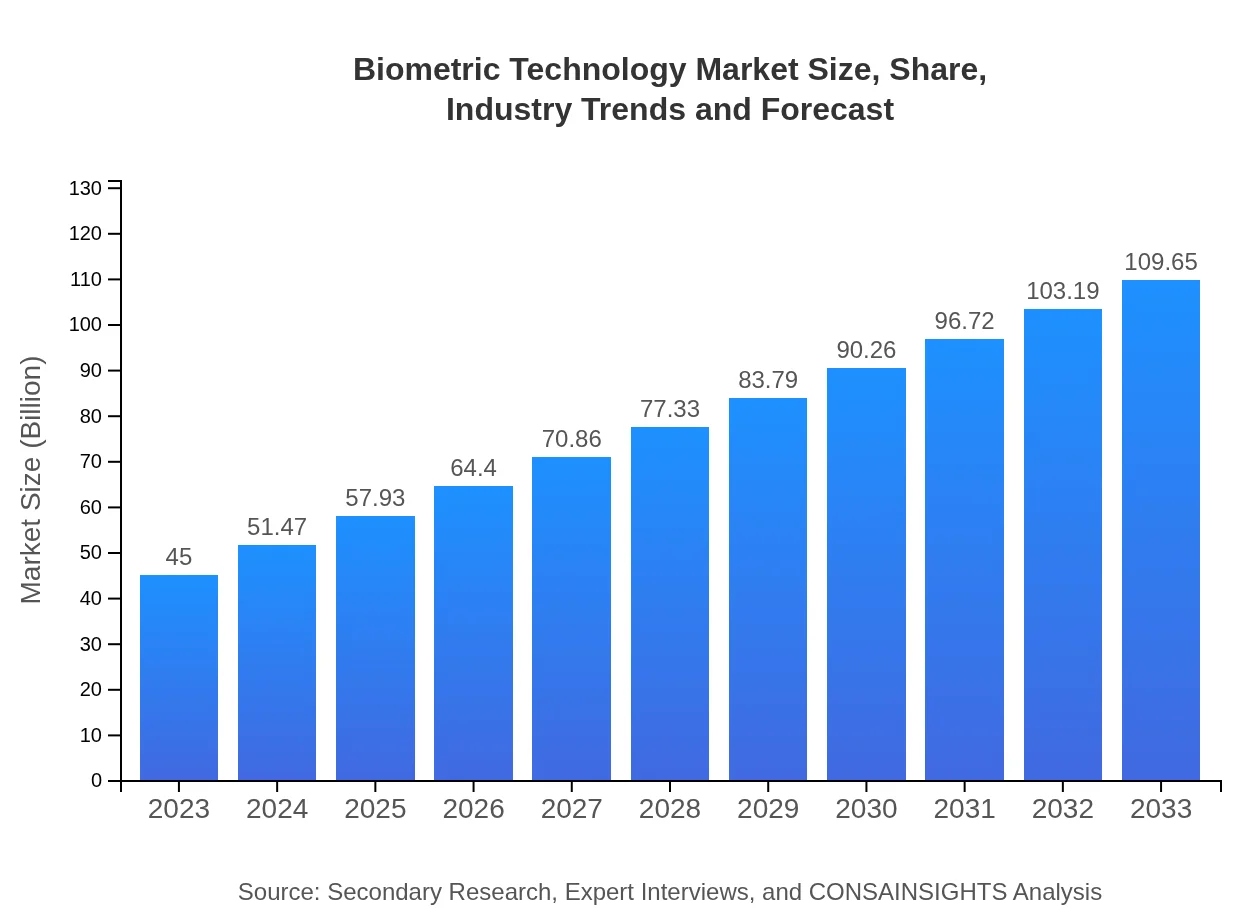

| 2023 Market Size | $45.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $109.65 Billion |

| Top Companies | NEC Corporation, Gemalto N.V. (Thales Group), Fujitsu, Suprema Inc., IDEMIA |

| Last Modified Date | 31 January 2026 |

Biometric Technology Market Overview

Customize Biometric Technology Market Report market research report

- ✔ Get in-depth analysis of Biometric Technology market size, growth, and forecasts.

