Biopesticides Market Report

Published Date: 02 February 2026 | Report Code: biopesticides

Biopesticides Market Size, Share, Industry Trends and Forecast to 2033

This report provides a comprehensive analysis of the biopesticides market, highlighting key trends, forecasts from 2023 to 2033, and in-depth insights on market dynamics, segmentation, and regional performance.

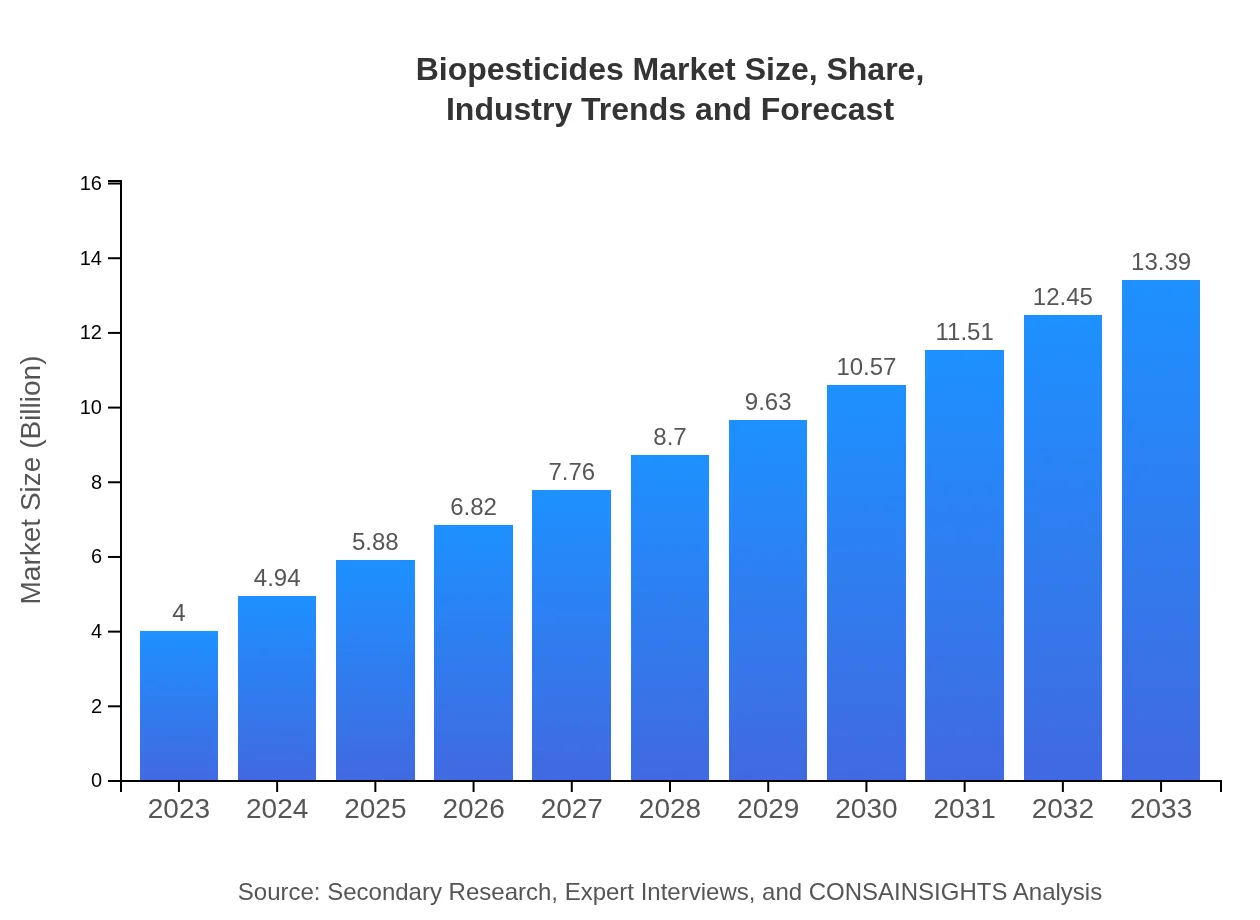

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $4.00 Billion |

| CAGR (2023-2033) | 12.3% |

| 2033 Market Size | $13.39 Billion |

| Top Companies | BASF SE, Syngenta AG, FMC Corporation, Novozymes A/S, Valent BioSciences |

| Last Modified Date | 02 February 2026 |

Biopesticides Market Overview

Customize Biopesticides Market Report market research report

- ✔ Get in-depth analysis of Biopesticides market size, growth, and forecasts.

