Biopharmaceuticals Contract Manufacturing Market Report

Published Date: 31 January 2026 | Report Code: biopharmaceuticals-contract-manufacturing

Biopharmaceuticals Contract Manufacturing Market Size, Share, Industry Trends and Forecast to 2033

This report provides an in-depth analysis of the Biopharmaceuticals Contract Manufacturing market, offering insights into market trends, segmentation, regional analysis, and key players from 2023 to 2033.

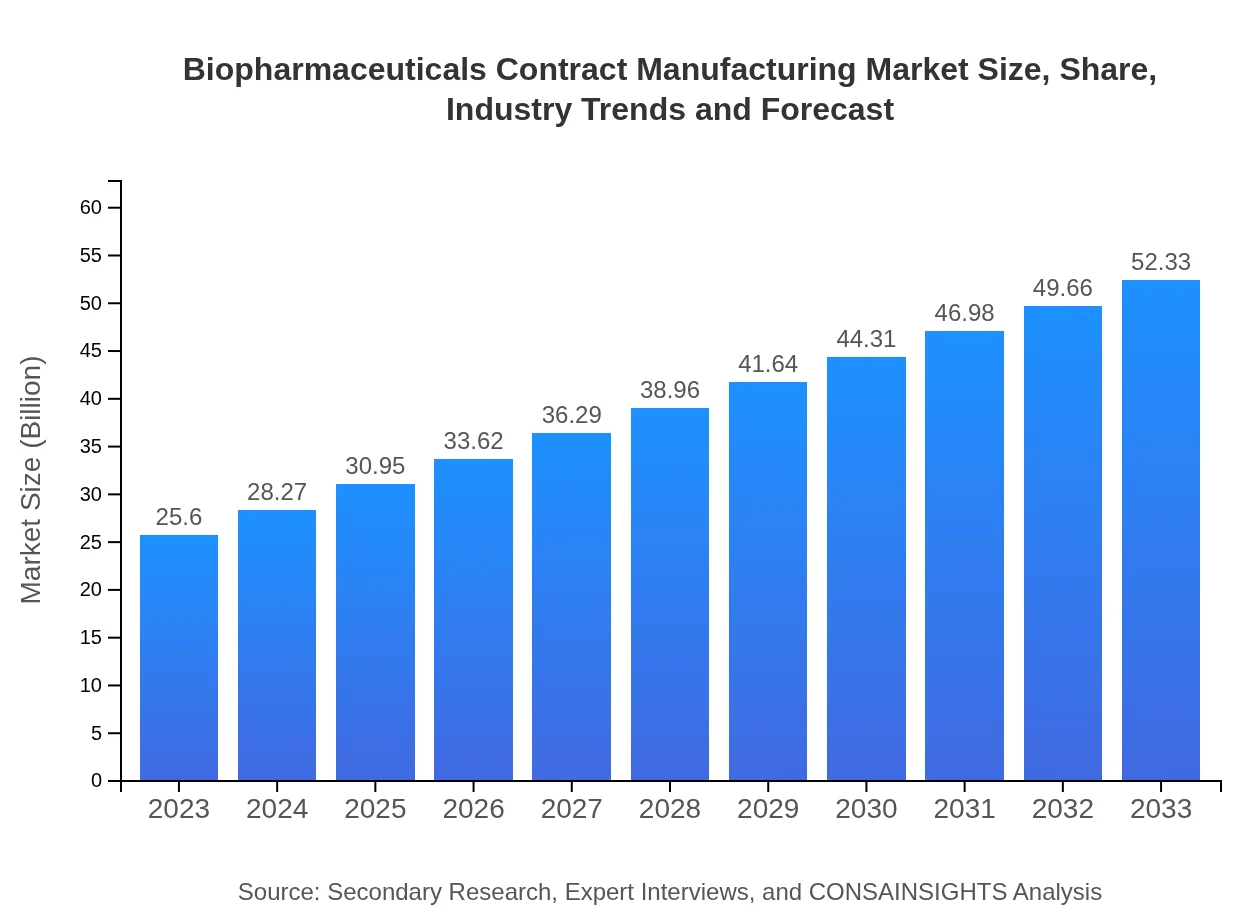

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $25.60 Billion |

| CAGR (2023-2033) | 7.2% |

| 2033 Market Size | $52.33 Billion |

| Top Companies | Lonza Group, Samsung Biologics, WuXi AppTec |

| Last Modified Date | 31 January 2026 |

Biopharmaceuticals Contract Manufacturing Market Overview

Customize Biopharmaceuticals Contract Manufacturing Market Report market research report

- ✔ Get in-depth analysis of Biopharmaceuticals Contract Manufacturing market size, growth, and forecasts.