- ✔ Understand Biometric Technology's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biometric Technology

What is the Market Size & CAGR of Biometric Technology market in 2023?

Biometric Technology Industry Analysis

Biometric Technology Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biometric Technology Market Analysis Report by Region

Europe Biometric Technology Market Report:

The European market is projected to grow from $11.77 billion in 2023 to $28.69 billion by 2033. Expansion is driven by stringent data protection regulations and the adoption of biometric systems in various sectors, including hospitality and finance.Asia Pacific Biometric Technology Market Report:

The Asia Pacific region is expected to see substantial growth, with the market projected to grow from $8.76 billion in 2023 to approximately $21.35 billion by 2033, driven by rapid urbanization, increasing crime rates, and government initiatives promoting biometric identification.North America Biometric Technology Market Report:

North America remains the largest market, anticipated to increase from $15.60 billion in 2023 to $38.02 billion by 2033. The high demand for biometric systems in government, healthcare, and corporate security drives this growth, alongside increasing investments in technology.South America Biometric Technology Market Report:

In South America, the biometric market is expected to expand from $3.47 billion in 2023 to $8.45 billion by 2033, largely supported by growing awareness of biometric solutions in the banking and retail sectors.Middle East & Africa Biometric Technology Market Report:

In the Middle East and Africa, the market is set to rise from $5.40 billion in 2023 to $13.15 billion by 2033, fueled by increasing security needs in public sectors and technological advancements in biometric identification solutions.Tell us your focus area and get a customized research report.