- ✔ Understand Biopesticides's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biopesticides

What is the Market Size & CAGR of Biopesticides market in 2023?

Biopesticides Industry Analysis

Biopesticides Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biopesticides Market Analysis Report by Region

Europe Biopesticides Market Report:

Europe is anticipated to see significant growth, increasing from $1.19 billion in 2023 to $3.99 billion by 2033. Stringent regulations on chemical pesticide use in favor of organic and eco-friendly alternatives are propelling the biopesticides market in this region.Asia Pacific Biopesticides Market Report:

The Asia Pacific region is expected to grow significantly, from $0.75 billion in 2023 to $2.53 billion in 2033, driven by the increasing adoption of sustainable farming practices in countries like India and China. The region's diverse agricultural base further enhances the demand for biopesticides.North America Biopesticides Market Report:

The North American market is forecasted to expand from $1.46 billion in 2023 to $4.87 billion in 2033. The increasing use of biopesticides in the U.S. and Canada is largely driven by regulatory support and consumer demand for organic produce.South America Biopesticides Market Report:

In South America, the market is projected to grow from $0.28 billion in 2023 to $0.93 billion in 2033. Agricultural expansion in Brazil and Argentina, coupled with a rising trend towards organic farming, is influencing the growth of biopesticides in this region.Middle East & Africa Biopesticides Market Report:

The market in the Middle East and Africa is forecasted to increase from $0.32 billion in 2023 to $1.07 billion in 2033. Growing concerns over food security and soil health are encouraging the adoption of biopesticides across various agricultural sectors.Tell us your focus area and get a customized research report.