- ✔ Understand Biopharmaceuticals Contract Manufacturing's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biopharmaceuticals Contract Manufacturing

What is the Market Size & CAGR of Biopharmaceuticals Contract Manufacturing market in 2023?

Biopharmaceuticals Contract Manufacturing Industry Analysis

Biopharmaceuticals Contract Manufacturing Market Segmentation and Scope

Tell us your focus area and get a customized research report.

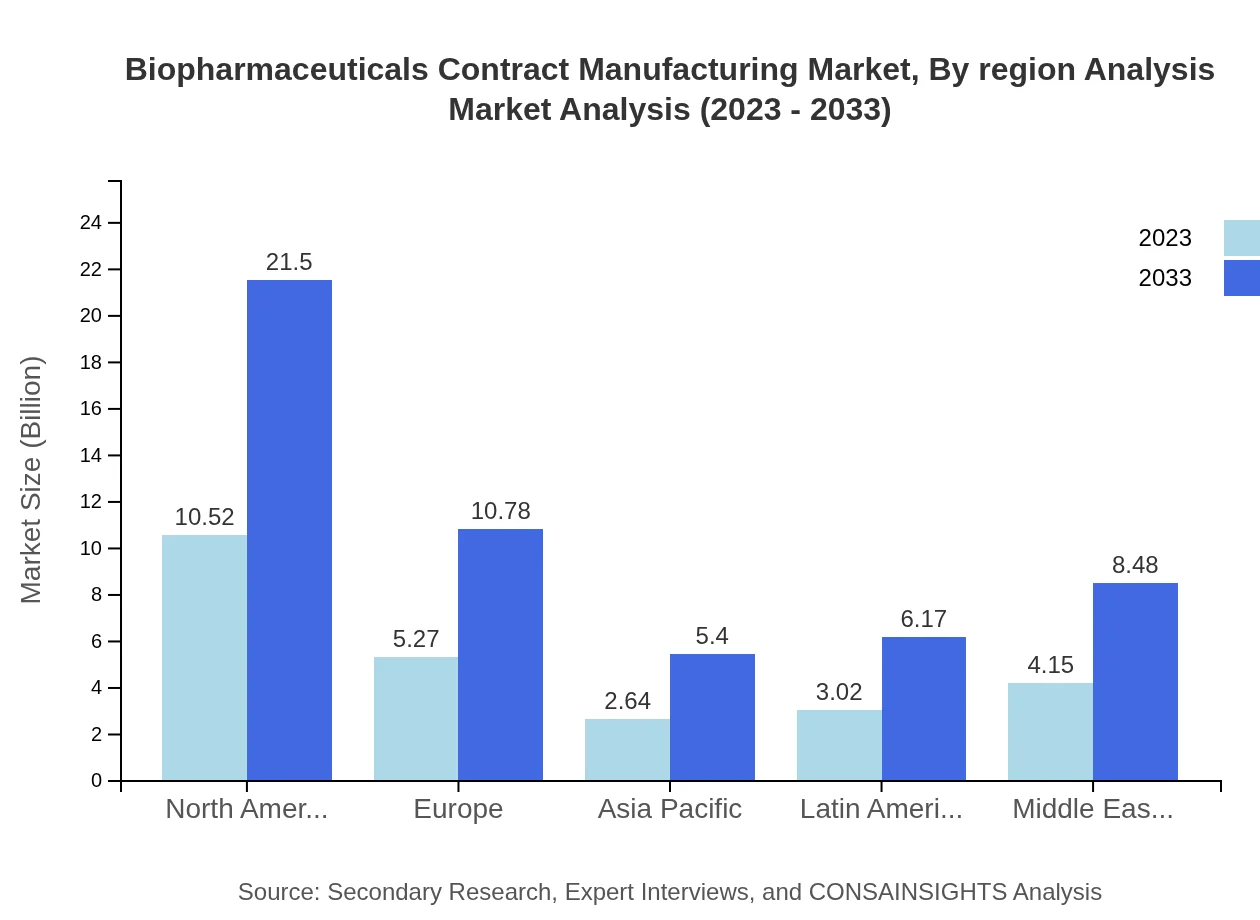

Biopharmaceuticals Contract Manufacturing Market Analysis Report by Region

Europe Biopharmaceuticals Contract Manufacturing Market Report:

