Biopharmaceuticals Market Report

Published Date: 31 January 2026 | Report Code: biopharmaceuticals

Biopharmaceuticals Market Size, Share, Industry Trends and Forecast to 2033

This report provides extensive insights into the biopharmaceuticals market from 2023 to 2033, covering market size, trends, forecasts, and key regional analysis. It aims to equip stakeholders with data-driven strategies for navigating the evolving biopharmaceutical landscape.

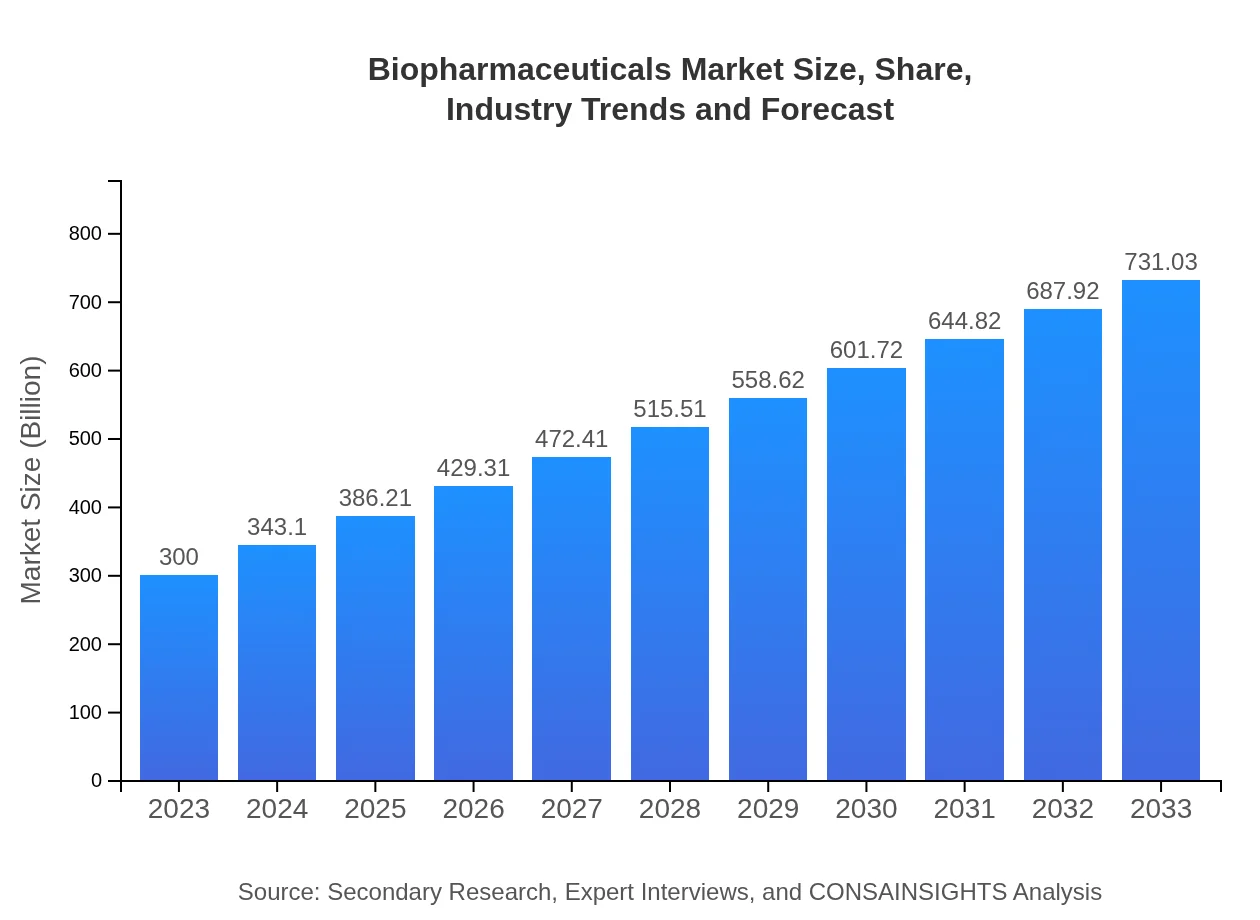

| Metric | Value |

|---|---|

| Study Period | 2023 - 2033 |

| 2023 Market Size | $300.00 Billion |

| CAGR (2023-2033) | 9% |

| 2033 Market Size | $731.03 Billion |

| Top Companies | AbbVie Inc., Roche Holding AG, Amgen Inc., Johnson & Johnson, Pfizer Inc. |

| Last Modified Date | 31 January 2026 |

Biopharmaceuticals Market Overview

Customize Biopharmaceuticals Market Report market research report

- ✔ Get in-depth analysis of Biopharmaceuticals market size, growth, and forecasts.