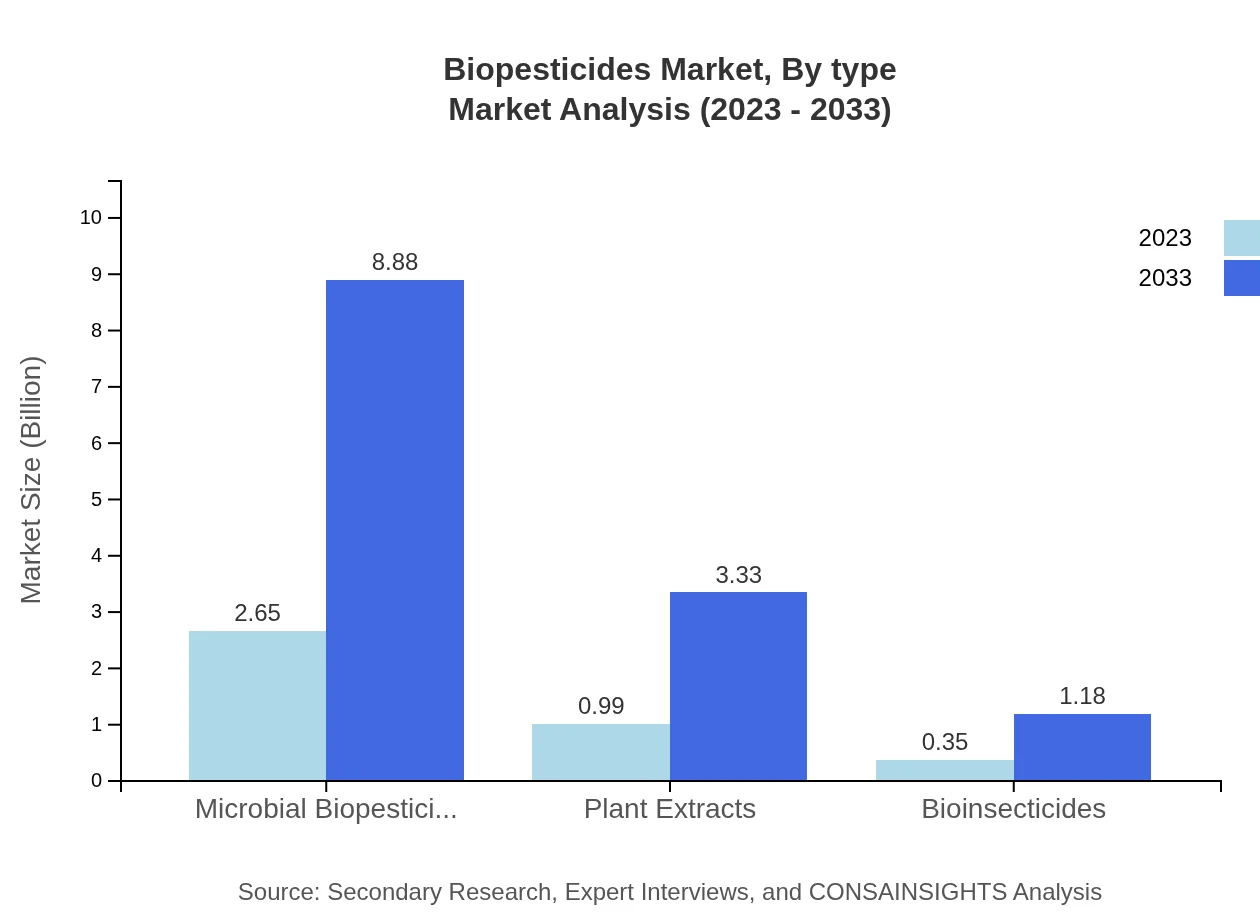

Biopesticides Market Analysis By Type

In terms of product type, microbial biopesticides lead the market with a value rising from $2.65 billion in 2023 to $8.88 billion in 2033, maintaining a market share of 66.33%. Plant extracts are expected to grow from $0.99 billion to $3.33 billion, holding a 24.87% market share. Bioinsecticides also show growth potential, increasing from $0.35 billion to $1.18 billion, though they maintain a smaller share of 8.8%.