The European market for biopharmaceuticals contract manufacturing is projected to increase from $7.81 billion in 2023 to $15.97 billion by 2033. The presence of stringent regulatory frameworks helps maintain high-quality manufacturing standards, while growing investments in research and development are further boosting the market.Asia Pacific Biopharmaceuticals Contract Manufacturing Market Report:

The Asia Pacific biopharmaceuticals contract manufacturing market is projected to grow from $4.82 billion in 2023 to $9.84 billion by 2033, showcasing a commendable CAGR. This growth is fueled by increasing investments in biopharmaceutical manufacturing capabilities and a skilled labor force, complemented by favorable regulatory environments.North America Biopharmaceuticals Contract Manufacturing Market Report:

North America remains the dominant market for biopharmaceuticals contract manufacturing, expected to grow from $9.33 billion in 2023 to $19.08 billion by 2033. The market is driven by the prevalence of chronic diseases and the presence of major pharmaceutical companies, coupled with advanced manufacturing techniques.South America Biopharmaceuticals Contract Manufacturing Market Report:

South America exhibits a growing biopharmaceuticals contract manufacturing market, expanding from $1.15 billion in 2023 to $2.36 billion in 2033. The rise is attributed to increasing healthcare investments and a growing demand for biologics amid an expanding healthcare infrastructure.Middle East & Africa Biopharmaceuticals Contract Manufacturing Market Report:

The biopharmaceutical contract manufacturing market in the Middle East and Africa is expected to expand from $2.48 billion in 2023 to $5.08 billion by 2033. This growth is facilitated by increasing government initiatives to enhance healthcare capabilities and investments in biotechnology.Tell us your focus area and get a customized research report.