- ✔ Understand Biopharmaceuticals's regional dynamics and industry-specific trends.

- ✔ Identify potential applications, end-user demand, and growth segments in Biopharmaceuticals

What is the Market Size & CAGR of Biopharmaceuticals market in 2023?

Biopharmaceuticals Industry Analysis

Biopharmaceuticals Market Segmentation and Scope

Tell us your focus area and get a customized research report.

Biopharmaceuticals Market Analysis Report by Region

Europe Biopharmaceuticals Market Report:

The European market is projected to grow from 87.51 billion USD in 2023 to 213.24 billion USD by 2033. Factors such as heightened focus on biologics and the adoption of innovative therapies are propelling market momentum in this region.Asia Pacific Biopharmaceuticals Market Report:

With a market size projected at 58.38 billion USD in 2023, the Asia Pacific region is set to reach 142.26 billion USD by 2033. Strong growth is driven by increasing government investment in healthcare, rising patient awareness, and an expanding biopharmaceutical manufacturing base.North America Biopharmaceuticals Market Report:

North America currently leads the biopharmaceuticals market with a size of 105.93 billion USD expected to escalate to 258.13 billion USD by 2033. The presence of major pharmaceutical corporations, significant R&D investments, and a favorable regulatory environment are key growth drivers.South America Biopharmaceuticals Market Report:

In South America, the biopharmaceuticals market is estimated to grow from 26.67 billion USD in 2023 to 64.99 billion USD in 2033. The region is gaining traction due to improved healthcare infrastructure and the growing prevalence of chronic diseases, necessitating advanced treatments.Middle East & Africa Biopharmaceuticals Market Report:

Finally, the Middle East and Africa market is estimated at 21.51 billion USD in 2023, growing to 52.41 billion USD by 2033. Growth is largely attributed to improvements in healthcare policies and an increasing demand for effective treatment solutions in the region.Tell us your focus area and get a customized research report.