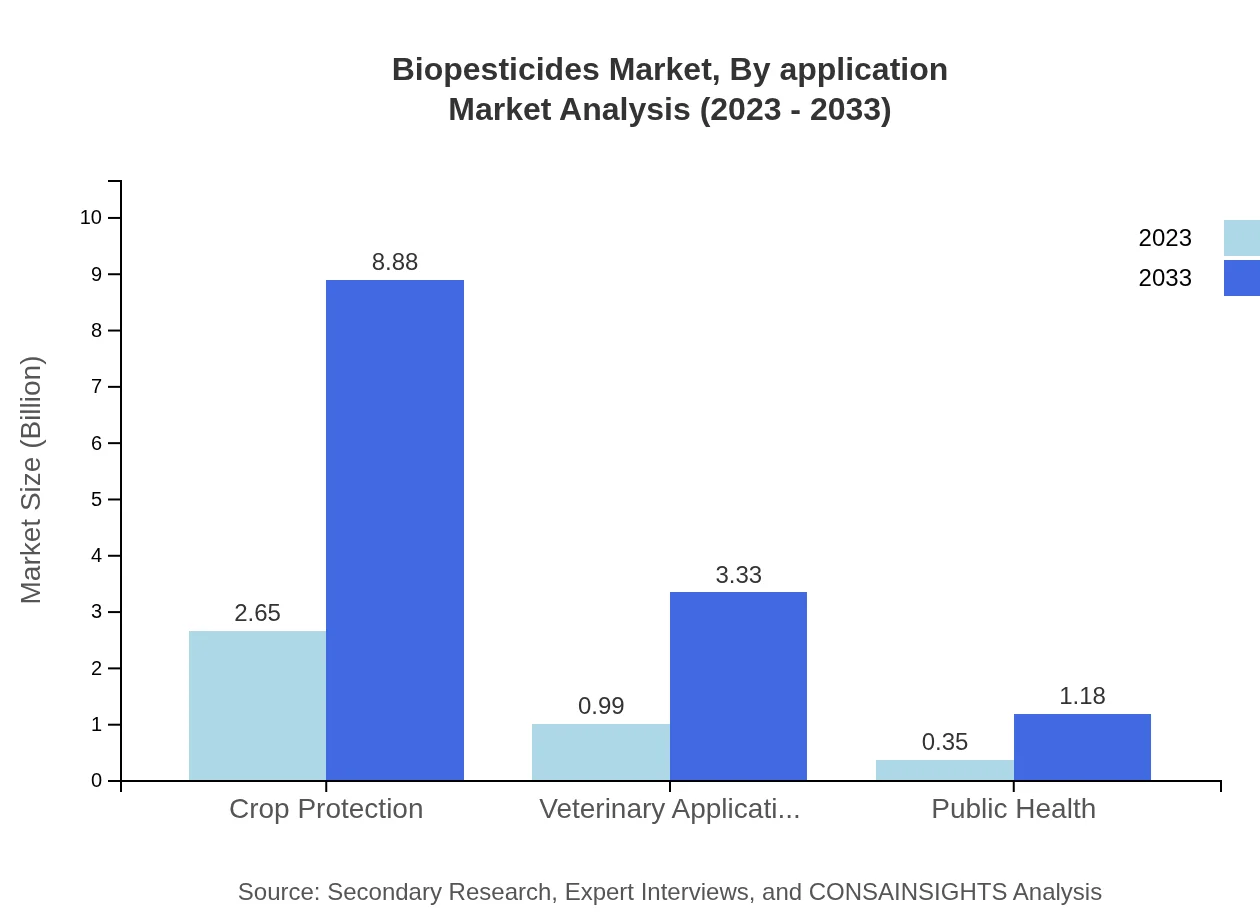

Biopesticides Market Analysis By Application

The key applications of biopesticides include crop protection, which dominates the market, growing from $2.65 billion in 2023 to $8.88 billion by 2033. Public health applications, designed to combat pests affecting human health, also show solid growth from $0.35 billion to $1.18 billion.