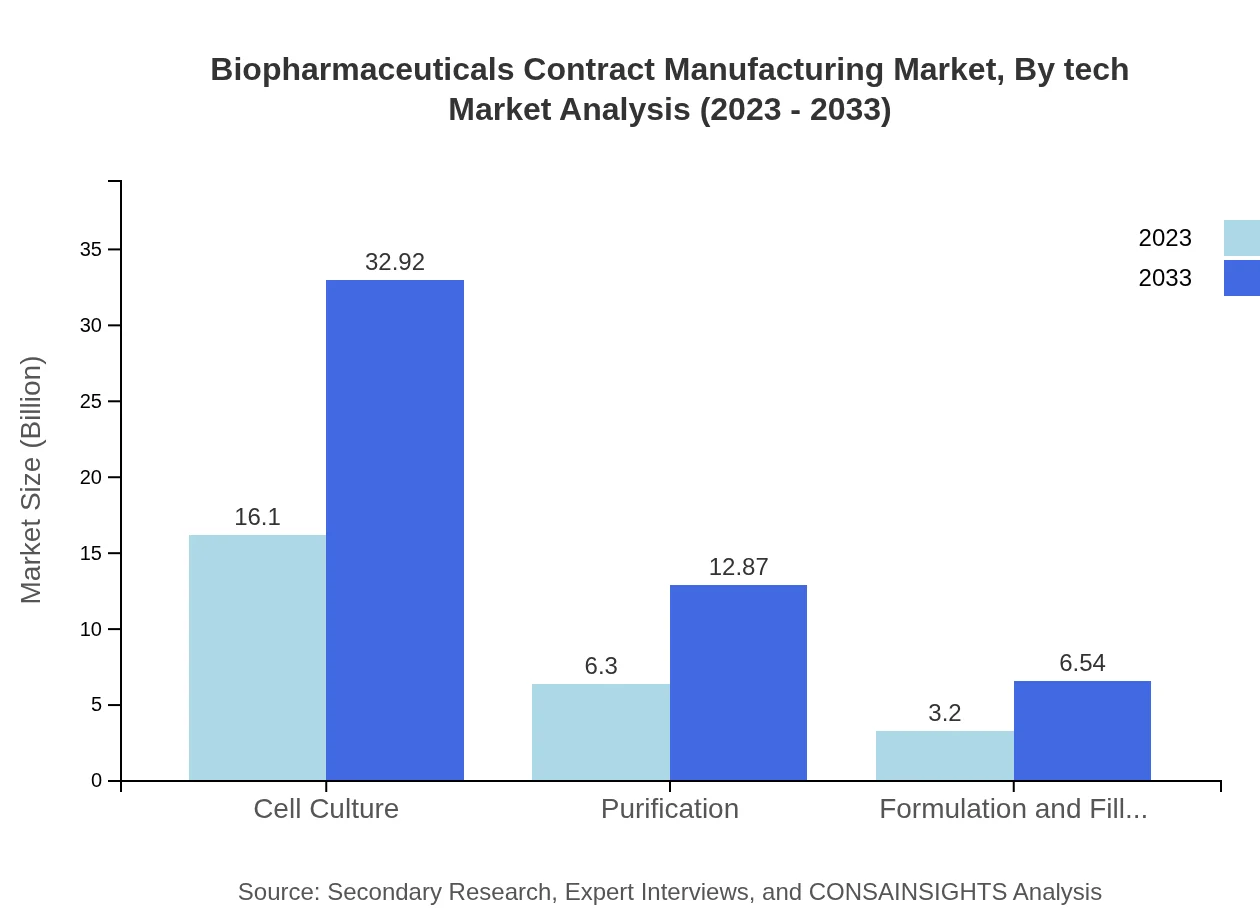

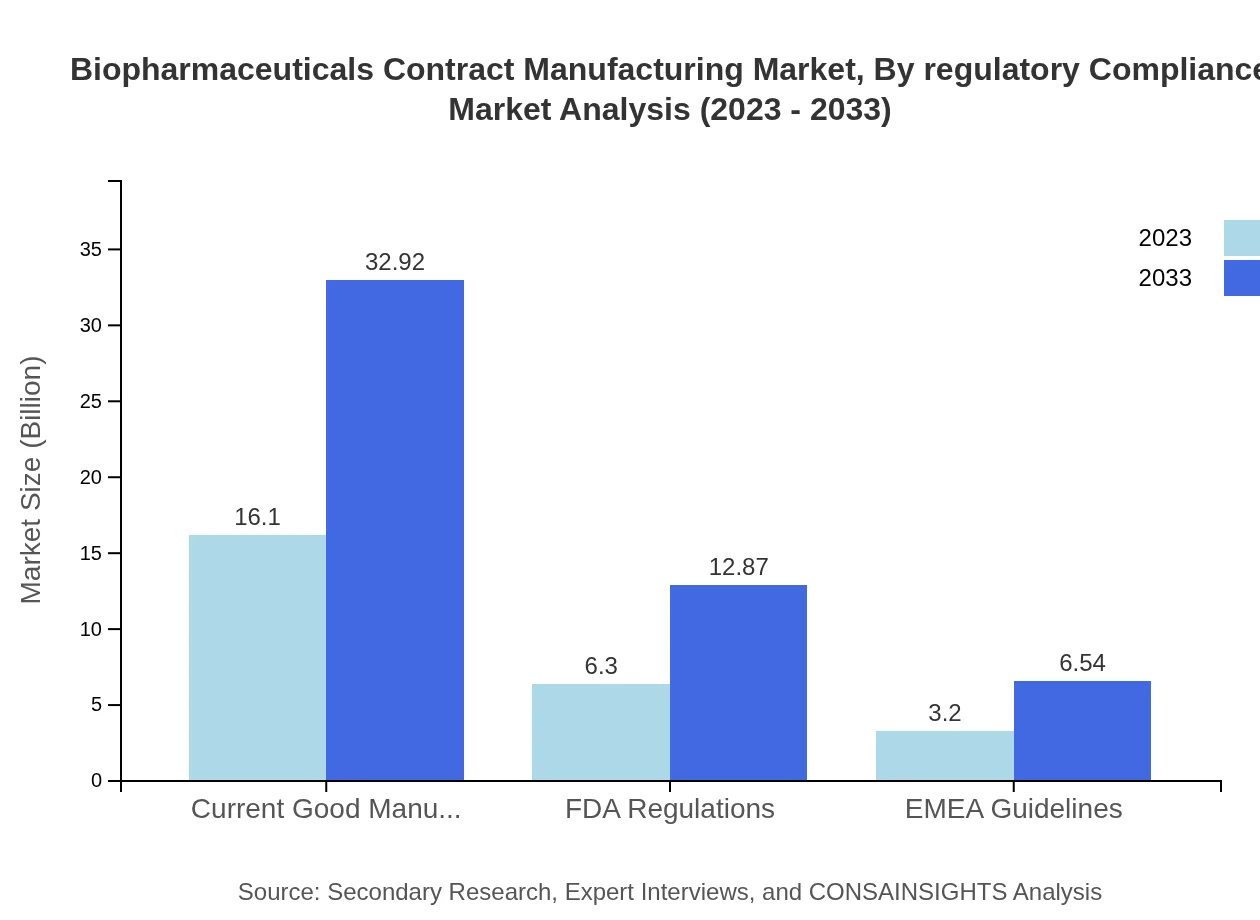

Biopharmaceuticals Contract Manufacturing Market Analysis By Tech

The key technology segments shaping the biopharmaceuticals contract manufacturing market include cell culture and purification processes. Cell culture technology dominates the market due to its extensive application in producing mammalian cell lines for biopharmaceuticals, with a market size projected to grow from $16.10 billion in 2023 to $32.92 billion by 2033.