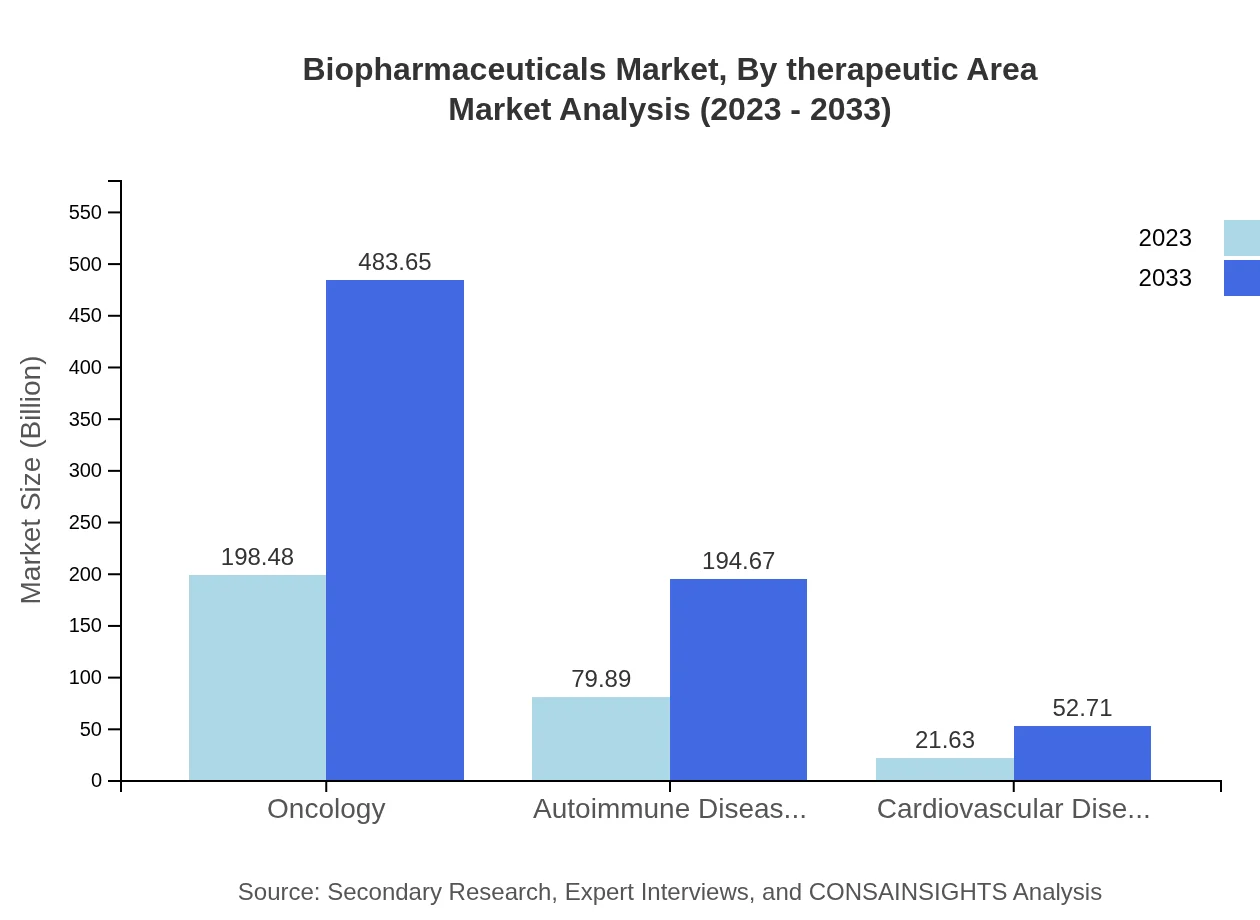

Biopharmaceuticals Market Analysis By Therapeutic Area

The biopharmaceuticals market by therapeutic area reveals monoclonal antibodies leading with a market size of 198.48 billion USD in 2023 and 483.65 billion USD by 2033, representing an increasing share of 66.16%. Vaccines are expected to grow from 79.89 billion USD to 194.67 billion USD, indicating a share of 26.63%. Additionally, gene therapy products are gaining traction, with a size of 21.63 billion USD expanding to 52.71 billion USD, holding a share of 7.21%.