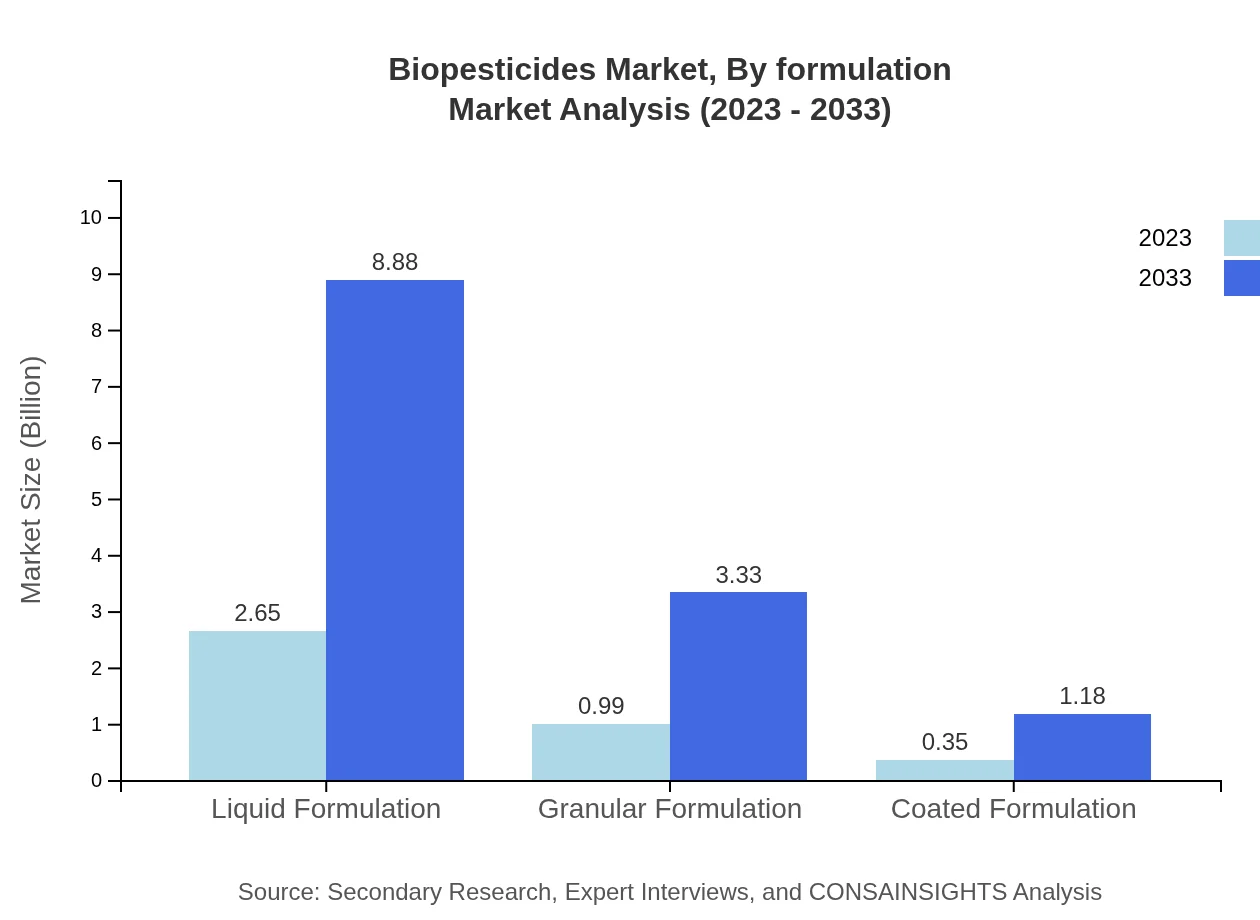

Biopesticides Market Analysis By Formulation

In terms of formulation, liquid formulations are the frontrunners, projected to grow from $2.65 billion in 2023 to $8.88 billion by 2033, while granular formulations and coated formulations follow with revenues rising from $0.99 billion to $3.33 billion, and $0.35 billion to $1.18 billion, respectively.