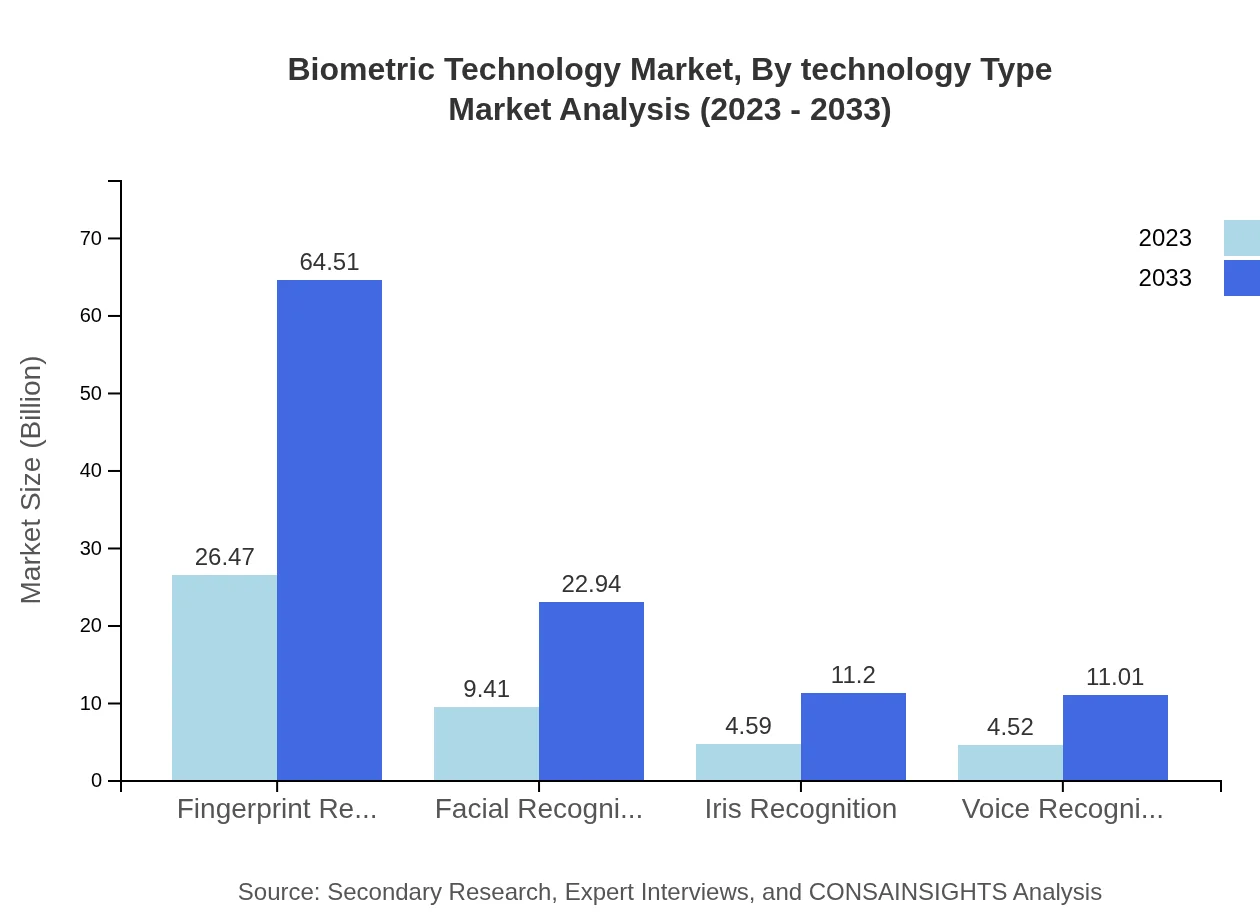

Biometric Technology Market Analysis By Technology Type

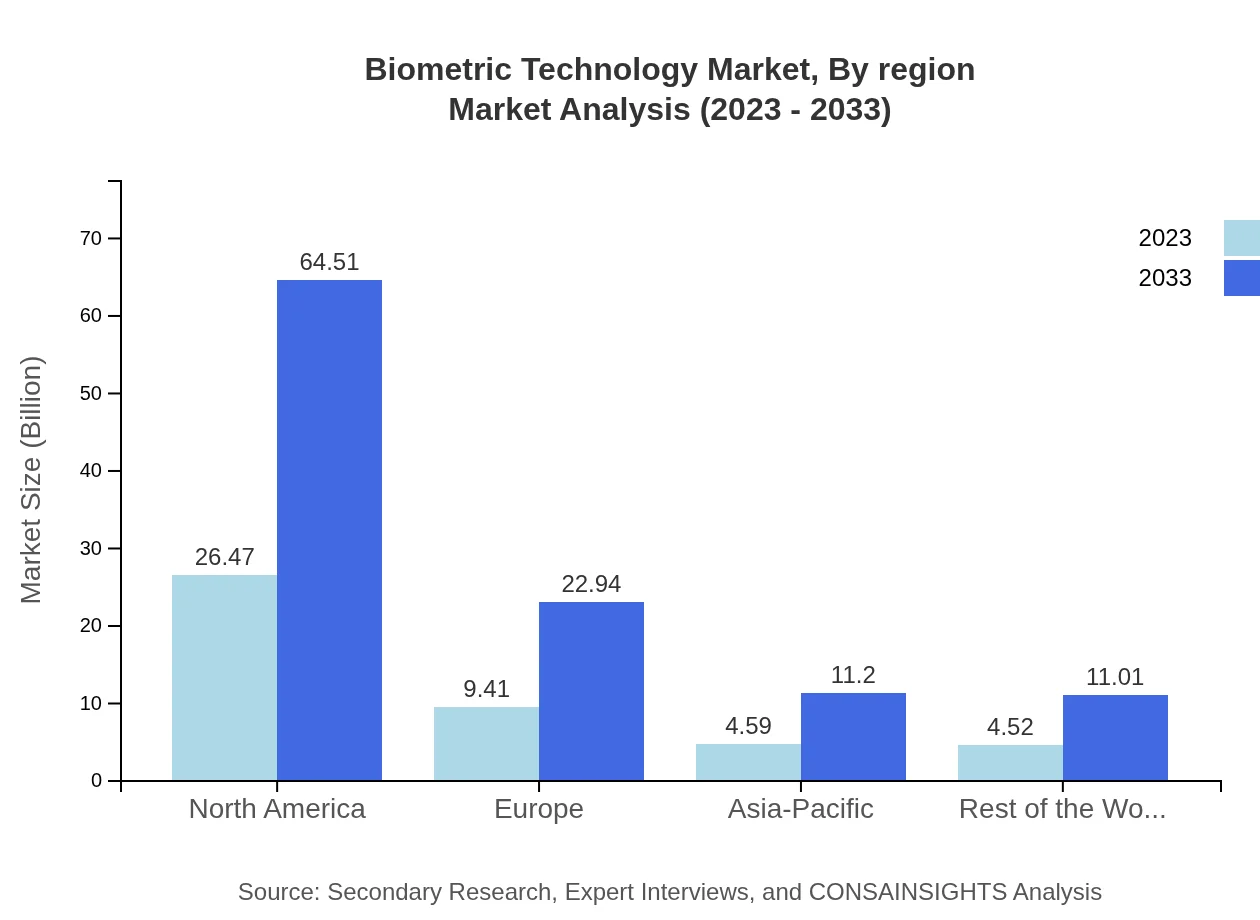

The Biometric Technology market by technology type is dominated by Fingerprint Recognition, which is valued at $26.47 billion in 2023 and projected to reach $64.51 billion by 2033, capturing 58.83% of the market share. Following this, Facial Recognition, with a size of $9.41 billion in 2023 growing to $22.94 billion by the end of the forecast period, holds crucial applications in security and analytics. Iris Recognition and Voice Recognition also represent significant segments, showing healthy growth rates.