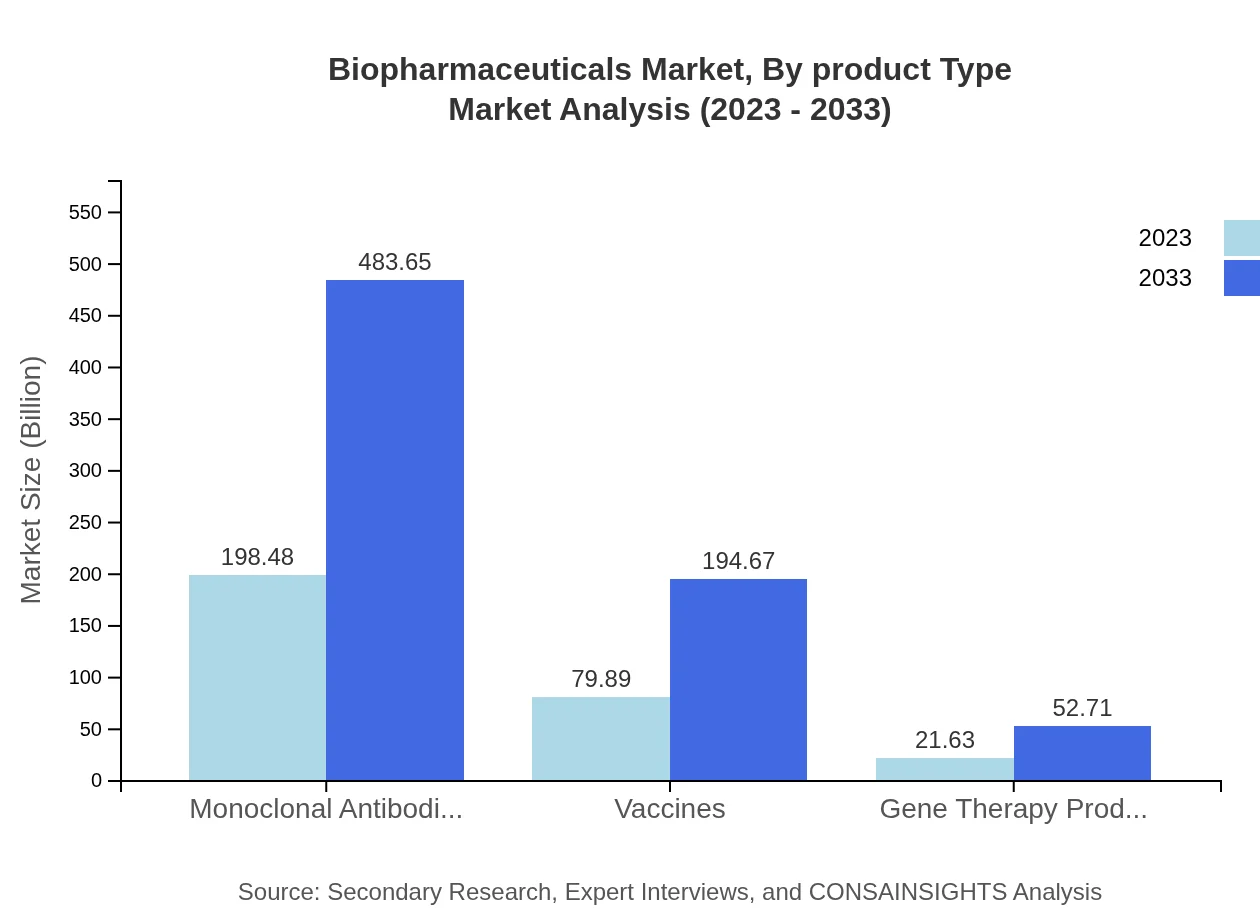

Biopharmaceuticals Market Analysis By Product Type

The product type analysis shows that monoclonal antibodies dominate, with a size of 198.48 billion USD in 2023 and 483.65 billion USD by 2033. Vaccines follow at 79.89 billion USD to 194.67 billion USD, and gene therapy products range from 21.63 billion USD to 52.71 billion USD over the same period. These products are pivotal, accounting for significant market shares and expected growth.