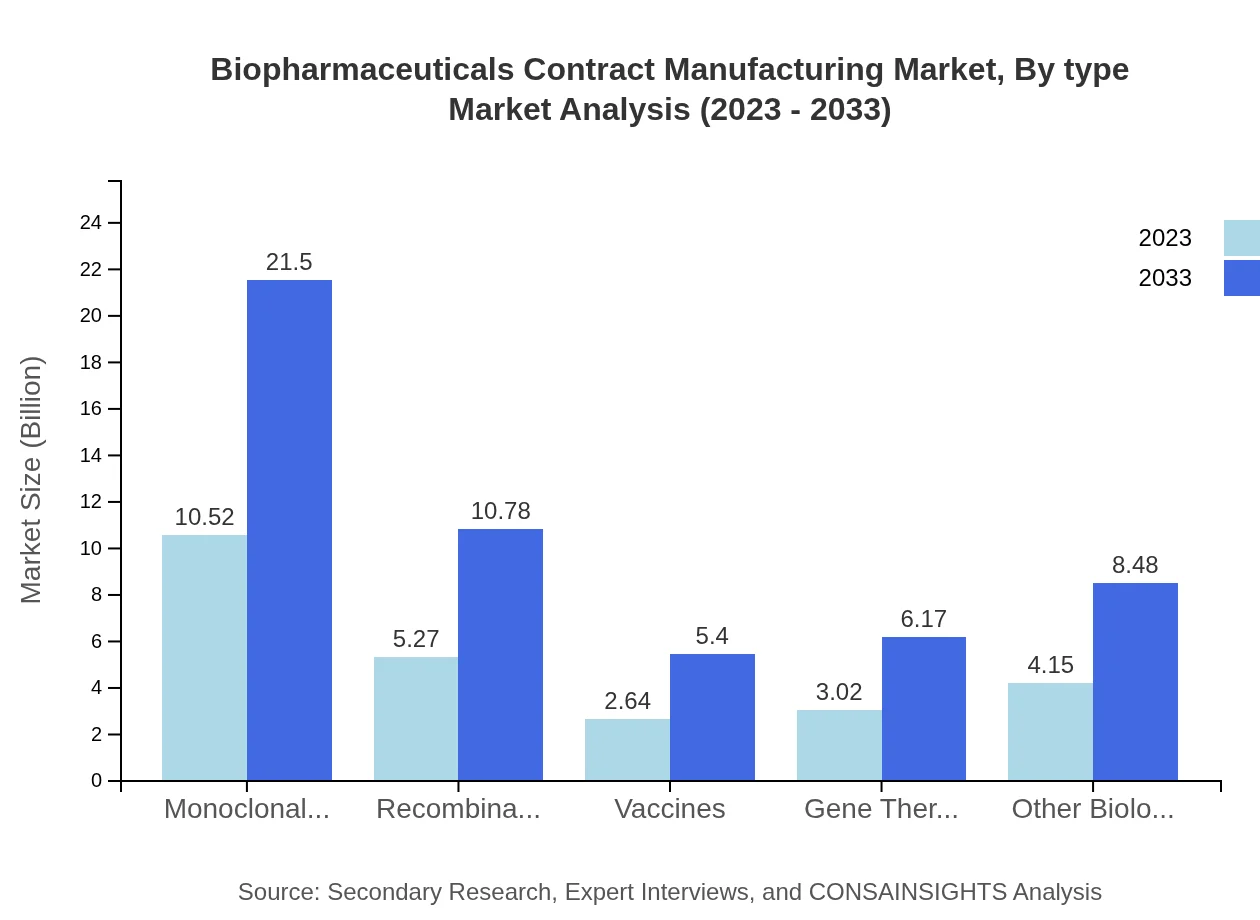

Biopharmaceuticals Contract Manufacturing Market Analysis By Type

Product types such as monoclonal antibodies, recombinant proteins, and vaccines are crucial in the biopharmaceuticals contract manufacturing landscape. Monoclonal antibodies' market size is expected to reach $21.50 billion by 2033 from $10.52 billion in 2023, highlighting their significance in therapeutic applications.