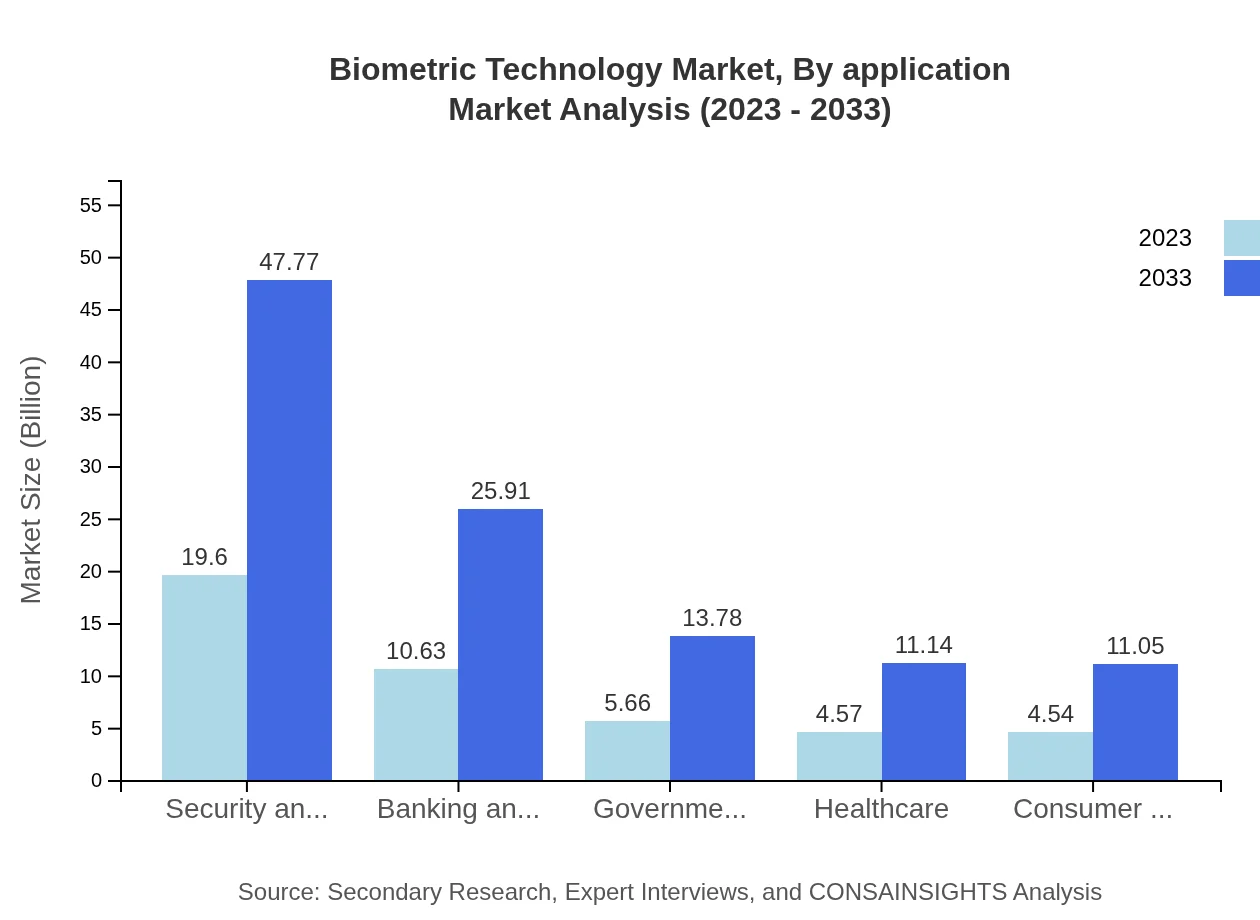

Biometric Technology Market Analysis By Application

Analyzing the market by application reveals Government and Public Services leading with a market size of $19.60 billion in 2023, projected to grow to $47.77 billion by 2033. Following this, Banking and Financial Services account for $10.63 billion in 2023, expected to increase to $25.91 billion. Retail and Healthcare applications demonstrate significant growth potential, particularly with heightened focus on identity verification and patient safety.