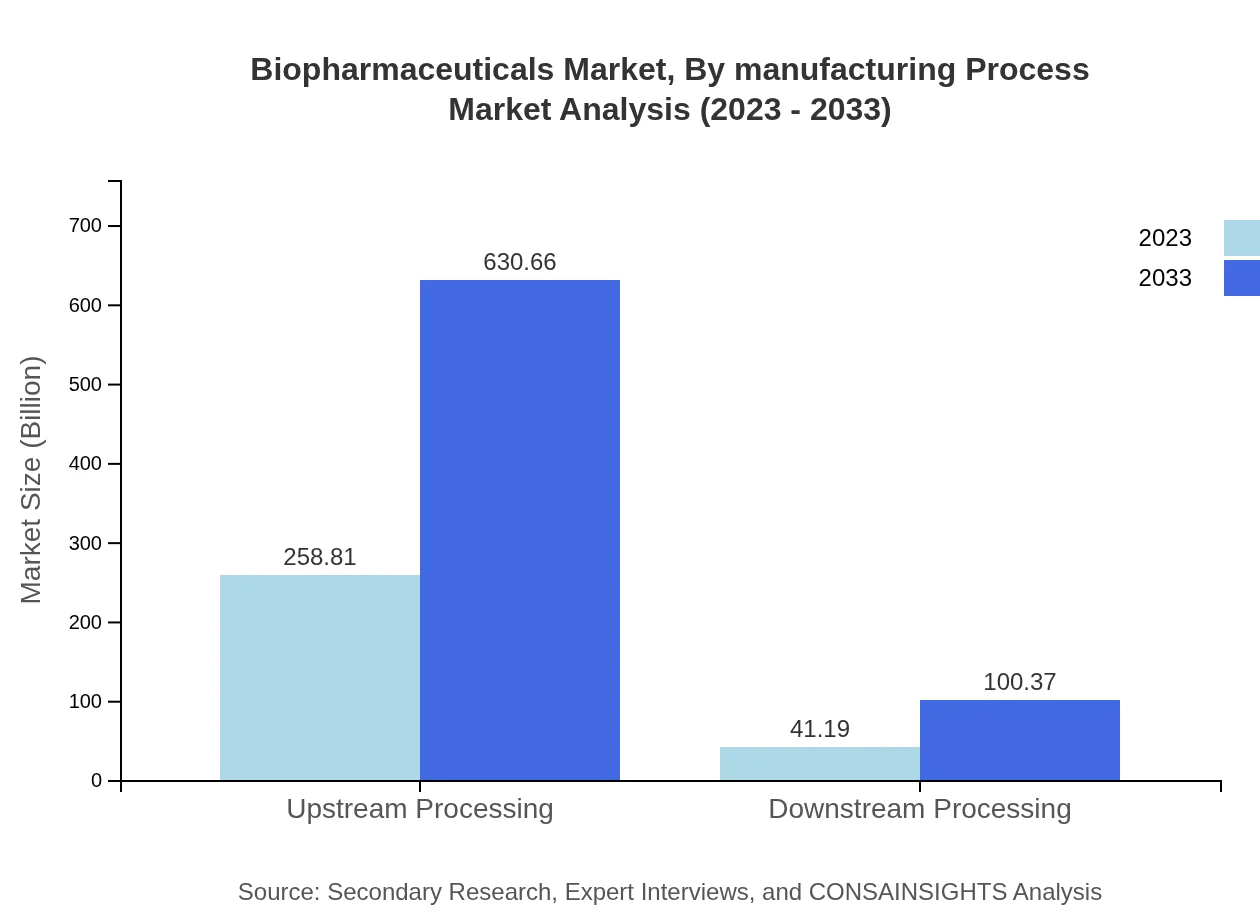

Biopharmaceuticals Market Analysis By Manufacturing Process

The market is segmented by manufacturing process into upstream and downstream processing. The upstream processing segment is valued at 258.81 billion USD in 2023 and is projected to double to 630.66 billion USD by 2033, maintaining an overwhelming share of 86.27%. Meanwhile, downstream processing is anticipated to grow from 41.19 billion USD to 100.37 billion USD, securing a share of 13.73%.