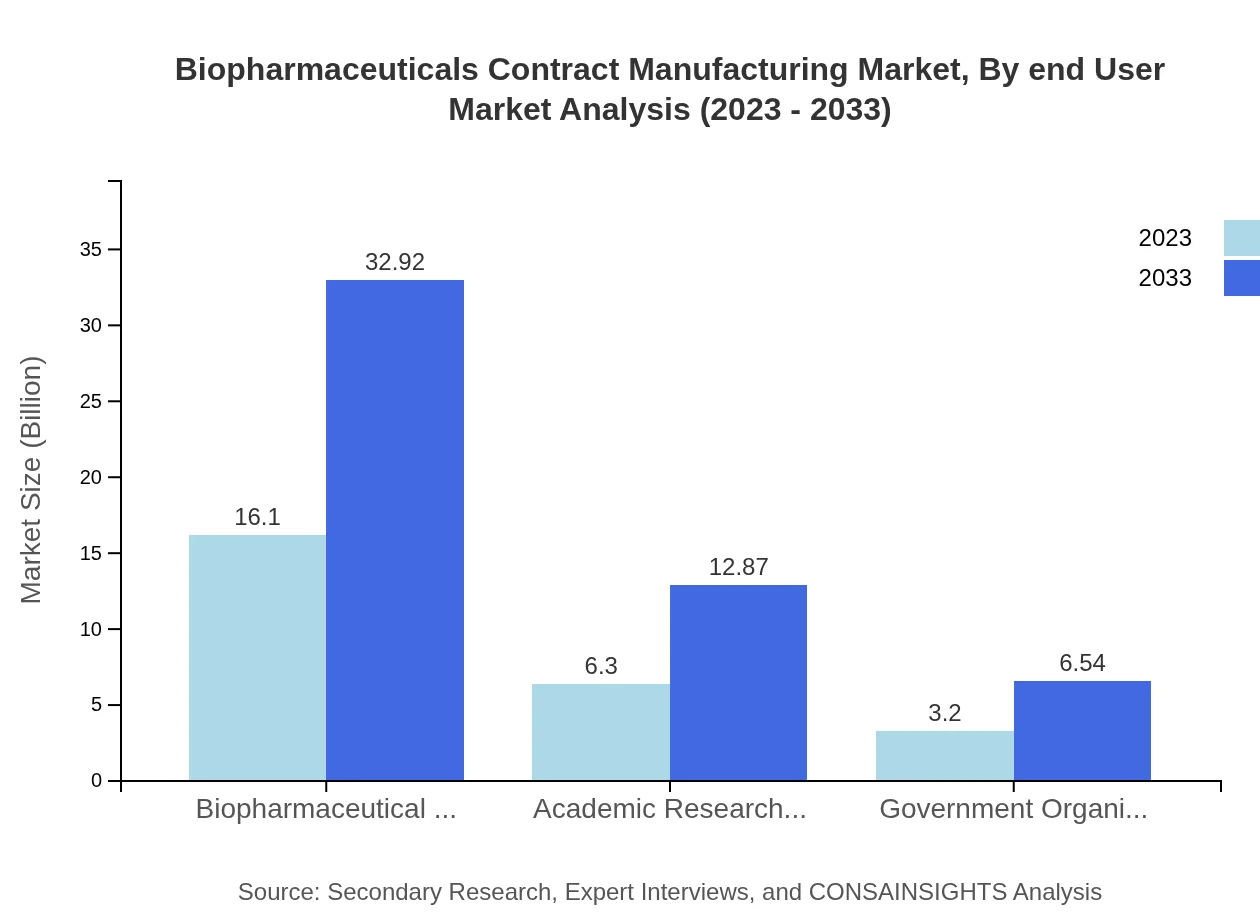

Biopharmaceuticals Contract Manufacturing Market Analysis By End User

The primary end-users include biopharmaceutical companies, academic research organizations, and government entities. Biopharmaceutical companies hold the largest market share, accounting for over 60% of the overall biopharmaceuticals contract manufacturing sector, underlining their reliance on external partners for efficiency and scalability.

Biopharmaceuticals Contract Manufacturing Market Analysis By Region Analysis

Regional analysis reveals that North America and Europe are leading in terms of market share, driven by advanced healthcare infrastructure and high R&D investments. Asia Pacific is emerging with rapid growth prospects due to increasing manufacturing capacities and strategic investment opportunities.

Biopharmaceuticals Contract Manufacturing Market Analysis By Regulatory Compliance

Compliance with FDA regulations, EMA guidelines, and current good manufacturing practices (cGMP) remains critical for market growth. Adherence to these regulations ensures product quality and safety, thus fostering consumer trust and enhancing market sustainability.

Biopharmaceuticals Contract Manufacturing Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biopharmaceuticals Contract Manufacturing Industry

Lonza Group:

Lonza is a Swiss multinational that provides integrated and sustainable solutions to healthcare and life sciences, with a strong focus on biologics contract manufacturing.Samsung Biologics:

Samsung Biologics is a South Korean company recognized for its robust contract manufacturing services, specializing in cell culture and biologics production.WuXi AppTec:

WuXi AppTec offers comprehensive services in the biopharmaceutical sector, including contract manufacturing, R&D, and regulatory advisory to support accelerated product development.We're grateful to work with incredible clients.

FAQs

What is the market size of biopharmaceuticals contract manufacturing?

The biopharmaceuticals contract manufacturing market is valued at approximately $25.6 billion in 2023, with a projected CAGR of 7.2%, indicating robust growth for the industry through 2033.

What are the key market players or companies in the biopharmaceuticals contract manufacturing industry?

Key players in the biopharmaceuticals contract manufacturing industry include global companies such as Lonza, Boehringer Ingelheim, and Fujifilm Diosynth Biotechnologies, each contributing significantly to the market through various services.

What are the primary factors driving the growth in the biopharmaceuticals contract manufacturing industry?

Factors driving growth include the increasing demand for biologics, advancements in biopharmaceutical technologies, and the rising prevalence of chronic diseases requiring effective therapeutic drugs.

Which region is the fastest Growing in the biopharmaceuticals contract manufacturing?

North America is currently the fastest-growing region, expanding from $9.33 billion in 2023 to $19.08 billion by 2033, reflecting a significant market demand for biopharmaceuticals in this area.

Does ConsaInsights provide customized market report data for the biopharmaceuticals contract manufacturing industry?

Yes, ConsaInsights offers tailored market report data to meet specific client needs in the biopharmaceuticals contract manufacturing industry, ensuring relevant insights that align with unique business objectives.

What deliverables can I expect from this biopharmaceuticals contract manufacturing market research project?

Deliverables may include detailed analytical reports, market forecasts, competitive landscape overviews, and insights on key trends and opportunities within the biopharmaceutical contract manufacturing space.

What are the market trends of biopharmaceuticals contract manufacturing?

Market trends indicate a shift towards personalized medicine, increased outsourcing by pharmaceutical companies, and greater focus on compliance with regulatory standards in manufacturing processes.