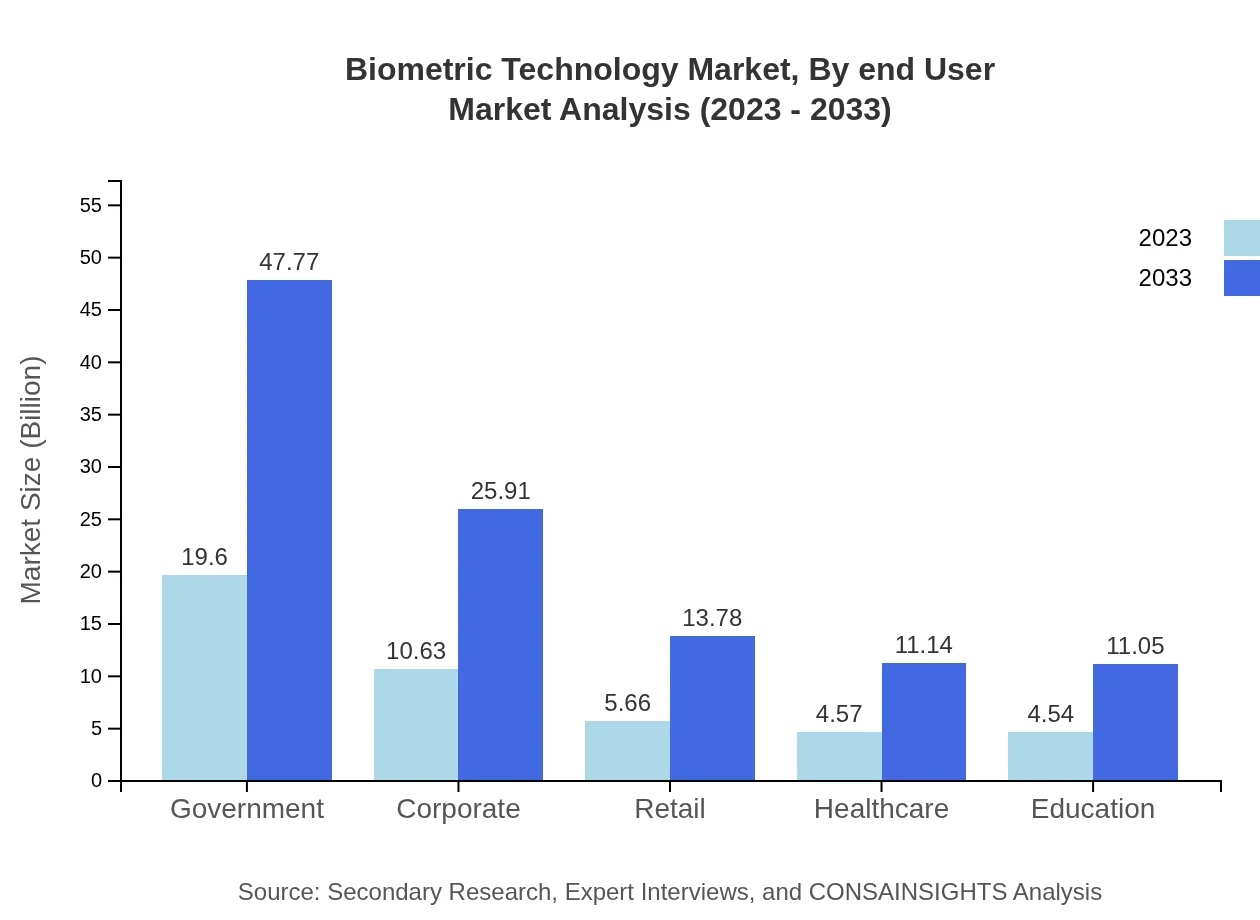

Biometric Technology Market Analysis By End User

The market is also segmented by end-user, with corporations and governments being the top consumers, demanding robust security solutions. The Corporate segment, currently valued at $10.63 billion in 2023, is set to expand to $25.91 billion by 2033. Retail and Healthcare are emerging as critical sectors as they implement biometric systems to enhance customer interaction and improve operational efficiency.

Biometric Technology Market Analysis By Region

Each region's dynamics play a crucial role in driving the biometric market. North America remains a technological leader with investments and diverse applications. Asia Pacific's rapid urbanization drives adoption in both urban and rural areas. Europe is witnessing regulatory influences while Africa's growth is largely due to security concerns, providing opportunities for future developments.