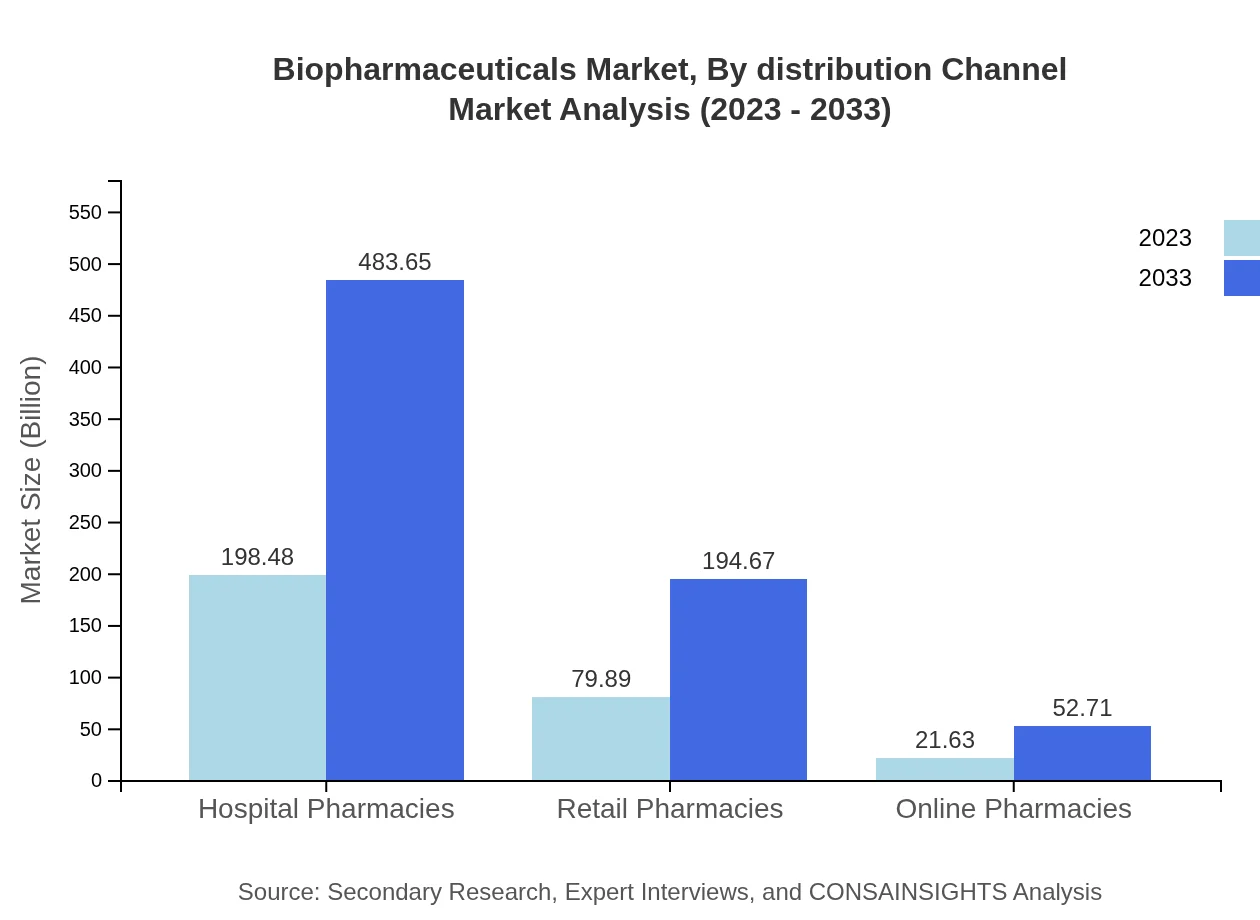

Biopharmaceuticals Market Analysis By Distribution Channel

Distribution channel segmentation reveals hospital pharmacies leading with a size of 198.48 billion USD for 2023 and 483.65 billion USD by 2033. Furthermore, retail pharmacies are projected to grow from 79.89 billion USD to 194.67 billion USD, with online pharmacies increasing from 21.63 billion USD to 52.71 billion USD, collectively channeling a substantial share of the market.