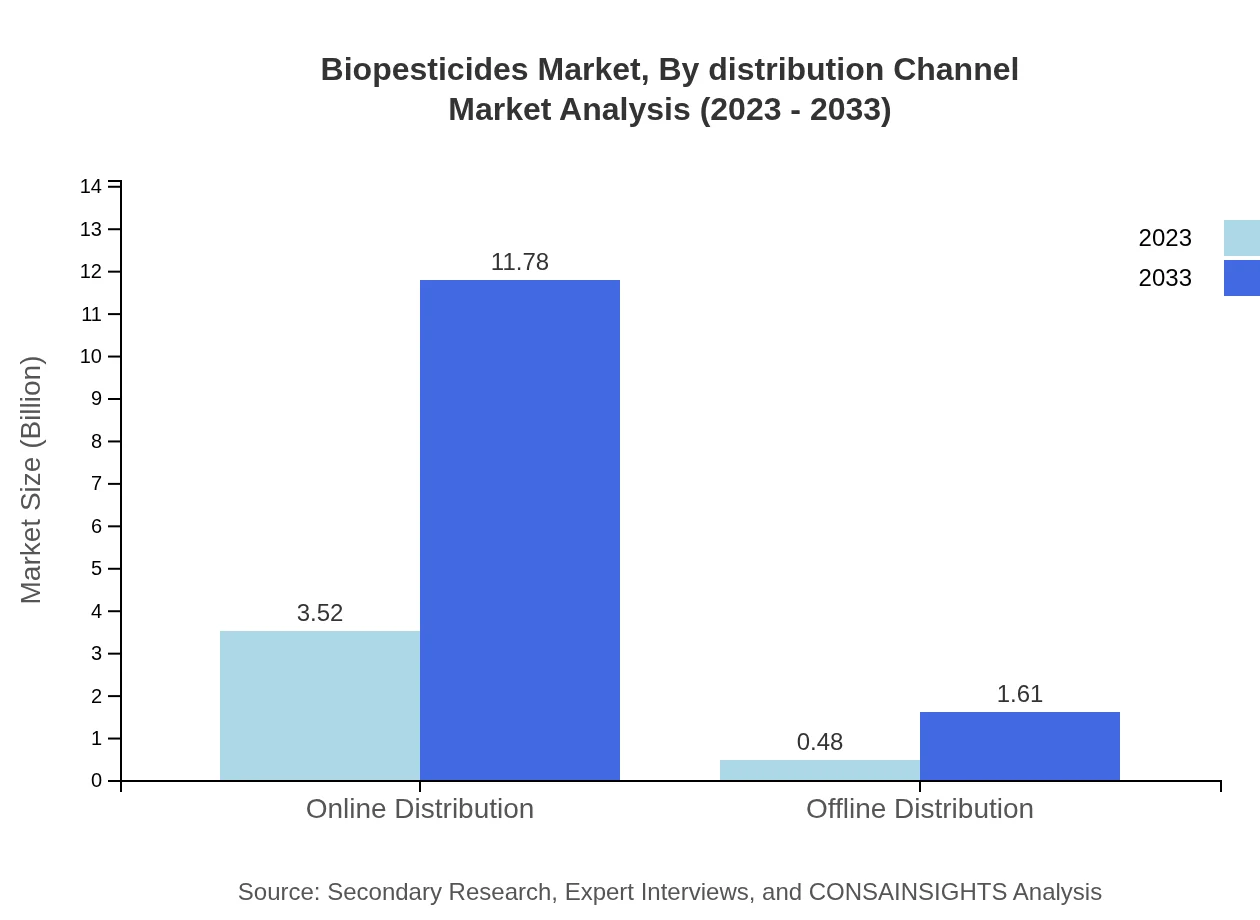

Biopesticides Market Analysis By Distribution Channel

Online distribution channels show strong growth, expected to increase from $3.52 billion in 2023 to $11.78 billion in 2033, accounting for 87.98% of the market share. Offline avenues, while growing from $0.48 billion to $1.61 billion, represent a smaller segment of the distribution landscape.