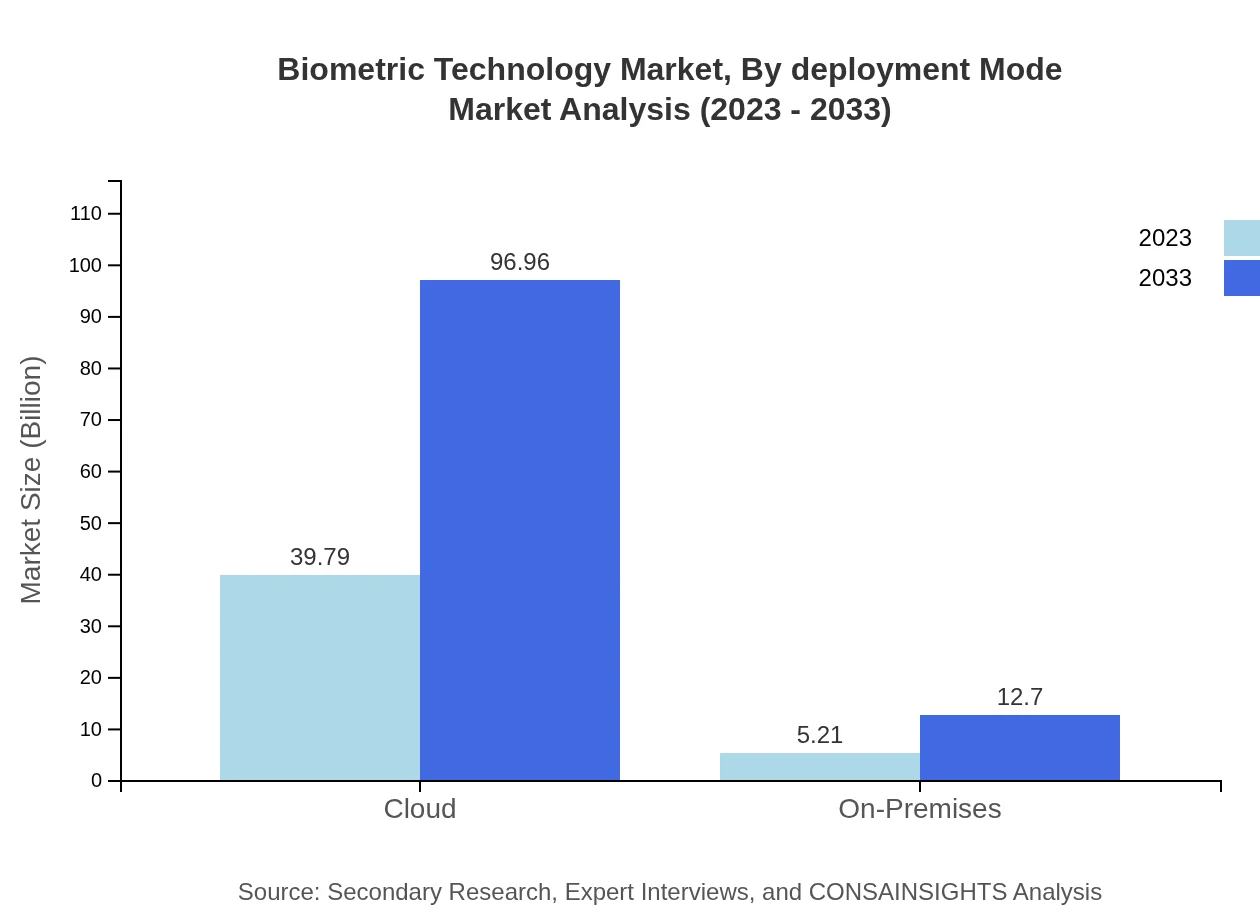

Biometric Technology Market Analysis By Deployment Mode

In terms of deployment mode, Cloud solutions are leading due to their scalability and efficiency, generating $39.79 billion in 2023, expected to grow to $96.96 billion. On-Premises deployment also has a solid market, projected to rise from $5.21 billion to $12.70 billion, reflecting organizational preferences for customized security solutions.

Biometric Technology Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biometric Technology Industry

NEC Corporation:

A leader in biometric identification and security, NEC Corporation specializes in providing solutions for facial and fingerprint recognition technologies across various sectors.Gemalto N.V. (Thales Group):

As a global leader in digital security, Gemalto provides essential biometric solutions ensuring secure access and identity verification in numerous applications.Fujitsu:

Fujitsu is recognized for its advanced biometric technologies including fingerprint and palm vein authentication systems tailored for security-sensitive applications.Suprema Inc.:

Specializing in biometric access control systems and time attendance solutions, Suprema is a pioneer in developing cutting-edge fingerprint recognition technologies.IDEMIA:

IDEMIA excels in providing augmented identity solutions with innovative biometrics integrated into various sectors, enhancing security and user experience.We're grateful to work with incredible clients.

FAQs

What is the market size of biometric Technology?

The biometric technology market is currently valued at approximately $45 billion. With a projected compound annual growth rate (CAGR) of 9%, it is expected to grow significantly over the next decade, reaching higher valuations by 2033.

What are the key market players or companies in this biometric technology industry?

Key players in the biometric technology industry include major companies such as NEC Corporation, Thales Group, and HID Global. These organizations are recognized for their innovations and contributions to fingerprint scanning, facial recognition, and other biometric systems.

What are the primary factors driving the growth in the biometric technology industry?

Growth in the biometric technology industry is driven by increasing security concerns, the rise of financial fraud, and a growing demand for fast, efficient identification solutions. Additionally, advancements in technology enhance both the reliability and acceptance of biometrics.

Which region is the fastest Growing in the biometric technology market?

The fastest-growing region in the biometric technology market is North America. The market size is projected to grow from $15.60 billion in 2023 to $38.02 billion in 2033, showing a strong demand across various sectors.

Does ConsaInsights provide customized market report data for the biometric technology industry?

Yes, ConsaInsights offers customized market report data tailored to the specific needs and insights required by clients in the biometric technology sector, ensuring comprehensive analysis and relevant data for strategic decision-making.

What deliverables can I expect from this biometric technology market research project?

Deliverables from the biometric technology market research project include detailed market size analysis, trend reports, competitive landscape evaluations, and regional breakdowns. Clients will receive actionable insights to inform their business strategies.

What are the market trends of biometric technology?

Current trends in the biometric technology market include the shift towards multi-modal biometric systems, increased integration into mobile devices, and advancing artificial intelligence applications to enhance biometric accuracy and efficiency.