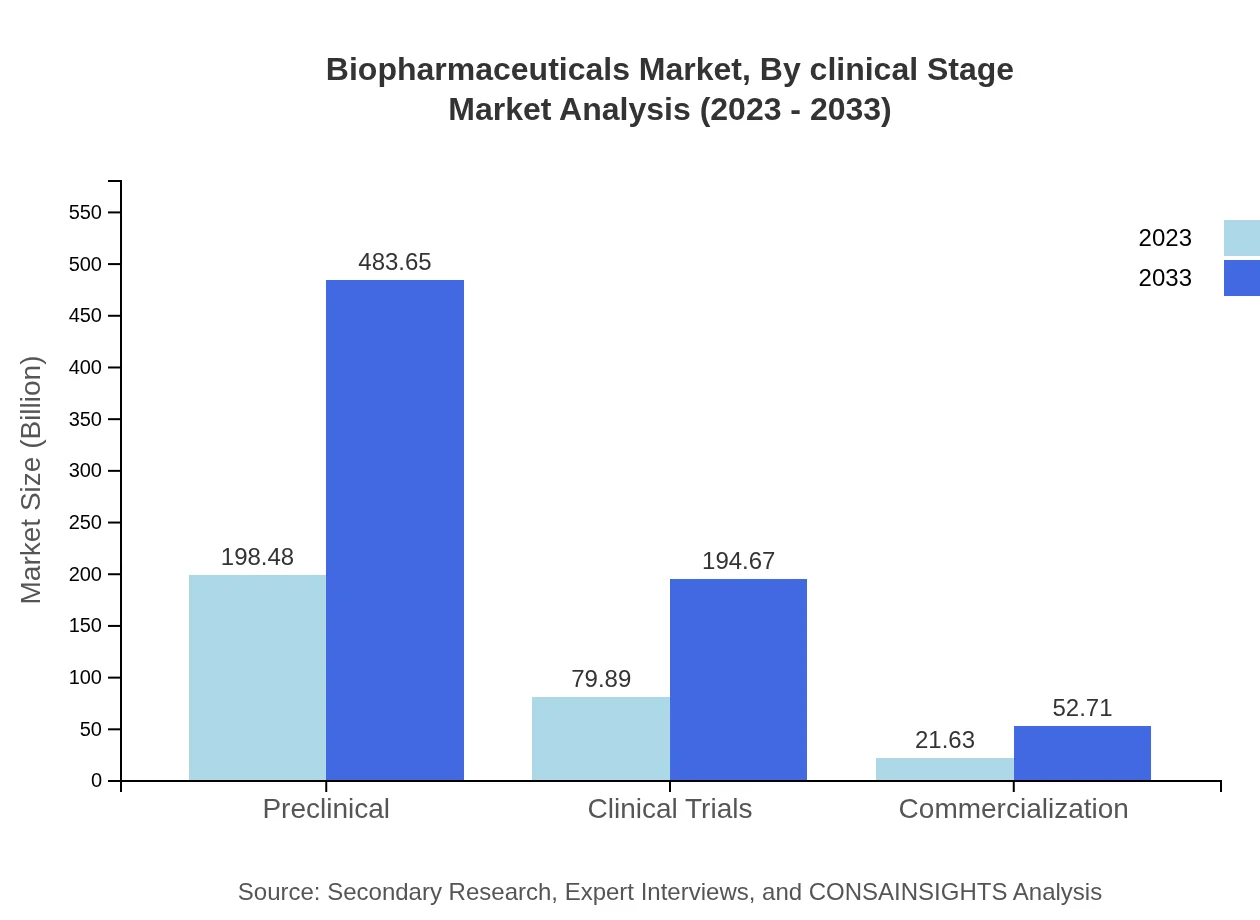

Biopharmaceuticals Market Analysis By Clinical Stage

The clinical stage breakdown of the biopharmaceutical market indicates preclinical stages leading at 198.48 billion USD in 2023, projected to expand to 483.65 billion USD by 2033. Similarly, clinical trials show significant growth from 79.89 billion USD to 194.67 billion USD, while commercialization sees a rise from 21.63 billion USD to 52.71 billion USD, highlighting the importance of these stages in drug development.

Biopharmaceuticals Market Trends and Future Forecast

Tell us your focus area and get a customized research report.

Global Market Leaders and Top Companies in Biopharmaceuticals Industry

AbbVie Inc.:

AbbVie is a global biopharmaceutical leader known for its innovatively designed methodologies in drug discovery and production. Its blockbuster drugs target severe immunological and oncology conditions.Roche Holding AG:

Roche is renowned for its development of monoclonal antibodies and diagnostics solutions. Its strategic focus on precision medicine significantly enhances its footprint in the biopharmaceutical landscape.Amgen Inc.:

Amgen is one of the largest biotechnology companies, specializing in a broad range of novel therapeutic interventions and continuously investing in innovative research and development.Johnson & Johnson:

Johnson & Johnson operates across multiple segments, with its biopharmaceutical division focusing on immunology, oncology, and neuroscience, driving significant growth through robust clinical pipelines.Pfizer Inc.:

Pfizer is known for its research-driven approach and a diverse portfolio of vaccines and biologics, emerging as a global leader post-COVID-19 vaccine rollouts.We're grateful to work with incredible clients.

FAQs

What is the market size of biopharmaceuticals?

The biopharmaceuticals market size is projected to reach approximately $300 billion by 2033, growing at a CAGR of 9% from 2023. This growth reflects the increasing demand for innovative therapies and advancements in biotechnology.

What are the key market players or companies in the biopharmaceuticals industry?

Key players in the biopharmaceuticals industry include major pharmaceutical companies such as Pfizer, Roche, Johnson & Johnson, Novartis, and Merck. These companies lead in developing biologics, biosimilars, and innovative therapeutics.

What are the primary factors driving the growth in the biopharmaceuticals industry?

The growth in biopharmaceuticals is driven by advancements in biotechnology, an increasing number of chronic diseases, a rising focus on personalized medicine, and significant investments in R&D by pharmaceutical companies.

Which region is the fastest Growing in the biopharmaceuticals market?

North America is the fastest-growing region in the biopharmaceuticals market, with market size projected to increase from $105.93 billion in 2023 to $258.13 billion by 2033, benefiting from advanced healthcare infrastructure and innovation.

Does ConsaInsights provide customized market report data for the biopharmaceuticals industry?

Yes, ConsaInsights offers customized market report data tailored to specific needs within the biopharmaceuticals industry, addressing unique queries and providing in-depth insights relevant to individual market interests.

What deliverables can I expect from this biopharmaceuticals market research project?

Deliverables from this biopharmaceuticals market research project typically include a comprehensive market analysis report, executive summaries, regional and segment insights, market forecasts, and strategic recommendations based on current industry trends.

What are the market trends of biopharmaceuticals?

Current market trends in biopharmaceuticals include the rise of monoclonal antibodies, an increase in vaccine development, advancements in gene therapy, and a growing focus on decentralized clinical trials, enhancing accessibility and patient-centric solutions.