Biopesticides Market Analysis By Crop Type

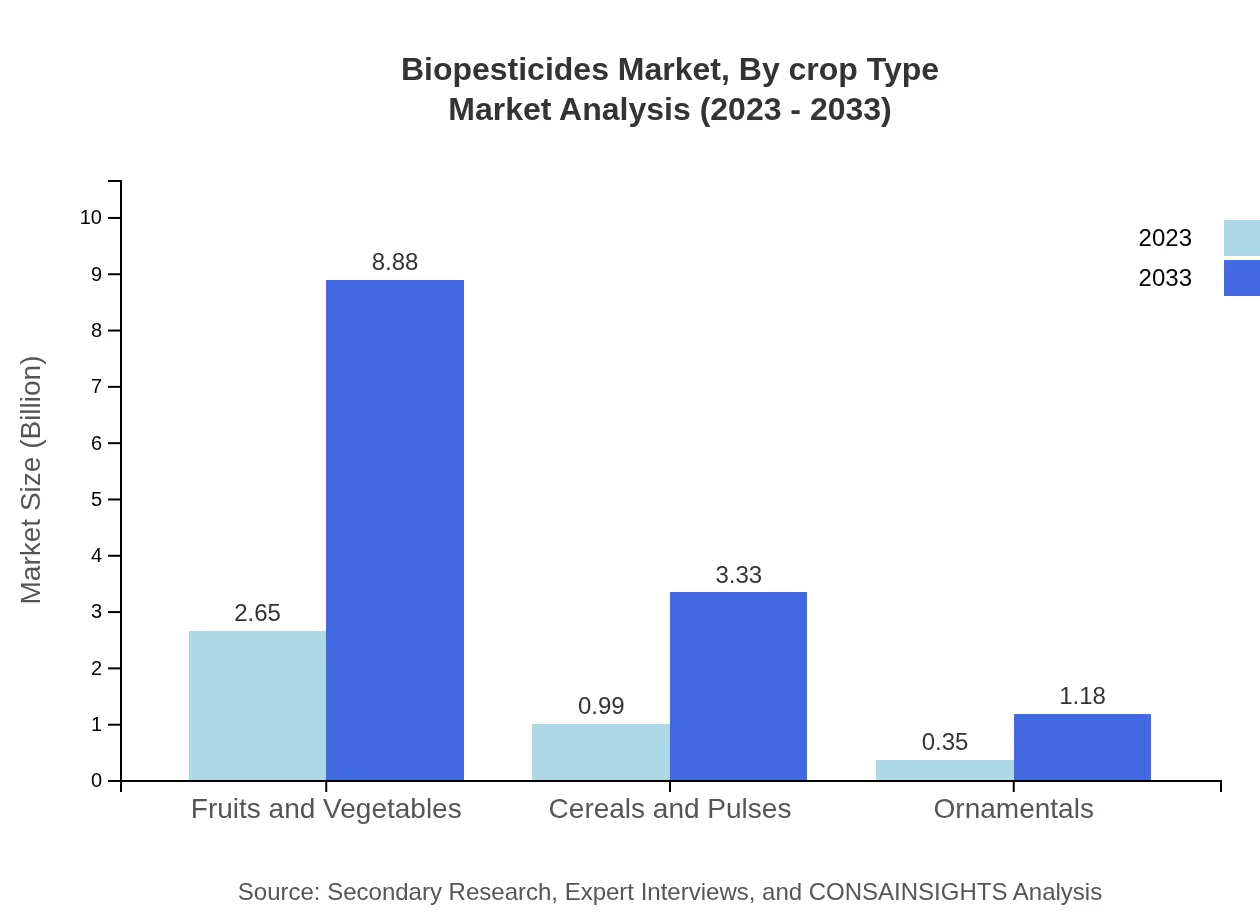

Key crops include fruits and vegetables, cereals and pulses, and ornamentals. Fruits and vegetables will continue to dominate the market, showing robust growth from $2.65 billion to $8.88 billion, while cereals and pulses will rise from $0.99 billion to $3.33 billion, alongside ornamentals growing from $0.35 billion to $1.18 billion.

Biopesticides Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biopesticides Industry

BASF SE:

A global leader in agricultural solutions, BASF SE develops innovative biopesticide products designed to enhance crop yield while minimizing environmental impact.Syngenta AG:

Syngenta AG is renowned for its advanced agricultural products and technologies, including a diverse range of biopesticides targeting pest-control needs across various crop types.FMC Corporation:

FMC Corporation produces cutting-edge biopesticides that leverage microbial technology to provide effective pest management while adhering to organic farming standards.Novozymes A/S:

Specializing in biological solutions, Novozymes focuses on developing enzymatic products that improve agricultural sustainability, including reliable biopesticides.Valent BioSciences:

Valent BioSciences offers a portfolio of biopesticides targeting various crop and pest challenges, emphasizing sustainable methods and integrated pest management.We're grateful to work with incredible clients.

FAQs

What is the market size of biopesticides?

The biopesticides market is projected to reach approximately $4 billion by 2033, growing at a CAGR of 12.3% from its current value. This growth reflects an increasing focus on sustainable agriculture and eco-friendly pest management.

What are the key market players or companies in the biopesticides industry?

Key players in the biopesticides market include companies like Bayer AG, BASF SE, Syngenta AG, and Dow AgroSciences, which are leading in innovation and sustainability practices. These companies are crucial in driving market trends and technological advancements.

What are the primary factors driving the growth in the biopesticides industry?

Growth in the biopesticides industry is primarily driven by rising consumer demand for organic produce, stringent regulations on chemical pesticides, and increasing prevalence of sustainable farming practices. These factors together enhance the adoption rate of biopesticide solutions among farmers.

Which region is the fastest Growing in the biopesticides market?

The fastest-growing region for biopesticides is Europe, projected to expand from $1.19 billion in 2023 to $3.99 billion by 2033. Significant growth is also observed in Asia-Pacific, with an anticipated increase from $0.75 billion to $2.53 billion within the same timeframe.

Does ConsInsights provide customized market report data for the biopesticides industry?

Yes, ConsInsights offers customized market report data tailored to specific client needs in the biopesticides industry. This allows stakeholders to gain insights unique to their requirements and market conditions.

What deliverables can I expect from this biopesticides market research project?

Deliverables from the biopesticides market research project include comprehensive market analysis reports, trend forecasts, competitive landscape assessments, segment-wise performance details, and actionable insights tailored for strategic decision-making.

What are the market trends of biopesticides?

The current trends in the biopesticides market indicate a shift towards microbial biopesticides and plant extracts. Microbial biopesticides alone constituted approximately 66.33% of the market share in 2023, highlighting growing acceptance and innovation in this segment.